Home - Index - News - Kronkursförsvaret 1992 - Finanskrisen - EMU - Cataclysm - Wall Street Bubbles - Huspriser

This is not the wacky proclamation of a doomsday cult, apocalypse bible prophecy sect, or conspiracy theory society. Rather, it is the scientific conclusion of the best paid, most widely-respected geologists, physicists, and investment bankers in the world. These are rational, professional, conservative individuals who are absolutely terrified by a phenomenon known as global "Peak Oil."

Life After the Oil Crash

Lifeaftertheoilcrash.net/Breaking News

Av Riksbankens penningpolitiska rapport förra veckan framgick att man räknar med ett oljepris på i snitt 99 dollar per fat under 2011.

|

The increase in China’s energy demand between 2002 and 2005 was equivalent to Japan’s current annual energy use.” |

|

Currently 1 billion people (Prosperity) use 85% of the world’s oil. |

|

Peaking is a term used in oil geology to define the critical point at which reservoirs can no longer produce increasing amounts of oil. (This tends to happen when reservoirs are about half-empty.) ''Peak oil'' is the point at which maximum production is reached; afterward, no matter how many wells are drilled in a country, production begins to decline. Saudi Arabia and other OPEC members may have enough oil to last for generations, but that is no longer the issue. The eventual and painful shift to different sources of energy -- the start of the post-oil age -- does not begin when the last drop of oil is sucked from under the Arabian desert. It begins when producers are unable to continue increasing their output to meet rising demand. |

The Economic Consequences of the Peak

has moved here

I today, April 11th 2011, hereby declare to have invented the phrase

The Economic Consequences of the Peak

Rolf Englund

Or ECP fort short

Most of us have heard about the book by John Maynard Keynes "The Economic Consequences of the Peace (1919)", even if we have not read it.

In that book he warned of the consequences The Treaty of Versailles which ended WW I and probably partly caused WW II.

I googled the phrase and found from December 27, 2007 an article by Gregory Clark on the economic consequences of peak oil

I also found Economic Impact of Peak Oil, September 23, 2007

OK, that was very close. But not quite.

Oljan har tagit miljoner år att bildas. Och på dryga 100 år har vi förbrukat hälften av jordens oljetillgångar...

På mindre än tjugo år skall vi konsumera vad som återstår...

Hur har det kunnat bli så?

Gunnar Lindstedt i boken "Olja - Jakten på det svarta guldet när världens oljekällor sinar", 2005

Det finns en del skräcksenarior som har slagit mig på senare tid", berättar Gunnar.

"Om oljan försvinner och det globala systemet inte längre fungerar är risken stor att vi går rakt in i väggen.

Att vid denna tidpunkt bygga upp ett nytt hållbart samhälle under rådande resursbrist kan bli problematiskt.

Det vore bättre att dra ner på takten nu och 'ställa om' medan vi fortfarande har oljeresurser.

Peak Oil and the Second Great Depression (2010-2030):

A Survival Guide for Investors and Savers After Peak Oi

Kenneth D Worth 2011

In the introduction he writes:

Why am I so pessimistic? Well, two things.

The first is "Peak Oil". The second is what I refer to as Peak Debt.

Too Hot to Handle? The Future of Civil Nuclear Power

Oxford Reserach Group

The Long Emergency: Surviving the End of Oil, Climate Change, and Other

Converging Catastrophes of the Twenty-First Century

(Paperback) by James Howard Kunstler

The Party's Over: Oil, War and the Fate of Industrial Societies

by Richard Heinberg

The End of Oil : On the Edge of a Perilous New World

by Paul Roberts

Robert Lacey, Inside the Kingdom:

Kings, Clerics, Modernists, Terrorists and the Struggle for Saudi Arabia

Review in FT: Laceys thesis is quite simple. The modern kingdom of Saudi Arabia is a partnership between the Saudi royal family and Wahhabism, an austere interpretation of Sunni Islam

FT December 18 2009

Saudi Arabia: A kingdom on guard

Alarmed by the rise of political Islam, the House of Saud is increasingly hardline at home and aggressive abroad

FT 26 March 2014

Twilight in the Desert: The Coming Saudi Oil Shock and the World Economy

by Matthew R. Simmons

The fall of the House of Saud.

by Robert Baer in The Atlantic Monthly May 2003

The Oil Age is Over: What to Expect as the World Runs Out of Cheap Oil, 2005-2050

by Matt Savinar

Click here

The Prize: The Epic Quest for Oil, Money, and Power

by Daniel Yergin

Events of the past three months have shattered many assumptions about the Middle East.

The endurance of America’s special relationship with Saudi Arabia may now be next,

especially as the presence of Saudi troops on Bahraini soil presents the White House with a stark choice

between relations with Riyadh and support for democracy.

Ian Bremmer, FT March 17 2011

The writer is the president of Eurasia Group and author of The End of the Free Market

The problem with oil is not its scarcity, rather its concentration.

That is one powerful conclusion drawn by Michael Klare in “Blood and Oil”, a thoughtful and well-researched history of oil and geopolitics.

Mr Klare is certainly critical of American policy, particularly of the way the United States has cosied up to nasty regimes because of their supplies of oil, helping prop up the House of Saud, for instance. Yet he counters the claim that the invasion of Iraq was “all about oil”.Mr Klare provides a service when he puts America's close ties with Saudi Arabia in a historical context that mocks the charges — made by Michael Moore, for example, in his film “Fahrenheit 9/11 — that the Bush clan has done most to shape the relationship. He starts with that meeting between Roosevelt and Ibn Saud. He notes that it was the doctrine of Jimmy Carter, a Democrat, explicitly to defend America's access to oil exports from the Persian Gulf "by any means necessary".

The Economist about oil books, 7/10 2004

Links

What are the best arguments against peak oil?

The case against peak oil gloom and doom

“Peak oil” is pure military-industrial-complex propaganda

*

*

*

The UK Industry Taskforce on Peak Oil and Energy Security (ITPOES)

is a group of British companies concerned that threats to energy security are not receiving the attention they merit.

Read more here

The group says a new "peak oil threat" is likely to be felt in the UK within the next five years.

BBC 18 November 2010

*

FT blog: Wikileaks gives a boost to peak oil theories

International Energy Agency (IEA)

Energy Information Administration's (EIA)

The Economist background about Oil

BP Statistical Review of World Energy 2008

Stridsberg Powertrain AB

37 - 50% less fuel consumption - Can this really be true?

A reasonable question is why a start up company like Stridsberg Powertrain should come up with a concept that increases efficiency as much as the Stirgear concept is claimed to do.

Visit HDD High Density Drives AB you can find electric servo motors that give some 3 to 4 times more torque from a given volume when compared to leading servo motor manufacturers.

Case in point: the Brazilian state-run oil giant Petrobas is heavily in debt ($115 billion in 2013) and in danger of defaulting

oftwominds.com/blogjan15/state-oil-dinosaurs1-15.html

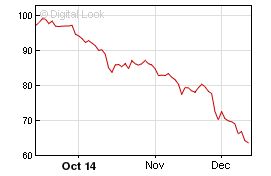

Oil price fall driven by failed speculation?

I heard on BBC or was it CNN that the explanation was that

hedgefunds and others had invested with borrowed money with the oil contracts as collateral.

Now we se a lot of Margin Calls, Don´t we?

Rolf Englund blog 12 december 2014

2014

The flow of Opec petrodollars into global financial markets is set to dry up

as the collapse in the oil price delivers a $316bn hit to the cartel’s revenues.

The $316bn figure would be much higher if other big oil exporters including Russia,

Norway, Mexico, Kazakhstan and Oman are taken into account.

Financial Times, 3 December 2014

Next Bubble Is Forming: U.S. Government Bonds

Brazil's Petrobras is the most indebted company in the world.

PwC has refused to sign off on the books. The stock price has dropped 87pc from the peak.

Ambrose Evans-Pritchard, 19 Nov 2014

Genombrott för solenergin?

Global solar dominance in sight as science trumps fossil fuels

Rolf Englund blog 2014-04-10

Saudi Arabia: A kingdom on guard

Alarmed by the rise of political Islam, the House of Saud is increasingly hardline at home and aggressive abroad

We believe that oil is close to a peak

This is not the “peak oil” widely discussed several years ago, when several theorists,

who have since gone strangely quiet, reckoned that supply would flatten and then fall.

