Finanskrisen 2007 -

RBS has advised clients to brace for a “cataclysmic year” and a global deflationary crisis,

warning that major stock markets could fall by a fifth and oil may plummet to $16 a barrel.

Ambrose Evans-Pritchard, 11 Jan 2016

“Fangs” — Facebook, Amazon, Netflix and Google

As with the first Shanghai Surprise, the stark reaction to this week’s Chinese events reveals deep lack of confidence in the health of the western corporate sector.

Even if the situation now stabilises — as it did for several months back in 2007 —

the message of concern, in both west and east, is clear.

John Authers, FT 8 January 2016

One of the (many) fascinating things about this latest global financial crisis is that there’s no single catalyst.

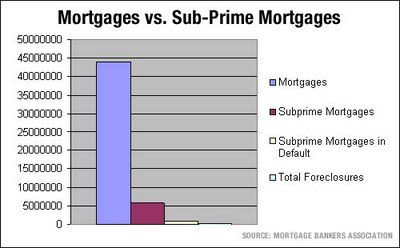

Unlike 2008 when the carnage could be traced back to US subprime housing, or 2000 when tech stocks crashed and pulled down everything else,

this time around a whole bunch of seemingly-unrelated things are unraveling all at once.

zerohedge 7 January 2016

Submitted by John Rubino via DollarCollapse.com

Interest rates, for instance, were high by current standards at the beginning of past crises, which gave central banks plenty of leeway to comfort the afflicted with big rate cut announcements.

Today rates are near zero in most places and negative in many.

Full text

Top of page

News

A Year of Sovereign Defaults?

Carmen Reinhart, Project Syndicate 31 December 2015

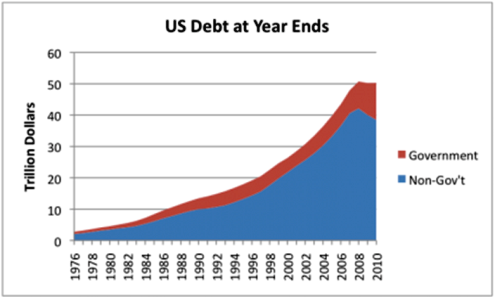

Like so many other features of the global economy, debt accumulation and default tends to occur in cycles. Since 1800, the global economy has endured several such cycles, with the share of independent countries undergoing restructuring during any given year oscillating between zero and 50%

The most recent default cycle includes the emerging-market debt crises of the 1980s and 1990s. Most countries resolved their external-debt problems by the mid-1990s, but a substantial share of countries in the lowest-income group remain in chronic arrears with their official creditors.

Read more at https://www.project-syndicate.org/commentary/sovereign-default-wave-emerging-markets-by-carmen-reinhart-2015-12#z8IKDElycECkDZ8Q.99

Welcome, then, to what Carmen Reinhart, senior fellow at the Peterson Institute for International Economics in Washington,

and Harvard’s Kenneth Rogoff call “the second great contraction” (the Great Depression of the 1930s being the first).

Den stora paniken 1873, som ledde till den långa depressionen 1873–96.

Waldemar Ingdahl, SvD Understreckare 13 februari 2009

1873 års ”stora panik” hade sin grund i den osäkra politiska strukturen i Europa.

I det ombildade Österrike-Ungern, det nyligen enade Tyskland och i det åter republikanska Frankrike, stödde staten uppkomsten av en ny typ av kreditinstitut som utfärdade inteckningar i det kommunala bostadsbyggandet för sämre bemedlade.

Det var lätt att låna, och en stor byggboom inleddes. Tomtvärdena verkade ständigt fortsätta stiga.

Det var operahusens, wienerbalernas, boulevardernas och de magnifika byggprojektens tid. Europa hade börjat ta tillväxten för given när kraschen kom.

Full text

Other crashes

Top of page

News

The S&P 500 finished 2015 with a loss of 0.7 per cent,

its worst annual performance since the financial crisis in 2008 when it declined 38.5 per cent.

Financial Times 31 December 2015

Getting economies "back to normal" was always the hope during that remarkable time when the financial system was in danger of going bust.

I'm not sure anyone thought that, eight years on, we would still be in a near zero interest rate world.

Or, in cases such as the eurozone, a negative interest rate world.

Kamal Ahmed, BBC Business editor, 16 December 2015

Central banks around the world slashed interest rates to near zero and created billions of pounds of support for governments and the wider economy.

Full text

Top of page

News

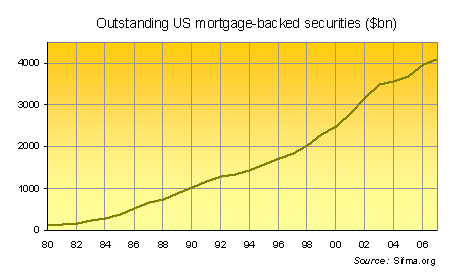

As every student of recent economic history will know, the first rumble of thunder in the Global Financial Crisis came with the collapse in the summer of 2007 of two large Bear Stearns hedge funds.

Investors demanded their money back, but managers were unable to liquidate their positions fast enough to deliver.

Jeremy Warner, Telegraph 15 December 2015

These early signs of panic were to snowball into an all-embracing run on the global banking system, forcing central banks to flood the market with cheap liquidity to prevent mass liquidation and economic collapse.

Are we about to see history repeat itself?

Full text

Frozen withdrawals in 2007 and 2015

Rolf Englund blog 2015-12-12

Doom

A day after a prominent Wall Street firm shocked investors by freezing withdrawals from a credit mutual fund, things only got nastier in the junk-bond market.

Prices on the high-risk securities sank to levels not seen in six years and, to add to the growing sense of alarm,

billionaire investor Carl Icahn said the selloff is only starting.

Bloomberg 11 December 2015

“The meltdown in High Yield is just beginning," Icahn, who’s been betting against the high-yield market, wrote on his verified Twitter account Friday.

Full text

Top of page

News

US and Europe still live with the legacies of the financial crisis of 2007-09 and the subsequent eurozone crisis.

Could better policies have prevented that outcome; and, if so, what might they have been?

Martin Wolf, FT 10 November 2015

A recovery is under way, but only in a limited sense. The change in gross domestic product of crisis-hit countries is now almost universally positive.

But GDP remains far below what might have been expected from pre-crisis trends.

This raises two further questions: could the adverse impact of the crisis have been smaller? And can it still be reversed?

The answer to the first must be yes. But it would have required stronger fiscal and monetary responses, and more aggressive restructuring of damaged financial institutions.

The eurozone, in particular, should have done far better.

Full text

Top of page

News

Some people never learn. They follow the same path that destroyed their finances in the past.

Wall Street is desperately packaging the increasing amounts of subprime slime in new derivatives of mass destruction and peddling them to clients, while shorting those same derivatives.

It’s called the Goldman Sachs method. When home prices begin to tumble, these derivatives will self-destruct again.

What is happening today is nothing more than rearranging the deck chairs on the Titanic.

zerohedge 25 September 2015

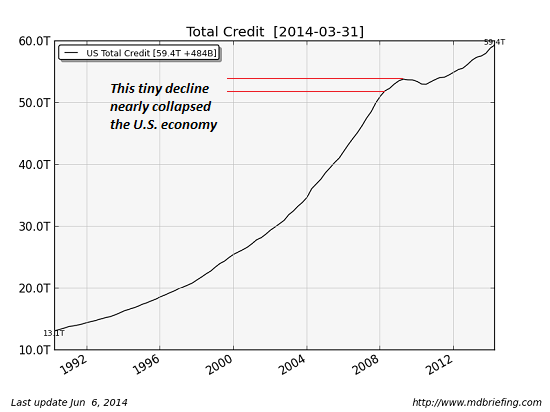

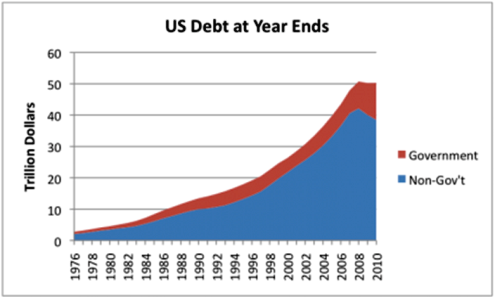

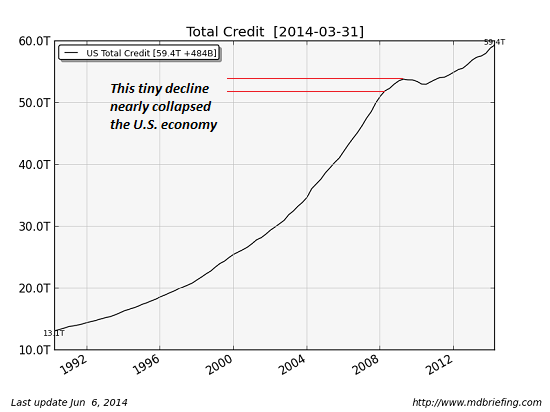

The table is set for the next financial crisis. The apologists for the warped ideology that has resulted in $10 trillion of additional debt being layered on the original un-payable $52 trillion, argue subprime lending is lower than the 2008 peak, so all is well.

