Om att inte förstå Kina

Rutger Palmstierna, Svensk Tidskrift 1985

Finanskrisen -

The Great Recession

Home - Index -

News - Kronkursförsvaret 1992 - EMU - Cataclysm -

Financial Crisis - Wall Street - Huspriser

Dollarn - Biggles - HSB - Löntagarfonder - Skuldkrisen 80-talet - Contact

China

Hongkong

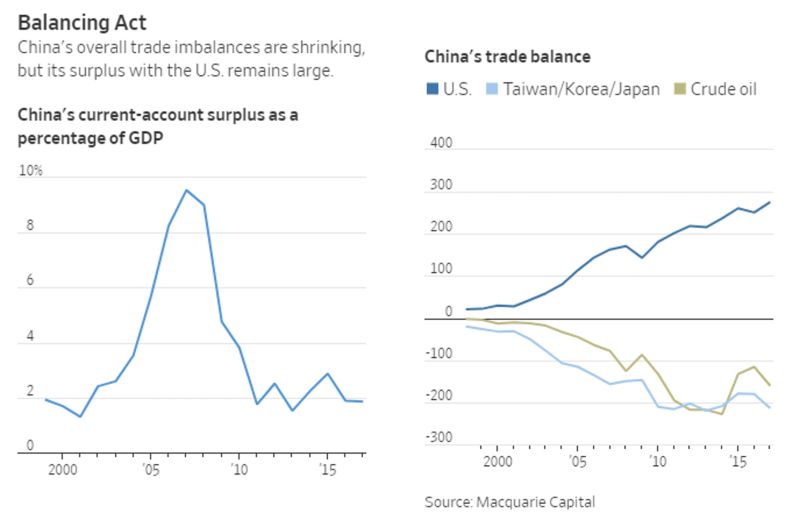

China's Global Trade Surplus Expected to Go Negative

Mish 30 July 2018

A Fifth of China’s Homes Are Empty. That’s 50 Million Apartments

Bloomberg News 8 november 2018

Xi has said homes are for living in, not for speculation.

China’s debt threat: time to rein in the lending boom

Martin Wolf FT 25 July 2018

“If something can’t go on forever, it will stop.” This statement by Herbert Stein, chairman of the US council of economic advisers under Richard Nixon and Gerald Ford, tells us that debt cannot grow faster than an economy forever.

That is going to be true for China, too

“If something can’t go on forever, it will stop.”

China has avoided a recession for a quarter-century

Macroeconomists should think about credit policy as an important supplement

to the traditional fiscal and monetary tools of recession-fighting.

Noah Smith 19 July 2018

China’s $10 trillion ecosystem of unregulated lending, known as shadow banking.

Bloomberg 19 July 2018

Chinese companies may be living on borrowed time with the biggest cash flow deficit in six years.

The shadow banking system and The Volcker Rule

A China Borrower's $11 Billion Debt Pile Comes Crashing Down

Bloomberg 18 July 2018

Trump’s Trade War May Spark a Chinese Debt Crisis

A tighter dollar will make the bursting of the credit bubble an inevitability

The whole economy is a Ponzi scheme.

Anne Stevenson-Yang Bloomberg 18 July 2018

Chinese real estate is in bubble territory

From June 2015 through the end of last year, the 100 City Price Index rose 31 percent to nearly $202 per square foot.

That's 38 percent higher than the median price per square foot in the U.S., where per-capita income is more than 700 percent higher than in China.

Not surprisingly, this has put homeownership out of reach for most Chinese.

Bloomberg 24 June 2018

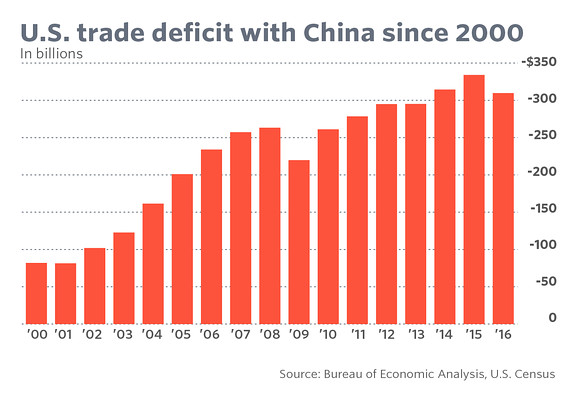

China is an easy political target.

After all, it accounted for 46% of America’s colossal $800 billion merchandise trade gap in 2017.

Stephen S. Roach Project Syndicate 23 May 2018

It’s not just China.

Global debt rose to a record $233 trillion in the third quarter of 2017,

more than $16 trillion higher from the end of 2016, according to the Institute of International Finance.

Bloomberg 22 January 2018

Private non-financial sector debt hit all-time highs in Canada, France, Hong Kong, South Korea, Switzerland and Turkey.

As interest rates begin to increase, borrowers might start to feel pain even though the ratio of debt-to-GDP has fallen as growth accelerated.

“We’ve seen the world leverage up,” said Tim Adams, the institute’s president who will be in Davos. “It’s been an incredibly low rate environment which I suspect is going to change.”

Hong Kong, the Asian hub is fast emerging as a test case of the global tightening cycle,

forced to import the monetary policy of the US Federal Reserve – nolens volens –

as a result of its long-standing exchange link to the US dollar.

Ambrose Evans-Pritchard Telegraph 26 March 2018

Victim of the "Impossible Trinity”: you cannot control the currency, and monetary policy, and have open capital flows.

In times of stress, one must give.

The worry is that a sudden surge in borrowing costs could bring Hong Kong’s spectacular housing boom to a screeching halt and expose the fragility of its "carry trade" lending to highly-leveraged Chinese companies.

nolens volens = Lat. vare sig man vill eller inte

The Economist explains economics

What is the impossible trinity?

Why fixed currencies, monetary autonomy and capital mobility are incompatible

Click

China risks 'Minsky Moment' as debt reaches saturation

Ambrose 19 October 2017

China’s lending boom since the downturn in early 2015 is comparable to the massive stimulus after the Lehman crisis.

