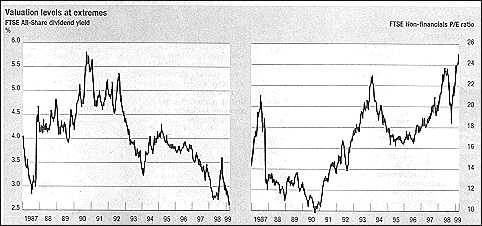

Dividend yield - - - - - - - - - - - P/E ratio

In retrospect, looking at the financial and economic carnage when a bubble goes pop, there's always the puzzle over how so many smart people could be so dumb with their money. Charles Mackay, author of the 19th-century classic Extraordinary Popular Delusions and the Madness of Crowds, captured the essential dynamic.

"Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one."

Maybe modern-day oil traders could profit from reading Mackay's book, even though it was published in 1841.

Business Week June 11, 2008

- Ja, det är ju märkligt att människor inte tänker på vad som hände 1907

sa Rydenfelt, Nils-Eric Sandberg, DN 18/10 1996

Bonfire of the insanities

The Economist, September 25, 1999

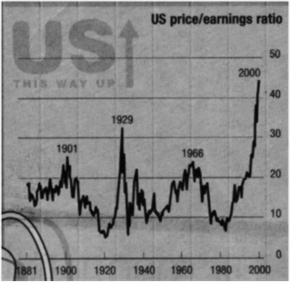

Some economists believe that there is no such thing as a bubble because markets are always rational and efficient. But history suggests otherwise. In their time, tulips, canals, railways, gold, silver, property and share prices have all bubbled up and then gone “pop”. Each time investors convince themselves that this time it will be different. It never is.

The craziest bubble of all time was tulipmania in the Netherlands in the 1630s. Tulip bulbs, newly arrived from Turkey, became wildly fashionable, and prices soared. At the height of the mania, speculators paid 5,500 florins (equivalent to more than $50,000 in today’s money) for a single rare bulb.

Charles Mackay, in his classic 1841 book “Extraordinary Popular Delusions and the Madness of Crowds”, tells how one unfortunate sailor, who was rather partial to onions, was sent down to a rich man’s kitchen for breakfast, and ate a tulip bulb worth 3,000 florins by mistake. He ended up in prison, but at least he had a good laugh a year later when prices plunged and bulbs became virtually worthless.

Another infamous example was the South Sea Bubble in 1720. The London-based South Sea Company came up with an ingenious plan to take over Britain’s national debt in return for interest and sole trading rights to the South Seas (South America) and hence, in theory, access to the treasures of the gold and silver mines in Peru and Mexico.

http://www.amazon.com/gp/product/0471133124/002-9891844-1568857?v=glance&n=283155

1920s: “...Paul Clay, of Moody’s Investor Service. Speaking on “injurious financial fallacies” on December 28, 1928...observed:

First among these fallacies is the new era delusion as typified by the famous dictum, ‘This is a new era. Statistics of the past don’t count.’ Every period of great prosperity is considered to be a new era and so much better fortified to give promise of permanence”

Ghosts of Booms Past

By Robert J. Samuelson Washington

Post, February 8, 2001

It may be a sign of the times that a 10th-grade history teacher recently assigned the following essay topic: What caused the Great Depression, and how do economic conditions then (the 1920s) and now compare? I know because a desperate mother—a friend—called seeking some useful references for her daughter.

My first reaction was: Good luck. For decades, the causes of the Great Depression baffled economists. My second reaction was: Lots of people may be quietly asking similar questions. So now that her paper is done, I’ll attempt some answers.

The parallels between the 1920s and today are intriguing and (of course) unnerving, because the Depression was—after the Civil War—America’s greatest social calamity. In 1933 joblessness hit a record 25 percent of the labor force. Indeed, unemployment remained in double digits from 1931 until 1940, when it was cured by World War II defense spending. The Great Depression was terrifying because it was so resilient.

Hardly anyone thinks it could happen again.

Stagflation: a term coined by economists in the 1970s to describe the previously unprecedented combination of slow economic growth and rising prices.

The Great Bull Market : Wall Street in the 1920’s by Robert Sobel

Short History of Financial Euphoria by John Kenneth Galbraith

Where the Money Grows : And Anatomy of the Bubble (Wiley Investment Classics) by Garet Garrett, Christopher M. Byron

Anatomy of a Crash 1929 by J. R. Levien

Did Monetary Forces Cause the Great Depression? by Peter Temin

Golden Fetters: The Gold Standard and the Great Depression, 1919-1939 by Barry Eichengreen (Preface), and Harold James