Rolf Englund, Den Stora bankkraschen

Timbro, 1983

News

Index - 1992 - EMU

Economics - US Dollar - Finanskrisen - Houseprices - Contact

Basel

Rolf Englund blog 13 augusti 2013

Should stresses emerge, market liquidity will evaporate again:

the insidious illusion of permanent liquidity has not gone away.

Agustín Carstens, general manager of the Bank for International Settlements, FT 25 June 2018

insidious = proceeding in a gradual, subtle way, but with very harmful effects.

Banks may be disguising their borrowings

with debt ratios falling within limits imposed by regulators just four times a year.

Bloomberg 24 June 2018

Lenders use repurchase agreements -- known as repos -- to massage down their assets as reporting dates approach, typically as quarters end,

the Bank for International Settlements said in its Annual Economic Report.

Banks today are much better capitalised than before, and much of the risky lending is now occurring in the non-bank world,

namely by hedge funds, private equity groups and mutual funds. But that is not a reason to relax.

Gillian Tett FT 26 April 2018

To protect the economy from future mega-bank failures, much more work needs to be done.

Mark Roe, professor at Harvard Law School, Project Syndicate 17 April

Under the current plan, certain creditors are designated in advance to absorb a failed bank’s losses once the equity is wiped out. Those creditors’ debts are thus riskier, and should be more expensive to the bank than the debt that is not designated to be turned into equity.

Yet the Fed economists conclude that, in the market, this is not the case. Why?

The third explanation is more ominous. Maybe financial markets understand the plans, but don’t (yet) find them credible.

Weekend restructuring of mega-banks has never been tried, and commentators still see potential hurdles to overcome. Maybe knowledgeable investors assume that, ultimately, banks and the government will not treat the designated loss-absorbing creditors any differently than others.

Either everyone will go down, or everyone will get bailed out.

Mark Roe: the global financial system is no safer today than it was in 2007. Febr 2017

Taken together, existing capital requirements and stress tests still aren't enough to prepare banks for a real crisis.

As soon as people start to think a bank is going bust, it’s doomed.

So it needs enough equity to absorb severe losses and continue operating.

Bloomberg Editorial 16 April 2018

The largest institutions currently have as little as $6 in equity for each $100 in assets.

Research by the Minneapolis Fed suggests that they would need more than twice that amount to make disaster acceptably unlikely.

Top of pageThe revised Basel bank-capital standards are complete at last

But have Europe’s banks got off lightly?

The Economist print 14 December 2017

Europe’s banks are stronger than they were, but not strong enough

The Economist print 30 November 2017

Banking remains far too undercapitalised for comfort

Leverage ratios closer to 5:1 will help give creditors confidence in liabilities

Martin Wolf, FT 21 September 2017

The most important purpose of money is to serve as a safe source of purchasing power in an uncertain world. Unimpeachable liquidity is money’s point.

Yet bank money is least reliable when finance becomes most fragile.

This system is designed to fail.

To deal with this difficulty, a source of so much instability over the centuries, governments have provided ever-increasing quantities of insurance and offsetting regulation.

The insurance encourages banks to take ever-larger risks

Senior officials argue that capital requirements have increased 10-fold.

Yet this is true only if one relies on the alchemy of risk-weighting.

In the UK, actual leverage has merely halved, to around 25 to one.

In brief, it has gone from the insane to the merely ridiculous.

The Bankers' New Clothes: What's Wrong with Banking and What to Do about It

The risk-weighted Basel capital adequacy regime, despite post-crisis tweaking, is fundamentally flawed.

Sovereign debt enjoys excessively favourable treatment so eurozone banks stuff their balance sheets

with the IOUs of seriously over-indebted governments.

John Plender, FT 6 August 2017

A parallel problem in the English speaking countries is the excessively favourable treatment of mortgage debt,

which encourages asset price bubbles and puts home ownership out of reach for young people.

Hushållens höga och stigande skuldsättning utgör ett allvarligt hot mot den finansiella och den makroekonomiska stabiliteten.

Det finns även sårbarheter i det svenska banksystemet och dess motståndskraft behöver därför stärkas.

Det gäller såväl bankernas förmåga att hantera likviditetsrisker som deras kapitalnivåer.

Samtidigt är det nödvändigt att Riksbanken har en tillräckligt stor valutareserv om det uppstår likviditetsbehov i utländsk valuta som inte bankerna själva kan hantera.

Riksbanken Finansiell Stabilitet 24 maj 2017

Revised international rules, known as Basel 3 (still a work in progress),

have forced banks to bulk up, adding equity and convertible debt to their balance-sheets.

The idea is that a big bank should be able to absorb the worst conceivable blow

without taking down other institutions or needing to be rescued.

The Economist 6 May 2017

Deutsche Bank Seeks $8.6 Billion Selling Shares at 35% Discount

Bloomberg 19 March 2017

The global financial system is no safer today than it was in 2007.

If those who use overnight mortgage pools receive priority over other creditors, as is the case today...

Mark Roe, professor at Harvard Law School, Project Syndicate, 31 January 2017

Basel

Sweden also has objected to the 75 percent floor

because its banks have bigger holdings of mortgages than those in other countries.

Sweden’s historically stable housing market makes such mortgages less risky than what standardized formulas suggest, Swedish regulators and banks have argued.

Bloomberg 3 January 2017

Deutsche Bank AG, UniCredit SpA and eight other European Union banks

would fall short of the European Central Bank’s capital demands on Banca Monte dei Paschi di Siena SpA

Bloomberg 30 December 2016

The ECB told Monte Paschi it needed enough capital to push its common equity Tier 1 ratio to 8 percent of risk-weighted assets in the adverse scenario of the stress test

Top of pageJust €300bn

Study shows 133 banks will have to issue no more than €300bn to meet capital standards

FT 14 December 2016

The European Banking Authority has dramatically reduced its estimates of the extra financing banks must raise to meet new standards on loss absorbing capital.

The EBA had estimated back in July that EU banks would have to raise as much as €790bn to meet the new rules, but a new impact study shows that the 133 banks will have to issue no more than €300bn in the worst case scenario.

Top of pageStorbankerna är skyldiga att hålla en viss mängd tillgångar som ses som likvida, som alltså enkelt kan säljas vid behov.

Bankernas så kallade likviditetsreserver består till stor del av andra bankers bostadsobligationer,

ett korsägande som kritiserats av bland annat internationella valutafonden.

SvD Louise Andrén Meiton 12 december 2016

Basel - Italy MPS

EU reform was supposed to make investors shoulder bank rescue costs.

But it has struggled to overcome one big hurdle: politicians seem unwilling to implement it.

FT 6 December 2016

The coming days will be crucial for the future of the European economy.

The Basel Committee on Banking Supervision will officially present its final set of proposals on capital requirements for the banking sector,

known as the Basel IV framework.

Frédéric Oudéa, FT 28 November 2016

The writer is president of the European Banking Federation

The Basel Committee is targeting the degree of variability in how banks define the risks that ultimately determine their capital requirements.

Top of pageSwedish sentiment is nothing compared with the opposition Mr Ingves is facing in his other job,

as head of the Basel Committee on Banking Supervision.

There, he is pushing hard to finalise another leg of post-crisis global financial reform.

FT 17 October 2016

Risky banks face higher capital needs from latest Basel reforms

FT 7 October 2016

Central banks would still act as lenders of last resort.

But they would no longer be forced to lend against virtually any asset, since that very possibility must create moral hazard.

Lord Mervyn King, former governor of the Bank of England. His book is called The End of Alchemy.

Martin Wolf, FT 31 May 2016

We are still groping for truth about the financial crisis

It has been eight years since Lehman Brothers went bankrupt and still it defines the calendar.

For anyone in the financial world, time is divided into Before Lehman, and After Lehman.

John Authers, FT 16 September 2016

The latest progress reports from the Financial Stability Board (FSB) in Basel

outline definite improvements in stability-enhancing financial regulations in 24 of the world’s largest economies.

