Home - Index - News - Krisen 1992 - EMU - Cataclysm - Wall Street Bubbles - Huspriser - Dollarn - Löntagarfonder - Contact

Banks - Basel - Conduits or structured investment vehicles (SIVs), Credit-default swaps, Monolines and Disintermediation

Derivatives contracts indicate that investors believe the 10-year Treasury yield

will be below the 3 per cent mark in two, five and even 10 years’ time.

Robin Wigglesworth, FT 12 January 2018

Deutsche Bank Co-Co bond yields hit 12%

Rolf Englund blog 8 Febr 2016

Uh-oh: Trouble is brewing again in the repo market

The collapse of repurchase agreements — "repos" as they are known on Wall Street — signaled the beginning of the financial crisis, and there's trouble brewing in the market again.

CNBC 13 August 2014

Banks are retreating from repos as new regulations tighten controls on the types of risks they're allowed to take

JPMorgan Joins Goldman in Designing Derivatives for a New Generation

Bloomberg 12 August 2014

Derivatives that helped inflate the 2007 credit bubble are being remade for a new generation.

JPMorgan Chase & Co. is offering a swap contract tied to a speculative-grade loan index that makes it easier for investors to wager on the debt.

Goldman Sachs Group Inc. is planning as much as 10 billion euros ($13.4 billion) of structured investments that bundle debt into top-rated securities, while ProShares last week started offering exchange-traded funds backed by credit-default swaps on company debt.

CDS again

What Happens Now That Argentina Is in 'Selective Default'

It’s up to the International Swaps & Derivatives Association to determine whether a default has occurred.

If it does, holders of the credit default swaps are entitled to a big payment.

Business Week, July 30, 2014 with nice pic of BA

CVA, Credit value adjustment

Optioner, terminer och swappar, det vill säga derivat på underliggande tillgångar

Warren Buffett har kallat dem finansiella massförstörelsevapen

SvD Näringsliv 9 januari 2013

En av många slutsatser som drogs av Lehman Brothers-kollapsen 2008 var att kontrollen över derivatmarknaden behövde förbättras. Det gäller särskilt så kallade motpartsrisker, det vill säga risken att motparten i en affär inte klarar sin del av förpliktelsen så länge derivatet lever.

Denna risk håller nu på att få ett pris. Priset kallas CVA, Credit value adjustment, och den innebär att banker som handlar med derivat, dels beroende på regelkrav, dels på grund av egna lönsamhetsmål, sätter ett pris som speglar risken för en tänkbar framtida förlust.

$32 Trillion Market

Whether you think any of that is a productive use of capital, credit-default swaps have become so ingrained in the financial markets, with $32 trillion in contracts outstanding, that any hiccup in their use could be disastrous. Concerns arose earlier this month that CDS were no longer reliable after an ISDA panel ruled that a Greek credit event hadn’t occurred, even though bondholders were accepting more than 50 percent reductions in value. But when Greece invoked a legal clause making the reductions mandatory for all private bondholders, the ISDA panel immediately moved to trigger the swaps.

Mr Greenspan described the new world in 2002:

“The use of a growing array of derivatives and the related application of more sophisticated methods for measuring and managing risk are key factors underpinning the enhanced resilience of our largest financial institutions. As a result, not only have individual financial institutions become less vulnerable to shocks from underlying risk factors, but also the financial system as a whole has become more stable.”

John Kay, FT December 28 2009

That must rank high among observations the speaker wishes he had not made. “Those of us who have looked to the self-interest of leading institutions to protect shareholders’ equity are in a state of shocked disbelief,” Mr Greenspan told Congress last year. “The whole intellectual edifice [the modern risk management paradigm] collapsed in the summer of last year.”

The $55 trillion question

The financial crisis has put a spotlight on the obscure world of credit default swaps

- which trade in a vast, unregulated market that most people haven't heard of

and even fewer understand.

Will this be the next disaster?

