Skuldfrågan/ Who is responsible?

SIV = structured investment vehicle

Financial Crisis

|

Rolf Englund IntCom internetional

|

Home - Index - News - Kronkursförsvaret 1992 - EMU - Economics - Cataclysm - Wall Street Bubbles - US Dollar - Houseprices - Contact

Banks...

Basel - Too Big To Fail - The Volcker Rule - Finanskrisen/The Great Recession

Så här blir du bank

Click

Recall that the conventional story in which banks merely channel existing funds from savers to those with investments to finance is wrong.

Banks create new money in the form of deposits when they issue loans.

This is why banking is an inherently unstable and destabilising activity.

Martin Sandbu, FT 1 March 2018

Svaret på galaxens alla frågor är inte 42.

För ekonomi och banker är svaret 20.

Rolf Engluns blog 23 augusti 2013

The legacy of the great crash of 2008 — economic, financial and political — hangs heavy in the air:

banks bailed out to the tune of £500bn; the bankers responsible punished only in the court of public opinion;

the imbalance between risk and sky-high rewards barely addressed by boards and shareholders.

FT editor Lionel Barber 23 November 2018

How Greece Is Scrambling to Save Its Banks — Again

Bloomberg 23 november 2018

Bank runs in the digital era

Thomas Hale FT Alphaville 29 March 2019

He /former Canadian central banker Mark Zelmer/ the argues that “past experience” has shown how quickly runs can take place in a digital world, and that the risk may grow due to the introduction of Open Banking, which was introduced in the UK last year to require banks to allow third parties to access account data

Once, you closed down the bank. Now, it’s the internet you’d have to close.

Minsky

Liquidity is an elusive quality at the best of times. In a bear market it can disappear in a moment.

Rest assured that not all of today’s trading strategies are predicated on that reality.

John Plender FT 13 November 2018

Peter Praet, the ECB’s chief economist, told a Financial Times conference that

he was particularly worried about “the degree of leverage in the financial system ...

because of the shadow banking system”.

Patrick Jenkins FT 1 October 2018

Under krisåren spenderade EU-länderna sammanlagt över 2 000 miljarder euro i skattepengar för att rädda banker.

Teresa Küchler SvD 15/9 2018

Grekland, Irland, Portugal, Spanien och Cypern fick alla enorma räddningslån från EU och IMF,

och en stor del av pengarna gick till att hålla kommersiella banker flytande

– samtidigt som befolkningarna i de krisdrabbade länderna underkastades hårda åtstramningspaket, med sänkta löner och pensioner.

...

- Den stora risken var att Grekland skulle utlösa en kris i italienska, franska och tyska banker.

Nu finns i praktiken en EU-garanti för de utestående grekiska statsobligationerna.

Anders Borg, TT, SvD papper 22 februari 2012

Småstadsbank blev nordisk jätte – när gick det fel?

I dag ställer sig alla samma fråga:

Är det möjligt att ledningen och styrelsen inte hade någon aning om vad som pågick?

SvD 23 februari 2019

Vi som barn läste Lyckoslanten har en lika romantisk som felaktig bild av banker

Idoga sparare satte in pengar på Sparbanken (numera Swedbank) som lånade ut pengarna till driftiga företagare i bygden mot god säkerhet.

Riktigt så är det inte.

Man skall först och främst skilja på inlåning och upplåning.

Englund blog 11 augusti 2018

Är storbankerna så stresståliga som Finansinspektionen antyder?

Patricia Hedelius: SvD 25 november 2018

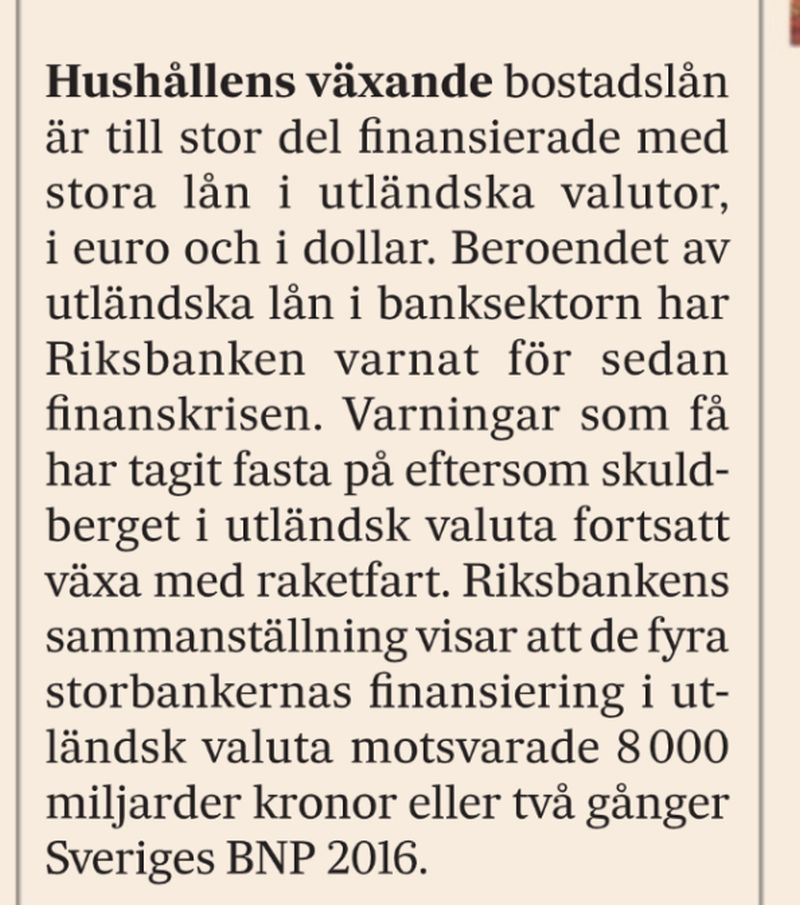

Alldeles nyligen presenterade Riksbanken sin senaste finansiella stabilitetsrapport.

Där skriver den svenska centralbanken att vissa av storbankerna både spås få brist på utländska valutor och svenska kronor i en kris. Riksbanken bedömer till exempel att en del av bankerna bara har buffert för tre dagar i en stressad situation.

Det stannar inte där. Enligt Riksbanken är storbankernas affärer så insyltade i varandra att det motsvarar 40 procent av det viktiga kärnkapitalet.

Bankernas utlåning till hushållen - Swedbank störst

Cornucopia 18 juli 2018

Av 3 597 048 MSEK i utlåning till hushållen står Swedbank, Handelsbanken, SEB och Nordea för 74 %.

Bankcheferna tror inte på kris:

”Borg för alarmistisk”

SvD 5 juli 2018

Sweden

Indebtedness worries both FI and the central bank, the Riksbank, which fears that a sharp fall in house prices could lead debt-laden households to spend less, knocking back growth and employment.

It worries that banks, of which just four account for 75% of mortgages, could find loans harder to fund.

They do this by selling bonds, some in foreign currency, with the loans as collateral.

The Economist 21 June 2018

Håller vi på att återuppleva 2007?

Om utlänningar börjar bli nervösa över hur det står till i landet så kan bankerna få problem eftersom två tredjedelar av de pengar de lånar upp är utländsk valuta.

Birgitta Forsberg, SvD Näringsliv 30 april 2018

---

www.internetional.se/cred2189.htm

---

Rolf Englund på Nationalekonomiska Föreningen januari 1990

Vi ser också att affärsbankernas lånestock i utländsk valuta är nästan lika stor som den är i svenska kronor.

Lånen i utländsk valuta hos affärs- och sparbankerna är tillsammans nästan 300 miljarder. Det är mer än dubbelt så mycket som sparbankernas utlåning i svenska kronor.

Jag föreställer mig att de som har lånat upp dessa 300 miljarder inte avser att ha dessa lån när nästa devalvering kommer.

Fyra svenska börsbolag står för nästan hälften - 46 procent - av storbolagens samlade utdelningar.

Börsbolagen är händelsevis Handelsbanken, Nordea, SEB och Swedbank.

En svensk medelklassfamilj som bor i hus eller bostadsrätt kan nu ta stora lån och betala pyttelite i ränta

för att renovera, köpa bilar eller fritidshus.

Aftonbladet 27 November 2017

Det är inte längre för att Sverige säljer bilar, malm och skog som tillväxten ökar. Det är för att våra banker går så bra.

I dag är det - tack vare att bostadspriserna ökat - lån på banken som gör att vi har råd att handla och höja vår levnadsstandard.

I Katalys rapport No. 38 Finansialiseringen av Sverige visar rapportförfattarna Markus Kallifatides och Claes Belfrage att svenskt samhällsliv finansialiserats.

Bankernas utlandslån 8.000 miljarder kronor

Patricia Hedelius SvD 8 oktober 2018

Hjälp från USA spelade en avgörande roll för svensk ekonomi under den förra finanskrisen.

Men Sverige kan inte räkna med någon hjälp alls nästa gång en kris slår till.

Varningen kommer från vice riksbankschef Cecilia Skingsley, SvD 10 oktober 2018

Krisen drabbade inte minst svenska banker som lånar det mesta av sina pengar på kreditmarknaden i stället för från vanliga sparare – pengar som de sedan lånar ut till exempelvis bolånetagare. Svenska banker tar också stora lån i dollar, och när finanskrisen slog till fanns det helt plötsligt inga dollar som bankerna kunde låna för att betala sina skulder.

