Financial Crisis

Home - Index - News - Kronkursförsvaret 1992 - EMU - Economics - Cataclysm - Wall Street Bubbles - US Dollar - Houseprices

The lessons of 1937

”Det som satte stopp för trettiotalsdepressionen i USA var ett massivt underskottfinansierat program för offentliga arbeten som kallas andra världskriget”.

Carl Johan Gardell, Understreckare SvD 13 augusti 2009

FDR’s attempts to revive the economy are viewed as a failure in light of the devastating second depression that occurred in 1937-38.

Instead, the Great Depression finally ended with the explosive growth of military expenditures starting in mid-1940.

Capitalism in America: A History, by Alan Greenspan and Adrian Wooldridge

FT 16 October 2018

Why It Might Be A Good Time To Revisit Ray Dalio's 1937 Analog

via zerohedge 26 July 2018

The correlation between the S&P 500 over the past four years and the four years leading up to the 1937 top is roughly 94%.

As I have suggested in the past, price analogs are not very valuable on their own but when the fundamentals also parallel closely they become far more interesting.

Tillväxten steg och arbetslösheten föll. Men det kom även bakslag, som 1937

när Roosevelt tvingade skära i bidragen för att minska statsskulden som ökat kraftigt och

man lyckades aldrig riktigt ta sig ur depressionen.

Det var egentligen Hitler som lyckades få fart på den amerikanska ekonomin igen.

Therese Larsson Hultin, SvD 6 juli 2017

”Det som satte stopp för trettiotalsdepressionen i USA var ett massivt underskottfinansierat program för offentliga arbeten som kallas andra världskriget”.

Carl Johan Gardell, Understreckare SvD 13 augusti 2009

John Maynard Keynes Is the Economist the World Needs Now

Politicians ignored Keynes in 1937. Doing so again could tank the economy

Peter Coy, Businessweek's economics editor, October 30, 2014

Understanding Today’s Stagnation

Ever since the “Great Recession” of 2007-2009, the world’s major central banks have kept short-term interest rates at near-zero levels.

Why is all this economic life support necessary, and why for so long?

Robert J. Shiller, 23 May 2017

Parallels to 1937

Now, as then, people have been disappointed for a long time, and many are despairing.

They are becoming more fearful for their long-term economic future.

Robert J. Shiller, a 2013 Nobel laureate in economics, Project Syndicate, 11 September 2014

There is a name for the despair that has been driving discontent since the financial crisis.

That name is the “new normal,” referring to long-term diminished prospects for economic growth, a term popularized by Bill Gross

The despair felt after 1937 led to the emergence of similar new terms then, too.

“Secular stagnation,” referring to long-term economic malaise, is one example.

The word secular comes from the Latin saeculum, meaning a generation or a century.

The word stagnation suggests a swamp /träsk/, implying a breeding ground for virulent dangers.

In his magnum opus The Moral Consequences of Economic Growth, Benjamin M. Friedman showed many examples of declining economic growth giving rise – with variable and sometimes long lags – to intolerance, aggressive nationalism, and war.

He concluded that, “The value of a rising standard of living lies not just in the concrete improvements it brings to how individuals live but in how it shapes the social, political, and ultimately the moral character of a people.”

Consider what happened in 1936. F.D.R. had just won a smashing re-election victory

It’s very hard to communicate even the most basic truths of macroeconomics,

like the need to run deficits to support employment in bad times.

You can argue that Mr. Obama should have tried harder to get these ideas across;

many economists cringed /To shrink, tense or recoil, as in fear, disgust or embarrassment/ when he began echoing Republican rhetoric about the need for the federal government to tighten its belt along with America’s families.

Paul Krugman, New York Times 23 January 2014

But, even if he had tried, it’s doubtful that he would have succeeded.

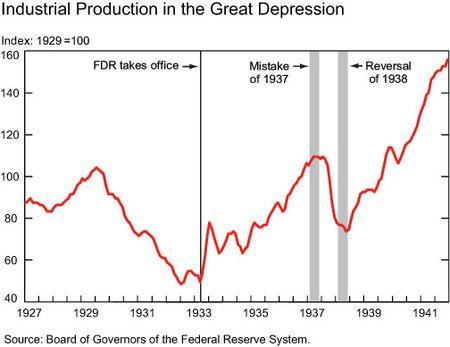

Consider what happened in 1936. F.D.R. had just won a smashing re-election victory, largely because of the success of his deficit-spending policies. It’s often forgotten now, but his first term was marked by rapid economic recovery and sharply falling unemployment.

But the public remained wedded to economic orthodoxy: by a more than 2-to-1 majority, voters surveyed by Gallup just after the election called for a balanced budget.