Their “Dashboard” tabulates progress in 14 different regulatory areas.

Robert J. Shiller, Project Syndicate 18 May 2016

FSB gives high marks for all 24 countries in implementing the Basel III risk-based capital requirements.

But the situation is not altogether reassuring. These risk-based capital requirements may not be high enough, as Anat Admati and Martin Hellwig argued in their influential book The Bankers New Clothes.

And there has been much less progress in a dozen other regulatory areas that the FSB tabulates.

Money market funds are an alternative to banks for storing one’s money, offering somewhat higher interest rates,

but without the insurance that protects bank deposits in many countries. As with bank deposits, investors can take their money out at any time.

And, like bank deposits, the funds are potentially subject to a run if a large number of people try to withdraw their money at the same time.

The day after the Lehman Brothers bankruptcy was announced, a major United States money market fund, Reserve Primary Fund, which had invested in Lehman debt,

was in serious trouble. With assets totaling less than it owed to investors, the fund seemed to be on the verge of a run.

As panic rose among the public, the federal government, fearing a major run on other money market funds, guaranteed all such funds for one year,

starting September 19, 2008.

In the 2008 angry zeitgeist, the public reaction to a relatively minor event took on stunning proportions.

It took almost six years after the crisis for the US Securities and Exchange Commission to reduce money market funds’ vulnerability,

by requiring in 2014 a “floating NAV” (net asset value),

which means that prime money market funds no longer promise to pay out a dollar for a dollar’s nominal value.

Eight years after triggering a crisis that nearly brought down the global financial system, the United States remains plagued by confusion about what reforms are needed to prevent it from happening again.

What Americans are sure about is that they are angry with the financial sector.

This is reflected in the success of recent Hollywood movies such as The Big Short

Jeffrey Frankel, a professor at Harvard University, Project Syndicate 24 Febr 2016

Stocks Tumble After Fed Plans Too-Big-To-Fail Bank Counterparty Risk Cap

The Fed proposed a rule that would limit banks with $500 bln or more of assets from having net credit exposure

to a “major counterparty” in excess of 15% of the lender’s tier 1 capital.

zerohedge 4 March 2016

What is 'Tier 1 Capital'

investopedia.com

Basel

Bank turmoil:

are Europe’s new bail-in rules to blame?

FT, February 11, 2016

Known in EU jargon as the Bank Recovery and Resolution Directive,

the legislation is the centrepiece of efforts to avoid a repeat of the €1.6tn of taxpayer support

to banks during the 2008 financial crisis.

Deutsche Bank Co-Co bond yields hit 12%

Rolf Englund blog 8 Febr 2016

Bank debt capital issuance has touched an all-time high

as new rules in the aftermath of the global financial crisis have prompted global financial institutions to shore up their balance sheets

with unprecedented volumes of subordinated bonds.

Finanacial Times, January 19, 2015

Global banks more than doubled debt issuance to $274.5bn last year driven by a sixfold rise in Asian bonds, according to Dealogic.

The debt flurry was driven by Basel III rules stipulating that banks must hold capital, a mix of equity and debt which can potentially incur losses,

equivalent to a minimum of 8 per cent of risk-weighted assets.

“We have a lacuna in financial regulation — the assumption behind the fair value accounting standards and regulatory capital is

that the values used by institutions are comparable — it would seem that they are not!”

Sir David Tweedie, chairman of the International Valuation Standards Council, FT 4 December 2014

Investors and regulators are closely watching bank balance sheets as the Basel III reforms to improve global financial stability

require that banks improve their equity buffers and reduce leverage.

“We need to nail this before we have another disaster ...

It’s a potential threat to financial stability and can’t be allowed to continue,” Sir David told the Financial Times.

It is with regret and sadness we announce the death of money on November 16th 2014 in Brisbane, Australia

G20 will announce that bank deposits are just part of commercial banks’ capital structure,

and also that they are far from the most senior portion of that structure.

With deposits then subjected to a decline in nominal value following a bank failure, will some investors prefer banknotes to bank deposits?

Such a change in preference is known as a "bank run."

Russell Napier of ERIC, via zerohedge, 11 November 2014

As ever, there is a first-mover advantage.

There are only about 600 million 500 Euro notes available, though sizeable arbitrage profits still exist on warehouses full of 200 Euro notes.

As the function of such warehouses is focused on the role of money as a store of value, a role no longer fulfilled by the large-scale deposit,

one should expect a premium to develop, and potentially a secondary market in note-filled, well-protected warehouses.

For warehouses full of German Euro notes - those are the ones with a serial number beginning in X - a particularly high premium may arise

due to risks of a future Euro break-up.

"extend and pretend/delay and pray"

Bank stress tests an unconvincing fudge

Willem Buiter, FT 30 October 2014

A future crisis is likely to unfold as follows.

New institutional arrangements and banking regulations have altered market structures in ways likely to amplify shocks in a future financial crisis.

Designed to address problems exposed by the global financial crisis and to reduce instability, new initiatives may have done the reverse.

Satyajit Das, FT October 29, 2014

Systems flooded with cash can sometimes freeze.

Having lots of money in the system does not guarantee that funding will flow freely

Gillian Tett, FT October 16, 2014

Shadow banks

One example is the operation of so-called repo markets, where banks lend to so-called shadow banks,

such as hedge funds, against the security of bonds.

BBC 14 October 2014

Basel

Given the enormous social and economic costs when high levels of mortgage debt meet a crash in house prices,

one would expect regulators to be fully engaged on the issue.

Unfortunately, they are not.

Amit Tyagi, Vice President and Head of Group Credit Risk and Portfolio Management at the National Bank of Abu Dhabi, Project Syndicate, 9 September 2014

Although the Basel Committee on Banking Supervisio proposed reforms after the 2008 crisis that are aimed at strengthening the financial system, mortgage regulations have changed little.

The key to mortgage regulation is the concept of “risk weight,” a measure that increases with the probability that a borrower will default. For example, a loan to AAA-rated Microsoft has a 0% risk weight, meaning that it is virtually risk-free. A loan to the Indian government will have a risk weight of 50%.

When it comes to mortgages, the standard risk weight is 35% (down from 50% a decade ago).

"not only too big to fail, but too big to rescue"

There is a time-honoured way of protecting taxpayers from picking up the bill for the failure of a systemically important financial institution.

It involves central banks and finance ministries pressing a better capitalised bank to absorb the ailing business through an arranged merger.

Yet it is becoming clear that this tool of crisis management can no longer be put to use,

raising questions about the authorities’ ability to stabilise the financial system in a crisis.

John Plender, FT, September 1, 2014

Equally important is the problem of banks that are not only too big to fail, but too big to rescue

because their liabilities are so big that the government lacks the fiscal capacity to stand behind them.

The devastation wrought by oversized banks in Ireland and Iceland offers a stark lesson.

A paradox at the heart of this new approach to systemic crises is that bailing in creditors is likely to have far-reaching effects because,

unlike a bailout, it will inflict losses on other systemically important financial institutions... This is a recipe for panic.

Basel, Stresstester och kapitaltäckningsregler

Robert Jenkins, Financial Times, August 27, 2014

Highly Recommended

After all, if the Basel regulations are right, why bother with stress tests?

If bank risk-taking is now supported by sufficient loss-absorbing equity, why is it necessary to check that the banks can absorb the losses they might soon have to take?

Robert Jenkins is a senior fellow at Better Markets. He recently served on the Financial Policy Committee of the Bank of England

Back in 1856 one of this newspaper’s editors, Walter Bagehot:

the need for central banks to rescue banks during crises. But the bail-out charges should be punitive.

The Economist editorial, 12 April 2014

Given not only the inevitability of such moments of panic but also finance’s systemic role in the economy, a government had to devise some special rules to make finance safer.

