The markets believe in Goldilocks

But the bears are out there

Buttonwood, The Economist print 7 December 2017

Mr Edwards’ “Ice Age” thesis

first honed in the late 1990s that markets in the West were about to follow the example set by Japan

suffering violent deflation, bond yields heading to zero and a collapse in equity values

after the Japanese bubble burst at the end of the 1980s.

FT 9 June 2018

Full text

Japan

"How Wrong I Was": Albert Edwards Says "My Reputation For Calling Stocks Is In Tatters"

zerohedge 25 April 2018

Indeed, because as Bank of America observed recently, every time the stock market threatened to tumble, central banks would step in: that, if anything, is what Edwards failed to anticipate. The rest is merely noise

To be sure, Edwards will eventually get the last laugh as the constant, artificial interventions assure that the (final) crash will be unlike anything ever experienced: "a recession delayed is ultimately a recession deepened as more and more credit excesses have built up, Minsky-like, in the system."

Then again, will it be worth having a final laugh if the S&P is hovering near zero, the fiat system has been crushed, modern economics discredited, and life as we know it overturned? We'll cross that bridge when we come to it, for now however, Edwards has to bear the cross of his own forecasting indignities

Full text

Top of page

Perhaps the most unhelpful of the psychological flaws we are prone to as investors is confirmation bias.

Our desire to seek out information that reinforces our existing beliefs and to reject anything that undermines our prejudices is powerful and dangerous.

Tom Stevenson Telegraph 10 November 2017

Société Générale strategist, and well known permabear, Albert Edwards warns

that the past few sessions of falling prices seen in high-yield bonds and stocks of highly indebted companies

could suggest excessive leverage might be “the key area of vulnerability that could bring down the inflated pyramid scheme that the central banks have created.”

MarketWatch 16 November 2017

Edwards says U.S. corporation’s net debt-to-earnings ratios, one common way to assess corporate leverage, has more than doubled since the 2007-’09 financial crisis, but junk-bond credit spreads, the premium investors demand for owning riskier debt versus safer Treasurys, has narrowed

Full text

Albert Edwards, US profits are actually declining.

John Authers, FT 9 June 2017

Albert’s key point is to base on the official government NIPA (National Income and Profit Accounts), which show total profits within the economy. They are released as part of regular GDP data, and we have just had a new edition.

NIPA profits are broader than straight corporate profits, and less vulnerable to management by CFOs.

When companies no longer have confidence in strong profits, they tend to cut back on their investment and that harms economic growth.

Once we look at the differing performance of domestically generated profits and international profits, it begins to look as though S&P companies’ earnings owe almost everything to growth overseas

Full text

"Investors Should Be Petrified" Of The Coming Ice Age:

Here Are Albert Edwards' Scariest Charts

zerohedge 7 June 2017

The big Ice Age call was that the tight positive correlation between equity yields and bond yields that market participants had enjoyed since 1982, driven by ever-lower inflation, would break down

Full text

If you’re buying stocks today, says noted permabear Albert Edwards,

you need a psychiatric evaluation.

Sue Chang, MarketWatch Sept 19, 2016

Japan is the catalyst that could bring the record-setting bull market for stocks across the globe to a screeching halt,

according to Société Générale’s uberbear Albert Edwards, Market Watch 10 January 2018

Full text

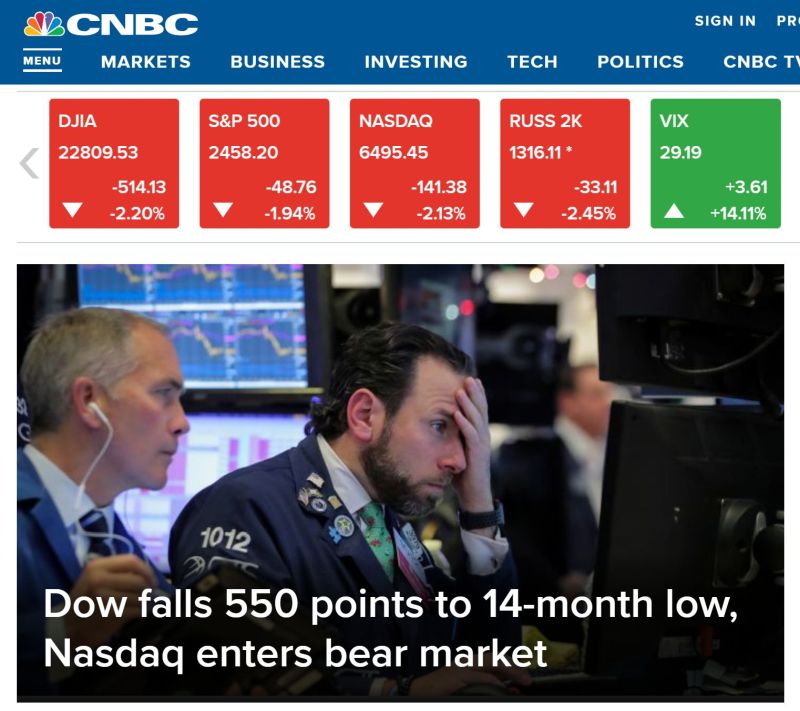

news

US stocks suffer worst week in a decade

BBC 21 December 2018

U.S. Trade Gap Widens to $55.5 billion a 10-Year High

Overall exports came in at $211 billion

Imports $266.5 billion

Bloomberg 6 december 2018

Long term, this is good for the health of the market: El-Erian

Top of page

Each of the five 'FAANG' stocks slipped into a bear market

CNBC 18 November 2018

davidstockmanscontracorner.com/peak-trump-bubble-bursting-why-the-donald-wont-make-maga-nor-drain-the-swamp-part-1/

Turn off the liquidity taps and the ability to believe the impossible evaporates

Merryn Somerset Webb FT 26 October 2018

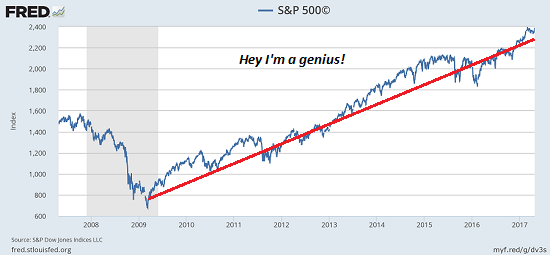

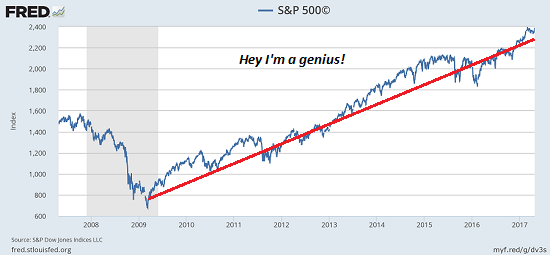

When money is constantly cheap and available everything seems straightforward.

Markets go up whatever happens, leaving investors free to tell any story they like about why.

It is easy to believe that tech companies with profits in the low millions are worth many billions.

Or, as one fund manager told me last month, that traditional equity valuation methods are no longer the point

Full text

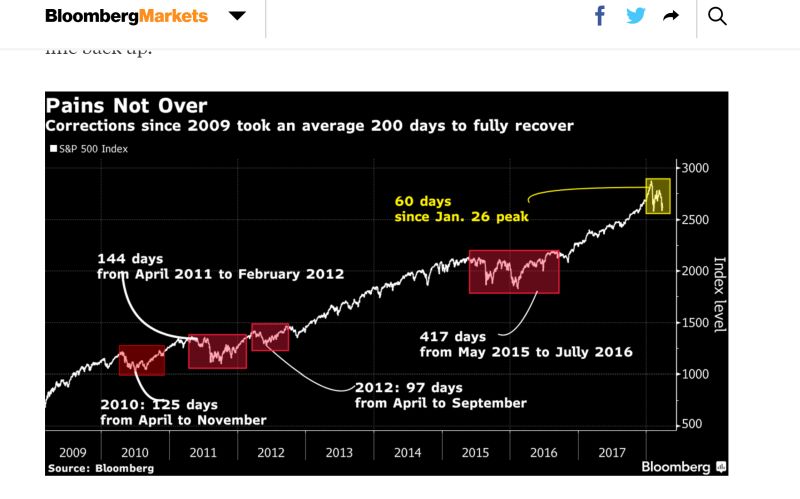

Apparently, investors believe that this boom is going to last, or at least that other investors think it should last

A bear market could come without warning or apparent reason, or with the next recession

Robert J. Schiller Project Syndicate 24 september 2018

It is important to bear in mind that earnings are highly volatile.