Situationen var mycket allvarlig och räddades av den amerikanska centralbanken som gick med på att förse Riksbanken med tillräckligt med dollar för att rädda de svenska bankerna.

Hushållens höga och stigande skuldsättning utgör ett allvarligt hot mot den finansiella och den makroekonomiska stabiliteten.

Det finns även sårbarheter i det svenska banksystemet och dess motståndskraft behöver därför stärkas.

Det gäller såväl bankernas förmåga att hantera likviditetsrisker som deras kapitalnivåer.

Samtidigt är det nödvändigt att Riksbanken har en tillräckligt stor valutareserv om det uppstår likviditetsbehov i utländsk valuta som inte bankerna själva kan hantera.

Riksbanken Finansiell Stabilitet 24 maj 2017

Riksbankens rapport De svenska storbankernas strukturella likviditetsrisker

De lånar in korta pengar och lånar ut långa – det klassiska receptet för allvarliga finanskriser.

Den svenska banksektorns tillgångar motsvarade 340 procent av BNP i slutet av 2015.

Gunnar Wetterberg, Expressen 26 februari 2017

Tidigare hanterades bolånen av särskilda bolåneinstitut. De gav ut bostadsobligationer med mycket långa löptider, som svarade mot låntagarnas amorteringstider.

På 1950-talet uppgick den återstående löptiden på bostadsobligationerna till nästan 40 år.

Problemet är att löptiden på bankernas tillgångar är mycket längre.

Swedbank och Handelsbanken är värst, med 15,5 respektive 14,8 års löptid på tillgångarna, mot 3,7 år på skulderna.

De svenska storbankernas strukturella likviditetsrisker

Finansiella stabilitetsrådet skall vara redo vid skarpt läge

Stockholm och andra svenska storstäder kan bli det Nya Norrland, fast i en ond spiral av utflyttning och bristande affärsunderlag.

När bostäderna stiger i värde konsumerar hushållen ungefär 25 procent av värdestegringen.

Den konsumtionen försvinner om bostadspriserna inte längre stiger.

Mattias Svensson, Fastighetstidningen 3 oktober 2017

Basel

Sweden also has objected to the 75 percent floor

because its banks have bigger holdings of mortgages than those in other countries.

Sweden’s historically stable housing market makes such mortgages less risky than what standardized formulas suggest, Swedish regulators and banks have argued.

Bloomberg 3 January 2017

So a bigger proportion of mortgages make the risk weighting look small compared with total assets.

Deutsche Bank AG and Commerzbank AG will be affected more than most big lenders and may have to raise additional capital,

if and when the Basel Committee on Banking Supervision implements a proposed floor for how much their risk-weighting of assets can veer from standardized measures.

Catherine Mann, the OECD’s chief economist, Canada and Sweden,

had “very high” commercial and residential property prices

Telegraph 2 January 2017

Storbankerna är skyldiga att hålla en viss mängd tillgångar som ses som likvida, som alltså enkelt kan säljas vid behov.

Bankernas så kallade likviditetsreserver består till stor del av andra bankers bostadsobligationer,

ett korsägande som kritiserats av bland annat internationella valutafonden.

SvD Louise Andrén Meiton 12 december 2016

Per Bolund säger att Finansdepartementet inte har gjort några egna stresstester av systemet med bostadsobligationer.

Han litar på Finansinspektionen och Riksbankens analyser.

Riksbanken

Storbankernas likviditet och kapitaltillgång behöver säkras

och riskerna med hushållens ökande skuldsättning måste hanteras

SvD 23 November2016

Då storbankerna är exponerade på flera marknader anser banken bland annat att Finansinspektionen bör ställa krav på likviditetstäckningskrav i alla väsentliga valutor

och snarast införa ett bruttosoliditetskrav. Nivån på kravet bör sättas till fem procent, föreslår Riksbanken.

– Under alla de negativa scenarior som vi kan tänka oss

så är det extremt svårt att se hur man som investerare kan förlora pengar på bostadsobligationer,

därför har de en unik position, säger John Arne Wang, chef för upplåning och likviditetshantering på SEB.

Myntet har två sidor. Om investerarens risk är liten är den potentiellt långt större för bolånekunden.

SvD Näringsliv, Louise Andrén Meiton, 15 november 2016

Någon som länge varnat för åska och storm är riksbankschef Stefan Ingves.

Han har skrikit sig hes och varnat för att de svenska storbankerna bara blir större och större och därmed innebär en större risk för hela landets ekonomi.

Det är ingen hemlighet att Stefan Ingves varit kritisk till Nordeas planer att bli en gigantisk bank med Sverige som yttersta garant i en kris.

SvD 19 juni 2016

FI-chefen Erik Thedéen å sin sida gillar riskvägda mått – att banken behöver ha mer egna pengar när de lånar ut till byggbolaget Svea än till familjen Svensson som vill köpa en lägenhet.

Svenska storbanker kan tvingas låna upp 588 miljarder kronor i efterställda lån,

som ska kunna omvandlas till eget kapital i ett krisskede, enligt ratinginstitutet Moody's

SvT/TT 12 maj 2016

zc

Bank lending in 2018 looks a lot like bank lending pre-2008.

Worse, macroeconomic policies, designed as a methadone fix to see a debt-addicted world though the post-crisis years,

have actually led to increased leverage outside the banking sector

FT 9 October 2018

In aggregate, global debt now stands at close to $250tn, according to the Institute of International Finance,

nearly 40 per cent more than in 2008. In that artificially low-interest environment, investors’ hunger for decent yields has pushed asset prices — from Florida apartments to fine art — up to record levels.

The world has not learned the lessons of the financial crisis

Banks are safer, but too much of what has gone wrong since 2008 could happen again

The Economist editorial 6 September 2018

Europe’s banking union lacks the key element of deposit insurance

Isabel Schnabel member of the German Council of Economic Experts FT 28 August 2018

Turkish lira tumbles further as crisis mounts

ECB concerned about exposure of European banks to borrowers in Turkey

FT 10 August 2018

How To Deal With Failed Banks

Resolving a failing bank should rely on bail-ins:

private stakeholders should bear the losses

IMF blog 3 July 2018

During the global financial crisis, policymakers faced a steep trade-off in handling bank failures. Using public funds to rescue failing banks (bail-outs) could weaken market discipline and lead to excessive risk taking—the moral hazard effect.

Letting private investors absorb the losses (bail-ins) could destabilize the financial sector and the economy as a whole—the spillover effect. In most cases, banks were bailed out.

This created public resentment and prompted policymakers to introduce measures to shift the burden of bank resolution away from taxpayers to private investors.

Lehman Brothers

While risk no longer sits in the banking system, it has not vanished.

It grows ever clearer that risk has been moved, primarily to the pension system.

John Authers FT 26 July 2018

When Richard Fuld, the chief executive of Lehman Brothers, received the news in 2008 that no one would ride to the rescue of his failing bank, he is reported to have said: “So I’m the schmuck?”

The sheer complexity of pensions also helps to make them a much more attractive place to bear risks. Few understand them, so they tend not to be the subject of mainstream debate.

China’s $10 trillion ecosystem of unregulated lending, known as shadow banking.

Bloomberg 19 July 2018

German savings banks, known as Sparkassen, form an important feature of the country's banking assets.

Unlike in other European countries, German Sparkassen also hold direct links with local political communities.

Bruegel July 2018

European banks still have post-crisis repairs to do

Former US policymakers say their counterparts did not do enough to stop the rot

Gillian Tett FT 19 July 2018

“In the early days of the crisis the European banks were in worse shape than the US banks and they hid it because...

Ben Bernanke, Henry Paulson and Timothy Geithner

Martin Wolf: My own view is that the people, including Geithner, who dealt with this crisis made big mistakes

but also saved the world from another Great Depression

Click

Should stresses emerge, market liquidity will evaporate again:

the insidious illusion of permanent liquidity has not gone away.

Agustín Carstens, general manager of the Bank for International Settlements, FT 25 June 2018

Banks may be disguising their borrowings

with debt ratios falling within limits imposed by regulators just four times a year.

Bloomberg 24 June 2018

Lenders use repurchase agreements -- known as repos -- to massage down their assets as reporting dates approach, typically as quarters end,

the Bank for International Settlements said in its Annual Economic Report.

Post-crisis, financial regulators decided to nominate a select few GSifis

(global systemically important financial institutions).

From the market top on January 26 until May 31, they lost $800bn in market capital, or about 18 per cent.

John Authers FT 14 June 2018

Bankunion

Man vill skapa förutsättningar för att bryta den så kallade ”doomloop”,

den negativa feedback, som finns mellan ett svagt banksystem och svaga offentliga finanser.

Statssekreterare Karolina Ekholm Intervju: Per Lindvall Realtid 15 juni 2018

Att /för Sverige/ bara lämna walk-over och ställa sig utanför bankunionen med motiveringen att detta är ett sätt för euroländerna att hantera sina självförvållade problem är inget självklart val.

När det gäller hanteringen av krisbanker enligt resolutionsmekanismen SRM, som innefattar resolutionsfonden och resolutionsstyrelsen,

så har hanteringen av de italienska bankerna med storbanken Monte dei Paschi i spetsen skapat en viss oro för hur reglerna kommer att tillämpas.