And F.D.R., unfortunately, listened; his attempt to balance the budget soon plunged America back into recession.

At this point the economic case for austerity — for slashing government spending even in the face of a weak economy — has collapsed.

Ending stimulus has never been a problem — in fact, the historical record shows that it almost always ends too soon.

Paul Krugman, NYT May 5, 2013

Partly that reflects vested interests, for austerity policies serve the interests of wealthy creditors; partly it reflects the unwillingness of influential people to admit being wrong.

But there is, I believe, a further obstacle to change: widespread, deep-seated cynicism about the ability of democratic governments, once engaged in stimulus, to change course in the future.

So now seems like a good time to point out that this cynicism, which sounds realistic and worldly-wise, is actually sheer fantasy.

Ending stimulus has never been a problem — in fact, the historical record shows that it almost always ends too soon.

F.D.R. cut back sharply in 1937, plunging America back into recession; the Recovery Act had its peak effect in 2010, and has since faded away, a fade that has been a major reason for our slow recovery.

2013 Looks a Lot Like 1937 in Four Fearsome Ways

Amity Shlaes, Bloomberg, Nov 19, 2012

In this case, “1937” means a market drop similar to the one after the re-election of another Democratic president, Franklin D. Roosevelt, in 1936.

After this year’s election, President Barack Obama made it clear that budgeting was his priority: “I’m ready and willing to make big commitments to make sure that we’re locking in the kind of deficit reductions that stabilize our deficit, start bringing it down, start bringing down our debt. I’m confident we can do it.”

Roosevelt too opened his second term on a sober budget-cutting note. The president, wrote journalist Anne O’Hare McCormick in 1937, was like “the Dutch householder who carefully totes up his accounts every month and who is really annoyed now that he is bent on balancing the budget, that Congress can’t stop spending.”

The Forgotten Man: A New History of the Great Depression, by Amity Shlaes.

This new book is the finest history of the Great Depression ever written.

Steven F. Hayward, National Review, July 30, 2007

Genom att tredubbla olika inkomstskatter 1934-38 lyckades Roosevelt också uppnå budgetbalans. Detta skedde dock till priset av en ny, kraftig konjunkturnedgång 1938

Det är senare keynesiansk mytbildning som skapat bilden av Roosevelt som en företrädare för Keynes' politik.

Någon egentlig krislösning framkom inte i USA utan rustningsutgifterna inför andra världskriget löste problemet med arbetslösheten och produktionsminskningen

Latvia, Internal devalutation

Oh, wow — another bank bailout, this time in Spain. Who could have predicted that?

The answer, of course, is everybody.

Paul Krugman, New York Times June 10, 2012

For years Spain and other troubled European nations have been told that they can only recover through a combination of fiscal austerity and “internal devaluation,” which basically means cutting wages.

It’s now completely clear that this strategy can’t work unless there is strong growth and, yes, a moderate amount of inflation in the European “core,” mainly Germany.

Consider, for example, what Jörg Asmussen, the German representative on the European Central Bank’s executive board, just said in Latvia, which has become the poster child for supposedly successful austerity.

Latvian success consists of one year of pretty good growth following a Depression-level economic decline over the previous three years.

True, 5.5 percent growth is a lot better than nothing. But it’s worth noting that America’s economy grew almost twice that fast — 10.9 percent! — in 1934, as it rebounded from the worst of the Great Depression.

What explains this trans-Atlantic paralysis in the face of an ongoing human and economic disaster?

Whatever the deep roots of this paralysis, it’s becoming increasingly clear that it will take utter catastrophe to get any real policy action that goes beyond bank bailouts.

But don’t despair: at the rate things are going, especially in Europe, utter catastrophe may be just around the corner.

A learned article making the case that high unemployment is the result of our failure to adapt to rapid technological change, and that there are no easy answers.

In particular, welfare programs designed to protect workers from the costs of change are making things much worse.

Clearly, the problem requires structural reform, and it’s foolish to think that it could be solved just by increasing demand.

Paul Krugman, New York Times 9 May 2012

Re-elected with 61 percent of the vote in 1936, President Franklin D. Roosevelt told his supporters,

"Now I'm going back to do what they call balance the budget."

True to his word, he cut spending and promptly sent the nation into a recession - a sharper decline than in 1929

Kenneth Lipartito, Bloomberg 12 March 2012

Appointed chairman of the Federal Reserve by Roosevelt, Eccles was unable to get his fellow Fed governors to embrace a more liberal monetary policy. But he was an early supporter of Keynesian fiscal stimulus.

Gradually other business leaders came to conclusions similar to Eccles. Charles E. Wilson, president of General Electric, called for spending to restore full employment.

What caused the recession of 1937-38?

