“So far we are seeing, at worst, an orderly decline in the housing market,” he said.

Tim Iacono, 13 January 2012

Home - Index -

News - Carl Bildt och Krisen 1992 - EMU - Cataclysm -

Wall Street Bubbles - Houseprices

Dollar - Economics - The Great Recession (Subprime) - Contact

Man Who Says "Bubbles Only Identified When They Burst" Detects Bubbles

Alan Greenspan says there are "Bubbles in Stocks and Bonds".

Mike "Mish" Shedlock, 2 February 2018

"There are two bubbles: We have a stock market bubble, and we have a bond market bubble," the former Federal Reserve chairman told Bloomberg TV on Wednesday.

The Keynesian Fed economists who were dismissive of Reagan’s trickle-down theory

still don’t appear to see the irony in the fact that they applied trickle-down monetary policy

in the hope that by giving a boost to asset prices they would create wealth that would trickle down to the bottom 50% of the US population or to Main Street.

It didn’t.

John Mauldin 17 November 2017

I understand that we were caught up in an unprecedented crisis back then, and I actually think QE1 was a reasonable and rational response;

but QEs 2 and 3 were simply the Fed trying to manipulate the market.

We’re in bubble territory again, but this time might be different

Martin Wolf, FT 10 November 2017

With real interest rates on safe securities so low, asset prices should be high. That is basic economics.

Maybe, they should not be as high as they now are. But it is far from obvious they are in extreme bubble territory.

The biggest exception, even given current low real interest rates, may well be US stocks.

So the question is whether current conditions — low real interest rates and low and stable inflation — will last.

A final perspective is to insist, nevertheless, that ultra-low real interest rates will have to rise, in the end, even if not right away.

That may be true. But nobody knows when. Rates may be not far from present levels for decades.

The question rather is whether asset prices can adjust without bringing down either financial system or economy.

The cult of inflation targeting began in New Zealand in the late Eighties.

In the wrong circumstances such a doctrine is a formula for asset bubbles and deranged financial cycles,

and that is precisely what events have conspired to produce.

Ambrose 1 November 2017

The logic of constructing an entire financial order around one arbitrary variable such as inflation was never compelling.

This technocrat urge to fine-tune prices is a radical departure from their historic role of central banks:

to ensure financial stability and act as a lender-of-last resort in a crisis.

Japan saw a variant in the Eighties.

The BoJ’s governor Yasushi Mieno confessed later that the bank’s great mistake was to suppose that it was safe to let rip with monetary stimulus since inflation was tumbling.

The result was the Nikkei Bubble.

Mr Mieno later warned his global colleagues that the most dangerous asset booms can only occur when inflation is low. Nobody listened.

The BIS suggests that they may actually have caused the great monetary conundrum of our age:

a relentless drop in the Wicksellian "natural rate of interest".

Almost nine years into our global expansion yields on ten-year US Treasuries – the global price of money – are still just 2.36pc.

German Bunds are trading at yields below zero all the way out to 2024.

Unconventional policies are turning out to be a classic game-theoretic bad equilibrium:

each central bank stands to gain by keeping interest rates low, but, collectively, their approach constitutes a trap.

Kaushik Basu, Project Syndicate 18 October 2017

In recent years, the world’s major central banks have pursued unprecedentedly easy monetary policies, including what a recent Deutsche Bank report calls “multi-century all-time lows in interest rates.”

That, together with large-scale quantitative easing, has injected a massive $32 trillion into the global economy over the last nine years.

Persistently low interest rates can cause people to worry about their retirement funds, spurring them to save more. Far from boosting consumption, as intended, monetary stimulus may create an environment that dampens demand, weakening prospects for economic growth.

Today, no single country can steer the world away from this trap.

Kaushik Basu, former Chief Economist of the World Bank, is Professor of Economics at Cornell University and Nonresident Senior Fellow at the Brookings Institution.

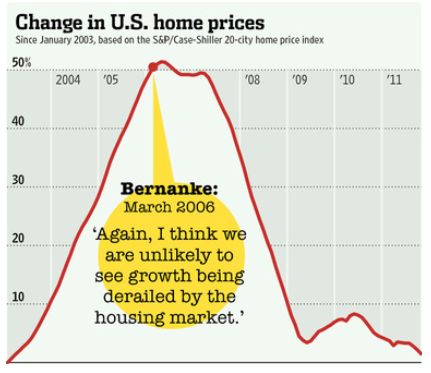

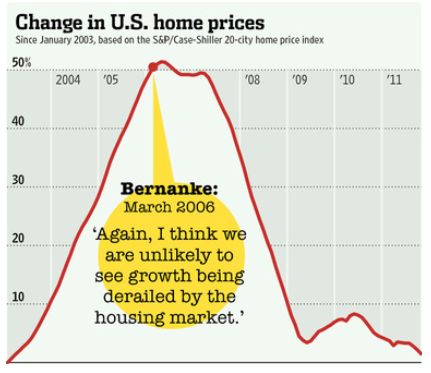

Do Central Bankers Know A Bubble When They See One?

From its March 2000 peak to its October 2002 bottom the NASDAQ declined 80%.

In August 2002 Greenspan gave a speech at the Fed’s conference in Jackson Hole.

Ben Bernanke, gave a speech titled, “The Great Moderation.”

zerohedge 3 January 2017

What causes asset bubbles?

Most econ models are still based on rational expectations,

the idea that people don’t systematically make errors when forecasting the future.

This idea was advanced by many star economists of the 1970s and '80s,

including the highly influential macroeconomist Robert Lucas.

Noah Smith, Bloomberg 8 December 2016

By reducing the incomes of retirees and terrifying near-retirees,

the Fed successfully reduced economic activity.

John Mauldin 9 October 2016

Monetary policy in a low-rate world

Martin Wolf, FT 13 Sepptember 2016

Monetary policy is not exhausted, and active use of it is essential.

But undue reliance on monetary policy is problematic.

Martin Wolf, FT 25 May 2016

At the height of the last property bubble in 2005, Alan Greenspan, then chairman of the Federal Reserve,

said society could not long tolerate a situation where most people we were suffering from declining standards of living.

Edward Luce, FT March 13, 2016

Faced with the most severe economic downturn since the Great Depression, the U.S. Federal Reserve did the only thing it could: flood the financial system with liquidity.

The move to so-called easy money arguably saved the world from a worse fate and radically changed the economic backdrop as well as the landscape for financial markets.

Bloomberg via englundmacro.blogspot.se/2016/02/these-are-things-that-correlate

Caruana and Greenspan about stocks and shocks

Rolf Englund blog 6 Febr 2016

Martin Wolf:

What might central banks do if the next recession hit while interest rates were still far below pre-2008 levels?

FT February 2016

Today Will Be a Watershed Moment for Financial Markets

We are in uncharted waters after nearly 20 years of madcap money printing by the Fed and other central banks.

Everything has been wildly inflated — stocks, bonds, real estate — and also the entire real economy as measured by global GDP.

That includes trade volumes, capital spending, commodity prices, energy and mining capacity, manufacturing investment, bulk carriers and containerships.

Also, warehouse and distribution facilities, brick and mortar retail space and much, much more.

David Stockman • December 15, 2015

The world’s central banks are finally out of dry powder.

They no longer have the means to inflate the global credit and financial bubble.

That’s why I’m calling today’s FOMC meeting the most crucial inflection point since 1929.

We have reached the apogee of history’s greatest credit inflation. Now we’re hurtling into a prolonged worldwide deflation.

The argument for an interest-rate rise now is not a compelling one

Just because it seems inevitable does not mean it is a good idea.

FT editorial December 15, 2015

I många år har debatten på området handlat om centralbankernas beteende:

bör de försöka hålla tillbaka bubblor och dämpa marknadskurser som äventyrar den finansiella stabiliteten,

eller bara städa upp när bubblorna har brustit?

Barry Eichengreen, DN 2015-08-14

Centralbankscheferna kan visserligen inte veta säkert när kurserna har nått ohållbara höjder.

Men de kan inte heller veta säkert när inflationen ska ta fart. Penningpolitik är en konst, inte en vetenskap: konsten att gissa rätt.

Och som krisen 2008–09 visade är det mycket dyrt och ineffektivt att bara städa upp efter bubblorna.