That toughness rested on the view that governments should as far as they could treat financiers like any other industry, forcing bankers and investors to take as much of the risk as possible themselves.

The more the state protected the system, the more likely it was that people in it would take risks with impunity.

In America a citizen can now deposit up to $250,000 in any bank blindly, because that sum is insured by a government scheme:

what incentive is there to check that the bank is any good?

Most countries still encourage firms and individuals to borrow by allowing them to deduct interest payments against tax.

The mortgage-interest subsidy in America is worth over $100 billion.

Too big to Fail

Global banks can no longer assume continuing access to the Federal Reserve’s discount lending window

as an element of their living wills

FT 17 August 2014

Biggest US banks forced to hold $68bn in extra capital

US regulators have held out the prospect of more draconian measures after ratcheting up capital requirements for the biggest US banks

– from JPMorgan Chase to Goldman Sachs – forcing them to hold at least $68bn in additional capital.

A new “leverage ratio” will force the eight largest US banks to hold a minimum of 5 per cent equity to total assets to absorb losses in a crisis and proposes adopting a more stringent way of calculating the rule.

FT April 8, 2014

Of 30 banks tested, only Zions, a Utah-based lender, failed to maintain a minimum capital ratio of 5 per cent equity to risk-weighted assets.

But BofA, Morgan Stanley, JPMorgan and Goldman all came out with less than a 7 per cent capital ratio – much weaker than anticipated.

FT 20 March 2014

This week, the Federal Reserve will present the results of stress tests designed to ensure that the largest U.S. banks won't turn the next financial crisis into an economic disaster.

There's just one problem: If the tests were realistic, most of the banks would fail.

Bloomberg 19 March 2014

Bankföreningens förslag om att fler bankkunder ska amortera är sunt. Men mellan raderna framgår att det tycks handla om att slippa andra bolåneregler – som skulle kosta bankerna betydligt mer.

”Vi är inga krängare av banklån, vi är seriösa rådgivare som bryr oss om samhället och kunden.”

Det verkar vid en första anblick vara budskapet från banksektorn nu. Bankföreningen, med vd Thomas Östros

SvD 19 mars 2014

The EU wants money-market funds to hold more reserves.

Furthermore, EU finance ministers are drafting rules for winding down troubled banks that would force stock- and bondholders to take a hit before any taxpayer bailouts are approved.

The EU plan also would require banks to contribute to a 55 billion-euro ($75.5 billion) bailout fund.

A. Gary Shilling, 6 March 2014

The Federal Reserve final rule requiring higher capital levels from non-US banks,

including Deutsche Bank, Barclays and Credit Suisse,

with the aim of avoiding a US government bailout if their New York operations run into trouble.

FT February 19, 2014

Janet Yellen announced February 19th that America’s central bank is moving to

cut off the massive financial lifeline that has been subsidizing the European banking system since the beginning of the global financial crisis in March of 2008.

By delaying foreign bank compliance with the stringent capital and borrowing requirements of section 165 of the Dodd–Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank) imposed on American banks,

the Fed was engaging in the moral hazard of allowing Europe to borrow at virtually zero interest from the Fed to fund its bloated social welfare states.

Chair Yellen’s actions mean the Fed is cutting off Europe and providing greater support for U.S. borrowing.

Breitbart, 24 February 2014

Basel

We should accept that government-led international financial regulation has failed

Any bank operating internationally can be effectively wound up without bringing the banking system down.

That is a worthy aim and one that is achievable.

Philip Booth, The Institute of Economic Affairs and professor at Cass Business School, Telegraph 20 February 2014

Svaret på galaxens alla frågor är inte 42.

För ekonomi och banker är svaret 20.

Rolf Engluns blog 23 augusti 2013

When Europe’s leaders set out in June 2012 to break the “vicious circle” between banks and sovereigns,

they left rules for treating government bonds untouched, an oversight that may subvert their drive to prevent a recurrence of the debt crisis.

Under EU rules, banks can rate all debt issued by the bloc’s 28 national governments as risk-free,

avoiding any increase in their capital requirements.

Bloomberg, 10 February 2012

EMU:s chef för banktillsynsmyndigheten SSM, Danièle Nouy:

"En av de största lärdomarna av den nuvarande krisen är att det inte finns någon riskfri tillgång, så statspapper är inga riskfria tillgångar.

Det har visat sig, så nu måste vi reagera"

Rolf Englund blog med länkar 10 februari 2014

Strong Governments, Weak Banks

Banks in the northern eurozone have capital ratios that are, on average, less than half of the capital ratios of banks in the eurozone’s periphery.

Paradoxically, financially strong governments breed fragile banks.

Paul De Grauwe, Yuemei Ji, CEPS Policy Briefs, 25 November 2013

From May 2007 until the day before the Lehman bankruptcy, bank stock prices measured by the KBW index had already fallen by 40 per cent,

signalling that a recession had started which brought down housing prices.

Regulators did nothing because they were focused on meaningless indicators of financial distress:

risk-weighted capital ratios, which basically remained unchanged during the whole period.

Theo Vermaelen, Professor of Finance, Insead, Fontainebleau, France, FT, October 16, 2013

If one lesson should have been learnt from the crisis, it is this: pay attention to markets, they are not as stupid as you think. Unfortunately, considering the continued obsession with risk-weighted capital ratios and stress tests, regulators have not learnt this lesson.

Basel

We should accept that government-led international financial regulation has failed

Any bank operating internationally can be effectively wound up without bringing the banking system down.

That is a worthy aim and one that is achievable.

Philip Booth, The Institute of Economic Affairs and professor at Cass Business School, Telegraph 20 February 2014

Holy Grail?

Market-based bank capital regulation

A new, robust approach that uses market information but does not depend upon markets being ‘right’.

Under the proposed regulatory system (i) bank losses are credibly borne by the private sector

(ii) systemically important institutions cannot collapse suddenly;

(iii) bank investment is counter-cyclical;

and (iv) regulatory actions depend upon market signals.

Jeremy Bulow, Jacob Goldfield, Paul Klemperer, Vox, 29 August 2013

Regeringen presenterade idag nya åtgärder kring hur den finansiella stabiliteten ska värnas

Sverige har Europas tredje största banksystem, ett system som dessutom har sämre tilltagna buffertar än i många andra länder.

Och som är väldigt beroende av att låna utomlands.

Andreas Cervenka, SvD Näringsliv, 26 augusti 2013

Eurozone banks need to shed €3.2tn in assets to meet Basel III

Europe’s biggest banks will have to cut €661bn of assets and generate €47bn of fresh capital

Deutsche Bank, Crédit Agricole and Barclays the banks most in need

Financial Times, August 11, 2013

Europe’s biggest banks will have to cut €661bn of assets and generate €47bn of fresh capital over the next five years to comply with forthcoming regulations aimed at reducing the likelihood of another taxpayer funded bailout.

The figures form part of an analysis by the UK’s Royal Bank of Scotland – which singles out Deutsche Bank, Crédit Agricole and Barclays as the banks most in need of fresh capital – highlighting that five years on since the financial crisis, Europe’s banks are still “too big to fail”.

Europe’s banking sector assets are worth €32tn, or more than three times the single currency zone’s annual gross domestic product.

“The process by which money is created is so simple that the mind is repelled.”

Click here

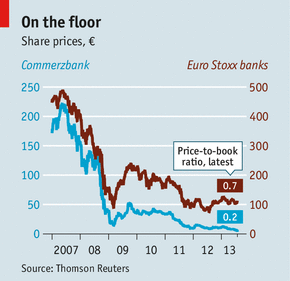

Commerzbank - The second-biggest bank in Europe’s strongest economy

Buying Dresdner Bank in the summer of 2008

The Economist, July 27th 2013

How much capital should banks have?

Basel III, risk-weighted capital between 8 and 12%

Lev Ratnovski, Vox, 28 July 2013

Basel III imposes on banks an equity-to-risk-weighted-assets ratio (risk-weighted capital) of between 8 and 12%.