CNN/Fortune SEPTEMBER 30, 2008

In just over a decade these privately traded derivatives contracts ballooned from nothing into a $54.6 trillion market. CDS are the fastest-growing major type of financial derivatives. More important, they've played a critical role in the unfolding financial crisis. First, by ostensibly providing "insurance" on risky mortgage bonds, they encouraged and enabled reckless behavior during the housing bubble.

AT FIRST GLANCE, credit default swaps don't look all that scary. A CDS is just a contract: The "buyer" plunks down something that resembles a premium, and the "seller" agrees to make a specific payment if a particular event, such as a bond default, occurs. Used soberly, CDS offer concrete benefits: If you're holding bonds and you're worried that the issuer won't be able to pay, buying CDS should cover your loss.

There is an esoteric financial instrument called credit default swaps.

The notional amount of CDS contracts outstanding is roughly $45,000bn.

To put it into perspective, that is about equal to half the total US household wealth and about five times the national debt.

George Soros FT 2/4 2008

Street Prepares for Worst As Lehman Deal Stalls

In a sign that Wall Street is preparing for the worst — a possible bankruptcy filing by Lehman Brothers brokers Sunday afternoon were streaming into their offices and a special trading session for credit default swaps was called.

CNBC 14 Sep 2008 01:26 PM ET

US house prices have fallen at the sharpest rate in more than 20 years,

and American consumers are now at their most pessimistic since Richard Nixon was in the White House

Fed stopped derivatives implosion

Daily Telegraph 25/03/2008

Back in April 1999, didn't the Chairman of the Federal Reserve, the Chairman of the SEC, The Secretary of the Treasury and the Chairperson of the CFTC jointly prepare a 140 page report on the Lessons of LTCM in which they stated that:

The principal policy issue arising out of the events...is how to constrain excessive leverage...

Mark Wenzel, April 13, 2008

"The principal policy issue arising out of the events...is how to constrain excessive leverage. By increasing the chance that problems at one financial institution could be transmitted to other institutions, excessive leverage can increase the likelihood of a general breakdown in the functioning of financial markets. This issue is not limited to hedge funds; other financial institutions are often larger and more highly leveraged than most hedge funds...The LTCM episode well illustrates the need for all participants in our financial system, not only hedge funds, to face constraints in the amount of leverage they can assume."

Doom

Although nearly 70% of the Americans do fear a recession, the possibility of a major crisis is not considered.

We have 600 trillion in world liabilities plus more than a 400 trillion-derivatives neutron bomb, all of which will go off when the Westerners (from EU and US) will no longer be able to borrow.

Sharon-Brigitte Kayser, January 16, 2008

RE: Highly recommended

If Warren Buffett can't figure out derivatives, can anybody?

Markets are tied together in ways that regulators and even Wall Street professionals struggle to comprehend.

Bonds are bound to stocks, which are tied to currencies around the world.

Jesse Eisinger, may 2007

The binding threads are derivatives, and the brightest minds on Wall Street worry about how they work—especially as stock markets around the world hit a bump.

The term derivatives describes an array of financial contracts whose value is determined by, or derived from, an underlying asset such as a stock or currency.

The derivatives market, one of the fastest-growing areas of finance, is estimated at $300 trillion.

A subset of that—credit default swaps, which are derivatives based on companies’ creditworthiness—last year reached $26 trillion, twice the size of the U.S. economy.

We might no longer be in the economics textbooks' market economy but in an economy much more influenced by the stock market, the currency market, the credit market and the real estate market, an economy that might be called a markets economy.

Rolf Englund, Letter to the Editor, Financial Times June 5 2007

Derivatives

A nuclear winter?

When Warren Buffett said that derivatives were “financial weapons of mass destruction”, this was just the kind of crisis the investment seer had in mind.

The Economist print, Sep 18th 2008

Are these devices (derivatives) a clever way to disperse risk or are they

“financial weapons of mass destruction”, in Warren Buffett's phrase,

that are poorly understood and perilous boosters of credit?

