www.maynardkeynes.org -

News on this page -

Stabilitetspakten -

About Keynes at Wikipedia

/The Treatise on Money's/ message was that

savings and investment, being different activities

carried on by different people,

could not simply be presumed identical.

It took interest rate to bring them

into equilibrium

Keynes’s General Theory at 80

First, Keynes invented macroeconomics – the theory of output as a whole.

Keynes’s second major legacy is the notion that governments can and should prevent depressions.

Milton Friedman reasserted the pre-Keynesian view of how market economies work.

Inflation, Friedman said, resulted from attempts by Keynesian governments to force down unemployment below its “natural” rate.

Robert Skidelsky, Project Syndicate 23 Febr 2016

The Keynes comeback

A trio of new books celebrate the man and declare victory for his ideas

“This present crisis is a crisis of systemic ignorance not asymmetric information.”

The Economist print Oct 1st 2009

For 30 years or so Keynesianism ruled

The new assault was led by Milton Friedman and followed up by a galaxy of clever young disciples

Adaptive Expectations, Rational Expectations, Real Business Cycle Theory, Efficient Financial Market Theory – they all poured off the Chicago assembly line, their inventors awarded Nobel Prizes

Then along came the almost Great Depression of today

Robert Skidelsky, Financial Times June 9 2009

John Maynard Keynes and Milton Friedman were the most influential economists of the 20th century.

Their differences were, indeed, profound. But so was what they shared. More interesting, neither won and neither lost:

today’s policy orthodoxies are a synthesis of their two approaches.

Martin Wolf, Financial Times, November 22 2006

The theory that so influences the European policymakers is now the dominant one, at least in the academic world. It has been given various names. Let us call it the new classical theory. It is intriguing that a theory developed by American economists is disregarded by the US authorities but is taken very seriously in Europe.

It is equally puzzling that Keynesianism, which is utterly discredited in the academic world, has continued to guide the actions of the US authorities in the past 10 years, and even seems to be working.

Paul de Grauwe, Financial Times 17/8 2005

John Maynard Keynes:

Fighting for Britain, 1937-1946

by Robert Skidelsky

In the spring of 2005 a panel of “conservative scholars and policy leaders” was asked to identify the most dangerous books of the 19th and 20th centuries. You can get a sense of the panel’s leanings by the fact that both Charles Darwin and Betty Friedan ranked high on the list. But The General Theory of Employment, Interest, and Money did very well, too. In fact, John Maynard Keynes beat out V.I. Lenin and Frantz Fanon. Keynes, who declared in the book’s oft-quoted conclusion that “soon or late, it is ideas, not vested interests, which are dangerous for good or evil,” [384] would probably have been pleased.

But Keynes was no socialist – he came to save capitalism, not to bury it.

Keynes wrote during a time of mass unemployment, of waste and suffering on an incredible scale. A reasonable man might well have concluded that capitalism had failed, and that only huge institutional changes – perhaps the nationalization of the means of production – could restore economic sanity. Many reasonable people did, in fact, reach that conclusion: large numbers of British and American intellectuals who had no particular antipathy toward markets and private property became socialists during the depression

Introduction by Paul Krugman to The General Theory of Employment, Interest, and Money, by John Maynard Keynes

The Unofficial Paul Krugman Archive

Friends, Romans, Countrymen, I come to bury Caesar, not to praise him.

Keynes' 1936, The General Theory of Employment, Interest and Money,

is available free online

With the General Theory, as it became known, Keynes sought to develop an theory that could explain the determination of aggregate output - and as a consequence, employment. He posited that the determining factor to be aggregate demand.

Among the revolutionary concepts initiated by Keynes was the concept of a demand-determined equilibrium wherein unemployment is possible, the ineffectiveness of price flexibility to cure unemployment, a unique theory of money based on 'liquidity preference', the introduction of radical uncertainty and expectations, the marginal efficiency of investment schedule breaking Say's Law (and thus reversing the savings-investment causation), the possibility of using government fiscal and monetary policy to help eliminate recessions and control economic booms.

Indeed, with this book, he almost single-handedly constructed the fundamental relationships and ideas behind what became known as 'macroeconomics'."

The IS-LM framework, invented by Sir John Hicks in 1937 as an interpretation of Keynes's “General Theory”

casts useful light on why bond yields are so low.

The Economist 11/8 2005

In 2013 economists at the IMF rendered their verdict on these austerity programmes:

they had done far more economic damage than had been initially predicted, including by the fund itself.

What had the IMF got wrong when it made its earlier, more sanguine forecasts?

It had dramatically underestimated the fiscal multiplier.

The Economist print 13 August 2016

Highly Recommended

Krugman essay

How Economics Survived the Economic Crisis

Unlike the Great Depression of the 1930s, which produced Keynesian economics, and the stagflation of the 1970s, which gave rise to Milton Friedman's monetarism, the Great Recession has elicited no such response from the economics profession. Why?

Robert Skidelsky, Project Syndicate, 18 January 2018

An elegant essay by the Nobel laureate economist Paul Krugman

His answer to Queen Elizabeth II’s now-famous question: “Why did no one see it coming?” Krugman’s cheerful response is that the New Keynesians were looking the other way. Theirs was a failure not of theory, but of “data collection.” They had “overlooked” crucial institutional changes in the financial system. While this was regrettable, it raised no “deep conceptual issue” – that is, it didn’t demand that they reconsider their theory.

In my view, New Keynesian economists turned a blind eye to instabilities building up in the banking system, because their models told them that financial institutions could accurately price risk. So there was a “deep conceptual issue” involved in New Keynesian analysis: its failure to explain how banks might come to “underprice risk worldwide,” as Alan Greenspan put it.

Full text

Economic theory discredited

Top of page

The return of Keynesianism

Martin Sandbu's Free Lunch, FT 24 October 2016

A speech given by Federal Reserve chair Janet Yellen 10 days ago has received a lot of attention in the economic community

and deserves an even broader hearing.

Its modest focus — it is titled “Macroeconomic research after the crisis” — is deceptive.

Beyond useful research recommendations, Yellen’s words carry more profound implications,

including an admission of the extent to which central bankers are navigating in the dark,

and a return to much more aggressive policies for demand management than modern macroeconomic theory had until recently admitted.

Full text

DSGE macroeconomics does not really allow for the large-scale financial panic we saw in 2008,

nor for some of the main contending explanations for the slow recovery and a level of economic activity that remains far below the pre-crisis trend.

Martin Sandbu, FT 19 January 2018

Janet Yellen

Finanskrisen 2007 -

Jag tycker det är skriande uppenbart att räntan världen över är för låg och att en större del av stimulanserna borde ske via finanspolitiken.

Men väljarna och därmed deras medlöpande politiker är rädda för budgetunderskott och vill hellre att villaägarna skall låna än att staten skall göra det.

Rolf Englund blog 5 december 2009

Top of page

We are all Keynesians now, so let's get fiscal

Monetary policy is close to the limits.

Ambrose Evans-Pritchard 4 August 2016

As a biographer and aficionado of John Maynard Keynes, I am sometimes asked:

“What would Keynes think about negative interest rates?”

Robert Skidelsky, Project Syndicate 24 May 2016

Full text

David Glasner: “What’s Wrong with Monetarism?”

Friedman soft in his criticism of Keynesian doctrines

Brad DeLong 27 April 2016

Friedman famously held the Fed responsible for the depth and duration of what he called the Great Contraction…

in sharp contrast to hard-core laissez-faire opponents of Fed policy, who regarded even the mild and largely ineffectual steps taken by the Fed…

as illegitimate interventionism to obstruct the salutary liquidation of bad investments, thereby postponing the necessary reallocation of real resources to more valuable uses…

Friedman has always been regarded with suspicion by laissez-faire dogmatists who correctly judged him to be soft in his criticism of Keynesian doctrines….

Friedman had Keynesian inclinations which, depending on his audience, he sometimes emphasized, and sometimes suppressed

Full text

Friedman

NAIRU

Monetarism

Top of page

The contemporary central bank based mutation of the old Keynesian and Friedmanite fallacies

is rooted in this debt-centric economics but is far more dangerous.

Owing to his anti-gold standard worldview, Friedman failed to realize that fiat money was nothing more than debt,

but at least he swore an oath of restraint in the form of a fixed rule (such as 3% per annum) for the growth of credit money.

David Stockman, 16 April 2016

We use the term “Keynesian” loosely to stand for economic interventionists of all schools.

