“Taming globalisation and redirecting it to meet the interests of working people has been,

and still is, the defining political challenge of our era.”

FT 30 October 2017

Over the past four decades, globalization has enabled the transfer of millions of jobs from the US to various emerging-market countries.

It changed the relative value of capital and labor all over the world. The top earners started getting a larger share of their income from investments than from their labor. They own the “means of production,” and the producers did increasingly well from the ’70s forward.

Nobody paid much attention to the unevenly distributed benefits of globalization, until around 40 million Americans lost their jobs in the 2007–2009 recession. Now, the backlash has begun, and it’s not going to stop until the situation improves for those who have been left behind.

John Mauldin/Niall Ferguson January 2018

I want to make clear that the goal of this letter is not to say whether liberal internationalism is good or bad, or defend the backlash against it. My objective is to highlight the current state of the order and give insight into Niall’s argument behind why he believes it is over.

Niall says the EU’s mishandling of the financial and migrant crises have resulted in a total loss of confidence in the institution

Full text

Is This the End of the Liberal International Order?: The Munk Debates Paperback – December 4, 2017

by Niall Ferguson Fareed Zakaria

Niall Ferguson at IntCom

In 1948, Paul A. Samuelson’s “factor-price equalization theorem” lucidly showed that under conditions of unlimited free trade without transportation costs (and with other idealized assumptions),

market forces would equalize the prices of all factors of production, including the wage rate for any standardized kind of labor, around the world.

In a perfect world, people don’t have to move to another country to get a higher wage.

Ultimately, they need only be able to participate in producing output that is sold internationally.

As technology reduces the cost of transportation and communications to near the vanishing point,

achieving this equalization is increasingly feasible.

International Trade and the Equalisation of Factor Prices

Paul A. Samuelson, The Economic Journal Vol. 58, No. 230 (Jun., 1948), pp. 163-184

For now, this recognition still faces strong competition from patriotic impulses,

rooted in a social contract among nationals who have paid taxes over the years

or performed military service to build or defend what they saw as exclusively theirs.

Allowing unlimited immigration would seem to violate this contract.

But the most important steps to address birthplace injustice probably will not target immigration.

Instead, they will focus on fostering economic freedom.

Robert J. Shiller, a 2013 Nobel laureate in economics, Project Syndicate 19 September 2016

Full text

Robert J. Shiller at IntCom

Top of page

In Defense of Globalization

The current climate is far too permissive of share-repurchase programs

Jim O'Neill, Project Syndicate 17 January 2017

Richard Baldwin summarises it acutely in his new book, The Great Convergence.

The driving force of the old globalisation was the falling cost of moving goods.

The driving force of this more recent wave has been the falling cost of moving ideas.

Stephanie Flanders, chief market strategist for Europe at JPMorgan Asset Management, FT 8 January 2017

Full text

Richard Baldwin The Great Convergence

Top of page

Behind the tendency towards economic growth lie two powerful forces:

innovation at the frontier of the world economy, particularly in the US, and catch-up by laggard economies.

The two are linked: the more the frontier economies innovate, the greater the room for catch-up.

Martin Wolf, FT 3 January 2017

3. “The China Shock: Learning from Labor-Market Adjustment to Large Changes in Trade,” by David Autor, David Dorn and Gordon Hanson

This is the paper that shook the world of economics.

Looking at local data, Autor et al. found that import competition from China was devastating for American manufacturing workers.

People who lost their jobs to the China Shock mostly didn’t find new good jobs -- instead they took big permanent pay cuts or went on welfare.

Noah Smith:

Here’s a list of 10 excellent economics books and papers I read in 2016

The Retreat from Hyper-Globalization

Flows of Goods and Services, People and Capital Have Overwhelmed the Ability of Political Processes to Accommodate Them

Remember: you can have (1) deep economic and financial integration, (2) an autonomous nation-state and

(3) responsive, representative government — two out of three.

WTF?, November 2016

Top of page

Globaliseringen har oåterkalleligen krympt världen och vid fronten konfronteras man med den rent fysiskt,

en front som går genom förorten eller på landsbygden, inte i storstaden.

Skulle invandrarna vara lika fysiskt påtagliga och närvarande i Stockholm som ute i landet hade SD förmodligen redan varit Sveriges största parti.

Richard Swartz, Kolumn DN 8 oktober 2016

Ingen är emot att andra får det bättre, fast bara om det inte sker på vår bekostnad.

Men det är just vad som verkar ske när globaliseringen blir till förlorade jobb

och en jättelik folkvandring som väller in över oss européer och amerikaner.

Full text

Richard Swartz har bytt uppfattning om EMU utan att be om ursäkt

Rolf Englund blog 2012

Marian Radetzki, unemployment and Stall Speed

Top of page

News

The IMF paper said the slow recovery had been made worse by the fact that

what growth there had been “bypassed many low-income earners” and

“raised anxiety about globalisation and worsened the political climate for reform”.

FT 1 Sepember 2016

How do we persuade citizens that the rise of the emerging countries, the brightest story of our era, is to be welcomed, rather than resented or even resisted,

when what they experience is financial disarray, falling house prices, recession and soaring costs of essential commodities?

Martin Wolf, Financial Times, April 22 2008

Trump, Le Pen and the enduring appeal of nationalism

In a globalised era, even a country as big as America can feel small.

Mark Mazower on why politicians such as Donald Trump are in fashion

FT 29 April 2016

There is still no better place to look for an answer than in a little polemic written more than 30 years ago.

Benedict Anderson’s Imagined Communities (1983) remains a classic effort to explain nationalism’s durability and to come to terms with the passions it can unleash.

Full text

Is the World Getting Crazier, But We No Longer Notice?

Charles Hugh Smith, April 2016

Top of page

Men – invänder någon – det går ju bra för Sverige. BNP växer mer än i andra länder.

Jovisst, men det är i huvudsak en tillväxt som under snart ett decennium baserats på hushållens konsumtion.

Detta är i sin tur en följd av att ekonomin dopats med skattesänkningar.