Huvudregeln är att bankernas ägare och fordringsägare i första hand ska ta smällen, så kallad bail-in.

Euron lyfter Sverige

Den inre marknaden är EU:s viktigaste ekonomiska projekt. Men nationella valutor med rörliga växelkurser fungerar som handelshinder.

Därför är en gemensam valuta ett naturligt och nödvändigt steg för att realisera den gemensamma marknaden.

Pontus Braunerhjelm, Karolina Ekholm, Klas Eklund, Richard Friberg, Mattias Ganslandt, Hans Genberg, John Hassler, Ulf Jakobsson, Pehr Wissén Carl Johan Åberg

SvD Brännpunkt 14/5 2003

Författarna medverkar i boken "Därför euron" som i dag ges ut på Ekerlids förlag.

Sluta dalta med krisbankerna

Svajande storbanker hålls under armarna med hjälp av statliga insatser, läs subventioner,

där staten och skattebetalarna bär en allt större del av riskerna utan att få eller ta betalt.

Per Lindvall e24.se 2009-06-10

What fixes does the euro really need?

As Isabel Schnabel and Nicolas Véron have recently explained, this requires, at a minimum,

that banks’ creditworthiness is no longer at the mercy of the public finances in the country they happen to emerge from —

that the “doom loop” between banks and sovereigns be broken.

Martin Sandbu 11 June 2018

Mario Draghi, the euro’s central banker, inimitably set out what this means in his speech in Florence last month;

the single best guide to the eurozone’s challenges.

Italy turmoil shows banking ‘doom loop’ still a powerful force

FT 5 June 2018

The idea that Italy could vote in a referendum to leave the eurozone and bring back the lira still sounds far-fetched to most investors. But even the faintest chance of such a dire outcome for anyone holding Italian sovereign bonds was enough to prompt Moody’s to put the credit ratings of 12 Italian banks on review for downgrade last week.

The reason the Italian political crisis caused so much angst was the ill health of Europe’s banks

which remain bloated and over-levered.

John Authers FT 2 June 2018

I find it unforgivable that the last Irish government guaranteed bank debt so insouciantly and that the rest of the European Union has supported this decision.

For a sovereign to destroy its own credit, to save creditors of its banks, is plainly wrong.

It does not make it better, but worse, that it is doing so largely to protect financial systems in other countries.

Martin Wolf, FT March 8 2011

How to Escape Basel III Doom Loop

What has been the biggest economic policy error of the post-Lehman era?

I used to think the answer was obvious. The euro zone's decision to impose losses on holders of Greek government bonds

Simon Nixon, WSJ 7 October 2011

The European Commission is urging governments and the European Parliament to complete the EU’s banking union by 2019

and thus cut the “doom loop”, in which weak banks and sovereigns drag each other down

The Economist print 30 November 2017

The European Union's effort to break the link between banks and government debt may make things worse.

Bloomberg 15 December 2017

However, if the price of these bonds plummets -- or, worse, if these bonds have to be restructured -- banks get into trouble, as Greek banks found.

RBS Government’s stake is worth around £24bn,

little more than half the £45bn of public money used to keep the bank afloat

Jeremy Warner 12 May 2018

Even adding back the £6bn the Government creamed off RBS via the so-called “asset protection scheme”, that’s quite a loss to the public purse.

I am no populist.

Yet when I think of the sums earned by those responsible for dumping this mess on to the UK taxpayer,

even my blood boils.

Martin Wolf, Financial Times March 5 2009

The reason the Italian political crisis caused so much angst was the ill health of Europe’s banks

which remain bloated and over-levered.

John Authers FT 2 June 2018

This makes them vulnerable to risks such as an Italian default.

And as the banks remain huge, they are effectively too big for their governments to save.

It is European banking health that makes any risk to the structure of the eurozone so toxic.

Banks today are much better capitalised than before, and much of the risky lending is now occurring in the non-bank world,

namely by hedge funds, private equity groups and mutual funds. But that is not a reason to relax.

Gillian Tett FT 26 April 2018

Just a few days ago the IMF warned about the risks of overheating in risky loan and bonds markets.

“Signs of late cycle credit dynamics are already emerging in the leveraged loan market,” the IMF Global Financial Stability Report observes, noting that “in some cases, [this is] reminiscent of past episodes of investor excesses”.

To protect the economy from future mega-bank failures, much more work needs to be done.

Mark Roe, professor at Harvard Law School, Project Syndicate 17 April

Twin reports by the IMF sketch a chain-reaction of dangerous consequences for world finance.

The policy – if you can call it that – puts the US on an untenable debt trajectory.

It smacks of Latin American caudillo populism, a Peronist contagion that threatens to destroy the moral foundations of the Great Republic.

Ambrose Evans-Pritchard Telegraph 18 April 2018

Taken together, existing capital requirements and stress tests still aren't enough to prepare banks for a real crisis.

As soon as people start to think a bank is going bust, it’s doomed.

So it needs enough equity to absorb severe losses and continue operating.

Bloomberg Editorial 16 April 2018

Recall that the conventional story in which banks merely channel existing funds from savers to those with investments to finance is wrong.

Banks create new money in the form of deposits when they issue loans.

This is why banking is an inherently unstable and destabilising activity.

Martin Sandbu, FT 1 March 2018

Crisis and Response: An FDIC History, 2008–2013

FDIC December 2017

US ‘too big to fail’

Treasury plans ‘Chapter 14’ bankruptcy process to shield taxpayers from bank collapses

FT 21 February 2018

The Coming Financial Crisis

Bank deposits fell strictly into two classes, depending on the preference of the depositor and the terms offered by banks:

time deposits, and demand deposits.

Doug Casey 27 December 2017

In the business of accepting time deposits, a banker is a dealer in credit, acting as an intermediary between lenders and borrowers.

An honest banker should no more lend out demand deposit money than Allied Van and Storage should lend out the furniture you’ve paid it to store.

In 1934, to restore confidence in commercial banks, the US government instituted the Federal Deposit Insurance Corporation (FDIC) deposit insurance in the amount of $2,500 per depositor per bank, eventually raising coverage to today’s $250,000.

In Europe, €100,000 is the amount guaranteed by the state.

FDIC insurance covers about $9.3 trillion of deposits, but the institution has assets of only $25 billion.

Earlier this year, Fed Chair Janet Yellen explained how she doesn’t think we’ll have another financial crisis “in our lifetimes.”

Ben Bernanke said in May 2007

- We believe the effect of the troubles in the subprime sector on the broader housing market will likely be limited, and we do not expect significant spillovers from the subprime market to the rest of the economy or to the financial system.

As many of you know, I have spent much of the last seven years explaining to anyone who will listen that banks do not "lend out" deposits or reserves.

Rather, they create both loan assets and matching deposit liabilities "from nothing" by means of double entry accounting entries.

Creating money with a stroke of the pen (or a few taps on a computer keyboard) is what banks do.

Frances Coppola, 29 October 2017

Regulators approve living wills designed to avert future bailouts

Fed and FDIC found “living wills” drawn up by eight of the country’s largest and most complex banks were satisfactory.

FT 20 December 2017

The revised Basel bank-capital standards are complete at last

But have Europe’s banks got off lightly?

The Economist print 14 December 2017

Europe’s banks are stronger than they were, but not strong enough

The Economist print 30 November 2017

The European Commission is pushing ahead on yet another front. It is urging governments and the European Parliament to complete the EU’s banking union by 2019 and thus cut the “doom loop”, in which weak banks and sovereigns drag each other down

One big missing piece is a common European deposit-insurance scheme. Germans and other northerners have balked at the thought of bailing out supposedly feckless southerners. To allay such fears, the commission wants to go gradually

Among their other shortcomings, banks had done too little, too late, to recognise losses on wobbly assets.

Under existing standards they make provisions only when losses are incurred, even if they see trouble coming.

IFRS 9, which comes into force on January 1st, obliges them to provide for expected losses instead.

The Economist 16 November 2017

“Shadow banking”

It's larger than the world economy. It poses risks to financial stability.

Bloomberg, 20 November 2017

The most devastating runs of the 2008 financial crisis were not on bank deposits — as happened during the Great Depression —

but on shadow banks such as Lehman Brothers (a broker-dealer) and money-market funds.

As many of you know, I have spent much of the last seven years explaining to anyone who will listen that banks do not "lend out" deposits or reserves.

Rather, they create both loan assets and matching deposit liabilities "from nothing" by means of double entry accounting entries.

Creating money with a stroke of the pen (or a few taps on a computer keyboard) is what banks do.

Frances Coppola, 29 October 2017

Banking remains far too undercapitalised for comfort

Leverage ratios closer to 5:1 will help give creditors confidence in liabilities

Martin Wolf, FT 21 September 2017

Western capitalism has few sacred cows left.

It is time to question one of them: the independence of central banks from elected governments.

Yanis Varoufakis, Project Syndicate 29 August 2017

Italy’s €17bn bank rescue deal

Critics say use of state funds to deal with failing Veneto banks undermines EU rules

FT 26 June 2017

Italy will commit as much as 17 billion euros ($19 billion) to clean up two failed banks

Banca Popolare di Vicenza SpA and Veneto Banca SpA

The lenders will be split into good and bad banks.