Full text

Robert J. Schiller

Top of page

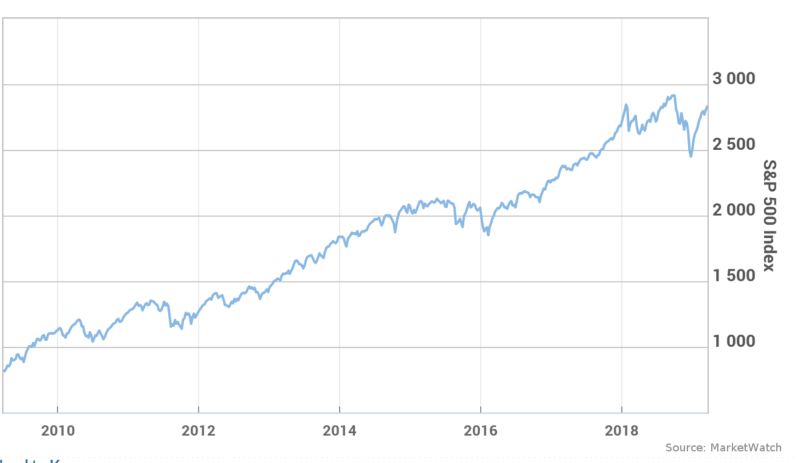

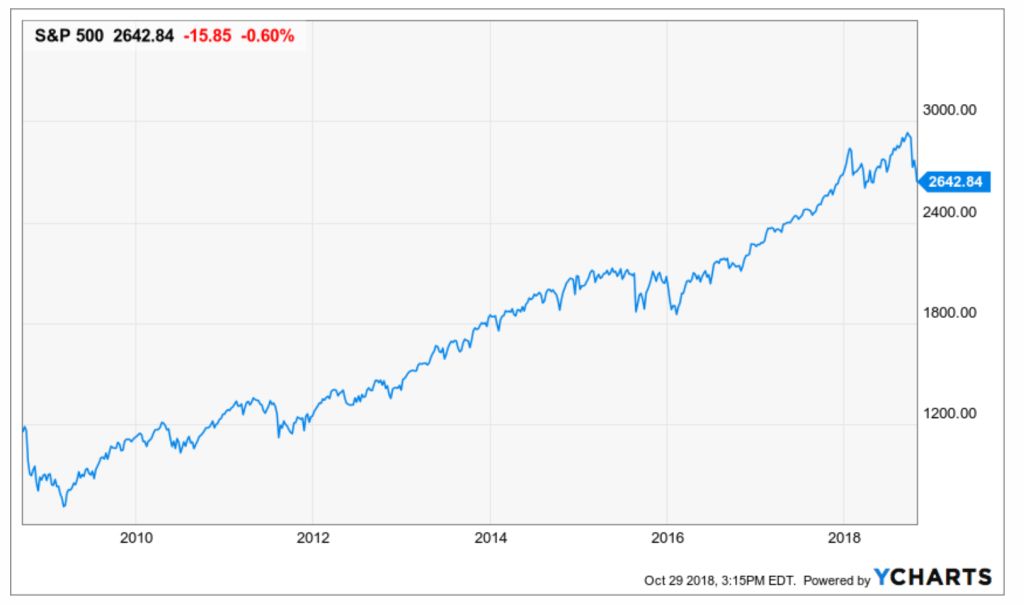

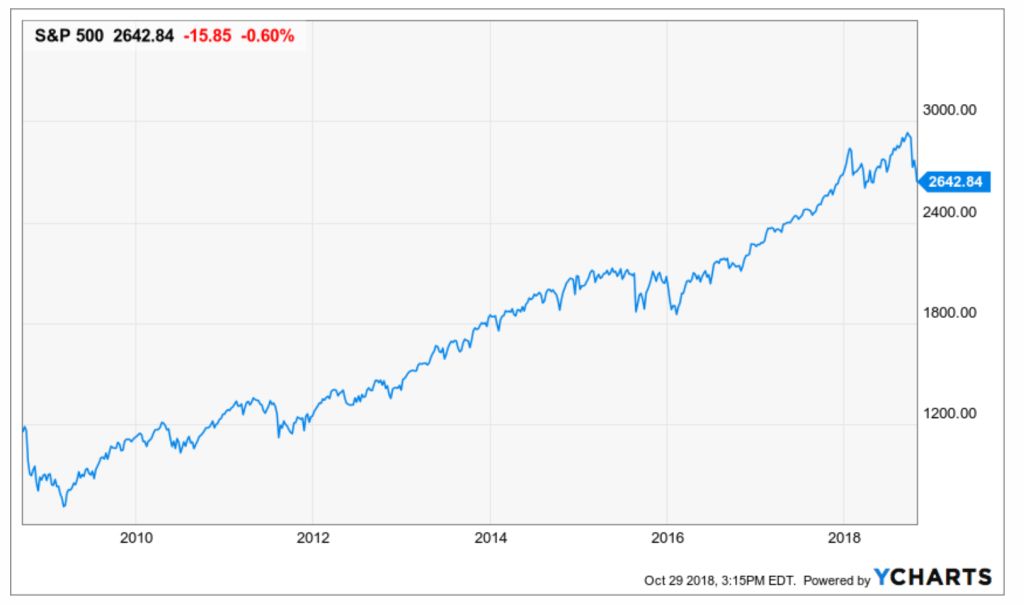

Investors who bought the day before Lehman failed are up 130%

CNBC 10 September 2018

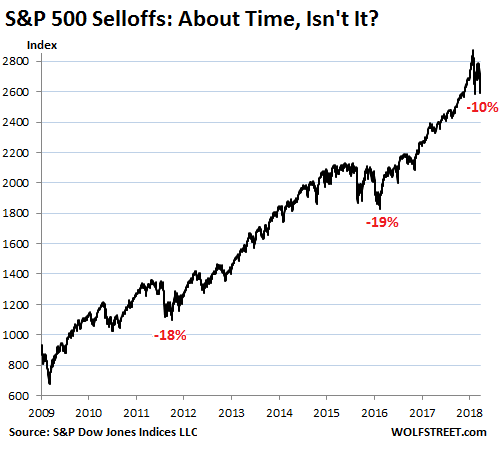

By Sept. 12, 2008 — the Friday before the effort to rescue Lehman came up short in a big way and unleashed a new level of panic and pain — the S&P 500 had been falling for nearly a year.

It had dropped 22 percent from its October 2007 peak by mid-July.

Full text

Ingen börskrasch inom två år

Finansveteranen och företagsledaren Carl Bennet tror inte att nästa finanskris står för dörren.

Men han säger att man ska vara försiktig.

SvD 24 augusti 2018

Full text

Hussman sees Nasdaq sinking 57%, Dow tumbling 69%

Hussman’s claim to fame includes forecasting the market collapses of 2000 and 2007-2008.

Sue Chang MarketWatch July 31, 2018

Since then, however, he’s also become known as a permabear for his repeated calls for sharp stock market declines

and his oft-repeated mantra of “overbought, overvalued, overbullish” as the bull market continues into its ninth year.

Full text

Top of page

John Hussman On FAANGs

Investors should, but rarely do, anticipate the enormous growth deceleration that occurs once tiny companies in emerging industries become behemoths in mature industries.

You can’t just look backward and extrapolate. In the coming years, investors should expect the revenue growth of

the FAANG group to deteriorate toward a nominal growth rate of less than 10%, and gradually toward 4%.

John Hussman via zerohedge 27 July 2018

Full text

See Also

The popularity of ETFs has soared in the past decade.

The proportion of U.S. equity-fund assets that are passively managed has nearly doubled in that time to nearly 40 percent.

Satyajit Das Bloomberg 27 June 2018

Full text

Party Like It’s 19,990

So. Is the smart money with ETFs?

the most successful investment innovation of our time.

John Authers FT 21 December 2016

Top of page

France’s market watchdog is bracing for a surge in global bond yields and a Wall Street crash

as soon as this year, fearing that contagion will spread to Europe and snuff out the fragile recovery.

Ambrose Evans-Pritchard Telegraph 5 July 2018

“The world has never been so indebted – even more than before the 2007 crisis – and this debt has never been so risky,” said the Autorité des Marchés Financiers (AMF) in its annual report.

Full text

World debt ratios have spiralled to record levels during the era of super-easy money and

markets are showing tell-tale signs of late-cycle excess,

leaving the international financial system acutely vulnerable to a jump in borrowing costs.

Ambrose Evans-Pritchard, Telegraph 24 June 2018

Top of page

Former U.S. Treasury Secretary Lawrence Summers:

“The consequences of another economic downturn dwarf and massively exceed

any adverse consequences associated with inflation pushing a bit above 2 percent,”

Summers said at a European Central Bank conference in Sintra, Portugal.

Bloomberg 18 June 2018

TIPS in a Rising Interest Rate Environment

Click

Ready to weather the storm?

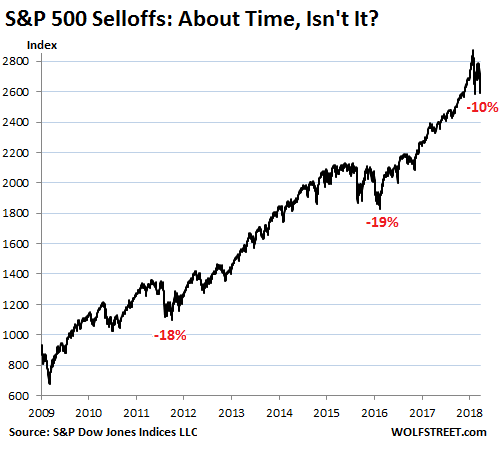

The end of the bull market is upon us. Or maybe it’s really close.

Getting closer? Nobody really has a clue on the timing, of course.

MarketWatch 12 June 2018

The only thing we do know for sure is that the fun has to end eventually.

If you want to make a lot of money in the downturn, you’ll have to ramp up risk. One of the easiest ways to achieve this is to buy ETFs that profit from market decline

No sign of the bull dying just yet.

Full text with nice pic

Top of page

The high-yield bond market. That’s the polite name for “junk” bonds

issued by companies that can’t earn an investment-grade rating even from our famously lenient bond rating agencies.

John Mauldin 25 May 2018

Goldman conclude that, when it comes to market risk factors, "liquidity is the new leverage"

in a world in which HFTs are the marginal price setters

Zerohedge 22 May 2018

Today’s high-yield bond market - I think the crisis will begin there

The problem will be massive illiquidity.

John Mauldin 11 May 2018

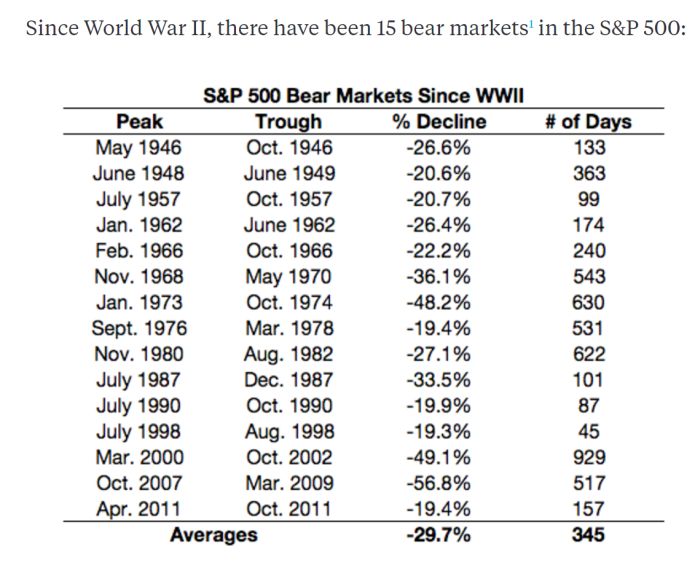

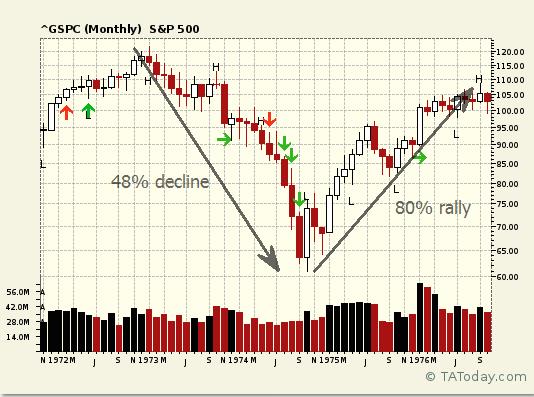

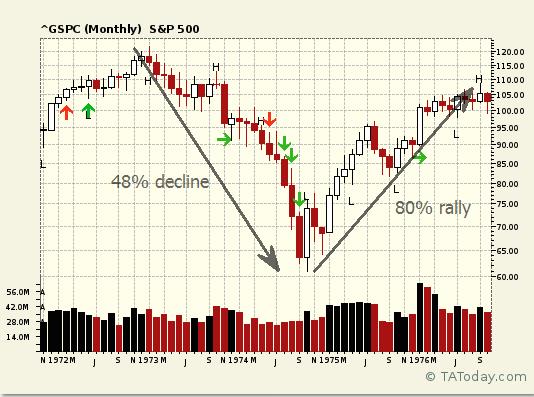

We must heed warnings from the 1970s bear market

The first quarter of 1975 saw the end of the most savage bear market for stocks since the 1930s.