Barry Eichengreen: French and German banks have been able to sell their holdings of Greek government bonds,

largely to the ECB, which has acted as bond purchaser of last resort.

2015-04-15

One of the things that occurred to me is the consequence of the 2008 crisis.

I knew something was brewing, but I missed the actual date as frankly did everybody else.

Alan Greenspan, Telegraph 10 August 2015

Lord Skidelsky said that Keynes would have found two things upsetting.

First, he would be frustrated with the lack of precautions taken to prevent a huge financial crash like the one we saw in 2008.

Secondly, Lord Skidelsky believes Keynes wouldn't be happy with the policy measures taken after the crash. Keynes would have wanted a more "buoyant response," he said.

Specifically, he doesn't think Keynes would have liked the Federal Reserve's quantitative easing

BloombergTV, 13 August 2015

The lesson from Asia and Latin America in the 1990s was that currency pegs reinforced and indeed exacerbated financial cycles.

Asset prices tended to overshoot on the upside, creating macro imbalances that were eventually corrected through catastrophic devaluations.

FT 13 August 2015

Federal Reserve is headed down a familiar – and highly dangerous – path.

Steeped in denial of its past mistakes, the Fed is pursuing the same incremental approach

that helped set the stage for the financial crisis of 2008-2009.

The consequences could be similarly catastrophic.

Stephen S. Roach, Project Syndicate,23 December 2014

This bears an eerie resemblance to the script of 2004-2006, when the Fed’s incremental approach led to the near-fatal mistake of condoning mounting excesses in financial markets and the real economy. After pushing the federal funds rate to a 45-year low of 1% following the collapse of the equity bubble of the early 2000s, the Fed delayed policy normalization for an inordinately long period. And when it finally began to raise the benchmark rate, it did so excruciatingly slowly.

In the 24 months from June 2004, the FOMC raised the federal funds rate from 1% to 5.25% in 17 increments of 25 basis points each. Meanwhile, housing and credit bubbles were rapidly expanding, fueling excessive household consumption, a sharp drop in personal savings, and a record current-account deficit – imbalances that set the stage for the meltdown that was soon to follow.

Central banking has lost its way. Trapped in a post-crisis quagmire of zero interest rates and swollen balance sheets, the world’s major central banks do not have an effective strategy for regaining control over financial markets or the real economies that they are supposed to manage. Policy levers – both benchmark interest rates and central banks’ balance sheets – remain at their emergency settings, even though the emergency ended long ago.

Stephen S. Roach, former Chairman of Morgan Stanley Asia is the author of the new book Unbalanced: The Codependency of America and China.

The Fed put

Federal Reserve uttered the single word “patience” and everything changed.

On Wednesday the stock market rose 2 per cent and on Thursday the Dow Jones Industrial index had its best day in three years.

The market dependence on Fed policy has never seemed greater

Financial Times December 19, 2014

Greenspan, 88:

How to unwind the huge increase in the size of its balance sheet with minimal impact.

It is not going to be easy, and it is not obvious exactly how to do it.

Interview with Alan Greenspan, MarketWatch 24 July 2014

Conventional wisdom has it natural interest rates have fallen

With debt in the developed world standing at higher levels than before the financial crisis,

one of the more disturbing threats to financial stability is an unexpectedly sharp rise in global interest rates.

John Plender, Financial Times June 24, 2014

Fed’s easy money has disconnected markets from the real economy

Junk bond spreads near all-time lows and stocks at record highs

Is it time to sound the alarm over levels in the credit or equity markets?

Henny Sender, Financial Times 6 June 2014

Only the ignorant live in fear of hyperinflation

Failure to understand the monetary system has made it more difficult for central banks to act

Martin Wolf, FT April 10, 2014

Volcker startade sedelpressarna, inte Greenspan

Rolf Englund blog 2014-04-08

The Bank of England will never unwind QE, nor should it

Governor Mark Carney more or less acknowledged this morning that the Bank of England will never reverse its £375bn of Gilts purchases.

Quite right too.

Ambrose Evans-Pritchard, 11 March 2014

How to make a graceful exit

Central banks’ forward guidance is a forgivable sin

Financial Times editorial, March 10, 2014

Centralbanker skall INTE vara förutsägbara. Basel-banken stöder Englund.

Rolf Englund blog 10 mars 2014

Centralbanker skall INTE vara förutsägbara

Det är inte bra att aktörerna känner sig säkra. Det gör dem bara med oförsiktiga.

Rolf Englund blog 2014-02-13

Greenspan - The Map and the Territory: Risk, Human Nature, and the Future of Forecasting

Why is it called The Map and the Territory ? I could not find reference to map or territory in it.

And I was looking for such references, because more than two years ago I wrote an essay on the state of economics called “The Map is not the Territory”.

Mr Greenspan did not refer to that essay. Nor, more strikingly, did he refer to another book published the previous year with exactly Mr Greenspan’s own title.

John Kay, FT 11 March 2014

The phrase “the map is not the territory” was coined in the 1920s by Alfred Korzybski, the Polish philosopher.

The essence of Korzybski’s thought is that we interpret the world through abstractions, abstractions that should not be confused with “the world as it really is”.

There are many different possible maps of the same territory, each useful for specific purposes

The Map and the Territory: Risk, Human Nature, and the Future of Forecasting, at Amazon

Greenspan, the Keynesian

Justin Fox at the Harvard Business Review has collated some interesting extracts from a conversation he had with Alan Greenspan late last year.

Greenspan (generally pigeon-holed as a free-market loving Ayn Randian type) is getting pretty Keynesian nowadays.

Indeed, having understood that the 2008 crisis revealed a “flaw” in his world view, rather than getting bitter about it, Greenspan appears to have spent the last few years trying to understand where he went wrong.

Izabella Kaminska, FT Alphaville, Jan 9, 2014

What Alan Greenspan Has Learned Since 2008

Justin Fox, January 7, 2014

Eight ways conventional financial wisdom has changed post crisis

Nobody assumes subprime mortgage bonds are safe, for example, or blithely trusts triple-A credit ratings.

Nor do they presume that big banks cannot collapse, or that western central banks cannot keep rates at zero.

Gillian Tett, Financial Times December 26, 2013

The Hubble bubble theory of the continuous expansion of the financial universe

All of which is a whimsical way of suggesting that perhaps Larry Summers has a point.

Perhaps inflating asset bubbles one after the other isn’t such a bad idea. Perhaps it’s even necessary?

Izabella Kaminska, FT Alphaville 6 December 2013

The Stock Market's Da Vinci Code

The Plunge Protection Team

Jonathan Moreland, March. 1, 2006

During a speech given on Jan. 14, 1997, at a university in Leuven, Belgium, Greenspan said: “We have the responsibility to prevent major financial market disruptions through development and enforcement of prudent regulatory standards and, if necessary in rare circumstance, through direct intervention in market events.”

The U.S. Executive Order 12631, signed on March 19, 1988, by President Reagan, established the “Working Group on Financial Markets.”

Working Group on Financial Markets, Wikipedia

Former Fed Chief Greenspan Sees No Bubble in Dow 16,000

Bloomberg, Nov 28, 2013

...

The day of the speech, the Dow Jones industrial average closed at 6,437.10 points

But how do we know when irrational exuberance has unduly escalated asset values?

Chairman Alan Greenspan, December 5, 1996

Greenspans bok om finanskrisen sågas

”The map and the territory”

Den är tänkt som en analys av vad som gick snett före krisen

men slutar med försvaret att alla missade varningssignalerna.

SvD Näringsliv 22 oktober 2013

Resorting all too freely to the first person plural, Greenspan describes the book as “an effort to understand how we all got it so wrong, and what we can learn from the fact that we did.”

The remarkable thing is that Greenspan continues to get it wrong.

Daniel Akst, Bloomberg, Oct 17, 2013

It’s time to pounce on Alan. That’s Alan as in Greenspan, whose new book — “The Map and the Territory: Risk, Human Nature, and the Future of Forecasting ” — has just appeared.

It provides a fresh opportunity for critics to attack the former chairman of the Federal Reserve Board (1987-2006).

Here are some samples.

Robert J. Samuelson, October 28, 2013

"One thing that shocked me is that

not only did the Federal Reserve's very sophisticated model completely miss (the Lehman crash on) September 15th, 2008,

but so did the IMF, so did JP Morgan, which was forecasting American economic growth three days before the crisis hit, going up all through 2009 and 2010."