Bloomberg 25 June 2017

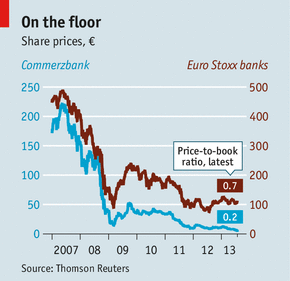

Markets Don't Trust Banks, and They're Right

The financial crisis should have led to fundamental change. It hasn’t happened.

Mark Whitehouse, Bloomberg 30 maj 2017

Almost a decade after a crisis that nearly brought down the global financial system, markets still aren’t showing much confidence in banks.

It’s understandable that, after years of wrangling and thousands of pages of new rules, regulators might want to consider their mission accomplished.

Yet, as former U.S. Treasury Secretary Larry Summers has taken to pointing out, markets don’t appear to believe that banks are much healthier. This is evident in how they value equity -- that is, the amount by which a bank says its assets exceed its liabilities.

Back in the early 2000s, investors often paid $2 or more for each dollar in book equity, a sign that they trusted banks’ accounting and expected to reap significant profits.

Now, though, even after the mini-boom following Donald Trump’s election, they’re valuing the largest five U.S. banks at about $1.16 per dollar of book equity, and the top five European banks even less.

Here’s how that looks:

Monte dei Paschi rescue deal now close

MPS, the oldest bank in the world, was shown to be one of the sickest, too.

FT 22 May 2017

A decade after the crisis, how are the world’s banks doing?

For too many, leverage was the path first to profit and then to ruin.

The Economist 6 May 2017

IMF Global Financial Stability Report

April 2017

Glass-Steagall was one of the most successful financial laws Congress has ever enacted.

Before Glass-Steagall, financial panics, as they used to be called, were a staple of American life.

But after the Depression, financial crises stopped until 2008, by which time it had been repealed.

Joe Nocera, Bloomberg 6 April 2017

Deutsche Bank Seeks $8.6 Billion Selling Shares at 35% Discount

Bloomberg 19 March 2017

The bank said previously that the latest share sale would boost its common equity Tier 1 ratio, a key benchmark of financial strength, to 14.1 percent and vowed to keep it “comfortably above” 13 percent. The measure stood at 11.9 percent at the end of 2016.

Postmortem plans for banks under threat of exinction

If there was one big realisation to come out of the financial crisis

— alongside the fact that banks were riskier than believed —

it was this: policymakers did not know how to wind up a bank without causing chaos.

FT 6 March 2017

Banks globally have paid $321 billion in fines since 2008

for an abundance of regulatory failings from money laundering to market manipulation and terrorist financing,

according to data from Boston Consulting Group.

Bloomberg 2 March 2017

Why are German banks the only ones backtracking on integration?

One possible reason is that domestic financial authorities, skeptical about the euro’s future, have instructed banks to cut their exposure to the rest of the eurozone.

German banks received €239 billion ($253 billion) in state aid between 2009 and 2015.

Federico Fubini, Project Syndicate 30 January 2017

The global financial system is no safer today than it was in 2007.

If those who use overnight mortgage pools receive priority over other creditors, as is the case today...

Mark Roe, professor at Harvard Law School, Project Syndicate, 31 January 2017

Just €300bn

Study shows 133 banks will have to issue no more than €300bn to meet capital standards

FT 14 December 2016

Risky banks face higher capital needs from latest Basel reforms

FT 7 October 2016

Deutsche Bank

Merkel and other EU leaders face a quandary. Markets assume they won’t deploy their biggest weapon

-- bail-in, or imposing losses on private investors --

when it comes to a giant like Deutsche Bank because of the risk of contagion.

Bloomberg 5 October 2016

More than nine years after the start of the global financial crisis,

worries over the health of the financial system remain significant, especially in Europe.

Martin Wolf. FT 4 October 2016

This should not be surprising. But it should be disturbing.

Since August 2007 the 471 financial companies that form Datastream’s financials equities sector

lost over one trillion euros in market value.

FT 8 August 2016

Italy’s banking woes have the potential to wipe out investors and

undo over 60 years of supranational state-building in Europe.

zerohedge 12 July 2016

The 2007-08 episode clearly demonstrated that financial crises, particularly when they involve the banking sector,

can be enormously expensive both in terms of direct fiscal costs and associated costs for the real economy.

Over the period 2008-14 accumulated gross financial sector assistance by euro area governments amounted to 8% of euro area GDP,

of which, so far, around 3% has been recovered

Lecture by Vítor Constâncio, Vice-President of the ECB, 7 July 2016

If the Fed wants the big banks to ease off on lending to the commercial real estate sector, for example,

it simply increases the hypothetical losses under the most stressful scenario.

Hey presto: the bank in question has to taper its plans for dividends and share buybacks

— reducing its return on equity — or risk a damaging rejection when the results are in.

FT 8 July 2016

The big bank bloodbath:

losses near half a trillion dollars

MarketWatch 7 July 2016

At 20 big banks, plunging share prices this year have erased a quarter of their combined market value

I agree with those who reacted to Mr Renzi’s proposal by saying

there is no case to suspend the bail-in rules that are encapsulated in the Bank Recovery and Resolution Directive,

which came into force at the start of the year,

and that doing so would fatally damage the credibility of the brand-new bailout framework.

Philipp Hildebrand, FT 5 July 2016

But, as Angela Merkel, German chancellor, has pointed out...

The writer is vice-chairman of BlackRock and a former chairman of the governing board of the Swiss National Bank

Shares in Italy’s two largest banks Intesa Sanpaolo and UniCredit,

closed down almost 23 per cent and almost 24 per cent respectively.

In Spain, Banco Santander and Banco Sabadell’s stocks fell more than 14 per cent and 19 per cent respectively.

Germany’s Deutsche Bank dropped about 14 per cent.

FT 28 June 2016

Will IT disrupt finance?

Martin Wolf FT 8 March 2016

Stocks Tumble After Fed Plans Too-Big-To-Fail Bank Counterparty Risk Cap

The Fed proposed a rule that would limit banks with $500 bln or more of assets from having net credit exposure

to a “major counterparty” in excess of 15% of the lender’s tier 1 capital.

zerohedge 4 March 2016

What is 'Tier 1 Capital'

investopedia.com

Bill Gross says negative rates are going to crush the banks

MarketWatch 3 March 2016

Baltikum Swedbank SEB och Bolånen

Andreas Cervenka, SvD 3 mars 2016

Royal Bank of Scotland's shares dived 8 pc as the bank reported

its eight consecutive year of losses since it was bailed out by the taxpayer in 2008.

Telegraph 26 Febr 2016

The bailed-out bank lost £2bn in the year, taking its total losses since the financial crisis to £ 51.6 bn.

Sub-zero central bank rates should be welcomed, not lamented,Sandbu

Rolf Englund blog 16 Febr 2016

European stock markets rallied for a second straight session on Monday,

with bank shares leading the charge higher after news

the European Central Bank may buy Italian bad loans.

MarketWatch 15 Febr 2016

A negative feedback loop between bail-in instruments and equity has developed, leading to a loss of confidence.

Recent developments in Italy and Portugal have awoken investors to these new risks.

FT 15 Febr 2016

Basel

Bank turmoil:

are Europe’s new bail-in rules to blame?

FT, February 11, 2016

The Stoxx 600 index of European financial institutions fell 5.6 per cent on Monday

Deutsche Bank led a rout in global bank stocks

FT 8 Febr 2016

Deutsche has one of the weakest capital ratios among large global banks.

Deutsche Bank Is Forced To Issue Statement Defending Its Liquidity

Deutsche Bank Co-Co bond yields hit 12%.

Two-year German government bonds now yield -0.50%.

MishTalk, Febr 8. 2016

Why coco bonds are worrying investors

FT February 9, 2016

Banks

John Kay’s new book, “Other People’s Money”, does the job;

it should be read by everyone concerned with preventing the next crisis.

The Economist 22 August 2015

The early books after the crash, like Andrew Ross Sorkin’s “Too Big to Fail”, analysed how the collapse unfolded in minute detail;

Mr Kay, an academic and columnist for the Financial Times, takes the longer and broader view.

“We need some of the things that Citigroup and Goldman Sachs do, but we do not need Citigroup and Goldman Sachs to do them,” he writes.

Banks are Not Intermediaries of Loanable Funds – and Why This Matters

Yves Smith, June 19, 2015

Draghi would like his trillion euros to go to Italian factories to re-equip themselves, to Greek tourist resorts to smarten themselves up,

and to German consumers to spend more on that Italian-made stuff and those Greek holidays.

But banks won’t want to lend to Italian or Greek companies just because they have a lot more money on their balance sheet.

So if a trillion euros get printed in Frankfurt, a lot of it will wash its way across the English Channel.

Matthew Lynn, Telegaph 19 Jan 2015

Svenska storbanker kan tvingas låna upp 588 miljarder kronor i efterställda lån,

som ska kunna omvandlas till eget kapital i ett krisskede, enligt ratinginstitutet Moody's

SvT/TT 12 maj 2016

Finanskriskommittén

Riksgäldens garantiprogram för bankerna infördes 2008.

Sammanlagt ställdes bankgarantier för 354 miljarder kronor.

SvD Näringsliv 18 november 2014

Ingen av garantierna behövde infrias.