We believe that demand, not supply, could decline.

The Economist print, August 3rd 2013

Demand for oil has, with a couple of blips in the 1970s and 1980s, risen steadily alongside ever-increasing travel by car, plane and ship. Three-fifths of it ends up in fuel tanks.

With billions of Chinese and Indians growing richer and itching to get behind the wheel of a car, the big oil companies, the International Energy Agency (IEA) and America’s Energy Information Administration all predict that demand will keep on rising. One of the oil giants, Britain’s BP, reckons it will grow from 89m b/d now to 104m b/d by 2030.

We believe that they are wrong, and that oil is close to a peak.This is not the “peak oil” widely discussed several years ago, when several theorists, who have since gone strangely quiet, reckoned that supply would flatten and then fall.

We believe that demand, not supply, could decline.

In the rich world oil demand has already peaked: it has fallen since 2005. Even allowing for all those new drivers in Beijing and Delhi, two revolutions in technology will dampen the world’s thirst for the black stuff.

Gas from shale beds. This, along with vast new discoveries of conventional gas, has recently helped increase the world’s reserves from 50 to 200 years.

In America, where thanks to Mr Mitchell shale gas already billows from the ground, liquefied or compressed gas is finding its way into the tanks of lorries, buses and local-delivery vehicles. Gas could also replace oil in ships, power stations, petrochemical plants and domestic and industrial heating systems, and thus displace a few million barrels of oil a day by 2020.

The other great change is in automotive technology. Rapid advances in engine and vehicle design also threaten oil’s dominance.

Not surprisingly, the oil “supermajors” and the IEA disagree. They point out that most of the emerging world has a long way to go before it owns as many cars, or drives as many miles per head, as America.

The biggest impact of declining demand could be geopolitical. Oil underpins Vladimir Putin’s kleptocracy. The Kremlin will find it more difficult to impose its will on the country if its main source of patronage is diminished.

The Saudi princes have relied on a high oil price to balance their budgets while paying for lavish social programmes to placate the restless young generation that has taken to the streets elsewhere. Their huge financial reserves can plug the gap for a while; but if the oil flows into the kingdom’s coffers less readily, buying off the opposition will be harder and the chances of upheaval greater.

Om 54 år, engligt Illustrerad Vetanskap, nr 11/2013

Ready for today - Preparing for tomorrow

Myndigheten för samhällsskydd och beredskap

US crude oil rallies to 16-month high

Nymex August West Texas Intermediate jumped $1.56 to $108.04 a barrel, the highest since October 2010

Financial Times, July 18, 2013

Brent crude jumped to $115 a barrel last week.

Petrol costs in Germany and across much of Europe are now at record levels in local currencies.

This is a remarkable state of affairs given the world economy is close to a double-dip slump right now, the latest relapse in our contained global depression.

Ambrose Evans-Pritchard, 26 Aug 2012

The world will hit one day peak Oil

Dr. Marc Faber, author of the Gloom, Boom and Doom repor, at

Financial Doom Blog February 14, 2011

So says Goldman Sachs

"A key reason for concern is the sharp rise in gasoline prices so far in 2011

which is siphoning off household income at a run rate equivalent to $100 billion per year,"

writes economist Andrew Tilton CNN 18/4 2011

1 gallon = 3,78541178 liter

1 USD = SEK 6,30

An extra $20 a barrel means America will pay an additional $69.3 billion /SEK 431 miljarder/ each year

Simon Hobbs, CNBC 14 Apr 2011

The Energy Information Administration‘s latest estimate is that the US will import 9.5 million barrels of oil each day in 2011.

If that holds despite the higher price of crude, that’s 3.46 billion barrels a year.

Remember: That’s a direct transfer of wealth straight out the United States to oil-producing nations. No multiplier effect, no extra American jobs and no extra American growth.

Now that’s an oil price shock.

Canada and, in particular, the oil sands of northern Alberta, may hold reserves equal to Saudi Arabia's

that's 100 years' worth of current U.S. demand.

cnn.com/2011/04/11/

Literally squeezing and boiling oil out of the sand is expensive and environmentally hazardous, but costs are declining.

Oil sands, WikipediaU.S. and Brent crude futures pushed higher Tuesday, despite a fresh warning from the International Energy Agency that high prices could erode demand

a flat reading of Saudi Arabian production raised questions about spare capacity

CNBC 12 Apr 2011

Analysts also said that a flat reading of Saudi Arabian production raised questions about spare capacity, which lent further upside to prices in the session.

Säkerheten går före allt annat, säger den tyska förbundskanslern Angela Merkel. Men det är inte sant.

Tillväxten går före allt annat. Drömmen om att kunna leva i överflöd eller åtminstone välstånd är i dag spridd över hela världen, egentligen den enda globaliserade religionen i vår tid, en dröm som bokstavligen livnär sig på energi.

Och utan kärnkraft och fossila bränslen är den drömmen slutdrömd;

Richard Swartz, kolumn DN 2011-03-19

visserligen förordas vind-, våg- och solkraft samt liknande terapier av välmenande ignoranter eller intellektuella flagellanter, men som ett slags lyx för redan välmående västerlänningar och utan att kineser, indier, afrikaner eller sydamerikaner blivit tillfrågade.

Top of pageTime to worry about oil?

Until recently, the received wisdom in the city was (a) that the steep rise in the oil price would be temporary,

and (b) that it would only cause serious problems if it went to $150 a barrel.

At least one of those two beliefs is now being tested. Possibly both.

Stephanie Flanders, the BBC's economics editor, 8 March 2011

The ECB's governors might usefully study

Systematic Monetary Policy and the Effects of Oil Price Shocks, a seminal work in 1997 by a Professor Ben Bernanke of Princeton.

The reason why such shocks often lead to slumps is because policymakers make a hash of it.

The ECB seems caught in a 1970s time-warp, wedded to the fallacy that the Yom Kippur oil shock caused the Great Inflation.

The actual cause was rampant growth of the broad money supply, US spending on the Vietnam War and the Great Society, and a near ubiquitous picture of over-stimulus and over-heating across the West.

It was a demand story, not a supply shock.

Ambrose Evans-Pritchard 7 March 2011

Top of pageSaudi Arabia’s stock index has tumbled 11pc in wild trading over the past two days

The latest sell-off was triggered by the arrest of a Shi’ite cleric in the Kingdom’s Eastern Province

after he called for democratic reforms and a constitutional monarchy.

The province is home to Saudi Arabia’s aggrieved Shi’ite minority and also holds the country’s vast Ghawar oilfield,

placing it at the epicentre of global crude supply.

Ambrose Evans-Pritchard, 2 March 2011

Saudi King Abdullah has scant leeway. His own legitimacy stems from Wahabi clerics, who refuse any compromise with the Shia. He is 87 and in poor health, raising the prospect of an imminent succession struggle that favours the hard-line interior minister Prince Nayef.

