Home - Index -

News - Kronkursförsvaret 1992 - EMU - Cataclysm -

Wall Street Bubbles - Houseprices

Dollarn - Biggles - HSB - Löntagarfonder

- Contact

Latin American debt crisis

Wikipedia

I sin bok Capitalism 4.0 skriver Anatole Kaletsky:

USA:s tidigare centralbankschef Paul Volcker är mest känd för att ha blivit tillsatt av Ronald Reagan för att få ner inflationen, vilket lyckades genom en hård åtramning med recession som följd.

Det ryktet kvarlever med märklig kraft.

Men Kaletsky menar att det var Paul Volcker som ledde återgången till "demand management".

- In the United States, the return to demand management began as early as the summer of 1982, when a three-year recession and the bankruptcy of the Mexican government persuaded the Fed that its experiment with monetarism had gone too far.

"Den stora bankkraschen",

Rolf Englund Timbro 1983

It is not the best book about the Debt Crisis, but it might be the first book about the Debt Crisis.

Under sommaren 1966 hade jag ett tillfälligt uppdrag att för Timbros föregångare, Utredningsbyrån för Samhällsfrågor, göra en utredning om svenskt U-landsbistånd. Där skrev jag bl a att:

"U-ländernas växande skuldbörda inger allvarliga farhågor. Det antas ibland att finansiering på vanliga viilkor och från privata källor kommer att bli lättare. Men u-länder med enorma skulder och stora fasta återbetalningsskyldigheter kommer efter konventionella mått att vara föga kreditvärdiga. Om den offentliga hjälpen någon gång i framtiden kommer att upphöra är det svårt att tro annat än att nästa fas skulle bestå i moratorium på förfallande skulder...Detta gör att länder som nu eller inom kort tvingas göra stora återbetalningar... bland dessa länder ingår Argentina, Brasilien, Chile, Turkiet och Indien."

The lesson from Asia and Latin America in the 1990s was that currency pegs reinforced and indeed exacerbated financial cycles.

Asset prices tended to overshoot on the upside, creating macro imbalances that were eventually corrected through catastrophic devaluations.

FT 13 August 2015

Subprime like The Debt Crisis of the 80's

Argentina, Brazil and all the rest put the US banking system in jeopardy of grinding to a halt.

The amount of the loans exceeded the required capitalization of the US banks.

John Mauldin April 5 2008

Germany's looming S&L crisis

German savings banks are the backbone of Germany's unique economic system.

If they go pop, so will Ludwig Erhard's social market economy.

Wolfgang Münchau, Eurointelligence 14.06.2007

A market correction is coming, this time for real

Mr. Rhodes gained a reputation for international financial diplomacy in the 1980s for his leadership in helping manage the external-debt crisis that involved many developing nations and their creditors worldwide.

During that period and in the 1990s he headed the advisory committees of international banks that negotiated debt-restructuring agreements for Argentina, Brazil, Mexico, Peru and Uruguay

William Rhodes, FT March 29 2007

I en riksdagsmotion av Per Unckel till 1976/77 års riksdag påtalades behovet av "att inom ramen för OECD upprätta ett rapporteringssystem avseende u-ländernas växande skulder inom det västerländska banksystemet.

Tanzania och

andra enpartistater som Sverige har stött

Bengt Säve-Söderberg, statssekr. åt biståndsminister Lena Hjelm-Wallén:

- Man måste vara vaksam så att inte en

enpartistat förvandlas till något som inte

är demokrati.

ur manus till boken Bistånd med slagsida, Rolf Englund Timbro 1991

Rolf Englund om svenskt bistånd till Tanzania

ur manus till boken Bistånd med

slagsida, Timbro 1991

Ingvar Carlsson: När socialdemokratin kallar sig det tredje alternativet betyder det inte att vi söker någon sorts medelväg mitt emellan kommunism och kapitalism. Det betyder att socialdemokratin vill söka andra vägar än dem som representeras av dessa båda system, eftersom vi menar att inget av dem funnit tillfredsställande lösningar på problemen om mänsklig frihet, jämlikhet och solidaritet. Och socialdemokratin i Sverige är inte ensam om att söka dessa nya vägar. Många länder, inte minst bland de nya staterna i tredje världen, har också förkastat de gamla lösningarna och arbetar med att finna nya metoder