Non-financial debt has galloped up to 300pc of GDP, uncharted territory for a big developing economy.

The IMF warned in its Global Financial Stability Report that the smaller and medium size banks rely on short-term funding to cover 34pc of their total lending, and most of this is on maturities of three months or less. This exposes them to a “funding shock” if conditions suddenly tighten, forcing them to sell assets into an illiquid market at fire-sale prices.

This is what happened to Northern Rock, Lehman Brothers, and AIG in the global financial crisis when the wholesale capital markets seized up.

China’s Debt Bomb - Danger or Dud?

Bloomberg 24 May 2017

To doomsayers, China's $27 trillion pile of public and private debt is a threat to the global economy.

Or maybe it's just a manageable byproduct of the boom that created the world’s second-biggest economy.

America hardly makes any of the stuff it buys from China anymore

The U.S. trade deficit totaled $501 billion in 2016 and China accounted for about 62% of the overall gap.

MarketWatch 6 April 2017

US policymakers should worry about China’s capital account, not its current account.

That is where danger now lies.

Martin Wolf, FT 4 April 2017

China devaluation risk is rising

as capital outflows reach danger level

Ambrose, Telegraph 21 December 2016

Stimulus was comparable in scale China's post-Lehman blitz,

but the effects have been far less because the efficiency of credit has collapsed.

It now takes four yuan of loans to generate one yuan of growth.

Net capital outflows accelerated last month to the highest level since the currency panic a year ago.

That panic - nota bene - led to an 12pc fall in the Dow.

China is in trouble, but this is not yet a 'Lehman' moment for world economy

Ambrose Evans-Pritchard 2015

3. “The China Shock: Learning from Labor-Market Adjustment to Large Changes in Trade,” by David Autor, David Dorn and Gordon Hanson

This is the paper that shook the world of economics.

Looking at local data, Autor et al. found that import competition from China was devastating for American manufacturing workers.

People who lost their jobs to the China Shock mostly didn’t find new good jobs -- instead they took big permanent pay cuts or went on welfare.

Noah Smith:

Here’s a list of 10 excellent economics books and papers I read in 2016

Factor-price equalization - Faktorprisutjämning

The vast size of China’s debt mountain — which stands at over 250 per cent of gross domestic product,

up from 125 per cent in 2008 — means that even minor increases in short-term interest rates

may squeeze corporate activity and precipitate defaults

FT 8 December 2016

Before 1971, US global hegemony was predicated upon America’s current-account surplus with the rest of the capitalist world,

which the US helped to stabilize by recycling part of its surplus to Europe and Japan.

This underpinned economic stability and sharply declining inequality everywhere.

But, as America slipped into a deficit position, that global system could no longer function,

giving rise to what I have called the Global Minotaur phase.

Yanis Varoufakis, Project Syndicate 28 November 2016

Lack of Chinese capital may well force the US to pay a steeper price for external financing,

through a weaker dollar, higher real interest rates, or both

Stephen S. Roach, Projet Syndicate 23 May 2016

The Chinese Communist Party is now officially worried about mounting debt.

“A tree cannot grow up to the sky—high leverage will definitely lead to high risks,”

said a front-page commentary in the People’s Daily on May 9.

Bloomberg 13 May 2016

The author of the commentary was identified as “an authoritative person,” usually code for the top leadership.

“Any mishandling will lead to systemic financial risks, negative economic growth, or even have households’ savings evaporate.

That’s deadly.”

China is likely to experience greater financial turbulence than it has seen recently,

which may not happen by the end of this year but will not take three years either.

George Magnus, FT 29 April 2016

The writer is an associate at Oxford university’s China Centre and a senior economic adviser at UBS

I mistakenly took Squawk Box off mute this morning.

It was just in time to hear one of the regular anchors — the one who makes Joe Kernen sound slightly insightful by comparison —

forecast a pick-up in global growth on the grounds that “China is recovering”.

Even then, the overwhelming share of this explosion of new credit went to pay interest on the existing mountain of IOUs.

Charles Ponzi could never have imagined a scam so audacious.

China debt load - $25tn - reaches record high as risk to economy mounts

FT April 24, 2016

Beijing has turned to massive lending to boost economic growth, bringing total net debt to Rmb163tn ($25tn)

While the absolute size of China’s debt load is a concern, more worrying is the speed at which it has accumulated — Chinese debt was only 148 per cent of GDP at the end of 2007.

Full text/China/ consumed more cement during three years (2011-2013) than did the US during the entire twentieth century.

David Stockman, 11 April 2016

Enabled by an endless $30 trillion flow of credit from its state controlled banking apparatus and its shadow banking affiliates,

China went berserk building factories, warehouses, ports, office towers, malls, apartments, roads, airports, train stations,

high speed railways, stadiums, monumental public buildings and much more.

If you want an analogy, 6.6 gigatons of cement is 14.5 trillion pounds.

The Hoover dam used about 1.8 billion pounds of cement.

So in 3 years China consumed enough cement to build the Hoover dam 8,000 times over

The apparent prosperity is not that of a sustainable economic miracle; its the front street of the greatest Potemkin Village in world history.

China has become a credit-driven economic madhouse.

The 50% of GDP attributable to fixed asset investment actually constitutes the most spectacular spree of malinvestment and waste in recorded history.

It is the footprint of a future depression, not evidence of sustainable growth and prosperity.

The world economy is in no position to absorb another big deflationary shock.

The possibility of another big deflationary shock from China over the next several years is real.

Martin Wolf, FT 29 March 2016

China’s got problems, but it won’t run out of reserves

http://ftalphaville.ft.com/2016/02/26/2154382/chinas-got-problems-but-it-wont-run-out-of-reserves/

Here Comes The Red Swan And Other Reasons To Be Very Afraid

China is a monumental doomsday machine that bears no more resemblance

to anything that could be called stable, sustainable capitalism

than did Lenin’s New Economic Policy of the early 1920s.

David Stockman 25 February 2016

The regime is in a horrendous bind because it has played out the greatest credit spree in world history.