Douglas Irwin, Vox, 11 September 2011

The recession is often attributed to a tightening of fiscal and monetary policy. Christina Romer (2009) and others have argued that it is relevant to today’s situation because it illustrates the dangers of a premature withdrawal of stimulus when the economy is still weak.

But the recession remains somewhat of a mystery because the two most frequently mentioned causes – the reduction in the fiscal deficit and the Federal Reserve’s decision to double reserve requirements – do not appear to have been powerful enough to generate a recession of the magnitude seen.

Top of pageAnd here we are, with markets now deeply worried not by deficits but by stalling growth, fearing not fiscal profligacy but fiscal austerity, and with interest rates at historic lows.

Instead of turning into Greece, we’ve turned into Japan, except much worse.

And policy is replaying 1937.

Paul Krugman, 19 August 2011

In the past, you could make excuses on the grounds of ignorance. In the 1930s they didn’t have basic macroeconomics. Even in Japan in the 1990s you could argue that it took a long time to realize that the liquidity trap was a real possibility in the modern world.

But we came into this crisis with a pretty good understanding of what was at stake and pretty good analysis of the policy options — yet policy makers and, I’m sorry to say, many economists just chose to ignore all that and go with their prejudices instead.

The events of 1937-38, the so-called recession within the Depression, with a major caveat: it was a lot worse back then. The Dow Jones industrial average dropped 49 percent from its peak in 1937. Manufacturing output fell by 37 percent, a steeper decline than in 1929-33. Unemployment, which had been slowly declining, to 14 percent from 25 percent, surged to 19 percent. Price declines led to deflation.

“The parallels to what is happening now are very strong,” Robert McElvaine, author of “The Great Depression: America, 1929-1941” and a professor of history at Millsaps College, said this week. Then as now, policy makers were struggling with how and when to turn off the fiscal stimulus and monetary easing that had been used to combat the initial crisis.

1937! So demand will be depressed in both crisis and non-crisis economies;

this will lead to a vigorous recovery through … what?

Paul Krugman, July 21, 2011, 11:51 AM

The Telegraph has a leaked draft of the eurozone rescue plan for Greece.

9. All euro area Member States will adhere strictly to the agreed fiscal targets, improve competitiveness and address macro-economic imbalances. Deficits in all countries except those under a programme will be brought below 3% by 2013 at the latest.

OK, so we’re going to demand harsh austerity in the debt-crisis countries; and meanwhile, we’re also going to have austerity in the non-debt-crisis countries.

Plus, the ECB is raising rates.

So demand will be depressed in both crisis and non-crisis economies; this will lead to a vigorous recovery through … what?

Full text

It is time to drop the emphasis on core inflation

Why the Fed will repeat its worst error

Is the Fed doomed to repeat its most infamous mistake,

The 1937 monetary tightening that extended the Great Depression?

Colin Barr, CNN, 6 June 2011

Bullard, the president of the Federal Reserve Bank of St. Louis. Last month he published a paper calling core inflation "a rotten concept" and urging the Fed to stop paying attention to it.

"It is time to drop the emphasis on core inflation as a meaningful way to interpret the inflation process in the U.S.," he said in a May 18 speech at New York University.

Perhaps Bullard wants to show the Fed knows people can't eat iPads for dinner. In an interview, Bullard says he believes the Fed risks losing credibility with the public by ignoring the prices of goods that account for a substantial share of household spending.

"It's damaging to the Fed to talk about core inflation when everyone can see headline inflation is rising," Bullard said last month. "We need to talk about our challenge in terms of headline inflation, not restate it in terms of something else."

1938 in 2010

PAUL KRUGMAN, NYT September 5, 2010

We weren’t supposed to find ourselves replaying the late 1930s. President Obama’s economists promised not to repeat the mistakes of 1937, when F.D.R. pulled back fiscal stimulus too soon. But by making his program too small and too short-lived, Mr. Obama did just that: the stimulus raised growth while it lasted, but it made only a small dent in unemployment — and now it’s fading out.

And just as some of us feared, the inadequacy of the administration’s initial economic plan has landed it — and the nation — in a political trap. More stimulus is desperately needed, but in the public’s eyes the failure of the initial program to deliver a convincing recovery has discredited government action to create jobs.

...

TO: President Obama FROM: Thomas I. Palley

Plan B for Obama on the economy

FT, September 6, 2010

German Government Agrees on Historic Austerity Program

Right or wrong – whether this plunges the whole world into a deflationary abyss from which there is no escape or if, somehow, this has the desired effect of restoring financial stability over time

– it’s nice to see that there are at least a few elected officials in the world who question the idea of simply piling on more debt to cure the world’s economic ills.

Tim Iacono 7 Jun 2010

Deja Vu: Will the U.S. Undergo a Reprise of 1937?