This is comprised of the 4.5% basic ratio, 2.5% conservation buffer, 2.5% countercyclical buffer (in upturns),

and up to 2.5% surcharge on systemic banks.

Some countries have higher capital requirements.

Singapore imposes a 2% surcharge over Basel; the Vickers proposals in the UK call for a 3% surcharge;

and Switzerland requires that its international banks hold extra 6% capital, bringing total capital requirements to 18-19%.

Quick: I say "German banks," and what's the first thing that comes to your mind?

Deutsche Bank? Big, German – must be stable and low-risk.

The fact that southern Europeans are opening accounts left and right in DB must mean that DB is lower-risk than the local wild guys.

Except that they have the largest derivatives portfolio, at $70 trillion

(but don't worry because it all nets out, sort of, and of course there is no counter-party risk!),

and they are the most highly leveraged bank in Europe (at 60:1 in the last tests – not a misprint)

John Mauldin, 16 december 2013

If something happens to DB, they are, in all likelihood, Too Big To Save, even for Germany.

But Deutschebank is not my focus here today. It is their much smaller brethren, Too small to be called siblings, actually. More like first cousins twice removed. But there are a lot of them, and they all piled into some very interesting and, as it turns out, very questionable trades. And the story begins with the American consumer.

Deutsche Bank AG, Barclays and Societe Generale

Europe’s biggest banks, which more than doubled their highest-quality capital to $1 trillion since 2007 to meet tougher rules,

may have further to go as regulators scrutinize how lenders judge the riskiness of their assets.

Bloomberg, 23 July, 2013

Deutsche Bank AG, Barclays and Societe Generale SA are among European banks that issued stock,

sold units or hoarded earnings to bring capital, as a proportion of assets weighted by risk, into line with new global rules.

Now some regulators are questioning the weightings, typically set by the banks’ own models, and embracing a broader measure of equity to total assets known as the leverage ratio that ignores risk.

The focus on leverage is the latest effort by financial watchdogs to prevent a repeat of the taxpayer-funded bank rescues of 2008.

The Basel Committee on Banking Supervision, which sets global banking standards, is taking a closer look at risk weightings after finding wide variations in a study of 32 lenders,

Stefan Ingves, the group’s chairman, said this month.

"Enligt vår uppfattning stod det finansiella systemet i Sverige inför en kollaps den 24 september 1992."

Stefan Ingves

Considering issuing at least €6bn in hybrid equity capital such as convertible bonds

Deutsche Bank set to shrink to achieve leverage target

Deutsche Bank has one of the lowest leverage ratios of large banks globally

Financial Times, July 21, 2013

The most pressing concern for banks is a relatively tough new rule that regulators proposed last week that could force banks to build up more capital, the financial buffer they maintain to absorb losses. But the banks did not demonstrate any difficulty in meeting the proposed rules, and the banks now appear to have fewer allies in Washington than at any time since the financial crisis.

Treasury secretary, Jacob J. Lew, effectively issued an ultimatum to Wall Street,

calling for the swift adoption of rules introduced through the Dodd-Frank financial overhaul law, which Congress passed in 2010.

New York Times, July 18, 2013

Mr. Lew also said that he might be open to stricter measures if enough had not been done to remove the threat that big banks can pose to the wider economy.

“If we get to the end of this year, and cannot, with an honest, straight face, say that we’ve ended ‘too big to fail,’ we’re going to have to look at other options because the policy of Dodd-Frank and the policy of the administration is to end ‘too big to fail,’ ” Mr. Lew said.

In Britain regulators last month unexpectedly told banks to meet a “leverage ratio” of 3% by the end of 2013.

The leverage ratio sets the amount of equity that banks need as a proportion of their total balance-sheets;

unlike the commonly used capital ratio, assets are not weighted to reflect their riskiness.

On July 2nd America formally adopted the Basel 3 rules on capital.

a suggestion by Daniel Tarullo, a Fed governor, that America would impose a leverage ratio that is higher than the 3% minimum agreed to in Basel 3.

The Economist print, July 6, 2013

Two big lenders, Barclays and Nationwide, that were doing fine under the conventional measures of capital fell short on the leverage test.

There is mounting suspicion among regulators that the models banks use to calculate the riskiness of their assets (and thus their capital cushions) underestimate the dangers they face.

UK and much of the eurozone appear determined to repeat the mistakes that inflicted stagnation on Japan

Basel III’s backstop leverage figure is just 3 per cent by 2019.

For a banking system to operate on the basis that a fall of a mere 3 per cent in the value of bank assets

will wipe out the banks is simply absurd

John Plender, Financial Times, June 21, 2013

All the more so when banks’ risk-management techniques were shown to be hopelessly flawed in the crisis, yet remain substantially unchanged. The dangers here were highlighted when JPMorgan, supposedly the best risk manager in the business, lost $6bn in the “London whale” trading fiasco. Its much admired bosses had no notion at all of what was afoot.

It follows that on current policy another financial crisis is probable.

And since it is clear that there is no political will for further bailouts in the US, little at the German heart of the eurozone and limited fiscal capacity for bailouts in the UK,

a new crisis would be much more damaging to the world economy.

In effect, the UK and much of the eurozone appear determined to repeat the mistakes that inflicted stagnation on Japan for the past 23 years, but with more financial risk.

It’s hard to write a happy ending to ‘QE’ story

Have we finally witnessed the end of the great 32-year bull market in bonds?

John Plender, Financial Times, June 18, 2013

Värdet av de så kallade implicita statsgarantierna för bankerna

Swedbanks Sverigechef Catrin Fransson:

”Det är inte skattebetalarna som bär risken, utan aktieägarna”

Vi behöver dock inte raljera utan kan istället konsultera en rapport från Riksbanken

Andreas Cervenka, SvD Näringsliv 14 februari

Get Basel III right and avoid Basel IV

To protect banks and the taxpayer, we must insist on strong capital for all banks

Thomas M. Hoenig, vice-chairman of the Federal Deposit Insurance Corporation, Financial Times 12 December 2012

Basel III is meant to increase the quantity and quality of capital on the balance sheet. Some remain confident that Basel III accurately assigns risk weights to numerous categories of assets.

Unfortunately, the weightings are more arcane than ever and, therefore, even less useful.

Despite the promise of higher capital levels and better quality capital, Basel’s new minimum leverage ratio requirement is only 3 per cent,

about the same as that of the largest US banks when the global crisis erupted.

Basel III offers more complexity and, therefore, new opportunities to circumvent the system. But it does not offer any more certainty that banks will be well capitalised when the next crisis hits.

Before deposit insurance was introduced, the tangible equity capital ratios for US banks of all sizes averaged above 10 per cent. Depositors insisted on these levels if they were to trust the bank with their money. Now, instead of capital, the public relies on deposit insurance for protection, leaving other banks and taxpayers to backstop a failed financial institution.

Considering issuing at least €6bn in hybrid equity capital such as convertible bonds

Deutsche Bank set to shrink to achieve leverage target

Deutsche Bank has one of the lowest leverage ratios of large banks globally

Financial Times, July 21, 2013

The German lender’s estimated ratio of equity to assets stood at 2.1 per cent at the end of the first quarter,

the second-lowest of 18 banks ranked by Morgan Stanley analysts.

Ja, då kanske vi inte är fullt så överkapitaliserade som ögat tycker,

säger Annika Falkengren, SvD Näringsliv 6 oktober 2011

Is Deutsche Bank The Next Lehman?

Deutsche Bank is sitting on more than $75 Trillion in derivatives bets

— an amount that is twenty times greater than German GDP.

Tyler Durden, zerohedge 13 June 2015

Germany’s largest banks were €14bn short of the capital needed to meet incoming Basel III banking rules

The banks, which include the two largest by assets – Deutsche Bank and Commerzbank – managed to cut

their collective capital shortfall from €32bn in the second half of 2012,

as lenders responded to pressure from investors to improve their balance sheets ahead of the introduction of the Basel III rule book by 2019.