This cycle of undisciplined, debt-fueled digging, building, spending and speculating took

its collective balance sheet from $500 billion of debt in the mid-1990s to the $30 trillion tower of the same that now gyrates heavily over the land.

Hysteria over China has become ridiculous

China is recovering but the world is not yet out of the woods.

Capital outflows are dangerous wild card in China's currency drama

Ambrose Evans-Pritchard, 27 January 2016

Articles are appearing across the world debating whether Mr Soros and his putative wolf pack will succeed in doing to the People's Bank of China (PBOC) what he did to the Bank of England in 1992 - in the latter case with entirely positive consequences.

China is not a $10 trillion growth miracle with transition challenges;

it is a quasi-totalitarian nation gone mad digging, building, borrowing, spending and speculating

in a magnitude that has no historical parallel.

David Stockman 27 January 2016

It cannot be slowed, stabilized or transitioned by edicts and new plans from the comrades in Beijing.

It is the greatest economic trainwreck in human history barreling toward a bridgeless chasm.

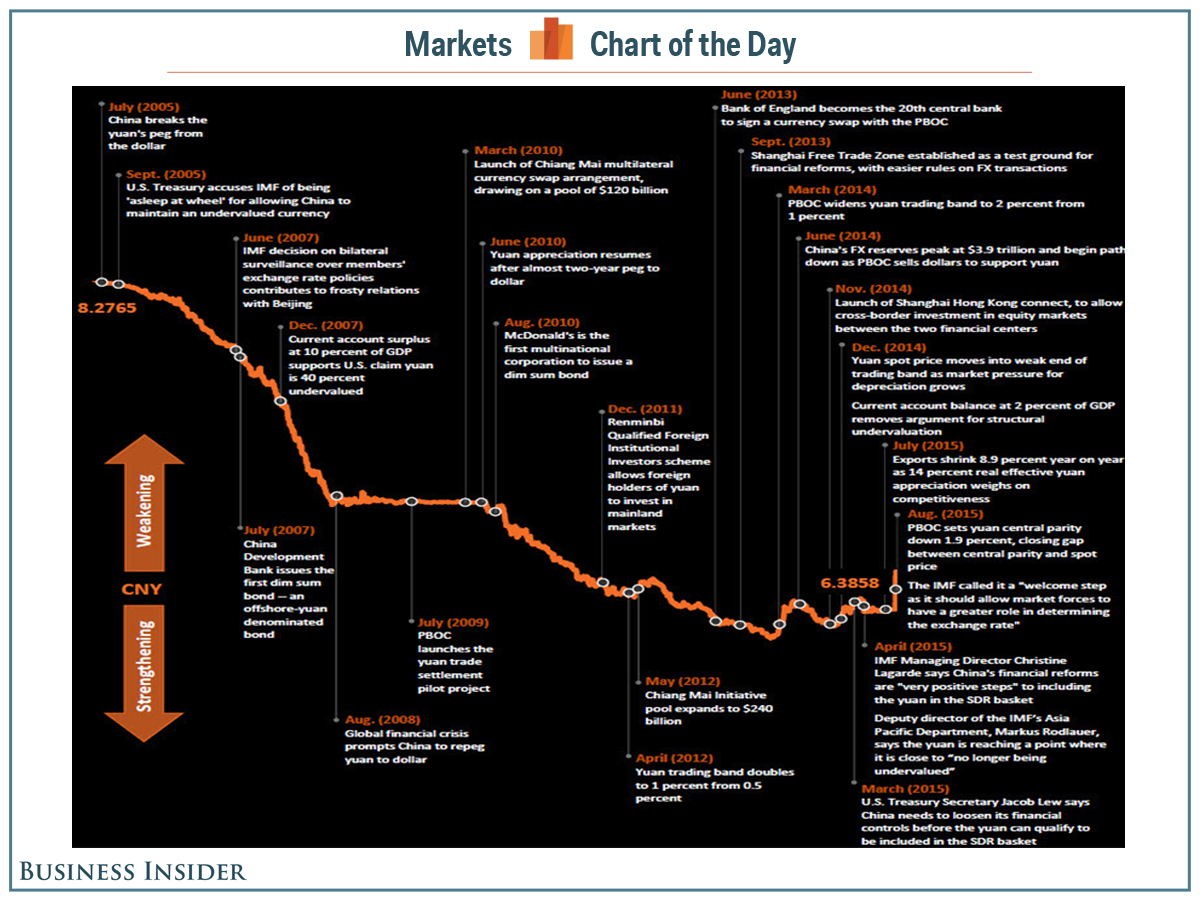

"Letting renminbi float is better than tightening controls"

China’s accelerating capital flight. The nervousness has now gone mainstream,

with Japan’s central bank governor publicly advising Beijing to tighten controls on capital outflows.

The FT’s editorial column agrees.

Martin Sandbu, FT Free Lunch 26 January 2016

There are two very good contrarian points one might make against this by-now-conventional narrative.

One is: doesn’t China already have capital controls?

The second is: doesn’t it still run a current account surplus — in other words, trading and earning enough to continue to rack up financial claims on the rest of the world? In other words, what is there to worry about?

What is really happening is that the public sector is financing a redenomination of private claims from renminbi into dollars and other hard currency.

China Stocks Enter Bear Market as State-Fueled Rally Evaporates

Bloomberg News, January 15, 2016

The Shanghai Composite Index sank 3.5 percent to 2,900.97 at the close,

falling 21 percent from its December high and sinking below its nadir during a $5 trillion rout in August.

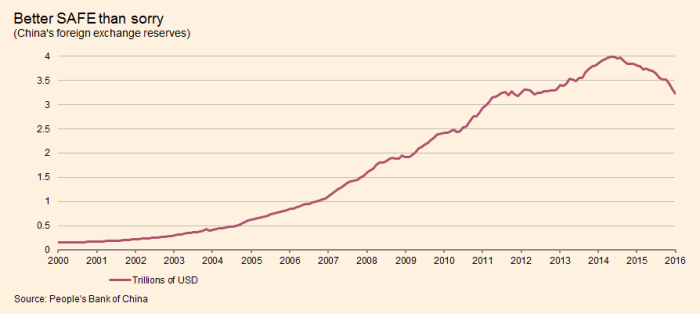

China has since spent tens of billions of its foreign-exchange reserves in an effort to keep the currency from falling

The central issue is the classic dichotomy of the modern Communist Party as it seeks more market oriented policies but retains an inherent distrust of risk

— leading to a reluctance to let markets be the final arbiter of either equity prices or foreign exchange rates.