They fail to realize the system is far more fragile and will collapse once the next Lehman moment arrives. The country is already in, or headed into recession.

All economic indicators are flashing red. The stock market has fallen over 10% in the last month. Virtually every new car owner you see driving that fancy BMW, Lexus, or Volvo is underwater on their auto loan.

Home price growth has stalled at record levels. Mortgage rates are poised to rise from record lows. We all know what happens next. Look out below.

Full text

Top of page

News

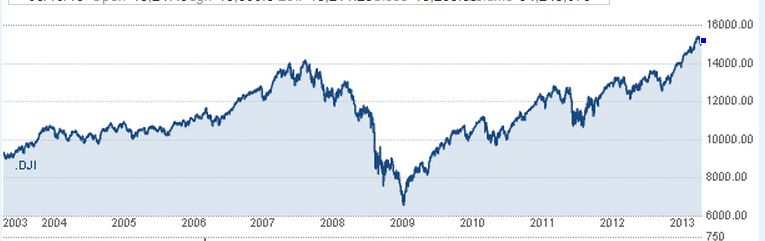

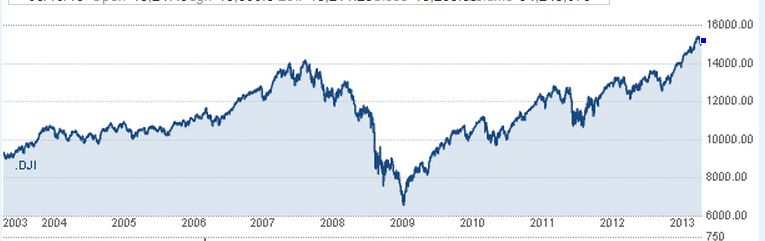

Turbulence in financial markets gathered momentum amid intensifying concern over slowing global growth,

pushing the Dow Jones Industrial Average into a correction and giving other stock gauges their worse losses since 2011.

21 August 2015

Lord Skidelsky said that Keynes would have found two things upsetting.

First, he would be frustrated with the lack of precautions taken to prevent a huge financial crash like the one we saw in 2008.

Secondly, Lord Skidelsky believes Keynes wouldn't be happy with the policy measures taken after the crash. Keynes would have wanted a more "buoyant response," he said.

Specifically, he doesn't think Keynes would have liked the Federal Reserve's quantitative easing

BloombergTV, 13 August 2015

… the recovery has been very very slow. We've been for many years in a state of semi-stagnation, and the recovery is still very very weak in the European Union.

The actual recovery measures we've taken, particularly quantitative easing, have actually skewed the recovery towards asset buying and real estate,

thus threatening to recreate the circumstances that led to crash in the first place.

Full text

Keynes

Rolf Englund;

Själv brukar jag med en dåres envishet upprepa följande ord, första gången den 5 december 2009:

Jag tycker det är skriande uppenbart att räntan världen över är för låg och att en större del av stimulanserna borde ske via finanspolitiken.

Top of page

News

One of the things that occurred to me is the consequence of the 2008 crisis.

I knew something was brewing, but I missed the actual date as frankly did everybody else.

Alan Greenspan, Telegraph 10 August 2015

Explainer: Puerto Rico’s debt problems

FT June 29, 2015

How did a small island of just 3.5m people manage to amass $70bn of debts,

as well as a pile of unfunded pension liabilities?

Full text

Top of page

News

Monetary policymakers have run out of room to fight the next crisis

with interest rates unable to go lower, the BIS warns

Telegraph 28 June 2015

The so-called central bank of central banks launched a scatching critique of global monetary policy in its annual report.

The BIS claimed that central banks have backed themselves into a corner after repeatedly cutting interest rates to shore up their economies.

These low interest rates have in turn fuelled economic booms, encouraging excessive risk taking.

Booms have then turned to busts, which policymakers have responded to with even lower rates.

Full text

Jag tycker det är skriande uppenbart att räntan världen över är för låg och att en större del av stimulanserna borde ske via finanspolitiken.

Men väljarna och därmed deras medlöpande politiker är rädda för budgetunderskott och vill hellre att villaägarna skall låna än att staten skall göra det.

Strategin synes vara att det gäller att stabilisera, helst höja, villapriserna så att konsumenterna främst i USA skall återgå till att konsumera med lånta pengar, dvs just det som ledde fram till katastrofen.

Detta kan inte vara klokt.

Rolf Englund blog 5 december 2009

Top of page

News

Output is financially sustainable when spending patterns and the distribution of income are such that the fruit of economic activity can be absorbed without creating dangerous imbalances in the financial system.

It is unsustainable if generating enough demand to absorb the output of the economy requires too much borrowing, real rates of interest rates that are far below zero, or both.

Martin Wolf, FT 14 April 2015

Full text

Top of page

Next Bubble Is Forming: U.S. Government Bonds

Martin Wolf at IntCom

News

We May Be Facing a Textbook Emerging-Market Crisis

Argentina and Turkey look like outliers but the rot could spread fast.

Satyajit Das Bloomberg 3 september 2018

Do eerie parallels presage new crisis?

Falling oil, rising dollar and US rate rise fears also present in 1997-98

Satyajit Das, FT February 23, 2015

Weak growth, high debt levels, disinflation or deflation, policy driven destructive competitive devaluations, inflated financial risk taking and mispricing compounds the problems.

The impending crisis may develop as follows.

Full text

A future crisis is likely to unfold as follows.

Satyajit Das, FT October 29, 2014

Central banks have created the illusion of calm. It won't last.

Satyajit Das, Bloomberg 3 januari 2018

The biggest debt write-offs in the history of the world

In 1792BC, the self-proclaimed King Hammurabi of Babylon forgave all citizens’ debts owed to the government, high-ranking officials, and dignitaries.

If any one owe a debt for a loan, and a storm prostrates the grain, or the harvest fail, or the grain does not growth for lack of water,

in that year he need not give his creditor any grain, he washes his debt-tablet in water and pays no rent for this year.

Hammourabi’s jubilees were part of a long line of debt cancellations that can be traced back to Mesopotamia as long ago as 2400BC.

Mehreen Khan, Telegraph, 2 Feb 2015

Following the end of WWII, the London Debt Agreement of 1953 saw the abolition of all of Germany's external debt.

The total forgiveness amounted to around 280pc of GDP from 1947-53, according to historian Albrecht Ritschl.

Full text

Crashes

The U.S. dollar, at its highest level in nine years, is about to fall off its perch.

That’s the outlook, at least, of Lawrence G. McDonald, n his New York Times best-seller, “A Colossal Failure of Common Sense,” warned colleagues at Lehman Brothers

Energy companies took out $1.6 trillion worth of debt since 2009. Since 2012, emerging market governments and companies have taken out around $2 trillion worth of debt.

The catch here is that they often borrowed in dollars.

MarketWatch 7 january 2015

Top of page

The US Federal Reserve has pulled the trigger. Emerging markets must now brace for their ordeal by fire.

They have collectively borrowed $5.7 trillion in US dollars, a currency they cannot print and do not control.

This hard-currency debt has tripled in a decade, split between $3.1 trillion in bank loans and $2.6 trillion in bonds.

It is comparable in scale and ratio-terms to any of the biggest cross-border lending sprees of the past two centuries.

Ambrose Evans-Pritchard 17 Dec 2014

Full text

The Fed put

Federal Reserve uttered the single word “patience” and everything changed.

On Wednesday the stock market rose 2 per cent and on Thursday the Dow Jones Industrial index had its best day in three years.

The market dependence on Fed policy has never seemed greater

Financial Times December 19, 2014

The lights are again flashing red on the dashboard of the world economy, David Cameron warned yesterday.

Just to extend the metaphor, the plane is flying on empty, having pretty much exhausted its fiscal and monetary reserves,

and there is no sign of a safe landing strip in sight.

Jeremy Warner, Telegraph, 18 Nov 2014

Finanskriskommittén

Riksgäldens garantiprogram för bankerna infördes 2008.

Sammanlagt ställdes bankgarantier för 354 miljarder kronor.

SvD Näringsliv 18 november 2014

Finanskrisen

Martin Wolf på Financial Times är, vågar jag påstå, den världsledande journalisten på området finansiell ekonomi.

När han analyserar den globala finanskris som fortfarande pågår lyssnar alla som vill förstå.

Nils Lundgren, Axess Magasin nr 8, november 2014

Wolf konstaterar att bara sedan 1980 har vi drabbats av sex stora finanskriser som har skakat världsekonomin:

den latinamerikanska krisen (tidigt 1980-tal), den japanska krisen (tidigt 1990-tal), Tequilakrisen (inleddes i Mexiko 1994), den ostasiatiska krisen (1997–1999), den globala finanskrisen (2007–2009) och eurozonkrisen (2010–2013).

Därtill har det uppstått många finanskriser av mera begränsad och regional karaktär.

Den svenska finanskrisen 1990–1994 var mycket dramatisk och förändrade svensk ekonomi och politik på ett genomgripande sätt.

Enligt en IMF-rapport från 2012 inträffade inte mindre 147 bankkriser under perioden 1970–2011.

Det är uppenbart att den globala finanssektorn är extremt instabil och att

de realekonomiska kostnaderna för dessa finanskriser i form av förlorad produktion, arbetslöshet och kapitalförluster är enorma.