Rolf Englund om svenskt bistånd till Tanzania och Vietnam,

Ingvar Carlsson om socialismen och kapitalismen samt om socialdemokraterna och enpartistaten

ur manus till boken

Bistånd med slagsida, Timbro 1991

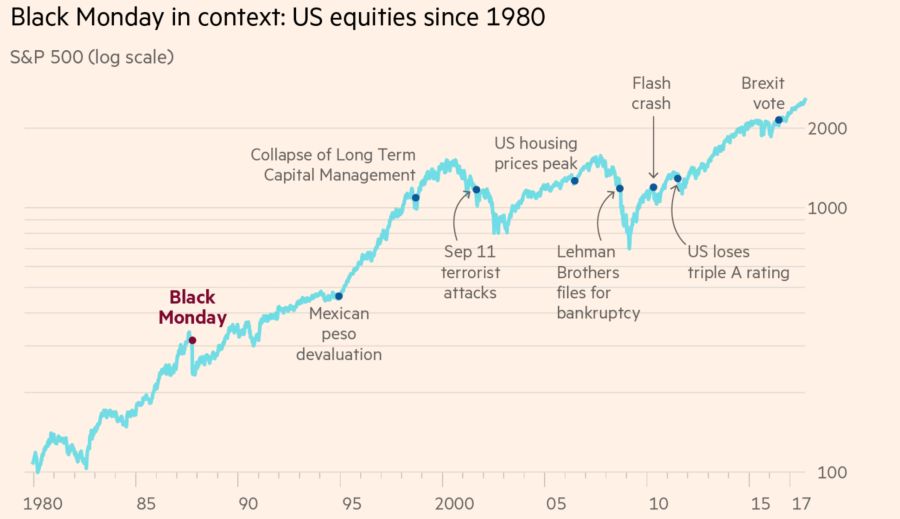

Black Monday, October 19 1987, the US stock market fell by more than 20 per cent.

October has always been the month of highest crash risk — in addition to 1987, try 1929, 1997 and 2008

The big question is: could it happen again?

John Authers, FT 17 October 2017

There have been huge changes since then.

Has this rendered the market more or less prone to a sudden extreme accident like Black Monday?

How big is the risk of another Black Monday equities crash?

FT 17 October 2017

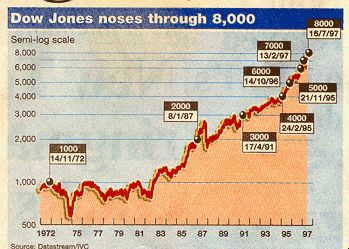

On Oct. 19, 1987, stock markets around the world imploded, with the Dow Jones Industrial Average dropping 508 points,

or 22%, marking its largest one-day percentage decline on record.

MarketWatch 19 October 2016

The Crash of ’87, From the Wall Street Players Who Lived It

Bloomberg 14 October 2017

Twenty-five years after “Black Monday”

— when the U.S. stock market went into a free fall and the Dow Jones Industrial Average lost 22.6 percent in a single trading session —

“We do have circuit-breakers and in theory they would work very well, but the human psychology that was around in 1987 is still around today.”

CNBC 19 October 2012

Indeed, high-frequency trading, which uses software to post trades in microseconds, has been blamed for a number of high-profile glitches on global stock markets over recent months, the most infamous example being the so-called “flash crash” of May 2010 when the Dow industrials plunged 9 percent and recovered minutes later.

