News Home

Home - Index - News - Carl Bildt och Krisen 1992 - Economics - Cataclysm - Wall Street Bubbles - US Dollar

Stagflation explained

Stagflation. Plain and simple.

Asset prices simply cannot be justified relative to consumer prices.

FakeBen January 15, 2008

How can inflation accelerate if the economy is slowing?

The economists at the Fed think of monetary policy within the context of a two-dimensional Phillips Curve. When the economy grows, so does inflation. When the economy contracts, disinflation occurs.

Unfortunately, out here in reality, the Phillips Curve does not exist. It never did.

It is absolutely the wrong model to explain our economy.

The problem with the Phillips Curve is that it does not take into account the difference between credit creation and money creation.

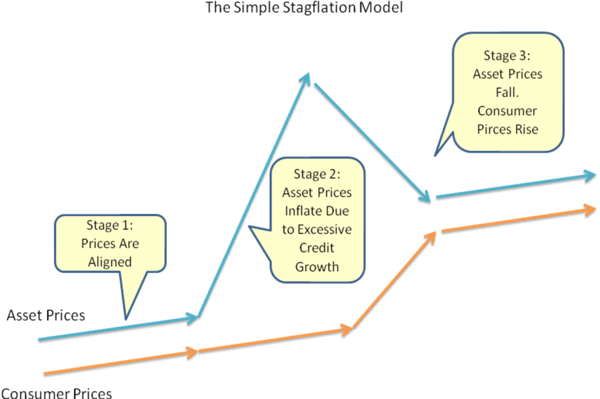

Credit creation drives up asset prices.

Houses increase in value, stock portfolios go up in price, and yet consumer inflation is moderate. We feel really, really rich. Times are good.

Over time, massive credit growth causes asset prices to become overpriced relative to consumer prices, commodity prices, and wages.

That is the situation we are in now.

Few can afford houses at their current prices. And many companies cannot generate enough earnings to support their debt levels and stock prices. Asset prices simply cannot be justified relative to consumer prices.

The Fed doesn't want asset prices to come down because asset prices lead to bankruptcies, especially among banks which are highly leveraged.

Fed has to create actual money to replace the credit that is being destroyed.

This money creation creates consumer price inflation.