Under senare tid har effekten förstärkts av Riksbankens åtgärder för att göra kronans värde mer attraktivt för utländska köpare

Den låga produktivitetstillväxten

Men vad kan man vänta av ett land där kafébranschen är den snabbast växande och

där politikens fokus legat på att subventionera lågproduktiva jobb i stället för att utbilda arbetskraft?

Jan Edling: Jobben som försvann GP 20 februari 2016

Top of page

News

Per Schlingmann, en av ”arbetslinjens” arkitekter, dödförklarar nu det begrepp som kanske mer än något annat präglat svensk politik under de senaste tio åren.

Den nya tidens Gud stavas Globalisering, Urbanisering och Digitalisering.

Förändringarna är så omfattande att vi kan tala om att vi befinner oss i ett nytt paradigm.

Per Schlingmann, DN 2015-05-11

Full text

News

Top of page

- Integrationen av de 4/5 av världen som är fattig med den rika femtedelen

har möjlighet att bli en av de två eller tre mest betydelsefulla ekonomiska

utvecklingsskedena - i jämnhöjd med renässansen och den industriella

revolutionen.

Lawrence Summers, rektor för Harvard University, i Davos, januari 2006

Källa: Lars-Georg Bergkvist, SvD Näringsliv 28/1 20

"Från att ha varit ett teorem i forskarkurserna i utrikeshandelsteori har

plötsligt faktorprisutjämning, och ett fall i reallönerna i västerlandet, blivit

en högst konkret realitet. Och då väljer de flesta nationalekonomer att blunda

för teoremet, och/eller att krångla till ytterligare, så att lönenivån inte

nödvändigtvis behöver falla - och sedan slår de sig till ro. Varpå sjukskrivningarna,

skatterna och riksbankspolitiken fortsätter att dominera våra ledande debattfora och

tankesmedjor, också inom den nationalekonomiska professionen."

Mats Persson och Marian Radetzki i Ekonomisk Debatt

Mats Persson

Most Americans are worse off than they were at the beginning of the 21st century,

while the top sliver are dramatically richer.

Edward Luce, FT 4 January 2015

There is no reason to believe the US has found the answer to that.

Relative to most of Europe, America’s middle class have better prospects, particularly in the short term.

But in the long run, we are all subject to the same grand squeeze.

Full text

Top of page

Three events that shaped our world

This year is the 100th anniversary of the start of the first world war,

the 70th anniversary of D-Day and

the 25th anniversaries of the collapse of the Soviet empire and the savage crackdown around Tiananmen Square.

Martin Wolf, Financial Times June 10, 2014

The success of the Allied D-Day landings on the Normandy beaches ensured victory in Europe would not lie solely with one of the totalitarian powers. A free and democratic western Europe would emerge under US protection.

The postwar division of Europe was a tragedy, though an inevitable one: the US was not going to fight the Soviet Union immediately after its alliance with it.

The salient characteristic of the past quarter of a century is globalisation

The Great Recession, like the Great Depression, damaged globalisation, as the McKinsey Global Institute shows in a recent study.

Given the damage done by the global financial crisis and evident concern about how the global market economy is operating, notably over the distribution of the gains, a bigger backlash than today’s is possible.

If there is one lesson from the past 100 years it is that we are doomed to co-operate. Yet we remain tribal.

This tension between co-operation and conflict is permanent.

In the past century humanity experienced extremes of both. The history of the next century will be shaped by how we approach very similar choices.

Full text

Första Världskriget

Martin Wolf

The dynamic interplay of networks and hierarchies that has led to the creation and destruction of economic systems in generations past…

and will ultimately drive political outcomes in today’s unbalanced and rapidly changing global economic system.

Niall Ferguson, via John Mauldin, 11 June 2014

The Butterfly Defect:

How Globalization Creates Systemic Risks, and What to do About It

by Ian Goldin and Mike Mariathasan

Review by Shawn Donnan, FT, July 20, 2014

Full text

Amazon

Pandemic

Top of page

Twenty years later, it is astonishing how our understanding of globalization has changed.

Mexico? American jobs went to China instead.

Did not live up to Mr. Gore’s implicit promise that globalization would improve the living standards of most American workers.

Instead, globalization is now often perceived as a leading driver of rampant inequality and wage stagnation.

But what globalization did achieve was to greatly improve the lot of hundreds of millions of people in China and other corners of Asia.

Eduardo Porter, NYT 18 March 2014

Full text

Top of page

Another decade of western economic malaise – or, God forbid, another financial crisis –

is likely to see more radical solutions and politicians emerging.

Gideon Rachman. FT December 9, 2013

It would be nice to believe that talk of a decline in western living standards is simply hype.

But, unfortunately, the numbers suggest that the public are on to something.

According to researchers at the Brookings Institution, the wages of working-age men in the US – adjusted for inflation – have fallen by 19 per cent since 1970

Full text

Top of page

At the heart of the new global economy are what Peter Nolan, professor of Chinese development at Cambridge university, calls “systems integrator” companies – businesses with dominant brands and superior technologies, which are at the apex of value chains that serve the global middle classes.

Prof Nolan concludes that the number of globally dominant businesses in the manufacture of large commercial aircraft and carbonated drinks was two;

of mobile telecommunications infrastructure and smart phones, just three;

of beer, elevators, heavy-duty trucks and personal computers, four; of digital cameras, six; and of

motor vehicles and pharmaceuticals, 10.

Martin Wolf, Financial Times, July 9, 2013

In these cases, dominant businesses supplied between half and all of the world market.

Moreover, “one hundred giant firms, all from the high-income countries, account for over three-fifths of the total R&D expenditure among the world’s top 1,400 companies. They are the foundation of the world’s technical progress in the era of capitalist globalisation”.

The book

Full text of Martin Wolf

More by Martin Wolf

Peter Nolan

Top of page

Partyt är över för västvärlden

Jag är intresserad av dystopier. Och tv. Och bantning.

Utifrån dessa hobbies har jag formulerat en gedigen omvärldsanalys.

En duktig flicka, Ann-Charlotte Marteus, Expressen 8 maj 2013

De kinesiska flanörerna framstod, oavsett biologisk ålder, som vuxna i klassisk mening:

allvarliga, nyktra, bärande sina plikter utan knot.