Alan Greenspan, BBC, 20 October 2013

Why all the talk of a bond bubble?

What is a bubble, anyway? Surprisingly, there’s no standard definition.

But I’d define it as a situation in which asset prices appear to be based on implausible or inconsistent views about the future.

Dot-com prices in 1999 ... housing prices in 2006

Is there anything comparable going on in today’s bond market?

Paul Krugman, New York Times 9 May 2013

In the fixed interest sector something irrational is undoubtedly going on

Despite the oft-heard central bankers’ refrain that bubbles are impossible to identify until after they have been pricked,

historical comparisons leave little doubt that this is a bubble

John Plender, FT January 29, 2013

To what extent was the economics profession to blame for the financial crisis?

Misunderstanding Financial Crises: Why We Don’t See Them Coming, by Gary B. Gorton, Oxford University Press

Review by John Plender, FT January 13, 2013

The boom and bust of Mervyn King

It looks like a powerful admission of error on his part. But...

When any of us say "if I knew then what I know now", we are excusing ourselves, rather than apologising.

Robert Peston, BBC Business editor, 3 May 2012

En del bedömare /däribland Lars Jonung/ tror att Greenspan i USA

skulle ha kunnat undvika finanskrisen genom att hålla högre styrränta.

Men kapitalet från Kina hade sannolikt ändå sänkt räntan.

Danne Nordling, 7 september 2011

38 olika förklaringar till krisen

Greenspans politik var nödvändig och tillräcklig för finanskraschen.

Lars Jonung, professor i nationalekonomi vid Lunds universitet och ny ordförande för Finanspolitiska rådet, DN 7 september 2011

Mr Bernanke was appointed by former President George W Bush in 2006, tasked with following the 18-year reign of Mr Greenspan, whom Gordon Brown that year introduced in London as "the man acknowledged to be the world's greatest economic leader of our generation".

BBC 3 December 2009

After eighteen years as the world’s most powerful central banker, Alan Greenspan has changed the way people think about money, credit,

and most importantly, he has changed the way people view debt.

Debt, a pariah to generations following the Great Depression, has been embraced by recent generations.

Tim Iacono, February 11, 2011

Recent generations, that is, who are now far enough removed from the tragedy of the 1930s that history’s lessons of excess credit and debt have been forgotten.

Debt, always a tempting seductress, has been raised to new levels of respectability under the tutelage of Mr. Greenspan.

Many, emboldened by rising asset prices, have completely lost what had been for centuries a largely uninterrupted natural aversion to borrowing money.

Många unga, högutbildade medelinkomsttagare i Stockholm är lånemiljonärer.

Fortsätter prisrallyt uppåt kan de fortsätta att använda sina villor och innerstadsbostadsrätter som bankomater för att plocka ut ännu mer pengar och åka till Bahamas på semester eller köpa en teppanyakihäll.

Sofia Nerbrand, Kolumn SvD 17/1 2011

Greenspan: 'I was right 70% of the time'

CNN Money April 7, 2010

Morgan Stanley’s former Asia chief Stephen Roach:

“Alan Greenspan kept the policy rate too low for too long, set us up for credit and property bubbles that led to an enormous crisis, [and] I think Ben Bernanke is just rerunning the Greenspan movie of seven or eight years ago.”

You’ll read much the same thing from Roach on this very first TMTGM post from about five-and-a-half years ago

July 9, 2010, by Tim Iacono

For his comment five years ago click at The Test

Fed boss Greenspan says no one saw the crisis coming. Really?

Only in America would it be possible to spawn a financial crisis so devastating that it would collapse the entire world economy.

Jeremy Warner, Daily Telegraph 7 Apr 2010

Only in America could the man responsible for interest rates and banking regulation at the time, Alan Greenspan, incredulously insist, as he has again in testimony to the Financial Crisis Commission, that he had very little to do with it.

And only in America could you imagine the story of a one-eyed neurology intern with undiagnosed Asperger's Syndrome (no not Gordon Brown) who ended up making a fortune by applying the principles of "value investing" to subprime mortgage lending.

Greenspan says no one saw it coming. Well, this man did.

Everyone has heard of Warren Buffett, the modern day master of "value investing", and most will recognise the name of John Paulson, the hedge fund manager who famously made billions riding the credit crunch storm.

But not many will know of Dr Mike Burry, a one time neurologist who according to a new book* by the former bond salesman Michael Lewis, predicted the crisis almost exactly and persuaded Wall Street to create the instrume

The Big Short: Inside the Doomsday Machine, by Michael Lewis

Mr Greenspan described the new world in 2002:

“The use of a growing array of derivatives and the related application of more sophisticated methods for measuring and managing risk are key factors underpinning the enhanced resilience of our largest financial institutions. As a result, not only have individual financial institutions become less vulnerable to shocks from underlying risk factors, but also the financial system as a whole has become more stable.”

John Kay, FT December 28 2009

Mot bakgrund av den kraftigaste recessionen i världsekonomin sedan andra världskriget finns det anledning att se över om den politik som centralbanker bedriver kan utformas för att bättre kunna främja en balanserad ekonomisk utveckling.

Vice riksbankschef Karolina Ekholm 2009-12-04

To put it in monetary policy terms, the Fed is boosting the supply of money to offset the decline in velocity,

which is the amount of turnover in the money stock.

Velocity has been falling like a newspaper stock amid the panic.

For our readers who recall their economic textbooks, Irving Fisher's famous equation is MV=PT.

Wall Street Journal editorial 30/10 2008

Amelia Earhart, the world's most famous female aviator, became the first woman to fly across the Atlantic in 1928.

Unfortunately, her Lockheed Electra disappeared over the Pacific

Amelia's story has much in common with Alan Greenspan's latter years at the helm of the Federal Reserve.

The serial bubble-blower appeared to lose his compass and the subsequent hard landing in uncharted territories

Irish Times, July 24, 2009

Greenspan has said that bubbles are difficult if not impossible to identify, a convenient excuse for a man who presided over and nurtured two of the greatest bubbles in US history.

The evidence suggests that the stock market and housing bubbles were not only easy to spot, but difficult to miss even to the untrained eye.

As a shell-shocked world tries to fathom how its economic collapse happened, commentators are busily outbidding each other with claims about the exceptional nature of this crisis.

But the most astounding fact is how familiar it look compared to past financial crashes.

The story of the modern capitalist economy is a rhythmic repetition of cycles, syncopated by eerily similar crises.

Financial Times March 9 2009

Financial crises are all different, but they have one fundamental source

That is the unquenchable capability of human beings when confronted with

long periods of prosperity to presume that it will continue.

Alan Greenspan, BBC 8 September 2009

Speaking a year after the collapse of US investment bank Lehman Brothers, which was followed by a worldwide financial crisis and global recession, Mr Greenspan described the behaviour as "human nature".

He said the current crisis was triggered by the trade in US sub-prime mortgages - home loans given to people with bad credit histories - but he added that any factor could have been the catalyst.

If it were not the problem of these toxic debts "something sooner or later would have emerged", Mr Greenspan said.

The extraordinary risk-management discipline that developed out of the writings of the University of Chicago’s Harry Markowitz in the 1950s

produced insights that won several Nobel prizes in economics.

It was widely embraced not only by academia but also by

a large majority of financial professionals and global regulators

But in August 2007, the risk-management structure cracked

a potential loss of at least $1,000bn

Alan Greenspan, Financial Times March 26 2009

The extraordinary risk-management discipline that developed out of the writings of the University of Chicago’s Harry Markowitz in the 1950s produced insights that won several Nobel prizes in economics. It was widely embraced not only by academia but also by a large majority of financial professionals and global regulators.

But in August 2007, the risk-management structure cracked. All the sophisticated mathematics and computer wizardry essentially rested on one central premise: that the enlightened self-interest of owners and managers of financial institutions would lead them to maintain a sufficient buffer against insolvency by actively monitoring their firms’ capital and risk positions. For generations, that premise appeared incontestable but, in the summer of 2007, it failed. It is clear that the levels of complexity to which market practitioners, at the height of their euphoria, carried risk-management techniques and risk-product design were too much for even the most sophisticated market players to handle prudently.