Något är i grunden fel!

Wolfs bok handlar om de två senaste kriserna på listan.

Full text

Ja till EU - nej till EMU?

Huvudpunkter i Nils Lundgrens föredragning i Helsingfors inför riksdagens utrikesutskott den 21 september 1994

Ja, det var 1994 och det håller än

In my book, The Shifts and the Shocks, I suggest that a number of shifts in the world economy

created chronically weak demand in the absence of credit booms.

US, the eurozone, Japan and the UK have been suffering from “chronic demand deficiency syndrome”.

More precisely, their private sectors have failed to spend enough to bring output close to its potential

without the inducements of ultra-aggressive monetary policies, large fiscal deficits, or both.

Martin Wolf, FT November 25, 2014

What happens then is a “balance-sheet recession” – a period when the indebted focus on paying down debt

Still more unorthodox is outright monetary financing of fiscal deficits,

as Adair Turner, former chairman of the UK’s Financial Services Authority, has recommended.

This means nationalising the creation of money now delegated to often-irresponsible private banks.

Full text

Martin Wolf

Today’s most important economic illness: chronic demand deficiency syndrome.

David Cameron “red warning lights are once again flashing on the dashboard of the global economy”.

Martin Wolf, Financial Times 18 november 2014

RE: The best book I have ever read

In my book The Shifts and the Shocks, I argue that pre-crisis trends

– huge global current account imbalances, rising inequality and weak propensity to invest –

had already created weak underlying demand in high-income countries.

The de facto response of policy makers was toleration, if not promotion, of credit booms.

When these collapsed, extraordinary policy easing was needed both to replace the lost demand impetus from the credit bubbles and to

offset the drag on demand from debt overhangs, predominantly in private sectors:

too many people had borrowed too much.

Martin Wolf, FT October 9, 2014

The Germans have a name for their unique economic framework: ordoliberalism.

Wolfgang Münchau FT 16 November 2014

List of economic crises

Wikipedia

Eevery Fed tightening cycle has brought a financial crisis. Here is the list.

Chad Hudson March 2, 2005

Hindsight is a wonderful thing, especially when it comes to explaining market crashes.

The glaringly obvious guide to the next crash

James Mackintosh, FT September 21, 2014

The financial crises and the years of economic malaise that followed represent profound failures of the economy and of policy.

Above all, they were failures of understanding.

We have learnt much since. But we have not learnt enough to avoid a repeat of this painful experience.

As I argue in a new book, we retain unbalanced and financially fragile economies.

Martin Wolf, Financial Times, September 3, 2014

Those in charge saw little danger in the rapid growth of credit; they were largely unconcerned by rising leverage; they thought financial innovation added to rather than reduced stability;

and they believed it was easier to clean up after asset-price bubbles burst than to prevent them from growing in the first place.

On all this they were proved wrong, as the late and disregarded Hyman Minsky had sought to warn them.

The new regulatory regime is an astonishingly complex response to the failures of this model.

But “keep it simple, stupid” is as good a rule in regulation as it is in life.

The sensible solution seems clear: force banks to fund themselves with equity to a far greater extent than they do today.

Full text

Martin Wolf, The Shifts and the Shocks: What We’ve Learned – and Have Still to Learn – from the Financial Crisis

Martin Wolf

Glass-Steagall Act

Economic theory discredited

One of the United States’ defining – and disheartening – economic trends over the last 40 years has been

real-wage stagnation for most workers.

Median full-time male worker earned $50,033 in 2013,

barely distinguishable from the comparable (inflation-adjusted) figure of $49,678 in 1973.

Laura Tyson, Project Syndicate, 26 September 2014

Because most households earn the bulk of their income from their labor, the absence of real-wage growth is a major factor behind the stagnation of family incomes. The average family income of the bottom 90% of households has been flat since about 1980. Real family income for the median household in 2013 was 8% below its 2007 level and nearly 9% below its 1999 peak.

Stagnating middle-class wages and family incomes are a major factor behind the US economy’s slow recovery from the 2007-2009 recession, and pose a serious threat to long-term growth and competitiveness. Household consumption accounts for more than two-thirds of aggregate demand, and consumption growth depends on income growth for the bottom 90%.

Read more here

Marian Radetzki, unemployment and Stall Speed

The Greater Depression

First it was the 2007 financial crisis. Then it became the 2008 financial crisis.

Next it was the downturn of 2008-2009. Finally, in mid-2009, it was dubbed the “Great Recession.”

Late 2009, the world breathed a collective a sigh of relief. We would not, it was believed, have to move on to the next label,

which would inevitably contain the dreaded D-word. But...

J. Bradford DeLong, Project Syndicate, 28 august 2014

Read more here

Stabiliseringspolitik

The world is at risk of another financial crash following a steep rise in asset prices,

according to Raghuram Rajan, governor of the Reserve Bank of India

– and one of the few people to have warned of the last financial crisis.

FT 7 August 2014

UK house price growth has taken the multiple of average home values to

more than five times earnings for the first time since the financial crisis.

Telegraph 7 August 2014 with nice chart

Why We're Doomed: Interest and Debt

Charles Hugh Smith, July 15, 2014

Full text

BIS Slams the Fed

"A Controlled Collapse?"

I propose Yellen is clueless. If she had any sense, she would have acted in advance to prevent an asset bubble

or at least stall the one Bernanke had started.

The Fed is not going to attempt a controlled collapse.

Yet, a collapse is coming. It will be anything but controlled.

Mike "Mish" Shedlock, 11 July 2014

The Coming Liquidity Crisis

What was the cause of the last crisis? Everybody points to subprime debt, but that was really just a trigger.

What happened was that everybody in the financial world became distrustful of everybody else’s balance sheet

Dylan Grice and John Mauldin 7 July 2014

What was the cause of the last crisis? Everybody points to subprime debt, but that was really just a trigger.

What happened was that everybody in the financial world became distrustful of everybody else’s balance sheet

and so decided to go to cash, but there was so much debt and so much invested in illiquid assets that everybody couldn’t get out of the theater at the same time.

It is happening again today.

The intense drive for yield is driving down interest rates and volatility, pushing up assets of all kinds,

and setting us up for the same song, second verse of the 2008 crisis.

While I have been hinting around about that possibility for some time, it really crystallized for me this morning

as I was reading the latest “Popular Delusions” from Dylan Grice.

Let me quote a bit from the opening of his typically brilliant essay:

French ten-year bonds (OATS) are paying 1.7%. Spanish (2.68%) and Italian (2.83%) debt are paying roughly the equivalent of US debt. German debt, at 1.27%, pays less than half of US debt at 2.64%. Somewhere in that equation, sovereign debt is spectacularly mispriced. Rated ten-year corporate bonds are paying between 3% and 3.4%. That is less than a 1% premium for bonds that are only single-A. Seriously?

You should be thinking of cash not as cash per se, but as an option on future deep-value trades.

Full text

www.edelweissjournal.com/issues

Doom

The International Monetary Fund pointed out this month that housing can do a lot of damage.

An increase in prices provides an initial spur to the wider economy: construction activity is boosted and homeowners grow richer.

But as a boom continues, leverage grows and price rises become unsustainable.

The bursting of a bubble devastates bank balance sheets and leaves behind an economy that must painfully reallocate productive resources from a bloated construction industry to other sectors.

Mark Schieritz, economics correspondent of Die Zeit, Financial Times June 22, 2014

”Det kan vara årets viktigaste bok om ekonomi, det skulle kunna vara den viktigaste boken sedan finanskrisen.”

Det är inget dåligt beröm författarna Atif Mian och Amir Sufi får för sin bok 'House of debt' och berömmet kommer från ingen mindre än Larry Summers.

Louise Andrén Meiton, SvD Näringsliv 15 juni 2014

Lawrence Summers on ‘House of Debt’

Did the response to the financial crisis focus too much on banks while neglecting over-indebted homeowners?

Lawrence Summers, Financial Times June 6, 2014

Claudio Borio, the BIS's chief economist,

says this refusal to let the business cycle run its course and to purge bad debts is corrosive.

leads to "time inconsistency". It steals growth and prosperity from the future,

and pulls the interest rate structure far below its (Wicksellian) natural rate.

"The risk is that the global economy may be in a deceptively stable disequilibrium," he said.

Ambrose Evans-Pritchard 4 June 2014

Full text

Bubbles have three stages: expansionary; then contractionary; and,

finally, perhaps inflationary.

The world economy is now in the second stage.

That is why today's worry is deflation. But it is unlikely to stay there for ever.

Ultimately, efforts to ward off post-bubble deflation risk creating its opposite.

A more helpful guide is the Swedish-Austrian theory of the business cycle, developed by Knut Wicksell

Martin Wolf Financial Times 28/5 2003

Top of page

From March 2000 to the autumn of 2002,

the US stock market declined more than 40 per cent. Losses were a staggering $8tn.

The reason that the real economic effects of the collapse of internet stocks were well contained is that the internet bubble was not financed by debt

Contrast the situation that followed the collapse of real estate prices in 2007

after a period when the (inflation adjusted) prices of single family houses had doubled over the preceding decade.