Britterna var livliga och sorglösa, av allt att döma på väg mot dagens shoppingräd med osäkrade kreditkort.

Som rara tanklösa tonåringar i medelåldern.

Full text

BBC

Weimarrepubliken handlade det om i en artikel med rubriken

"Don't mention the war" av Ann-Charlotte Marteus i Expressen 19 feb 2012.

The decline of western dominance

US and western Europe GDP per head is three times the world average.

Such discrepancies can hardly be expected to last in an increasingly globalised planet

Samuel Brittan, Financial Times January 3, 2013

Only a fool would make firm assertions about the future. How many pundits writing at the dawn of 1913 predicted the oncoming first world war, let alone two such wars that almost finished off European civilisation? What one can do is examine the implications of trends already in evidence.

It may be worth starting with the German writer Oswald Spengler who published in 1918-1923 an alarmist book, The Decline of the West. He was not so much wrong as premature.

And like many “declinists” he failed to see that a decline in relative position was compatible with high and even rising western living standards.

Full text

På toppen av bubblan känns allt bra

Vi befinner oss fortfarande nära toppen av bostadsprisbubblan.

Vi har fortfarande svenska löner och kinesiska priser.

Men vänta bara.

Rolf Englund blog 4 januari 2013

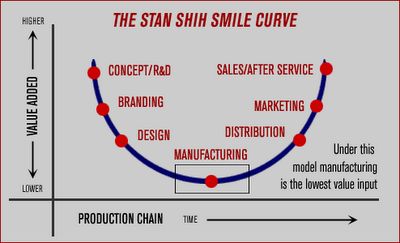

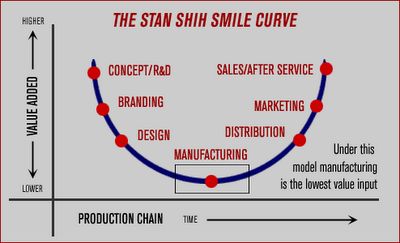

Perhaps you’ve never heard of Stan Shih, but in Asia, he is a rock star capitalist –the founder of Acer Computer,

a genius business theorist and now a hotshot VC.

Sony Mobile Communications minskar arbetsstyrkan i Lund med 650 tjänster och flyttar huvudkontoret till Japan.

Beskedet från Lund ger inte några skäl till panik. Men ...

SvD-ledare, P J Anders Linder, 24 augusti 2012

Var och en för sig är den här sortens förändringar helt naturliga i den internationaliserade marknadsekonomin, men det finns starka skäl att studera mönstren.

Sverige lutar sig farligt tungt mot ett begränsat antal globaliserade storföretag.

Förmår Sverige locka nya, högkvalificerade investeringar i samma takt som gamla (minns AstraZeneca i Södertälje) avvecklas?

Full text

Svenska Dagbladet

Början på sidan

Globaliseringsrådet

Globaliseringsrådet började sitt arbete 2007 med uppgiften att analysera hur Sverige ska kunna hävda sig väl i globaliseringens tid.

I slutrapporten "Bortom krisen"presenteras ett antal rekommendationer kring hur Sverige kan stärka sin konkurrenskraft och attraktivitet i en global ekonomi.

George Orwell's utopian vision has found an echo in a little-known French philosopher

The West-knows-best, free-market-fundamentalism of the 1980s and triumphalist 1990s lasted until 2001-2008,

when it was exploded by 9/11, the sub-prime crash, global warming and the rise of China.

John Lichfield, The Independet, 1 March 2011

Since then, nothing. Countless thinkers have examined parts of the puzzle. How can we halt climate change when the world is incurably addicted to growth? Can the Western values of openness and democracy survive the anti-Western radicalisation of Islam?

Full text

The East India Company

The Company that ruled the waves

It was one of the first companies to offer limited liability to its shareholders.

It laid the foundations of the British empire.

The Economist print Dec 17th 2011

Top of page

According to yesterday’s UN figures, world food prices rose to another record high in January,

Fed by explosive growth in demand in the developing world, the costs of fuel, metal and other commodities are following a similar trajectory.

Daily Telegraph 3 Feb 2011

The effect is to create what, for the West, is a quite unfamiliar phenomenon. Inflation is rising, even though the “rich” economies remain profoundly weakened, with abundant spare capacity and surplus labour. For the first time in living memory, America no longer determines the nature of the commodities cycle. The West is out of kilter with the rest of the world, and with little ability to force through wage claims that match inflation, many of its citizens are finding that their living standards are deflating accordingly.

Full text

Globalisation is the megatrend of our age.

Globalisation means change - within societies and economies as well as between societies and economies.

And success in the age of globalisation is to a large extent decided by the ability of nations and economies to change.

Carl Bildt, Utrikesminister, Tal vid Bilgi University, Istanbul 6 mars 2011

"The countries of North Africa and the Middle East will see a rise in population that will equal two Egypt's - app 160 million people - during the next two decades or so.

And to the East of our Union there is a vast region with its 12 very different countries between us and the borders of China - the 80 million people of the six Eastern Partnership countries, the 140 million people of Russia and the nearly 60 million people of the five countries of Central Asia.

Alliansen, EMU och det Östliga Partnerskapet

Om Alliansens valmanifest

Södra grannskapsområdet

Full text

With production workers in manufacturing down to about 6 percent of U.S. employment, there aren’t many assembly-line jobs left to lose. Meanwhile, quite a lot of white-collar work currently carried out by well-educated, relatively well-paid workers may soon be computerized. Roombas are cute, but robot janitors are a long way off; computerized legal research and computer-aided medical diagnosis are already here.

Once, only manufacturing workers needed to worry about competition from overseas,

but the combination of computers and telecommunications has made it possible to provide many services at long range.

Paul Krugman 6/3 2011

And research by my Princeton colleagues Alan Blinder and Alan Krueger suggests that high-wage jobs performed by highly educated workers are, if anything, more “offshorable” than jobs done by low-paid, less-educated workers. If they’re right, growing international trade in services will further hollow out the U.S. job market.

Full text

How to Restore the American Dream

Americans fear that we are in the midst of not a cyclical downturn but a structural shift,

one that poses huge new challenges to the average American job, pressures the average American wage and endangers the average American Dream. The middle class, many Americans have come to believe, is being hollowed out.