John Plender FT 25 April 2018

Why everybody should stop blaming Trump and his tariffs for the market retreat

MarketWatch 26 March 2018

Full text

Bloomberg 28 March 2018

There ain’t no recession.

Larry Kudlow, National Review, 5 December 2007

Yes, 2007

Markets are back in fairyland again.

For many investors, the regret of missing out on what may well be a once-in-a-generation bull market

overshadows any anxiety about the next crash. Animal spirits are all too evident.

Amin Rajan FT 16 March 2018

Top of page

When the huge telecom adjustment drops out of the CPI less food and energy base next month

the Y/Y figure will also sharply accelerate.

David Stockman 9 March 2018

Full text

Neither central bankers nor Wall Street ever see these new style recessions coming because, in fact,

they can't be detected from even an astute reading of the macro-economic tea-leaves.

David Stockman 9 March 2018

What Robert Shiller, a Nobel economics laureate at Yale University, calls “narrative economics”

The key insight, he says, is to move on from the economic assumption that people think rationally

John Authers FT 12 March 2018

Why Is No One Listening to Jeremy Grantham?

In normal times it’s reasonable to believe clients are concerned about how well a manager can handle a downturn.

“But in a bubble, forget it,” he says.

“Clients care much, much more about underperforming all their friends on the golf course.”

Institutional Investor 28 Fabruary 2018

To the mind of Grantham, who called the major bubbles of 2000 and 2007, this story was more evidence of a “melt-up” in the stock market, which he had warned about just weeks before.

This is when the market shoots up after several years of rising prices, signaling the final stages of a great bubble near to bursting, according to the 79-year-old.

Full text

Top of page

When valuations are high, the maths points to lower returns

Buttonwood, The Economist Feb 21st 2018

Even if US pension funds put their entire portfolios in equities—a highly risky strategy—they are not going to make the 7-8% they assume.

This doesn’t require one to forecast a 2008-style crash, as one city finance director said to me. It is just maths.

Full text

Top of page

Increase in US inflation sparks bond market sell-off

Treasury yields hit 4-year highs as Wall St fears sharper rate increases

FT 15 February 2018

The US offers the best real return, at 4.3 per cent, narrowly beating Sweden,

which had a slightly better nominal return, but also saw higher inflation.

FT Alphaville 13 February 2018

Full text

Is the 9-Year Long Dead Cat Bounce Finally Ending?

Charles Hugh Smith, 6 February 2018

The term dead cat bounce is market lingo for a "recovery" after markets decline due to fundamental reversals.

Markets tend to bounce back after sharp declines as participants (human and digital) who have been trained to "buy the dips" once again buy the decline, and the financial media rushes to reassure everyone that nothing has actually changed, everything is still peachy-keen wonderfulness.

Full text

Financial Crisis

Top of page

What on Earth Happened to Stocks?

Bloomberg 6 February 2018

I hate to admit this, but I think I have found a good historical parallel for what is happening in the markets.

And it is with spring and summer of 2007, on the eve of the credit crisis.

John Authers, FT 6 February 2018

I dislike admitting this because I do not want to be accused of alarmism, but here are the salient points.

Jean Ergas of Tigress Financial Partners: This is the unwinding of a massive carry trade, in which people borrowed at 0 per cent and put money into stocks for a yield of 2 per cent.

Full text

Finanskrisen 2007

The Bond Market

Carry Trade

There is a time to be in stocks… and a time to be out of them.

Without knowing the future, you can still know when something is not normal.

And when something is not normal… it is just biding its time until it becomes normal again.

Bill Bonner February 2018

You will note that global debt was only $30 trillion in 1994. Now it is $230 trillion

Full text

Am I predicting the Greater Depression may be upon us?

Well, I'm not a fortune teller.

But my gut feel is: yes.

Doug Casey, July 2007

Top of page

Even though they told us, and most of us believe, that QE was responsible for the inflation of asset prices across the board,

somehow quantitative tightening (QT) is not supposed to have the opposite effect.

John Mauldin, 3 February 2018

Full text

The Market's Goldilocks Era Is Nearing an End

Our monetary indicator has recently risen above zero,

meaning there is a greater probability inflation the will rise above the Fed's target than stay below.

Lars Christensen, Bloomberg 2 February 2018

Full text

---

The markets believe in Goldilocks

But the bears are out there

Buttonwood, The Economist print 7 December 2017

Top of page

US bond market sell-off deepens

10-year Treasury yield rises to fresh four-year high at just under 2.8%

“We think that the current level of rates do not yet pose a major risk for equity multiples,” Marko Kolanovic, a senior strategist at JPMorgan, wrote in a note on Thursday.

FT 2 February 2018

Cash it's not about a return on your money; it's about return of your money.

Mitch Goldberg, CNBC 1 February 2018

Preservation of capital might not be the most exciting investment objective ... but it is a worthy one when the market is signaling that both stocks and bonds are overvalued."

Full text

Top of page

Which is the tail and which is the dog?

The dollar is falling, the oil price is rising, bond yields are rising

and stocks have just endured two uncharacteristically tough days after a prolonged period of exuberance.

John Authers, FT 30 January 2018

The economy needs higher rates, but not because of any threat of faster inflation.

The economy needs rate hikes to curb speculative excess.

Jared Dillian, Bloomberg 16 januari 2018

There's a great big pile of evidence that financial markets have reached the speculative mania phase.

The Federal Reserve’s response to all of this has been to engage in a ridiculous discussion about inflation targeting. Policy makers are still concerned about the rate of inflation being too low and are seemingly oblivious to the signs of excess speculation all around them.

There was a time when back-to-back speculative bubbles had so damaged the economy and investor psyche that the thought of allowing a third one to form would have been unconscionable -- and yet, here we are.