The followers of JM Keynes and Milton Friedman alike fit that category.

So do some of the more rabid supply siders who claim the power to stimulate ultra-high economic growth with the tools of tax policy alone.

The common denominator is economic statism.

Full text

Resurgent Keynesianism

IMF a worry over insufficient aggregate demand

Martin Sandbu, FT Free Lunch 14 April 2016

Top of page

For several years now the small coterie of Keynesian academics and apparatchiks

who have seized nearly absolute financial power through the Fed’s printing presses

have justified the lunacy of unending ZIRP and massive QE on the grounds that there is too little inflation.

David Stockman, February 20, 2016

Hayek Versus Keynes

During World War Two, John Maynard Keynes and Friedrich Hayek spent all night together, alone, on the roof of the chapel of King’s College, Cambridge.

“It was, perhaps, the most unusual episode in the long running duel between the two giants of twentieth century economic thought.

John Mauldin, 3 September 2015

John Maynard Keynes Is the Economist the World Needs Now

Politicians ignored Keynes in 1937. Doing so again could tank the economy

Peter Coy, Businessweek's economics editor, October 30, 2014

Full text

The lessons of 1937

Top of page

UK

IMF and its Keynesian fellow-travellers were convinced that his squeeze on public spending meant that the recovery would take years to materialise.

We now know that the Chancellor was right and the IMF spectacularly wrong.

Allister Heath, Telegraph 24 July 2014

None of this is to downplay the UK’s remaining problems. GDP is at a new high but national income per person remains lower than it was: the population has grown, but productivity has fallen; Mr Osborne should have pushed through more supply-side reforms to try to solve this. The average worker therefore remains poorer than before the crisis.

But for all the problems, the real story is that the pessimists were wrong and Britain is booming again – and for that we should all be grateful.

Full text

UK

Interndevalvering

Top of page

I’ll eat my hat. The St Louis Federal Reserve – the last bastion of monetary orthodoxy in the Fed family –

has just published a paper that basically deems quantitative easing to be useless.

John Maynard Keynes was right all along.

The working paper by Yi Wen and Jing Wu cites China as the world’s resounding success story post-Lehman

Ambrose Evans-Pritchard, March 28th, 2014

While the West and other Brics have deployed the wrong instruments, forgotten the lessons of the 1930s, and failed to recover fully from the slump. It could have been written by Paul Krugman (well, almost).

It makes the point – often forgotten in the West – that China suffered a 45pc collapse in exports when the storm hit, “one of the largest trade collapses in world history since the Great Depression.”

a paper that basically deems quantitative easing to be useless

Full text

China

- Jag tycker det är skriande uppenbart att räntan världen över är för låg

och att en större del av stimulanserna borde ske via finanspolitiken, skrev jag i december 2009.

Top of page

Keynes, Krugman, Secular Stagnation and The Death of the Rentiers

Izabella Kaminska, FT Alphaville, 23 January 2014

Paul Krugman's point refers to John Maynard Keynes’s famous observation that one day the global economy would rid itself of the plague of economic value-sucking rentiers by arriving at a post-scarcity moment. At such a time an abundance of capital would make economic rent an impossibility.

Rates would naturally fall to zero to reflect the excess of capital, and rentiers would have to die.

Today we’re calling that idea “secular stagnation”. Which of course sounds more impressive than plain old “abundance” and new enough to be able to distance itself from Marxist economics.

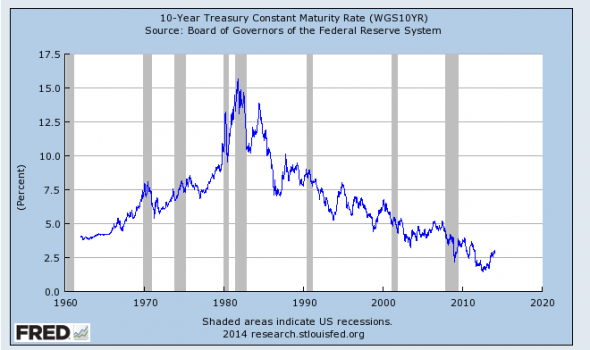

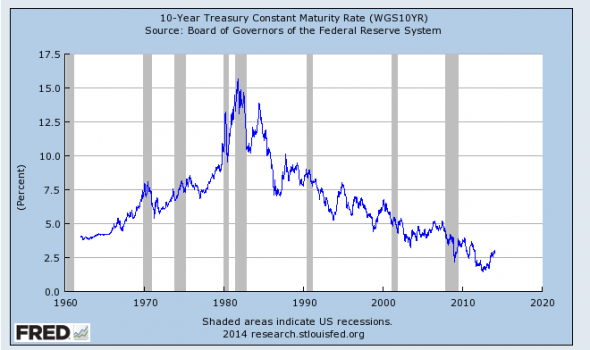

One need only look at the trend for the 10-year yield to get the picture:

Based on that analysis, the surest sign that our society is on the verge of exactly such a secular stagnation story is the increasing frequency and severity of bubbles today. But ...

Full text

Izabella Kaminska at IntCom

The Euthanasia of the Rentier

Paul Krugman, NYT 22 January 2014

A commenter quotes John Maynard Keynes:

The outstanding faults of the economic society in which we live are its failure to provide for full employment and its arbitrary and inequitable distribution of wealth and incomes.

It is, of course, a perfect quote for our times, too. It comes from the last chapter of the General Theory — a chapter that definitely bears rereading in the light of current debates.

keynes/john_maynard/chapter24

For what Keynes describes in this chapter is, pretty much, a condition of secular stagnation — of persistently low returns on investment, in which there is a chronic oversupply of saving. He believed, in 1936, that this would be the state of affairs in the decades ahead, and was of course wrong in that belief.

But he wasn’t wrong about the possibility of such a state of affairs, and since Larry Summers came out as a secular stagnationist, the view that we may well be there now has gone mainstream.

Full text

At present the world’s high propensity to save is not matched by a desire to invest.

High-income economies have had ultra-cheap money for more than five years. Japan has lived with it for almost 20.

The highest interest rate charged by any of the four most important central banks in the high-income economies is 0.5 per cent at the Bank of England.

Martin Wolf, FT May 6, 2014

Top of page

It's hard to think of a British man born in the 1880s whose name you hear more often, in current debates, than John Maynard Keynes.

I've made a TV series, with help from the Open University, about three economic thinkers from the past who have something interesting to tell us about the financial crisis and how to get past it:

Friedrich Hayek, Karl Marx and, tonight, Keynes.

Stephanie Flanders, BBC Economics editor, 17 September 2012

You might think it an odd trio for a series. Even for BBC Two.

If you've heard Hayek's name, it will have been as Keynes' arch enemy - the "Austrian" economist who wrote the Road to Serfdom and believed that markets should be as free as humanly possible.

And Marx - well, wasn't he some some kind of Communist?

But what all three had in common was that they understood both the genius of capitalism, and its inherent instability.

Full text

Har Borg knäckt den keynesianska koden?

Man håller igen när det går trögt och gasar på när hjulen rullar.

Det är inte ortodox konjunkturpolitik, om man så säger.

SvD-ledare 25 augusti 2012

Top of page

The macroeconomics of John Maynard Keynes continue to dominate the global economic policy debate to this very day.

But many have forgotten that the great intellectual was also one of the most active investors of his era.

Gavyn Davies, Financial Times, August 22, 2012

Full text

Top of page

Man behöver inte tro på Keynes teorier från 1930-talet för att se både

den politiska och ekonomiska faran i en finanspolitik som spär på nedgången.

Det långsiktigt nödvändiga – att sanera skuldsatta ekonomier – är inte en klok strategi i ett akut läge.

Peter Wolodarski, DN 13 maj 2012

Bond yields have been extraordinarily low in the developed world in recent times because the economies have been stuck in, or very near, a liquidity trap.

Longer term government interest rates have remained positive, but at 1.9 per cent they were very close to the territory which Keynes warned about,

in which the future yield on the bonds did not compensate holders for the risk of capital loss if economic circumstances changed.

Gavyn Davies, FT, 18 March 2012

The truth, although nobody on the right will ever admit it, is that

Friedman was basically a Keynesian — or, if you like, a Hicksian.