I think they are right.

Fareed Zakaria Time Magazine, Oct. 21, 2010

The American dream for me, growing up in India in the 1970s, looked something like the opening credits of Dallas. The blockbuster TV series began with a kaleidoscope of big, brassy, sexy images — tracts of open land, shiny skyscrapers, fancy cars, cowboy businessmen and the very dreamy Victoria Principal.

The term American Dream was coined during the Great Depression. The historian James Truslow Adams published The Epic of America in 1931, in an atmosphere of even greater despair than today's. He wanted to call his book The American Dream, but his publishers objected. No one will pay $3.50 for a book about a "dream," they said. Still, Adams used the phrase so often that it entered the lexicon.

Read more: www.time.com/

Top of page

Ur BORTOM KRISEN - Om ett framgångsrikt Sverige i den nya globala ekonomin

Ds 2009:21

Globaliseringens kraft har underskattats av världens politiska ledare.

Sveriges sårbarhet har inte tagits på tillräckligt allvar. Det som gynnat oss i uppgång kan slå hårt tillbaka i nedgång.

Skulle bara några av de storföretag som svarar för huvuddelen av vår export försvinna, rämnar en stor del av basen för vårt välstånd.

Vår union, EU, är inte en tillräckligt pålitlig kraft för fri handel med varor och tjänster

– skulden för att den senaste stora handelsförhandlingen, Doha-rundan, misslyckades åvilar delvis också EU.

Sverige ska vara Kunskapslandet, som också marknadsför sig som landet med Nobelpriset och forskningssatsningar i världstopp:

”The Knowledge Nation”, som också har förmågan att omsätta vetenskapliga resultat till produktion, ”The Land of Innovation”.

Kommentar av Rolf Englund:

Det låter ju bra, men klicka på länken ovan: Fredrik Häréns lysande tal på Kunskapens dag

20 år efter Tienanmen: Kina köper Hummer, Rolf Englund blog 2009-06-03

Since the start of the Great Recession in December 2007, the U.S. economy has shed 8.4 million jobs

and failed to create another 2.7 million required by an ever-larger pool of potential workers.

Robert Reich 12/4 2010

- Var det Hitlers fel att han fick så mycket applåder?

Vår tids rädsla för allvar

Hur ska vi skapa jobb när vi lägger ut allt arbete till arbetskraft i-fattigare länder?

Vi har svåra tider framför oss.

Roy Andersson intervjuad i SvD 2/1 2009

- Jag skäms nästan för medierna, till exempel. Bristen på allvar i TV och tidningar. Jakten på tittarsiffror. Anna Anka. Alla dessa fruktansvärda utslagningsprogram. Det är en skam.

Full text

Boken Vår tids rädsla för allvar, i samma anda som Åsa Mobergs Heder, Sanning och Rätt om Sverige i Andra Världskriget

Ur boken (s. 48):

- Var det Hitlers fel att han fick så mycket applåder?

Top of page

Davos 2012

BBC Davos 2012

CNBC Davos 2012

News

World Economic Forum, Davos 2010

BBC Special Report

The Death of Davos Man

Bruce Nussbaum Businessweek January 21, 2010

The Great Recession of the past two years is revealing that globalization, the economic ideology of Davos Man, was never more than a gloss over nascent nationalism. In the end, it is the nation-state and the local taxpayer that is saving the banks and businesses run by Davos Man from total destruction.

While globalization has clearly improved the lives of millions of Chinese, we can now see that it has also led to the immiseration of millions of middle class and poor Americans

Real US family income has not grown in two decades and is down 4% for the past 10 years.

Real earnings of full-time US workers with Ph.ds has fallen by 10% since 1990.

Davos Man now stands naked in front of the world, devoid of the mantel of superior economic theory /The efficient-markets hypothesis/ and absent the technical (certainly financial) skills required to guide the world economy.

Full text

Davos 2009

Top of page

The tendency of U.S. living standards to converge towards Brazilian ones is a product of globalization,

and a natural result of economic arbitrage in a world of excessive and growing population and ever-easier communications.

The world’s average GDP per capita, on a purchasing power parity basis, was $11,640 in 2011, just below Brazil’s $11,719, and somewhat below Bulgaria’s $14,603 or Malaysia’s $15,589.

Martin Hutchinson, November 12, 2012

If Brazilian labor is equivalent in quality and other factors of production to U.S. labor, then U.S. GDP per capita of $48,442 is bound to converge on it over time.

Full text

Top of page

For millions, the American Dream is fading.

The middle class – the core of the world’s largest economy – is being gutted

as incomes fall and once-reliable jobs disappear.

Global Post November 2012

Full text

Behind the drama in Europe lies a global crisis

The euro is under threat – along with our entire free-market system

In Washington the US Senate voted 94:0 to prevent IMF from using its cash to help countries that are inextricably trapped in a debt spiral.

Edmund Conway Daily Telegraph 19 May 2010

The truly significant questions about globalization, I think, are harder to answer.

Is an increasingly interconnected world economy basically stable?

Or does it generate periodic crises that harm everyone and spawn international conflict?

Robert J. Samuelson, Newsweek Jul 21, 2008 Issue

there is a general anxiety that we are in the grip of worldwide economic and financial forces that we do not understand and cannot easily control.

This sense of foreboding is not unreasonable.

Consumer confidence at its lowest point since 1952

with two exceptions (April and May 1980).

The expectation is for things to get worse.

People fear what they don't understand, and the global economy seems both mysterious and menacing.

Full text

Top of page

A recession of global dimensions?

U.S. consumers have the past six years been

the most maniacal spending machines the world has ever seen.

CNN, Geoff Colvin, senior editor-at-large, January 22 2008

Top of page

Investors fear a "black swan" catastrophic event in the financial markets right now more than ever before.

At least according to the CBOE Skew Index. Put simply, traders are buying options that pay off only if the stock market drops a whole lot.

CNBC 13 October 2015

Full text

This unusual options trade signals that Wall Street is bracing for a black swan

It is important to note that the CBOE SKEW differs from the so-called CBOE Volatility Index VIX, — another measure of implied volatility, known as the fear gauge.