Full text

bloomberg/contributors/jared-dillian

Top of page

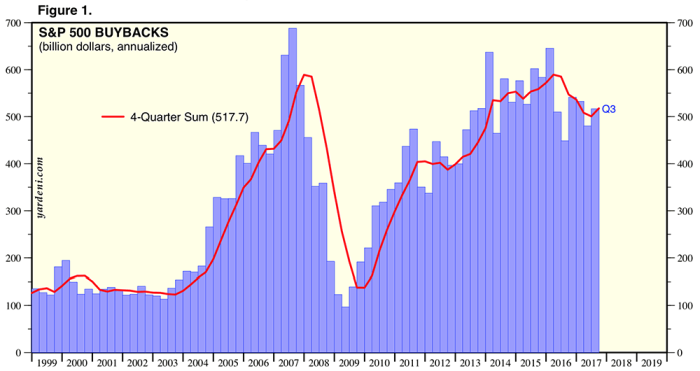

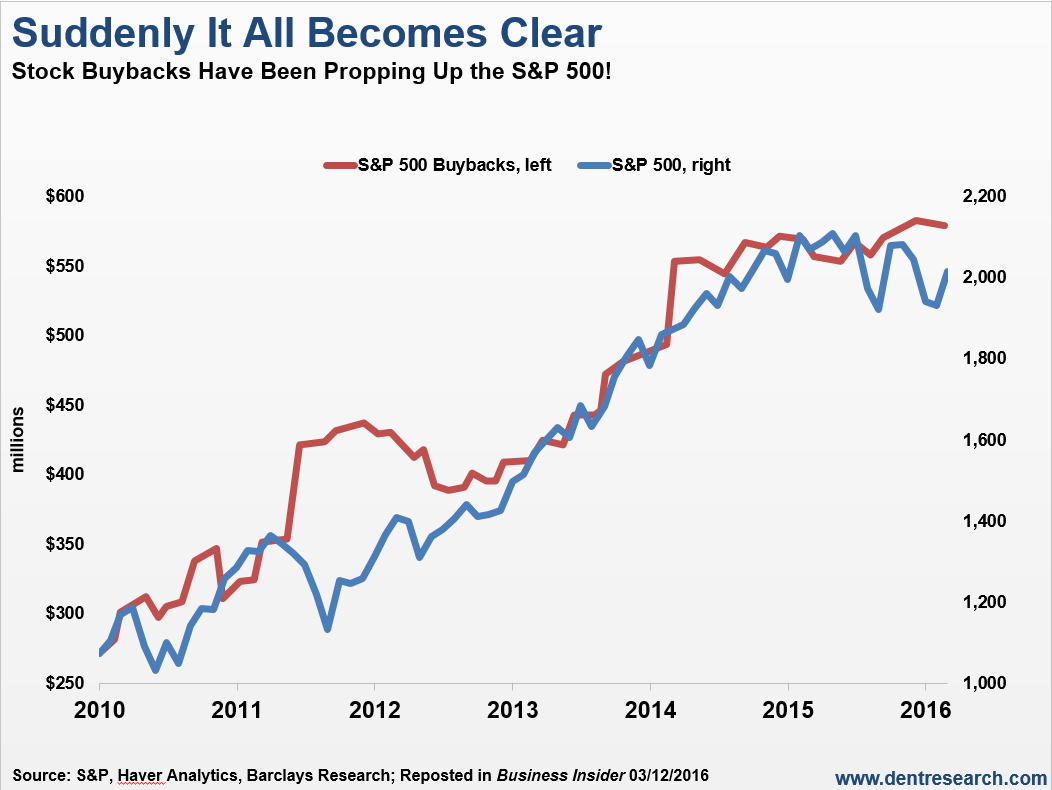

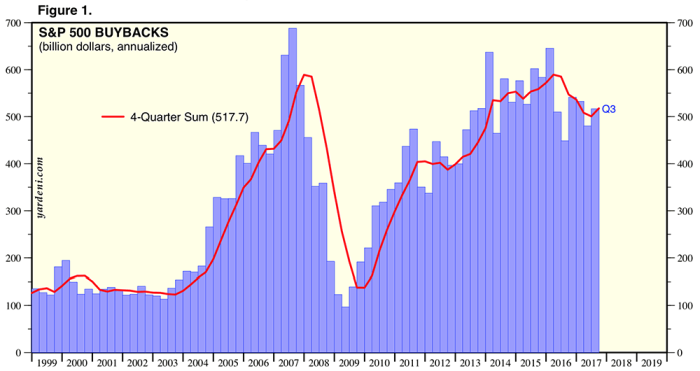

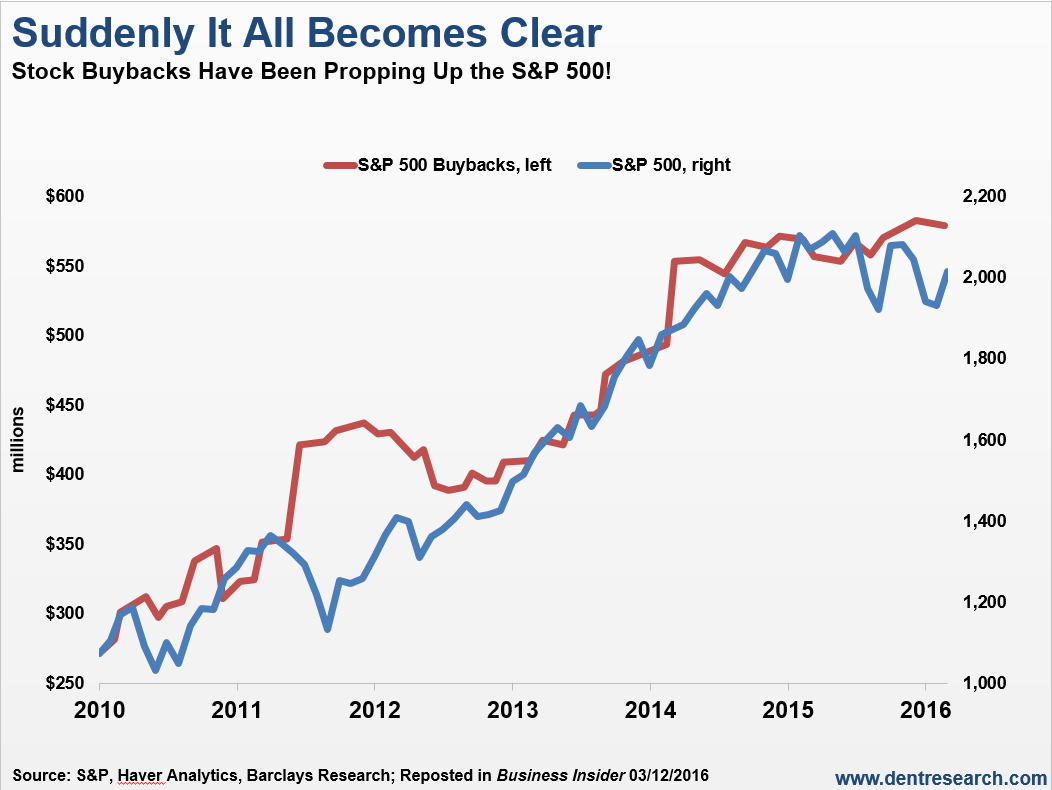

"flush with cash from the tax cut", US companies are heading for a "stock buyback binge of historic proportions".

Corporate stock buying is now cranking at a $1 trillion annual rate or

nearly double the rate of the last several years.

David Stockman 2 March 2018

Full text

About buybacks at my blogg

Lex in Depth: the case against share buybacks

S&P 500 companies have spent $1.1tn on share repurchase programmes over the past two years

FT 30 January 2018

Full text

Top of page

In 2016, total corporate debt increased by $717 billion, yet investment in plant and equipment fell by $21 billion.

Where did the money go? Buybacks and dividend payouts

John Mauldin Lacy Hunt January 2018

The majority of it has gone toward share buybacks and dividend payouts.

It has been a similar story over the past decade as buybacks have risen to near record levels.

Full text

Top of page

The global bond rout has begun, leaving equities on borrowed time

Ambrose Evans-Pritchard, 10 JANUARY 2018

The Secular Bond Bull Market Has ended, perhaps.

John Mauldin, Bill Gross, 10 January 2018

Could it really have arrived? Are global stocks about to tank in an all consuming way?

Indeed, is this the moment Albert Edwards has been waiting for since 1996?

Of course, Edwards is perhaps London’s best-known doom-monger when it comes to stocks.

FT Alphaville Monday, March 5th, 2007

Albert Edwards: "Let Me Tell You How This All Ends"

The weak dollar, Edwards warns, should be seen as merely a shuffling of deckchairs on the Titanic before the global economy sinks below the icy waves.

via Englund blog 8 May 2016

Albert Edwards at zerohedge

Last of the market bears wait in hope of a crisis

FT 10 January 2018

Full text

Top of page

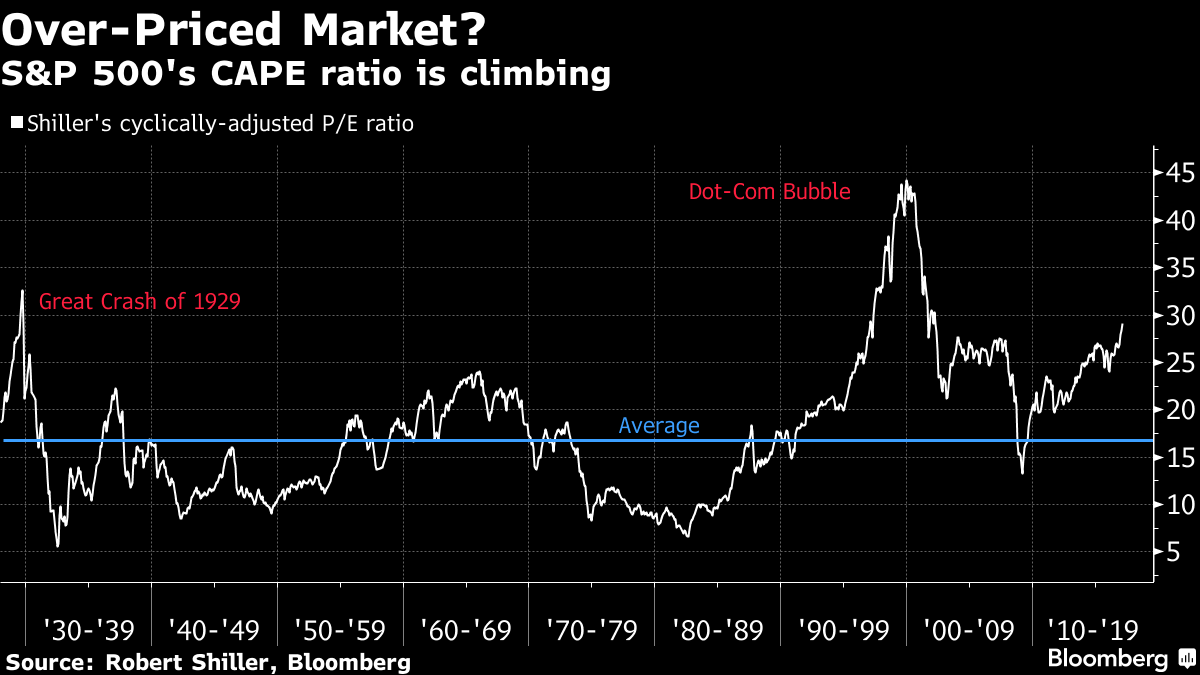

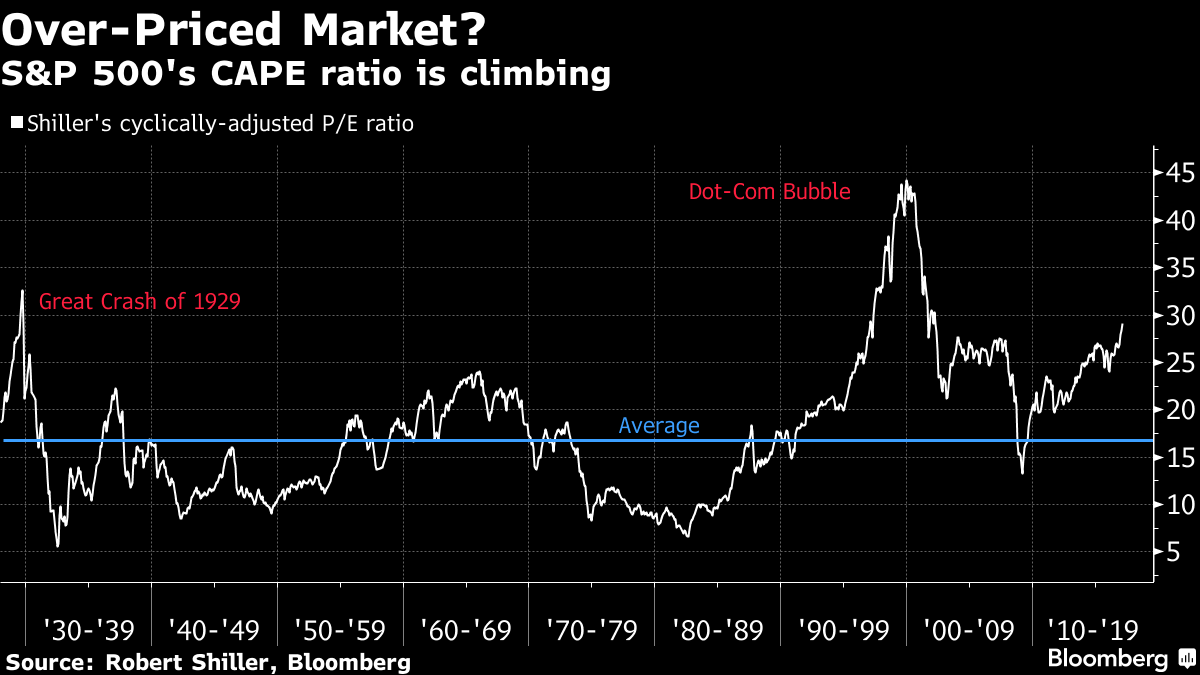

A major S&P ratio has a whiff of 1929. Is this a bubble yet?

John Plender FT 5 January 2018

The story behind this longstanding bull market relates to the pursuit by the biggest central banks of asymmetric monetary policy, where they put a safety net under markets when they plunge but fail to cap them when they rise.

Asset purchasing by the central banks has been morally hazardous because the safety net encourages greater risk-taking.

Other factors will tend to extend the bull run regardless.

The scale of momentum trading is unprecedented, with 30 per cent or more of US equities in passive indexed funds

and algorithmic trading taking an increasing share of transactions.

Buybacks are insensitive to valuation because of the acute principal-agent problem in which executives find themselves.

Full text

Top of page

How to explain the paradox of low market volatility, record highs on the world’s stock markets and reduced levels of investor anxiety despite rising political risk?

Axel Weber, former head of the Bundesbank, now chairman of UBS, FT 1 January 2018

A drastic decline in economic prospects, job insecurity, stagnating real wages, unsustainable pension systems and, above all, growing inequality have combined to create a sense of discontent and injustice.

Markets are very good at discovering, trading, pricing and insuring risks, but they are not good at mapping the unpredictable nature of politics.

Uncertainty — by definition — cannot be priced.

That’s why markets often ignore it and take a wait-and-see approach.

Today’s low financial market volatilities are deceptive and underestimate the underlying risks — or rather, uncertainties.

Investors and policymakers should enjoy the upswing while it lasts, since it will not last.

Full text

Merkel ECB Candidate

German Central Bank Head Axel Weber Resigns

Following a week of speculation about his future, German central bank President Axel Weber has resigned, effective at the end of April.

The move is a blow to Chancellor Angela Merkel, and leaves her without a candidate for the presidency of the European Central Bank.