The 2011 oil shock

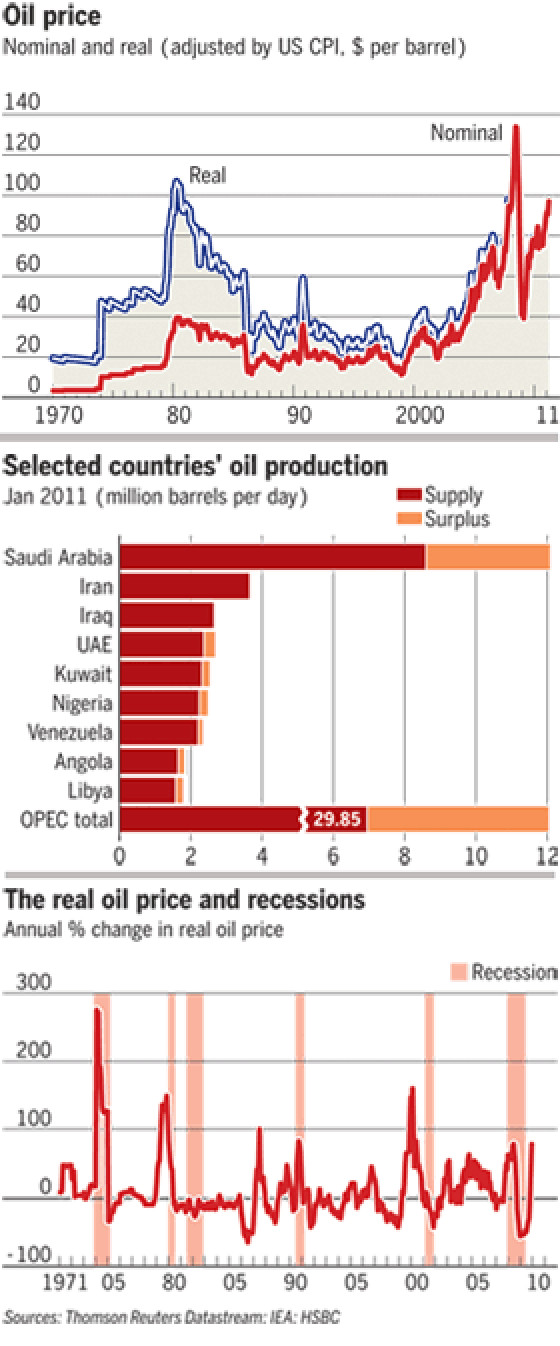

The Arab oil embargo of 1973, the Iranian revolution in 1978-79 and Saddam Hussein’s invasion of Kuwait in 1990 are all painful reminders of how the region’s combustible mix of geopolitics and geology can wreak havoc.

There are good reasons to worry. The Middle East and north Africa produce more than one-third of the world’s oil.

The Economist print March 3rd 2011

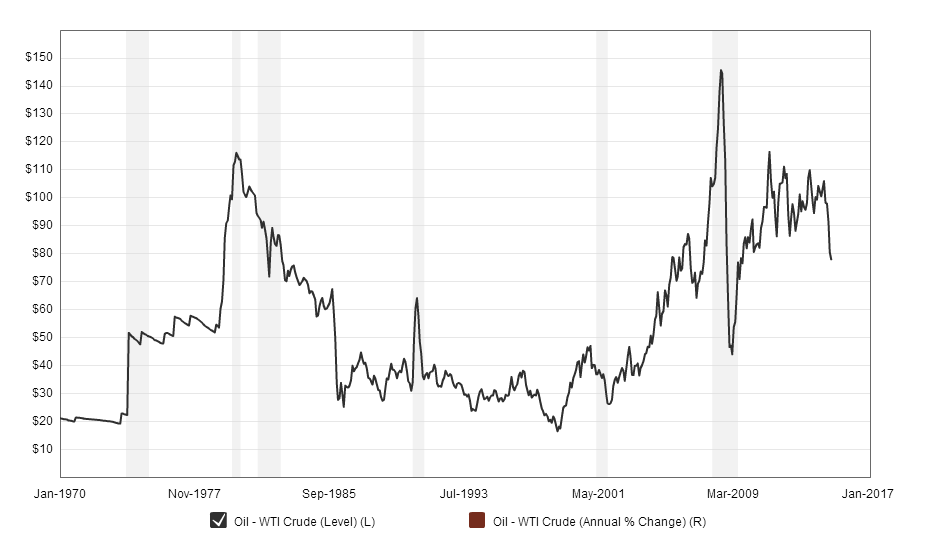

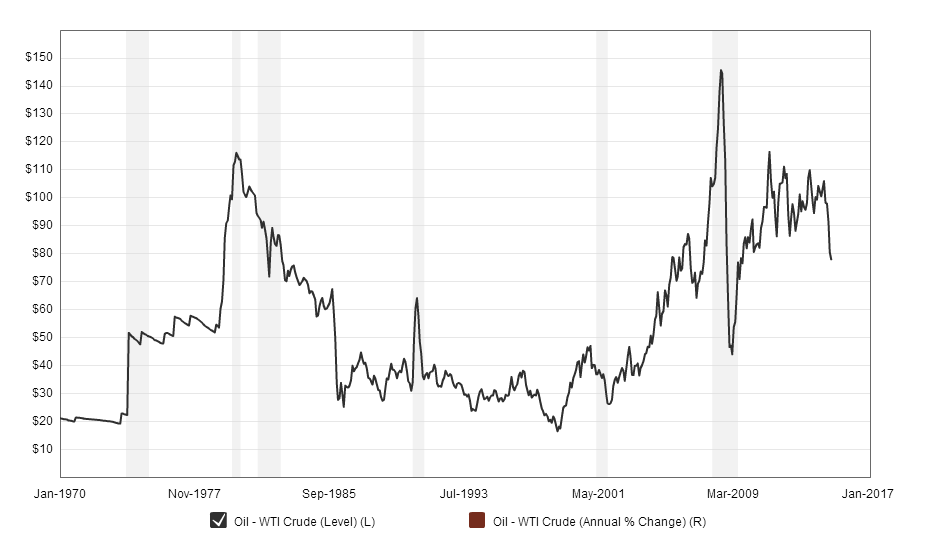

In 2008, oil prices approached $150 per barrel.

Shortly afterwards, the global economy collapsed.

Stephen King, HSBC's group chief economist, 28 February 2011

Economics is not a science. There are no laws or cast iron relationships – as there are in "pure sciences", such as physics or chemistry. Throughout recent history, though, there have been a handful of economic variables between which the links have been pretty solid.

Ever since the early 1970s, every single time oil prices have spiked sharply (rising by 80pc or more),

regular as clockwork the US has entered recession.

Given America's massive influence on worldwide economic sentiment,

the past five global recessions have all come in the wake of sharp jumps in the price of crude.

Liam Halligan, Daily Telegraph, 26 Feb 2011

Only 8 months ago, oil was trading close to $65 a barrel.

China and India between them are home to a third of the world's population.

As they grow, these countries are investing massively in infrastructure development – which is highly energy intensive.

At the same time, more and more of their citizens are becoming wealthier, acquiring cars, air conditioners and refrigerators for the first time,

while switching to protein-rich diets.

In 2010, Chinese oil use grew by an astonishing 15.1pc year-on-year, with the People's Republic now burning more than 10m barrels daily. And given that China's per capita oil usage is still only a fraction of Western levels, as the country's massive population gets richer, overall oil consumption will certainly keep rising and could even accelerate.

Top of pagePetrol prices in America are substantially below levels elsewhere in the rich world,

and this is almost entirely due to the rock bottom level of petrol tax rates.

Very nice chart

The Economist Feb 23rd 2011

The low cost of petrol encourages greater dependence; the average American uses much more oil per day than other rich world citizens.

This dependence also impacts infrastructure investment choices, leading to substantially more spending on highways than transit alternatives.

And this, in turn, reduces the ability of American households to substitute away from driving when oil prices rise.

Gene Sharp is no Che Guevara but he may have had more influence than any other political theorist of his generation.

His central message is that the power of dictatorships comes from the willing obedience of the people they govern

- and that if the people can develop techniques of withholding their consent, a regime will crumble.

BBC 21 February 2011

De senaste årens historiska forskning har kommit fram att de flesta samarbetade mer eller mindre med de tyska ockupanterna, motståndsrörelserna var obetydliga, precis som i det forna östeuropa.

Skälet till att samarbetet var inte i första hand ideologiska sympatier utan känslan utan en känsla av att den tyska segern var given respektive att kommunistregimerna föreföll stabila.

Timur Kuran har sin bok Privat sanning, offentlig lögn utgiven av Ratio beskrivit hur och varför folk anpassar sig.

Rolf Englund 8/5 2000

Will Saudi Arabia be Next?

The country supplies about 12% of global oil production and sits on at least a fifth of the world’s oil reserves.

Bahrain is near key parts of the country’s crude reserves.

CNBC, 20 Feb 2011

Close ties between the United States and Bahrain

CNN video 2010

Bloody crack-down in Bahrain

The situation is fraught with risk since a Sunni monarchy rules a Shia majority

with mixed Iranian ancestry and sympathetic ties to Tehran.

Ambrose Evans-Pritchard, 18 Feb 2011

If you thought the revolution in Egypt posed some tricky dilemmas for

American foreign policy, how about the upheavals in Bahrain?