Paul Krugman, NYT blog 14 March 2012

Economists And Post-Crisis Policy (Also Ireland)

Henry Farrell and John Quiggin have posted their fascinating paper on the rise and

temporary, I think) fall of Keynesian economics in the aftermath of the financial crisis

Paul Krugman, March 11, 2012

Han är bildad, Ambrose; Grekland, Tyskland och the London Debt Agreement of 1953

Rolf Englund blog 13/2 2012

Keynes

Finding the human causes of this financial crisis can set us on the road to recovery

The starting point is to recognise that this proto-depression is not natural or inevitable. It is not the result of destruction through earthquake, or famine.

It results from human actions and inactions.

Confronting the painful reality of depression conditions in the 1930s, he explained how this happened, why it might persist and what needed to be done to overcome it.

Roger Bootle, Daily Telegraph 9 Oct 2011

The post-crisis European Union offers insight into a contentious economic question:

How fast do wages fall in the face of high unemployment?

WSJ 19 Sept 2011

The question is far from academic. Millions of Europeans who lost their jobs in countries hard-hit by the crisis won’t see their prospects improve

until companies believe labor is cheap enough to start hiring again.

Full text

It’s tempting to argue that the economic failures of recent years prove that economists don’t have the answers.

But the truth is actually worse: in reality, standard economics offered good answers,

but political leaders — and all too many economists — chose to forget or ignore what they should have known.

Paul Krugman, New York Times 6 January 2013

The story, at this point, is fairly straightforward. The financial crisis led, through several channels, to a sharp fall in private spending: residential investment plunged as the housing bubble burst; consumers began saving more as the illusory wealth created by the bubble vanished, while the mortgage debt remained. And this fall in private spending led, inevitably, to a global recession.

For an economy is not like a household. A family can decide to spend less and try to earn more. But in the economy as a whole, spending and earning go together: my spending is your income; your spending is my income. If everyone tries to slash spending at the same time, incomes will fall — and unemployment will soar.

But it all went wrong in 2010. The crisis in Greece was taken, wrongly, as a sign that all governments had better slash spending and deficits right away.

Austerity became the order of the day, and supposed experts who should have known better cheered the process on, while the warnings of some (but not enough) economists that austerity would derail recovery were ignored.

For example, the president of the European Central Bank confidently asserted that “the idea that austerity measures could trigger stagnation is incorrect.”

Full text

Greece

I really wonder about the state of economics education.

Paul Krugman on Ireland

New York Times 23 Sept 2011

Look, standard Keynesian models, open-economy version, tell a very clear story about what happens when a country pegs its exchange rate at a level that leaves its industry uncompetitive.

The country doesn’t stay depressed forever: high unemployment leads to actual or at least relative deflation, which gradually improves cost-competitiveness, which leads to rising net exports and gradual expansion. In the long run, full employment is restored; it’s just that in the long run we’re all, well, you get the picture.

That was Keynes’s whole point in The Economic Consequences of Mr. Churchill — not that the return to gold at too high a parity would mean depression forever, but that it would subject Britain to years of unnecessary suffering.

Seeing some growth in Ireland, then, is not at all a refutation of Keynesian economics — it’s exactly what you’d expect, given that Ireland is in fact gradually achieving an “internal devaluation” via relative deflation.

Full text

Ireland

Economic theory discredited

Top of page

News

Despite Keynes'protestations, the Chancellor of the Exchequer, Winston Churchill, announced on

28 April 1925 that Britain was returning to the pound at its prewar gold value

(Skidelsky 1992: 200).

Churchill himself had expressed deep fears about the

wisdom of his policy, recognizing that it would create great hardship (Gilbert

1977: 97-8). In the middle of July, Keynes responded with a scathing set of

articles entitled "The Economic Consequences of Mr Churchill" (Keynes 1925).

He warned:

Mr. Churchill's policy of improving the exchange by 10 percent was, sooner or

later, a policy of reducing everyone's wages .... Deflation does not reduce

wages automatically. It reduces them by causing unemployment.

The proper

object of dear money is to check in incipient boom.

Woe to those whose faith

leads them to use it to aggravate a depression. (Keynes 1925: 208 and 220).

Jenkins skriver härom:

The momentum of conventional wisdom swept them (Keynes-McKenna)away...

a remarkable example of a strong not a weak minister nonetheless reluctantly succumbing,

grudgingly adjustning himself to the near unanimous, near irresistible flow of

establishment opinion.

Read more here

Germany’s incoming “grand coalition” of Christian Democrats and Social Democrats is about to commit the biggest economic policy error since unification – the attempt to pursue budget consolidation at the expense of all other economic policy goals. In doing so, it risks turning a five-year-long stagnation into a full-scale depression.

It would be more accurate, perhaps, to compare her /Ms Merkel/ to Heinrich Brüning, a Christian conservative who was German chancellor from 1930 to 1932.

Wolfgang Munchau, Financial Times, 7/11 2005

Wolfgang Munchau is an associate editor of the Financial Times

Är det rätt att stimulera ekonomin med ökade statliga utgifter i samband med en kris, som Keynes menade?

Eller kan stimulanspolitik snarare hämma den långsiktiga tillväxten, enligt Hayeks synsätt?

Om stimulansåtgärder finansieras med hjälp av tidigare överskott snarare än genom massiv belåning är riskerna med stimulanspolitik små.

Johnny Munkhammar och Nima Sanandaji, Svensk Tidskrift, 20 maj 2011

Full text

---

Grekland, Spanien och grunderna i macro

BNP är C + I + G +/- X Skall det vara så svårt att förstå för microhjärnorna?

Rolf Englund blog 2010-05-29

The debate over post-crisis monetary and fiscal policy has been heating up, on both sides of the Atlantic.

So who is right? It will come as no surprise that economists disagree deeply.

Martin Wolf, Financial Times, 2 June 2011

Mr Congdon notes, correctly, that reductions in the cyclically-adjusted fiscal deficit have coincided with economic expansions.

But the fact that A coincides with B does not mean A causes B.

B might cause A. Or C and D might cause A and B.

Full text

More by Martin Wolf

---

Thomas J. Sargent and Christopher A. Sims of the U.S. won the 2011 Nobel Prize in Economics "for their empirical research on cause and effect in the macroeconomy," the Royal Swedish Academy of Sciences said Monday

Thomas J. Sargent and Christopher A. Sims of the U.S. won the 2011 Nobel Prize in Economics

Mr. Sargent is perhaps best known for his work in the early 1970s on "rational expectations theory,"

WSJ 10 October 2011

"rational expectations theory," argues that people base their behavior not just on government policies but also on what they expect those policies and their impacts to be in the future.

Mats Persson tillhör Nobelkommittén för Ekonomipriset, som utdelat priset till bl a Robert Lucas, vars teser om marknadens rationella förväntningar

har sjunkit i värde efter den finanskris som inte kunnat hända om marknaden haft rationella förväntningar.

Rolf Englund blog 28 sept 2011

Top of page

News

The disappointing economic data on US activity in recent months has brought a key policy debate back into focus.

The Keynesian side of this debate has been well served, with frequent outstanding contributions from Paul Krugman, Brad DeLong and others.

But I have had more trouble finding serious economic contributions from the classical school, even though they seem to be gaining ground in political and policy circles on both sides of the Atlantic.

For that reason, I was particularly interested in the recent lecture on the US recession given by the University of Chicago’s Robert Lucas.

Lucas is universally recognised as an intellectual giant, and his lecture gives a neat synopsis of what the classical school currently thinks, straight from the horse’s mouth.

Gavin Davies FT blog 31 may 2011

Full text

Dagens globala finanskris har utlöst en kris för ämnet nationalekonomi.

Sökandet efter bättre ekonomisk analys pågår för fullt.

Lars Jonung kolumn DN 29/4 2010

In a guest article,

Robert Lucas rebuts criticisms that

the financial crisis represents a failure of economics

The Economist print, Aug 6th 2009

Top of page

---

A strange thing has happened to policy discussion: on both sides of the Atlantic,

a consensus has emerged among movers and shakers that nothing can or should be done about jobs.

Paul Krugman 29 May 2011

John Kay provides an enlightening discussion of our awkwardness in thinking about contingent events that cannot be pressed into a probabilistic framework – Rumsfeldian “unknown unknowns”

(“Why we struggle to make sense of our roulette wheel world”, Comment, March 16).

