End of the Oil Era

(Earlier Page)

Peak Food

|

John Mauldin, October 14, 2013

Peak Cheap Oil,

which is something that we can quite confidently argue is now safely in the rear-view mirror.

And someday, no matter how much the shale oil plays ultimately contribute to the story, those, too,

shall have their days of ascendancy followed by a terminal decline.

Chris Martenson, September 30, 2013

Our economy is dependent on cheap oil for transportation.

Ron Beasley, Sept 26th, 2011

Zachary Shahan, September 17, 2011

I today, April 11th 2011, hereby declare to have invented the phrase

The Economic Consequences of the Peak

Rolf Englund

Or ECP fort short

Most of us have heard about the book by John Maynard Keynes "The Economic Consequences of the Peace (1919)", even if we have not read it.

In that book he warned of the consequences The Treaty of Versailles which ended WW I and probably partly caused WW II.

I googled the phrase and found from December 27, 2007 an article by Gregory Clark on the economic consequences of peak oil

I also found Economic Impact of Peak Oil, September 23, 2007

OK, that was very close. But not quite.

När Peak Oil höjer prisena och ny-Hooveristerna kör åtstramning

UK riots: 16,000 officers policing London's streets

Rolf Englund blog 9 augusti 2011

A Former BP Exec Explains Why Peak Oil Is Real [PRESENTATION]

Click here

Consider this:

It took all of human history into the 20th century to reach a population of 2 billion.

But in just the next 40 years, the world will add another 2 billion (for a total of 9 billion).

agriculture, as well as oil, metals, and other materials

CNN/Fortune 26 May 2011

To Jeremy Grantham, who oversees $110 billion at GMO, such a dramatic rise in the number of consumers means a world in which agriculture, as well as oil, metals, and other materials, is deeply strained.

Befolkningsökningen - Population growth

Min rubrik var

Peak Oil för dumskallar - Peak Oil for Dummies

Peak Oil innebär att oljeproduktionen når ett maximum och sedan dalar mot noll. Peak Oil sägs ha inträffat i Texas 1971 och i Norge för tio år sedan. Det viktiga ur ekonomisk synpunkt är vad som händer när det uppstår en brist, när efterfrågan överstiger tillgången.

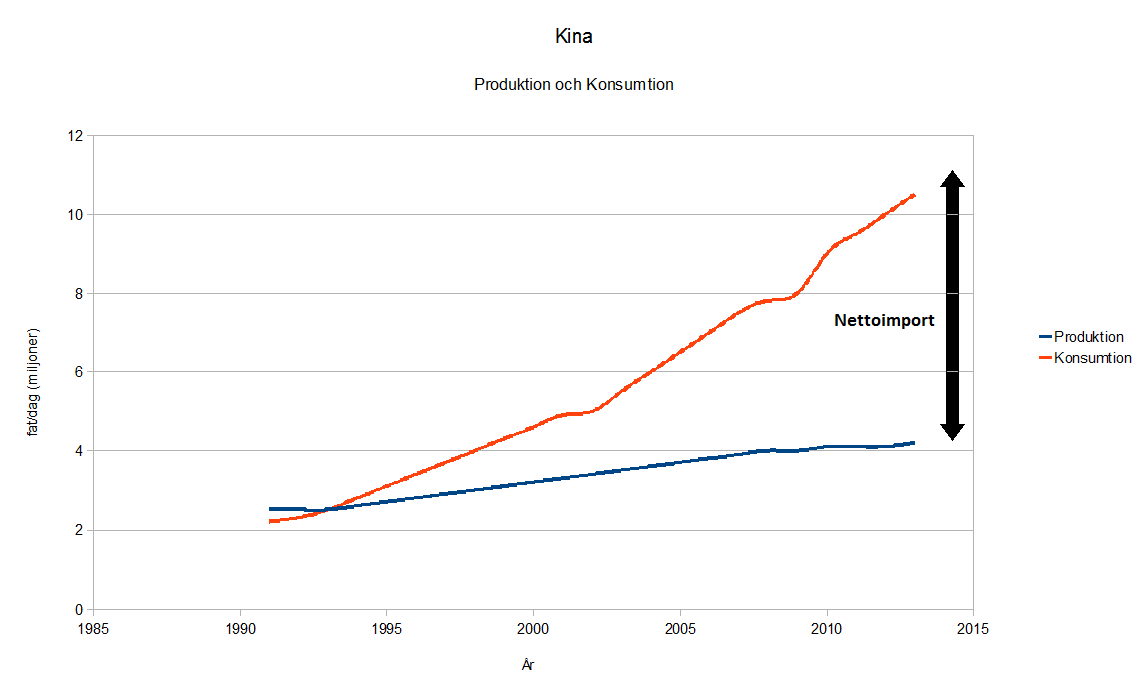

Det nya är att efterfrågan från länder som Indien och Kina blivit större vad vi tidigare hade en aaaning om.