Bahrain is a

tiny place. But is also the base for the US Fifth Fleet – the basis of

American power in the Persian Gulf.

Gideon Rachman blog February 17, 2011

Aleklett

Är vi på väg mot en ny oljeprischock eller är den senaste tidens starka återhämtning bara tillfällig?

I grafiken kan du följa oljepriset per fat (Brent) sedan år 2000.

DN 2011-02-05

Kjell Aleklett är professor i fysik vid Uppsala universitet och en av grundarna av Aspo, en organisation som varnar för framtida oljebrist utifrån teorin om oljeproduktionstoppen (peak-oil). Han är inte förvånad över att priserna rusar.

–Nej, det kommer de att fortsätta att göra. Vi kan nå 2008 års nivåer fortare än vi anar, säger han.

Bakgrunden är att vi redan passerat toppen när det gäller råolja, säger han och hänvisar till IEA, International energy agency, som säger samma sak (Weo 2008).

As on most things, economists disagree – sometimes violently – on the question of

whether apparently ballooning global demand for energy can be met in an economically sustainable way.

One trusts to the genius of markets to find efficiencies and alternative

The other takes the view that rising demand will drive prices so high that it kills growth and/or excludes poorer countries from participating in it, with potentially catastrophic economic, social and geo-political consequences.

BP has placed itself firmly with the former of these two camps with its latest "Energy Outlook"

Jeremy Warner Daily Telegraph 20 Jan 2011

It seems more than probable that oil will break back through the $100 a barrel mark in the coming months; the speed of recovery in the world economy has taken everyone by surprise. But there's nothing in the fundamentals to say that this is but a staging post on the road to $200, or even $300 oil.

Oil is back above $90 a barrel.

What the commodity markets are telling us is that we’re living in a finite world, in which the rapid growth of emerging economies is placing pressure on limited supplies of raw materials, pushing up their prices.

Paul Krugman NYT December 26, 2010

Copper and cotton have hit record highs. Wheat and corn prices are way up. Over all, world commodity prices have risen by a quarter in the past six months.

Right now, rising commodity prices are basically the result of global recovery. They have no bearing, one way or another, on U.S. monetary policy.

The graph shows the U.S. trade deficit,

with and without petroleum

CalculatedRisk December 12, 2010

Higly Recommended

To meet even the conservative growth rates posited in the economics section, global energy

production would need to rise by 1.3% per year. By the 2030s, demand is estimated to be nearly 50%

greater than today. To meet that demand, even assuming more effective conservation measures, the

world would need to add roughly the equivalent of Saudi Arabia’s current energy production every

seven years.

U.S. Joint Forces Command’s Joint Operating Environment (JOE), February 2010

Oil price graph July 2010

Calculated risk

Oil has been a slumbering giant for nearly a year, but experts say

the world's most important commodity is set to resume its climb back to $100 by this summer at the latest.

Time Magazine 2 may 2010

If speculators — including investment banks and hedge funds — add fuel to the momentum as they did two years earlier when light crude topped out at $147, oil might be trading at even higher highs around the time of the next U.S. presidential election. This could turn energy security into the top campaign issue, ahead of health care, financial reform and climate change.

abc åäö

The world's oil reserves have been exaggerated by up to a third,

according to Sir David King, the Government's former chief scientist, who has warned of shortages and price spikes within years.

Daily Telegraph 22 March 2010

The scientist and researchers from Oxford University argue that official figures are inflated because member countries of the oil cartel, OPEC, over-reported reserves in the 1980s when competing for global market share.

Their new research argues that estimates of conventional reserves should be downgraded from 1,150bn to 1,350bn barrels

to between 850bn and 900bn barrels and

claims that demand may outstrip supply as early as 2014.

Peak oil:

Revelations that the Saudis have overstated their oil reserves are

a timely reminder of the huge threat to the global economy

Guardian 10 February 2011

Den produktion av kol och olja som IPCC:s skräckscenarier bygger på över huvud taget inte är möjlig.

Detta kan förvisso lindra oron för klimatet, men å andra sidan måste vi oroa oss desto mer för framtida energibrist

Kjell Aleklett DN Debatt 7/12 2009

Nu verkar det som om statsministern /Göran Persson/ accepterar min analys,

skriver Kjell Aleklett i ett första inlägg i en debattserie om oljan och energiförsörjningen.

UNT 13 jan 2006

Kommissionen mot oljeberoendets slutrapport.

I rapporten föreslår kommissionen en rad långtgående, konkreta åtgärder

som till år 2020 kan bryta vårt oljeberoende och påtagligt minska användningen av oljeprodukter.

I have seen the future, and it works

Peak Oil och framtidens nyhetsförmedling

Rolf Englund blog oktober 2009

Click

Our civilisation is based on fossil fuel.

But since the end of 2001, the real price of oil has risen some six-fold.

Today, the real price is higher than since the beginning of the previous century.

Martin Wolf, Financial Times, June 24, 2008

EIA skrev ner sin prognos för världsproduktionen av olja 2030, från 118 till 100 mb/d.

Den för tidigt publicerade uppgiften finns i Annual Energy Outlook 2008 (Early Release) vars egentliga publikationsdatum är i december 2008.

Daniel Berg, ORDFRONT MAGASIN NR 7-8/2008

Rapporten innebär något av ett paradigmskifte: utöver att EIA valde att gå ut med sin nedskrivning i förtid, baseras den på siffror från bland annat USGS, oljeoptimismens främsta västerländska institution. Rapporten underminerar den sista bastionen för en oproblematisk syn framtida oljeproduktion och stödjer rapporterna om "mognande" (sinande) oljefält.

eia.doe.gov/oiaf/forecasting.html

Det började med oförklarligt stigande priser på olja, mat och råvaror.

Som en skakning på övre däck.

Det fortsatte med en förhärjande, allt uppslukande inflation dår alla dittills gällande ekonomiska värden urholkas. Allt fast förflyktigades, det nyss billiga var dyrt och västvärlden tvangs ompröva hela sin livsstil. Mat och värme, inte handväskor, var vad som intresserade folk.

Snart kollapsade hela det industriella jordbruket, det vill säga i stort sett allt som som håller världens befolkning vid liv, och förhärjande hungerepidemier började dra över den fattiga världen.

Följderna av en kommande klimatkatastrof? Nej, det hotande resultatet av den brist på olja som världen just börjat skönja konturerna av, om man ska tro ekonomen Daniel Berg i nya numret av Ordfront (7-8/2008). Någonstans måste ju den ändliga resursen olja ta slut, och många menar att vi ungefär nu passerar höjdpunkten, "peak oil".

Daniel Gross

Houston, We Have No Problems

Houston has become a sort of Silicon Valley for the global energy industry.

Newsweek, Jun 30, 2008 Issue

The IEA puts a date on peak oil production - 2020

The Economist print December 10th 2009

Fatih Birol, the chief economist of the International Energy Agency (IEA), believes that if no big new discoveries are made, "the output of conventional oil will peak in 2020 if oil demand grows on a business-as-usual basis."

Coming from the band of geologists and former oil-industry hands who believe that the world is facing an imminent shortage of oil, this would be unremarkable.

But coming from the IEA, the source of closely watched annual predictions about world energy markets, it is a new and striking claim.

Dr Fatih Birol, chief economist at International Energy Agency (IEA):

Global production is likely to peak in about 10 years

In most fields, oil production has now peaked,

which means that other sources of supply have to be found to meet existing demand.

The Independent, 3 August 2009

The future of energy

A fundamental change is coming sooner than you might think

The Economist print edition, June 19th 2008

As the price of petroleum rises through the roof and the idea that oil might run out is no longer whispered in corners but openly discussed, there is a temptation to believe that the end of the world is, indeed, nigh.

Not everyone, however, is so pessimistic. For, in the imaginations of a coterie of physicists, biologists and engineers, an alternative world is taking shape.

As the special report in this issue describes, plans for the end of the fossil-fuel economy are now being laid

The "peak oil" theory – that oil production has reached its maximum and will soon begin its decline, bringing potentially catastrophic consequences to the modern world – no longer just comes from internet crackpots and conspiracy theorists;

now geologists, market analysts and oil prospectors believe that this scenario is becoming reality.