– Jag tycker att det var en lyckad åtgärd. Den sattes in när svenska och utländska banker hade finansieringsproblem och därför behövde den här typen av statligt stöd, säger Lars Hörngren, chefsekonom på Riksgälden och tidigare ordförande i Finanskriskommittén.

– Det var för att säkra kreditgivningen under kristiden. BNP föll för att exporten drabbades

men den inhemska konsumtionen tuffade ändå på någorlunda väl. Det berodde på att det fanns krediter att tillgå

Anders Borg är duktig, men tänk om de goda tiderna beror på bostadsbubblan, som på Irland

Rolf Englund 2011-11-23

Finanskriskommittén

På basis av nya EU-regler för finanskrishantering lämnar Finanskriskommittén förslag om ett nytt förfarande kallat resolution.

Förförandet innebär att om en konkurs i en krisbank skulle hota den finansiella stabiliteten,

kan staten genom att besluta att sätta den i resolution ta kontroll över banken.

Staten kan sedan sälja hela eller delar av verksamheten eller driva den vidare och genom rekonstruktionsåtgärder på nytt göra den livskraftig.

Bakgrund

I december 2013 antog EU ett direktiv som syftar till att ge medlemsstaterna de befogenheter som krävs

för att utan spridningseffekter till andra banker och utan stora kostnader för staten hantera banker i kris.

Finanskriskommitténs uppdrag har varit att lägga förslag om hur EU-direktivet ska genomföras i svensk lagstiftning.

Will the asset quality review and stress tests conducted by the European Central Bank and the European Banking Authority mark a turning point in the eurozone’s crisis?

Leverage is 20 to 1 in Spain and Italy; 25 to 1 in Germany and France; and 30 Lto 1 in the Netherlands.

It is questionable whether this is enough loss-absorbing capital.

Martin Wolf, FT October 28, 2014

America’s eight biggest banks used to have 23 times more loans and investments than loss-absorbing capital

if a twenty-third of their assets had had to be written off, they would have gone bust.

Now they are only 14 times “levered”.

The Economist print September 27th 2014

The Bankers’ New Clothes start

I cannot think of a sillier approach to the problem than that suggested by Ms Admati.

Banks would shrink their balance sheets to match, with devastating consequences for the wider economy

Jeremy Warner, Telegraph 11 August 2014

Anat argues that current capital requirements are grossly inadequate. Banks will never be entirely safe, she insists, until equity capital is expanded to 30pc of lending, roughly six times current requirements

Any adverse consequences for lending, she argued, could be avoided by forcing bankers to suspend dividends and cut pay until they had achieved the new thresholds. Come again? No, that is not how banks would deal with such capital requirements.

In practice, they would shrink their balance sheets to match, regardless of any ban on dividends and bonuses, with devastating consequences for the wider economy.

This is in essence what’s happening in Europe right now in response to the European Central Bank’s asset quality review.

Paul Volcker, the former Federal Reserve chairman who gave his name to a new rule that limits commercial banks from using deposits for risky proprietary trading, once confided that his rule would only work if it were kept simple enough to be written on half a page.

In the event, the final version runs to 71 pages, with a further 900 of interpretation.

The age of the mega investment banks, with their free ride on government-guaranteed deposits, may be over

Anat Admati

When bank apologists write self-serving balderdash, I shrug my shoulders and move on. Anat gets on a plane.

She said she was glad that policy makers finally seemed to be listening. But, she said, she was frustrated by the lack of progress and not sure about how to press ahead.

To the contrary, this has been one of the most successful campaigns to change ideas in economic policy, in a short time, that I have ever seen.

If you want to study how an academic economist can have a major influence on public policy, this is it.

The Grumpy Economist, 10 August 2014

“The Bankers’ New Clothes: What’s Wrong With Banking and What to Do About It,”

Bankers are nearly unanimous on the subject of Anat R. Admati, the Stanford finance professor and persistent industry gadfly:

Her ideas are wildly impractical, bad for the American economy and not to be taken seriously.

But after years of quixotic advocacy, Ms. Admati is reaching some very prominent ears.

Last month, President Obama invited her and five other economists to a private lunch to discuss their ideas.

Binyamin Applebaum, New York Times 9 August 2014

She left him with a copy of “The Bankers’ New Clothes: What’s Wrong With Banking and What to Do About It,” a 2013 book she co-authored.

A few weeks later, she testified for the first time before the Senate Banking Committee.

This is the most important book to have come out of the financial crisis.

The Bankers’ New Clothes: What’s Wrong with Banking and What to Do About It,

by Anat Admati and Martin Hellwig, Princeton

Review by Martin Wolf, March 17, 2013

bankersnewclothes.com/

Click here

The Bankers’ New Clothes start

The world's oldest surviving bank, Monte dei Paschi di Siena (MPS), has reported a bigger-than-expected loss.

The Italian bank, which has been in business since 1472, reported a second quarter loss of 179m euros (£142m),

three times the loss analysts had been expecting. It was the bank's ninth consecutive quarterly loss

BBC 7 August 2014

The end game may have finally arrived for Banca Monte dei Paschi di Siena SpA.

An institution that’s seen its stock fall by 99 percent since 2009, recorded 15 billion euros in losses

Has until year-end to raise 5 billion euros of capital - seven times its current market value

Bloomberg 23 November 2016

"extend and pretend."

Some banks have a special technique for dealing with business borrowers who can't repay loans coming due:

Give them more time, hoping things improve and they can repay later.

Banks call it a wise strategy. Skeptics call it "extend and pretend."

Wall Street Journal, 7 July 2010

Varifrån fick SEB 498 miljarder?

Rolf Englund blog 2014-07-14

Sverige i skuldfällan

"Låneskulden i utlandet 719 miljarder förra året, skriver Englund"

Svenska Dagbladet, Näringsliv, Ord mot Ord, 1991-05-30

De svenska bankerna har tillgångar som motsvarar fyra gånger Sveriges hela BNP.

– Schweiz, Cypern och Nederländerna ligger högre. De har haft sina problem. Och under oss har vi Storbritannien, Danmark och Spanien och de har haft sina problem

– Samtidigt vet vi att mer än hälften av bankernas finansiering sker utomlands och det betyder att man där kan ha synpunkter på vår bolånemarknad.

I slutändan är det de utländska placerarnas syn på oss som är avgörande.

Den svenska bolånemarknaden har därmed blivit systemviktig

Stefan Ingves, DN 3 januari 2014

"Enligt vår uppfattning stod det finansiella systemet i Sverige inför en kollaps den 24 september 1992."

Klick

Regeringen presenterade idag nya åtgärder kring hur den finansiella stabiliteten ska värnas

Sverige har Europas tredje största banksystem, ett system som dessutom har sämre tilltagna buffertar än i många andra länder.

Och som är väldigt beroende av att låna utomlands.

Andreas Cervenka, SvD Näringsliv, 26 augusti 2013

Liksom tidigare var Peter Norman tydlig med att Sveriges stora banksektor är ett bekymmer.

- Bara Storbritannien och Schweiz i Europa har större banksystem i förhållande till BNP.

Regeringen föreslår att bankerna ska betala en avgift för Riksbankens valutareserv, vars huvudsakliga syfte är att se till att svenska banker kan få tag i pengar i kristider eftersom de envisas med att vara beroende av utländska kapitalmarknader.

Riksbanken tog ju ifjol det mycket omdebatterade beslutet att utöka valutareserven med 100 miljarder kronor av detta skäl.

- Det är är därför rimligt att bankerna är med och finansierar detta, sade Peter Norman.

Regeringen skriver också i sin promemoria att avgifterna till den fond, Stabilitetsfonden, som ska användas för att stötta banker i kristider är för låga och att avgifterna ses över. Men det räcker inte.

Regeringen funderar också på att ytterligare skärpa kraven på bankerna.

- Det svenska banksystemet är väldigt välkapitaliserat och robust och omvärlden ser med på avund på Sveriges finansiella stabilitet, sade Norman men tillade i nästa andetag: - Vi behöver öka bufferterna i det svenska banksystemet utöver redan aviserade och beslutade åtgärder.

En paradox. Om nu de svenska bankerna är de finansiella fort som ministern (och bankerna själva) hävdar, varför behövs det ytterligare skyddsvallar?

Sverige har ju redan tidigare sagt att kapitalnivåerna i svenska banker ska vara högre än vad regelverket i övriga EU kräver.

En liten ledtråd kanske finns i en skrift som Riksbanken publicerade i somras. I rapporten behandlas så kallad bruttosoliditet, det vill säga hur mycket kapital bankerna har i förhållande till sina tillgångar utan hänsyn till olika komplicerade riskmodeller, ett ämne som bloggen bland annat avhandlat här, här och här.

Det nuvarande systemet med så kallade riskvikter har fått hård kritik eftersom det lämnat stort utrymme för bankerna att själva skruva på siffrorna.

I rapporten avslöjas att den största orsaken till att de svenska bankerna ökat sina kapitalnivåer de senaste åren är inte att det skjutits till pengar från ägarna utan att de riskvägda tillgångarna minskat. Det har skett genom att riskfylld utlåning minskat och lågriskutlåning ökat (läs bolån).

Men den största effekten kommer från att bankerna omklassificerat låneportföljerna så att de själva tillåtits bedöma risken, vilket, som av en händelse, inneburit lägre kapitalkrav.