Det skriver Rolf Englund, tidigare på Timbro, och en av grundarna av Medborgare mot EMU, Newsmill 2011-05-03

Som Financial Times Martin Wolf skrev 13 november 2007 var ökningen i Kinas oljeförbrukning mellan 2002 och 2005 lika stor som Japans årliga förbrukning. Bristen ligger långt närmare i tiden och blir långt större än vad vi har trott.

Befolkningsökningen - Population growth

More about it here - Mer här

The Peak Oil Crisis: Peak Oil Elasticity

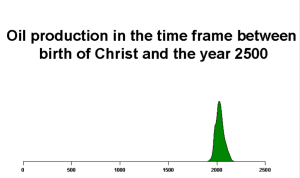

Oljan har tagit miljoner år att bildas. Och på dryga 100 år har vi förbrukat hälften av jordens oljetillgångar...

På mindre än tjugo år skall vi konsumera vad som återstår...

Hur har det kunnat bli så?

Gunnar Lindstedt i boken "Olja - Jakten på det svarta guldet när världens oljekällor sinar", 2005

Det finns en del skräcksenarior som har slagit mig på senare tid", berättar Gunnar.

"Om oljan försvinner och det globala systemet inte längre fungerar är risken stor att vi går rakt in i väggen.

Att vid denna tidpunkt bygga upp ett nytt hållbart samhälle under rådande resursbrist kan bli problematiskt.

Det vore bättre att dra ner på takten nu och 'ställa om' medan vi fortfarande har oljeresurser.

IEA 2012 forecast that the US would be a net oil exporter by 2030 helped bring shale oil production to global attention.

But now it expects US light tight oil production, which includes shale, to peak in 2020 and decline thereafter

Financial Times, 12 November 2013

The International Energy Agency has sounded the alarm about a potential oil supply crunch and higher prices as key Gulf producers delay investment in the face of surging US shale output.

In a strident warning against complacency in the oil market, the developed world’s energy body said key Gulf producers have been adopting a “wait and see approach” to investment, because of the perception that the US shale revolution would produce an “abundance of oil”.

“I am really worried that we are giving the wrong signals to the Middle East, which may end up with us not having investment in a timely manner,” said Fatih Birol, chief economist at the IEA. Mr Birol was speaking as the Paris-based IEA unveiled its annual outlook for the energy market.

Its 2012 forecast that the US would be a net oil exporter by 2030 helped bring shale oil production to global attention.

But it expects US light tight oil production, which includes shale, to peak in 2020 and decline thereafter, even as global demand continues to grow to 101m barrels a day by 2035, from about 90m b/d today.

IEA annual outlook for the energy market

Då är det väl ingen fara då?

World has 10 years of shale oil, reports US

Financial Times, June 10, 2013

Tar oljan snart slut?

Danne Nordling blog 14 juni, 2006, OBS 2006

Jag var igår 13/6 på Nationalekonomiska föreningen och lyssnade på professor Marian Radetzki, som talade över ämnet "hur högt kan oljepriset bli". Det bestod till större delen av en kritik mot de s k oljepessimisterna eller "peak-oil-företrädarna" som hävdar att oljekonsumtionen kulminerar när hälften av alla resurser förbrukats. Detta kommer att inträffa det här årtiondet pga resursbrist.

Debatten började den 12 maj 2005 då professor Kjell Aleklett, ordförande i ASPO, the Association for the Study of Peak Oil&Gas, skrev ett inlägg på Brännpunkt i SvD där Kinas stigande konsumtion anfördes som argument för att toppen för oljekonsumtionen snart är nådd.

År 2003 var konsumtionen i Kina 6 milj fat och den kan kanske bli 10 milj år 2010.