Michael Savage The Independent 12 June 2008

We now stand at the high water mark of oil production.

That means that not only will we never be able to produce much more oil than the 87 million barrels a day we now consume,

but world oil production will actually begin to fall very soon, causing not only ever higher prices, but also creating the prospect of

shortages, industrial upheaval, battles over ever-depleting resources, and even an end to the modern world built upon the assumption of a plentiful supply of cheap oil.

Is it possible for the vast mass of humanity to enjoy the living standards of today’s high-income countries?

This is, arguably, the biggest question confronting humanity in the 21st century.

Martin Wolf, Financial Times June 10 2008

BP: Oljan räcker 41 år till

DI 2008-06-11

British Petroleum tror att världens nuvarande oljereserver bara räcker i 41 år till med dagens förbrukningstakt.

Det visar bolagets årliga statistikrapport.

"Are We 'Running Out'? I Thought

There Was 40 Years of the Stuff Left"

IEA says high oil prices needed to cap demand

the west’s energy watchdog said in its most candid admission that

oil supply is struggling to catch up with relentless Asian demand for oil.

FT June 10 2008

Fewer than 5 percent of Americans take public transit to work

Any serious reduction in American driving will require more than this

— it will mean changing how and where many of us live.

Paul Krugman May 19, 2008

Greater Atlanta has roughly the same population as Greater Berlin — but Berlin is a city of trains, buses and bikes, while Atlanta is a city of cars, cars and cars.

Changing the geography of American metropolitan areas will be hard. For one thing, houses last a lot longer than cars. Long after today’s S.U.V.’s have become antique collectors’ items, millions of people will still be living in subdivisions built when gas was $1.50 or less a gallon.

Are speculators mainly, or even largely, responsible for high oil prices?

And if they aren’t, why have so many commentators insisted, year after year, that there’s an oil bubble?

Paul Krugman, NYT 12/5 2008

All through oil’s five-year price surge, which has taken it from $25 a barrel to last week’s close above $125, there have been many voices declaring that it’s all a bubble, unsupported by the fundamentals of supply and demand.

Traditionally, denunciations of speculators come from the left of the political spectrum. In the case of oil prices, however, the most vociferous proponents of the view that it’s all the speculators’ fault have been conservatives — people whom you wouldn’t normally expect to see warning about the nefarious activities of investment banks and hedge funds.

After all, a realistic view of what’s happened over the past few years suggests that we’re heading into an era of increasingly scarce, costly oil.

In 1973 the US imported 33 per cent of its oil; today it imports about 60 per cent and this figure could rise to 70 per cent by 2020.

America’s transport system is still completely dependent on oil.

It is common to say that the Gulf is a “vital strategic area”.

“Strategic” is shorthand for saying that it is home to two-thirds of the world’s known oil reserves.

Gideon Rachman, FT May 12 2008

Death of the SUV

Sport utility vehicles and pickup trucks - symbols of Americans' obsession with horsepower, size, and status - are falling out of favor as consumers rich and poor encounter sticker shock at the pump,

paying upward of $80 to fill gas tanks.

Mish May 7 2008

Do high oil prices matter? Isn't the world now less dependent on oil?

You'd think so, if you listened to conventional wisdom.

Liam Halligan, Economics Editor, Daily Telegraph, 19/11/2007

Oil is reaching near-historic highs not due to politically motivated supply constraints but because the world has changed structurally. On the demand-side, the rapidly-industrializing "emerging giants" of the East are using crude like billyo.

Optimists say the world economy is now immune to high oil prices. After all, since 1999, global commerce has boomed despite the ever-growing cost of crude. The Western world is less energy-intensive, they say, given our increasing reliance on service industries.

Even in the West, if oil is so unimportant, why are we using much more of it than we did in the early 1970s?

Sedan slutet av 1990-talet har oljan blivit sex gånger dyrare

Ändå ser man inga kristecken som stagflation

Inte ens om oljan på allvar skulle börja sina behöver det betyda någon ekonomisk kris.

Johan Schück, DN 16/11 2007

Do high oil prices matter? Isn't the world now less dependent on oil?

You'd think so, if you listened to conventional wisdom.

Even in the West, if oil is so unimportant, why are we using much more of it than we did in the early 1970s?

Liam Halligan, Economics Editor, Daily Telegraph, 19/11/2007

Oil closes in on $100 a barrel level

FT 2007-11-07

Oil hits $98 on weakening dollar

BBC 2007-11-07 with good links

The oil squeeze has just begun

It's going to get tighter over the next five years under pressure from both the supply and demand ends.

Jubak's Journa l7/17 2007

The world has two energy crises but no real answers

Gideon Rachman, FT July 10 2007

IEA:

World will face oil crunch "in five years"

FT 10/7 2007

The world is facing an oil supply “crunch” within five years that will force up prices to record levels and increase the west’s dependence on oil cartel Opec, the industrialised countries’ energy watchdog has warned.

In its starkest warning yet on the world’s fuel outlook, the International Energy Agency said “oil looks extremely tight in five years time” and there are “prospects of even tighter natural gas markets at the turn of the decade”.

The IEA said that supply was falling faster than expected in mature areas, such as the North Sea or Mexico, while projects in new provinces such as the Russian Far East, faced long delays. Meanwhile consumption is accelerating on strong economic growth in emerging countries.

Saudi Arabia is running the U.S. economy.

Because the United States still doesn't have a national energy policy, we've thrown decisions about how fast our economy grows and whether our standard of living rises or falls into the hands of Saudi Arabia's oil ministry.

Jim Jubak 5/6 2007

I sin bok "Till sista droppen" från 2005 försöker förre Shell-experten, numera miljöaktivisten, Jeremy Legget,

blicka bortom konsekvenserna av både oljebristen och klimatförändringarna

Dan Jansson DN 30/5 2007

Half Gone: Oil, Gas, Hot Air and the Global Energy Crisis

Oljekulturen, och med den hela den oljedrivna tillväxtekonomin, är definitivt på väg att bli historia.

FN:s klimatpanel IPCC grundar sina antaganden på att världens befolkning kommer att fortsätta förbruka allt mer av fossila bränslen.

Men sanningen är den motsatta. Produktionen av olja i världen kommer inom högst ett decennium att nå sin absoluta topp - "Peak Oil"

Kjell Aleklett DN Debatt 18/5 2007

In the US Sunbelt there are new suburbs in which every house sits on an acre of land. Without cars, these places are uninhabitable. And they are settled at a low enough density to make public transport impracticable.

So breaking dependence on the car would involve not just paying for public transport infrastructure: it would involve writing off thousands of billions of dollars of recent private and public real-estate development.

Christopher Caldwell, FT 27/1 2007

The writer is a senior editor at The Weekly Standard

China's surplus is dwarfed by those of oil-exporting emerging economies, which are expected to total $500 billion.

These surpluses are having a huge impact on international capital flows; and they may, unless the right policy prescriptions are applied, undermine efforts to unwind global imbalances in an orderly way.

The Economist 7/12 2006

This post is written for those who hold the view, understandably, that peak-oil may be a hoax.

I sometimes forget that skepticism of corporate power distorted by bubble-vision makes the study of peak-oil seem like the quest of a knave.

But if it’s not a ruse, the ramifications are vast.

And it’s my contention that most people view technology, energy, and its related solutions with an irrational, often theocratic belief. I want to skip the numbers, if possible, and simply suggest that the issue called peak-oil deserves serious reflection.

M.A. Nystrom 10/11 2006

World demand for oil is set to increase 37% by 2030,

according to the US-based Energy Information Administration's (EIA) annual report.

BBC 20/6 2006, with good links

Kazakhstan moved to reduce its dependency on Russia on Friday, signing a US-backed agreement to supply oil for a key Caspian-Mediterranean pipeline that will provide an alternative energy source for Europe.

The agreement signed by Nursultan Nazarbayev, president of Kazakhstan, and Ilham Aliyev, president of Azerbaijan, resolves one of the outstanding issues to be settled before a long sought-after visit to the White House by Mr Nazarbayev, analysts said.