FT January 6, 2016

This contradiction at the heart of the party’s economic and financial reforms was laid bare in August, when China’s central bank surrendered its power to set the renminbi’s “daily fix” against the US dollar wherever it wanted and instead tied it to the previous day’s close.

The People’s Bank of China has since spent tens of billions of its foreign-exchange reserves in an effort to keep the currency from falling too sharply against the dollar.

China’s forex reserves drop by record $108bn in December

Given that depreciation expectations are now entrenched, analysts say further intervention would slow down,

but not reverse, the weakening trend. Such spending could be wasted if it only delays the inevitable, they say.

FT January 7, 2016

It is in this context that we might reflect on the recent announcement of a $512bn fall in currency reserves in 2015.

Since China has a current account and net direct investment surplus of about $600bn,

implied capital outflows must have been close to $1tn.

George Magnus, FT 11 Jsnuary 2016

George Magnus is an associate at Oxford university’s China Centre and senior economic adviser to UBS

Some of this was capital flight.

Given the interplay between capital flight, a more uncertain “managed” currency depreciation and a private credit binge that’s going in the wrong direction,

China’s credit crisis may be approaching now just that little bit faster.

The US Federal Reserve and other western central banks have failed to anticipate this deflation environment,

persistently undershoot their inflation targets and appear powerless to reverse the trend.

At some point, we will probably wonder if it is time for the anti-deflation baton to pass to governments.

George Magnus, FT December 24, 2014

Heed the fears of the financial markets

Experience suggests that the best indicator of a country’s future economic prospects is the decisions its citizens make about keeping capital at home or exporting it abroad.

The renminbi is under pressure because Chinese citizens are eager to move their money overseas.

Were it not for the substantial recent depletion of China’s reserves, the renminbi would have fallen further

Larry Summers, FT January 10, 2016

You may wonder why we are worrying about defence of the Chinese currency at all when China still has $3.33?trillion of foreign exchange reserves to throw at the problem.

Yet the fact is that the Chinese are burning through their reserves at frightening speed.

Jeremy Warner 9 Jan 2016

It would only take three or four more months of this before China’s once mighty arsenal looks less than adequate for such a large economy.

In the meantime, the foreign exchange reserve sell-off is having a similar effect to a monetary tightening, which is just what the fast slowing Chinese economy doesn’t need right now.

Be Scared of China's Debt, Not Its Stocks

Noah Smith, Bloomberg JAN 7, 2016

This shadow banking system has enabled a large buildup of bad debt, much of it related directly or indirectly to real estate.

If property prices fall, trust companies will go broke, and banks -- having invested in the trust companies -- will be on the hook.

That will create the conditions for a really destructive crash.

Though most Austrians on the Internet spend their time flogging gold, hyperventilating about inflation and calling various people communists,

the original "Austrian school" thinkers -- Ludwig von Mises and Friedrich Hayek -- had some other ideas as well.

And some of these might be useful for thinking about China.

Noah Smith, Bloomberg 5 August 2015

Investors have become much more concerned that a larger devaluation may be in the works,

either through the choice of the Chinese authorities, or because the outflow of private capital is getting out of hand.

Some bears in the currency markets believe that China could soon be suffering from a genuine exchange rate crisis,

in which its enormous foreign exchange reserves could be quickly drained.

Gavyn Davies, FT 6 January 2016

That would indeed be a severe shock to global markets, since it would effectively export the deflationary forces that are overpowering the Chinese manufacturing sector to the rest of the world, and would probably require direct measures to restore the health of the Chinese financial system. But it still seems unlikely to happen, for now at least.

Relative to US levels, China’s GDP per head is where South Korea’s was in the mid-1980s.

South Korea’s real GDP per head has since nearly quadrupled in real terms, to reach almost 70 per cent of US levels.

Martin Wolf, Financial Times September 1, 2015

If China became as rich as Korea, its economy would be bigger than those of the US and Europe combined.

This is a case for long-run optimism. Against it is the caveat that “past performance is no guarantee of future performance”.

Recent events must be seen in the context of a deeper concern.

If they can, the economy will also sustain growth of 6-7 per cent.

If they cannot, economic and political instability threatens.

Martin Wolf, FT 25 August 2015

The Chinese market is not a normal one. Even more than most markets, this is a casino in which each player hopes to find a “greater fool” on whom to offload overpriced chips before it is too late. Such a market is bound to be extremely volatile. But its vagaries should tell one little about the wider Chinese economy.

Accommodative monetary policy was supposed to spur investment in productive activities

Last week’s renminbi devaluation brought into focus that since 2010,

China’s export-driven economy has laboured under a 25 per cent appreciation of its real effective exchange rate.

Avinash Persaud, FT August 24, 2015

Show steel and raise rates or the financial system will fracture

Accommodative monetary policy was supposed to spur investment in productive activities at home.

Instead, companies and banks hoarded cash. Much of the extra credit instead financed housing purchases at home,

or was funnelled into loans for companies and governments in emerging markets.

Jan 19, 2015

http://blogs.ft.com/gavyndavies/2015/08/12/has-china-just-pressed-the-escape-button/

TIMELINE: The Chinese yuan's tumultuous decade

Business Insider, Aug. 12, 2015

Though most Austrians on the Internet spend their time flogging gold, hyperventilating about inflation and calling various people communists,

the original "Austrian school" thinkers -- Ludwig von Mises and Friedrich Hayek -- had some other ideas as well.

And some of these might be useful for thinking about China.

