Martin Wolf on German labour costs

D-Mark

Home

WOLFGANG MUNCHAU, FT, 99-07-05

The German government’s package may be fiscally prudent but it does little to boost economic growth and employment

Germany’s business leaders have hailed the government’s deficit reduction package as a breakthrough for economic reform. But as far as reviving economic growth, corporate profits and employment are concerned, the package is next to useless.

Hans Eichel, finance minister, has delivered a fiscally prudent package. The main part is a DM30bn ($15.9bn) cut in government spending. Most of these cuts will come from the labour and social security budget. The rest is spread evenly throughout other government departments. A big chunk of savings will come from linking the annual rise in pension payments to the rate of inflation, as opposed to average earnings.

The second element will be a cut in corporate tax from 40 per cent to 25 per cent, effective from 2001. Companies will then face a maximum tax bill of 35 per cent, local business taxes included.

But these measures do not address the concerns of international investors and German companies for that matter. They have consistently criticised the structural rigidities in the economy, the high and rising cost of labour and the poor mix of fiscal and monetary policy since German unification.

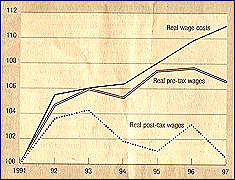

Between 1991 and 1997, the cost of employing German workers went up by 11 per cent. One would expect, therefore, German workers to be better off. But this is not case. Despite the rise in wage costs, net incomes remained virtually flat because of increases in tax and social security contributions.

Mr Eichel’s package fails on all three counts - policy mix, income taxes and labour market flexibility. It continues in the tradition of a pro-cyclical fiscal policy (a tightening of fiscal policy at a time of low economic growth).

Income taxes are reduced only marginally and the crippling social security contributions, which make up 40 per cent of wage costs, will only come down by a fraction.

Germany was a country with high income tax rates, but relatively generous tax write-offs. This government is cutting the tax rates marginally, while cracking down on the tax write-offs. The combined result is an effective tax increase for many middle- and high-income earners.

The new tax structure throws up all sorts of problems. While the corporate tax rate will fall from more than 50 per cent to 35 per cent, the top income tax rate will come down only to 48.5 per cent, leaving a gap of 13.5 percentage points.

From the point of view of taxation economics such discrimination makes no sense. It hinders the efficient allocation of resources, since investors will be driven by tax considerations rather than the quality of the investment.

The economics of tax cuts is complicated. In an open economy, such as Germany, cuts in corporate tax rates could have a smaller effect on economic growth than comparable income tax cuts. This is because income tax cuts translate more directly into higher consumer spending. Corporate tax cuts translate directly into higher profits. These may be reinvested in Germany, but not necessarily.

The government is equally confused over indirect labour costs. The recent healthcare reform programme may have succeeded in capping future increases in healthcare expenditure, but will not lead to a real cut in healthcare contributions.

Walter Riester, labour minister, has proposed a modest and highly commendable reform to Germany’s pension system, consisting of a capping of pension increases and a provision to encourage (or force) employees to save a small portion of their income through private pension funds or life insurance.

The proposal has caused an outcry among leftwing Social Democrats who are deeply attached to the present system, in which the pensions of the old are funded directly by contributions of the young.

The government has done nothing so far to remove structural rigidities in the economy. The country still operates an ancient competition law that treats consumers as economically illiterate. Shopping hours remain tightly regulated. The labour markets are now even more regulated than they were two years ago. It is extremely difficult for employers to dismiss employees with more than two years of service.

One reason Germany cannot scrap its ineffective dual company board structure - the split between management and supervisory boards - is the requirement to grant workers’ representatives half the seats on the supervisory board.

Mr Eichel’s package is a textbook example of how not to run fiscal policy. At a time of mass unemployment and low economic growth, he has opted for a tight fiscal policy. Even if economic growth were to pick up next year, as is projected, the continuing rigidities make it less likely that it could be maintained over sufficiently long periods. But this is precisely what is needed to reduce unemployment.

It would have been far more sensible for him to have done the exact opposite: opt for a meaningful cut in income (as well as corporate) tax rates and a removal of structural rigidities, and wait for economic growth to pick up before enacting a budget deficit reduction programme. This would have rendered fiscal policy anti-cyclical at last and removed structural obstacles to sustainable economic growth.

Oskar Lafontaine, Mr Eichel’s predecessor, was no reformer either. But at least he understood economics.