Det ifrågasattes av Radetzki den 12 juli 2005. Kinas ökning 2004 berodde på exceptionella förhållanden.

Peak Oil

Vi måste anpassa oss i betydligt snabbare takt än vi hittills gjort

Kjell Aleklett, Brännpunkt 23/4 2011

Aleklett

Är vi på väg mot en ny oljeprischock eller är den senaste tidens starka återhämtning bara tillfällig?

I grafiken kan du följa oljepriset per fat (Brent) sedan år 2000.

DN 2011-02-05

What cannot go on won't.

Please consider the energy bulletin article China’s Energy Future by Robert Rapier.

China uses about two barrels a year of oil per person. In the United States we use 23 barrels of oil per person per year.

If China’s usage grew to the U.S. equivalent, it would be 85 million barrels a day,

which is about the total consumption of oil for the world.

Mike Shedlock / Mish June 14, 2011

There will be a major disaster long before China consumes anywhere close to that amount. Yet China bulls insist China will keep growing at the same rate. Peak oil says it's not remotely possible.

China’s Energy Future

by Robert Rapier

Stein's Law: If something cannot go on for ever it will stop.

Herbert Stein

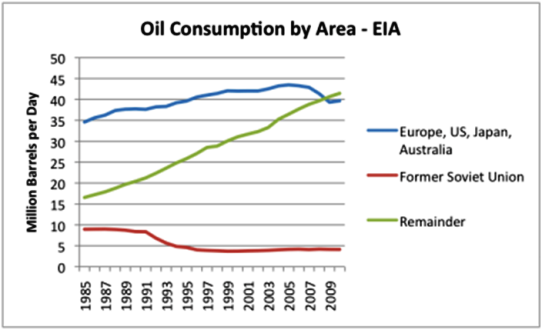

"The increase in China’s energy demand between 2002 and 2005 was equivalent to Japan’s current annual energy use.”

This nugget of information, buried in the International Energy Agency’s latest World Energy Outlook, tells one almost all one needs to know about what is happening to the world’s energy economy.

Martin Wolf, FT November 13 2007

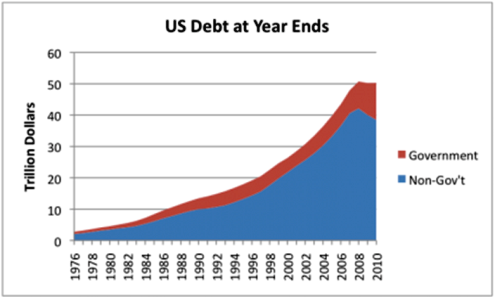

Peak Oil and the Second Great Depression (2010-2030):

A Survival Guide for Investors and Savers After Peak Oi

Kenneth D Worth 2011

In the introduction he writes:

Why am I so pessimistic? Well, two things.

The first is "Peak Oil". The second is what I refer to as Peak Debt.

zc

The US trade deficit narrowed to its lowest level in four years in November,

as rising sales of oil pushed US exports to a record high.

BBC 7 January 2014

The trade gap dropped by 12.9 % to $34.3bn in November, the smallest monthly deficit since October 2009.

Imports fell 1.4 % from October as a fall in demand for foreign oil offset a record level of imported cars.

After peaking at $102 per barrel in September, the average price of a barrel of imported crude oil has been falling.

It averaged $94.69 a barrel in November.

IEA 2012 forecast that the US would be a net oil exporter by 2030 helped bring shale oil production to global attention.

But now it expects US light tight oil production, which includes shale, to peak in 2020 and decline thereafter

Financial Times, 12 November 2013

De senaste 20 åren av kinesisk dominans på tillväxtmarknaden har sin förklaring i oljekonsumtionen.

Tyvärr så har nu peak oil inträffat och den globala oljeproduktionen har legat konstant runt 85 miljoner fat per dag de senaste åren.

Alltså måste Kinas eventuella framtida tillväxt ske på någon annans bekostnad, såvida vi inte får se ett riktigt mirakel.

Peakenergi, 5 juli 2013

Med andra ord har vi en akut brist på olja, men det är inte en brist som gör att det saknas bensin när du ska tanka.

Vi talar om en brist som förhindrar fortsatt tillväxt och därmed hotar att fälla det globala finansiella systemet.