Noah Smith, Bloomberg 5 August 2015

Moody’s last week, as they reiterated an earlier warning about the risks in the rapid expansion of Hong Kong banks’ lending to mainland Chinese entities. The exposure of Hong Kong to the mainland grew by 29% in 2013 to 2.3 trillion Hong Kong dollars ($297 billion), accounting for 20% of total banking assets, Moody’s said.

This, they said, poses credit challenges as it increases banks’ exposures to China’s economic and financial vulnerabilities, as well as pressuring some of the banks’ liquidity profiles and capitalization levels.

Both the International Monetary Fund and the Hong Kong Monetary Authority have also recently flagged similar concerns about the wall of money Hong Kong was sending into a slowing and fragile-looking Chinese economy.

Earlier this year, brokerage Jefferies described a “parabolic” rise in lending to mainland China, which it saw as a looming problem for Hong Kong. From almost zero in 2009, this lending has reached 150% of Hong Kong’s GDP.

MarketWatch 29 June 2014

The overall trade-weighted value of the renminbi has not changed in the past decade

but the Chinese currency has strengthened by 30 per cent relative to the dollar during those 10 years.

Martin Feldstein, FT May 15, 2014

After almost two decades of nearly unceasing increases in real estate prices and construction across China,

one of the world’s longest-running bull markets finally seems to be stalling,

with broad consequences for China’s economy and possibly its politics as well.

New York Times 13 May 2014

Housing starts plummeted 25 percent last month from a year ago, the Chinese government announced on Tuesday

— a severe blow for a country in which residential real estate construction has come to account for one-ninth of all economic output.

Prices have begun falling for new apartments and old ones, and the volume of deals is drying up.

telegraph.co.uk/China-reverts-to-credit-as-property-slump-threatens-to-drag-down-economy.html

Chinese property is the most important sector in the global economy

This time China’s property bubble really could burst

George Magnus, FT May 12, 2014

I’ll eat my hat. The St Louis Federal Reserve – the last bastion of monetary orthodoxy in the Fed family –

has just published a paper that basically deems quantitative easing to be useless.

John Maynard Keynes was right all along.

The working paper by Yi Wen and Jing Wu cites China as the world’s resounding success story post-Lehman

Ambrose Evans-Pritchard, March 28th, 2014

The growth in lending at the Hong Kong subsidiaries of China’s largest banks

has led to Moody’s warning about the increased risks they pose to their parents

as they increase their exposure to the mainland economy.

Telegraph 25 March 2014

Credit Suisse last week downgraded the shares of HSBC,

one of the Swiss bank’s corporate broking clients, to ‘sell’ in part over worries at developments in Hong Kong.

In particular, Credit Suisse pointed to the potential unwinding of the increasingly popular renminbi carry trade,

whereby many Chinese companies and banks have borrowed money offshore at a lower interest rate, normally in dollars,

to invest back in China at a much higher rate.

"It is difficult to gently deflate a bubble."

The balance of evidence is that most powerful Chinese leader since Mao Zedong

aims to prick China's $24 trillion credit bubble early in his 10-year term,

This may be well-advised for China, but the rest of the world seems remarkably nonchalant over the implications.

Ambrose Evans-Pritchard, 12 Feb 2014

"China is getting serious about deleveraging," says Patrick Legland and Wei Yao from Societe Generale.

"It is difficult to gently deflate a bubble. There is a very real possibility that this slow deflation may get out of control and lead to a hard landing."

Wealthy Chinese mainlanders are voting with their feet in eye-popping numbers and preparing to emigrate

— taking both their money and family with them.

MarketWatch, 9 February 2014

First it was reported that mainlanders made up 91% of all applications for investment visas going to Australia since the scheme was launched in 2012. But this was small beer compared to Canada, as it was disclosed there was a backlog of 57,000 applications from China for investment-immigrant visas. The South China Morning Post reported 45,000 mainlanders were seeking to emigrate to British Columbia alone, with an estimated minimum combined wealth of not less than 90 billion Hong Kong dollars ($11.6 billion).

"We've Created A Global Debt Monster" China

Jim Reid, Deutsche Bank, via zerohedge, 3 February 2014

Deutsche Bank credit strategist Jim Reid has been on fire lately with his assessment of the Greece situation.

In his latest note he offers what's perhaps the most compelling comparison yet between Greece and Lehman

Jim Reid, Business Insider Juni 2011

Alphaville Posts tagged 'Jim Reid'

China’s credit-fueled bubble economy is falling to pieces before our very eyes.

Between 2008 and 2013, China’s credit market increased from $9 trillion to an incredible $23 trillion.

zerohedge, 25 January 2014

To give this number some perspective, China’s GDP is a little over $7 trillion. So China today has a credit market well north of 300% of its GDP.

There is simply no other way to view this than as a bubble.

Indeed, we see all of the clear signs of a bubble in the real estate markets today with countless ghost cities, massive empty malls, and other excess capacity.

The Rockefeller Group sold control of Rockefeller Center to the Mitsubishi Estate Company of Tokyo,

New York Times, October 31, 1989

Om att inte förstå Kina

Rutger Palmstierna, Svensk Tidskrift 1985

High Road to China, The Movie

Youtube

Holdings of Treasuries in China, the largest foreign lender to the U.S., fell in June

amid discussion by Federal Reserve officials about slowing the pace their bond purchases.

China’s stake dropped by $21.5 billion in June, to $1.276 trillion,

Bloomberg, August 15, 2013

In May, surging imports pushed the US trade deficit up by 12 per cent to $45bn, which was the largest jump in five years.

Imports from China accounted for almost two-thirds of that.

If it continues, the US-China deficit will exceed $300bn this year.

Edward Luce, Financial Times, July 7, 2013

De senaste 20 åren av kinesisk dominans på tillväxtmarknaden har sin förklaring i oljekonsumtionen.

Tyvärr så har nu peak oil inträffat och den globala oljeproduktionen har legat konstant runt 85 miljoner fat per dag de senaste åren.

Alltså måste Kinas eventuella framtida tillväxt ske på någon annans bekostnad, såvida vi inte får se ett riktigt mirakel.