Even with the breakdown of self-regulation, the financial system would have held together had the second bulwark against crisis – our regulatory system – functioned effectively. But, under crisis pressure, it too failed

What, in my experience, supervision and examination can do is set and enforce capital and collateral requirements and other rules that are preventative and do not require anticipating an uncertain future.

Free-market capitalism has emerged from the battle of ideas as the most effective means to maximise material wellbeing, but it has also been periodically derailed by asset-price bubbles and rare but devastating economic collapse that engenders widespread misery.

Bubbles seem to require prolonged periods of prosperity, damped inflation and low long-term interest rates.

Euphoria-driven bubbles do not arise in inflation-racked or unsuccessful economies.

I do not recall bubbles emerging in the former Soviet Union.

History also demonstrates that underpriced risk – the hallmark of bubbles – can persist for years.

I feared “irrational exuberance” in 1996, but the dotcom bubble proceeded to inflate for another four years.

Similarly, I opined in a federal open market committee meeting in 2002 that “it’s hard to escape the conclusion that ... our extraordinary housing boom ... finan ced by very large increases in mortgage debt, cannot continue indefinitely into the future”.

The housing bubble did continue to inflate into 2006.

Analysis of the US consolidated bank balance sheet suggests

a potential loss of at least $1,000bn out of the more than $12,000bn of US commercial bank assets at original book value.

Finanskrisen - The Great Recession

Skuldfrågan/ Who is responsible?

Greenspan: The Fed Didn't Cause the Housing Bubble

Lower rates on long-term, fixed-rate mortgages and

not the Federal Reserve's policies are to blame for the U.S. housing bubble.

CNBC 11 Mar 2009

"Between 2002 and 2005, home mortgage rates led U.S. home price change by 11 months.

This correlation between home prices and mortgage rates was highly significant,

and a far better indicator of rising home prices than the fed-funds rate,"

Greenspan wrote in the Wall Street Journal.

See also

Conundrum

Houseprices

"The high priest of laisser-faire capitalism"

The US government may have to nationalise some banks on a temporary basis

to fix the financial system and restore the flow of credit

Alan Greenspan, Financial Times February 18 2009

Mr Greenspan , who for decades was regarded as the high priest of laisser-faire capitalism, said nationalisation could be the least bad option left for policymakers.

Temporary government ownership would ”allow the government to transfer toxic assets to a bad bank without the problem of how to price them (kurs här).”

But he cautioned that holders of senior debt – bonds that would be paid off before other claims – might have to be protected even in the event of nationalisation.

”You would have to be very careful about imposing any loss on senior creditors of any bank taken under government control because it could impact the senior debt of all other banks,” he said. “This is a credit crisis and it is essential to preserve an anchor for the financing of the system. That anchor is the senior debt.”

The fundamental problem with the Paulson scheme is that it is neither a necessary nor an efficient solution.

It is not necessary, because the Federal Reserve is able to manage illiquidity through its many lender-of-last resort operations.

It is not efficient, because it can only deal with insolvency by buying bad assets at far above their true value, thereby guaranteeing big losses for taxpayers and providing an open-ended bail-out to the most irresponsible investors.

Martin Wolf, Financial Times, September 23 2008 19:38

In an echo of the Watergate hearings 35 years ago, Mr. Greenspan was asked

when he knew there was a housing bubble and

when he told the public about it.

He answered that he never anticipated home prices could fall so much.

"I did not forecast a significant decline because we had never had a significant decline in prices," he said.

Wall Street Journal, October 24, 2008

, I would add one by Luigi Zingales of Chicago University’s graduate school of business.

Why Paulson is Wrong

a short note by Luigi Zingales

A finance expert's review of Paulson's Resolution Trust Corporation (RTC)

Mea Culpa

Greenspan told Congress he is "shocked" at the breakdown in U.S. credit markets and

said he was "partially" wrong to resist regulation of some securities.

CNBC, 23 October 2008

Despite concerns he had in 2005 that risks were being underestimated by investors, "this crisis, however, has turned out to be much broader than anything I could have imagined," Greenspan said to the House of Representatives Committee on Oversight and Government Reform.

"Those of us who have looked to the self-interest of lending institutions to protect shareholder's equity (myself especially) are in a state of shocked disbelief," said Greenspan

He also conceded he was "partially wrong" about his belief that certain derivatives, such as credit default swaps, did not need to be regulated.

Kommentar av Rolf Englund:

Alltid något. Och när skall Carl Bildt erkänna att han gjorde något misstag under kronkursförsvaret?

“I made a mistake in presuming that the self-interest of organisations, specifically banks and others, was such that they were best capable of protecting their own shareholders,”

I don’t know about you, but when I read such a naïve statement coming from the man who was once the most powerful banker in the world, I’m the one who’s in a state of shock and disbelief.

Ian Wyatt, October 24 2008

As Greenspan himself said yesterday “Those of us who have looked to the self-interest of lending institutions to protect shareholder's equity -- myself especially -- are in a state of shocked disbelief…"

Greenspan is saying he expected the lenders to police themselves. And now he’s “shocked” that they didn’t. You mean Wall Street will put profits and bonuses above the interest of faceless shareholders? No! Say it ain’t so!

the old “Orient Express” conclusion – that everybody, from borrowers, to lenders, to Congressmen, to Greenspan, “did it” – won’t satisfy the need to hang somebody up by their thumbs.

Some people were apparently shocked to learn that gambling was occurring at Rick's Cabaret.

Michael E. Lewitt, Mauldin's Outside The Box 2007-11-05

...

Man Who Says "Bubbles Only Identified When They Burst" Detects Bubbles

Alan Greenspan says there are "Bubbles in Stocks and Bonds".

Mike "Mish" Shedlock, 2 February 2018

Alan Greenspan's tragic mistake

negative real interest rates from 2002 into 2005

It was a painful spectacle to watch.

Wall Street Journal, editorial, October 24, 2008

The original bubble was in housing prices and mortgage-related assets,

which the Federal Reserve helped to create with its negative real interest rates from 2002 into 2005.

This was Alan Greenspan's tragic mistake, not that the former Fed chief will acknowledge it.

Testifying before Congress yesterday, Mr. Greenspan pinned the crisis on mortgage securitizers, risk modelers and lending institutions, thus contributing to the Washington narrative that government had little to do with it. The Fed's monetary policy apparently gets a pass.

The media and Members of Congress will use Mr. Greenspan's testimony to impugn /oppose or attack as false or lacking integrity/

the very free market principles that the former Ayn Rand protégé has spent his life promoting.

It was a painful spectacle to watch.

Nyliberalerna tysta så det dånar

Det intellektuella civilkuraget hos den stora kader nyliberala ekonomer, som under årtionden hyllat USA:s ansvarslösa marknadsekonomi, imponerar inte.

Bo Rothstein m fl diskuterar detta

A lifelong libertarian, Alan Greenspan does not ordinarily advocate giving the government more power.

But he does so in a new epilogue to the paperback edition of his memoir,

parts of which were made available to The Economist.

The Economist print edition Aug 7th 2008

The /banking/ insolvency crisis will come to an end only as home prices in the US begin to stabilise

Home prices will stabilise only when the absorption of the huge excess of single-family vacant homes is much further advanced

Alan Greenspan, Financial Times, August 4 2008

The current financial crisis in the US is likely to be judged in retrospect as the most wrenching since the end of the second world war.

It will end eventually when home prices stabilise and with them the value of equity in homes supporting troubled mortgage securities.

Alan Greenspan, Financial Times, March 17 2008

The contraction phase of credit and business cycles, driven by fear, have historically been far shorter and far more abrupt than the expansion phase, which is driven by a slow but cumulative build-up of euphoria.

Economists have argued that greater transparency is beneficial....

But greater transparency of central bank policymaking – in which committee deliberations are made more open to the public – may prevent the full and frank discussion needed to make the best decisions.

In a recent paper (Meade and Stasavage 2008), we compare discussions of the Fed’s Federal Open Market Committee (FOMC) before and after committee members knew that all statements would eventually be made public.

Our empirical results indicate that after 1993, when FOMC participants knew that their deliberations would be made public, they were less likely to challenge then Fed chairman Alan Greenspan.

This suggests that greater transparency hindered free deliberation and may have permitted Greenspan's views on interest rates to dominate US policymaking....