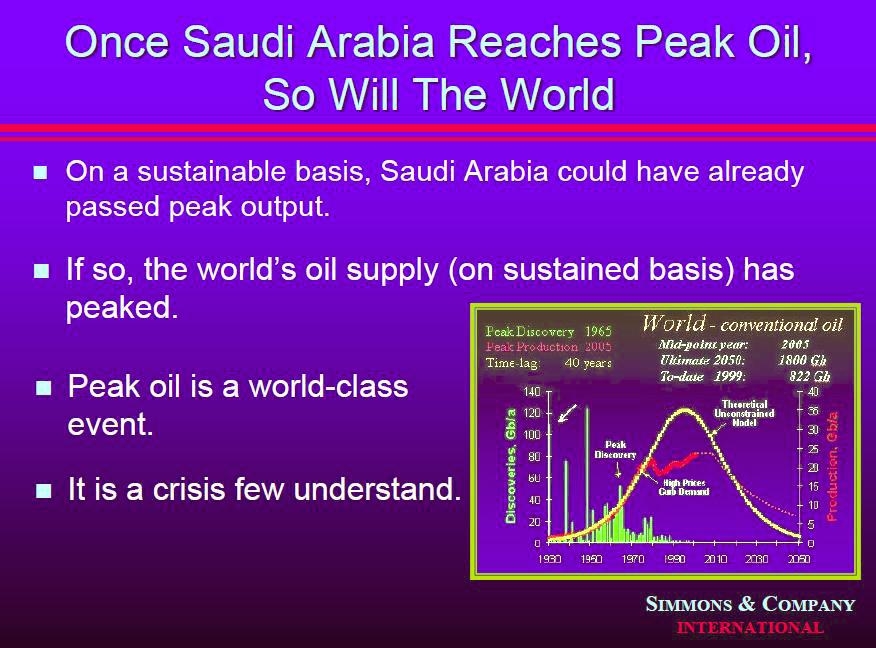

Twilight in the Desert: The Coming Saudi Oil Shock and the World Economy

Då är det väl ingen fara då?

World has 10 years of shale oil, reports US

Financial Times, June 10, 2013

The shale-gas revolution in America - on the verge of self-sufficiency in natural gas.

This week the International Energy Agency (IEA) predicted that the United States would become the world’s largest oil producer by 2020,

outstripping Saudi Arabia and Russia

The Economist, 17 November print edition

There has been a very strong and concerted public-relations effort to spin the recent shale energy plays of the U.S. as complete game-changers for the world energy outlook.

These efforts do not square up well with the data and are creating a vast misperception about the current risks and future opportunities among the general populace and energy organizations alike.

The world remains quite hopelessly addicted to petroleum, and the future will be shaped by scarcity – not abundance, as some have claimed.

Chris Martenson, 15 January 2013

The really big picture goes like this:

Humans discovered about 400 million years worth of stored sunlight in the form of coal, oil, and natural gas, and have developed technologies that will essentially see all of that treasure burned up in just 300 to 400 years.

On the faulty assumption that fossil fuels will always be a resource we could draw upon, we fashioned economic, monetary, and other assorted belief systems based on permanent abundance, plus a species population on track to number around 9 billion souls by 2050.

There are two numbers to keep firmly in mind. The first is 22, and the other is 10. In the past 22 years, half of all of the oil ever burned has been burned. Such is the nature of exponentially increasing demand. And the oil burned in the last 22 years was the easy and cheap stuff discovered 30 to 40 years ago. Which brings us to the number 10.

In every calorie of food that comes to your table are hidden 10 calories of fossil fuels, making modern agriculture and food delivery the first type in history that consumes more energy than it delivers. Someday fossil fuels will be all gone.

Forget America’s fiscal cliff, Europe’s currency troubles or the emerging-markets slowdown.

The most important story in the global economy today may well be some good news

“contrary to what most people believe, oil supply capacity is growing worldwide at such an unprecedented level that it might outpace consumption.”

New York Times, August 9, 2012

Until very recently, our collective assumption was that oil was running out. That was partly a matter of what seemed like geological common sense. It took millions of years for the earth to crush plankton into fossil fuels; it is logical to think that it would take millions of years to create more.

The rise of the emerging markets, with their energy-hungry billions, was a further reason it seemed obvious we would have less oil and gas in 2020 than we do today.

Obvious — but wrong. Thanks in part to technologies like horizontal drilling and hydraulic fracking, we are entering a new age of abundant oil.