John Maynard Keynes, the eminent early 20th-century theoretician of probability, encapsulated the concept brilliantly in an article he wrote on another subject, economics:

Top of page

Bernanke Leaps into a Liquidity Trap

If consumers wish to reduce their debt, and companies do not have a desirable menu of potential investments, there is little benefit in reducing interest rates

John P. Hussman, Ph.D. www.hussmanfunds.com, at John Mauldin 5/11 2010

"There is the possibility ... that after the rate of interest has fallen to a certain level, liquidity preference is virtually absolute in the sense that almost everyone prefers cash to holding a debt at so low a rate of interest. In this event, the monetary authority would have lost effective control."

- John Maynard Keynes, The General Theory

One of the many controversies regarding Keynesian economic theory centers around the idea of a "liquidity trap." Apart from suggesting the potential risk, Keynes himself did not focus much of his analysis on the idea, so much of what passes for debate is based on the ideas of economists other than Keynes, particularly Keynes' contemporary John Hicks. In the Hicksian interpretation of the liquidity trap, monetary policy transmits its effect on the real economy by way of interest rates. In that view, the loss of monetary control occurs because, at some point, a further reduction of interest rates fails to stimulate additional demand for capital investment.

Full text

Keynes Paradox of Thrift

The reason that the current recovery is below par is that the economy is experiencing a massive paradox of thrift.

Michael E. Lewitt, at John Mauldin, 1/11 2010

The most extended discussion of the paradox of thrift occurs in Chapter 23 of The General Theory, which is actually part of a series of chapters contained in Book IV entitled “Short Notes Suggested by the General Theory.” The discussion of the paradox of thrift in this chapter is primarily devoted to a historical survey of the idea and is relatively disjointed. Keynes’ clearest description of the concept comes much earlier in The General Theory when he writes the following:

“The reconciliation of the identity between saving and investment with the apparent ‘free-will’ of the individual to save what he chooses irrespective of what he or others may be investing, essentially depends on saving being, like spending, a two-sided affair. For although the amount of his own saving is unlikely to have any significant influence on his own income, the reactions of the amount of his consumption on the incomes of others makes it impossible for all individuals simultaneously to save any given sums. Every such attempt to save more by reducing consumption will so affect incomes that the attempt necessarily defeats itself. It is, of course, just as impossible for the community as a whole to save less than the amount of current investment, since the attempt to do so will necessarily raise incomes to a level at which the sums which individuals choose to save add up to a figure exactly equal to the amount of investment.”

In order for the fallacy of thrift to slow economic growth, the capital that consumers and businesses are saving would normally have to be available to recirculate in the economy through loans or investments. This recirculation is precisely what is not happening today, or at least not nearly at the rate necessary to lift growth to a level that would create significant job growth. And this is the Keynesian lesson that fiscal and monetary policymakers appear to have forgotten as they have forged their post-crisis strategy – rather than indiscriminately easing monetary conditions, it is necessary to create an environment in which savings-conscious consumers and corporations are willing to allow their funds to recirculate.

The reason that the current recovery is below par is that the economy is experiencing a massive paradox of thrift. A combination of factors has led individual economic actors – both consumers and corporations – to believe that it is in their best individual interest to save rather to spend, to repay debt rather than borrow. The result has been an increase in the personal savings rate from slightly negative to approximately 6-7 percent, and a significant improvement in corporate balance sheets (corporations are now sitting on approximately $1 trillion of cash). This has improved the financial condition of these individual economic actors, but deprived the broader economy of consumption and investment spending.

Full text

...

Savings and investment, being different activities, carried on by different people, could not simply be presumed identical.

John Maynard Keynes

Top of page

A 69-year-old plan for dealing with imbalances in currency unions

One weekend in September 1941, John Maynard Keynes sat down in his farmhouse in Tilton to consider

how the world’s currencies might be managed once the war was over.

Within a few days the prolific economist produced two papers.

These set out his thoughts on what lay behind the breakdown in the early 1930s of the gold standard, in which currencies were linked at fixed rates to the gold price and so to each other.

The Economist September 23rd 2010

As Robert Skidelsky argues in his biography of Keynes*, this also reflected the contrasting views in America and Britain of the collapse of the gold standard.

America associated its earlier prosperity with the standard’s stability and the Depression with the system’s breakdown.

Britain linked the misery of the 1920s to the gold straitjacket and its subsequent recovery to being freed from it.

The belief that more discipline for debtors is the cure for imbalances persists, though in Germany rather than America.

Now a deficit country, America thinks surplus countries should adjust too.

“John Maynard Keynes: Fighting for Britain 1937-1946” (Macmillan, 2000)

Top of page

My new maxim, never to stand in the middle of a fight between Paul Krugman and Niall Ferguson

It says a lot about the talents of John Maynard Keynes – and just as much about the shortcomings of modern macroeconomics – that when the financial crisis struck, policymakers instinctively reached not for their fancy models, but for the Keynesian idea of fiscal stimulus

Tim Harford, FT July 20 2010

If stimulus were to be the solution, what would be the problem?

The problem would be that too many of us wanted to save money or pay off debts; that is, we wanted others to pay for our services but weren’t so keen on paying for theirs right now.

Simple arithmetic suggests this would leave slack in the economy.

Fiscal multipliers are certainly fun.

If the fiscal multiplier is 0.5, we’re getting government projects at half price: the government project draws half its resources away from private-sector activity, but the other half is just soaking up slack.

If the fiscal multiplier is 1.6, as President Barack Obama’s Council of Economic Advisers has estimated, we get a free government project and a larger private sector.

It was in this future paradise that Keynes famously imagined that the economics profession might be thought of as “humble, competent people, on a level with dentists”. We economists have a way to go yet.

Full text

Multiplikatorn

Tim Harford home page

The great austerity debate

Keynes Versus Hayek, 1932

It’s deeply tragic that we’re having to have this debate all over again,

as the world economy slides into deflation and stagnation

Paul Krugman July 9, 2010

Are these hardships necessary?

The trick of the British establishment is to turn discussion from “whether to” into “how to” questions. The media debate is on which government services to cut or on the balance between spending cuts and tax increases. Once the discussion has been channelled into these trenches the establishment has won.

The real argument, however, should be on whether we need unparalleled fiscal austerity or not.

Samuel Brittan, FT June 17 2010

Keynes och moral hazard

Min hypotes är att det finns en makroekonomisk moral hazard (ung trygghetsrisktagande) som innebär att själva föreställningen, att det finns en kraftfull stabiliseringspolitik att ta till om det skulle gå snett, kan leda till stora obalanser.

Danne Nordling 4 mars 2010

Även om deras slutsatser skiljer sig åt är både Hayeks och Keynes teorier födda ur rädsla.

De är inte utopiska, de utlovar inget framtida lyckorike. De säger bara att den som följer deras läror har en god chans att undvika social kollaps, anarki och diktatur.

DN-ledare 4 mars 2010 signerad Henrik Berggren

The parallel with what happened in 1931 is irresistible.

The current stampede to thrift shows that the re-conversion to Keynes in the wake of the financial collapse of 2008 was only skin-deep

We are about to embark on a momentous experiment to discover which of the two stories about the economy is true

Robert Skidelsky, FT June 16 2010

Lord Skidelsky is emeritus professor of political economy at the University of Warwick.

His latest book is Keynes: The Return of the Master

The implicit premise of the coming retrenchment is that market economies are always at, or rapidly return to, full employment. It follows that a stimulus, whether fiscal or monetary, cannot improve on the existing situation. All that increased government spending does is to withdraw money from the private sector; all that printing money does is to cause inflation.

These propositions are a re-run of the famous “Treasury view” of 1929.

By contrast, Keynes argued that demand can fall short of supply, and that when this happened, government vice turned into virtue. In a slump, governments should increase, not reduce, their deficits to make up for the deficit in private spending.

Any attempt by government to increase its saving (in other words, to balance its budget) would only worsen the slump. This was his “paradox of thrift”.

The current stampede to thrift shows that the re-conversion to Keynes in the wake of the financial collapse of 2008 was only skin-deep: the first story remains deeply lodged in the minds of economists and politicians.

The parallel with what happened in 1931 is irresistible. In February of that year, Philip Snowden, the Labour government’s chancellor of the exchequer, set up the May Committee to recommend cuts in public spending.

Conservative spokesmen often claim that fiscal consolidation causes economies to recover. If so, the effect of the outbreak of public frugality in 1931 was curiously roundabout. Cuts in salaries produceda “mutiny” of naval ratings at Invergordon, suggesting that the empire was crumbling. This was enough to force Britain off the gold standard. A combination of sterling depreciation and lower interest rates revived exports and started a housing boom. But there was never a complete recovery until the war. Such evidence for the success of the cuts is the stuff of castles in the sky.