Burton Malkiel, author of A Random Walk Down Wall Street, Financial Times 21 May 2014

Full text

Don't Sell Out

Burton G. Malkiel. Wall Street Journal 2001-09-26

A Random Walk Down Wall Street

Martin Hellwig ”The Bankers' New Clothes: What's Wrong with Banking and What to Do About It”

The 2008 crisis was made possible by an extremely fragile financial system

in which banks and many other businesses indulged in excessive leverage — too much borrowing — as well as hazardous reliance on short-term funding

and negligent risk management, with lax regulatory supervision by the government.

Roger E. Alcaly, The York Review of Books, 5 June 2014

The regulatory failures in the buildup to the recent crisis were induced by the same complacency that infected the financial system and economy

in the latter stages of the period economists call “the great moderation,” beginning in the early 1980s and spanning roughly two decades of relatively steady growth and low inflation,

interrupted only by recessions that were short and mild.

Full text

"This is the most important book to have come out of the financial crisis", Martin Wolf

Top of page

Are financial crises an inevitable feature of capitalism?

Must the government rescue the system when huge crises occur?

In his book Stress Test , Timothy Geithner answers “yes” to both questions.

Yet these answers also harm the legitimacy of a market economy.

Martin Wolf, Financial Times, 27 May 2014

It is bad enough if capitalism is crisis-prone.

It is worse still if the state feels obliged to rescue those whose folly or criminality caused the damage, to protect the innocent.

Mr Geithner argues not only that crises are sure to recur but that governments must react with overwhelming force.

The only way to stop a crisis is to remove the circumstances making it rational to panic.

Full text

"a how-to manual for anyone faced with a financial crisis"

Mr Geithner was known for his brutal candour, and as an author, he does not disappoint.

Stress Test: Reflections on Financial Crises

The Economist print 17 May 2014

At one meeting he realised that John Thain, Merrill Lynch’s chief, did not know the name of his chief risk officer who was sitting next to him.

In 2008 he had the right instinct. But taken too far, it affirms suspicions that many firms and markets are “too big to fail”

Full text

Tim Geithner

Stress Test: Reflections on Financial Crises, lunch with Martin Wolf

"the big persistent misperception is that we acted out of an excessive concern for the banks"

Financial Times 15 May 2014

In the 1990s, he worked on the Mexican and Asian crises.

As president of the New York Federal Reserve (2003 to January 2009) and then as President Barack Obama’s Treasury secretary (until January 2013),

he was at the centre of efforts to cope with the financial crisis that hit the US in 2007 and reached its peak a year later.

“to lean against the instinctive reactions people have in a normal crisis, which is to let it burn out, be indifferent to the failure of individual firms, or embrace austerity quickly.

And I think the big persistent misperception is that we acted out of an excessive concern for the banks rather than out of recognition that if you leave the country vulnerable to the failure of the system,

you leave the average person exposed to much greater damage even than we saw in this crisis.”

Martin Wolf: My own view is that the people, including Geithner, who dealt with this crisis made big mistakes

but also saved the world from another Great Depression

Full text

Tim Geithner

Martin Wolf

Lehman Brothers

Utvecklingen av finanskrisen, som briserade 2008, hade kunnat se helt annorlunda ut.

Det slår Timothy Geithner, chef på Federal Reserves New York-kontor fast i sin nya bok "Stress test".

SvD Näringsliv, 13 maj 2014

“The Great Recession: Causes and Consequences.”

We were suffering from inadequate demand.

Why, at the moment it was most needed and could have done the most good, did economics fail?

Paul Krugman, NYT 1 May 2014

Policy makers and politicians have ignored both the textbooks and the lessons of history. And the result has been a vast economic and human catastrophe, with trillions of dollars of productive potential squandered and millions of families placed in dire straits for no good reason.

Economists who took their own textbooks seriously quickly diagnosed the nature of our economic malaise: We were suffering from inadequate demand.

The financial crisis and the housing bust created an environment in which everyone was trying to spend less, but my spending is your income and your spending is my income, so when everyone tries to cut spending at the same time the result is an overall decline in incomes and a depressed economy.

And we know (or should know) that depressed economies behave quite differently from economies that are at or near full employment.

For example, many seemingly knowledgeable people — bankers, business leaders, public officials — warned that budget deficits would lead to soaring interest rates and inflation.

But economists knew that such warnings, which might have made sense under normal conditions, were way off base under the conditions we actually faced.

Sure enough, interest and inflation rates stayed low.

Full text

Economic theory discredited

Stabiliseringspolitik

Money Mania: Booms, Panics and Busts from Ancient Greece to the Great Meltdown by Bob Swarup. Bloomsbury Press

So what does Mr Swarup’s offering, Money Mania, add to the field? First it is unusually well-told, and expansive in scope.

Similarities between different episodes are breathtaking. Events in Ancient Rome and Athens, and Georgian Britain followed the same pattern as the crisis of 2008.

Review by John Authers, FT 27 April 2014

David Wessels bok om finanskrisen 'In Fed we Trust' Ben Bernanke's War on the Great Panic

I december firade Federal Reserve 100 år.

I december var det också fem år sedan styrräntan sänktes mot noll.

Louise Andrén Meiton, SvD 28 mars 2014

Wall Street banks and their foreign rivals have paid out $100bn in US legal settlements

since the financial crisis, according to Financial Times research

regulators and the Obama administration seek to counter perceptions that bankers have got off lightly for their role in the financial crisis.

Financial Times, 25 March 2014

Now that Ben Bernanke is no longer the head of the Fed, he can finally tell the truth about what caused the financial crash.

At least that's what a packed auditorium of over 1000 people as part of the financial conference staged by National Bank of Abu Dhabi, the UAE's largest bank, was hoping for earlier today when they paid an exorbitant amount of money to hear the former chairman talk.

Ben Bernanke about what caused the financial crash

So what was the reason, according to the man who was easily the most powerful person in the world for nearly a decade?

Ready?

"Overconfidence."

Tyler Durden, zerohedge, 4 March 2014

Bernanke's explanation, brought to us by Reuters, we wonder: did he perhaps get into the reason for the overconfidence? Maybe such as the Fed's endless hubris in believing it knew what it was doing, when time after time and especially over the past 30 years, the US central bank has shown that all it now does is lead the nation from bubble to bubble, from crisis to crisis, and replaces one asset bubble, first the dot com, then the housing, with another, even bigger one, until we get to the biggest bubble of all time - the stock market as you see it currently, where the S&P 500 soars to all time highs and when news of an ICBM launch can barely cause a dent in a ridiculous upward ramp driven by, you guessed it, overconfidence.

Full text at zerohedge

Ben Bernanke

Matthew O’Brien at The Atlantic has done the math. Fed.

In August 2008 there were 322 mentions of inflation, versus only 28 of unemployment and 19 of systemic risks or crises.

In the meeting on Sept. 16, 2008 — the day after Lehman fell! — there were 129 mentions of inflation

versus 26 mentions of unemployment and only four of systemic risks or crises.

Paul Krugman, 2 March 2014

In part it reflects the belief that the government should never seek to mitigate economic pain, because the private sector always knows best.

Back in the 1930s, Austrian economists like Friedrich Hayek and Joseph Schumpeter inveighed against any effort to fight the depression with easy money;

to do so, warned Schumpeter, would be to leave “the work of depressions undone.”

Modern conservatives are generally less open about the harshness of their view, but it’s pretty much the same.

Full text

How the Fed Let the World Blow Up in 2008

High oil prices blinded the Fed to the growing danger before the crash

MATTHEW O'BRIENFEB 26 2014

Can the European Central Bank legally act as lender of last resort to ensure the survival of the euro?

This question is of fundamental importance for the sustainability of the monetary union.

Recently, the German Constitutional Court ruled that it cannot.

In the court’s view the ECB has the power to conduct monetary policy,

but not to support member states in financial distress even if necessary to ensure the survival of the common currency.

Katharina Pistor, Vox, 26 February 2014

Janet Yellen announced February 19th that America’s central bank is moving to

cut off the massive financial lifeline that has been subsidizing the European banking system since the beginning of the global financial crisis in March of 2008.

By delaying foreign bank compliance with the stringent capital and borrowing requirements of section 165 of the Dodd–Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank) imposed on American banks,

the Fed was engaging in the moral hazard of allowing Europe to borrow at virtually zero interest from the Fed to fund its bloated social welfare states.

Chair Yellen’s actions mean the Fed is cutting off Europe and providing greater support for U.S. borrowing.

Breitbart, 24 February 2014

Full text

RE: Det förefaller som om det var Fed och inte ECB som ställde upp som Lender of Last Resort för de europeiska bankerna

som professor Pelotard har viskat i mitt öra.

The Federal Reserve final rule requiring higher capital levels from non-US banks,

including Deutsche Bank, Barclays and Credit Suisse,

with the aim of avoiding a US government bailout if their New York operations run into trouble.

FT February 19, 2014

European bank executives welcomed concessions by the Fed,

which came after a massive lobbying effort that enlisted the support of some US banks worried about retaliation from European regulators.

In particular, several bankers and lawyers said that they were relieved by a delay in the implementation

allowing more time for banks to increase their capital levels by retaining profits.