Peakenergi, 5 juli 2013

Nice chart

Fitch says China credit bubble unprecedented in modern world history

Ambrose Evans-Pritchard, 16 June 2013

Offshore vehicles and other forms of irregular lending make up over half of all new credit.

"It means nothing if you can off-load any bad asset you want.

A lot of the banking exposure to property is not booked as property," she said.

Concerns are rising after a string of upsets in Quingdao, Ordos, Jilin and elsewhere, in so-called trust products, a $1.4 trillion segment of the shadow banking system.

Mrs Chu said the banks had been forced to park over $3 trillion in reserves at the central bank, giving them a "massive savings account that can be drawn down" in a crisis,

but this may not be enough to avert trouble given the sheer scale of the lending boom.

Overall credit has jumped from $9 trillion to $23 trillion since the Lehman crisis.

"They have replicated the entire US commercial banking system in five years," she said.

The ratio of credit to GDP has jumped by 75 percentage points to 200pc of GDP,

compared to roughly 40 points in the US over five years leading up to the subprime bubble,

or in Japan before the Nikkei bubble burst in 1990.

"This is beyond anything we have ever seen before in a large economy. We don't know how this will play out. The next six months will be crucial," she said.

The agency downgraded China's long-term currency rating to AA- debt in April but still thinks the government can handle any banking crisis, however bad.

"The Chinese state has a lot of firepower. It is very able and very willing to support the banking sector.

The real question is what this means for growth, and therefore for social and political risk," said Mrs Chu.

Det är en del, företrädesvis fastighetsmäklare och bankekonomer, som försöker intala sig själva och oss andra att bostadspriserna kan plana ut.

Men bostadsbubblor, liksom andra bubblor, har en mycket karaktäristisk form.

Det brukar, alltid, se ut så här.

Rolf Englund blog 25 mars 2012

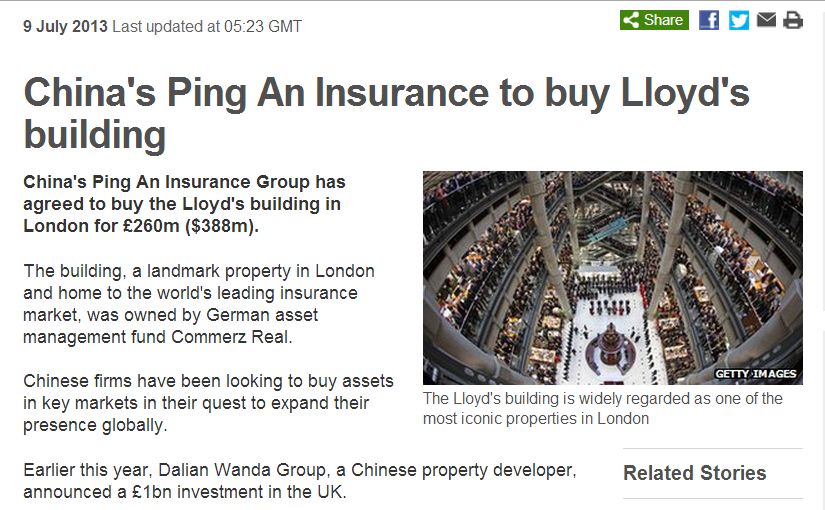

China wants to break the ultimate taboo and buy into Western companies such as Apple, Boeing and Intel

China has punctured the last delusion. There will be no rescue of Italy until Europe agrees to major strategic concessions

Ambrose Evans-Pritchard, in Dalian, China, 14 Sep 2011

Mr Wen said he had spoken to José Manuel Barroso, the president of the European Commission, laying the conditions for Chinese intervention.

"I made clear to him that we are confident Europe will overcome its difficulties and make a full recovery. We have on many occasions expressed our readiness to extend a helping hand, and that we are willing to invest more in European countries."

"At the same time, we need bold steps to give redirection to China's strategic objective. We believe they should recognise China's full market economy status," he said, referring to World Trade Organisation (WTO) rules.

"To show one's sincerity on this issue ... is the way a friend treats another friend," he said, answering a question after his speech.

Peak Oil

The reason, as with so many global economic trends, can be summed up in a single word: China.

Since 2008, the last time oil passed $100 per barrel, demand in the developed world has fallen by 2.7m barrels per day,

or 6 per cent, and 4 per cent in the US, according to Trevor Houser of the Rhodium Group in New York.

At the same time, demand in developing countries has grown by 4.4m b/d, or 11 per cent, with China accounting for roughly half that growth.

FT April 25 2011

Kina

USA:s största fordringsägare med över 1150 miljarder dollar placerade i amerikanska statspapper

Andreas Cervenka, SvD e24 25/4 2011

Det senaste året har kineserna blivit allt mer irriterade och öppet mästrande gentemot Washington. Det är ju trots allt Kina som tagit ansvaret för att hålla igång världsekonomin när USA och Europa sanerar på hemmaplan. Förra året växte Kinas BNP med 10 procent och takten håller i sig i år.

Unscientific but entertaining estimates of how long citizens would need to work

to afford a 100-square-metre apartment in central Beijing, which currently sells for about Rmb3m ($450,000)

FT December 23 2010

USA hotar med tullar och extremt expansiv penningpolitik

för att få fart på den inhemska ekonomin, pressa upp inflationen och därmed driva ner värdet på dollarn.

Källan till striden om valutapolitiken är den traditionella: växelkursen är bestämd av staten – inte av marknaden.

Lars Jonung, Kolumn DN 27/10 2010

Samtliga faktorer som gjorde dollarn till världsvaluta har försvagats.

Dagens finanskris har avslöjat oroväckande brister i USA:s ekonomi och finansväsende.

Euron blev en framgång. Den är i dag efter dollarn den främsta reservvalutan.

Kina har behövt USA som marknad för sin export och USA har behövt Kina som finansiär av sina underskott – alltmedan de globala obalanserna obönhörligt cementerats.

