Financial Crisis 2007

Hedge Funds

News Home

But how do we know when irrational exuberance has unduly escalated asset values

December 5, 1996

We can see that in the inverse relationship exhibited by price/earnings ratios and the rate of inflation in the past. which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade?

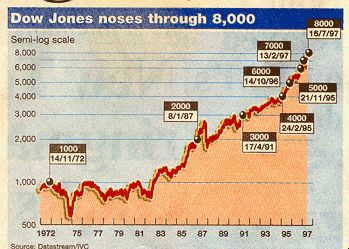

The day of the speech, the Dow Jones industrial average closed at 6,437.10 points

Sharon Reier, Herald Tribune, DECEMBER 1, 2001

Former Fed Chief Greenspan Sees No Bubble in Dow 16,000

Bloomberg, Nov 28, 2013

Infectious Exuberance

Financial bubbles are like epidemics

Robert J. Shiller, July/August 2008 Atlantic Monthly

CNN/WSJ

"The human race has never found a way to confront bubbles," Former Federal Reserve Chairman Alan Greenspan said Thursday

in reference to the euphoria that can precede contractions, or reactions,

like the current market turmoil, according to a published report.

Greenspan compared the turmoil to that of 1987 and in 1998,

when the giant hedge fund Long-Term Capital Management nearly collapsed,

the Wall Street Journal reported on its Web site.

"The behavior in what we are observing in the last seven weeks is identical in many respects to what we saw in 1998, what we saw in the stock-market crash of 1987, I suspect what we saw in the land-boom collapse of 1837 and certainly [the bank panic of] 1907," Greenspan said at the event organized by the Brookings Papers on Economic Activity, according to the Journal.

Bernanke’s Sophie's Choice:

"The housing market or stock market Mr. Bernanke. You may only be able to try and save one..."