Full text

Thanks To QE

Bernanke Has Injected Foreign Banks With Over $1 Trillion In Cash For First Time Ever

Tyler Durden, zerohedge, 21 May 2013

Full text

How The Fed Is Handing Over Billions In "Profits" To Foreign Banks Each Year

All the cash generated by Fed excess reserves, has gone to foreign banks operating in the US, which according to the Fed, are vastly composed of European financial institutions.

Tyler Durden, zerohedge, 11 February 2013

Why has the Fed paid some $6 billion in interest to foreign banks, in the process subsidizing and keeping insolvent European and other foreign banks, in business and explicitly to the detriment of countless US-based banks who have to compete with Fed-funded foreign banks

Full text

The Fed's $600 Billion Stealth Bailout Of Foreign /European/ Banks Continues

At The Expense Of The Domestic Economy, Or Explaining Where All The QE2 Money Went

Tyler Durden, zerohedge, 6 December 2011

Courtesy of the recently declassified Fed discount window documents, we now know that the biggest beneficiaries of the Fed's generosity during the peak of the credit crisis were foreign banks, among which Belgium's Dexia was the most troubled, and thus most lent to, bank.

Many speculated that the US central bank would primarily focus its "rescue" efforts on US banks, not US-based (or local branches) of foreign (read European) banks: after all that's what the ECB is for.

If it becomes popular knowledge that the Chairman of the Fed, despite explicit instructions to enforce the trickle down of "printed" dollars to US banks, was only concerned about rescuing foreign banks with the $600 billion in excess cash created out of QE2, then all political hell is about to break loose

Full text

Basel

Banks

ECB

Yellen

Top of page

The Great Recession: Bailout

Paul Krugman, NYT, 23 February 23, 2014

Download from here

Pdf

Recession - The R-word - Transcripts

Policy makers at the Federal Reserve tell us not to worry,

that it’s mostly just bad weather and the normal ups and downs of the economic data.

But what if they’re wrong? Would they tell us if they thought we were heading for a new recession?

Rex Nutting, MarketWatch, Feb. 27, 2014

Laughing all the way to an economic crash

How the central bank coped with a crisis

DAVID WEIDNER'S WRITING ON THE WALL, MarketWatch, Feb. 25, 2014

“There are some critics who say we panicked in response to the market sell-off of that Monday.

I do not believe that’s the case, and I don’t believe it’s the case because I find it impossible to believe.”

Hilarious. What’s also impossible to believe was that curious bit of logic was spoken by Richard Fisher, president of the Federal Reserve Bank of Dallas, in 2008.

Fisher was speaking at one of several meetings of the Fed’s Open Market Committee in response to a financial crisis that was unfolding.

Transcripts of those meetings, more than 1,500 pages worth , were released at the end of last week

William C. Dudley, head of the open market desk, at one key meeting in June 2008. That month he gave a status report to the committee about Lehman Brothers, which would file for bankruptcy less than 90 days later.

“Lehman’s short-term financing counterparties have generally proved to be patient,” Dudley said. “The financing backstop provided by the Primary Dealer Credit Facility has been cited by many counterparties as a critical element that has encouraged them to keep their financing lines to Lehman in place.”

To be fair to Dudley, his assessment wasn’t too far off at the time. The worst of Lehman’s descent didn’t happen until September.

Full text

Transcripts of the U.S. central bank's meeting on Sept. 16 2008

Feb 21, 2014 Reuters/CNBC

Federal Reserve policymakers, in an emotional meeting on one of the darkest days of the 2008 financial crisis, were worried the failure of Lehman Brothers a day earlier would wreak havoc on a teetering financial system but feared cutting already low interest rates might prove an over-reaction.

Transcripts of the U.S. central bank's meeting on Sept. 16 of that year, released on Friday, showed then Fed Chairman Ben Bernanke flatly telling his colleagues he was philosophically torn about the collapse of the investment bank.

They also threw fresh light on a debate over whether to loosen monetary policy in the face of a crisis that was fast engulfing financial markets but which some policymakers thought would be resolved relatively quickly.

Full text

Full text of Transcripts at Fed

Lehman Brothers

On the morning after Lehman Brothers filed for bankruptcy in 2008, most Federal Reserve officials still believed that the American economy would keep growing despite the metastasizing financial crisis.

The Fed’s policy-making committee voted unanimously against bolstering the economy by cutting interest rates, and several officials praised what they described as the decision to let Lehman fail,

saying it would help to restore a sense of accountability on Wall Street.

That optimism would not long endure. Just minutes after the end of that first meeting, a smaller group of Fed officials agreed to rescue the faltering insurance giant the American International Group, a company never before subject to Fed supervision that until then was barely on the government’s radar.

New York Times, 21 February 2014

As the world’s financial system stood on the verge of collapse in October 2008, Janet L. Yellen...

Mr. Bernanke, as chairman, played the role of mediator and consensus builder, Ms. Yellen often became the most outspoken defender of the policies, and a reference point for others.

New York Times, FEB. 21, 2014

Centralbanker skall INTE vara förutsägbara

Det är inte bra att aktörerna känner sig säkra. Det gör dem bara med oförsiktiga.

Rolf Englund blog 2014-02-13

Full text

Investors are hoping for a Goldilocks outcome for the US economy,

with growth forecast to be close to 3 per cent, but inflation just 1.6

This may happen. But the consensus is dangerously, well, consensual.

The gap between the highest and lowest growth forecasts is down to levels last seen at the height of the credit bubble in 2007, and before that at the end of the dotcom boom.

James Mackintosh, FT 11 Febr 2014

The danger is that investors, economists and the Fed turn out to be wrong.

When everyone agrees, any upset disturbs markets far more than when there is a wide range of views, as all will want to change their position at once.

Full text

Goldilocks

Top of page

This time is different

Don’t fret about soaring asset prices – this time is different

The probability of a rerun of what happened in the past decade is low

Wolfgang Munchau, Financial Times, December 29, 2013

All-time-high house prices in 10 of top 50 US metro areas

Home prices have zipped back into record territory in a handful of American cities,

a milestone that comes seven years after the housing bust ravaged the market and the broader economy.

MarketWatch, Dec. 30, 2013

Rolf Englund blog 5 december 2009:

- Jag tycker det är skriande uppenbart att räntan världen över är för låg och att en större del av stimulanserna borde ske via finanspolitiken. Men väljarna och därmed deras medlöpande politiker är rädda för budgetunderskott och vill hellre att villaägarna skall låna än att staten skall göra det.

Strategin synes vara att det gäller att stabilisera, helst höja, villapriserna så att konsumenterna främst i USA skall återgå till att konsumera med lånta pengar, dvs just det som ledde fram till katastrofen.

Detta kan inte vara klokt.

Klicka här

This is the most important book to have come out of the financial crisis.

The Bankers’ New Clothes: What’s Wrong with Banking and What to Do About It,

by Anat Admati and Martin Hellwig, Princeton

Review by Martin Wolf, March 17, 2013

Eight ways conventional financial wisdom has changed post crisis

Nobody assumes subprime mortgage bonds are safe, for example, or blithely trusts triple-A credit ratings.

Nor do they presume that big banks cannot collapse, or that western central banks cannot keep rates at zero.

Gillian Tett, Financial Times December 26, 2013

Full text

Gillian Tett - Asset price bubbles and Central Bank Policy

Posterity will regard the economic performance we are now witnessing as a golden age.

It will also know, although we do not, how long this era lasts.

Martin Wolf, FT, 2/5 2007

When Lehman Brothers went bankrupt and AIG was taken over by the US government in the fall of 2008, the world almost came to an end.

Major banks in the US and the UK were literally hours away from shutting down, and ATMs were on the verge of running out of cash.

John Mauldin 29 October 2013

From 2008 to now: Charts of the financial crisis

MarketWatch, September 18, 2013

Watch the charts here

Varför min sida om Finanskrisen heter hedgefunds.htm

Finanskrisen och därmed eurokrisen tog sin början i Frankrike,

när tre hedgefonder tillhöriga Frankrikes största bank, BNP Paribas,

inställde betalningarna i augusti 2007.

Rolf Englund blog 26 augusti 2013

Stockholmsbörsen rasar för tredje dagen i rad, en nedgång som kostat aktieägarna nästan 300 miljarder kronor.

Årets uppgång är snart ett minne blott - och ett 40-tal aktier handlas på årslägsta.

DI 24 juni 2013

Full text

Hollande Bids Adieu to EU Vacation Culture as Crisis Lingers

six years after a phone call from Frankfurt shattered former European Central Bank President Jean-Claude Trichet’s holiday in northern France.

The caller informed him that three troubled BNP Paribas SA hedge funds were causing money markets to seize up, the first signal that a global financial crisis was breaking out.

Bloomberg, Aug 26, 2013

You could read about it at the time on this website

Dow 2003-2013

"We are all Keynesians now"

Why do we pursue austerity when it seems not to work?

Rogoff and Reinhart?

John Mauldin 22 April 2013

Highly Recommended

What do I think about the real problems that are surfacing in the Rogoff and Reinhart assertion that debt above a ratio of 90% debt to GDP seems to slow economic growth by 1% (especially since I have quoted that data more than a few times)?

The first question comes from correspondence I have had with Ms. Aga Barberini, who works in the investment world in Milan, Italy. She came there from Poland some 20 years ago.