Full text

---

So far, so good. But here is my question: what is your “plan B”?

I have been fascinated – if appalled – by the pre-Keynesian approach you and the prime minister have taken to the UK’s fiscal challenges.

What Keynes called “the Treasury view” – that fiscal policy has no effect on activity, even in a deep recession – is alive and well in Downing Street.

Martin Wolf, 10 June 10 2010

Top of page

The crucial issue for Spain and its European neighbours is the credibility of its “stability plan”, which outlines sharp cuts in government spending, including a near-freeze on hiring civil servants, and aims to reduce the deficit from 11.4 per cent of gross domestic product last year to 3 per cent of GDP in 2013.

Mr Zapatero and his ministers, like their foreign peers, deserve some sympathy for their post-Keynesian hangover. At a meeting in London this month Mr Zapatero recalled that the same organisations and markets that had demanded massive fiscal stimulus to avert an economic depression were now complaining about the resulting fiscal deficits. “What a paradox. What a contradiction,” he said.

The bad news for Mr Zapatero and other deficit-burdened European prime ministers is that the markets, impersonal yet fickle, do not give a damn about paradoxes or who was to blame yesterday for a problem today.

http://www.nejtillemu.com/spanien.htm#Unfortunately

If new-classical and new-Keynesian economics are both wrong, where do we go from here?

For 30 years, macroeconomists have been of two stripes: new-classical and new-Keynesian.

Neither has anything interesting to say about the current crisis.

Roger E.A. Farmer FT January 28, 2010

Har centralbankernas inflationsmålspolitik bidragit till krisen?

Hur kommer det sig att Keynes återuppstått?

Klas Eklund December 27th, 2009

Ekonomiläroböckerna och finanskrisen

I min egen lärobok, som har kommit i elva upplagor, finns visserligen en del avsnitt

om bubblor och om irrationaliteten och kasten på t.ex valutamarknaderna.

Men de avsnitten måste byggas ut till nästa upplaga.

Likaså måste Keynes få en grundligare behandling - inte minst begreppet “likviditetsfälla” och

hur den påverkar penningpolitiken.

Klas Eklund blog 2/3 2009

- Most mainstream macroeconomic theoretical innovations since the 1970s

(the New Classical rational expectations revolution associated with such names as Robert E. Lucas Jr., Edward Prescott, Thomas Sargent, Robert Barro etc, and the New Keynesian theorizing of Michael Woodford and many others)

have turned out to be self-referential, inward-looking distractions at best.

Rolf Englund agreeing with Willem Buiter, blogging at Maverecon, 5/2 2009

CNN uppfinner det Kenyesianska hjulet på nytt

Saving more and cutting debt might sound like a good plan to deal with the recession.

But if everyone does that, it'll only make matters worse.

Chris Isidore, CNNMoney.com senior writer, February 12, 2009

Time to plan for post-Keynesian era

Mainstream Keynesian economics is facing its last hurrah. The global fiscal stimulus championed last year by the Obama administration is coming undone, repudiated by the same Group of 20 that endorsed it last year.

Jeffrey Sachs, FT June 7 2010

Now, against a backdrop of a widening sovereign debt crisis, we need to abandon short-term thinking in favour of the long-term investments needed for sustained recovery.

Certain counter-cyclical spending is vital on social grounds. But stimulus measures such as temporary tax cuts for households or car scrappage schemes were dispiriting wastes of scarce time and money. They reflected a hope that a temporary fiscal bridge would carry us back to consumption and housing-led growth – a dubious proposition since the old “normal” had been financially unsustainable.

Now we face a world economy with weak aggregate demand in the US and Europe, bulging budget deficits, sovereign debt downgrading and consumers unwilling to borrow. Governments are fighting for market credibility via draconian cuts in spending.

This too is the wrong approach. We should avoid a simplistic austerity to follow the simplistic stimulus of last year.

Full text

...

Lost Decade, Here We Come

The deficit hawks have taken over the G20

Paul Krugman June 6, 2010

This is a glorious moment to be an economist

Now we call for trillion dollar stimulus plans on the basis of little more than citing John Maynard Keynes

Benn Steil, Financial Times, February 5 2009

Top of page

Keynes offers us the best way to think about the financial crisis

Martin Wolf, Financial Times, December 23 2008

Highly recommended

Svenskt Näringsliv gör helt om, dock utan att göra en pudel

Nu behövs en aktiv statlig finanspolitik där regeringen släpper loss reformer och offentliga jobb för cirka 50 miljarder det närmaste året.

Svenskt Näringslivs verkställande direktör Urban Bäckström och chefsekonom Stefan Fölster, DN Debatt 16/11 2008

Skall Urban Bäckström och Svenskt Näringsliv tvingas göra en pudel?

Rolf Englund blog 2008-10-26

Top of page

Keynes had no sure cure for slumps

The recent collapse of speculation on houses is a non-monetary phenomenon

Edmund Phelps, Financial Times, November 4 2008

PIMCO’s Investment Committee to a man (no women yet) believes that capitalism is the best and most effective economic system ever devised,

but it has a flaw: it is inherently unstable.

Bill Gross, October 2008

The current crisis reminds us that, in a free economy, the price of the greatly improved long-term performance that only free economies can provide is an ineradicable economic cycle.

As John Maynard Keynes pointed out in the 1930s, the cause of the cycle is alternating moods of optimism and pessimism, and

its motor is credit, which enables optimism to determine economic activity.

Nigel Lawson. Time Magazine, October. 01, 2008

Top of page

Many today are complaining about Alan Greenspan’s monetary stewardship, which kept these three locomotives stoked:

“serial bubble-blower” is the most polite phrase that I have heard.

But would the world economy really be better off today under an alternative monetary policy that kept unemployment in America at an average rate of 7% rather than 5%?

Would it really be better off today if some $300 billion per year of US demand for the manufactures of Europe, Asia, and Latin America had simply gone missing?

Brad DeLong April 05, 2008

The world economy, as John Maynard Keynes put it 75 years ago, is developing magneto trouble. What it needs is a push – more aggregate demand. In the US, the weak dollar will be a powerful boost to net exports, and thus to aggregate demand.

But, from the perspective of the world as a whole, net exports are a zero-sum game.

So we will have to rely on other sources of aggregate demand.

Full text

US Dollar

Top of page

Inspired by John Maynard Keynes's “General Theory”, many economists in the 1960s and early 1970s viewed government tax and spending decisions as the prime tool for smoothing the economic cycle.

That confidence was later shattered by stagflation and rising budget deficits. The modern consensus has been that monetary policy, administered by an independent central bank, makes a better first weapon against recession than the whims of politicians.

But now, after more than three decades in the wilderness, Keynesian-style fiscal policy seems to be staging a comeback.

The Economist print 14/2 2008

Who is right depends on the answer to two questions.

Do countries have more room to use counter-cyclical fiscal policy than they used to?

And what is the evidence that it works?

With stingier unemployment benefits and a lower federal tax take, America has fewer “automatic stabilisers” than other rich countries do. Since many American states are forced, by law, to run balanced budgets they cut spending or raise taxes in a downturn—the opposite of Keynesian pump-priming. Federal-stimulus packages, in part, counter those trends. With higher tax burdens and more generous jobless benefits, European countries get a bigger fiscal boost without any change in policy.

Full text

Top op page

The issue here is not whether there is going to be a recession in the world or individual countries,

but what governments and central banks could do about it.

There are many problems about policies to maintain activity,

but lack of policy instruments is not one of them.

Samuel Brittan, January 17 2008

Of course, things would be much easier if national authorities had used the recent expansion to strengthen their underlying positions, notably to put their budgets in order and at least to keep a weather eye on the growth of money and credit.

US three-month market interest rates at near 4 per cent still leave plenty of room for further reductions, as do euro rates. UK rates, at well over 5½ per cent, leave even more room. By contrast, during the last deflation scare, when Federal Reserve member Ben Bernanke alarmed financial coelacanths by talking (hypothetically) of helicopter money, US rates were down to just over 1 per cent.

RE: See also helicopters

Contrary to some alarmist fears, long-term rates did not move in the opposite direction, although they did not fall very much.

RE: See also Conundrum

If there really were to be a generalised lack of spending, national and international authorities would have the means to counteract it. There is no need to talk ourselves into a Great Depression.

RE: See Doom and 1929

Full text

Recession

Samuel Brittan

Top op page

Let's look at what Bernanke really said.