As the energy expert Leonardo Maugeri contends in a recent report published by the Belfer Center at the John F. Kennedy School of Government at Harvard, “contrary to what most people believe, oil supply capacity is growing worldwide at such an unprecedented level that it might outpace consumption.”

Mr. Maugeri thinks the tipping point will be 2015. Until then, the oil market will be “highly volatile” and “prone to extreme movements in opposite directions.” But after 2015, Mr. Maugeri predicts a “glut of oil,” which could lead to a fall, or even a “collapse,” in prices.

Brent crude jumped to $115 a barrel last week.

Petrol costs in Germany and across much of Europe are now at record levels in local currencies.

This is a remarkable state of affairs given the world economy is close to a double-dip slump right now, the latest relapse in our contained global depression.

Ambrose Evans-Pritchard, 26 Aug 2012

Diesel is above the political pain threshold of $4 a gallon in the US, hence reports circulating last week that the International Energy Agency (IEA) is preparing to release strategic reserves.

Barclays Capital expects a “monster” effect this quarter as the crude market tightens by 2.4m barrels a day (bpd), with little extra supply in sight.

Goldman Sachs said the industry is chronically incapable of meeting global needs. “It is only a matter of time before inventories and OPEC spare capacity become effectively exhausted, requiring higher oil prices to restrain demand,” said its oil guru David Greely.

Across the country, the oil and gas industry is vastly increasing production, reversing two decades of decline.

Using new technology and spurred by rising oil prices since the mid-2000s, the industry is extracting millions of barrels more a week,

The increasing production and declining consumption have unexpectedly brought the United States markedly closer to a goal

that has tantalized presidents since Richard Nixon: independence from foreign energy sources

NYT/CNBC 23 March 2012

Given the discoveries of the past few years in the exploitation of shale gas and oil

should lead to sustained improvement in the US trade deficit

Energy imports account for around half of the US trade deficit (while the other half is broadly manufactured goods from China).

Today the US, through its trade deficit, sends roughly US$500bn worth of cash to the rest of the world every year.

Louis Gave, March 14, 2012

Plateau Oil meets 125m Chinese cars

The unpleasant fact we must all face is that the relentless supply crunch

- call it `Peak Oil’ if you want, or `Plateau Oil’-

was briefly disguised during the Great Recession and is

already back with a vengeance before the West has fully recovered

Ambrose Evans-Pritchard, Telegraph 4 March 2012

Burning Oil to Keep Cool:

The Hidden Energy Crisis in Saudi Arabia

(RE: and other hot countries, e.g. India)

Chatham House, December 2011

Domestic energy demand growth in Saudi Arabia is cause for international concern. If it continues at the current rate, it could jeopardize the country's ability to stabilize world oil markets.

Daniel Yergin’s peak oil commentary in last Saturday’s Wall Street Journal has set the econoblogosphere to chattering,

In addition to the clash of the titans, i.e. James Hamilton’s “More thoughts on peak oil” rejoinder to Yergin, the mere mortals are going at it, too.

Dr. Michael Giberson, theenergycollective.com, 24 Sept 2011

Michael Levi did a quick round-up of reactions at his Council on Foreign Relations-based blog, then added his views. He expressed some exasperation about the “muddled, often faith based” arguing that goes on when peak oil is the topic.

In 2011, we consume four to six barrels for every one barrel of oil discovered.

And to make matters worse, the newly discovered oil is much more expensive to refine and will further undermine our global system that is centred around cheap oil;

everything from shampoo and fertiliser to asphalt and electronics is dependent on oil.

Imtiaz Rafi Butt, The Nation, September 10, 2011

The writer is the chairman of the Jinnah Rafi Foundation and honorary consul for Malaysia.

Even though many economic pundits are trying their utmost to convince the world that it is in recovery, and that the mistakes leading to the financial meltdown of 2008 have been corrected, I have great concern that these experts, who did not see the 2008 fiasco coming, are ignoring the facts and seem to be in a state of denial.

Globally, there are now seven billion people, and populations in the rapidly developing countries, such as India and China, are starting to behave like American consumers. Thus, these countries will now be competing for the same resources as the US, causing further global inflation.

En bok, en författare stora förnekelsen"

vårt förhållande till jordens tillgångar och myten om att de är oändliga.

Anders Wijkman intervjuas av Birger Schlaug.