Der Spiegel 11 February 2011

More about Axel Weber, former head of the Bundesbank, now chairman of UBS.

Top of page

The former Bank of England head urges the finance industry to rethink risk.

Clive Crook Bloomberg 31 March 2016

Mervyn King's new book "The End of Alchemy: Money, Banking, and the Future of the Global Economy"

The central idea is "radical uncertainty," meaning the kind of uncertainty that statistical analysis can't deal with. For risks you can precisely define and measure against historical data, you can calculate probabilities. That's why the risk your house will burn down, for instance, is easily insurable.

The distinction between risk and uncertainty isn't new. Economists have understood it since 1921, when Frank Knight wrote about it; John Maynard Keynes thought it was vitally important.

But economics hasn't known where to go with the idea. The problem isn't just that economists have concentrated on analyzing things that can be analyzed, which was understandable; it's also that they've applied the probabilistic approach in areas where it doesn't work.

Full text

Top of page

The world is set up for the unwinding of three mega-trends:

unconventional monetary policy, the real economy’s dependence on assets,

and a potentially destabilizing global saving arbitrage.

At risk are the very fundamentals that underpin current optimism.

One or more of these pillars of complacency will, I suspect, crumble in 2018.

Stephen S. Roach, Projet Syndicate 14 December 2017

End of an era for irrational complacency in markets

Alberto Gallo FT 6 December 2017

The signs are widespread. Yields on European junk bonds have fallen below US Treasuries.

Emerging market countries with a history of default, such as Argentina, have issued 100-year bonds.

Facebook, Amazon, Apple, Netflix and Snapchat together are worth more than the whole German Dax.

Banks are again marketing CDOs.

Cash-park assets including property, art, collectibles and cryptocurrencies are soaring in a parabolic fashion, like life rafts in a sea of central bank liquidity.

Full text

Articles of Alberto Gallo at Bloomberg

Top of page

Fallande bopriser ett hot mot hela börsen

Anders Elgemyr analytiker på Jarl Securities har sammanställt en lista över de mest riskfyllda aktierna kopplade till bostäder.

Patricia Hedelius SvD 6 december 2017

Top of page

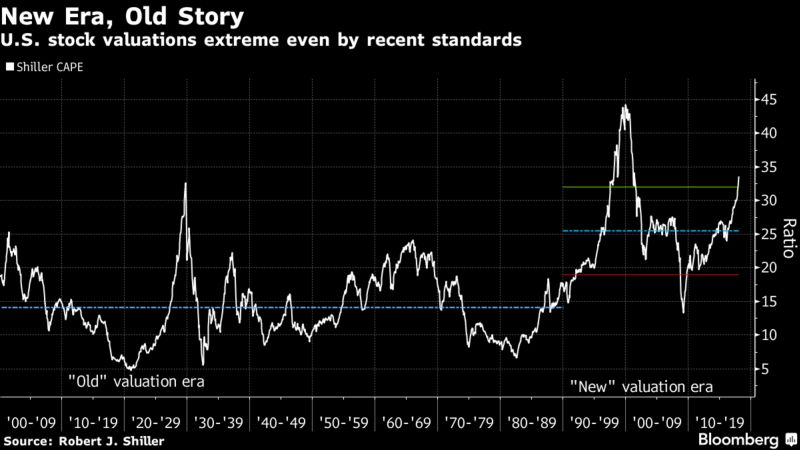

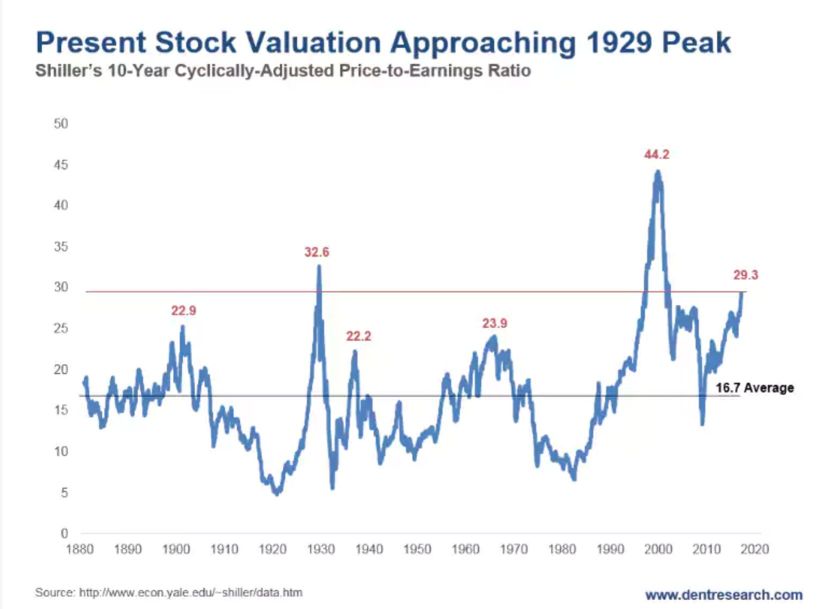

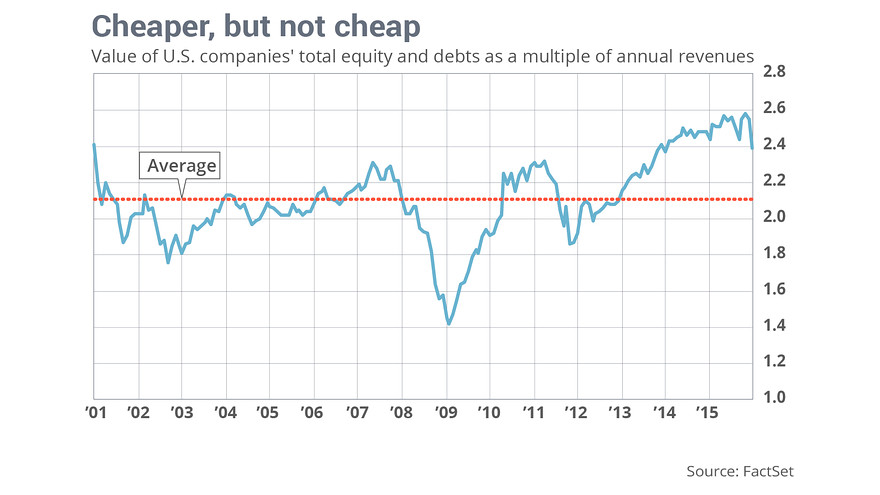

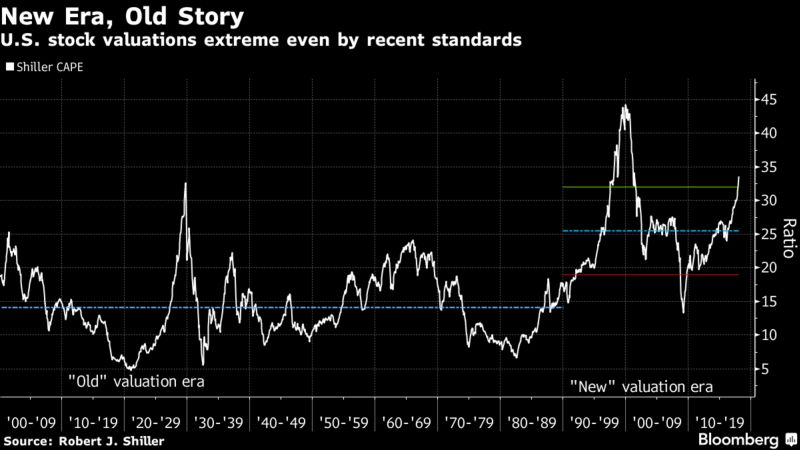

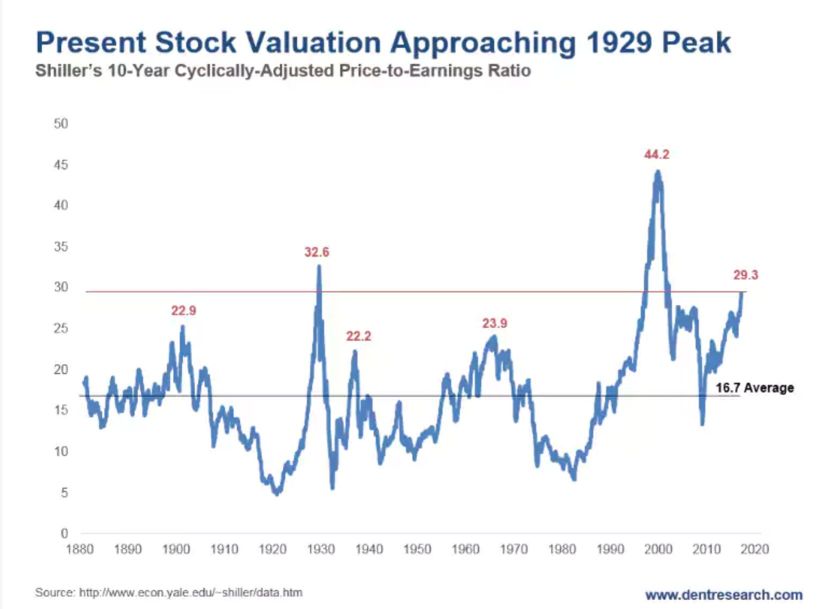

Stock valuations are high by historical standards, the report noted. The cyclically adjusted price-to-earnings ratio of the S&P 500 is at its 97th percentile relative to the last 130 years.

Market Watch 5 December 2017

What many analysts still see as a temporary bubble, pumped up by artificial and unsustainable monetary stimulus,

is maturing into a structural expansion of economic activity, profits, and employment

that probably has many more years to run.

Anatole Kaletsky, Project Syndicate, 27 November 2017

By demonstrating the success of monetary stimulus, the US has provided a roadmap that other countries have followed

Full text

Exuberance is not always ‘irrational’

Robert Shiller may or may not have deserved a Nobel Prize for his academic work on behavioral economics

but as a practical guide to investing, his approach has been thoroughly refuted by real-world experience.

Anatole Kaletsky, Reuters, 25 July 2014

Top of page

Perhaps the most unhelpful of the psychological flaws we are prone to as investors is confirmation bias.

Our desire to seek out information that reinforces our existing beliefs and to reject anything that undermines our prejudices is powerful and dangerous.

Tom Stevenson Telegraph 10 November 2017

Anyone questioning whether financial markets are in a bubble should consider what we witnessed in 2017

John Mauldin 25 November 2017

Top of page

We’re in bubble territory again, but this time might be different

Martin Wolf, FT 10 November 2017

The Fangs have delivered spectacularly in the past couple of years.

originally named for the initials of Facebook, Amazon, Netflix and Google, and now typically also including Apple and Microsoft

John Authers, FT 8 November 2017

Full text

“Fangs” — Facebook, Amazon, Netflix and Google —

and for a slightly wider group that added Microsoft, Salesforce, eBay, Starbucks and Priceline to create the “Nifty Nine”.