"Sustained deflation can be highly destructive to a modern economy and should be strongly resisted. Fortunately, for the foreseeable future, the chances of a serious deflation in the United States appear remote indeed, in large part because of our economy's underlying strengths but also because of the determination of the Federal Reserve and other U.S. policymakers to act..."

John Mauldin, 28/10 2005

Very Important Article

Classical economic theory suggests that interest rates automatically bring saving and investment into a productive balance.

The central principle of Keynesianism, however, is that this alignment between saving and investment is not always automatic, and that a misalignment can have serious consequences.

The Economist, Survey The World Economy, 22/9 2005

The modern consensus is that both classical and Keynesian theory can be right, but over different time frames. In the long term, saving and investment will be brought into line by the cost of capital. But in the short term, firms' appetite to invest is volatile, and policymakers may need to step in to shore up demand.

Thus, although saving and investment are equal ex-post, economic theory leaves plenty of room for an ex-ante saving glut.

Full text

It is little wonder that Mr Greenspan has become an almost legendary figure. Yet how good has his performance been and what lessons does his tenure bequeath?

Mr Volcker had to crush inflation. Mr Greenspan had merely to keep the show on the road.

Another reason for questioning the unique sagacity of the chairman is that low inflation has broken out all over the world.

Surprisingly for a man once known as a gold bug and disciple of Ayn Rand’s libertarian philosophy, Mr Greenspan has emerged as the policymaker closest in spirit to Maynard Keynes.

Martin Wolf, Financial Times, 19/10 2005

The burden of supporting the world economy can hardly rest indefinitely on the shoulders of Anglo-American shoppers and home owners.

Samuel Brittan 11/5 2007

Historical experience argues that monetary policy should be the first line of defence against both slump and inflationary boom.

Unfortunately, we cannot just leave matters here. It is easy to envisage situations in which both monetary and fiscal policy would be necessary to achieve a modicum of stability

Samuel Brittan, Financial Times 2/9 2005

Historical experience argues that monetary policy should be the first line of defence against both slump and inflationary boom. Not only can it be changed much more quickly and with less political embarrassment but the record suggests that fiscal changes on their own without adequate monetary backing are often ineffective. Moreover, monetary policy has the great virtue, when used as a stimulus, of not leaving behind a mass of deadweight debt to be serviced from the public purse.

Unfortunately, we cannot just leave matters here. It is easy to envisage situations in which both monetary and fiscal policy would be necessary to achieve a modicum of stability, but they would have to work together to do so

The not-so-golden rule, championed by Gordon Brown, the British chancellor of the exchequer, is to aim for a current balance but exclude public investment – now rising towards 3 per cent of GDP – from the calculation. This is, however, based on a false analogy with private investment. It would be much better, in my view, to accept a modest permissible overall deficit and put much less emphasis on the current-capital distinction.

None of these problems justifies the orthodox attitude, which is a form of “not in front of the children”. Many in the financial world know that unbalanced budgets may sometimes be theoretically desirable but are against admitting it, lest politicians misuse the knowledge and borrow to excess. This is the old fallacy of telling noble lies to encourage good behaviour. It is a good rule of thumb to avoid large budget deficits but it is not a principle to be pursued in all circumstances and at all costs.

Full text

Demand and Supply

Top

Jag har sagt det förut. Persson har rätt i att det blir knepigt för Alliansen att gå till val på löfte om fler nya jobb tack vare sänkta ersättningsnivåer i socialförsäkringen.

Maria Abrahamsson, SvD-ledarsida 16/2 2006

Särskilt om detta sker i ett läge då den svenska ekonomin tuffar på bättre än på länge. För att vinna den matchen måste Alliansen bli klart bättre på att förklara sambandet mellan lägre ersättning och nya jobb.

Full text

I ett år nu har moderatkansliet försörjt politiska reportrar och kommentatorer med en ström av promemorior. De har utgått från förhållandet att ungefär en miljon svenskar i arbetsför ålder inte försörjer sig på arbetsmarknaden.

Utgångspunkten är alltså att det finns en mängd obesatta platser och att en rad människor är sjukskrivna trots att de kan arbeta. Till en del är detta naturligtvis sant, men bara till en del.

DN-ledare 28/9 2005

Arbetslösa ska söka jobb, sjuka ska söka doktorn, gör de inte det får de inga pengar. Så kan programmet sammanfattas i stark förenkling.

Utgångspunkten är alltså att det finns en mängd obesatta platser och att en rad männi-skor är sjukskrivna trots att de kan arbeta.

Till en del är detta naturligtvis sant, men bara till en del.

Det måste bli lättare både att anställa och avskeda, då får vi en rörligare arbetsmarknad. Och en rörligare arbetsmarknad erbjuder fler arbetstillfällen

Full text

Kommentar av Rolf Englund:

DN undviker huvudproblemet, att det finns för få lediga platser.

Det är lättare att avskeda i Sverige än i Tyskland, Frankrike och Spanien.

Arbetsbrist är saklig grund för avsked. Företagen anställer när det

finns arbete som behöver utföras som man inte klarar med den

befintliga arbetsstyrkan. Den totala efterfrågan är för låg.

Sänka ersättningsnivåerna för att få sjukskrivna och arbetslösa att

gå till arbetsförmedlingen skall man göra när det är brist på

arbetskraft och företagen inte får nog med arbetssökande. Det är

faktiskt inte läget i dag. Vet man inte det inom Alliansen?

Top

Jag ställde frågan hur Lars Calmfors kunde tänka sig att den strukturella arbetslösheten skulle minska

genom att öka utbudet av arbetskraft.

Danne Nordling 22/9 2005

Min slutsats av detta är att DN-intervjun gav en missvisande bild av vad Calmfors egentligen tyckte. Detta återfaller på Johan Schück, som kanske inte fann det "lämpligt" att ställa frågor om stimulanspolitik som går stick i stäv med Alliansens solidariserande med en järnhård finanspolitik baserad på gamle Say.

Full text

Top

The new German government’s deflationary macroeconomic policies will sabotage potentially favourable results of supply-side reforms.

The need for mutual support between pro-competitive supply-side reforms and expansionary macroeconomic policies should be obvious to anyone with an understanding of Keynesian economics.

It has been amply demonstrated in practice — positively by the success of the US and UK economies since the mid-1980s and negatively by the consistent forecasting failures of the pre-Keynesian economic flat-earthers of the European Central Bank

Anatole Kaletsky, The Times, September 19, 2005

Den svenska massarbetslösheten fordrar ett omfattande reformprogram som bygger om socialförsäkringarna, sänker skatterna på arbetsinkomster, uppmuntrar företagande och ökar flexibiliteten på arbetsmarknaden.

DN-ledare 19/9 2005

Ekonomin är för stel för att skapa ordentligt med nya jobb när det går uppåt, och i stället för att mjuka upp strukturerna vill regeringen mjuka upp statsfinanserna.

SvD-ledare 2005

Statens minus för 2006 uppskattades till 30 miljarder kronor - och det under ett rätt gynnsamt år, då man borde ha överskott och samla i ladorna.

Full text

The contrast between the macroeconomic management of the US and that of the eurozone during the past five years could not be greater

Where does this difference come from?

The practical men in Frankfurt have become the slaves of a theory telling us that the sources of economic cycles are shocks in technology (productivity shocks) and changes in preferences.

Paul de Grauwe, Financial Times 17/8 2005

The increasing attention paid to growing U.S. current account deficits has bred nightmare scenarios of a sharp decline in the foreign-exchange value of the dollar and rising U.S. interest rates.

Financial markets, by contrast, appear more sanguine. Inflation-indexed bonds in the U.S. are yielding only about 1.5% in real terms, and the IMF's estimate of the long-term world real interest rate is about 2%.

Glenn Hubbard, dean of Columbia Business School, was chairman of the Council of Economic Advisers under President George W. Bush,

Wall Street Journal, 23/6 2005

Vägen ur krisen gick via tuffa reformer. Budgeten sanerades, inflationen togs ned och den ekonomisk-politiska ramen blev trovärdigt stabil. Sysselsättningen i offentlig sektor reducerades och ersättningsnivåerna sänktes.

Men det har varken vänster eller höger kunnat erkänna. Vänstern har inte velat anklagas för högerpolitik, och högern har velat kritisera.