The Vix stands at 17, well off its high of 52,

reached during the Wall Street rout back in August spurred by worries about petering economic growth in China, the world’s second-largest economy.

MarketWatch 14 October 2015

“Black Swan” events — those well outside an ordinary distribution of outcomes — that cause massive losses

Peddlers of tail-risk products like to compare them to insurance

The Economist print 24/3 2011

Interest is revving up again as revolutions in the Middle East and Japan’s earthquake have destabilised markets and increased volatility, leaving battered investors searching anew for protection.

Peddlers of tail-risk products like to compare them to insurance: investors pay premiums every year to avoid financial catastrophe later. Some even get philosophical. Vineer Bhansali of PIMCO, a big fund manager, has likened tail risk to Pascal’s wager—the argument that you’re better off believing in God than suffering the consequences of being wrong. The same is true with drastic dives in markets.

Full text

Top

What Nassim Taleb Can Teach Us

“I am as orthodox neoclassical economist as they make them, not a fringe heterodox or something.

I just do not like unreliable models that use some math like regression and miss a layer of stochasticity, and get wrong results, and I hate sloppy mechanistic reliance on bad statistical methods.

I do not like models that fragilize. I do not like models that work on someone's computer but not in reality.

This is standard economics.”

zerohedge 3 May 2017, Authored by Jeff Deist via The Mises Institute

For an excellent (albeit indirect) analysis of how Austrians and libertarians can advance their cause from a minority position,

Taleb’s recent article The Most Intolerant Wins: The Dictatorship of the Small Minority is a must-read.

Full text at zerohedge

Nassim Taleb at Google

Economic theory discredited

Top

For global financial markets, once-in-a-lifetime events are happening with such regularity that black swans may as well be white swans.

Such supposedly rare occurrences, brought into the national consciousness largely through Nassim Taleb’s 2007 book, “The Black Swan,” have dominated the markets for more than a decade.

CNBC 16/3 2011

Full text

Nassim Nicholas Taleb, renowned derivatives trader, university professor and author of "The Black Swan," warned

of the growing risk the nation has taken on as a result of poor decisions by the Fed and policymakers, including

trillions of dollars in taxpayer money funneled into bailouts of private industry.

"This transformation from private debt ... to public debt" is "bad" from a risk standpoint and "immoral"

Shahien Nasiripour Huffington Post 30/9 2010

Full text

Critics of “economic sciences” sometimes refer to the development of a “pseudoscience” of economics, arguing that it uses the trappings of science, like dense mathematics, but only for show.

For example, in his 2004 book Fooled by Randomness, Nassim Nicholas Taleb said of economic sciences:

“You can disguise charlatanism under the weight of equations, and nobody can catch you since there is no such thing as a controlled experiment.”

Robert J. Shiller, Project Syndicate, 6 November 2013

Moral Hazard

Top

The economic situation today is drastically worse than a couple years ago,

and the euro is doomed as a concept,

Nassim Taleb, professor and author of the bestselling book "The Black Swan,"

CNBC 10 June 2010

"We had less debt cumulatively (two years ago), and more people employed. Today, we have more risk in the system, and a smaller tax base," Taleb said

"Banks balance sheets are just as bad as they were" two years ago when the crisis began and "the quality of the risks hasn't improved," he added.

Full text

Finanskrisen - Nejtillemu.com

We have two options. The first is to deflate debt, the other is to inflate assets

The core of the problem, the unavoidable truth, is that our economic system is laden with debt,

about triple the amount relative to gross domestic product that we had in the 1980s.

Nassim Nicholas Taleb and Mark Spitznagel, FT July 13 2009

The complexity created by globalisation and the internet causes economic and business values (such as company revenues, commodity prices or unemployment) to experience more extreme variations than ever before.

Our ability to forecast suffers due to this complexity and the occurrence of the occasional extreme event, or “black swan”.

Such degradation in predictability should have made companies more conservative in their capital structure, not more aggressive

– yet private equity, homeowners and others have been recklessly amassing debt.

Such non-linearity makes the mathematics used by economists rather useless. Our research shows that economic papers that rely on mathematics are not scientifically valid. Not only do they underestimate the possibility of “black swans” but they are unaware that we do not have any ability to deal with the mathematics of extreme events. The same flaw found in risk models that helped cause the financial meltdown is present in economic models invoked by “experts”. Anyone relying on these models for conclusions is deluded.

We have two options. The first is to deflate debt, the other is to inflate assets (or counter their deflation with a collection of stimulus packages.)

Asking the economics establishment for guidance (particularly after its failure to see the risk in the economy) is akin to asking to be led by the blind – instead we need to rebuild the world to make it resistant to the economist’s mystifications.

Full text

What I hear more and more, both from bankers and from economists, is that the only way to end our financial crisis is through inflation.

Their argument is that high inflation would reduce the real level of debt, allowing indebted households and banks to deleverage faster and with less pain.

The advocates of such a strategy are not marginal and cranky academics. They include some of the most influential US economists.

Wolfgang Münchau, Financial Times, May 24 2009

Top

There is nothing particularly new about the most recent financial crisis

We refer to them as being "white swan events"

to compare them with the idea of a black swan event that has been popularized by my friend Nassim Taleb.

Nouriel Roubini, Motley Fool May 14, 2010

Roubini's new book is Crisis Economics: A Crash Course in the Future of Finance,

which he co-authored with Stephen Mihm.

What surprised me the most was that when you look, historically, you see a pattern of crisis occurring with similar pattern - asset bubbles, leverage, risk taking, and so on, and we seem like we're never learning from history.

It's not just a random outcome of a distribution with a fat tail of a financial crisis. It's the result of a buildup of macro financial policy vulnerabilities - asset bubbles, booms that are followed by leveraging up of the private sector and the public sector - and eventually, the bust and the crash come.

So in some sense, they are white swans in the sense of being predictable, but it seems like people never learn from experience.

Full text

Finanskrisen

Top of page

Det är ironiskt att Nassim Nicholas Taleb vunnit världsrykte för att han förutspådde finanskrisen när hans stora poäng är att det är omöjligt att göra prognoser.