Financial Times 28 May 2013

Deutsche Bank, Germany's largest bank has issued 2.96 bn euros worth of stock

in a bid to reassure investors over the strength of its balance sheet.

The new shares are part of Deutsche's plans to raise 4.9 bn euros in total

BBC 30 April 2013

Deutsche Bank

The Bank With The Biggest Derivative Exposure In The World

zerohedge 29 april 2013

While the vast majority of readers may be left with the impression that JPMorgan's mindboggling $69.5 trillion

in gross notional derivative exposure as of Q4 2012 may be the largest in the world,

they would be surprised to learn that that is not the case.

In fact, the bank with the single largest derivative exposure is not located in the US at all, but in the heart of Europe,

and its name, as some may have guessed by now, is Deutsche Bank.

The amount in question? ... Or roughly $2 trillion more than JPMorgan's.

The good news for Deutsche Bank's accountants and shareholders, and for Germany's spinmasters, is that through the magic of netting, this number collapses into €776.7 billion in positive market value exposure (assets), and €756.4 billion in negative market value exposure (liabilities), both of which are the single largest asset and liability line item in the firm's €2 trillion balance sheet

Which, of course, is the primary reason why Germany, theatrically kicking and screaming for the past four years, has done everything in its power, even "yielding" to the ECB, to make sure there is no domino-like collapse of European banks, which would most certainly precipitate just the kind of collateral chain breakage and net-to-gross conversion that is what causes Anshu Jain, and every other bank CEO, to wake up drenched in sweat every night.

Finally, just to keep it all in perspective, below is a chart showing Germany's GDP compared to Deutsche Bank's total derivative exposure.

If nothing else, it should make clear, once and for all, just who is truly calling the Mutually Assured Destruction shots in Europe.

*

Banca Monte dei Paschi di Siena

Recently, CNBC’s John Carney and DealBreaker’s Matt Levine observed that

Deutsche Bank was able to report a higher Tier 1 capital ratio in its most recent quarter

not by reducing the loans on its books or by increasing its earnings,

but by changing the way it calculates its risk weighted assets.

zerohedge 15 February 2013

January 17, Bloomberg reported that “Deutsche Bank designed a derivative for Banca Monte dei Paschi di Siena SpA

at the height of the financial crisis that obscured losses at the world’s oldest lender before it sought a taxpayer bailout.”

The Bloomberg story set-off a wave of investigations which ultimately revealed that

the world’s oldest bank made a series of bad derivatives bets that will ultimately cost it three quarters of a billion euros.

The Bank of Italy has since approved a 3.9 billion euro taxpayer-sponsored bailout.

French and German banks reduced their exposures to these markets by some 30-40 percent

ECB has taken extraordinary action to protect monetary union with the LTRO and conditional OMT.

Unfortunately, fragmentation continues and remains debilitating.

A common safety net is another essential element.

This would involve common deposit insurance and common backstop.

The other union Europe needs to contemplate is fiscal union.

David Lipton, First Deputy Managing Director IMF, April 25, 2013

The idea of “risk-weighted assets” gained prominence after the agreement of the Basel 2 rules on bank capital,

which rewarded banks with the most creditworthy borrowers by allowing them to set aside less capital than their more daredevil peers.

Basel 2

A residential mortgage might be considered ten times safer than a personal loan, for instance.A bank with the same value of each on its loan book would only have to hold 10% as much capital against the mortgages compared with the riskier personal loans.

The Economist print, Dec 8th 2012

But the system was soon gamed. Banks realised that they could spice up their returns by holding assets that were safe enough to require little capital, but risky enough to deliver profits.

The obvious pre-crisis examples were American subprime mortgages that had been bundled up and then insured.

Because risk models said these would hardly ever produce losses, banks were able to load up on them without having to set aside much capital.

Baselkommittén

Dåliga nyheter för SEB, Swedbank, Handelsbanken och Nordea.

De svenska bankerna har väldigt bra kvalitet på sina tillgångar, exempelvis mycket bostadsutlåning.

Men det får man alltså inte tillgodoräkna sig i det nya måttet.

SvD/e24 2009-12-18

Basel

Bank of England’s latest financial stability report call for the banks to bolster their capital base in order to boost their capacity for lending to industry and commerce.

Yet there is a chicken-and-egg problem here that relates to investors’ readiness to stump up.

For as the Financial Policy Committee itself points out, the banks sell at a discount of around a third to net asset value because of

uncertainty about the value of assets that are difficult to price and a well justified conviction that the assets are overvalued.

John Plender, Financial Times 4 December 2012

British banks will have to raise £20bn-£50bn of new capital or dramatically restructure their businesses

after the Bank of England made it clear it did not trust the way they value their books.

Financial Times, November 29, 2012

"Socialism is to become rich, together", Deng Hsiao Ping

The IRA, Basel III, Fiscal Cliffs and Economic Mysticism

Will Congress go over the fiscal cliff? Yes, we've been going for decades, really since the social unrest of the 1970s.

The threat of social unrest is why the Fed has kept interest rates artifically low for so long, but now even that expedient has run its course.

Richard Christopher Whalen, zerohedge 14 November 2012

Read my 2010 book "Inflated: How Money & Debt Built the American Dream."

Why won’t those wretched banks lend money?

Deleveraging, Basel Capital rules, Liquidity coverage ratios

Gillian Tett, Financial Times, October 11, 2012

In the US, bank assets were close to 80 per cent of gross domestic product.

In the EU, they were 350 per cent.

EU has a banking sector that is not only too big to fail, but too big to save

Martin Wolf, Financial Times, 4 October 2012

Global regulators are coalescing around plans to soften the impact of planned bank liquidity buffers

by allowing institutions to count a wider variety of assets towards the requirements and changing the calculations in key ways to somewhat reduce the overall amount.

Financial Times, 2 September 2012

The Basel Committee on Banking Supervision, which sets the worldwide standards, has been promising for more than a year to take a second look at the “liquidity coverage ratio”, which is due to take effect in 2015 and requires banks to hold a stock of easy-to-sell assets against a 30-day market crisis.

The French government has been forced to rescue a distressed domestic mortgage lender, Basel III

Financial Times, 2 September 2012

Pierre Moscovici, finance minister, added that tough new requirements under the Basel III capital requirements for banks had also played a role in CIF’s inability to stand on its own two feet.

Helgens franska bail-out liknar Lehmans

Rolf Englund blog 2012-09-02

Jackson Hole Paper 2

Destroying the Tower of Basel

Andy Haldane, the Bank of England’s executive director for financial stability is about to call on the world’s top economic officials

to cast aside more than 50 years’-worth of thinking on how the global financial system should be regulated.

Financial Times, Money Supply Blog, August 31, 2012

When then-IMF chief economist Raghuram Rajan used his Jackson Hole address in 2005 to warn that there were problems afoot in the global financial system, the reception he got was as frosty as the snow-covered peaks of the mountains that surround the Wyoming resort.

It’s ironic that a speech that is a paean to simplicity comes with 26 footnotes and 65 references.

But Mr Haldane makes a good point in suggesting that, at 616 pages in its 2010 format, Basel III is overlong and relies too much on banks’ internal models to make millions of calculations about the riskiness of individual loans.

As the recent losses at JP Morgan – and indeed the subprime crisis — have shown, those models are often flawed.

In a recent powerful defence of finance capitalism, Raghuram Rajan and Luigi Zingales argue that free markets are vulnerable to attack in downturns because they rest on fragile foundations, depending on the goodwill of politicians for their existence.

Saving Capitalism From The Capitalists, Crown Business (2003)

John Plender, Financial Times, August 21 2008

Let us look at alternative ways of accelerating deleveraging.

Broadly there are two: capital transactions and default.

The latter, in turn, comes in two varieties: plain vanilla default and inflationary default.