”I det senare fallet har alltså riskvikterna minskat trots att den faktiska kreditrisken som är förknippad med lånen sannolikt inte har förändrats”, skriver Riksbanken.

Riksbanken konstaterar också att svenska banker ligger ganska dåligt till när det gäller bruttosoliditet. Den genomsnittliga siffran (kapital genom skulder) för svenska banker är 3,4 procent, jämfört med det globala snittet på 3,8 procent.

I de nya så kallade Basel III-reglerna är golvet satt vid 3 procent, vilket motsvarar att banken kan belåna varje krona i kapital 33 gånger om, något som skulle betraktas som en huvudlöst hög risk i vilken annan bransch som helst.

Full text2012 var icke finansiella företag och hushållens skulder i Sverige uppe i 576 % av BNP mot eurozonens 340 % år 2011.

http://cornucopia.cornubot.se/2013/05/den-svenska-skuldbubblan-i-relation.html

De fyra svenska storbankerna Swedbank, SEB, Handelsbanken och Nordea visar på samlade

tillgångar (utlåning) på 12 500 miljarder kronor.

Det samlade aktiekapitalet i samma banker är 565 miljarder kronor.

Det motsvarar att varje krona i kapital är belånad 22 gånger

Andreas Cervenka, SvD Näringsliv 11 februari 2013

"some malfunctions occurred and mistakes were made"

U.S. poised to impose record fine /nearly $9 billion/ on BNP Paribas

French bank expected to plead guilty to sanctions breaches

MarketWatch 30 June 2014

On Friday, Jean-Laurent Bonnafé, the BNP Paribas’s CEO, sent a humble message to the bank’s 200,000 employees:

“Let me put it clearly: We will be severely punished. Because some malfunctions occurred and mistakes were made.”

Secular stagnation

There’s something more significant going on in the industrialised global economy than the effects of a banking crisis per se

The financial intermediation industry loses its raison d’etre in such an environment

Izabella Kaminska, FT Alphaville 17 April 2014

Part of the BEYOND SCARCITY SERIES

Larry Summers was interviewed by Chrystia Freeland at the INET conference in Toronto last week, in a conversation that very usefully expanded upon his thoughts about secular stagnation.

It’s a reassuring interview for us because so many of the statements he made echo what we (and other bloggers such as Steve Randy Waldman) have been saying for some time. Namely, that there’s something more significant going on in the industrialised global economy than the effects of a banking crisis per se, and that that *something* is probably related to technological abundance.

More so, that this phenomenon is having strange macro effects on capitalist incentives.

There was also a nod to the point we’ve made for a long time, that the financial intermediation industry loses its raison d’etre in such an environment, and worse than that, potentially becomes a malignant rather than constructive force on development and growth. In short, that negative rates are hardly the solution.

Biggest US banks forced to hold $68bn in extra capital

US regulators have held out the prospect of more draconian measures after ratcheting up capital requirements for the biggest US banks

– from JPMorgan Chase to Goldman Sachs – forcing them to hold at least $68bn in additional capital.

A new “leverage ratio” will force the eight largest US banks to hold a minimum of 5 per cent equity to total assets to absorb losses in a crisis and proposes adopting a more stringent way of calculating the rule.

FT April 8, 2014

Wall Street banks and their foreign rivals have paid out $100bn in US legal settlements

since the financial crisis, according to Financial Times research

regulators and the Obama administration seek to counter perceptions that bankers have got off lightly for their role in the financial crisis.

Financial Times, 25 March 2014

One of the abiding truisms of economics is that growth doesn’t happen without credit expansion.

This is well explained in a recent paper by the Bank of England,

which points out that money in the modern economy is largely created by commercial banks making loans.

It is a common misconception to think that banks only lend what they can borrow from depositors.

Jeremy Warner, 24 March 2014

European Banking Authority (EBA) revealed what information would be published about each bank.

The region's 124 most important banks are undergoing an assessment of their risky assets

designed to determine how well they would cope with future market shocks.

CMBC 20 August 2014

It also revealed that, for the first time, what's known as a bank's "fully-loaded" common equity tier 1 capital ratio would be published.

The common equity tier 1 capital ratio measures a lender's core equity capital against its risk-weighted assets and is a key measure of a bank's ability to withstand economic shocks. This "fully-loaded" ratio is designed to provide a comparable measure across the EU, to avoid reporting discrepancies in different countries.

European Banking Authority (EBA)

Fed stress test:

Banks lose $501 bln in bad recession

29 of 30 banks above Fed’s minimum levels for capital

MarketWatch, March 20, 2014

...

Of 30 banks tested, only Zions, a Utah-based lender, failed to maintain a minimum capital ratio of 5 per cent equity to risk-weighted assets.

But BofA, Morgan Stanley, JPMorgan and Goldman all came out with less than a 7 per cent capital ratio – much weaker than anticipated.

FT 20 March 2014

Thousands of ECB auditors have begun examining the balance sheets of euro-zone banks.

Stress tests are coming soon. With the European Central Bank in charge of oversight, many hope the EU's financial industry will return to health. But there are risks.

http://www.spiegel.de/international/business/banks-in-europe-concerned-about-upcoming-ecb-run-stress-tests-a-956668.html

This week, the Federal Reserve will present the results of stress tests designed to ensure that the largest U.S. banks won't turn the next financial crisis into an economic disaster.

There's just one problem: If the tests were realistic, most of the banks would fail.

Bloomberg 19 March 2014

Bankföreningens förslag om att fler bankkunder ska amortera är sunt. Men mellan raderna framgår att det tycks handla om att slippa andra bolåneregler – som skulle kosta bankerna betydligt mer.

”Vi är inga krängare av banklån, vi är seriösa rådgivare som bryr oss om samhället och kunden.”

Det verkar vid en första anblick vara budskapet från banksektorn nu. Bankföreningen, med vd Thomas Östros

SvD 19 mars 2014

These concerns have led the Bank of Italy to conduct its own intensive examinations across the nation, such as the one at Banca Alberobello, ahead of the ECB tests. From Banca di Sicilia in the deep south to Banco di Trento e Bolzano, in the German-speaking northeast, the Bank of Italy is staging its toughest examination of the nation’s banks in history.

Financial Times, 4 March 2014

RBS shares were down by more than 9% to around 320p.

The average price paid by the government in 2008 was 500p.

BBC 27 February 2014

Janet Yellen announced February 19th that America’s central bank is moving to

cut off the massive financial lifeline that has been subsidizing the European banking system since the beginning of the global financial crisis in March of 2008.

By delaying foreign bank compliance with the stringent capital and borrowing requirements of section 165 of the Dodd–Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank) imposed on American banks,

the Fed was engaging in the moral hazard of allowing Europe to borrow at virtually zero interest from the Fed to fund its bloated social welfare states.

Chair Yellen’s actions mean the Fed is cutting off Europe and providing greater support for U.S. borrowing.

Breitbart, 24 February 2014

EU, Ryssland och IMF bailar ut Ukrainas fordringsägare?

Rolf Englund blog 2014-02-24

Quick: I say "German banks," and what's the first thing that comes to your mind?

Deutsche Bank? Big, German – must be stable and low-risk.

The fact that southern Europeans are opening accounts left and right in DB must mean that DB is lower-risk than the local wild guys.

Except that they have the largest derivatives portfolio, at $70 trillion

(but don't worry because it all nets out, sort of, and of course there is no counter-party risk!),

and they are the most highly leveraged bank in Europe (at 60:1 in the last tests – not a misprint)

John Mauldin, 16 december 2013

Are banks dead?

Mobile payments are a smarter financial investment

Jeff Reeves, MarketWatch Dec. 16, 2013

A host of technological innovations, regulations and long-term trends have reshaped the financial sector… and not all for the better.

Here’s a quick rundown of the challenges bank stocks are facing in this new environment.

At the base of the Volcker rule is a sound principle – that federally insured deposits should be not be used for speculation. If banks want cheap funding from deposits, they must accept limits on what they can do with the money.

Lex, Financial Times December 6, 2013

"This is the most important book to have come out of the financial crisis", Martin Wolf

Martin Hellwig har skrivit boken ”The Bankers' New Clothes: What's Wrong with Banking and What to Do About It”.

Han anser att en äkta bankunion är en absolut nödvändighet om eurosamarbetet ska överleva.

SvD Näringsliv 26 december 2013

Martin Hellwig radar upp exempel på hur stresstesterna borde göras.

– Gå igenom de spanska sparbankerna Cajas och värdera de underliggande säkerheterna i fastigheter. Gör samma sak med holländska banker.

Gå igenom de 100 miljarder euro som de tyska bankerna HSH Nordbank, Commerzbank, Nord LB, har lånat ut till shipping. Och så vidare och så vidare

Martin Hellwig betonar att många problem återfinns i det tyska banksystemet. Förutom de stora lånen till shipping finns det en överkapacitet i banksystemet och de tyska bankerna har för lite eget kapital. det största problemet är Landesbankerna.

– De tyska landesbankerna (regionala banker delvis ägda av tyska delstater, reds anm.) har nästan aldrig tjänat några pengar men de älskas av tyska delstatsregeringar. För en politiker är en bank fantastisk, banken kan finansiera saker utan att politikerna behöver ta ansvar.

”The Bankers' New Clothes: What's Wrong with Banking and What to Do About It”.