SvD-ledare 25/1 2006

Makroperspektivet till trots är rapporten läsvärd och innehållsrik. Här bara två reflexioner:

Författarna betonar att vägen ur krisen gick via tuffa reformer. Budgeten sanerades, inflationen togs ned och den ekonomisk-politiska ramen blev trovärdigt stabil. Sysselsättningen i offentlig sektor reducerades och ersättningsnivåerna sänktes. En rad marknader avreglerades, pensionssystemet moderniserades och lönebildningen fick större lokala inslag.

Man kan gräla om det rätta namnet på politiken, men den innebär att det blivit mindre av kollektivism och detaljstyrning. Men det har varken vänster eller höger kunnat erkänna.

Vänstern har inte velat anklagas för högerpolitik, och högern har velat kritisera.

Full text

Göran Persson: Människors uppoffringar har givit resultat

i regeringsförklaringen i Riksdagen, Tisdagen den 14 september 1999

Att reformera välfärdsstaten (SNS Förlag, 2006)

Sedan en tid har det hävdats att Sveriges sysselsättningsproblem både beror på och skulle kunna lösas med finans- och penningpolitiska stimulanser.

Keynes är ett passerat kapitel och så bör det förbli.

SvD-ledare 29/7 2005

Sedan en tid har det hävdats att Sveriges sysselsättningsproblem både beror på och skulle kunna lösas med finans- och penningpolitiska stimulanser. Att konjunkturen nu är stabil och svagt ökande samtidigt som sysselsättningen fortsätter att minska indikerar att även den debatten är en återvändsgränd. Keynes är ett passerat kapitel och så bör det förbli.

Full text

Kommentar av Rolf Englund:

Detta är en extrem ståndpunkt, snarlik den som Svenskt Näringsliv gav

uttryck för under EMU-omröstningen, när PJ Anders Linder var

deras informationschef.

Svenskt Näringsliv skrev då i sitt remissyttrande över SOU 2002:16, Stabiliseringspolitik i valutaunionen, slutbetänkande samt underlagsrapporter

Svenskt SOU 2002:16, Stabiliseringspolitik i valutaunionen (Buffertfonder):

Svenskt Näringsliv avstyrker det föreslagna finanspolitiska rådet.

Det finns inget behov för ett sådant eftersom vi anser att aktiv stabiliseringspolitik inte skall bedrivas.

Top

Moderaterna vill se en utbudsexplosion på arbetsmarknaden genom stramare bidrag och lägre skatt på jobbinkomster.

Men partiet har få skarpa förslag som är inriktade på att öka den efterfrågan i ekonomin, som skulle möta det större utbudet.

Peter Wolodarski, DN 6/7 2005

Hur ska Sverige få fler arbetsgivare som är beredda att anställa? Den avgörande frågan saknar fortfarande Fredrik Reinfeldt ett bra svar på

De två inbjudna kommentatorerna, professor Assar Lindbeck och TCO:s Lena Hagman, var båda kritiska till moderaternas ensidiga fokusering på socialförsäkringarnas ersättningsnivåer.

Full text

Top

Pengarna från besparingarna använder moderaterna till förvärvsavdrag som är relativt sett mest betydelsefulla för låg- och medelinkomsttagare. Det är en operation som ytterligare ökar skillnaden mellan att arbeta och lyfta bidrag.

Någon förändring av efterfrågan och den totala jobbmängden blir det knappast. Möjligen kommer de redan sysselsatta att spara en del av skattesänkningen till skillnad mot bidragstagarna. Det kommer att minska efterfrågan något och sålunda öka arbetslösheten.

Dessvärre har vi inte fått någon ytterligare information om hur det skulle gå till när kanske 300 000 jobb skulle skapas med moderaternas politik.

Danne Nordling, blog 5/7 2005

Full text

Top

Strange things are happening in the world economy: falling interest rates on long-term securities, declining spreads between returns on safe and riskier assets, large fiscal deficits and huge global current account “imbalances” should not, in normal circumstances, coincide. So what is going on?

The answer, in a nutshell, is a global excess of desired savings against the background of weak investment, low inflation and ever more integrated economies.

To understand the present we need to go back to the 1930s. The “paradox of thrift” was the most counterintuitive and, to the classically trained economist, morally, theoretically and practically objectionable idea in John Maynard Keynes’ General Theory of Employment, Interest and Money, published in 1936, in response to the Great Depression.

Martin Wolf Financial Times June 13 2005

This year's Nobel prize honours two economists

Edward Prescott, of Arizona State University, and a Norwegian, Finn Kydland, of Carnegie Mellon University, honours research that has helped improve the practice of economic policy, as well as economists' understanding of booms and busts.

The Economist 14/10 2004

The two professors' work is based on a reconsideration of some of the ideas of John Maynard Keynes, an English economist whose theories held sway in the two or three decades after the second world war. His “General Theory of Employment, Interest and Money” laid out themes that were heavily informed by the Great Depression of the 1930s.

One was that economic recessions are caused in large part by a lack of “aggregate demand”, thanks perhaps to infectious bouts of mass pessimism.

While Keynesians were influenced by the hard times of the 1930s, this year's winners were inspired by the economic problems of the 1970s. Two features marked that decade.

First, there was “stagflation”, a combination of slow growth (or outright contraction) and high inflation. That perplexed many Keynesians, who thought that inflation came mostly with rapid growth.

The 1970s also saw a new desire among economists to understand an economy as the sum of millions of decisions by consumers and businesses, based ultimately on tastes and technological constraints; Keynes and his followers had tended to view the economy in aggregate terms, as if from a mountain top.

In a paper in 1977, they demonstrated the importance of credibility in economic policy. If governments cannot commit themselves credibly to a course, their policies may be futile.

Mr Kydland's and Mr Prescott's second Nobel-worthy idea, a new theory to explain business cycles, is more squarely opposed to Keynesian thought.

Rather than chalking up booms and busts to the vagaries of demand, as Keynes had done, they asked whether changes in technology, or other supply shocks such as a rise in oil prices, might be as important. After all, the American economy had grown sevenfold in the previous 100 years, thanks largely to improvements in technology. Might lulls in innovation be a prime cause of recessions, and surges a source of booms?

The professors found in one model that such fluctuations in technological growth could account for 70% of the swings of American business cycles in the post-war years.

This theory of “real business cycles” remains controversial. Many economists doubt that a depression like that of the 1930s could be explained mostly by variations in the pace of innovation.

Full story

“Real business cycles Home Page”

Nobelpristagare ekonomi 2004

Finn K. Kydland

Edward C. Prescott

Many economists find the real-business cycle theory totally unbelievable. No one can observe the technological shocks that are at the heart of this explanation, and it strikes many as simply ridiculous to argue that the unemployment during a recession is voluntary. On the other hand, the economists who have formed these arguments are among the brightest of the profession, and they can show that the patterns that their mathematical models generate are remarkably similar to the patterns that the real world generates.

Click here

Real business cycle theory to some extent went underground during the "years of high theory." Both Hayek and Keynes, while they drew from Wicksell, diverted our attentions away from traditional real business cycle theory mechanisms. Hayek blamed monetary expansion, while Keynes focused more on issues of animal spirits and liquidity premia, and sometimes sticky prices.

Click here

Satyajit Chatterjee, Senior Economist and Research Advisor, Federal Reserve Bank of Philadelphia

In an article published in 1986, Edward Prescott forcefully argued that during the post-World War II period, business cycles in the United States mostly resulted from random changes in the growth rate of business-sector productivity.1 He showed that upswings in economic activity occurred when productivity grew at an above-average rate and downswings occurred when productivity grew at a below-average rate.

Click here

Nouriel Roubini's Global Macroeconomic and Financial Policy Site

Top of page

I Ekonomisk Debatt nr 7 2003 argumenterar Anders Borg för att

finanspolitiken bör ges en tydligare institutionell ram. Han

förundras också över svenska ekonomers keynesfobi

Martin Flodén,

Ekonomisk Debatt nr 1/2004

Fisher, Keynes, Minsky, and Keen on "Bubbles in Everything" and Debt Deflation

iTulip

Are We All Keynesians (Again)?

Our late Levy

Institute colleague Hyman Minsky has been vindicated once more

Policy

Note 2001/10

Indeed, the budget surpluses of the past three years, which

have resulted from the long-term structural imbalance, are largely responsible

for this downturn. Until a fundamental restructuring of the federal budget

stance occurs, recovery is highly unlikely. What is needed is not a short-term

fiscal stimulus, but a "permanent" relaxation of the fiscal stance. At a

minimum, the cyclically adjusted fiscal relaxation that is required should

reach the level of roughly $600 billion per year within the next several years.