Men han har gång på gång påpekat att finanskrisen alls inte är någon svart svan, utan en helt vit svan.

The Times utnämnde honom till »the hottest thinker in the world« i en stort uppslagen artikel i somras.

Fokus 12/12 2008

Våren 2007 gick han i boken »The Black Swan« till frontalangrepp mot alla som tror att världen är begriplig och förutsägbar. I årtusenden var svanen en vit fågel i Europa, ända till de första européerna såg en svart svan i Australien. Världen präglas enligt Taleb av sådana oväntade och omvälvande svarta svanar, det gäller allt från terrordåd som 11 september eller upptäckten av penicillinet. Särskilt hårt angrep han ekonomer som ägnar sig åt finansiell riskbedömning eftersom de enligt honom vägrar att inse att världen inte är så välordnad och förutsägbar som deras modeller låter påskina. De statistiska modellerna kan inte fånga de sällsynta och omstörtande händelserna och när de väl inträffar blir följderna lätt katastrofala.

Företaget Universa, där Taleb verkar som rådgivare, gör investeringar baserade på teorin att ovanliga händelser och stora kursrörelser är vanligare än vad investerare i allmänhet tror och därför prissätts fel.

Han ger Nobels ekonomipriskommitté en släng av ansvaret för finanskrisen eftersom kommittén »gjort charlataner respekterade« genom att ge dem Nobelpris.

/RE: t ex Robert Lucas/

Full text

It was two years ago that Nicholas Taleb wrote those words in his book The Black Swan:

The increased concentration among banks seems to have the effect of making financial crisis less likely, but when they happen they are more global in scale and hit us very hard. We have moved from a diversified ecology of small banks, with varied lending policies, to a more homogeneous framework of firms that all resemble one another. True, we now have fewer failures, but when they occur ….I shiver at the thought.

James Quinn, September 22, 2008

They know nothing! They know nothing!”

These were the words of Jim Cramer just one short year ago. He was referring to the Federal Reserve, but today those words apply to the Federal Reserve, Treasury, Congress, CEOs, financial gurus, Larry Kudlow, Ben Stein, fund managers, and average Americans.

Anyone who tells you confidently what will happen tomorrow, next week, or next year is either a fool or a liar.

There are both positive and negative Black Swans. Examples of positive Black Swans are the invention of the Internet, planes, automobiles, and discovery of penicillin.

Full text

Black Swan

What happens if you add 3 billion new people (in a very short time) to the internet, and increase the bandwidth available to everyone by a factor of 20 today with a potential for a factor of 100 in the near future?

John Mauldin's Weekly E-Letter 11/5 2007

"What we call here a Black Swan (and capitalize it) is an event with the following three attributes.

"First, it is an outlier, as it lies outside the realm of regular expectations, because nothing in the past can convincingly point to its possibility.

Second, it carries an extreme impact.

Third, in spite of its outlier status, human nature makes us concoct explanations for its occurrence after the fact, making it explainable and predictable."

- Nicholas Nassim Taleb

Tom Friedman tells us that the internet, global outsourcing and a lowering of trade barriers all have increased competition and global trade to the point where the world is flat. I would contend that the world is still rather bumpy, but will soon be getting much flatter than Friedman or almost anyone today can imagine.

Full text

The Black Swan: The Impact of the Highly Improbable

by Nassim Nicholas Taleb

$700 billion rescue plan

Top of page

We have Tom Friedman with us this afternoon, to talk about his new book, The World Is Flat.

YaleGlobalOnline

Perhaps you’ve never heard of Stan Shih, but in Asia, he is a rock star capitalist –the founder of Acer Computer, a genius business theorist and now a hotshot VC.

Global wage arbitrage is not just about manufacturing,

The US has no intrinsic brainpower advantage, The smile curve is flattening

The idea that "The U.S. will remain strong in "right brain" work that entails "artistry, creativity, and empathy with the customer that requires being physically close to the market." is pure arrogance.

... Some have proposed that education is the answer. That presumes China and India and other countries are standing still. But India and China are not standing still. They are churning out engineers and PHDs faster than the US.

Michael Shedlock, 25/4 2007

Economists who insist that "offshore outsourcing" is just a routine extension of international trade are overlooking how major a transformation it will likely bring - and how significant the consequences could be.

The governments and societies of the developed world must start preparing, and fast.

Alan S. Blinder Foreign Affairs, March/April 2006

- Konjunkturen är den starkaste vi sett sedan 1970-talet, men det är ett cykliskt fenomen.

Just nu känns inte globaliseringsdebatten lika ödesmättad som för några år sedan, och det är ju för att boomen döljer den underliggande trenden.

Men trenden är tydlig. Västeuropa har ett enormt problem med arbetslöshet och undersysselsättning.

Problemen är särskilt allvarliga i de stora länderna i Kontinentaleuropa,

alltså Tyskland, Frankrike och Italien, men de finns också i ert land.

Hans-Werner Sinn, Affärsvärlden april 2007

Top of page

Globalisation

How to promote employment while protecting the low-paid

The Globalization of Labor, IMF World Economic Outlook

Martin Wolf, FT, April 11 2007

The subject is the focus of a background chapter to the latest World Economic Outlook from the International Monetary Fund.

The Globalization of Labor, World Economic Outlook, April 2007.

The right policy is to promote employment while augmenting the incomes of the low-paid or at least sharply reducing the taxation of labour.

It is also to promote the highest quality of basic education across the labour force and provide good opportunities for motivated workers to upgrade their skills.

The right policy is to combine openness to trade with a politically acceptable sharing of the gains in high-income countries. The challenge is huge. But it is one at which we cannot afford to fail.

Full text

More by Martin Wolf

Olof Ehrenkrona nyutnämnd ambassadör

som Carl Bildts rådgivare i globaliseringsfrågor.

Bunkergänget

Top of page

Tomorrow belongs to someone else

The inter-generational clash between the interests of those who have already grabbed the rewards of postwar prosperity and the young people now expected to support them in retirement.

There is nothing to say that globalisation will be forever.