URplay 2011

...

Anders Wijkman om det globala krisläget

Energi och Peak Oil

Youtube 2010

Will Technology Save Us From Peak Oil?

http://www.thestreet.com/story/11219321/1/will-technology-save-us-from-peak-oil.html

Past peak oil - life after cheap fossil fuels

Bulent Gokay, professor of international relations at Keele University UK, 4 August 2011

Oil is the most strategic raw material. It can hardly be overstated how crucial petroleum is to our modern industrial society. Oil fuels the economy. It is the largest single traded product in the world.

It provides about 95 per cent of all transportation fuels and 40 per cent of global energy.

Oil is also determinant of national security. Today's modern armies are entirely dependent on oil-powered ships, planes, helicopters and armoured vehicles.

Oil also supplies feedstock for thousands of manufactured products and is vital for food manufacturing. Some 17 per cent of our energy is used for producing food. Modern agriculture makes heavy use of oil in a variety of ways. We use oil for fertilisers, pesticides, and for the packaging and distribution of food.

Oil Prices and the Fall of the Soviet Union

Gail Tverberg, 11 August 2011

The Relationship Between Peak Oil and Peak Debt - Part 1 Gail Tverberg Tuesday, 12 July 201

The Relationship between Peak Oil and Peak Debt - Part 2 Gail Tverberg, 14 July 2011

Denial of peak oil becomes more dangerous by the day.

The Obama administration prattles about clean energy, solar, wind and ethanol,

when petroleum powers 96% of the transportation sector and 44% of the industrial sector.

TheBurningPlatform 15 June 2011

Coal provides 51% of the country’s electricity, and nuclear accounts for another 21%. Renewable energy contributes only 6.7% of the country’s energy needs, mostly from hydroelectric facilities.

Ethanol works nicely as a slogan but poorly as a solution. The ethanol boondoggle diverts 40% of the U.S. corn crop to fuel production.

The real cost to produce a gallon of ethanol (tariffs, lost energy, higher food costs) exceeds $7 and has contributed to the price of corn rising 112% in the last year.

The 107 million tons of grain that went to U.S. ethanol distilleries in 2009 would have been enough to feed 330 million people for one year.

The U.S. Energy Information Administration (EIA) calculated the costs in dollars per megawatt/hour of different energy sources as follows: Conventional coal power: $100.40; Natural gas: $83.10; Nuclear: $119.00; Onshore wind power: $149.30; Offshore wind power: $191.10; Thermal solar power: $256.60, Photo-voltaic solar power: $396.10.

Read more:

Fears about peak oil are misplaced.

Peak oilers focus on reserves and production of conventional (light) crude and ignore the much larger hydrocarbon base of heavy oils, coal, natural gas, kerogen and gas hydrates.

With current extraction and refining technologies there is an almost unlimited supply of fossil fuel energy -- including high energy-density liquid fuels suitable for transportation -- at real prices less than $100 per barrel.

We will have cooked the planet through global warming long before we run out of fossil fuels.

John Kemp June 15 (Reuters) The views expressed are his own

Estimates of conventional energy reserves - particularly in America - continue to grow.

U.S. oil-deposit estimates have been raised recently by a factor of five to 135 billion barrels,

and new methods of natural-gas extraction have put a 100 year’s supply within reach.

Washington Times, editorial 13 June 2011

China Surpasses US As Largest Energy Consumer;

World Has 46.2 Year Of Proved Oil Reserves;

Crude Has Lots Of Upside In Real Terms

zerohedge, 8 june 2011

In its just released must read Statistical Review of World Energy, BP has many critical observations, the key of which, while not a surprise to most, is that as of 2010, the US is no longer the world's biggest consumer of energy. The new leader, with a 20.3% share of global energy consumption: China. Keep in mind that the Chinese economy is still (in whatever centrally planned terms it discloses) not even half the size of the US, thus one can only imagine how far this number will rise should China ultimately succeed in its goal of converting from an export-led to a consumer-led society.

The extent of global oil demand is a subject that generates surprisingly little attention.

The reality is, though, that worldwide oil consumption is escalating far faster than is commonly understood.

New estimates by BP suggest that by 2030 the world will be consuming 40pc more energy than it does today.

Liam Halligan, Daily Telegraph 11 Jun 2011

Global demand in 2011 will go above 90m barrels per day for the first time in history, according to the International Energy Agency,

This is happening even though the Western world is in the economic doldrums.