Naked Capitalism 26/6 2008

Why Greenspan does not bear most of the blame

The US is in no way exceptional for the level of residential investment.

Somewhat to my surprise, the share of residential investment in UK gross domestic product has been much the same as in the US.

The outliers here are Ireland and Spain.

Martin Wolf FT April 8 2008

Greenspan’s 2004 speech extolling the virtues of adjustable-rate mortgages looks particularly imprudent now, in the light of rising delinquencies on those loans.

http://dailybriefing.blogs.fortune.cnn.com/2008/04/08/greenspan-lashes-out-again/

Greenspan: Bostadsbubblan inte Feds fel

Dagens Industri

Act now to stop the markets’ vicious circle

Paul De Grauwe March 19 2008

I am puzzled why the remarkably similar housing bubbles that emerged

in more than two dozen countries between 2001 and 2006 are not seen to have a common cause.

The dramatic fall in real long term interest rates statistically explains, and is the most likely major cause of, real estate capitalization rates that declined and converged across the globe. By 2006, long term interest rates for all developed and major developing economies declined to single digits, I believe for the first time ever.

Alan Greenspan, Financial Times April 6, 2008

Even with full authority to intervene, it is not credible that regulators would have been able to prevent the subprime debacle. It would have required insights that would enable regulators to override the investment judgments of the most experienced analysts of the private sector, the very people on whom regulators rely for their market insights. When investment judgments are distorted by euphoria, even so valuable a financial innovation as securitization will perform poorly.

If counterparty surveillance is abandoned or significantly weakened, we are left with regulation by the less informed.

Tim Iacono: Good afternoon.

Alan Greenspan: Good afternoon. My assistant tells me you've been writing about me.

Iacono: A little. Let's get right to the point. Are you responsible for the housing bubble?

Greenspan: No.

Iacono: Would you care to elaborate on that?

Tim Iacono 4/10 2007

Risk of Systemic Crises and Asset Bubbles

http://www.rgemonitor.com/175?cluster_id=7817

Many today are complaining about Alan Greenspan’s monetary stewardship - “serial bubble-blower” is the most polite phrase that I have heard.

But would the world economy really be better off today under an alternative monetary policy that kept unemployment in America at an average rate of 7% rather than 5%?

Would it really be better off today if some $300 billion per year of US demand for the manufactures of Europe, Asia, and Latin America had simply gone missing?

Brad DeLong April 05, 2008

Alan Greenspan memoirs: The Age of Turbulence

His book might equally have been entitled The Age of Disinflation.

For the big theme of this work is how the triumph of laisser faire capitalism

around the world over the past quarter-century delivered a golden period of low inflation, low interest rates and global prosperity.

Krishna Guha, Financial Times, September 17 2007

Our knowledge about many of the important linkages is far from complete

and in all likelihood will always remain so.

Monetary Policy under Uncertainty,

Alan Greenspan, Jackson Hole, August 29, 2003

"Despite the extensive efforts to capture and quantify these key macroeconomic relationships, our knowledge about many of the important linkages is far from complete and in all likelihood will always remain so. Every model, no matter how detailed or how well designed conceptually and empirically, is a vastly simplified representation of the world that we experience with all its intricacies on a day-to-day basis. Consequently, even with large advances in computational capabilities and greater comprehension of economic linkages, our knowledge base is barely able to keep pace with the ever-increasing complexity of our global economy."

Full text

Monetary Policy under Uncertainty

Ben S. Bernanke, October 19, 2007

Början på sidan - Top of page

20 years already? Alan Greenspan and the ‘irrational exuberance’

MarketWatch, Dec 5, 2016

Mr Greenspan was not certain that the equity market was indeed a bubble. But by September, he was explicitly referring to it in such terms: "I recognise that there is a stock market bubble problem at this point," he said at the September 24, 1996 meeting - the day the Dow closed at 5874.03.

- The Federal Reserve "cannot afford" to let U.S. housing prices fall sharply and will have to cut interest rates aggressively to prevent that from happening

"A Fed cannot afford to let homes go down by 10 to 15 percent like we saw in Japan," said Bill Gross, chief investment officer of Pacific Investment Management Co. or Pimco, on CNBC Television.

Nov 5 2007(Reuters)

The turmoil in the subprime mortgage-market is a "$1 trillion problem ... there are $1 trillion worth of subprimes and Alt-As and basically garbage loans," Gross said. He expects $250 billion of subprime and Alt-A mortgage loans to default and those defaults will fall to the balance sheets of investment stalwarts such as Merrill Lynch and Citigroup

The former Fed chairman urged central banks to avoid suppressing asset bubbles, which is "exceptionally difficult" to do.

"The critical issue on the whole subprime, and by extension, the international financial system

rests very narrowly on getting rid of probably 200,000-300,000 excess units in inventory," /-houses/

Alan Greenspan, CNN 2007-11-06

Central banks avoid worldwide inflation by maintaining monetary tightness at appropriate levels, he said.

Rolf Englund (webmaster): The source is not there any longer.

But you can read the same thing also at

http://save-our-land.blogspot.com/2007/11/modest-proposal-triggered-by-alan.html

America's IT-enabled productivity resurgence in the late 1990s was the siren song for the Greenspan-led Federal Reserve

- convincing the US central bank that it need not stand in the way of either rapid economic growth or excess liquidity creation.

In retrospect, that was the "original sin" of bubble-world - a Fed that condoned the equity bubble of the late 1990s and the asset-dependent US economy it spawned.

That set in motion a chain of events that has allowed one bubble to beget another - from equities to housing to credit.

Stephen S. Roach 2007-10-22

Joseph Stiglitz, a Nobel-prize winning economist,

said successive Federal Reserve chairmen have left the U.S. economy facing a ``very significant'' slowdown.

Bloomberg Feb. 26 2008

Current Fed chief Ben S. Bernanke was too slow to cut interest rates as the U.S. real-estate market deteriorated, while his predecessor, Alan Greenspan, ``actively looked the other way'' as the housing market inflated, Stiglitz said in a Bloomberg Television interview today in London.

Greenspan ``is right that this downturn is going to be the worst downturn in a quarter century, but he's largely to blame,'' Stiglitz said. ``It's not just that he was asleep at the wheel, he actively looked the other way'' by dismissing the housing-price appreciation as ``froth.''

European monetary-policy makers may also be underestimating the risks to economic growth, Stiglitz said. The European Central Bank's mandate, which sets price stability as the sole objective, is ``flawed'' because it prevents ECB President Jean-Claude Trichet from supporting job creation.

``He should not be focusing so much on inflation especially when so much of it is imported,'' Stiglitz said. ``Higher interest rates won't solve the problem of higher oil prices.''

Greenspan's errors in judgment seemed so obvious they beg the questions:

Why did he make them?

Did he actually set out to redistribute wealth from the middle class to the rich while the country itself essentially burned the furniture for heat?

After all, his bubbles made the sponsors of those bubbles fabulously wealthy, ultimately to the detriment of the average person and the United States as a whole.

Or was he simply not up to the task?

Bill Fleckenstein, CNBC January 17, 2008

It is oddly ironic that a small group like the Federal Open Market Committee, similar to those found at all levels of any former communist regime, would be in charge of the world's largest and most successful capitalist country - that is, the United States of America and its $13 trillion economy.

I saw the stock market bubble building and concluded it would end in disaster - about four years too soon!

Then again, I never pretended to know what the right interest rate to run the country was.

Greenspan's Bubbles: The Age of Ignorance at the Federal Reserve (Hardcover)

by William Fleckenstein and Fred Sheehan at Amazon UK

In 2007 there was one economic event of such overwhelming significance that it dwarfed all the others - the credit crunch. - Who was to blame?, Roger Bootle

Banks Gone Wild

Paul Krugman NYT November 23, 2007

This slump was both predictable and predicted. “These days,” I wrote in August 2005, “Americans make a living selling each other houses, paid for with money borrowed from the Chinese. Somehow, that doesn’t seem like a sustainable lifestyle.” It wasn’t.

You still hear occasional claims that the subprime fiasco is no big deal. Even though the numbers keep getting bigger — some observers are now talking about $400 billion in losses — these losses are small compared with the total value of financial assets.

But bad housing investments are crippling financial institutions that play a crucial role in providing credit, by wiping out much of their capital. In a recent report, Goldman Sachs suggested that housing-related losses could force banks and other players to cut lending by as much as $2 trillion — enough to trigger a nasty recession, if it happens quickly.