Financial Times 17/6 2006

More about Kazakhstan at Wikipedia

The 1,760-kilometer Baku-Tbilisi-Ceyhan pipeline to transport crude oil extracted from the Caspian Sea shelf to the Mediterranean Sea basin was inaugurated today near Azerbaijan's capital Baku.

The leaders of Azerbaijan, Georgia, Turkey, and Kazakhstan joined oil executives from nearly 40 countries at the opening ceremony for the line, which bypasses Russia.

Radio Free Europe/Radio Liberty 25/5 2005

Many observers - including myself and the IMF - predicted in 2004 and later that high oil prices would lead to a U.S. and global economic slowdown; but such a slowdown actually did not actually materialize.

http://www.rgemonitor.com/blog/roubini/123823

Jag var igår 13/6 på Nationalekonomiska föreningen och lyssnade på professor Marian Radetzki, som talade över ämnet "hur högt kan oljepriset bli". Det bestod till större delen av en kritik mot de s k oljepessimisterna eller "peak-oil-företrädarna" som hävdar att oljekonsumtionen kulminerar när hälften av alla resurser förbrukats. Detta kommer att inträffa det här årtiondet pga resursbrist..

Danne Nordling 14/6 2006

Paradargumentet för peak-oil-företrädarna är att de nya fyndigheter av olja som nu hittas varje år är mindre än världens årliga oljeförbrukning. Alltså dröjer det inte särskilt länge innan det blir fysisk brist på olja. Mot detta anförde Radetzki att det historiskt har visat sig att nyupptäckta fyndigheter i genomsnitt varit sex gånger större än vad som troddes vid upptäckten.

Hur som helst skall det bli intressant att se om det blir en oljekris 2007 som Aleklett förutspådde för några år sedan. Mest intressant är dock om alla expertbedömningar om att oljepriset långsiktigt skall sjunka till 25-30 dollar per fat (mot ca 70 idag) skall slå in. Men dit återstår ännu många år.

The variety of opinions on how the future will play out in terms of energy is amazingly wide.

There are those like James Howard Kunstler, author of "The Long Emergency," who predict the end of civilization as we know it.

It is not just that we will run out of oil, but that the wars and climate change will undermine the very foundations of human society. He literally suggests you would be better off teaching your children to learn to hitch up a wagon than sending them to school to become a public relations executive.

John Mauldin 24/3 2006

I want to call your attention to a remarkable book by Peter Huber and Mark P. Mills called "The Bottomless Well."It is provocatively sub-titled "The Twilight of Fuel, the Virtue of Waste, and Why We Will Never Run Out of Energy." Huber and Mills take a very hard look at the way we normally think about energy and turn conventional thinking on its head. I highly recommend it.

They use a measure of energy they call a Quad or 100 quadrillion British Thermal Units. In the US we use about 100 Quads of energy a year: 40 to produce electricity, 30 to fuel our cars and another 30 to generate heat in one form or another. That is up from 7 Quads in 1910 and 35 Quads in 1950, and it is rising every year as we bring on more and more energy demanding products.

Most experts agree that we will reach the peak within 25-30 years.

It is less understandable that political leaders from Tokyo to London and Washington have failed

to deal with the threat of a disruption in oil flows from the Gulf.

Robert McFarlane and James Woolsey, Financial Times, January 24 2006

Robert McFarlane was President Reagan's national security adviser and now heads an energy and environmental development firm. James Woolsey, vice-president of Booz Allen Hamilton, was director of central intelligence, 1993-95

Because the impact of growing demand and dwindling supplies is long-term, it is not surprising that there has been only a cautious response to these factors from governments, with no noticeable action.

It is less understandable that political leaders from Tokyo to London and Washington have failed to deal with the threat of a disruption in oil flows from the Gulf. Such an attack on, say, Ras Tanura, an important oil-processing centre in Saudi Arabia, could remove up to 4m barrels a day from the market and overnight send the price of oil well above $100 a barrel.

Such a sharp disruption could last for up to a year and could lead within weeks first to the meltdown of the Japanese economy, due to its almost total dependence on imports, and before long to the collapse of other industrialised economies. This is not alarmist speculation; it approaches a consensus view among oil industry experts and among governments.

First, we must move away from reliance on petrol towards a mixture of alcohol (ethanol and methanol) and petrol. Second, cars and trucks should be made to burn a variety of fuels. Third, we should move to using hybrid-electric vehicles.

Russian gas monopoly Gazprom raised the price from $50 to $230 and Ukraine refused to pay.

The average price in the EU is $240.

BBC 2/1 2006

20 Triggers for the Coming Collapse

There's an 86% probability that America will collapse into a major economic recession

Richard Rainwater is No. 112 on the Forbes 400 list of America's richest, worth $2.3 billion made in oil and real estate

Fox News 10/1 2006

He reads books like "The Long Emergency: Surviving the End of the Oil Age, Climate Change and Other Converging Catastrophes of the 21st Century." He regularly checks blogs like Life AfterTheOilCrash.net, a clearinghouse for commentaries by "the best paid, most widely respected geologists, physicists, and investment bankers in the world."

OK, so the collapse is coming, that's a given in his scenario. But still, two crucial uncertainties remain: When will it start? And what will trigger it?

My prediction: There's an 86% probability that America will collapse into a major economic recession and a sustained bear market in 2006, far worse than the dark days of 2000-2002 with its $8 trillion loss of market cap.

20 Triggers for the Coming Collapse:

More about Chrashes on Wall Street

Richard Rainwater. Richard who?

Appearing in the current issue of Fortune Magazine:

An economic tsunami is about to hit the global economy as the world runs out of oil.

Tim Iacono 14/12 2005

Very Important Article

Rainwater is something of a behind-the-scenes type—at least as far as alpha-male billionaires go. He counts President Bush as a personal friend but dislikes politics, and frankly, when he gets worked up, he says some pretty far-out things that could easily be taken out of context. Such as: An economic tsunami is about to hit the global economy as the world runs out of oil. Or a coalition of communist and Islamic states may decide to stop selling their precious crude to Americans any day now.

Global imbalances, the U.S. dollar, unsound fiscal policies, raging commodities markets, a real estate crash, and Rome burning all seem to be manageable, but an economic tsunami as the world runs out of oil?

That sounds like something that we should keep an eye on.

The Rainwater Prophecy

Richard Rainwater made billions by knowing how to profit from a crisis. Now he foresees the biggest one yet.

Such insights have allowed Rainwater to turn moments of cataclysm into gigantic paydays before

Fortune, December 26, 2005

The dollar’s surprise strength this year has been partly caused by Opec’s recycling of petrodollars.

The currency has risen 13.5 per cent to $1.17 against the euro when most commentators had forecast a fourth straight year of losses.

Financial Times, 5/12 2005

Politicians and pundits explain /US/ current-account deficit by pointing at China.

In fact, the of countries with the biggest surpluses is no longer Asia but oil exporters

This year, oil exporters could haul in $700 billion from selling oil to foreigners.

The Economist, 10/11 2005

The latest annual World Energy Outlook report from the International Energy Agency (IEA)

Under current consumption trends, energy demand will rise by more than 50% over the next 25 years

It says the world has seen "years of under-investment" in both oil production and the refinery sector.

BBC 7/11 2005

The oil industry is bracing for a disaster as Hurricane Rita hit Category 4, with the potential to reach Category 5, and heads towards energy infrastructure in Texas.

"If (Rita) keeps going on its current path, it's going to basically destroy the rest of the (energy complex Hurricane) Katrina didn't," Matthew Simmons, CEO of independent energy investment bank Simmons & Co. International, told CNBC's "Squawk Box."

CNBC 21/9 2005

Oljan behöver inte ta slut för att det ska bli kaos. Det räcker med att den blir en bristvara för att vår civilisation, uppbyggd av plast och billiga transporter, hotar att kollapsa.

Colin Campbell bildade ASPO (Association for the study of peak-oil and gas)

Lars Berge, SvD 5/12 2005

Till och med ett av de stora oljebolagen har nu krupit till korset. I somras lanserade giganten Chevron en massiv kampanj för att tala om för allmänheten att det billiga fossila bränslets era snart är över. En glasnost som förstås borde ha kommit långt, långt tidigare. Som Lindstedt skriver: beslutsfattare, företag och politiker kunde ha lyssnat och börjat förbereda en omställning. I stället har de ignorerat honom så länge de kunnat.