China and India between them are home to a third of the world's population.

As they grow, these countries are investing massively in infrastructure development – roads, buildings, machinery. This is highly energy-intensive. In conjunction with this, their vast and fast-growing populations are becoming wealthier, acquiring cars and consumer goods for the first time, while switching to protein-rich diets.

When Monbiot then interviewed IEA Chief Economist Fatih Birol, and he revealed that the peak would come by 2020 (Birol has since gone on record stating that no government is prepared for peak oil, and that conventional production may have already peaked in 2006), he repeated a previous Freedom of Information Act request to find out what preparations the government had made for peak oil:

So I sent the government another request: in the light of what the IEA has revealed, what contingency plans has the UK now made?

The response amazed me: "With sufficient investment, the government does not believe that global oil production will peak between now and 2020 and consequently we do not have any contingency plans specific to a peak in oil production."

treehugger, 17 June 2011

The government was warned by its own civil servants two years ago that there could be

"significant negative economic consequences" to the UK posed by near-term "peak oil" energy shortages.

Terry Macalister, guardian, 15 June 2011

Ministers were told it was impossible to know exactly when production might fail to meet supply but when it did there could be global consequences, including "civil unrest".

Yet ministers consistently played down the threat with the contemporaneous Wicks review into energy security (PDF) effectively dismissing peak oil as alarmist and irrelevant.

The Department of Energy and Climate Change (DECC) is refusing to hand over policy documents about "peak oil" – the point at which oil production reaches its maximum and then declines – under the Freedom of Information (FoI) Act, despite releasing others in which it admits "secrecy around the topic is probably not good".

Terry Macalister and Lionel Badal, The Observer, 22 August 2010

Experts say they have received a letter from David Mackay, chief scientific adviser to the DECC, asking for information and advice on peak oil amid a growing campaign from industrialists such as Sir Richard Branson for the government to put contingency plans in place to deal with any future crisis.

Not just that the global economy remains severely unbalanced or that it is business as usual in an unreformed financial sector.

It is not even that the euro area could trigger the sort of mayhem last seen in the autumn of 2008.

It is that oil prices have been rocketing and greenhouse gas emissions increased by a record amount last year.

There is the potential there for not just one crisis but three: a situation where the ATMs freeze up, the planet warms up, and the lights go out

Larry Elliott, Guardian, 31 May 2011

Deja vu for the global economy

As explained in this earlier blog, economic fundamentals suggest that oil prices may have trouble maintaining their present levels,

and seem quite likely to drop by 10-20 per cent in coming quarters.

If that proves correct, then the global slowdown, like last year’s, will prove temporary.

If not, then it is a different ball game entirely.

Gavyn Davies May 29, 2011

Last week, the International Energy Agency’s Governing Board expressed “serious concern” that

the rise in oil prices since September threatens economic recovery

by “widening global imbalances, reducing household and business income and placing upward pressure on inflation and interest rates.”

Market Watch, May 29, 2011

The only thing that could prevent another oil shock from happening before the end of 2012 would be another major economic contraction

One part I whiffed on was in my prediction that the world community would have embraced the idea of Peak Oil by now and begun adjusting accordingly

Perhaps things are being differently and more seriously considered behind closed doors, but out in public the dominant story line concerns reinvigorating consumer demand, not a looming liquid fuel crisis.

How the major economies can continue proceeding with a business-as-usual mindset given the oil data is really quite a mystery to me

Chris Martenson's Blog, May 27, 2011

The Coming Economic Contraction

Economic contraction, the lowering of material wealth standards especially for the middle classes,

is more complex than the simple redistribution of tiny increments of wealth from the multitude to the aggressively rich.

James Keye / May 25th, 2011

Economic contraction, the lowering of material wealth standards especially for the middle classes, is more complex than the simple redistribution of tiny increments of wealth from the multitude to the aggressively rich. There is a more serious process in play. It is that those peoples and nations using more than an average of about 2.5 hectares per capita of the earth’s productive capacity must bring down their use (1 hectare = 100 meters by 100 meters = 2.47 acres): this can be done with some equity and social justice or it can be done in dynamic struggle to keep present levels, increase use on the old pattern, if possible, and push want and despair off onto others.