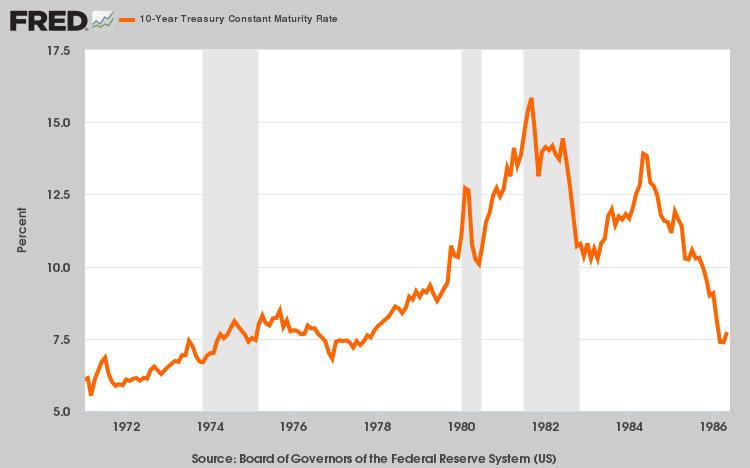

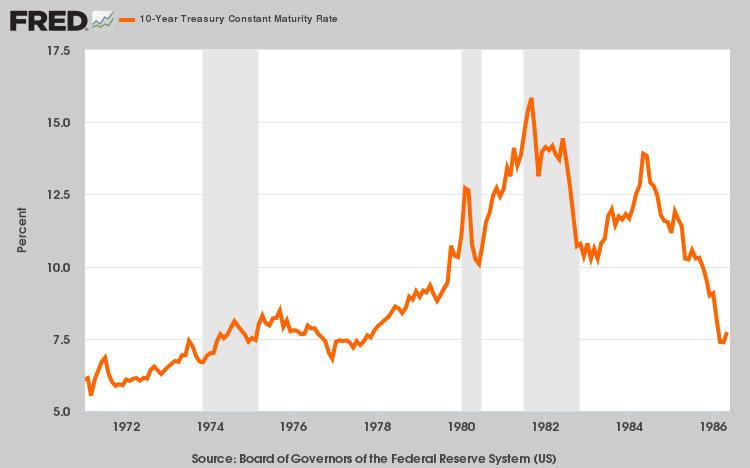

Kan Du se Kraschen 1987?

Spot The Crasch of 1987!

Observera den verkliga kraschen 1974-1975

just innan Saigon föll och Meidner lade fram sitt förslag om Löntagarfonder.

Notice the real Crasch of 1974-1975, with Stagflation and all that.

The Economist print, Oct 20th 2012:

The one-day price fall of 23% in 1987, seemingly unconnected to economic fundamentals, gave a hint that markets are not always efficient.

But Mr Greenspan declined this newspaper’s advice to intervene both when dotcom stocks surged in the late 1990s and when house prices rocketed in the early 2000s.

For investors, markets became a one-way bet: central banks would intervene when markets were falling, but not when they were rising.

The “great moderation” was a long period of steady growth and low inflation — and a huge build-up of debt.

A real recession would quite likely end the current bear market in stocks,

just as in 1974, when a recession arrived to put an end to a savage bear market.

It was a period, in its combination of economic slowdown and post-bubble financial meltdown,

with a striking resemblance to the bear market that started in 2007

Jim Jubak CNBC 30/9 2008

Take a look at the timing of the bear market of 1973-74 and the recession of 1974-75. This 21-month bear market was a killer. The Standard & Poor's 500 Index ($INX) fell 50% from January 1973 through October 1974.

If you compare the timing of the recession and the end of the bear market, you'll notice that the stock market bottomed in October 1974. That's at the beginning of the fourth quarter. At that point, the recession had just begun and had another quarter and two thirds to run. From the end of October 1974 through the end of March 1975, while the recession was running in full roar, the S&P 500 actually climbed 13%.

Because stocks don't reflect the economy but anticipate it, the stock market rallies before a recession actually ends. And it was the visible onset of a recession that, in the case of the 1974-75 recession, helped the stock market find a bottom.

Remember what happened after the stock market bottomed at the end of 1974. The recovery off that bottom was excruciatingly slow. The S&P 500 didn't break above its January 1973 high and stay there until 1982.

The cyclical bear market did indeed end in October 1974, but the years that followed were a terrible period of stagnation for investors, with the economy burdened by high energy prices, high inflation and slow growth.

I think, as in 1974-75, the stock market will face a huge challenge. If the Federal Reserve and other central banks succeed in ending the financial crisis, they will have done it by flooding the financial markets with cash.