Philip Stephens, Financial Times 20/2 2007

David Willetts is one of the few politicians ready to address the issues. The Tory education spokesman, a rare politician who combines intelligence with common sense, has given several thoughtful speeches about “the biggest, most powerful, most prosperous group in Britain today – the baby boomers”. One of

Mr Willetts’ themes is that the Conservatives, too long trapped in the past, should recast themselves as the champion of future generations. He wants the baby boomers to step up to their responsibilities.

Half of Britain’s £6,000bn of financial wealth, he points out, is in housing. Who owns it? The baby boomers. What is more, they bought their property cheaply and then saw their borrowings written off by high inflation. Half of the rest of this wealth lies in funded pension schemes. The beneficiaries? A postwar generation that now intends to exchange the security of jobs for life for over-generous retirement incomes.

The widening gap between richest and poorest is producing a growing sense that globalisation is not fair. Politicians have begun to take notice. Rightly so. Today’s inequality is tomorrow’s social immobility. Rising crime increasingly marks out communities left behind by the global economy. There is nothing to say that globalisation will be forever.

Full text

Top of page

Book review:

The Writing on the Wall: China and the West in the 21st Century by Will Hutton

Hutton takes on the most important political and economic story of our time. He has also produced a thought-provoking, wide-ranging and largely correct analysis.

The book advances five fundamental and, in my view, fundamentally correct propositions.

First, for all its manifest achievements, the Chinese attempt to marry a communist party-state with the market is unsustainable.

Martin Wolf 4/2 2007

The enlightenment values of reason, pluralism, freedom and equality

Hutton still finds it difficult to admit that the idea of a self-regulating market economy is itself one of the greatest achievements of the enlightenment. I believe, too, that he is far too pessimistic about the US. Corrective forces are already at work in that greatest of republics.

Full text

The book at Amazon

More by Martin Wolf

Top of page

The People's Bank of China (PBOC), the nation's central bank, is capable and well-respected around the world.

However, monetary policy can work well only to the extent that financial markets are sufficiently developed to allow the monetary authorities' interest-rate decisions to affect economic activity in a reasonably predictable way.

Chairman Ben S. Bernanke, Chinese Academy of Social Sciences, 15/12 2006

Top of page

Under de närmaste två decennierna kommer Sverige att möta tre fundamentala ekonomiska utmaningar - globaliseringen, konsekvenserna av den svenska befolkningens åldrande och omställningen av vårt energisystem.

Dessa utmaningar kräver drastiska omställningar för att rädda jobben och säkra välfärden.

Börje Tallroth, SvD Brännpunkt 10/9 2006

Vad som gör dessa utmaningar så formidabla är att de möter Sverige mer eller mindre samtidigt - under de närmaste två decennierna. Det råder inte heller någon osäkerhet om de krafter som är i rörelse. Mot denna bakgrund förväntar man att debatten inför riksdagsvalet borde handla om hur blocken avser att hantera dessa utmaningar. I stället gör partierna utspel, som är dåligt anpassade till de ekonomiska realiteter som väntar Sverige.

Full text

Top

How globalisation is shifting France’s political faultline

John Thornhill, Financial Times, 29/5 2006

The study, conducted by Telos, an online think-tank, and Sciences Po university in Paris, suggests that in next year’s presidential and parliamentary elections French voters are likely to be presented with a stark ideological choice.

Will French voters endorse the promise of market reform and the opportunities thrown up by globalisation or will they defend the singularity of the French social model, with its reliance on a strong public sector and an extensive welfare state? The outcome could have enormous significance for the French economy and society and for the European project as a whole.

Whereas 70 per cent of the governing UMP party deputies attribute France’s high unemployment rate to the inflexibility of its labour market, 71 per cent of Socialist MPs blame it on the direct or indirect impact of global competition. Whereas 43 per cent of UMP deputies say that globalisation is mostly a positive phenomenon, only 5 per cent of Socialists agree.

According to Zaki Laïdi, the founder of Telos who conducted the study, the centre of gravity in the UMP party has shifted markedly towards the “liberal” right under the leadership of Mr Sarkozy, while that of the Socialist party has veered towards the “anti-liberal” left following the rejection of Europe’s constitutional treaty in a national referendum exactly a year ago today.

The paternalistic and nationalist strains of the Gaullist right – as embodied by President Jacques Chirac – appear to be fading fast while the more economically liberal wing of the party led by Mr Sarkozy is in the ascendant.

Full text

Det finns ingen anledning att tro att löner och arbetsvillkor kommer att försämras kraftigt som en följd av förändringarna på den kinesiska arbetsmarknaden

DN-ledare 28/5 2006

Vad betyder då detta för jobben hemma i Sverige? Med all säkerhet en omställning, i vilken många traditionella industri- och tjänste-arbeten försvinner eller flyttar. Men alls inte i den omfattning eller med de negativa konsekvenser som en del hävdat.

Varningarna för utflyttning till lågkostnadsländer har varit kraftigt överdrivna, vilket ekonomen Karolina Ekholm visar i den pedagogiska skriften "Ordning och reda om outsourcing" (SNS).

Det finns heller ingen anledning att tro att löner och arbetsvillkor kommer att försämras kraftigt som en följd av förändringarna på den kinesiska arbetsmarknaden. Erfarenheten tyder tvärtom på att vi har allt att tjäna på fortsatt och fördjupad integration av världsekonomin.

Full text

Början på sidan/Top of page

Att Sverige skulle stå inför en närmast ödesbestämd utveckling mot sänkta löner och arbetsvillkor avfärdar LO-ekonomerna med att effekten av internationaliseringen skiljer sig åt mellan olika länder.

Utfallet bestäms av faktorer som kan påverkas med politiska verktyg. Det handlar bland annat om den grundläggande utbildningen, arbetskraftens förmåga, kollektivavtalens inriktning och innovationspolitiken.

LO 22/5 2006

Full text

I think it important to recognize that General Motors is a canary in this country’s economic coal mine; a forerunner for what’s to come for the broader economy

Bill Gross, Pimco, May 2006

"Är detta ett hot eller en möjlighet?"

I Ekonomisk debatt (1/2006) skrev nationalekonomerna Mats Persson och Marian Radetzki att den globala utbudsökningen kan leda till fallande reallöner i västvärlden.