- I will vote Berlusconi again. I can't stand communists even if they call themselves "the left."

If by "working" we mean that austerity is supposed to produce growth, then of course it doesn't work. By definition, austerity means you are reducing a fiscal deficit, and doing so will reduce growth in the short term. That begs the question, why would you want to do that?

"Austerity" is now the name we give to the situation where a government has to limit its spending during an economic downturn or recession.

"We are all Keynesians now" is a famous phrase uttered by Milton Friedman and attributed to US President Richard Nixon.

(The phrase was first attributed to Milton Friedman in the December 31, 1965, edition of Time magazine. In the February 4, 1966, edition, Friedman wrote a letter clarifying that his original statement was, "In one sense, we are all Keynesians now; in another, nobody is any longer a Keynesian.") (Wikipedia)

The problem that arose was that most countries rarely followed through on the second part of Keynes's prescription, which was to pay back the debt when times were good.

My inbox almost exploded the last two days as friends and colleagues sent me links to multiple sources talking about the problems with Rogoff and Reinhart's work and asked for my thoughts. Given that I find This Time Is Different one of the more important books of the last decade, let me provide some context.

In 2010, economists Carmen Reinhart and Kenneth Rogoff released a paper,"Growth in a Time of Debt."

Their main result was that "… median growth rates for countries with public debt over 90 percent of GDP are roughly one percent lower than otherwise; average (mean) growth rates are several percent lower." The work suggested that countries with debt-to-GDP ratios above 90 percent have a slightly negative average growth rate.

This has been one of the most cited stats in the public debate during the Great Recession.

If politicians want to keep the borrow-and-spend party going "just one more election cycle" and if no one takes away the punchbowl, the Bang! moment will most certainly arrive. That is the clear lesson of history.

It is almost irrelevant whether that number is 90% or 120% or 80%. It will be a different number for each country, depending on the confidence that investors have in the ability of a country to pay back its debt

As Reinhart and Rogoff wrote:

Highly indebted governments, banks, or corporations can seem to be merrily rolling along for an extended period, when bang! – confidence collapses, lenders disappear, and a crisis hits.

Bang! is the right word. It is the nature of human beings to assume that the current trend will work itself out, that things can't really be that bad. The trend is your friend … until it ends. Look at the bond markets only a year and then just a few months before World War I. There was no sign of an impending war. Everyone "knew" that cooler heads would prevail.

Italy is in a currency union called the Eurozone.

A currency union cannot allow its members to run up debts beyond what the market is willing to finance,

or the whole currency union will collapse.

Austerity is a consequence, not a punishment. A country loses access to cheap borrowed money as a consequence of running up too much debt and losing the confidence of lenders that the debt can be repaid.

Lenders don't sit around in clubs and discuss how to "punish" a country by requiring austerity; they simply decide not to lend.

If Italy were in control of its currency, might it make sense to print a little in the meantime, as the US, Great Britain, and Japan are doing?

There is certainly a school of thought that says yes. But in a currency union of multiple countries that are all at different places on the economic journey, it is almost impossible to have a one-size-fits-all monetary policy.

Full text

Martin Wolf och Rolf Englund om att den som har en sedelpress går inte i konkurs.

Click

Highly Recommended

The Last Time The Dow Was Here..

Zerohedge 5 March 2013

It is Highly Recommended to click here for Full text

It is five years to the day since the world woke up to something bad happening to the balance sheets of the world's largest banks.

That's five years since banks started to worry about lending to each other - and the global financial system started to seize up.

Stephanie Flanders, BBC Economics editor, 8 August 2012

Back then it was difficult for many outside the financial markets to see the potential risks for the global economy. It took the collapse of Lehman's investment bank and a world recession - a year later - to demonstrate that.

But, even pessimists would have hesitated to predict that Britain would still be struggling to put the crisis behind it, in the middle of 2012.

I have a more personal way of dating the crisis: my daughter, Claudia. She was born just weeks before the collapse of Lehman Brothers. Everyone said I had "missed the big story".

Now that baby is starting school next month, and the "big story" is still going strong. Alas.

Full text

Stephanie has been a reporter at the New York Times (2001); a speech writer and senior advisor to the US Treasury Secretary (1997-2001); a Financial Times leader-writer and columnist (1993-7); and an economist at the Institute for Fiscal Studies and London Business School.

She became BBC economics editor in April 2008. She has won numerous awards, including the 2010 Harold Wincott Award for online journalism.

Her father was Michael Flanders, of the 1950s and '60s musical comedy duo, Flanders and Swann.

She lives in West London with her partner and their two children.

Ambrose Evans-Pritchard, the Telegraph's international business editor,

has followed the global financial crisis from the credit crunch to the eurozone debt crisis.

Here is a selection of news and views from his stories, blogs and columns over the past five years.

Daily Telegraph, 9 August 2012

Ekot om den globla skuldkrisen

Dow Charts - Crisis jargon buster, BBC

The risks of what Sir Mervyn King, the Governor of the Bank of England, on Wednesday referred to as

the “unimaginable and unmentionable”, by which he meant a disorderly breakdown of the euro,

are high and getting worse.

Jeremy Warner, Daily Telegraph 10 Aug 2011

e24 11 augusti 02:54

Statsminister Fredrik Reinfeldt uttalar sig i kväll för första gången om den senaste finansiella oron.

– Det som skulle behöva göras är att sätta handling bakom orden om hårdare sparkrav

SvD 10 augusti 2011 kl 21:45 med bild av R omgiven av livvakter

Reinfeldt i Aktuellt 10 augusti 2011 om finanskrisen

Klicka här

De flesta av oss minns, eller bör minnas, hur den svenska regeringen, ledd av Carl Bildt, lade fram åtstramningspaket efter åtstramningspaket, likt Grekland, Irland, Italien, Spanien och Portugal i dag.

Det slutade med 500 procents ränta och Bildts berömda misslyckande som gav oss en flytande växelkurs.

Krisländerna inom eurozonen (EZ som den ibland kallas) har inte bara stora skulder och underskott i sina statsfinanser.

De har också en felaktig kostnadsnivå.

Läs mer här, på Rolf Englund blog 19 juli 2011

Det blir inte bättre av att det blir sämre

- Det är en i Sverige vanlig uppfattning att det var Göran Perssons nedskärningar som satte fart på den svenska ekonomin. Nedskärningarna räddade landet, tror många.

Men det som satte fart på den svenska ekonomin var att kronan sjönk och dollarn steg när Carl Bildt hade gjort sitt misslyckande.

Läs mer här, på Rolf Englund blog 5 juli 2011

“Central bankers have so far been the tower of strength,”

said Stefan Schneider, chief international economist at Deutsche Bank AG in Frankfurt.

“Lawmakers have done everything to destroy belief in their ability to solve the problems they’re facing.”

Bloomberg 11 August 2011

On Wednesday Mr Sarkozy summoned members of his government back from holiday for an emergency meeting

In a statement after the two hour meeting in the Elysee Palace in Paris, Mr Sarkozy said France’s pledge to reduce the budget deficit from last year’s 7.1 per cent to 3 per cent by 2013

“will be kept whatever the evolution of the economic situation”.

Financial Times 10 August 2011

Top of page

Nouriel Roubini och Arne "Ratos" Karlsson oense

Another recession may not be preventable. But policy can stop a second depression.

Nouriel Roubini

Ett så kraftigt kursfall förutsätter att man tror det ska bli en global djup recession,

och det tror inte jag

säger Arne Karlsson, vd på Ratos

Rolf Englund blog 10 augsti 2011

The general view is now that in this, the next round of the Great Recession,

there is a high risk of things getting worse, with no effective instruments at governments’ disposal.

The first point is correct but the second is not quite right.

Throughout the crisis – and before it – Keynesian economists provided a coherent interpretation of events

Joseph Stiglitz, August 9, 2011

Top of page

Skandias Realräntefond har stigit med 7,5 procent i år

Mest av alla Skandias fonder

Läs mer här

Past peak oil - life after cheap fossil fuels

Bulent Gokay, professor of international relations at Keele University UK, 4 August 2011

När Peak Oil höjer prisena och ny-Hooveristerna kör åtstramning

UK riots: 16,000 officers policing London's streets

Rolf Englund blog 9 augusti 2011

The Federal Reserve pledged for the first time to keep its benchmark interest rate at a record low at least through mid-2013

in a bid to revive the flagging recovery after a worldwide stock rout.

Bloomberg Aug 9, 2011

The underlying cause of this mess is the same as it was in the banking crash and Great Recession of 2007-9

- which is the recycling of the great surpluses of the exporting nations, China, Germany and Japan,

into the unsustainable debts of the great consuming nations, the US, UK, and much of the eurozone.

Robert Peston, BBC Business editor, 9 August 2011

Everyone agrees that bold action is required, but what kind of bold action?

Kenneth Rogoff, Financial Times August 8, 2011

Top of page

The Wilshire 5000 Total Market Index, the broadest index of U.S. stocks, lost 891.93 points, or just over 7%, Monday.

This represents a paper loss for the day of approximately $1.0 trillion.

CNN August 8, 2011

The crisis that started in the US real estate sector in 2007

has devastated state finances on both sides of the Atlantic and is threatening to wreck the euro and trigger a second global downturn.