Vägen till friare växelkurser och kapitalflöden – den värld som Cassel drömde om – är farofylld. Men större flexibilitet i det internationella valutasystemet krävs för att undvika en ”ödeläggelse” i stil med 1930-talets. I denna nya värld kommer världsvalutor som den amerikanska, europeiska och kinesiska kunna leva i fredlig konkurrens och samexistens.

By a vote of 348-79, Democrats and Republicans alike put aside their acrimonious differences and agreed, at least for a moment,

to stop blaming each other for the sad state of American economic life.

Instead, they agreed to blame China.

The bill is the perfect campaign gesture, bombastic, angry, self-righteous, and without much real-world consequence.

Zachary Karabell, Huffington Post, September 30, 2010

The office AFL-CIO union leader Richard Trumka issued a statement that encapsulated the thinking behind the bill: "the House of Representatives voted to put an end to the Chinese government's currency manipulation, which has destroyed millions of good American manufacturing jobs. For more than a decade, the Chinese government has deliberately manipulated the value of its currency, ballooning our trade deficit with China and costing American communities good jobs....Working people continue to mobilize to elect candidates who will put America's workers first and are committed to rebuilding an economy that values working people. This November we will send a powerful message that we will support those who vote for an economy that works for everyone."

The idea is that there is direct line between China, its currency, its exports of lower-cost goods to the United States, and the erosion of middle-class life and now soaring unemployment. But U.S. manufacturing has been bleeding jobs for decades, since the early 1970s, when the Rust Belt began to decay faced with competition from the likes of Japan and Germany. That continued almost unbroken for the next decades, as countries ranging from Taiwan to Mexico became the low-cost producers (remember Ross Perot's famous warning about NAFTA in 1992 and "the giant sucking sound" of jobs heading south-of-the-border?). California and the state of Washington were hit hard by cuts in defense spending in the early 1990s, and industry throughout the country shed jobs as technology and robotics allowed fewer workers to do more. China is simply the latest example of these trends and hardly a cause.

Of course, reason and fact aren't driving these measures. Emotion, anger and frustration are. There are good reasons to be angry with the state of affairs in this country and frustrated by the inability of the political class to do more than contribute to the confusion

John Connally, Nixon’s secretary of the Treasury, famously told the Europeans that

the dollar “is our currency, but your problem”.

The Chinese respond in kind. In the absence of currency adjustments, we are seeing a form of monetary warfare: in effect,

the US is seeking to inflate China, and China to deflate the US.

Both sides are convinced they are right; neither is succeeding; and the rest of the world suffers

Martin Wolf, FT September 28 2010

This is not the first time for such currency conflicts. In September 1985, now 25 years ago, the governments of France, West Germany, Japan, the US and the UK met at the Plaza Hotel in New York and agreed to push for depreciation of the US dollar.

¨

China may post its first trade deficit in six years

after a surge in imports of commodities and consumer goods, weakening U.S. arguments that the nation is keeping its currency undervalued to gain an advantage.

Bloomberg April 9 2010

The Chinese currency policy is, in effect, a development policy that works by subsidising foreign consumers who buy Chinese goods.

The export machine, at its peak in 2008, was running a colossal $426bn current account surplus.

China is sticking with this mercantilist policy. This year, its current account surplus is expected to be $291bn

FT Editorial March 19 2010

China and Germany unite to impose global deflation

Germany is in a supposedly irrevocable currency union with some of its principal customers. It now wants them to deflate their way to prosperity in a world of chronically weak aggregate demand.

I am beginning to wonder whether the open global economy is going to survive this crisis.

The eurozone may also be in some danger.

Martin Wolf, FT March 16 2010

Premier Wen Jiabao calls China’s economic growth path “unbalanced, uncoordinated, and unsustainable.”

Bloomberg March 4 2010

Wen, 67, will give what amounts to China’s State of the Union speech tomorrow to the National People’s Congress in Beijing.

Wen says China’s growth model - emphasizing investment, manufacturing and exports over consumption - is creating economic distortions.

He told an online audience on Feb. 27 that 2010 would be “the most complicated year for the country’s economy” as the government sought to control property prices and inflation stoked by $1.4 trillion in new lending last year.

China’s property-market data may be masking the degree that

speculation is driving prices in some of the larger cities

Bloomberg Jan. 25 2010

China property sales also jumped 75.5 percent to 4.4 trillion yuan last year, led by the eastern cities of Zhejiang and Shanghai. The boom follows an unprecedented 9.59 trillion yuan of new loans being extended last year, flooding the economy with cash.

China: 'Dubai times 1,000'?

James S Chanos

THE NEW YORK TIMES and Todayonline Jan 08, 2010

Now Mr Chanos, America's pre-eminent short-seller, is working to bust the myth of the biggest conglomerate of all: China Inc.

As most of the world bets on China to help lift the global economy out of recession, he claimed that that China's hyperstimulated economy is headed for a crash.

"I find it interesting that people who couldn't spell China 10 years ago are now experts on China," said Mr Jim Rogers, who co-founded the Quantum Fund with George Soros and now lives in Singapore. "China is not in a bubble." THE NEW YORK TIMES

“Bubbles are best identified by credit excesses, not valuation excesses,” Chanos said in a recent appearance on CNBC.

“And there’s no bigger credit excess than in China.”

He is planning a speech later this month at the University of Oxford to drive home his point.

Having accumulated $2,273bn in foreign currency reserves, China has kept its exchange rate down, to a degree unmatched in world economic history.

China has, as a result, distorted its own economy and that of the rest of the world.

Martin Wolf, FT December 8 2009

China Signals That It May Allow Currency to Rise Against Dollar

CNBC/Reuters, 11 Nov 2009

China sent its clearest signal yet that it was ready to allow yuan appreciation after an 18-month hiatus, saying on Wednesday it would consider major currencies, not just the dollar, in guiding the exchange rate.

In its third-quarter monetary policy report, the People's Bank of China departed from well-worn language on keeping the yuan "basically stable at a reasonable and balanced level." It hinted instead at a shift from an effective dollar peg that has been in place since the middle of last year.