Both groups gained more than 60 per cent for the year.

John Authers, FT 3 January 2016

Financial Crises

The Economist Essay

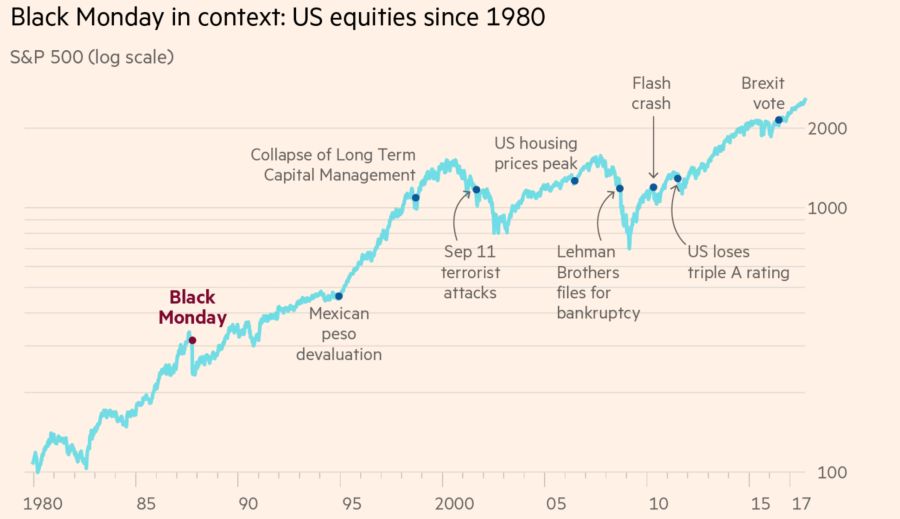

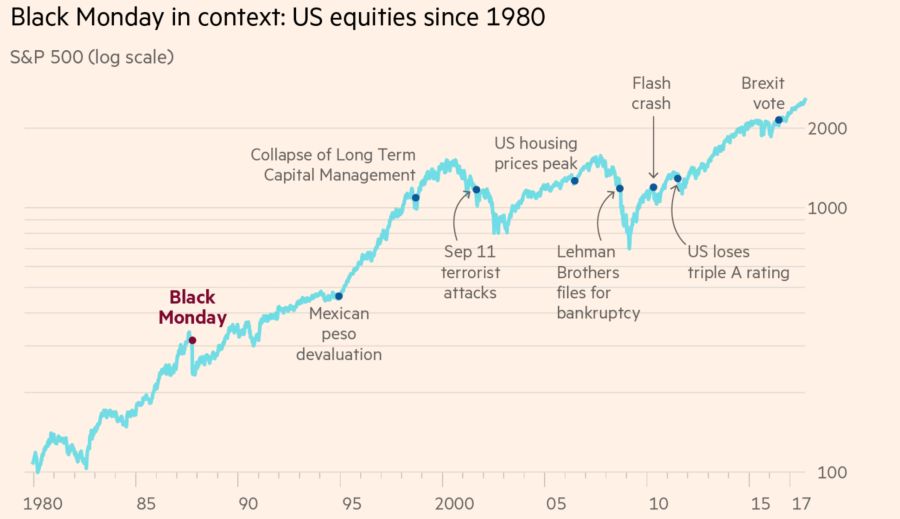

How big is the risk of another Black Monday equities crash?

FT 17 October 2017

Only at the peak of those two bubbles /“roaring 20s” and the dotcom mania of the late 1990s/

has America’s S&P 500 been higher as a multiple of earnings measured over a ten-year cycle.

The Economist 7 October 2017

Rarely have creditors demanded so little insurance against default, even on the riskiest “junk” bonds. And rarely have property prices around the world towered so high.

American house prices have bounced back since the financial crisis and are above their long-term average relative to rents. Those in Britain are well above it. And in Canada and Australia, they are in the stratosphere.

In his classic, “The Intelligent Investor”, first published in 1949, Benjamin Graham, a Wall Street sage, distilled what he called his secret of sound investment into three words: “margin of safety”.

Full text at https://www.economist.com/news/leaders/21730019-ultra-loose-monetary-policy-coming-end-it-best-tread-carefully-asset-prices-are

Can We See A Bubble If We're Inside The Bubble?

Charles Hugh Smith via zerohedge, 16 June 2017

If you visit San Francisco, you will find it difficult to walk more than a few blocks in central S.F. without encountering a major construction project.

This is of course a modern analog of the Gold Rush in the 1850s, and the previous tech/building boom in the late 1990s: an enormous influx of income drives a building boom and a mass influx of treasure-seekers, entrepreneurs, dreamers and those hoping to land a good-paying job in Boomland.

We know how every boom ends--in an equally violent bust. Yet in the euphoria of the boom, it's easy to think this one will last longer than the others.

Full text

Top of page

Current PE may be extremely elevated by the standards of the 1970s,

but it is only slightly elevated by the standards of the past few decades.

says Jeremy Grantham, MarketWatch 3 June 2017

Increased globalization, which increased the value of U.S. brands, paved way for tremendous growth in size, allowing firms to accumulate power and influence over politics and policy along the way.

The result is that corporate profitability is achieved without corresponding growth, which helps explain the reluctance by large corporations in the last several years to boost capital expenditures.

Full text

Top of page

Equities are stretched by any measure.

Shiller CAPE ratio has reached 29.3 - the highest in 130 years, leaving aside 1929 and the dotcom bubble.

Ambrose 18 May 2017

Full text

Top of page

The key point is this:

with so much growth already baked into financiers’ forecasts a sudden recession would create a nasty shock.

Gillian Tett, FT 18 May 2017

Full text

Doom

Top of page

If global stocks aren’t close to all time highs because of expectations of future growth,

profits to rise, and a generally strong sense the global economy is headed massively higher…

then maybe its time to quietly exit.

Take the cash, hide it in the mattress and wait for the next/coming storm to pass.

Bill Blain via zerohedge May 15th 2017

I’ve said many times before that the markets are being awfully complacent – why are they so high?

Just because bond yields are so low is not a good answer.

Bond yields are low because of QE distortion

Full text

Top of page

The smart money is record ‘short’ in stocks, and the dumb money is record ‘long’

Simon Maierhofer, MarketWatch 6 April 2017

While trend followers are all in, commercial hedgers (“smart money”) are “all out.”

In fact, hedgers have racked up more short positions than at any other time in history

Top of page

It feels like 2008 again

In 2017 total household debt will reach its previous peak of $12.68 trillion,

which it reached in the third quarter of 2008.

MarketWatch 3 April 2017

Top of page

Global fund managers say stock markets are more overvalued today than at any time this century,

but are continuing to buy equities aggressively, betting the day of reckoning is a way off yet.

Ambrose Evans-Pritchard 21 March 2017

A crash in the global bond markets remains a concern as inflation gathers pace.

Capital flight from China and a yuan devaluation have almost dropped off the radar screen.

Only the deflationary diehards still fret about ‘secular stagnation’.

Full text

Don’t look now, but the market’s big money is eyeing the exit

MarketWatch 21 March 2017

A popular options-market gauge of so-called black swan, or difficult to predict, events

is drawing the attention of some bears on Wall Street as it trades at record levels.

MarketWatch 21 March 2017

The CBOE Skew Index SKEW which measures the relative cost of purchasing out-of-the money put options on the S&P 500 index finished at a record of 153.34 on March 17,

Put options confer the right, but not necessarily an obligation, to sell an asset at a specific price and time,

while calls give the owner the right to buy an underlying asset

Full text

Doom

Top of page

Tempted to buy this dip?

Longtime bear John Hussman has been a steady voice in calling for an explosive end to this bull market.

Is he finally right?

MarketWatch 31 January 2018

Hussman said he expects the S&P to eventually lose two-thirds of its value.

Full text

---

This is the most dangerous and overvalued stock market on record

— worse than 2007, worse than 2000, even worse than 1929.

Or so warns Wall Street soothsayer John Hussman in his scariest jeremiad yet.

MarketWatch 14 March 2017

As of Friday, more than one-third of stocks are already below their 200-day moving averages.”

Don’t be fooled by the booming headline indexes. More NYSE stocks hit new 52-week lows last week than new 52-week highs, he notes.

In a nutshell: Run.

Full text

Fund manager and prominent bear John Hussman is warning investors once again of the potential for a big market plunge

In the note, Hussman acknowledges that he’s proven “fallible” since 2009

MarketWatch 29 September 2014

Top of page

Eight Years Of Bull Ends Tomorrow

David Stockman. Posted On Tuesday, March 14th, 2017

Why Robert Shiller Is Worried About the Trump Rally

Still about 30 percent below its high in 2000, stocks are almost as expensive now as they were on the eve of the 1929 crash.

Bloomberg 14 March 2017

Like the fable of the boy who cried wolf, Harris says pessimistic forecasters have so badly over-estimated the consequences of big events -- the rolling European debt crisis since 2010, the U.S. debt-ceiling standoff in 2011, Brexit in 2016 -- that traders have become conditioned to ignore them.

Even when bears are right, the past eight years have shown that central banks are more than willing to save the day when markets fall.

Full text

More by Robert J. Shiller

Doom

Top of page

The present outbreak of euphoria contains a number of distinct, bubble-like characteristics.

Markets are leaving themselves virtually no room for disappointment.

There is unfortunately a real possibility that Mr Trump will be unable to deliver on his tax cutting and infrastructure spending plans

Jeremy Warner, Telegraph 2 March 2017

All of sudden, Wall Street financiers no longer feel like pariahs. Instead, they’ve been embraced and invited into key positions in the White House. Oddly for someone who is said to be a “populist”,

Full text

Top of page

Be Prepared for a Bear Market, Bloomberg 6 February 2017

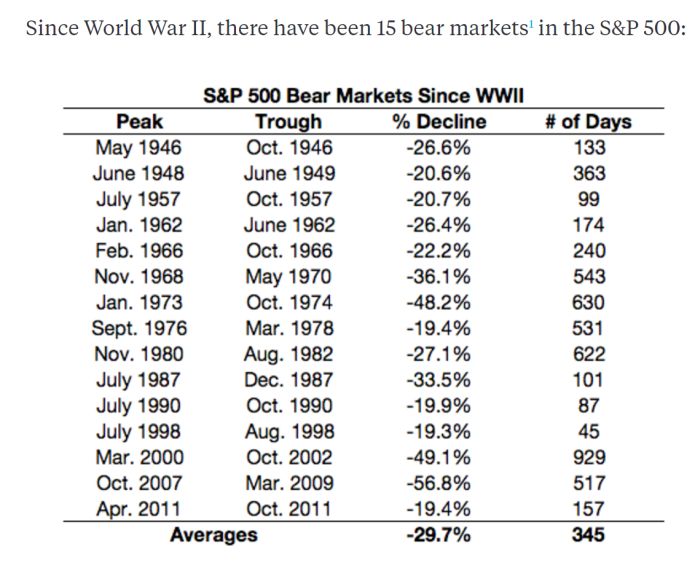

Between 11 January 1973 and 6 December 1974, Dow Jones lost over 45% of its value.