Der Spiegel 8 August 2011

"Det gäller bara Grekland", Mycket fiffigt, Too clever by half,

men allt var fel från början

Rolf Englund blog 2011-07-22

1937! So demand will be depressed in both crisis and non-crisis economies;

this will lead to a vigorous recovery through … what?

Paul Krugman, July 21, 2011, 11:51 AM

The eurozone is a modern version of the gold standard

with the expectation that long and painful adjustment processes in deficit countries would unfold without a systemic crisis.

Miguel Carrion, Eurointelligence 19 July 2011

Top of page

UK is the most indebted advanced economy in the world

At every level – public, corporate, household and financial – the UK is attempting to pay off its debts.

As long as this continues, there's unlikely to be much growth in real terms.

Jeremy Warner, Daily Telegraph, 19 July 2011

Top of page

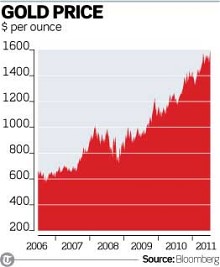

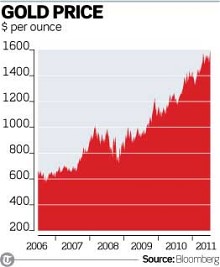

The World's Biggest Gold Reserves

CNBC July 2011

Raising taxes or cutting spending has side effects that cannot be ignored.

Either one or both will make it more difficult for the economy to grow. Let’s quickly look at a few basic economic equations.

The first is GDP = C + I + G + net exports, or

GDP is equal to Consumption (Consumer and Business) + Investment + Government Spending + Net Exports (Exports – Imports).

This is true for all times and countries.

John Mauldin 16 July 2011

Top of page

A question (to which I don’t have the full answer):

Why are the interest rates on Italian and Japanese debt so different?

As of right now, 10-year Japanese bonds are yielding 1.09 %; 10-year Italian bonds 5.76 %

Paul Krugman, July 16, 2011

Top of page

"50-60 procent nedsida för lägenhetspriserna"

säger Lars Wilderäng

e24 2011-07-12

Top of page

The Relationship Between Peak Oil and Peak Debt - Part 1

Gail Tverberg Tuesday, 12 July 201

The Economic Consequences of the Peak

Martin Wolf:

The US may be on the verge of making among the biggest and least-necessary financial mistakes in world history.

In the US, utopians of the right are seeking to smash the state that emerged from the 1930s and the second world war.

Via Rolf Englund blog

The key point here is the difference between raising the economy’s long-run growth rate, which is very hard,

and increasing demand when the economy is operating below potential, which isn’t hard at all.

Paul Krugman blog 12 July 2011

Top of page

50.2 billion USD, 330 miljarder SEK in May

The trade deficit in the U.S. widened in May to the highest level in almost three years, reflecting a surge in crude oil imports.

The gap grew 15 percent to $50.2 billion, exceeding all forecasts of 73 economists surveyed by Bloomberg News and the biggest since October 2008

Bloomberg 12 July 2011

Sverige, Irland och deras Tiger-ekonomier och bostadsbubblor

Rolf Englund blog 11 juli 2011

Tidskriften The Economist placerar Sverige bland de länder som har världens mest övervärderade bostadsmarknader.

Bara Hongkong, Australien och Frankrike anses ha mer uppblåsta huspriser.

DN 11 juli 2011

Confessions of a Financial Deregulator

Depression-era restrictions /Glass-Steagall/ on risk seemed less urgent,

given the US Federal Reserve’s proven ability to build firewalls between financial distress and aggregate demand.

New ways to borrow and to spread risk seemed to have little downside.

J. Bradford DeLong, project-syndicate.org, 2011

The Sorrow and the Pity of Another Liquidity Trap

I had read Hicks. I even knew Hicks. But I thought that his era, the Great Depression, had passed.

Brad DeLong, Bloomberg 5 July

Top of page

The truth is that creating jobs in a depressed economy is something government could and should be doing

Paul Krugman NYT 10 July 2011

Good, bad really, charts showing US Employment and Unemployment

John Mauldin 9 July 2011

While Democrats favor tax increases and mild adjustments to entitlements, Republicans pound the table for trillions of dollars of spending cuts and an axing of Obamacare.

Both, however, somewhat mystifyingly, believe that balancing the budget will magically produce 20 million jobs over the next 10 years.

Bill Gross, July 2011

Stall speed

Richard Yamarone notes that if year-over-year GDP growth dips below 2%, a recession always follows.

John Mauldin 2 July 2011

Debt ceiling

Although it is still very likely that Republican leaders in Congress will strike a last-minute deal with the White House,

the very fact that the two sides can contemplate a fight to the death over this issue is truly frightening,

not only for America but for the world as a whole.

Anatole Kaletsky, The Times July 6 2011

The Housing Horror Show Is Worse Than You Think

It starts with a steep decline lasting three or four years, followed by a brief rally that ends in years of stagnation.

The Dow took 35 years to return to pre-crash levels. The Nikkei trades at less than a third of where it peaked 22 years ago.

“The housing decline,” he says, “will be a long, multiyear process, and the multiplier effect across the economy will be enormous.”

Bloomberg 7 July 2011

Top of page

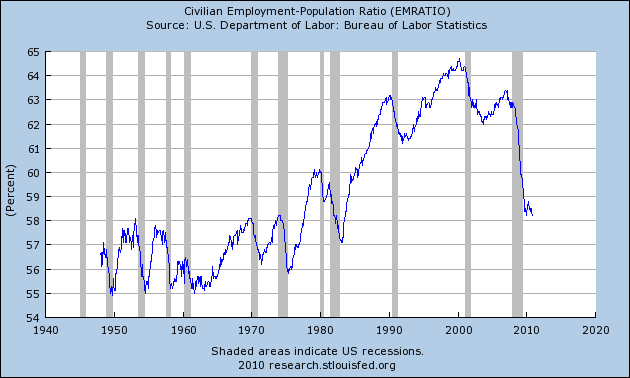

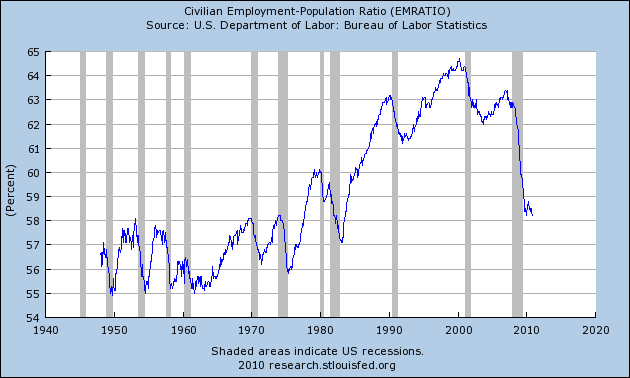

The employment population ratio fell to 58.2%, matching the lowest level during the current employment recession.

U-6, an alternate measure of labor underutilization that includes part time workers

and marginally attached workers, increased to 16.2%, the highest level this year.

CalculatedRisk 8 July 2011

Excellent graph

“Deleveraging” will dominate the rich world’s economies for years.

Done badly, it could wreck them

The process of deleveraging has barely begun

The Economist print July 7th 2011

Top of page

Europe Should Learn From Uruguay

In the 1990s he headed the advisory committees of international banks that negotiated debt-restructuring agreements for Argentina, Brazil, Mexico, Peru and Uruguay

Bill Rhodes, CNBC 7 Jul 2011

Angel Gurria, secretary general of OECD

dicusses whether there is a way out of the cycle of high debt and low growth that the developed world finds itself in.

Hard Talk BBC, 6 July 2011

Highly Recommended

Gary Shilling is looking for a brand new cyclical recession beginning in 2012

The economy, he says, is like a four-cylinder engine, and a recovery usually requires all four to be firing.

They are consumer spending, employment, housing and the reversal of the inventory cycle.

Howard Gold, MarketWatch 24 June 2011

Top of page

Nice, sort of, chart of Youth Unemployment

Sverige mellan Frankrike och Rumänien

The Economist 5 juli 2011

Grekland, Persson och Jens Henriksson

Det blir inte bättre av att det blir sämre

Rolf Englund blog 5 juli 2011

This is truly a tragedy

Barack Herbert Hoover Obama

Paul Krugman, New York Times, July 2, 2011

Many commentators remain complacent about the debt ceiling;

the very gravity of the consequences if the ceiling isn’t raised, they say, ensures that in the end politicians will do what must be done.

But this complacency misses two important facts about the situation: the extremism of the modern G.O.P.,

and the urgent need for President Obama to draw a line in the sand against further extortion.

Paul Krugman, New York Times, 30 June 2011

Top of page

Specter of Years of Stagnating Wages Haunts the Globe

Median male real US earnings have not risen since 1975

Average real Japanese household incomes after taxation fell in the decade to mid-2000s

And those in Germany have been falling in the past 10 years.

Chris Giles, Financial Times, 28 Jun 2011, via CNBC

Friedman and Keynes

Many economists agree that the drastic measures taken probably prevented a repeat of the Great Depression. But...