Amazon

Martin Hellwig ”The Bankers' New Clothes: What's Wrong with Banking and What to Do About It”

The 2008 crisis was made possible by an extremely fragile financial system

in which banks and many other businesses indulged in excessive leverage — too much borrowing — as well as hazardous reliance on short-term funding

and negligent risk management, with lax regulatory supervision by the government.

Roger E. Alcaly, The York Review of Books, 5 June 2014

This is the most important book to have come out of the financial crisis.

The Bankers’ New Clothes: What’s Wrong with Banking and What to Do About It,

by Anat Admati and Martin Hellwig, Princeton

Review by Martin Wolf, March 17, 2013

Link from FT November 29, 2013 Books of the Year

This is the most important book to have come out of the financial crisis.

It argues, convincingly, that the problem with banks is that they operate with vastly insufficient levels of equity capital, relative to their assets.

Targeting return on equity, without consideration of risk, allows bankers to pay themselves egregiously, while making their institutions and the economy hugely unstable.

It is two years since Mario Draghi launched his first big policy initiative as ECB president,

with the longer-term refinancing operation gratefully taken up by about 1,000 banks across the eurozone

The €1tn flood of cheap money extended under the scheme has served three vital purposes.

Patrick Jenkins, FT, November 27, 2013

Strong Governments, Weak Banks

Banks in the northern eurozone have capital ratios that are, on average, less than half of the capital ratios of banks in the eurozone’s periphery.

Paradoxically, financially strong governments breed fragile banks.

Paul De Grauwe, Yuemei Ji, CEPS Policy Briefs, 25 November 2013

13 miljarder dollar - 86 miljarder kronor

US bank JP Morgan Chase has agreed to a record $13bn settlement with US authorities

for misleading investors during the housing crisis.

BBC, 20 November 2013

It is the largest settlement ever between the US government and a corporation.

The bank acknowledged it made "serious misrepresentations to the public", but said it did not violate US laws.

Prospect of a deal on Volcker rule worries banks

FT, November 11, 2013

I bankvärlden är förändringen före och efter Lehman Brothers krasch dramatisk.

Då: En sektor beroende av pengar varje dag för att överleva.

I dag: Betydligt starkare banker, väl förberedda på nästa skandal och med målet att faller en ska resten stå starka.

Carolina Neurath, SvD Näringsliv, 13 september 2013

Rodney Alfvén, ir-chef på Nordea, betonar att bankerna, vid finanskrisens upprinnelse, hade betydligt lägre likviditet än i dag.

–Om du inte fick din dagliga dos av likviditet var du borta från marknaden. Nu har bankerna byggt upp betydligt större likviditetsbuffertar, säger han.

Nordea, som exempel, gick från 23 miljarder då till 66 miljarder i likviditet i dag.

–Så vi har nästan trefaldigat likviditetsbufferten, det är helt enkelt för att om det fryser till på marknaden igen så finns

tillräckligt med likviditet som gör att en bank överlever i minst 30 dagar i stressade situationer.

Det är så länge en bank ska ha likviditet för, förut var det i princip bara några dagar, säger han.

Anniversary of that Lehman collapse, is the system any safer or saner?

The good news is that the chance of another full-blown banking crisis has receded

The bad news is that the system is just as insane – perhaps more so.

Gillian Tett, Financial Times, September 12, 2013

Five years ago, the markets plunged into an Alice-in-Wonderland world. For when Lehman Brothers collapsed, the repercussions were so violent investors were faced with confronting “six impossible things before breakfast” each day, to paraphrase Lewis Carroll.

There are at least six peculiar features that might make Alice blink

The big banks are bigger – not smaller. The shadow banking world is taking over more activity, not less. The system depends more than ever on investor faith in central banks. The rich have become richer. Financiers have been prosecuted – but not for the credit bubble. Fannie and Freddie are alive and well.

Eurozone banks need to shed €3.2tn in assets to meet Basel III

Europe’s biggest banks will have to cut €661bn of assets and generate €47bn of fresh capital

Deutsche Bank, Crédit Agricole and Barclays the banks most in need

Financial Times, August 11, 2013

Commerzbank - The second-biggest bank in Europe’s strongest economy

Buying Dresdner Bank in the summer of 2008

The Economist, July 27th 2013

Brussels is demanding that Monte dei Paschi di Siena, the world's oldest bank, be subjected to tougher penalties

before it approves the €3.9bn state bailout of Italy’s third-biggest bank by assets.

Financial Times, July 28, 2013

Treasury secretary, Jacob J. Lew, effectively issued an ultimatum to Wall Street,

calling for the swift adoption of rules introduced through the Dodd-Frank financial overhaul law, which Congress passed in 2010.

New York Times, July 18, 2013

European Union reaches deal on failed banks

Another piece of a eurozone banking union that could eventually share the costs of future bank bailouts.

European taxpayers have extended about €1,600bn of support to banks since 2008.

Financial Times, June 27, 2013

Germany’s largest banks were €14bn short of the capital needed to meet incoming Basel III banking rules

The banks, which include the two largest by assets – Deutsche Bank and Commerzbank – managed to cut

their collective capital shortfall from €32bn in the second half of 2012,

as lenders responded to pressure from investors to improve their balance sheets ahead of the introduction of the Basel III rule book by 2019.

Financial Times 28 May 2013

Seven Dumb Things Bankers Say

Many of the arguments used to justify the size of the largest U.S. financial institutions simply don’t stand up to scrutiny.

It's important that folks in Washington keep this in mind as the political debate over

what to do about too-big-to-fail banks heats up.

Mark Whitehouse, Bloomberg, Apr 5, 2013

Critics of the big banks -- including the editors of Bloomberg View -- argue that the main advantage of being a JPMorgan-size giant is the ability to extract a subsidy from taxpayers. The larger and more systemically threatening banks are, the more confident they and their creditors can be that the government will bail them out in an emergency. This too-big-to-fail status allows such banks to borrow at lower rates than they otherwise would -- a perverse incentive that undermines market discipline, artificially bloats the financial sector and promotes the kind of credit binges that end in crises.

Michel Barnier, EU:s kommissionär för den inre marknaden, väntas inom kort lägga fram ett förslag om bankuppdelning baserat på idéer från Erkki Liikanen

Bankerna bör delas upp i två delar, där den traditionella bankverksamheten separeras från tradingen

Banker med garanterade insättningar förbjudas att ägna sig åt handel med allt för hög risk

SEB är den bank som skulle drabbas hårdast.

Finansmarknadminister Peter Norman gör allt vad han kan för att stoppa EU-processen.

Dagens Industri, 5 april 2013

What does a guarantee mean?

The argument for deposit insurance is that banks are inherently unstable, by virtue of their economic function;

they borrow money in the form of deposits (which can be instantly withdrawn) and lend to businesses on a longer-term basis.

The Economist, Buttonwood, March 19th 2013

Banks have a powerful incentive to get big and unwieldy.

The larger they are, the more disastrous their failure would be and

the more certain they can be of a government bailout in an emergency.

The result is an implicit subsidy

Why Should Taxpayers Give Big Banks 83 Billion USD a Year?

Bloomberg, Editors, 21 February 2013

The banks that are potentially the most dangerous can borrow at lower rates, because creditors perceive them as too big to fail.

Lately, economists have tried to pin down exactly how much the subsidy lowers big banks’ borrowing costs. In one relatively thorough effort, two researchers -- Kenichi Ueda of the International Monetary Fund and Beatrice Weder di Mauro of the University of Mainz -- put the number at about 0.8 percentage point. The discount applies to all their liabilities, including bonds and customer deposits.

Small as it might sound, 0.8 percentage point makes a big difference.

Multiplied by the total liabilities of the 10 largest U.S. banks by assets,

it amounts to a taxpayer subsidy of $83 billion a year.

Värdet av de så kallade implicita statsgarantierna för bankerna

Swedbanks Sverigechef Catrin Fransson:

”Det är inte skattebetalarna som bär risken, utan aktieägarna”

Vi behöver dock inte raljera utan kan istället konsultera en rapport från Riksbanken

Andreas Cervenka, SvD Näringsliv 14 februari

En rapport som även kollegan Carolina Neurath skrivit om nyligen.

/Därför slutade Borg skälla på bankerna/

Titeln är: ”Lämplig kapitalnivå i svenska storbanker – en samhällsekonomisk analys” och publicerades i debember 2011.

I rapporten konstateras att svenska bankers kapitalnivå i förhållande till de totala tillgångarna sjunkit stadigt, från cirka 17 procent på 20-talet till bara 4 procent för storbankerna idag.

Värdet av de så kallade implicita statsgarantierna för bankerna,

det vill säga den tysta överenskommelsen om att staten alltid finns där i bakgrunden med en hjälpande hand.

Garantin har inneburit att bankerna lånat i genomsnitt 0,86 procentenheter billigare. Det motsvarar 30 miljarder om året,

eller 270 miljarder under perioden 2002-2010.

Det utgör i sin tur drygt hälften (!) av storbankernas samlade vinster före skatt under samma tid, enligt Riksbanken.

Enligt vårpropositionen är riskerna i det svenska banksystemet i vissa avseenden större än i andra länder.

Regeringen ser att förnyad oro skulle kunna spridas till Sverige och påverka den finansiella stabiliteten.