How did things go so wrong?

Part of the answer is that people who should have been alert to the dangers, and taken precautionary measures, instead blithely assured Americans that everything was fine, and even encouraged them to take out risky mortgages.

Yes, Alan Greenspan, that means you.

The huge rewards executives receive if they can fake success are what led to the great corporate scandals of a few years back. There’s no indication that any laws were broken this time — but the public’s trust was nonetheless betrayed, once again.

Central banks should prick asset bubbles

Paul De Grauwe, FT November 1 2007

The credit crisis that hit the world economy in August teaches us many lessons about the workings of integrated financial markets.

It also teaches us something about the responsibilities of central banks.

Until the crisis, the consensus view was that central banks should target inflation and that is pretty much all they should do. In this view, central banks should not target (or try to influence) asset prices either, as was stressed by the former Federal Reserve chairman Alan Greenspan, because central banks cannot recognise bubbles ex ante.

Or, if they can, the macroeconomic consequences of bubbles and crashes are limited as long as central banks keep inflation on track.

Inflation targeting, we were told, is the new best practice for central bankers that makes it unnecessary for them to try to influence asset prices.

The credit crisis has unveiled the fallacy of this hands-off view.

Uncertainties about the future development of the US economy run deep.

There are two opposing views of what has happened to it since the early 1990s,

which originate in two very different theories of the business cycle.

Paul de Grauwe, FT 16/7 2007

The Fed, like the rest of the US, overreacted to September 11.

The Fed was, of course, right to cut nominal interest rates during the recession, but the Fed was not right to opt for negative real interest rates,

and to leave short-term nominal rates at 1% for a year.

Wolfgang Münchau, Eurointelligence 13.09.2007

The loose monetary conditions have no doubt encouraged a large amount of activity in the credit market. It has turned what would have been risky investments into riskless bets. It encouraged carry trades, which are a no-brainer when interest rates are negative; it encouraged a housing boom of unprecedented proportions, as everybody gained from the most reckless lending practices. For a long time, sellers and buyers in the housing market knew that house prices would rise faster than the cost of finance. In such an environment, it was entirely rational for people to take on levels of debts that would be considered excessive under normal circumstances. The Fed’s interest policy gave rise to numerous Ponzi schemes, the effect of which we are now seeing.

Should central banks take account of asset prices?

This was until recently one of the most hotly debated subjects in monetary economics.

As of this week, the issue has been effectively settled.

Everybody now believes, or rather acts as if, they should.

Eurointelligence, 19/9 2007

Highly recommended

Bernanke’s Sophie's Choice:

"The housing market or stock market Mr. Bernanke. You may only be able to try and save one..."

The Fed can indeed be accused of being a serial bubble-blower.

But this is not because it has been managed by incompetents.

It is because it has been managed by competent people responding to exceptional circumstances.

Martin Wolf, August 22 2007

Dr. Housing Bubble figures that the Fed and the banks

providing unlimited amounts of money to create the real estate bubble

(which I sarcastically note was created by the Fed and Congress to bail out the busted stock market bubble in 2000, which the Fed also provided the financing for)

has created US$5 trillion in “bubble wealth”.

Mogambo Guru 17/7 2007

Can the Fed Control Prices?

Bernanke admitted that he has no control over asset prices or even key interest rates. But does he have control over any prices?

Michael Shedlock 20/7 2007

Very unusual things going on now

Alan Greenspan said the prevalence of low interest rates throughout the world was one of the things that surprised him as he prepared

his reflections on his past for the new book he was promoting, "The Age of Turbulence."

CNN June 1 2007

The book, to be published in September, will also include commentary on the future, as well as reflections on his 18-1/2 years at the helm of the U.S. central bank.

"When I got to look at the future there were very unusual things going on now," said Greenspan, who was speaking at a publishing convention. "Interest rates in the United States are low, but they are low all over the world, including developing nations which never saw single-digit interest rates"

Alan Greenspan said he was concerned Chinese stocks might undergo a ``dramatic contraction''

after its main stock index jumped more than 90 percent this year.

May 23 2007 (Bloomberg)

Any excuse will do as markets continue to move on the expectation that global central banks don't have the cojones to withdraw liquidity, that is, to increase the cost of debt in our highly leveraged global financial system

May 17, 2007 (iTulip)

so the flow of money to finance deals will continue unabated. Like the IPO mania of 1999, this disease has infected not a few hundred board rooms of dot coms and telco companies, which industries represent a few percent of the US economy, but thousands of board rooms, representing just about every public company in every market and a significant share of the US economy. We have yet to speak to a CEO or senior exec of a public company that won't confide the giddy hope, bordering on conviction, that their company is next in line to receive a proposal for marriage from a larger company, an LBO from a private equity firm or hedge fund, or some other source of capital that will result in a personal financial windfall. These expectations have infected DOW and S&P investors as well. With so many betting that the company whose stock they own is likely to be over-bid in a take-over, why sell?

A market correction is coming, this time for real

Much of the good news has come as a result of extraordinary levels of liquidity pouring into opportunities around the globe. To a large extent this is due to the Federal Reserve’s expansionary monetary policies early in the decade and the US administration’s fiscal stimulus.

William Rhodes, FT March 29 2007

There are two phases in an asset price bubble that repeat themselves with clockwork regularity.

The first is the phase of the bogus economic theory. I am sure you heard the one about the paradigm shift

The second phase is a prolonged state of denial.

Wolfgang Munchau, FT 19/3 2007

In the US subprime mortgage bubble, we are now in phase two

The Europeans are still in phase one of their bubble. The bogus economic theory from Spain is that large immigration can maintain a construction boom indefinitely.

In Spain, the construction and housing sector accounts for 18.5 per cent of gross domestic product, about twice as high as the eurozone average, according to the latest data from the EU’s Ameco database. The comparable figure for Germany is 8.7 per cent.

In Spain, the average price of a square metre of residential property went up from about under €700 in 1997 to just under €2,000 ($2,700) at the end of last year – up threefold.

Another example is Ireland. In Ireland, the GDP share of construction and housing is even higher, at 20.7 per cent. While the performance of the Irish economy during the past few decades was remarkable, there are some deep underlying structural problems that are now surfacing. In particular, Ireland has been fast losing competitiveness within the eurozone – not a subject that has been talked about much outside Ireland recently. With interest rates rising and a slow return to sanity in the financial sector Ireland is going down the same route as Spain, perhaps only faster.

Spain - Ireland - US subprime mortgage bubble - paradigm shift/New Era - Wolfgang Munchau

Rolf Englund about New Era, June 29, 1999

Full textRecession in 2007?

Greenspan's recession comment opened the floodgates for the use of the "r word."

John H. Makin, 21/3 2007

Why the subprime bust will spread

Greenspan has been rightly criticized for letting a housing price "bubble" develop

Henry C K Liu

Greenspan: says yen carry trade is going strong but there could be a turnaround at some point.

Money CNN March 7 2007

I believe US stocks are now very attractive for investors.

Jeremy Siegel, FT, 26/4 2007

In the US, the long-term average p/e ratio has been 14.4 times, which corresponds to a 6.9 per cent earnings yield. This is extremely close to the historical average real return on equities.

There are two factors that argue for higher long-term p/e ratios:

the steep drop in transactions costs, which has allowed low-cost global diversification, and

the reduction in economic volatility, which should reduce the equity risk premium.

The reduction in transactions costs and bid-ask spreads has enabled investors to acquire and maintain a fully diversified global portfolio at a small fraction required before the deregulation of brokerage costs that prevailed 25 years ago.

In addition, the decline in the variability of real economic variables in the post-second world war economy should also lead to higher valuations. Economists call the reduced volatility “the Great Moderation” and have attributed it to better central bank policy and inventory control, and a growing service sector, which is inherently more stable than manufacturing.

These factors could boost the normal p/e ratio for equities to 20, with a resulting earnings yield of 5 per cent.

From that higher level, a 5 per cent real return on stocks still yields a 3 per cent premium over inflation-indexed bonds, a margin that many money managers believe is reasonable for stocks.

Comment by Rolf Englund:

I could not disagree more! In my not so humble opinion the "Imbalances" (US Trade deficit and all that)

mean that the world economy, and the US economy in particular is facing disaster.