Oil-producing countries have been warned /by IEA/to increase output

to safeguard global economic recovery or face the threat of the release of strategic stockpiles of oil by western countries for the first time since 2005

Financial Times 19 May 2011

Edward Burtynsky/OIL

fotografiska.eu/Museet/Utstaellningar/Burtynsky-OIL

Peak Oil at - ABC (Australian Broadcasting Corporation)

I it is interesting to watch the issue creep into the mainstream media

Liks to videos at youtube

May 2011

Dr Jonica Newby interviews Dr Fatih Birol of the International Energy Agency (IEA), Prof Kjell Aleklett of Uppsala University and President of the Association for Study of Peak Oil and Gas (ASPO), Dr Jeremy Leggett, Chris Skrebowski, and Professor Robert Bea.

Oil prices are likely to continue rising because the world's oil reserves are dwindling,

The world uses 86 million barrels of oil every day, he pointed out, adding: "we found some big oil fields in Brazil and let's say the bull estimates there are correct, that's still only two years worth."

famous investor and commodities bull Jim Rogers told CNBC 5 May 2011

In March, Rogers predicted that crude prices will rise over the next decade. (link)

"Where is the oil? I still want to know where is the oil? You know why the price of oil is going up? Because there is no oil," he said.

Just as we began to see at least the potential for peak oil and a rapid decline in the quality of some of our resources, we had the explosion of demand from China and India and the rest of the developing world.

Here, the key differences from the past were, as mentioned, the sheer scale of China and India and the unprecedented growth rates of developing countries in total. This acceleration of growth affected global demand quite suddenly.

Jeremy Grantham, the Chief Investment Officer of GMO Capital, with over $106 billion in assets under management, oilprice.com, 2nd May 2011

For a small window of time, about 250 years (starting, ironically, just in time to make Malthus’ predictions based on the past look ridiculously pessimistic), from 1800 to, say, 2050, hydrocarbons partially removed the barriers to rapid population growth, wealth, and scientific progress. World population will have shot up from 1 to at least 8, and possibly 11, billion in this window, and the average per capita income in developed countries has already increased perhaps a hundred-fold (from $400 a year to $40,000). Give or take.

Den norska oljeproduktionen passerade sin topp för tio år sedan

Trots det kommer det att investeras 750 miljarder svenska kronor de kommande fyra åren i landets offshorenäring

e24, 2011-04-30

Every step of the food chain rests entirely on oil and cheap energy

Peak Oil and Soil (Eric Andrews, August 1, 2007)

Peak Oil

The reason, as with so many global economic trends, can be summed up in a single word: China.

Since 2008, the last time oil passed $100 per barrel, demand in the developed world has fallen by 2.7m barrels per day,

or 6 per cent, and 4 per cent in the US, according to Trevor Houser of the Rhodium Group in New York.

At the same time, demand in developing countries has grown by 4.4m b/d, or 11 per cent, with China accounting for roughly half that growth.

FT April 25 2011

Peak Oil

Vi måste anpassa oss i betydligt snabbare takt än vi hittills gjort

Kjell Aleklett, Brännpunkt 23/4 2011

För tio år sedan, från den 1 mars till den 20 maj 2001, fick jag möjlighet att på Brännpunkt skriva fyra debattartiklar om oljans och naturgasens framtid.

Jag föreslog också att Göran Persson skulle ta till sig Peak Oil-problematiken, vilket han gjorde och tillsatte oljekommissionen.

Under fem år har jag försökt få industri- och energiminister Maud Olofsson (C), före detta infrastrukturminister Åsa Torstensson (C) och miljöminister Andreas Carlgren (C) intresserade av Peak Oil, men jag måste erkänna att jag har misslyckats.

Den 3 maj är jag inbjuden att hålla föredrag på ett seminarium om Peak Oil i EU-parlamentet

The combination of rising gasoline prices and the steepest increase in the cost of food in a generation

is threatening to push the US economy into a recession,

according to Craig Johnson, president of Customer Growth Partners

CNBC 21/4 2011

"The combined increase in the necessities of food and energy creates a harsh double whammy for already stressed consumers," Johnson said. The last time this happened was in the recession that lasted from 1973 to 1975.

Peak Oil

Energy Commissioner Andris Piebalgs has drawn attention to the 'overlooked' issue of dwindling oil reserves coupled with rapidly growing and unprecedented global demand

EurActiv 16 January 2008