De fyra största bankkoncernerna är nära sammanlänkade och deras gemensamma tillgångar är fyra gånger större än Sveriges BNP.

Dessutom är de svenska bankerna sammanlänkade med den internationella marknaden och svenska hushåll har en hög skuldsättning.

SvD Näringsliv, 15 april 2013

Sedan mitten av 1990-talet har hushållens skulder som andel av årlig disponibel inkomst, den så kallade skuldkvoten, ökat från 100 procent till 170 procent.

OECD, Internationella Valutafonden och senast Europeiska kommissionen har alla påpekat riskerna med den höga belåningsgraden.

"minst nio år med lågt resursutnyttjande"

Osäkerheten om den framtida konjunkturutvecklingen är stor och riskerna för en sämre utveckling överväger.

I euroområdet råder fortsatt stor osäkerhet om hur den statsfinansiella krisen kommer att utvecklas.

Politisk oro i flera euroländer kan leda till att turbulensen på de finansiella marknaderna återkommer.

Anders Borg, DN Debatt 15 april 2013

De fyra svenska storbankerna Swedbank, SEB, Handelsbanken och Nordea visar på samlade

tillgångar (utlåning) på 12 500 miljarder kronor.

Det samlade aktiekapitalet i samma banker är 565 miljarder kronor.

Det motsvarar att varje krona i kapital är belånad 22 gånger

Andreas Cervenka, SvD Näringsliv 11 februari 2013

De totala skulderna är därmed 11 935 miljarder kronor.

Som jämförelse kan nämnas att Sveriges BNP 2011 var cirka 3 500 miljarder.

Inom EU är bankernas totala tillgångar 47 000 miljarder euro, vilket motsvarar 366 procent av BNP.

(Det motsvarar över 400 000 miljarder kronor, svårt att förstå men sant).

Krockkudden för denna utlåning, eller kapitalandelen, är i genomsnitt strax under 5 procent, enligt Bank of International Settlements.

På 1800-talet var det inte ovanligt att bankerna hade så mycket som 50 procent i eget kapital. På den tiden bar nämligen ägarna fullt ansvar för alla förluster,

konstaterar Andrew Haldane, ansvarig för avdelningen för finansiell stabilitet på Bank of England i den här rapporten.

Finansministern har rätt, som när han i gårdagens DN-intervju pekade på

de svenska bankernas finansiering i utländsk valuta.

”Den är hög, den avviker från andra länders och den utgör ett väldigt tydligt riskmoment”, sade Anders Borg.

DN-ledare 28 december 2012

Faktum är att den så kallade krispolitiken från dag ett har handlat om en enda sak: att skydda och rädda bankerna.

Den turbulenta hösten 2008 bestämdes det att världens regeringar skulle skriva ut en blank check till alla stora banker och deras långivare.

Andreas Cervenka, SvD Näringsliv 23 december 2012

Om du lånar en miljon är det ditt problem. Lånar du en miljard kan det snabbt bli bankens huvudvärk.

Hundra eller tusen miljarder? Det får någon annan ta hand om, läs så kallat vanligt folk. Ganska få företagsägare kan tjäna enorma pengar på att trycka gaspedalen i botten och samtidigt surra fast ett lager av kvinnor, barn och pensionärer vid motorhuven som en skyddande krockkudde om det skulle inträffa tråkigheter längs vägen.

Detta är ingen slump. Tidningen Fokus beskrev nyligen i ett reportage hur den internationella banklobbyn lyckades övertyga europeiska politiker om nödvändigheten av att ”rädda” skuldtyngda länder som Grekland genom att i praktiken hålla banker och finansbolag skadelösa.

En manöver som ekonomiprofessorn Mats Persson kallar en av de största förmögenhetsöverföringarna någonsin från skattebetalare till bankägare.

It comes to something when one of the world’s major banks admits to fraud, but that’s what UBS did On Wednesday in agreeing to pay USD 1.5 bn (SEK 9.825 miljarder) in fines for rigging inter-bank interest rates.

Not that it seems to be creating much of a stir outside the financial pages.

It is as if we’ve been so anaesthetised by the events of the past five years that fines like this have lost their capacity to shock.

Jeremy Warner, Telegraph 19 Dec 2012

For the 12 or so banks involved in Libor manipulation, regulatory sanction is actually the least of their worries. No, it’s in the potential for compensation that the real threat to the banking system lies.

At any one time, the value of products based on Libor runs to hundreds of trillions of dollars. Potential losses from mis-stating Libor could therefore run to hundreds of billions of dollars.

Utdelningsfest för bankerna

Som så ofta i Anders Borgs retorik började meningen "Låt mig vara tydlig".

Sedan kom ännu en frustande kritiksalva mot banksektorn – som handlade om att de ska hålla i pengarna i stället för att dela ut till aktieägarna.

Om bankerna tänker lyssna på det? Nope.

Carolina Neurath, SvD Näringsliv 31 december 2012

De fyra storbankerna Swedbank, SEB, Nordea och Handelsbanken väntas tillsammans dela ut närmare 29 miljarder kronor på vårens årsstämmor.

Strax innan jul beslutade Riksbanken att förstärka den svenska valutareserven med 100 miljarder kronor.

Anledningen sades vara att Riksbanken i en krissituation ska kunna rädda svenska banker med utländsk valuta

Den avgående Riksgäldsdirektören Bo Lundgren: Ett demokratiskt problem. Det är rimligt att Sveriges Riksdag uttalar sig om hur stor valutareserven ska vara.

SvD Näringsliv 23 januari 2013

– Hur jag än rådbråkar min hjärna har jag svårt att se ett scenario där vi inte kan låna i dollar, det är en överdriven rädsla, säger Bo Lundgren.

Amorteringskrav

Anders Borg anser inte att amorteringskrav är aktuellt

se vad vi kan göra för att bankerna ska bli mindre beroende av växelkursberoende finansiering

SvD Näringsliv, 17 januari 2013

- Vi ska följa den plan vi har lagt fast - stärka kraven på bankernas kapitaltäckning, öka riskvikterna och sedan se vad vi kan göra för att bankerna ska bli mindre beroende av växelkursberoende finansiering, säger Anders Borg.

- Sedan får vi se hur hushållen reagerar. Vi vill inte åstadkomma en kraftig sättning på bostadsmarknaden.

Finansministern har rätt, som när han i gårdagens DN-intervju pekade på

de svenska bankernas finansiering i utländsk valuta.

”Den är hög, den avviker från andra länders och den utgör ett väldigt tydligt riskmoment”, sade Anders Borg.

DN-ledare 28 december 2012

Bankerna har sedan slutet av 1990-talet gjort sig mycket mer beroende av lån i utländska pengar, främst dollar.

Enligt Riksbanken handlar det om en ökning från motsvarande 200 miljarder kronor år 1998 till 1 500 miljarder år 2011.

Funding - Bankernas Upplåning, som skall rullas runt

– Poängen med en avgift eller kassakrav är att /bankerna/ ska gå ur en del av

sitt väldiga beroende av valuta- och swapmarknader och kanske mer gå över till en traditionell insättningsfinansiering

som ju är mer stabil och mindre riskfylld, säger Anders Borg.

DN/TT 14 december 2012

Finansminister Anders Borg (M) anser att bankerna ska vara med och betala för en ökad valutareserv, genom avgifter eller ökade kassakrav.

Det kan också vara ett sätt att få dem att öka den inhemska finansieringen, enligt Borg.

– Eftersom bankerna skapar en risk för den finansiella stabiliteten är det bra och klokt om de får ta ett ekonomiskt ansvar för det, sade Borg till journalister efter en debatt i riksdagen.

– Jag tror att vi långsiktigt behöver gå mot en större valutareserv. Vi har ett så pass stort banksystem och systemet har en så pass tung finansiering via valutamarknaderna att det är en risk för den finansiella stabiliteten.

Riksbanken lyfte nyligen på nytt bankernas stora beroende av utländsk finansiering som en risk för den finansiella stabiliteten.

Affärsbankernas lånestock i utländsk valuta är nästan lika stor som den är i svenska kronor.

Lånen i utländsk valuta hos affärs- och sparbankerna är tillsammans nästan 300 miljarder.

Det är mer än dubbelt så mycket som sparbankernas utlåning i svenska kronor.

Jag föreställer mig att de som har lånat upp dessa 300 miljarder inte avser att ha dessa lån när nästa devalvering kommer.

Rolf Englund på Nationalekonomiska Föreningen, januari 1990

Tittar man noga i bankernas balansräkningar kan man se att det är skillnad på å ena sidan ”inlåning” - insättarnas pengar – och å andra sidan ”upplåning” - pengar man lånat på marknaden bankerna emellan.

Banker kan komma i betalningssvårigheter om insättarna kommer och ställer sig i kö för att ta ut sina pengar – vilket är ovanligt och väl i Sverige senast drabbade HSB.

Banker kan också komma i betalningssvårigheter om de får bekymmer med sin ”upplåning”, dvs om andra banker, på goda eller dåliga grunder tror att banken har för mycket dåliga lån, inte vill rulla runt sina krediter.

Det var detta som gjorde den svenska finanskrisen i början på 90-talet akut.

Utländska banker misstrodde de svenska storbankerna med Handelsbanken och S-E-banken i spetsen. Mest misstrodde de Nordbanken och Götabanken.