Martin Wolf, Financial Times 30 July 2012

Data released by the ECB on Thursday showed that lending to households and business contracted by €88bn in between April and June.

Professor Tim Congdon said the chief cause of Europe's credit crunch is the EU policy of forcing banks

to raise core Tier 1 capital ratios to 9pc too fast. "Loans are shrinking because of a misguided regulatory assault.

It is crazy to make banks shrink risk assets in a recession,"

Ambrose 26 July 2012

The LTRO has left a host of problems in its wake, and is unlikely to be part of Mr Draghi's next set of tricks. RBS says Spanish and Italian banks have "parked" funds in sovereign bonds that have since plummeted in value. These lenders may have to crystalize large losses as they draw on the money to roll over their own debts.

€94bn, Andrea Enria, chairman of the European Banking Authority

The 9 per cent capital ratio they had to hit as a “temporary buffer” by June is to become permanent

Financial Times 15 July 2012

27 European banks had boosted capital by a combined €94bn to reach what it described last autumn as a “temporary” requirement for European banks to hold core tier one capital equivalent to at least 9 per cent of risk-weighted assets.

Kommentar av Rolf Englund

Hur har bankerna fått ihop 94 miljarder euro - runt 812 miljarder kronor?

Det luktar Creative Accounting. Stora lån från ECB till nära noll-ränta har väl också hjälpt till.

Laurence Kotlikoff suggests not what he calls “limited purpose banking”, but the end of banking.

I accept that leverage of 33 to one, as now officially proposed, is frighteningly high.

But I cannot see why the right answer should be no leverage at all.

Martin Wolf, Financial Times 12 July 2012

Where I would go further is towards substantially lower leverage and significantly greater transparency.

Not least, I would do everything I can to eliminate the idea that the state stands behind investment banking. That is an insane idea.

Big banks need extra $566bn

The world’s 29 largest global banks will need to raise an additional $566bn in new capital

or shed about $5.5tn in assets by 2018 to meet the new tougher Basel III bank capital standards,

a new study by Fitch Ratings has found.

Financial Times, 17 May 2012

A must read

Five years after the financial crisis hit the US and forced lenders there to shrink, Europe, too, is learning the meaning of “deleveraging”.

This is the process, in financial jargon, of unwinding excessive “leverage” – essentially the ratio of a bank’s assets, or loans, to its equity capital.

Patrick Jenkins and Brooke Masters, Financial Times, May 3, 2012

Sir Mervyn King has said - in a rare admission

- that the Bank of England failed to do enough to warn about the risks building up in the banking sector ahead of the financial crisis.

"We did preach sermons about the risks. But we didn't imagine the scale of the disaster that would occur when the risks crystallised,"

Telegraph 3 May 2012

Banks may have to disclose profits from carry trades derived from 1 trillion euros in ECB loans

and exclude the money from bonus pools

Bloomberg May 4, 2012

Profit from carry trades, where investors borrow money at a low interest rate to buy higher yielding securities, “should not count toward computation of remuneration and bonus pools” at banks, under plans being weighed by European Union lawmakers, according to a document obtained by Bloomberg News.

The measure is one of dozens of proposed amendments to legislation to implement global capital and liquidity rules for EU lenders.

Spain

The ECB’s trillion-euro liquidity operation brought temporary relief, but

only at the cost of increasing Spain’s financial fragility as its banks used the ECB’s loans to buy more of their government’s subsequently downgraded debt.

Bloomberg Editors May 1, 2012

Finansmannen Fredrik Lundberg har inget emot höjda kapitalkrav för banksektorn, men menar att det bör råda konkurrensneutralitet.

Även om de svenska bankerna är stora i förhållande till landets BNP, som Anders Borg använder som argument för höjda kapitalkrav på svenska banker, säger Lundberg till DI att Sverige inte bör avvika från andra länders kapitalkrav.

SvD Näringsliv, 30 augusti 2012

Basel

Mitt i natten gav EU:s finansministrar upp om att komma överens om nya kapitaltäckningsregler för banker.

Finansminister Anders Borg (M) var nöjd

Regeringen har redan, med stöd av riksdagen, Finansinspektionen och Riksbanken, sagt att de fyra svenska storbankerna måste öka sitt kapital till 10 procent 2013 och 12 procent 2015.

Orsaken till att regeringen vill kunna ställa hårdare krav på svenska banker är att

Sverige har den näst största banksektorn i EU, mätt som andel av BNP.

SvD Näringsliv 3 maj 2012

Banksystemets storlek gör att de finansiella riskerna blir större än i många andra EU-länder, vilket måste täckas upp på något vis.

EU set for clash on banking rules

Translating the “Basel III” international rules on bank capital into law has emerged as the most highly charged financial regulation issue in Brussels

Financial Times, May 1, 2012

At one extreme stands a French-led bloc pushing for softer requirements on bank capital and leverage plus a Brussels veto

At the other is Britain, which is calling for strict enforcement of the Basel minimum requirements and the right for national regulators to impose even tougher rules

Pro-cyclical folly

Europe faces Japan syndrome as credit demand implodes

The long-feared credit crunch has mutated instead into a collapse in DEMAND for loans.

Households and firms are comatose, or scared stiff, in a string of countries.

Ambrose Evans-Pritchard, April 25th, 2012

The credit squeeze is entirely predictable – and was widely predicted – given that banks must raise their core Tier 1 capital ratios to 9pc by July to meet EU rules, or face nationalisation.

The pro-cyclical folly of this beggars belief:

by all means impose higher buffers, but not during a recession, and not by letting banks slash their balance sheets.

The US at least forced its banks to raise capital, an entirely different policy since it does not lead to a lending crunch.

Går Tyskland med på att rekapitalisera spanska banker?

Borg, Rehn, Lagarde och Pakistans ledande Financial Daily

Rolf Englund blog 21 april 2012

Tänk om SvDs ledarsida vore lika duktiga som dom i Pakistan.

Grekiska banker rapporterade stora förluster.

Resultaten tyngs av nedskrivningar på värdet av statsobligationer

Företag och hushåll har fortsatt att ta ut sina tillgångar eftersom de befarar att banker ska gå omkull, och insättningarna har krympt dramatiskt.

I det andra stödpaketet för Grekland har omkring 50 miljarder euro öronmärkts för bankstöd.

DNT/TT 20 april 2012

Greek Banks Post $37 Billion Losses on Debt Restructuring

Bloomberg 20 April 2012

The high cost of disorderly deleveraging

In the last quarter of 2011 alone, the 58 banks in the IMF’s sample reduced assets by almost 580 bn dollar.

John Plender, Financial Times April 24, 2012

The risk is of a vicious circle whereby eurozone economic conditions deteriorate, so depressing bank earnings and weakening asset quality, which in turn requires increased provisions.

That erodes bank capital, creating more pressure for yet more deleveraging.

A further risk is that deleveraging becomes disorderly if synchronised sales of bank assets cause a downward spiral in prices, which leads not only to capital shrinkage but funding shortages as interbank lending is cut back.

IMF’s Global Financial Stability Report

World Economic Outlook

“it is ... critical to break the adverse feedback loops between subpar growth,

deteriorating fiscal positions, increasing recapitalisation needs, and deleveraging ..

Martin Wolf, Financial Times, April 24, 2012

A particularly important aspect of those risks is of further deleveraging by the banks.

This is necessary, given their bloated balance sheets. But it is economically dangerous.

To contain the dangers of disorderly deleveraging, capital will have to be inserted into banks, including by the new support funds.

IMF Global Financial Stability Report

Says European Banks May Have to Sell $3.8 Trillion in Assets

“It is essential to continue to avoid a synchronized, large-scale, and aggressive trimming of balance sheets that could do serious damage to asset prices, credit supply, and economic activity in Europe and beyond.”