Krisen är här - fastän recessionen ännu inte har börjat

Rolf Englund blog 30/9 2008

Paniken står på lur (på finansmarknaderna)

- SAF-Tidningen 87-06-12

"Stocks Plunge 508 Amid Panicky Selling; Percentage Decline Greater Than in 1929"

Wall Street Journal, 10/20/87, the day after the '87 Crash

BBC 19 october 1987

Some Books and articles about The LDC Debt Crisis

Ur förordet till min bok "Bistånd med slagsida"

Ingvar Carlssons största felbedömning

Där kan man även läsa om en av de största felbedömningar som har gjorts - den handlar om socialismens välståndsbildande kraft och har formulerats av Ingvar Carlsson och Anne-Marie Lindgren, den senare en person som på sin tid som ledarskribent på Stockholms-Tidningen (s) gjorde intellektuellt och moraliskt mycket hedrande insatser för att förhindra val till löntagarfondernas styrelser.

Det var ju så sent som på 1980-talet socialdemokraternas och LO:s uppfattning att Sveriges företag skulle ägas och styras av länsfonder.....

The government pretends it will not repay, while the IMF pretends it

will not lend.

In the end, reality breaks in: Argentina pays and the Fund

lends it the money with which to do so.

Financial Times editorial 11/3 2004

On Tuesday, Argentina must repay $3.1bn to the

International Monetary Fund

Mr Kirchner has said he will default on the

loan unless he receives prior assurance from the IMF that it will approve a

disbursement linked to the country's three-year agreement that would cover the

loan

Financial

Times 8/3 2004

Billions of dollars in hedge-fund money disappeared into thin air amid the GM mess.

What they have to do to recover could test the whole market.

CNBC 18/5 2005

Almost 20 years ago, the great crash of 1987 came about in large part as a result of stock market participants’ purchase of a kind of portfolio insurance that paradoxically caused the very type of volatility it was intended to prevent.

About seven years ago, the Long-Term Capital Management hedge-fund crisis sprang from a wrongheaded theory by prize-winning economists that tons of money could be made with little risk by betting that the sovereign debt of various European countries’ would converge.

And now we learn that one or more major hedge funds may have suffered substantial losses this month -- and potentially ignited a “contagion” -- as a result of blown-up trades related to U.S. automakers in esoteric risk-avoidance instruments called collateralized debt obligations and credit-default swaps.

Hedge funds and other investors seek to offload assets after suffering losses.

This has moved the price of some credit instruments in unusual ways and caused liquidity in some corners of the financial markets to evaporate

Financial Times 18/5 2005

While the overall scale of hedge fund selling and their losses is unclear, many observers suspect it will continue to distort the market for some time. Some fear the jitters could worsen, particularly if hedge funds' losses prompt investors to withdraw money at the end of the next financial quarter in June.

The coming storm

With markets

apparently safer, banks are trading ever-greater amounts in search of higher

returns. Expect trouble

The Economist 19/2 2004

IN THE autumn of 1998, at a conference organised by Credit Suisse First Boston in—appropriately enough—Monte Carlo, Allen Wheat, then head of the investment bank, stood up after dinner and delivered a breathtaking mea culpa. Some sort of apology certainly seemed in order given the huge sums the bank had just lost from extravagant gambles on the Russian economy in particular and financial markets in general.

The bets went spectacularly wrong after Russia defaulted, financial markets went berserk, and Long-Term Capital Management (LTCM), a very large hedge fund, had to be rescued by its bankers at the behest of the Federal Reserve. CSFB eventually admitted to losses of $1.3 billion. Before the end of this year, the bosses of many big banks may face the same unpalatable task which confronted Mr Wheat if, like him, they have the courage to admit their mistakes.

The reason is simple: the size of banks' bets is rising rapidly. This is because returns have fallen as fast as markets have risen. Yields on corporate debt of all types, for example, have fallen dramatically, and commissions for all sorts of businesses have also dropped. So banks are having to bet more of their own money to continue generating huge profits. But the amount that they have put on the table in recent months has become worryingly large.