And at that time Siegel argues that "the decline in the variability of real economic variables" should also lead to higher valuations.

Instead of reading Siegel you should perhaps better read Jonathan Livingston Seagull

Why have markets reached their exposed position? The answer is that success breeds excess.

This is the argument of a fascinating new paper from William White, economic adviser to the Bank for International Settlements.

The longer the period of macroeconomic stability, the greater the underlying excesses in investment and borrowing are likely to become. What happened to Japan in the 1980s is an example of this danger.

Martin Wolf, Financial Times 24/5 2006

Irrational Exuberance, Reconsidered

Now that we have 10 years of economic and financial data, we can now accurately determine whether the market was indeed "irrationally exuberant" in December 1996. The answer is decidedly no.

Jeremy Siegel, WSJ 6/12 2006

Ten years ago yesterday, Alan Greenspan made what was to become the most famous speech in his 18-year tenure as chairman of the Federal Reserve. Against a backdrop of a strong economy and soaring stock market, Mr. Greenspan said: "How do we know when irrational exuberance has unduly escalated asset values? . . . We should not underestimate . . . the interactions of asset markets and the economy. Asset prices, particularly, must be an integral part of the development of monetary policy."

When Mr. Greenspan spoke at the annual dinner of the American Enterprise Institute in Washington. The Dow Jones Industrial Average had crossed 5000 in November 1995 and 6000 in October 1996. On the day of Mr. Greenspan's speech, the Dow industrials stood at 6437, more than twice the level it reached only four years earlier.

There is no good evidence that the market was in a bubble when he uttered his famous line 10 years ago, and he was wise in stepping back from it. Irrational exuberance finally did hit the stock market, but not at the time or in the scope envisioned by his critics.

Nice chart at the top of this page

Recent stock market turbulence should abate because

the US economy remains fundamentally strong

President George W Bush, BBC 9/8 2007

President Bush said he believed the markets were set for a "soft landing".

In October 1929, Professor Irving Fisher of Yale University, a great guru of the markets, earned immortality with the pronouncement:

"stock prices have reached what looks like a permanently high plateau."

Read more

Ronald Reagans words from the 1987 Crasch:"Stocks went down because they were too high"

Ronald Reagan, 1987

Ben Bernanke laid out a soft-landing scenario for the US economy in his testimony to Congress,

with core inflation inching down to 2 per cent or below next year.

Financial Times 15/2 2007

The monetary policy report described the economic outlook as “favourable” - a judgement likely to fuel market optimism that the US is returning to a “Goldilocks” scenario, with the economy neither too hot nor too cold.

The US may be heading for a crash — but it's not the end of the world

Gerard Baker, The Times 15/8 2006

As elusive objectives go, the economic soft landing used to be up there with the lasting peace in the Middle East, the end to poverty in Africa and the cure for cancer. It featured prominently in the rhetorical promises of policymakers but rarely in the harsh reality of a world that refused to conform to wishful thinking.

Soft landing?

So many folks in the investment business - and in the country at large - haven't experienced a consumer-led recession in so long that they think this outcome is just not possible.

That's because the Federal Reserve Board has evolved into being a business-cycle suppressor and bubble manager.

Bill Fleckenstein, CNBC 18/12 2006

To review: We had a mindless equity bubble that was precipitated by a complete abdication of responsibility on the part of Fed monetary policy. That bubble popped in 2000, precipitating a recession led by businesses cutting back from their previous misallocations of capital. Next came our umpteen interest-rate cuts and tax cuts to help fight the aftermath, the result of which was a massive housing bubble - aided and abetted by the utterly irresponsible actions on the part of lenders.

Investors Hope the Fed Can Guide The Economy to a Soft Landing

History Says That's a Bad Bet

E.S. Browning, Wall Street Journal August 21, 2006

Whether the stock rally fizzles out or keeps going will depend heavily on whether Federal Reserve Chairman Ben Bernanke can pull off a nifty trick, piloting the economy to what professional investors call a soft landing.

A soft landing is what you want, but almost never get, at the end of a boom.

The idea is for the central bank to slow the economy just enough to prevent serious inflation, but not enough to choke off growth. Success brings another of Wall Street's favorite clichés - a Goldilocks economy, in which growth is not too hot and not too cold.

Trouble is, although they get talked about a lot, soft landings rarely happen. Going just far enough but not too far -- and doing so during an election year and amid conflicting economic signals - is one of the hardest things for monetary-policy makers to do. They almost never have succeeded.

Since the mid-1970s, almost every time the Fed has pushed rates higher, it has created a recession, a bear market or both. The notable exception came in 1994 and 1995, when the Fed raised rates without causing either, but did blow up the bond market and tank the Mexican peso.

Some fear the worst of all worlds - both inflation and an economic slump, an evil combination known as stagflation, the likes of which was last seen in the 1970s.

For years, real-estate brokers and home builders promised that the soaring property market eventually would glide to a soft landing.

It isn't working out that way.

Wall Street Journal 23/8 2006

"Soft Landing: Many See a Goldilocks Market, While Others See Stagflation Light."

John Mauldin, 18/8 2006

Mauldin: When everything is priced for perfection - and we are pretty perfect, I think - that's a difficult situation in which to be bullish on the stock market.

WSJ.com: Are we really priced for perfection? P/E ratios seem to be at reasonable levels.

Mauldin: John Hussman [manager of the Hussman Funds] has said that if you normalized earnings, meaning if you took earnings back [from a record-high percentage of GDP] to where they would normally be, the P/E for the S&P would be closer to 24 or 25.

If you revert earnings to the mean, you're looking at real room to fall.

There are certain issues the mention of which acts as a conversation stopper for most people. An example is: “Should central bankers target asset prices?” But the problem will not go away. What is at stake is the long-run credibility of central banks.

Even more important are the questions that it raises about the duration of the present happy combination of world economic growth and low inflation, which the National Institute of Economic and Social Research sees as the “strongest since the early 1970s”.

Samuel Brittan, FT, July 28 2006

Yet there is another school of thought, which is more diverse and less clearly articulated, that includes unreconstructed monetarists who fear the dismissal of near double-digit growth of monetary aggregates will bring its nemesis. Then there are the old financial hands who look at rising oil, gold and other commodity prices which have traditionally been key leading indicators.

Edward Heath, the former British prime minister, once compared the sole reliance on short-term interest rates to the actions of a one-club golfer. The stricture still applies.

RE: For more about Early 70's - see Stagflation

One central banker who understands inflation in its various forms is First Deputy Governor Eva Srejber of Sweden's Riksbank - who, in a speech last week about asset bubbles, showed that the applause meter has no place in the responsible conduct of monetary policy:

Longtime readers know that Eva and I are on the same page. It's refreshing to find a central banker somewhere who is capable of recognizing the facts - and willing to stand up publicly and call a bubble a bubble.

Bill Fleckenstein, CNBC 10/7 2006

In an attempt to avoid the consequences of the late-1990s stock mania, the Fed managed (after 13 rate cuts and several tax cuts) to precipitate a bubble in housing. That bubble, in my opinion, is a far more dangerous problem than the stock mania was, because of all the leverage involved

Bill Fleckenstein, CNBC 3/7 2006

For a year, through June 2004, the Federal Reserve held the federal funds rate at 1%.

Chairman Alan Greenspan and the chairman-to-be, Ben S. Bernanke, said they were fighting an anticipatory battle against deflation. They wanted to preserve the U.S. from a Japanese-style funk following the bursting of the stock-market bubble in 2000--01.

So they dropped lending rates to the floor and pushed home prices to the moon.

James Grant, 9/6 2006

You are Chairman Bernanke. What do you do?

A conscientious fellow, you try first to do no harm. You have made a lifelong study of deflation and the Great Depression. Of all the mistakes you could make at the helm of the Federal Open Market Committee, there is one you really want to avoid: You do not want to go down in history as the scholar of the Great Depression who inadvertently steered the highly leveraged U.S. economy into Great Depression Part II. You will be slow to tighten monetary policy when home prices are deflating, let the cpi be what it may.

You can be sure that gold will have its own bull market when the dollar resumes its bear market. When will that day come, and how high is up? I don't know - and neither does Bernanke.