Bloomberg 18 April 2012

The Washington-based IMF sees a resurgence of Europe’s debt turmoil as the biggest threat to global growth even after steps taken by governments and the European Central Bank helped ease tensions in financial markets. The challenge for policy makers is to make sure banks keep lending to companies and individuals even as they boost capital to comply with regulators’ requests.

Bankerna saknade 4.300 miljarder

De största globala bankerna skulle ha haft en brist på kärnkapital i juni 2011,

om de kommande Baselreglerna om kapitaltäckning hade trätt i kraft vid den tidpunkten.

DI/Bloomberg 12 april 2012

Vid samma tidpunkt skulle bankerna behöva ha ökat volym lätt omsättningsbara tillgångar med 1.760 miljarder euro för att klara de kommande likviditetsreglerna.

De nya Baselreglerna ska enligt nuvarande plan ha fasats in till 2019.

Det meddelade Baselkommittén på torsdagen, enligt Bloomberg News.

Spain's banks are fast joining the ranks of the most unloved in Europe just as many need to raise capital urgently,

deserted by investors who believe the country is on the brink of a recession that many lenders will not survive.

CNBC 11 April 2012

115 miljarder euro

BIS said the requirement for the eurozone’s largest banks to raise their tier one capital ratios to 9 per cent by June of this year

had destabilised the system by bringing fears of a drop-off in lending and a rise in asset sales “to the forefront of financial market concerns”.

Financial Times, 11 March 2012

The European Banking Authority, the London-based umbrella body of European Union banking regulators which is behind the recapitalisation exercise, said at the end of last year that 30 of the region’s largest banks needed to raise a total of €115bn in fresh capital to meet the requirements.

European Union officials joined Madrid on Wednesday in insisting Spain’s banks would not need a cash injection from the eurozone’s rescue fund,

despite concerns they will fail to raise more than €50bn in new government-mandated capital by the end of the year

The Spanish government last month passed laws requiring banks to present recapitalisation plans by the end of March

Financial Times 28 March 2012

Igår antog parlamentet en lag som tvingar de spanska bankerna att höja sin kapitaltäckning

De spanska bankernas osäkra fordringar,

som i huvudsak består av lån till den kollapsade fastighets- och byggnadssektorn,

uppgår till 7,6 % av bankernas tillgångar. En fördubbling sedan år 2008

Ekot 17 februari 2012

Bankernas stora problem: Ytan = Basen x Höjden

Rolf Englund blog, 16 Februari 2012

This week Europe’s banks had to tell the European Banking Authority how they plan to raise money to fill the holes on their balance sheets.

The numbers are huge. Greece’s banks have to find €30bn by June, Spain’s €26bn and Italy’s €15bn.

In total, the region’s banks have a shortfall of €115bn.

Financial Times, 20 January 2012

Would Northern Rock or Lehman Brothers have survived if they had had more capital?

Sadly not.

For the reality is that it is not the amount of capital a bank holds that protects it in a crisis,

but its ability to access ready cash for its immediate needs.

Financial Times, 20 January 2012

Italy

UniCredit shares fell nearly 15pc today on the size of the larger-than-expected discount, 43 procent

which is designed to help the bank meet a new minimum core capital requirement imposed by the European Banking Authority.

Harry Wilson, Banking Correspondent, Daily Telegraph, 4 Jan 2012

UniCredit shares tumbled 14.5pc to €5.42 as investors digested the surprise 43pc discount at which the new shares are being offered as part of a capital-raising programme.

Last month, the European Central Bank revealed that a total of €489bn was taken up through its new long-term refinancing operation (LTRO), which offered banks running out of eligible collateral the option to borrow three-year money.

Where is the ECB Printing Press?

European regulators allowed their banks to leverage up to 450 to 1 on their capital,

on the theory that sovereign nations in an enlightened Europe could not default, and therefore no reserves need to be kept for “investing” in government debt. And with those rules, banks borrowed massively and invested it in government debt, making the spread.

It was an awesome free profit machine. Until Greece became a road bump. Now it is a nightmare.

Even if you only invested 4% of your bank’s assets in Greek debt, if that is more than your capital then you are bankrupt.

John Mauldin, 12 Nov 2011

The banks are under massive pressure to raise their core Tier 1 capital ratios to 9pc by next June.

This requires a €2.5 trillion adjustment according to the BIS’s Global Stability Board.

Most of that is going to be done by slashing loan books – deleveraging in the jargon –

since they cannot raise fresh capital at a viable cost and don’t wish to be nationalised.

Ambrose Evans-Pritchard, December 21st, 2011

So will this extra €200bn be used to buy Italian and Spanish bonds, or instead to plug a frightening number of leaks across the financial system?

Funding - Deleveraging - Europakten

Fed's decision to accept the rules laid out by regulators in Basel that could come before Christmas

is a defeat for giant U.S. banks that argued the guidelines needn't be so strict.

could prompt them to reduce lending and hurt the economy

Wall Street Journal, 19 December 2011

At the same time, it isn't clear the bigger capital buffers will accomplish what regulators set out to do in the Dodd-Frank financial overhaul and other recent moves: end the "too big to fail" syndrome that paved the way for the government bailouts of the 2008-09 financial crisis.

How to Escape Basel III Doom Loop

What has been the biggest economic policy error of the post-Lehman era?

I used to think the answer was obvious. The euro zone's decision to impose losses on holders of Greek government bonds has been an unmitigated disaster, an entirely self-inflicted wound that has gravely destabilized the global economy.

But even as the euro-zone crisis unfolds, a potentially bigger man-made disaster looms. The Basel III global capital and liquidity rules

Simon Nixon, WSJ 7 October 2011

From the moment euro-zone leaders first agreed at their Deauville summit in October 2010 that bondholder losses would be a condition of any euro-zone bailout after 2013 — breaking the unwritten rule that sovereign bonds from a developed economy are risk-free — the bloc has been dragged into a vortex of despair from which it has so far found no escape, as first government bond markets, then bank funding markets and now ordinary bank lending to companies have seized up

As the euro-zone crisis unfolds, a potentially bigger man-made disaster looms. The Basel III global capital and liquidity rules were agreed at great speed and with much fanfare over the past three years at a time of premature post-Lehman triumphalism.

Central bankers and regulators mistook a prolonged period of robust global re-stocking, fueled by quantitative easing and a massive fiscal stimulus, for evidence that they had tamed the crisis.

Instead, with the economy now slowing, regulators may have trapped the world financial system in a highly deflationary doom-loop, in which banks are forced to shrink their balance sheets in a futile effort to meet ever-retreating capital-ratio targets.

En bank får låna ut 10–20 gånger sitt egna kapital.

Förlorar banken en miljard måste den alltså kräva låntagarna på 10–20 miljarder.

Det får konsekvenser i den reala ekonomin.

Tomas Fischer, Fokus 19/12 2008

Att en bank får lägre egetkapital har sina effekter.

Rolf Englund blog 1 sept 2011

Sammanlagt sitter banker i EU på cirka 30 procent av alla europeiska statspapper.

I flera länder är siffran högre. I det finansiellt skakiga Spanien ägs över 50 procent av statens skuld av banker, framförallt landets egna.

I de nya kapitalreglerna för banker, Basel III på finansfikonspråk, som är tänkta att tämja bankernas spekulation, klassas alla statspapper som helt riskfria.

Att låna ut till en stat anses så säkert att det inte kräver någon kapitalbuffert alls, något som gett bankerna skäl att köpa på sig ännu fler obligationer.

Andreas Cervenka, SvD 28 augusti 2011

Marcus Wallenberg vill inte se strängare eller tidigarelagda regler för svenska banker.

Anders Borgs utspel om att Sverige ska gå i bräschen för införandet av ett nytt regelverk för banker, har inte tagits emot med någon större glädje av de svenska storbankerna.

DI 24/3 2011

Finansministern har dessutom flaggat för hårdare regler för Sverige än för övriga EU, något som bland annat mött kritik från Bankföreningens vd Kerstin af Jochnick.