It could well happen again. There are any number of potential flashpoints: a rout in the dollar, say, or a spike in the oil price, or a big emerging market getting into trouble again. If it does happen, the chain reaction could be particularly devastating this time. Banks and hedge funds have increased their exposures most to those markets that they are least able to withdraw from. Think, if you will, of the extraordinary rise in the price of emerging-market debt and junk bonds. “I used to sleep easy at night with my VAR model,” said Mr Wheat in his speech more than five years ago in Monte Carlo. Suffice to say that he suffered a sleepless night or two when that model was found wanting—and that many a bank boss could be in for the same.

Rolf Englund 1987-10-26 Den annalkande stormen

Martin Wolf: IMF must stand up to blackmail

Financial Times January 27 2004

If you owe a bank a hundred pounds, you have a problem, but if you owe it a million, it has. Argentina's relationship with the International Monetary Fund provides a compelling demonstration of the truth of this famous remark by Lord Keynes.

Argentina owed the Fund not a mere million, but $16bn at the end of last year, which is 16 per cent of outstanding IMF credit. At the end of last August, Argentina also owed $18.3bn to the World Bank and another $1.9bn to the Inter-American Development Bank. So large are Argentina's debts to these institutions that, in a reversal of normal roles, its government holds their health hostage to the Fund's good behaviour.

In essence, the Fund is relending the principal Argentina owes. The stand-by agreement reached last September was explicitly designed to achieve this result. But the Fund is doing this even though Argentina's fiscal effort, structural policies and treatment of its non-preferred creditors are inadequate. It is, in effect, yielding to blackmail.

This damages the IMF itself, Argentina's private creditors and the Fund's other borrowers. It must stop. In making this criticism, I do not argue that Argentina was wrong to default. On the contrary, a default was inevitable long before the end of 2001. Between early 1994 and the end of 2000, the average premium of Argentine external dollar debt over US treasuries was just above seven percentage points. Big risks must come with such high rewards. Those who failed to diversify their portfolios in response deserve nobody's pity. They took on the risk knowingly. Ordinary Argentine citizens did not.

Lex: Brazil

moral hazard

August 8 2002

13:00

IMF loan counters strict bail-out policy

By

Alan Beattie, Financial Times, August 8 2002

Lex: Brazil

moral hazard

Published: August 8 2002 13:00

The $30bn IMF support package for Brazil shows expediency triumphing over ideology. The ideologists may rant and rave. But given the fragility of the global economy it is not unwelcome to see the Fund sticking its neck out a bit. In recent years, Brazil's monetary authorities have done the same, with the IMF egging them on.

The critics will moan that the bailout is another shot in the arm for moral hazard among private sector investors. They have a point. US and European banks with Brazilian exposure have effectively won a get out of jail free card.

IMF loan counters strict bail-out policy

By

Alan Beattie, Financial Times, August 8 2002

With its announcement of a $30bn (£19bn) rescue loan for Brazil, the International Monetary Fund seems to have drawn a line under the rhetorical embrace of strictly limited bail-outs, which spread through the policymaking community since the end of the Asian crisis.

The large amount of money, among the IMF's largest ever loans, on top of the billions Brazil has already borrowed, is indicative of a strong desire to get ahead of the curve. Brazil's delicate situation, with its tentative economic growth threatened by a falling currency that automatically pushed up the domestic value of its foreign debt, required a bold gesture of support to try to turn the vicious circle into a virtuous one.

With the exception of Argentina, which languishes in debt default after more than half a year of tortuous negotiations with the IMF, each of the cases that have come up since the new IMF team of managing director Horst Köhler and his deputy Anne Krueger took over - Turkey, Uruguay - have resulted in the fund saying yes, not no.

The US administration, whose no-bailouts rhetoric was particularly in evidence, has performed what appears to most observers to be a particularly marked retreat.

"This marks not so much a reversion to the huge pre-emptive crisis lending packages of the past as a confirmation that the trimming back of lending in practice was never as substantive as the rhetoric implies," said C. Fred Bergsten, director of the Institute of International Economics in Washington.