"Following the principles of initiative, controllability and gradualism, with reference to international capital flows and changes in major currencies, we will improve the yuan exchange-rate formation mechanism," the central bank said in a 46-page monetary policy report.China’s central bank warned that its counterparts in developed nations face difficult choices

as monetary easing threatens to cause “severe” inflation and exchange-rate volatility.

“Failure to manage the degree of easing may lead to concerns about mid- and long-term inflation and exchange-rate stability,”

the People’s Bank of China said in a quarterly monetary policy report, posted on its Web site today.

Bloomberg August 5 2009

China is growing incredibly fast.

If net exports contributed 3% to China's 12% growth in q2, China would have grown by a very respectable 9% even if its trade surplus didn't grow.

That is the missed opportunity.

This is a time when the global economy should be adjusting.

Brad Setser 19/7 2007

Yet with the dollar at a multi-year low -- and with the RMB still effectively pegged to the dollar -- China ends up getting a stimulus from the external side precisely when it doesn't need external stimulus. Right now, China's authorities want less growth, not more. China's premier famously called China's current pattern of growth unstable, unbalanced, uncoordinated, and unsustainable ...

If it is not too much of an intellectual stretch to say that China is part of the monetary union that is called the United States

— the 51st state, if you will —

then it is not too much of a stretch to say that what can go wrong is that China decides—or is forced—to secede.

Paul McCulley, June 2007

Who's the most powerful economist now?

We don't know his name. We don't even know if he IS an economist. But whoever runs Chinese financial policy - perhaps the head of the People's Bank of China - is the man to watch.

The Daily Reckoning, June 4, 2007

After spending Sunday afternoon in meditation on this subject - that whoever is the most important economist in the world is a smart guy. He's not going to do anything stupid. After all, he didn't get to where he is by being dumb.

True - Ben Strong was not exactly an idiot, either.

And the fellow running British financial policy back in the '20s was none other than Winston Churchill.

Saudi Arabia is running the U.S. economy.

Because the United States still doesn't have a national energy policy, we've thrown decisions about how fast our economy grows and whether our standard of living rises or falls into the hands of Saudi Arabia's oil ministry.

Jim Jubak 5/6 2007

By the Fed's own admission, the growth of global liquidity has reduced the U.S. central bank's ability to control interest rates -- and thus the economy -- in the United States. Think about this: The Fed raises short-term interest rates relentlessly from their 1% low in June 2003, and yet long-term rates sink as global cash flows overwhelm the Fed's domestic policy shifts.

See also: Conundrum

The G7 should, instead, be replaced by a multilateral body that can address such issues more effectively.

China’s current account surplus has exploded in recent years from a modest $46bn in 2003 to $250bn last year. (Japan $170bn)

Martin Wolf FT 30/5 2007

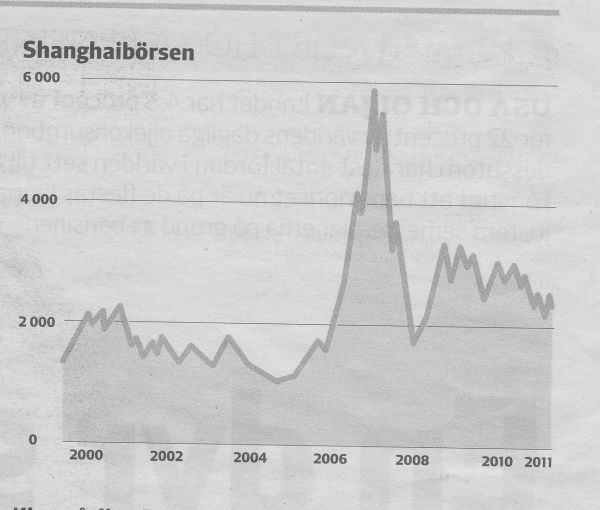

The Shanghai market has dropped 20 per cent in a week from the record high of 4,334.92 points it reached last Tuesday.

FT 5/6 2007

Alan Greenspan said he was concerned Chinese stocks might undergo a ``dramatic contraction''

after its main stock index jumped more than 90 percent this year.

May 23 2007 (Bloomberg)

When Mr. Greenspan spoke at the annual dinner of the American Enterprise Institute in Washington The Dow Jones Industrial Average had crossed 5000 in November 1995 and 6000 in October 1996. On the day of Mr. Greenspan's speech, the Dow industrials stood at 6437, more than twice the level it reached only four years earlier.

Jeremy Siegel, WSJ 6/12 2006

Dated perceptions of China

China runs a surplus with the US but a deficit with the rest of the world, so its trade is in rough balance.

New realities: China runs a big surplus with the world, not just the US.

The World Bank estimates that China’s 2006 current account surplus will reach $230b,

or 8.7% of China’s GDP.

Brad Setser 5/4 2007

The U.S. Commerce Department announced Friday that it will reverse its decades-long policy and begin to impose trade tariffs on some subsidized imports from China.

CNN March 30 2007

The growing mood in Congress for passing trade protection legislation that could start a series of retaliatory actions around the world that could result in a trade war, a la Smoot Hawley in the 1930s.

John Mauldin march 2007

Stephen Roach, Chief Economist at Morgan Stanley, writes a rather chilling description of his recent testimony before the Senate Finance committee. He noted that as he entered the room, he looked up and saw a picture of Senator Reed Smoot on the walls, as Smoot was a former chair of the committee and the co-sponsor of the Smoot-Hawley Tariff Act of 1930, largely responsible for the Great Depression.

Roach also accurately notes:

"America's middle-class angst - which is driving the politics of China bashing - reflects a US economy that failed to prepare its workforce for the pressures of an IT-enabled globalization."

Book review:

The Writing on the Wall: China and the West in the 21st Century by Will Hutton

Hutton takes on the most important political and economic story of our time. He has also produced a thought-provoking, wide-ranging and largely correct analysis.

The book advances five fundamental and, in my view, fundamentally correct propositions.

First, for all its manifest achievements, the Chinese attempt to marry a communist party-state with the market is unsustainable.

Martin Wolf 4/2 2007