Andreas Hedström, SvD ledarsida 28/4 2006

Men enligt Karolina Ekholm, docent vid Handelshögskolan i Stockholm och forskningsledare på Studieförbundet näringsliv och samhälle (SNS), råder det fortfarande stor osäkerhet om globaliseringens effekter på svensk arbetsmarknad.

Professor Lars Calmfors håller med Ekholm. Globaliseringen har inte skapat sysselsättningsproblem i Sverige, men den kan göra det i framtiden. Därför behövs det en större satsning på utbildning och - i syfte att öka löneflexibiliteten - skattelättnader för lågavlönade.

Full text

Och då väljer de flesta nationalekonomer att blunda

för teoremet, och/eller att krångla till ytterligare, så att lönenivån inte

nödvändigtvis behöver falla - och sedan slår de sig till ro. Varpå sjukskrivningarna,

skatterna och riksbankspolitiken fortsätter att dominera våra ledande debattfora och

tankesmedjor, också inom den nationalekonomiska professionen."

Mats Persson och Marian Radetzki i Ekonomisk Debatt

Ekonomi är inget nollsummespel.

Det är allt annat än självklart att höjd levnadsstandard i Asien ska leda till minskad välfärd i Sverige.

Andreas Hedström, SvD ledarsida 7/3 2006

Few things can fill the Anglo soul with such warm happiness as the sight of the French getting hysterical in public. Parisian riots are of a marvellously win-win proposition.

The dishonest, arrogant, self-interested, lazy baggage handlers, ticket collectors, air-traffic controllers, protected peasants and nihilistic, drivel-ranting students all get doused, bashed and gassed while the repellent attack dogs of the state, the CRS, get cobblestoned and bricked.

As an added pleasure there is the humiliation of the government.

AA Gill, The Sunday Times 9/4 2006

The Race to the Bottom:

Why a Worldwide Worker Surplus and Uncontrolled Free Trade Are Sinking American Living Standards

Book by Alan Tonelson

Blue-collar workers in factories have long been on the front line in facing global pressures. White-collar workers in services-based enterprises have not. That was then. The rules of engagement on the battleground of globalization have changed. Like manufacturing, the services economy is now on the leading edge of feeling the stresses and strains of an increasingly competitive and open world economy.

This is an extraordinary development in the continuum of economic history.

Stephen Roach, March 2006

How can the world's rich countries compete with the rising Asian powers? Not only do the latter possess vast reservoirs of cheap and hard-working labour, but they are rapidly upgrading their exports.

Soon, it is alleged, the Asian giants will undercut every producer located in rich countries.

The view that the Asians will simply end up more competitive in everything is absurd. What, then, is the true impact of the labour supply shock?

Martin Wolf, Financial Times 15/3 2006

This time, it is an expansion in the effective labour supply, which has tripled over the past two decades, according to Richard Freeman of Harvard University

In an integrated world economy, suggests Helmut Reisen of the Organisation for Economic Co-operation and Development, equilibrium real wages in high-income countries should fall by about 15 per cent.**

The end result is likely to be employment of unskilled labour almost exclusively in the production of non-tradeable goods and services. But provided controls are maintained on immigration of unskilled labour, that need be no disaster.

The end result is likely to be employment of unskilled labour almost exclusively in the production of non-tradeable goods and services. But provided controls are maintained on immigration of unskilled labour, that need be no disaster.

Full text

Globaliseringen och lönerna.

Nationalekonomer om framtiden som politikerna inte vill ha eller höra talas om.

Godmorgon Världen 12/3 2006

Globaliseringen får mycket svårare konsekvenser än vad nästan alla ekonomer tror, hävdar professorerna Mats Persson och Marian Radetzki

Johan Schück, DN 8/1 2006

En omvälvande förändring pågår i världen, utan att de akademiska ekonomerna inser det.

Det nya är att låglöneländerna Kina och Indien, med sina stora befolkningar, får tillträde till den globala ekonomin på alla nivåer. De nöjer sig inte längre med att ta över enkla uppgifter, utan konkurrerar snart lika mycket på marknaden för högutbildade.

Jobb har slagits ut även tidigare, till exempel då textilindustrin och skeppsvarven flyttade utomlands. Men då gällde det en strukturomvandling där enskilda branscher kunde ersättas av andra, med mer kvalificerat innehåll.

Att sänka fastställda löner är dock inte det enklaste, vare sig i Sverige eller andra länder. Men det viktigaste är inte de nominella lönerna, utan att reallönerna justeras ner, anser Mats Persson och Marian Radetzki. De tror inte att det räcker med de ofta upprepade recepten om ökad utbildning, mer forskning och utveckling eller förbättrat företagarklimat.

Full text

Marian Radetzki Home page

Marian Radetzkis bok "Sverige! Sverige! Fosterland?" ställer viktiga frågor om integrationen i personlig relief. Djupt lojal med Sverige men ändå med den utanförståendes skarpa blick pekar han på ihåligheten i svensk välfärd, ineffektiviteten i svensk u-hjälp och bristerna i svensk miljöpolitik.

Thure Stenström, SvD kultur 2/2 2006

Nästan alla ekonomer underskattar effekterna av globaliseringen, hävdade professorerna Mats Persson och Marian Radetzki i måndagens DN. Deras budskap till kollegerna var tydligt: i stället för att intressera sig för sjukskrivningar, a-kassor och styrräntor borde de oroa sig för vad som händer i den globala ekonomin.

Det vore välgörande om någon eller några tog upp den handske som Radetzki och Persson kastat. Litet talar nämligen för att deras förutsägelser är korrekta.

DN-ledare 14/1 2006

Enligt Persson och Radetzki väntar svåra tider för dem som arbetar i västvärlden, inklusive Sverige, som en följd av att "hundratals miljoner människor i Kina och Indien på kort tid blir tillgängliga för världsmarknaden". I konkurrensen på den globala arbetsmarknaden kan svenska löntagare tvingas välja mellan lägre reallöner och arbetslöshet. Så lyder i sammanfattning domedagsprofetian, som utvecklas i en kommande artikel i tidskriften Ekonomisk Debatt

Full text