Basel

Svenska bankföreningen har varnat för att svenska bankmodellen

med mycket bolån i balansräkningen

kan få problem om det införs ett absolut kapitalkrav i form av ett "hävstångsmått",

framräknat utan klassificering av bankernas utlåning i olika riskklasser.

DI/TT 2010-09-12

Martin Andersson, chef för svenska Finansinspektionen, säger att han inte delar föreningens åsikter, att svenska banker har god kapitaltäckning och påpekar att ett "hävstångsmått" möjligen kan bli infört tidigast 2018, med föregående beslut 2017.

...

Baselkommittén

Dåliga nyheter för SEB, Swedbank, Handelsbanken och Nordea.

De svenska bankerna har väldigt bra kvalitet på sina tillgångar, exempelvis mycket bostadsutlåning.

Men det får man alltså inte tillgodoräkna sig i det nya måttet.

SvD/e24 2009-12-18

Basel 2

A residential mortgage might be considered ten times safer than a personal loan, for instance.

A bank with the same value of each on its loan book would only have to hold 10% as much capital against the mortgages compared with the riskier personal loans.

The Economist print, Dec 8th 2012

Regulators want big, complex banks to hold larger buffers of capital to protect the financial system.

Big banks argue this is unnecessary because risk is diversified across their larger balance sheets.

Who is right? Natural sciences – especially epidemiology, ecology and genetics – provide clues.

The writers are executive director for financial stability at the Bank of England,

and a professor of zoology at Oxford University and former British chief scientific adviser

FT February 20 2011

From Basel III to Bern I

Patrick Raaflaub, Wall Street Journal 12 october 2010

Basel

Banks will also have to subtract items such as goodwill, some tax credits and minority investments from equity and retained earnings.

The aim is to make this key measure of capital reflect the equity that would be available to absorb losses in a crisis.

The real impact of the change could be equivalent to raising the minimum capital requirement from 2 per cent to 10 per cent for many banks.

The deductions are likely to cut many banks’ equity totals by between 30 per cent and 40 per cent, according to people who have seen the data.

Brooke Masters, FT September 16 2010

Regulators approve living wills designed to avert future bailouts

Fed and FDIC found “living wills” drawn up by eight of the country’s largest and most complex banks were satisfactory.

FT 20 December 2017

The handling of the current financial crisis has reinforced too big to fail doctrine.

So how can one reduce moral hazard and reduce expectations of future bail-outs?

Living wills to curtail too-big-to-fail, perhaps even thereby allowing systemically important banks, such as Citigroup, Goldman Sachs or Barclays, to fail or, at least, to be unwound.

Charles Goodhart and Dirk Schoenmaker, FT August 9 2010

The aim is to put in place, ex ante, conditions that would allow a wider range of options beyond having the whole bank rescued.

Robert Peston is one om my gurus

Click here for more gurus

Regulators agree 7% capital ratio for banks

Stiff resistance from a number of countries, led by Germany, many of whose banks typically have much lower stocks of core capital in the form of equity and retained earnings

- and will have great difficulty meeting the new standard.

Robert Peston, BBC 9 September 2010

Banks must have a minimum core tier one capital ratio, including a new so-called "buffer" to protect against extreme economic conditions

This is considerably lower than was wanted by the "hawks", the US, UK and Switzerland. They wanted a core tier one capital ratio of 8 to 9% including buffer, which is what British banks currently have to maintain. In fact most British banks currently have a core tier one ratio of around 10%.

Although this new 7% minimum ratio of core capital (in the form of equity and retained earnings) to assets (loans and investments) as measured on a risk-weighted basis represents a significant increase, some will argue that the ratio is still too low.

One reason for this is that the absolute minimum capital ratio, without buffer, will be around 4%, or double the previous minimum.

...

Basel

What happened in 2008, the collapse and rescue of the worldwide banking system, touched all of us: it turned a gentle recession into the worst recession since the 1930s; and we'll be living with the consequences, in the form of lower growth and squeezed living standards, for years.

Now imagine that the equivalent disaster had occurred in the airline industry, that almost every aeroplane came within a few seconds of dropping out of the skies.

In the aftermath, and however complex the engineering of a plane may be and irrespective of the intricacies of traffic control, the effort to mend and reform air transport would be conducted in full public gaze, using ideas and phrases understandable to all.

As citizens, we wouldn't tolerate anything else - and nor would politicians and regulators believe for an instant that they could get away with stitching up some ostensible solution in private.

So what is it about banking regulation that makes it inappropriate for discussion in front of the children?

Robert Preston, the BBC's business editor, 2 August 2010

So the clever clogs executives who run banks will be able to carry on as they have been doing for the past 30 years of globalised financial capitalism, which is to see the Basel strictures as the rules of a game to be exploited for vast profit.

That's the big message underlying the gobbledegook in the Basel Committee document I made you read at the outset. I'll translate three parts for you.

US regulators warn RBS and HSBC over living wills

BBC 24 March 2015

Following the 2010 Dodd Frank Act, banks are required to draw up living wills to show how they could go through ordinary bankruptcy without the help of the taxpayer in order to avoid a repeat of the 2008 financial crisis.

Under the act US regulators have the power to shut down or split up the operations of a US bank, or US subsidiary of a foreign bank.

The US Fed and FDIC have criticised a number of banks for having overly optimistic plans.

Last year, the two regulators censured 11 banks - among them JP Morgan Chase, Deutsche Bank, Barclays Bank and Bank of America - after they submitted living wills.

Too big to Fail

Global banks can no longer assume continuing access to the Federal Reserve’s discount lending window

as an element of their living wills

FT 17 August 2014

US regulators set out the specific guidance in confidential letters on August 5 detailing why they recently rejected the living wills of the world’s largest banks. Hundreds of banks took advantage of the discount lending window on multiple occasions during the 2008 credit crunch.

For the 2013 living wills, 11 banks ranging from Citigroup to Barclays were told they made unrealistic assumptions about how customers, counterparties and investors would behave in a crisis. In addition, they were informed that they failed to make or identify the kinds of structural changes that would be needed to ensure an orderly resolution.

EU leaders are fond of saying that there should be no more taxpayer-funded rescues.

Yet in the case of BES, they agreed to bail out depositors and senior bondholders all the same.

Which raises a question: do regulators want to end bailouts or not?

I fear that many of them still quietly subscribe to the view that bailouts are inevitable.

Sheila Bair,chairman of the Federal Deposit Insurance Corporation from 2006 to 2011, FT 7 August 2014

Basel

Sheila Bair, chairman of the Federal Deposit Insurance Corporation, has said some members of the committee setting international capital standards are “succumbing” to “disingenuous” lobbying from large banks. In an interview with the Financial Times,

Ms Bair also said she would not hesitate to use newly acquired powers to break up an institution if it could not provide a credible “living will”

describing how it could be wound up in the event of failure.

FT July 20 2010

Sheila Bair

Chairman Bair received a bachelor's degree from the University of Kansas

Not any more

Basel

Global banking regulators have reached a breakthrough agreement to tighten capital requirements and impose new worldwide liquidity and leverage standards,

but softened some of their proposals and delayed others to at least 2018.

FT July 26 2010

The The Basel Committee on Banking Supervision said on Monday that all but one of the 27 member countries had signed up to the new principles, which limit what banks can count as so-called tier-one capital – the only kind that can be counted on to absorb losses. The lone hold-out, said by people familiar with the situation to be Germany, said it would decide whether to sign on later this year.

The FT Deutschland column, Das Kapital, is perhaps most negative on the stress tests. It began the comment with a note that

only a fraction of Deutsche Bank’s tier one capital is genuine equity capital.

Most of it comes in the form of hybrid capital – which is still officially counts as tier one capital, which was an impressive 11.2% of total assets.

If you only look at equity capital, the ratio would fall to 1.3%.

The situation in the Landesbanken and the Spanish Cajas is even worse.

Eurointelligence 26/7 2010