Hans kalkyler... tyder på att vi kommer passera peak-oil inom två år. Då rasar vi över kanten. Efter 2007 kommer världen aldrig någonsin att bli sig lik igen. Det blir säkert på en måndag. I jävla december.

ASPO (Association for the study of peak-oil and gas)

Olja - jakten på det svarta guldet när världens oljekällor sinar

På drygt hundra år har vi förbrukat en stor del av dessa resurser och vant oss vid ett välfärdssamhälle som i allt väsentligt byggt på obegränsad tillgång till olja och billig energi. Nu väntar oljebrist med förödande konsekvenser.

Gunnar Lindstedt, Bokförlaget DN

Bokus 2005

Inom fem-tio år kommer priset på olja att mångdubblas och tvinga oss till en ny livsföring. Med dyrare energi blir manuellt arbete åter viktigare. Kampen om återstående oljetillgångar pågår redan för fullt. USA:s krig i Irak, Rysslands krig i Tjetjenien och hoten om ockupation av Iran är exempel på den kampom oljan som nu förs med militära medel.

Gunnar Lindstedt mottog 1998 Stora Journalistpriset och är en av Sveriges främsta grävande journalister. Han har tidigare utgivit mycket lovprisade böcker som Boo.com och IT-bubblan som sprack (2001) samt Svindlande affärer - historien om Trustor (2000).

Matthew Simmons

The high priest of €œpeak oil€ thinks world oil output can now only decline

July 10th 2008, From The Economist print edition

FOR a man who believes that the world as we know it is coming to an end, as least as far as energy is concerned, Matthew Simmons is remarkably cheerful. He magnanimously excuses The Economist€™s poor record of predicting the price of oil: our suggestion in 1999 that oil would remain dirt cheap was conventional wisdom at the time, he says soothingly.

He also shrugs off our more recent scepticism about his belief that the world€™s production of oil has peaked: he, too, hopes that €œpeak oil€ proves to be a myth, he says. But over a 40-year career in investment banking, Mr Simmons adds, he has learnt never to rely on wishful thinking.

Saudi grandees pooh-poohed Mr Simmons€™s 2005 book on the subject, €œTwilight in the Desert: the Coming Saudi Oil Shock and the World Economy€. But others held it up as convincing proof of the notion that the world€™s oil production would soon reach a pinnacle, never to be exceeded.

The Texas energy specialist, Matthew Simmons, has suggested that the world derives false comfort from Saudi Arabian assurances of willingness to increase production to meet consumer shortfalls (Twilight in the Desert, Wiley).

He argues that Saudi production is close to its peak sustainable volume and is likely to go into decline in the foreseeable future.

Samuel Brittan, Financial Times, 16 2005

Twilight in the Desert: The Coming Saudi Oil Shock and the World Economy

En stigande export till USA är vad som håller i gång både Asien och Europa. I längden är detta ohållbart,

För amerikanska hushåll är det kännbart när bensinen som nu har kommit upp i ett pris som motsvarar över sex kronor per liter.

Johan Schück, DN 10/9 2005

De har vant sig vid stor förbrukning som en del av sin livsstil, inte minst när det gäller biltransporter. Det fungerar vid en lägre prisnivå, men blir chockartat dyrt redan vid bensinpriser som ligger runt hälften av vad européer - med sin höga skattebelastning - nu tvingas vänja sig vid.

Värre är det om bensinpriset förblir högt eller, i sämsta fall, stiger ännu mer - kanske till följd av en ny orkan. Då skulle situationen kunna bli verkligt allvarlig. USA-ekonomin riskerar i så fall att gå in i en recession och dra övriga världen med sig.

700 bn dollar

Deflated by US consumer prices, the price of a barrel of oil is now higher than at any other time over the past 35 years, except during the shock that followed Saddam Hussein’s invasion of Iran

Martin Wolf 7/9 2005

Big rises in oil prices shift income from consumers to producers (and so from net importing countries to net exporters). The numbers here are big. A $40 increase represents a transfer from consumers to producers of $1,200bn a year (about 3 per cent of global GDP, at market prices).

The shift in income from oil importing countries to oil exporters is $700bn a year. Opec members alone gain as much as $400bn.

In the 1970s, the challenge of sustaining spending was known as “recycling”. Unfortunately, the recommended solution, which depended on encouraging developing countries to borrow, also helped generate the debt crisis of the 1980s.

Rolf Englund, Den Stora bankkraschen, Timbro, 1983

http://www.internetional.se/re82bok.htm

The breakdown of order in New Orleans, the looting and the mobs, the state of emergency and shoot-to-kill policy, do not look like something that should happen in the world's only superpower. Financial Times, September 3, 2005

With hindsight, it seems obvious that building a city for 500,000 people in a bowl-shaped depression below sea level on a coast of the US known for hurricanes was tempting fate.

Financial Times editorial, September 3 2005

The temporary lull in hurricane activity in Florida, from 1969 to 1989, spurred a reckless building boom, for example, putting billions of dollars worth of condos and hotels within reach of storm surges, notes Roger Pielke Jr., of the University of Colorado, Boulder. The Great Miami Hurricane of 1926 would have caused an estimated $90 billion damage had it occurred in 2000, he calculated. It caused just over $1 billion, in today's dollars.

Wall Street Journal September 2, 2005

In his 2000 book "Acts of God: The Unnatural History of Natural Disaster in America," Prof. Steinberg documented how much of the toll from "natural" disasters, from the 1886 Charleston earthquake to 1990s hurricanes, has been exacerbated by human actions.

The Katrina Crisis

What makes it an integrated crisis is that the entire energy supply system in the region has been disabled, and that the parts all depend upon each other for recovery. If the next weeks reveal that the losses are as large as some fear, this would constitute perhaps the biggest energy shocks since the 1970s

Mr. Yergin, chairman of Cambridge Energy Research Associates, is author of "The Prize: The Epic Quest for Oil, Money, and Power" (Free Press, 1993).

Daniel Yergin, Wall Street Journal, September 2, 2005

The immediate big hit is from the loss of that 10% of U.S. refining capacity. The world's refining system is stretched taut, and gasoline, diesel and jet fuel now teeter on the brink of short supply. The shortfall has been accentuated by the shutdown for part of the week -- due to electricity loss -- of the two major pipelines that carry refined products from the Gulf Coast to the Southeast and the Mid-Atlantic states. That is why wholesale gasoline prices have shot up 60 cents in four days. The shortfall will be made worse if panicked motorists rush to fill up. In that case, stations would be drained, only further fueling the scramble.

In some areas hardest hit by the disruption, $3-per-gallon gas has already become a fond memory in less than a week

RE: Bensinen i USA kostar nu sex kronor litern

CNBC 1/9 2005

USD 3 = 7,53 x 3 = SEK 22,59

1 gallon = 3,785 liter

22,59/3,785 = 5,96

Bensinen i USA kostar nu sex kronor litern

Why are oil prices so high?

Are oil prices high?

At $60 a barrel, oil is priced at 18 cents a pint!

Yes that is correct: 18 cents a pint. You can not buy water for 18 cents a pint.

Mike Shedlock / Mish

Kommentar av Rolf Englund

18 cent är SEK 1:35

1 pint = 0,4732 liter

Nu kommer det svåra

2,85 - om jag fått decimalkommat rätt

RÃ¥oljan kostar 2:85 per liter

Ramlösa 1,5 liter kostar runt 17:50

vilket ger ett literpris på SEK 11:67

dvs mer än 4 ggr priset på råolja.

Just nu (1/9 2005) ligger råoljepriset runt 70 dollar per fat.

En dollar kostar cirka 7:50 SEK

Ett fat är cirka 159 liter.

70 x 7,50 = 525 kr

525/159 = 3,30

Ergo, en liter råolja kostar SEK 3:30

How much oil do we really have?

In the 1980s OPEC decided to switch to a quota production system based on the size of reserves. The larger the reserves a country said it had the more it could pump. The more it could pump the more money it could make.

BBC 15/7 2005

A few years ago only a handful of geologists and academics were considering such a possibility.