Deflation took hold of the country for another two years and unemployment spiked to 20% and didn't drop below 15% until 1940. Property prices and stock markets languished below their pre-1929 levels until World War II shocked production back to life.

Roubini 16/12 2009

A lengthy recent analysis by RGE’s Mikka Pineda identifies striking similarities in U.S. inflation attitudes between the mid-1930s, when the U.S. began to show signs of recovery from the Depression, and 2009. Americans during the Great Depression voiced the same concerns about excess bank reserves, budget deficits, competitive devaluations and commodities speculation as they do today. Even dissenting arguments followed the same script in both eras. The eerie resemblance in the psychological and economic backdrop of the mid-1930s and 2009—both historic junctures when recovery was thought to have begun—raises concerns that the U.S. could be on the edge of a double-dip.

A stroll through the archives of TIME magazine and The New York Times reveals other similarities in the reactions of Americans today to fiscal and monetary easing and the reactions of their forebears of the mid-1930s. When the U.S. economy began to recover from the Great Depression, widespread fear of credit inflation, currency inflation and public debt inflation drove the Federal Reserve Board to hike reserve requirements by 50% and prompted Congress to slash spending. A premature retraction of economic stimulus, among other things, pushed the U.S. back into recession.

In terms of GDP growth, there was a brief recession lasting only about a year from autumn 1937. Business leaders at the time called it a mere “business recession” to whittle down excess capacity and high inventories built up in response to rising commodity prices. To everyone else, particularly those laborers considered “excess capacity,” the economy's fragile recovery took a big step back. Deflation took hold of the country for another two years and unemployment spiked to 20% and didn't drop below 15% until 1940. Property prices and stock markets languished below their pre-1929 levels until World War II shocked production back to life.

Today the U.S. is experiencing a similar situation with hawks calling for the immediate exit from both loose fiscal and monetary policy even amid high unemployment. Though past is not prologue, learning from past mistakes can make a considerable difference.

Krugman beskriver världsdepressionen i början av 30-talet som en efterfrågekris:

”Det som satte stopp för trettiotalsdepressionen i USA var ett massivt underskottfinansierat program för offentliga arbeten som kallas andra världskriget”.

Carl Johan Gardell, Understreckare SvD 13 augusti 2009

In an interview in Frankfurter Allgemeine, Robert Shiller forecasts that the next five years will be disappointing.

While the first wave of this crisis is over, he points out, there may be another wave coming with some delay, just as it happened during the 1929-1941 Great Depression.

Eurointelligence 31/8 2009

Die meisten Makroökonomen und Finanzmarktspezialisten waren zum Beispiel der festen Überzeugung, dass Finanzmärkte effizient sind, dass es keine Blasen gibt und dass wir die Marktpreise respektieren müssen als die kollektive Weisheit der Menschen, die jedermanns individuelles Wissen übersteigt. Es wäre lächerlich, den Markt in Frage zu stellen, dachten sie.

Das war einer der größten Fehler in der Geschichte des ökonomischen Denkens.

Full text at Frankfurter Allgemeine

There is no such thing as rational expectations.

Roosevelts New Deal på 30-talet gick ut på att med höjda inkomstskatter och utgiftsminskningar få balans i budgeten, som till slut uppnåddes 1938.

Då bröts uppgången och produktionen sjönk.

Först när balansmålet övergavs kunde ekonomin expandera tillräckligt mycket.

Danne Nordling, 20/2 2009

Leaving a financial crisis is like leaving an awkward social gathering: a good exit is essential.

In 1936-37, the Federal Reserve made a colossal mistake in its “exit strategy”.

Randall Kroszner, FT August 11 2009

The writer is Norman R. Bobins professor of economics at the University of Chicago’s Booth School of Business and a former governor of the US Federal Reserve

A fundamental misjudgment by the Fed was to assume that, as the economy revived, banks would manage liquidity exactly as they had prior to the banking crises earlier in the decade and hold only the legally required minimum. When the Fed sharply increased reserve requirements in 1936 and 1937 (see chart 1), banks responded by calling in loans to build a liquidity cushion above legal requirements, thereby sharply contracting money, credit and economic activity.

The recovery from the Depression is often described as slow

because America did not return to full employment until after the outbreak of the second world war. But...

Christina Romer, chairwoman of Barack Obama's Council of Economic Advisers and a scholar of the Depression,

The Economist print June 18th 2009

But the truth is the recovery in the four years after Franklin Roosevelt took office in 1933 was incredibly rapid.

However, that growth was halted by a second severe downturn in 1937-38, when unemployment surged again to 19%

The fundamental cause of this second recession was an unfortunate, and largely inadvertent, switch to contractionary fiscal and monetary policy.