Howard Gold, MarketWatch 1 July 2011

Det är en i Sverige vanlig uppfattning att det var Göran Perssons motsvarande nedskärningar som satte fart på den svenska ekonomin. Nedskärningarna räddade landet, tror många.

Det som satte fart på den svenska ekonomin var att kronan sjönk och dollarn steg när Carl Bildt hade gjort sitt misslyckande.

Rolf Englund blog 29 juni 2011

Why austerity alone risks a disaster

Martin Wolf, Financial Times June 28, 2011

Top of page

Every intervention so far has pretended that the crisis is one of liquidity, which can be solved by making loans to the troubled banks and governments in question.

Since there has been no open admission of default or debt restructuring by any of the troubled nations, the banking sector has not been forced to write down debt and raise more capital.

Gavyn Davies, FT blog June 19, 2011

Top of page

Denial of peak oil becomes more dangerous by the day.

The Obama administration prattles about clean energy, solar, wind and ethanol,

when petroleum powers 96% of the transportation sector and 44% of the industrial sector.

Nice Chart

TheBurningPlatform 15 June 2011

So I sent the government another request: in the light of what the IEA has revealed, what contingency plans has the UK now made?

The response amazed me: "With sufficient investment, the government does not believe that global oil production will peak between now and 2020 and consequently we do not have any contingency plans specific to a peak in oil production."

treehugger, 17 June 2011

Top of page

What is the “stall speed” of an economy?

Unemployment tends to rise when GDP growth falls below about 2.5-3 per cent

Gavyn Davies blog June 15, 2011

Whenever a big bank becomes insolvent, the Chancellor is faced with a stark choice.

Either you can bail the bank out with taxpayers’ money, his officials will tell him, or tomorrow there will be mayhem in the markets followed by economic collapse.

With the gun placed firmly against his head, the Chancellor will always opt for the apparent lesser of the two evils, and order a bail-out.

Jeremy Warner, Daily Telegraph 15 June 2011

According to the NBER, the “Great Recession” is now two years behind us,

but the recovery that normally follows a recession has not occurred.

While growth did rise for a while, it has been anaemic compared to the norm after a recession, and it is already trending down. Growth needs to exceed 3 per cent per annum to reduce unemployment—the rule of thumb known as Okun’s Law—and it needs to be substantially higher than this to make serious inroads into it. Instead, growth barely peeped its head above Okun’s level.

It is now below it again, and trending down.

Steve Keen June 11th, 2011

Top of page

The government was warned by its own civil servants two years ago that there could be

"significant negative economic consequences" to the UK posed by near-term "peak oil" energy shortages.

Terry Macalister, guardian, 15 June 2011

The Department of Energy and Climate Change (DECC) is refusing to hand over policy documents about "peak oil" – the point at which oil production reaches its maximum and then declines – under the Freedom of Information (FoI) Act, despite releasing others in which it admits "secrecy around the topic is probably not good".

Terry Macalister and Lionel Badal, The Observer, 22 August 2010

Top of page

It's official:

The housing crisis that began in 2006 and has recently entered a double dip

is now worse than the Great Depression.

CNBC 14 Jun 2011

Top of page

Nouriel Roubini:

Världsekonomin hotas av en ”perfekt storm” bestående av usla amerikanska statsfinanser,

omstrukturering av skulder i EMU, stagnation i Japan och inbromsning i Kina

DI 2011-06-13

Roubini Says ‘Perfect Storm’ May Threaten Global Economy

Bloomberg 13 June, 2011

Top of page

BP Report

China Surpasses US As Largest Energy Consumer;

World Has 46.2 Year Of Proved Oil Reserves;

Crude Has Lots Of Upside In Real Terms

zerohedge, 8 june 2011

The extent of global oil demand is a subject that generates surprisingly little attention.

The reality is, though, that worldwide oil consumption is escalating far faster than is commonly understood.

New estimates by BP suggest that by 2030 the world will be consuming 40pc more energy than it does today.

Liam Halligan, Daily Telegraph 11 Jun 2011

Top of page

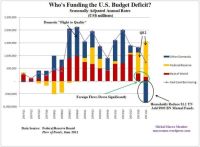

Who’s Been Buying Treasuries?

Tim Iacono 10 June 2011

Top of page

Robert Shiller, co-creator of the S&P/Case-Shiller Home Price Indices

Claiming that he wasn't making any predictions, he predicted that home prices could fall another 25 percent.

"Statisticians deal with things that repeat themselves. This housing boom and bust is so historic and unprecedented, you can't forecast the future because you have no comparison."

Diana Olick, CNBC Real Estate Reporter, 10June 2011

Household wealth has only recovered about half the $16.4 trillion lost in the Great Recession.

One reason that the U.S. economy still struggles to achieve sustained growth is that Americans are a long way from recovering the

trillions of dollars of household wealth lost during the Great Recession.

CNN 9 June 2011

Top of page

How could any central banker with half a brain have looked at that graphic

in 2003, 2004, and 2005 and not thought that there was some pretty big trouble ahead?

Tim Iacono, 8 June 2011

Top of page

It is time to drop the emphasis on core inflation

Why the Fed will repeat its worst error

Is the Fed doomed to repeat its most infamous mistake,

the 1937 monetary tightening that extended the Great Depression?

Colin Barr, CNN, 6 June 2011

Top of page

Frankfurter Allgemeine;

Deutsche Banken bangen mit Griechenland

The irony of all this is that Germany would take the biggest hit if there was the private sector participation that Angela Merkel and Wolfgang Schäuble are always asking for.

Eurointelligence 7 June 2011

Top of page

Är det rätt att stimulera ekonomin med ökade statliga utgifter i samband med en kris, som Keynes menade?

Eller kan stimulanspolitik snarare hämma den långsiktiga tillväxten, enligt Hayeks synsätt?

Om stimulansåtgärder finansieras med hjälp av tidigare överskott snarare än genom massiv belåning är riskerna med stimulanspolitik små.

Johnny Munkhammar och Nima Sanandaji, Svensk Tidskrift, 20 maj 2011

Grekland, Spanien och grunderna i macro

BNP är C + I + G +/- X Skall det vara så svårt att förstå för microhjärnorna?

Rolf Englund blog 2010-05-29

1991–1994 kom realräntechocken. Det rationella vore att släppa den fasta växelkursen.

Industrin kraschade, men regeringen behöll växelkursen, och lånade 600 miljarder för att hålla uppe statsutgifterna.

Nils-Eric Sandberg, Kristianstadsbladet 1 juni 2011

Has Vietnam turned a corner and become a good opportunity for investors?

CNBC 3 June 2011

USA: Huspriserna ner, arbetslösheten upp.

Det borde vara tvärtom för att krisen skall vara över

Rolf Englund blog 3 juni 2011

Home prices in Q1 of this year are now 2.9 percent below the previous quarterly bottom in Q1 of 2009,

effectively giving up all the gains of the past few years, which were of course fueled by the home buyer tax credit.

Diana Olick, CNBC Real Estate Reporter, 31 May 2011

the economy will need to add 200 thousand jobs per month to hold the unemployment rate steady.

The economy gained a mere 54,000 jobs in the month

The unemployment rate worsened to 9.1% from 9% in April

CNN June 3, 2011

The debate over post-crisis monetary and fiscal policy has been heating up, on both sides of the Atlantic.

So who is right? It will come as no surprise that economists disagree deeply.

Martin Wolf, Financial Times, 2 June 2011

---

A strange thing has happened to policy discussion: on both sides of the Atlantic,

a consensus has emerged among movers and shakers that nothing can or should be done about jobs.

Paul Krugman 29 May 2011

---

The disappointing economic data on US activity in recent months has brought a key policy debate back into focus.

The Keynesian side of this debate has been well served, with frequent outstanding contributions from Paul Krugman, Brad DeLong and others.

But I have had more trouble finding serious economic contributions from the classical school, even though they seem to be gaining ground in political and policy circles on both sides of the Atlantic.

For that reason, I was particularly interested in the recent lecture on the US recession given by the University of Chicago’s Robert Lucas.

Lucas is universally recognised as an intellectual giant, and his lecture gives a neat synopsis of what the classical school currently thinks, straight from the horse’s mouth.

Gavin Davies FT blog 31 may 2011

One Sunday in October 2008, Alistair Darling flew back from Washington to find Britain on the brink of banking meltdown. The chancellor was told by his Treasury officials that unless a rescue plan was announced by the time the City opened for business the following morning, there was no guarantee that cashpoints would work and that cheques would be honoured.

The possibility of global financial implosion concentrated minds wonderfully; bailout plans were announced that ensured disaster was averted. Co-ordinated and collective action meant there was no return to the 1930s, and within six months most countries were recovering.

Larry Elliott, Guardian, 31 May 2011

Not just that the global economy remains severely unbalanced or that it is business as usual in an unreformed financial sector.

It is not even that the euro area could trigger the sort of mayhem last seen in the autumn of 2008.

It is that oil prices have been rocketing and greenhouse gas emissions increased by a record amount last year.

There is the potential there for not just one crisis but three: a situation where the ATMs freeze up, the planet warms up, and the lights go out

Larry Elliott, Guardian, 31 May 2011

Top of page

Consider this:

It took all of human history into the 20th century to reach a population of 2 billion.