Is global oil production reaching a peak?

A French government report on the global oil industry forecasts a possible peak in world production as early as 2013.

BBC 10/6 2005

What does Peak Oil herald? It heralds the end of cheap energy. In just a short 100 year period our civilization has built a high reliance on cheap, abundant energy.

http://www.peakoil.org/

Matthew Simmons, highly recommended

In 1896, Svante Arrhenius, the Nobel Prize-winning chemist, predicted that burning fossil fuels would increase the concentration of carbon dioxide in the atmosphere and cause global warming. The recent statement from national science academies around the world confirms Arrhenius’s broad conclusion. It also shows that emissions of CO2 are disturbing the delicate balance of factors (such as sea temperature, salinity, currents, ice sheets and solar radiation) that maintained an exceptionally stable, gently warming climate over 8,000 years while human beings achieved the astonishing transformation that we call modern civilisation.

Lord Oxburgh, non-executive chairman of Shell Transport and Trading

Financial Times 4/7 2005

Our global infrastructure worth hundreds of trillions of dollars, and the global economy, are founded on cheap fossil fuels. Our challenge is to manage a transition to a low-carbon economy sufficiently soon to limit climate change and sufficiently gradually to be affordable during normal infrastructure renewal (of vehicles, power stations and so on). Much of our infrastructure is renewed on a 40 to 50-year timescale and if we start now we have a chance. We shall, in any case, have to find alternative sources of energy during the latter part of this century as oil reserves decline; climate change is simply pushing us to do it earlier.

While climate change is undoubtedly a serious problem, the most dangerous aspects are not likely to threaten us for several decades and even then will be ambiguous in their results, bringing benefits for some, hazards for others and little effect for a few.

But there is a danger whose consequences will be far more destructive and which will hit us much sooner. It is a danger that will effect everybody, rich or poor, wherever they live in the world. It will require enormous financial and scientific strides to defeat, strides which the world’s governments show few signs of taking. It is a danger which, quite feasibly, could lead to the end of our industrial civilisation.

It is the danger of oil depletion.

Twilight in the Desert:

The Coming Saudi Oil Shock and the World Economy (pdf),

Matthew R. Simmons, SCI, April 12, 2005

Highly recommended

The price of crude oil is not only reaching new heights in nominal terms but approaching the record real levels seen in 1979.

There are three main areas that are generating new concern about the outlook for oil prices: context, supply and the effects on the world economy.

The writer is senior economic adviser at UBS Investment Bank

George Magnus, Financial Times, August 16 2005

The new concerns arise from some quite contrarian perspectives, summarised as "peak oil". Some think the peak in global oil production could be reached some time between now and 2008, others that it will come between 2010 and 2020, but most agree it is within the next decade or so.

Concern about the depletion of conventional global reserves seems to have intensified for several reasons, including technological improvements in geological data gathering and analysis, the increasingly sparse reserves discovered by new drilling, and concerns that much of the world's conventional oil, especially in the Middle East, is coming from old and over-exploited mega-fields that are becoming less productive.

The overall net transfers from oil consumers to oil producers by 2007 are estimated at about $1,500bn - or nearly 3.5 per cent of world GDP. This would amount to a recycling problem of increasing complexity, from both an economic and a political point of view.

The IEA argues that remaining oil reserves could cover only 70 years

at the average annual consumption between 2003 and 2030.

Martin Wolf, Financial Times, 22/6 2005

We live in the age of Prometheus, the mythological titan who brought fire to humanity and was punished by Zeus, king of the gods. Since the dawn of the industrial revolution, human beings have become ever more ingenious in devising ways of turning fossilised energy into things we desire. Yet, at the base of our economic pyramid remains the release of energy captured by plants hundreds of millions of years ago.

The International Monetary Fund notes that, in real terms, prices remain roughly half of what they were during the second oil shock, which followed the Iranian revolution in 1979

IMF On these assumptions, overall demand for oil is forecast to grow, from an average of 82.4m barrels a day in 2004 to 138.5m in 2030 – a rise of 68 per cent. The high-income countries are forecast to generate just 25 per cent of this increase.

Where might the extra supply come from?

Those who believe in “Hubbert’s peak” – named after M.King Hubbert, who predicted (rightly) that oil production would peak in the early 1970s – argue that we are now very close to a global peak

Kenneth S.Deffeyes, Hubbert’s Peak(Princeton: Princeton University Press, 2001)

International oil companies have advertising campaigns warning that the world is running out of oil and calling on the public to help the industry do something about it.

Financial Times 4/8 2005

Vladislav Savic pekar på ett antal möjliga konflikthärdar i en relativt nära framtid på grund av kampen om världens krympande oljeresurser.

Savic, Vladislav: Det tysta kriget (Natur och Kultur)

Han menar att det pågår ett tyst krig om oljan och andra energikällor. Ett tyst krig därför att ingen vill säga rakt ut att kampen om oljan är den verkliga orsaken.

Han citerar professor Kjell Aleklett i Uppsala som hävdar att OPEC:s regler om produktionskvoter, baserade på storleken av respektive lands oljereserver, har lett till att många länder överdrivit sina tillgångar, för att få exportera mer. Oljan är alltså, enligt Aleklett, på väg att ta slut snabbare än man tidigare trott.

Som att prata dricks i baren på Titanic

För en människa är hundra år mycket. För en

geolog är oljeålderns sekund snart över.

Björn Lindahl,

SvD Näringsliv 18/8 2004

Så sent som 1952 stod USA fortfarande för hälften av all oljeproduktion i världen. Rätten att producera olja fördelades genom ett organ som kallades Texas Railroad Comission.

År 1971 hade emellertid den ökade efterfrågan på olja sugit upp all amerikansk överskottskapacitet. Makten över oljepriset vandrade över till Persiska Viken och oljekartellen Opec. Ett fat olja, exporterat från Saudiarabien, låg oförändrat på 1,80 dollar från 1961 till 1970.

Tre år senare, efter att de arabiska Opecländerna använt oljan som vapen i konflikten med Israel, hade priset ökat till 11 dollar per fat.

Den andra oljekrisen utlöstes av revolutionen i Iran 1979. Oljepriset steg till 40 dollar per fat - i dagens penningvärde hade det motsvarat drygt 90 dollar.

Kjell Aleklett

Professor Department of Radiation Sciences

Uppsala University

US light crude closed trading up $1.08 at a new 21 year high of

$46.58

BBC

with good links as usual 13/8 2004

The world's thirst for oil is being driven by booming growth in China and India, as well as a recovery in the US.

The International Energy Agency has revised upwards its estimate of world oil demand

BBC 11/8 2004

Just as certain as death and taxes is the

knowledge that

we shall one day be forced to learn to live without

oil.

BBC 19/4

2004

Oil

Andrew Oswald, Professor of Economics, Department of

Economics, Warwick University

Financial Times, November 1, 2000

Sir, Your leader "Troubled hearts in Jerusalem" (October 28) states that, because the western industrial economics are less dependent on oil than before, the risks from conflict in the Middle East are less alarming than a quarter of a century ago. This view is common. As I discovered last week while in the US, similar sentences can be found in newspapers such as the New York Times and the Wall Street Journal.

Yet here are the facts. In 1970, North America consumed 16m barrels of petroleum a day. Today it consumes 22m barrels. In 1970, the western European nations got through 12m barrels a day. This year they will consume 15m. In 1970, Japan consumed 4M barrels. Today it is 6m. This is not most people's idea of reduced dependence.

Moreover, to obtain oil, the western nations as a group rely more on imports than in the 1970s.

What is meant, I suspect, by the commonly repeated assertions about our lower reliance on petroleum, is that now, in 2000, we obtain more units of gross domestic product per unit of petroleum. in other words, we are more efficient at using oil. But that is little help. What your editorial should say, though it does not, is that if we bad the income and lifestyle of our parents' generation then we would today be less dependent on petroleum. We do not, of course. And the natural convulsion is therefore exactly the reverse of what you say. Western society is more dependent on oil that at any time in history.

Nuclear Power

Is the nuclear option as scary as it was in the 1950s?

Or is it now vital in the drive to stop global warming and meet the Kyoto targets for reducing carbon emissions?

BBC 20/6 2005