The Economist print edition 19/4 2007

A bond price might fall because investors are generally demanding higher yields for all fixed-income assets (interest-rate risk), because investors prefer bonds of one maturity date to another (duration risk), or because they think the company that issued the bond will have trouble repaying it. Derivatives separate this last factor—credit risk—from the other two.

This allows investors to insure themselves against the risk of default or, alternatively, to speculate that a default will occur. The instrument that does this is a credit-default swap or CDS

(see jargon guide).

Buffett in his 2002 letter to Berkshire Hathaway shareholders:

“Derivatives are financial weapons of mass destruction, carrying dangers that, while now latent, are potentially lethal."

Source

Credit default swaps are "instruments of destruction" that should be outlawed

George Soros CNBC 12 Jun 2009

Questions abound over a $700 billion rescue plan for Wall Street

Mr Paulson’s plan is stunning in its brevity (two-and-a-half pages) and audacity.

It would authorise him to purchase any “residential or commercial mortgages and any securities, obligations, or other instruments that are based on or related to such mortgages,” implying the right to take over derivative positions.

Economist.com Sep 22nd 2008

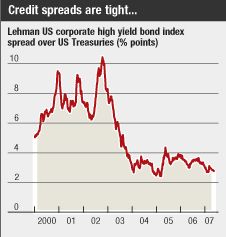

A market correction is coming, this time for real

Today, hedge funds, private equity and those involved in credit derivatives play important, and as yet largely untested, roles. The primary worry of many who make or regulate the market is not inflation or growth or interest rates, but instead the coming adjustment and the possible destabilising effect these new players could have on the functioning of international markets as liquidity recedes.

William Rhodes, FT March 29 2007

Timothy F. Geithner, head of Federal Reserve Bank of New York

High on Mr. Geithner’s to-do list is understanding and monitoring the $26 trillion credit derivatives market — twice the size of the United States economy — the fastest-growing financial market there is.

New York Times 9/2 2007

A credit derivative is a contract by two parties that allows a participant to reduce its exposure to the risk of default on bonds, loans, government securities or corporate securities. The cornerstone of the credit derivatives market is credit default swaps, a sort of insurance policy that allows two parties to exchange the credit risk of an issuer. Originally introduced as an instrument to bet on defaults, it has evolved into a widely used trading tool, especially among hedge funds, to bet on interest rates and spreads.

When Long-Term Capital Management tottered on the brink of collapse in 1998, the credit markets in the United States were controlled by such a small number of institutions that the New York Fed had to make calls to 14 Wall Street banks to try to resolve the crisis. Today, the number of institutions would be vastly higher.

I keep reading how this is all okay with everybody because nobody understands derivatives!

The real, Sinclairian truth is that they understand it perfectly, as derivatives are very, very easy to understand;

these are all just bets that were created, bought and sold for one silly equation-related reason or another,

and the Federal Reserve created all the money to finance it.

Is that so hard to understand? Really?

The Mugambo Guru 7/2 2007

What is harder to understand is the sheer arrogance to think that now, after all these thousands of years of economic cause-and-effect, anyone can even think that the Laws of the Economic Universe are suddenly made amenable to any insanity if you can restrict everything to a handful of variables, and derive an equation by combining them in various clever ways! Amazing!

Then (and this is a bigger, and more amazing, part) a country is thus set free to create as much money as the banks, or the government, wants, and now nothing bad will happen this time, like it has happened every other freaking time it has ever been tried in all of history, which was most of the time!

This is tantamount to saying that they have developed a winning "system" to bet on horse races, lotteries, roulette wheels and coin flips, and that the secret involves borrowing money to place derivative bets, and selling parts of these bets and other bets to other people (who borrow the money to buy them), all of whom borrow money to place offsetting bets of their own, and then everybody uses them as collateral to borrow some more money to make other derivative bets! Hahaha!

And they say they can't understand how this monster derivative thing works? Hahahaha!