But anyway, in macro, most models use Rational Expectations,

so let's think of "behavioral" as just meaning "non-RE".

I'm seeing macro people taking behavioral ideas more seriously.

Noahpinion 15 January 2017

Full text

behavioral economics

the dread moment

when scientists learn that up is down, black is white and everything they thought they understood about the world is wrong.

Noah Smith Bloomberg 1 June 2015

Rational Expectations

Top of page

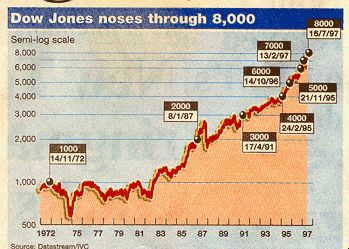

In nominal terms, the Dow is up 70% from its peak in January 2000.

The Dow is up only 19% in real (inflation-adjusted) terms since 2000.

A 19% increase in 17 years is underwhelming.

The national home price index that Case and I created is still 16% below its 2006 peak in real terms.

But hardly anyone focuses on these inflation-corrected numbers.

Robert J. Shiller, Project Syndicate 18 Jnuary 2017

Robert Shiller presidential address to the American Economic Association.

It was something out of the usual — as we should expect from as fertile, contrarian and original thinker as Shiller

— namely a plea for economists to take seriously the importance of “narrative epidemics”.

That is to say, be aware of the stories people tell one another about the economy, because they may have real effects.

Martin Sandbbu, FT 12 January 2017

Party Like It’s 19,990

So. Is the smart money with ETFs?

the most successful investment innovation of our time.

John Authers FT 21 December 2016

The blog kept by the fund manager John Hussman is much followed, even if it is also much derided.

He has been incorrectly bearish on US stocks for much of the post-crisis era.

But it would be unwise to ignore him.

More Hussman

investopedia.com/markets/etfs/

Full text

Top of page

Being journalists, and with a need to act as watchdogs, we have tended to err on the side of the negative and to ask “what could possibly go wrong?” There are no apologies for that.

The cyclically adjusted p/e (CAPE), a measure created by economist Robert Shiller,

“now stands over 27 and has been exceeded only in the 1929 mania,

the 2000 tech mania, and the 2007 housing and stock bubble,”

says Alan Newman in his Stock Market Crosscurrent letter (source: CNBC).

MarketWatch 20 December 2016

Full text

Top of page

Tail risks wagging the dog with Wall Street fear gauge

Markets, in moments of extreme stress, are prone to reset their expectations for the future

violently, rather than in a smooth and orderly manner.

Miles Johnson, FT 21 November 2016

Full text

Soros: General Theory of Reflexivity

It is possible that asset prices will come down gradually,

implying a slowdown rather than a collapse of spending and economic activity.

US households now own $21 trillion of equities, so a 35% decline in equity prices to their historic average

would involve a loss of more than $7.5 trillion.

Martin Feldstein, Project Syndicate 26 October 2016

Full text

Det är en del, företrädesvis fastighetsmäklare och bankekonomer, som försöker intala sig själva och oss andra att bostadspriserna kan plana ut.

Men bostadsbubblor, liksom andra bubblor, har en mycket karaktäristisk form. Det brukar, alltid, se ut så här.

Englund blog 25 mars 2012

Top of page

Oops, they did it again —

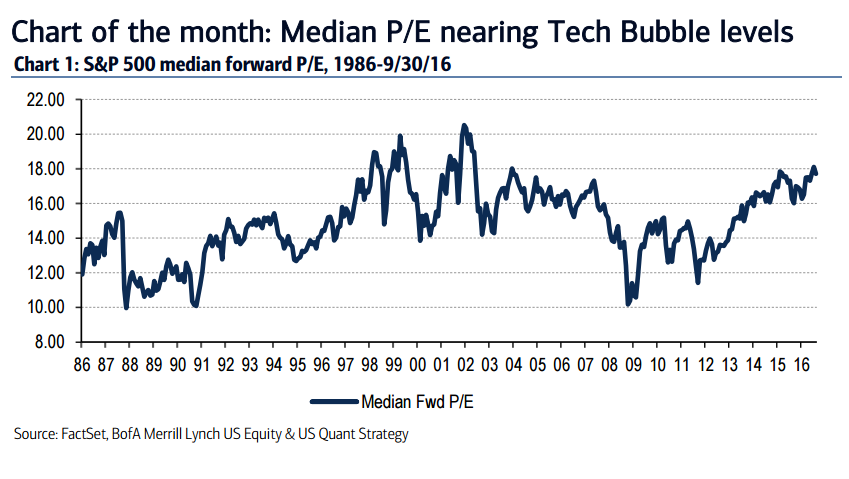

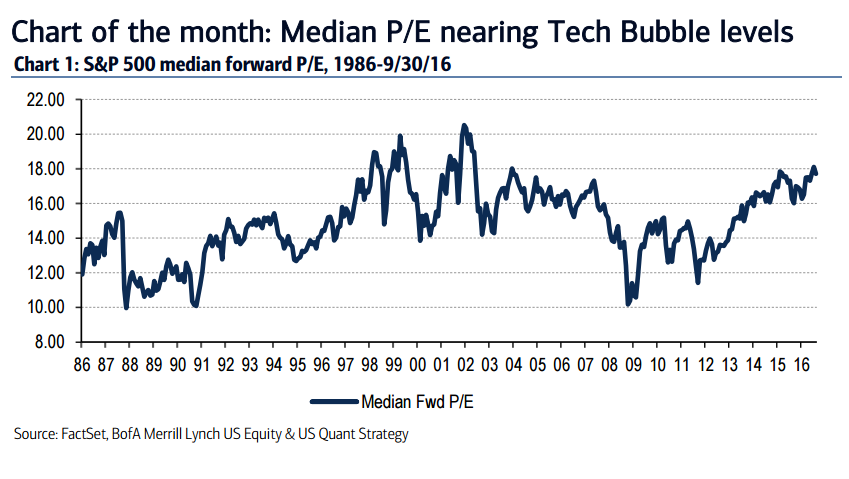

stocks flirt with lofty levels not seen in 15 years

MarketWatch 13 Oct 2016 9:43

The recent selloff notwithstanding, stocks are pricey.

Indeed, the last time the average S&P 500 stock was this expensive, Britney Spears was the hottest name in pop music

and the market was on its doomed path toward the meltdown that came to be known as the dot.com bust.

Valuation is near levels seen during the tech-bubble era, according to Savita Subramanian,

an equity and quantitative strategist at Bank of America Merrill Lynch.

Full text

Top of page

News

The big bank bloodbath:

losses near half a trillion dollars

MarketWatch 7 July 2016

The claim that you can capitalize the stock market at an unusually high PE multiple owing to ultra-low interest rates,

therefore, implies that deep negative real rates are a permanent condition, and that governments will be able to destroy savers until the end of time.

The truth of the matter is that interest rates have nowhere to go in the longer-run except up

David Stockman 5 July 2016

Median stock is currently trading in the 99th percentile of historical valuations

ZeroHedge 29 June 2016

Global bear market moves closer after Brexit

It could be that the tipping point for markets will come

when the great mass of investors concludes that the wizards of central banking are emperors with no clothes

and that anaemic global growth provides inadequate support for current equity valuations.

John Plender, FT 28 June 2016

Full text

John Plender

Why do the frogs of Wall Street stay in the boiling pot? Stockman.

Och Englund om de borgerliga grodorna som inte är lustiga att se.

Englund blog 14 maj 2016

2016: The End Of The Global Debt Super Cycle

ZeroHedge, 1 April 2016

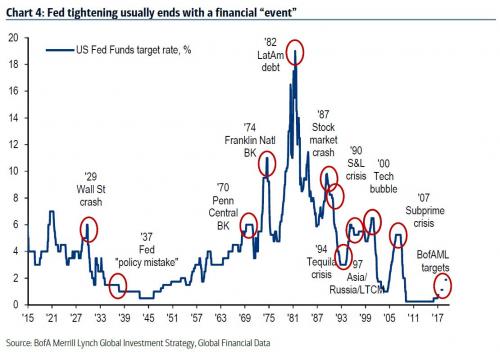

The day after the 1987 crash (Oct. 20, 1987) Alan Greenspan, Chairman of the Fed, announced to the world that

The Fed stood ready to provide whatever liquidity was needed by the banking system

to prevent the crash from turning into a systemic financial crisis.

That was the day the Fed “put” was born.

Fed Funds Rate drop from 6.5% to 1% from 2000 to 2003.

This in effect morphed the tech stock bubble into a housing bubble.

Top of page

News

Why I am reading Stockman and Varoufakis

Englund blog 26 March 2016

In Defense of Globalization

The current climate is far too permissive of share-repurchase programs

Jim O'Neill, Project Syndicate 17 January 2017

Jim O'Neill is a former chairman of Goldman Sachs Asset Management and former Commercial Secretary to the UK Treasury, is Honorary Professor of Economics at Manchester University and former Chairman of the Review on Antimicrobial Resistance.

Policymakers can take action to alleviate anxieties about globalization.

For starters, the seemingly endless growth of profits as a share of global GDP must stop.

Anyone who thinks this sounds radical needs to brush up on economics.

Higher profits should attract new market entrants, which would then erode incumbents’ profits through competition.

The fact that this isn’t happening suggests that some markets have been rigged, or have simply failed. Policymakers need to address this with stronger regulation in some areas.

For example, as I have previously argued, the current climate is far too permissive of share-repurchase programs.

Full text

Globalisation

Top of page

There’s Only One Buyer Keeping S&P 500’s Bull Market Alive

- $165 billion Buyback

Bloomberg Business, March 14, 2016

I’m confident we would see improvement on all fronts

if we got GDP growth back up to 4% for a few years.

John Mauldin, March 7, 2016

Goldman Sachs

“Our model suggests SPX calls are more attractive than at any time over the past 20 years”.

David Stockman, 7 March 2016

The next global financial crisis could start with U.S. stocks.

Satyajit Das, MarketWatch 2 March 2016

The real, less respectable reason why companies engage in buybacks,

namely to boost earnings per share by shrinking the equity.

John Plender, FT 1 March 2016

Full text

John Plender at IntCom

1929 - The Crash

Thursday, October 24, the Wall Street Stock Exchange crashes

Fuelled by frenetic speculation, and by the idea that everyone can get rich without limits

Curiositystream

Watch here

More about 1929

Click

Exchange-Traded Fund (ETF)

Investopedia

On The Impossibility Of Helicopter Money, And Why The Casino Will Crash

S&P 500 companies posted Q2 2016 earnings for the latest 12 month period at $86.66 per share.