Moral Hazard Interruptus

the Peoples Bank of China (PBOC), the Bank of Japan (BOJ) and the Federal Reserve

Paul McCulley, PIMCO, June 2006

Over the last year, monetary policy makers and market practitioners have spent a huge amount of mental energy, loads of computer time and gallons of ink examining the conundrum – the putatively too-low level of long-term real interest rates, both absolutely and relative to real short-term interest rates.

I’m not sure these four suspects necessarily committed the conundrum crime. They may have simply been at the scene of the crime! In which case, who dunnit? ‘Twas the oldest of villains named moral hazard, the bootlegger behind nearly all skinny risk premium crimes. And, in fact, there were three of them: the Peoples Bank of China (PBOC), the Bank of Japan (BOJ) and the Federal Reserve. Not that they did anything illegal, I hasten to add. Rather, for their own individual good reasons, they precommitted to absorbing three major risks from the global markets:

Debate as to whether the big three should have done what they did frequently takes on a religious character, with Keynesians applauding and Austrians booing. You know which camp I’m in! But regardless of your religious persuasion in these matters, we should all agree on what transpired: concerted global reflationary monetary policy, with central banks de facto shorting both a deflationary put at the bottom of their inflation comfort zones and an inflationary call at the top of those comfort zones.

Over the past six years, monetary authorities have turned the liquidity spigot wide open. This has given rise to an endless string of asset bubbles — from equities to bonds to property to risky assets (emerging markets and high-yield credit) to commodities.

Central banks have ducked responsibility for this state of affairs.

That could end up being a policy blunder of monumental proportions.

(see, for example, Alan Greenspan’s 3 January 2004 speech, “Risk and Uncertainty in Monetary Policy”)

Stephen S. Roach, Morgan Stanley, 22/5 2006

Suddenly, this year has all the ingredients of a Big One.

The dollar is sinking. Global stock markets are volatile. Bond-market interest rates are climbing. Oil prices are up. Gold is at a quarter-century high. Housing prices are softening. Protectionist pressures are intensifying. General Motors Corp. is a candidate for bankruptcy court. Iran may be on the verge of going nuclear. A nasty, partisan congressional election looms. And a new Federal Reserve chairman's inflation-fighting resolve is being tested.

Alan Greenspan certainly picked a good time to retire.

David Wessel, Wall Street Journal 25/5 2006

"We told you it was too good to last," the Cassandras are chanting.

And the OECD, while reiterating an upbeat forecast, allowed this week that "risks surrounding this scenario have increased."

Greenspan:Three Sins, One Gift

Sin #1 - Ignoring Asset Prices

Sin #2 - Bending to the Will of Others

Sin #3 - Fostering a Culture of Debt

The Gift - Hastening the Demise of Fiat Money

Tim Iacono 31/1 2006

Throughout history monetary systems have come and gone, though few people have understood what money is or how it works. Money is, and always has been, a medium of exchange - a way for people to trade their labor, or the fruits of their labor, for other goods that they want or need. To most people, it's as simple as that. But, money is also a store of value.

As anonymous economists at The Economist have already done most of the heavy lifting required to make the case for sin number one, Ignoring Asset Prices, attempting to recreate those arguments here seemed an unproductive use of time.

Their well-reasoned points have been liberally excerpted below, however readers are encouraged to enjoy the original accounts in their entirety - Monetary Myopia , and the cover story, Danger Time in America.

They are masterfully written and available at no cost.

Tim Iacono 13/1 2006

ALAN GREENSPAN

has been proclaimed “the greatest central banker who ever lived”. Among ordinary Americans he enjoys almost rock-star status. He has been awarded the Presidential Medal of Freedom, a British knighthood and the French Legion of Honour.

Does he really deserve such uniform praise?

The Economist, 12/1 2006

Danger time for America

The economy that Alan Greenspan is about to hand over is in a much less healthy state than is popularly assumed

The Economist editorial, 12/1 2006

Greenspan's reputation may not be totally secure

By Sir Howard Davies, BBC 29/12 2005

Sir Howard Davies is director of the London School of Economics. He has also been a deputy governor of the Bank of England, and chairman of the Financial Services Authority. He presents The Greenspan Years, to be broadcast on Monday, 2 January, 2006 at 2000 GMT on BBC Radio 4.

It is likely that the controversy will continue about his legacy.

The Bubble Cycle is Replacing the Business Cycle

Let's put to rest the myth that the Fed is blind to asset bubbles and never intentionally acts to prick them. The truth can be obtained by anyone with an internet browser and a few hours

Eric Janszen 22/12 2005

The Greenspan Warnings

Nick Barisheff November 22, 2005

Derivatives Dangers In remarks to Congress in October, 1998

The Potential Drop in Asset Values, Jackson Hole, Wyoming on August 26, 2005

The Housing Bubble, Jackson Hole on August 27, 2005

The Coming Crisis in Social Security, US House of Representatives, February 11, 2004

Oil Supply Risks, Washington, D.C., October 15, 2004

The Rising Budget Deficit, US House of Representatives, July 20, 2005

Rising Long-Term Interest Rates, in Germany, November 19, 2004

The Record-High Current Account Deficit, US House of Representatives, February 11, 2004

The Mess Greenspan Leaves

We can see here how the policy of inflating bubble after bubble to avoid the recessionary implications of previous bubbles has resulted in ever greater imbalances, with the savings rate falling ever lower after each bubble and the debt burden growing ever greater.

More disastrous, however, was the Federal Reserve's attempt to assist Great Britain who had been losing gold to us because the Bank of England refused to allow interest rates to rise

Stefan Karlsson, December 26, 2005

If the pernicious drift toward fiscal instability in the United States and elsewhere is not arrested

the adjustment process could be quite painful for the world economy

pernicious \pur-NISH-us\, adjective: Highly injurious; deadly; destructive; exceedingly harmful.

Alan Greenspan 2/12 2005

"To date, despite a current account deficit exceeding 6% of our gross domestic product, we -- or more exactly, the economic entities that comprise the U.S. economy -- are experiencing few difficulties in attracting the foreign saving required to finance it, as evidenced by the recent upward pressure on the dollar,"

I doubt, however, whether, given the current size of global financial markets, locking together two major currencies such as the dollar and the euro is feasible any longer. Over time, the required large domestic adjustments would be quite unlikely to be accepted by the majority of residents of either the United States or those of the euro area.

Remarks by Chairman Alan Greenspan, November 14, 2005

The markets are not behaving in the way that some, if not most, analysts anticipated as the U.S. current account deficit rose above its previous high of 3-1/2 percent of GDP recorded in 1986.

Alan Greenspan will be remembered as Copernicus, Columbus and Galileo, rolled into one.

In Europe central bankers and politicians still refuse to learn these lessons. They are still trying to apply the simplistic monetarist theory once believed to be the only alternative to the old gold standard, but thoroughly discredited by the Greenspan Fed.

Anatole Kaletsky, The Times, 27/10 2005

In 1971, however, President Nixon suddenly suspended the legal convertibility of the dollar into gold. The value of money was no longer linked to any objective standard of value, be it gold or cowrie shells. For the first time the whole world was operating what economists call “pure fiat money”.

In Britain, the possibility of managing an economy with pure paper money to achieve simultaneous price stability and full employment was a lesson that took 20 years to sink in. The moment of truth arrived on Black Wednesday in September 1992, when the Government was finally forced to take full responsibility for maintaining the value of money in Britain, instead of trying to peg the pound to the dollar, the deutschmark or the euro, in the same way as the pre-war Treasury had been obsessed with preserving the link to gold.

Comment by Rolf Englund:

For once, I beg to differ with Anatole Kaletsky.

Defending the exchange rate is fundamentally different to monetarism.

A central bank can target, the interest rate, the exchange rate or the money supply.

One of them - and the other numbers will be what they will be.

Que Sera, Sera

Sambandet mellan den fasta växelkursen och realräntechocken

Rolf Englund, oktober 2005

Alan Greenspan is everything an all-powerful central banker should be: boring, elderly, brainy, long-winded, and most importantly LUCKY.

Alan Greenspan has perpetuated a recession-less economy mentality that will ultimately lead to the mother of all recessions when the giant U.S. real estate bubble he created pops slowing our heavily-levered consumption-driven country

Bernanke will be the man in charge of trying to put Humpty Dumpty back together again.

Stein&McIntyre 25/10 2005