Full

text

Minsky, Hyman Stabilizing

an Unstable Economy. New Haven, Conn.: Yale University Press.

Are

Financial Markets Inherently Unstable?

Ten years on and sterling's

ejection from the European exchange rate mechanism

on Black Wednesday still

has a surreal quality about it.

Financial Times

2002-09-13

Picture the scene on September 16 1992. John Major's

senior ministers huddled around a borrowed transistor radio as the hurricane on

the currency markets washed away the government's economic policy and its

political authority.

The Bank of England's Eddie George pacing the prime

minister's temporary offices in Whitehall's Admiralty House, glued to his

pocket Reuters monitor as the Bank emptied it s foreign exchange reserves.

Interest rates raised to a breathtaking 15 per cent.

An ashen-faced

Norman Lamont, bathed

in television lights outside the Treasury, announcing, preposterously, that the

government had chosen to suspend sterling from the ERM.

A floating pound has rarely proved the shock absorber

described by disciples of perfect markets. Nor has a fixed currency been the

reliable lever of change imagined by those who want to force adjustments in the

real economy.

Winston Churchill took the latter view when sterling was

returned to the Gold Standard in 1925. Sane economics fell victim to sterling's

totemic status. Churchill had his doubts about restoring the pound's

convertibility to gold at $4.86, but he swallowed the argument that Britain

could not own up to its waning economic power by choosing a lower rate.

The decision, denounced by John Maynard Keynes in his

famous tract The Economic Consequences of Mr Churchill, helped tip

Britain into the depression.

.....more

Exchange Rates Precedents to EMU

In Discussion Paper No.

1390

Research Associate Tamim Bayoumi and Michael Bordo focus on two cases

in which major countries returned to a fixed gold standard at previous

parities: the resumption of specie convertibility by the US in 1879, and of

gold convertibility by the UK in 1925.

These historical perspectives, they argue, may be of value in

understanding issues involved when joining a fixed exchange rate regime –

particularly in the context of EMU and ERM. Bayoumi and Bordo compare the two

experiences in order to examine the degree to which their success or failure

reflects the exchange rate strategies themselves or the external environment in

which the parity resumptions occurred.

A common set of macroeconomic fundamentals is examined so as to identify

the important similarities and differences in underlying behaviour.

Full text

"What has Happened to

Monetarism?

An Investigation into the Keynesian Roots of Milton

Friedman's Monetary Thought and Its Apparent Monetarist Legacies"

Jörg

Bibow, The Levy Economics Institute, June 2002

Inflation can be too low

By Samuel

Brittan

Financial Times, June 5 2002 20:42

Bo Lundgren är av annan

mening

Är den

keynesianska ekonomin död?

Asienkrisen, Ryssland, IMF och

Argentina

Joseph Stiglitz

DN, 12 maj 2002

Remember fiscal policy?

How to use fiscal policy in a recession

The Economist Jan 17th 2002

Skyll Japankrisen

på Keynes

Mattias Lundbäck SvD ledarsida 2002-01-11

Divided we stand, united we fall

The

market requires individuals to act in their own self-interest.

But their

decisions can add up to recession

Michael Prowse, Financial Times; Nov 10,

2001

Keynes revisited

Gerard Baker and Ed Crooks,

Financial Times, October 5 2001 19:47

This week, with little ceremony, President George W. Bush quietly

brought to a close more than a decade of US economic policy orthodoxy. By

signalling his support for lower taxes and higher public spending in the next

year that could reach as high as $130bn (£88bn) - 1.3 per cent of gross

domestic product - he threw the US administration's weight behind the

proposition that a temporary deficiency in aggregate demand should be met by a

shift in government finances from surplus to deficit.

This argument, the simplest distillation of the teachings of John

Maynard Keynes, has been out of favour in much of the industrialised world for

10 years or more. But with the world's three largest economies - the US, Japan

and Germany - all in recession or close to it, the conventional wisdom is up

for re-assessment.

At Saturday's gathering in Washington of finance ministers and central

bankers from the Group of Seven leading industrial nations, the burden of

expectation will fall on governments to play their part in averting global

recession by cutting taxes and boosting public spending.

But as the US economy heads into recession, despite the sharpest

reduction in the cost of short-term borrowing for a generation, fears are

growing that the faith placed in monetary policy through the 1990s may be

misplaced. Even some Federal Reserve policymakers are not so sure these days

that interest rates alone can suffice. Fiscal policy is back in fashion.

The rest of the world, however, sees it rather differently. In Europe,

as in the US, the 1990s was a decade of remarkable fiscal consolidation, driven

in part by the requirements of the Maastricht treaty for countries that hoped

to join the euro. The difference is that the Europeans generally still believe

in trying to go further, at least over the long term. Although economic

slowdown will inevitably mean that budget deficits are going to rise across the

European Union, there is little enthusiasm for adding to those deficits with

additional tax cuts or increases in spending.

When Gerhard Schroder, Germany's chancellor, talked about the need for a

stimulus package for the EU this week, he was careful to stress that it would

have to be delivered within the limits of the eurozone's stability and growth

pact, which sets limits on budget deficits.

Full

text

A Flawed Stimulus Plan

New York Times,

October 6, 2001

Responding to the demands of Republicans in Congress, President Bush has

laid out a stimulus package that relies in large part on ineffective,

irresponsible and regressive tax cuts.

http://www.nytimes.com/2001/10/06/opinion/06SAT3.html

Stimulate With Care

By Robert J. Samuelson

Thursday, October 4, 2001

Before the attacks, business investment and exports were declining while

growth in consumer spending and housing was weakening. The economy was at a

standstill -- or in recession. Prospects are now worse. In late September

initial weekly unemployment claims hit 450,000, the highest since 1992. If the

government doesn't give the economy a shove, it's not clear what will.

But what's justified in principle could be botched in practice. As Alan

Greenspan warns, it is better "to be right than quick." The danger is that a

stimulus package might become (along with anything labeled "anti-terrorism") a

vehicle for all sorts of dubious tax giveaways or pork-barrel-spending

increases. Three guidelines suggest themselves: (a) any stimulus program should

be simple and noncontroversial, something the White House and Congress could

enact quickly; (b) because the need for "stimulus" is temporary, it should not

result in new permanent cuts in taxes or increases in spending; and (c) it

should be effective in supporting the economy.

http://www.washingtonpost.com/wp-dyn/articles/A2679-2001Oct3.html

Stimulate With Care

By Robert J. Samuelson

Thursday, October

4, 2001

Before the attacks, business investment and exports were declining

while growth in consumer spending and housing was weakening. The economy was at

a standstill -- or in recession. Prospects are now worse. In late September

initial weekly unemployment claims hit 450,000, the highest since 1992. If the

government doesn't give the economy a shove, it's not clear what will.

But what's justified in principle could be botched in practice. As

Alan Greenspan warns, it is better "to be right than quick." The danger is that

a stimulus package might become (along with anything labeled "anti-terrorism")

a vehicle for all sorts of dubious tax giveaways or pork-barrel-spending

increases. Three guidelines suggest themselves: (a) any stimulus program should

be simple and noncontroversial, something the White House and Congress could

enact quickly; (b) because the need for "stimulus" is temporary, it should not

result in new permanent cuts in taxes or increases in spending; and (c) it

should be effective in supporting the economy.

http://www.washingtonpost.com/wp-dyn/articles/A2679-2001Oct3.html

A Stimulus That Stimulates

That StimulatesWatching the debate over economic stimulus unfold on

Capitol Hill, we keep remembering that the GOP has often been called the stupid

party. So stupid, it seems, that it doesnt understand its own success.

Republicans emerged from a half-century as a minority party when

Ronald Reagan discovered how to revive a troubled economy. He inherited

inflation and stagnation, yet within two years sparked an amazing economic boom

that still echoes today. The surging prosperity paved the way for Mr. Reagans

Cold War victory and the rejuvenation of the American spirit. It also led to a

GOP resurgence that culminated in control of Congress.

Alas, the Republicans seem to have forgotten their victory formula.

Even in the Reagan years they never quite shook their accounting fixation on a

balanced budget. They bought into an arbitrary concept of the deficitignoring

the difference between capital and operating expensethat they would never apply

to their own households. The Reagan program would have been even better without

deficits, of course. But the plan was a historic success and the deficits