So at the August bubble high the market was being valued at a lunatic 25.1X.

David Stockman, August 17, 2016

Irrational exuberance begins to surface in US stock market

The multiple of 18 times next year’s projected earnings at which the S&P 500 currently trades...

is at its highest since 2002

John Authers, FT 17 August 2016

outstripping any level it reached during the credit bubble, or when the Federal Reserve was pumping up asset prices with QE bond purchases.

Full text

Crash Course: Stocks and other investments are wildly overvalued

The mispricing of assets across world markets has reached epidemic proportions.

Satyajit Das, MarketWatch Feb 25, 2016

Rather than inflation creating stagnation, we have deflation dragging the economy to stagnation.

Back then, a 37% and 49% decline in equity prices wasn’t called a crash but instead a bear market.

Don't expect a crash — expect a continued bleed.

L.A. Little, MarketWatch Feb 21, 2016

Full text

Stagflation

Secular Stagnation

Top of page

News

Chilling ways the global economy echoes 1930s Great Depression era

MarketWatch Feb 19, 2016

Financial author Edward Chancellor recently called attention to a paper

written by Claudio Borio, head economist at the Bank of International Settlements,

that provides a fuller picture of the causes of the Great Depression.

The paper’s thesis is that “financial elasticity” characterizes both the pre-Depression global economy and today’s global economy.

Elasticity refers to the buildup of capital imbalances such as money flows into emerging markets because of low rates in developed markets.

American investors brought their dollars home after the Fed hiked rates in 1928.

In 1930, several South American countries devalued their currencies and defaulted on their debt.

The crisis spread to Austria, Germany, and eventually to Britain, a heavy lender to Central Europe.

Britain eventually devalued its currency, but in the U.S. the Fed actually raised rates in late 1931 to stem gold outflows.

A banking panic ensued

Borio’s paper was written in August 2014, so it’s difficult to know what advice he’d have for the Federal Reserve today

The international monetary and financial system: its Achilles heel and what to do about it

Claudio Borio, Working Papers No 456, August 2014

Full text

1929

Top of page

News

Detta Wall Street diagram för den 10 februari 2016 kan bli historiskt

Rolf Englund blog 11 februari 2016

Draghi, Dennis, Wolodarski och Tomas Fischer

700 Days In No Man’s Land -- Why They Can’t Keep It Up

David Stockman, January 23, 2016

BTFD - That baleful refrain was led this time around by no less than the posse of oligarchs and apparatchiks assembled at Davos.

Thus, when Mario Draghi, the world’s most ludicrous monetary dunce, let on that there were “no limits” on how much fraudulent credit could be emitted by the ECB’s printing press, he surely spoke a frightening truism.

Yet the world largest asset gather, Larry Fink, founder of $4.5 trillion BlackRock, gushed with an endorsement:

“We’ve seen over the last few years you have to trust in Mario,” Laurence Fink, chief executive officer of BlackRock Inc., said in Davos.

“The market should never, as we have seen now, the market should not doubt Mario.”

Full text

”The sky is the limit”, sa chefen för Riksbanken

Medan Finland lät marken flyta den 8 september, bedrev Sverige sitt eget valutakrig i ytterligare drygt två månader.

Under den tiden plågades hushåll och företag av extrema räntor.

En marsch mot Poltava, som finansmannen Tomas Fischer uttryckte saken.

Peter Wolodarski, signerat, DN 9 september 2012

David Stockman at IntCom

Top of page

News

David Stockman On CNBC:

This Is A Dead Cat Bounce—-We’re At Peak Debt Headed For Recession

via Rolf Englund blog 2016-01-23

Dow could fall 5,000 points and still not be ‘cheap’

MarketWatch Jan 21, 2016

Full text

Top of page

News

A host on bubblevision this afternoon noted that the S&P 500 is now down $2 trillion for the year and

wondered if his panel could explain “what’s happened since January 1st?”

The implication, of course, was that since no new recessions have started that the market’s worst ever start of the year was surely overdone.

David Stockman 20 January 2016

Already in the first two and one-half weeks of trading this year, Amazon and Google are down nearly $60 billion each.

The FANGsas a group have lost $160 billion of market cap, or more than 33% of their entire 2015 bubble eruption.

Full text

David Stockman at IntCom

Top of page

News

The global financial system has become dangerously unstable and faces an avalanche of bankruptcies that will test social and political stability, a leading monetary theorist has warned.

"The situation is worse than it was in 2007. Our macroeconomic ammunition to fight downturns is essentially all used up,"

said William White, the Swiss-based chairman of the OECD's review committee and former chief economist of the Bank for International Settlements (BIS).

Ambrose Evans-Pritchard, in Davos 19 Jan 2016

The next task awaiting the global authorities is how to manage debt write-offs - and therefore a massive reordering of winners and losers in society - without setting off a political storm.

Mr White said Europe's creditors are likely to face some of the biggest haircuts.

European banks have already admitted to $1 trillion of non-performing loans:

they are heavily exposed to emerging markets and are almost certainly rolling over further bad debts that have never been disclosed.

Full text

William White, until recently economic adviser to the Bank for International Settlements

has resisted heroically the temptation to say: “I told you so.”

Samuel Brittan, Financial Times, August 14 2008

Why have markets reached their exposed position? The answer is that success breeds excess.

This is the argument of a fascinating new paper from William White, economic adviser to the Bank for International Settlements.

Martin Wolf, Financial Times 24/5 2006

Doom

Top of page

News

Dow futures fall more than 300 points as oil, Asia selloff rattle investors

Sara Sjolin, MarketWatch Jan 20, 2016

Full text

The bear market in stocks has finally arrived

Michael Sincere, MarketWatch Jan 20, 2016

Stage 1: Denial, Stage 2: High Anxiety, Stage 3: Fear, Stage 4: Panic

Right now, we’re in the denial stage.

Full text

Soon Comes The Deluge

David Stockman • January 19, 2016

News

China Stocks Enter Bear Market as State-Fueled Rally Evaporates

Bloomberg News, January 15, 2016

Top of page

AMZN and its three other FANG amigos had accounted for a $530 billion gain in market cap

while the other 496 stocks in the S&P 500 had declined by even larger amount.

That is, the apparently flat S&P 500 index of 2015 was hiding an incipient bear—–owing to a market narrowing action like none before.

Compared to the Fabulous FANGs (Facebook, Amazon, Netflix and Google)

David Stockman, January 13, 2016

Full text

Apart from a few stocks, the US markets are in a slump with fears post-crisis rally has run its course

John Authers, FT 3 January 2016

Top of page

News

http://englundmacro.blogspot.se/2016/04/famous-skeptic-socgens-albert-edwards.html

One person who is particularly bearish is the incomparable Albert Edwards. SocGen’s “uber bear” (or, more appropriately, “realist”)

is out with a particularly alarming assessment of the situation facing markets in the new year.

The Fed's pursuit of negligently loose monetary policies since 2009 is a misguided attempt to boost economic growth via asset price inflation and we will now reap the whirlwind

zerohedge 13 January 2016

Full text

Could it really have arrived? Are global stocks about to tank in an all consuming way?

Indeed, is this the moment Albert Edwards has been waiting for since 1996?

Of course, Edwards is perhaps London’s best-known doom-monger when it comes to stocks.

FT Alphaville Monday, March 5th, 2007

Some strategists are more cataclysmic.

Not invited to Jackson Hole was Albert Edwards, Société Générale’s famously bearish global strategist,

who warned this week the crisis would not be confined to emerging market economies with yawning current account deficits.

“I see this as the beginning of a process where the most wobbly domino falls

and topples the whole, precarious, rotten, risk-loving edifice that our policy makers have built,” he wrote in a note.

Financial Times, August 30, 2013

Albert Edwards at zerohedge

ZIRP and QE were terrible mistakes

Rolf Englund blog 4 January 2016

SocGen: brace for a 2008-style crash and US stocks to fall by 75pc

Notorious "uber bear" Albert Edwards warns that the world is about to "reap the whirlwind" of the US Fed's quantitative easing

Peter Spence, Telegraph Economics Correspondent, 13 January 2016

“The impossible trilogy of maintaining an independent domestic monetary policy and a semi-fixed exchange rate

while loosening capital account restrictions is hitting home,” he said.

Den 21 november 1985 vid ett-tiden fick jag /Lars Wohllin/ - som chef för Stadshypotek - meddelandet om att Riksbanken hade upphävt alla utlåningsrestriktioner.

Jag tittade på mina medarbetare och undrade om man på Riksbanken verkligen förstod vad man gjorde.

Click

Chinese companies have prepared themselves for a further fall in the yuan, Mr Edwards claimed, putting the country in “a better position to transmit a massive deflationary shock”.

Full text

Edwards at FT Alphaville

But I do hope this time around the Queen won’t ask, as she did in November 2008, why nobody saw this coming!

http://ftalphaville.ft.com/2016/01/13/2150068/if-i-am-right-the-sp-would-fall-to-550-a-75-decline-from-the-recent-2100-peak/

RBS has advised clients to brace for a “cataclysmic year” and a global deflationary crisis,

warning that major stock markets could fall by a fifth and oil may plummet to $16 a barrel.

Ambrose Evans-Pritchard, 11 Jan 2016

The bank’s credit team said markets are flashing stress alerts akin to the turbulent months before the Lehman crisis in 2008.

“Sell everything except high quality bonds. This is about return of capital, not return on capital.

In a crowded hall, exit doors are small,” it said in a client note.

Full text

Cataclysm

Top of page

News

One source of comfort is that the retail money, often called the dumb money by Wall Street,

is not all by itself in the wilderness of figuring out this market right now.

“Everyone is the dumb money. Not even the billionaires have any idea what’s going to happen next,”

says Greg Guenthner of the Daily Reckoning blog.

MarketWatch 12 January 2016

Hedge funds returned 1.56% last year, the lowest since 2011, according to Eurekahedge, so they sure didn’t have it all buttoned up either.

And what’s the point of panic when you can’t predict a crash anyway?

Robert P. Seawright, chief investment officer for Madison Avenue Securities says even in 1987 there was really no big “smoking gun.”

Full text

1987

Daily Reckoning blog

Top of page

News

Market Watch 11 January 2016

As with the first Shanghai Surprise, the stark reaction to this week’s Chinese events reveals deep lack of confidence in the health of the western corporate sector.

Even if the situation now stabilises — as it did for several months back in 2007 —

the message of concern, in both west and east, is clear.

John Authers, FT 8 January 2016

Full text

Yet there were some very high numbers for a group of four companies that have come to be known as the “Fangs” — Facebook, Amazon, Netflix and Google —

and for a slightly wider group that added Microsoft, Salesforce, eBay, Starbucks and Priceline to create the “Nifty Nine”.

Both groups gained more than 60 per cent for the year.

John Authers, FT 3 January 2016

Top of page

News

Earlier version of this page

Top of page