Dr. Housing Bubble figures that the Fed and the banks

providing unlimited amounts of money to create the real estate bubble

(which I sarcastically note was created by the Fed and Congress to bail out the busted stock market bubble in 2000, which the Fed also provided the financing for)

has created US$5 trillion in “bubble wealth”.

Mogambo Guru 17/7 2007

This must be a real Monetarist:

- I'm locked down, safe and secure, in the Mogambo Fortress Of Paranoia Central (MFOPC), away from the economic mayhem, and I'm idly surfing the net to monitor the unfolding slow-motion implosion of the world economy. I have my feet up on the console, and I am casually using the barrel of an AK-47 to tap out coded commands to the computer keyboard. Like an idiot, I wasn't really paying attention to what I was doing, old habits being what they are, and I reflexively clicked on Doug Noland's Credit Bubble Bulletin at PrudentBear.com.

Instantly, I knew I had made a mistake when, like some searing CIA laser beam burning into my fevered brain, the first thing I see is a graph of M2 money supply over the last twelve months.

It was horrifying, horrifying!

“I don’t think there has ever been a time in history when such a large proportion of the riskiest credit assets have been owned by such financially weak institutions

. . . with very limited capacity to withstand adverse credit events and market downturns."

Gillian Tett, FT 18/7 2007

Last week I received an email that made chilling reading. The author claimed to be a senior banker with strong feelings about a column I wrote last week, suggesting that the recent explosion in structured finance could be exacerbating the current exuberance of the credit markets, by creating additional leverage.

He then relates the case of a typical hedge fund, two times levered. That looks modest until you realise it is partly backed by fund of funds’ money (which is three times levered) and investing in deeply subordinated tranches of collateralised debt obligations, which are nine times levered. “Thus every €1m of CDO bonds [acquired] is effectively supported by less than €20,000 of end investors’ capital – a 2 per cent price decline in the CDO paper wipes out the capital supporting it.

It was no accident that the eurozone created a special purpose vehicle to manage this bail-out.

It is not just the name that reminds us of those notorious financial structures that brought us the subprime crisis.

Wolfgang Münchau, FT May 23 2010

If the Financial Times' Gillian Tett were hit by a bus, I'd be in a lot of trouble.

With all due respect to her colleagues, she is the best source of financial news.

naked capitalism blog, August 13, 2007

When bright sparks at ABN Amro, the Dutch bank, recently invented an innovative debt product, it triggered a wave of Star Wars jokes. For the eggheads christened their brainchild – which has taken credit markets by storm this winter – a CPDO.

It stands for constant proportion debt obligation but, with a name like that, some bankers quip, it might be a new friend for R2D2 and C3PO, the robots from the films.

Thus the credit markets are full of CDOs (collateralised debt obligations), ABSs (asset backed securities), CDSs (credit default swaps), LCDSs (loan CDSs) and even the ABCDS (a CDS of an ABS).

The creation of new instruments, such as complicated derivatives, probably makes the financial system stronger in the long run, by ensuring risk is better priced and more widely distributed.

But some of these instruments have yet to be tested by a severe recession or a big corporate default. If most people have made the same bet (that risky assets will outperform and that volatility will stay low), there could be an almighty scramble for the exits when the trend changes.

The Economist 4/1 2007

Quantum Finance:

The Science of Making Money Appear Out of Nowhere

Adrian Ash Dec 27th, 2006

The derivatives genie is now well out of the bottle, and these instruments will almost certainly multiply in variety and number until some event makes their toxicity clear....[They] are financial weapons of mass destruction, carrying dangers that, while now latent, are potentially lethal.

Warren Buffett, 2002 letter to shareholders

I Googled Warren Buffet 21/11 2005 and got 2,070,000 hits....

The Coming Disaster in the Derivatives Market

Michael Panzner, November 12, 2005

The Ballooning Credit Derivatives Market:

Easing Risk or Making It Worse?

Wharton, November 2, 2005