Financial Crisis

Home - Index - Krisen 1992 - EMU - Economics - Cataclysm - Wall Street Bubbles - US Dollar - Houseprices

The shadow banking system and The Volcker Rule

Basel - Too Big To Fail - The Bankers’ New Clothes - Finanskrisen/The Great Recession

At the base of the Volcker rule is a sound principle – that federally insured deposits should be not be used for speculation.

If banks want cheap funding from deposits, they must accept limits on what they can do with the money.

Lex, Financial Times December 6, 2013

Keeping at it, by Paul Volcker

Paul Volcker is the greatest man I have known.

He is endowed to the highest degree with what the Romans called virtus (virtue): moral courage, integrity, sagacity, prudence and devotion to the service of country.

Review by Martin Wolf FT 29 October 2018

Last week, I received a poignant invitation:

Paul Volcker, the legendary former chairman of the US Federal Reserve, asked me to visit his apartment to discuss his legacy.

Gillian Tett FT 25 October 2018

Mr Volcker is publishing his memoir. The release of Keeping At It was initially scheduled for late November but the publisher has rushed the date forward to October because the former Fed chair is ill.

So the towering figure of finance wanted to share some thoughts — and warnings — to current and future policymakers, politicians, voters and investors.

Peter Praet, the ECB’s chief economist, told a Financial Times conference that

he was particularly worried about “the degree of leverage in the financial system ...

because of the shadow banking system”.

Patrick Jenkins FT 1 October 2018

China’s $10 trillion ecosystem of unregulated lending, known as shadow banking.

Bloomberg 19 July 2018

Shadow banking nears pre-crisis peak

FT October 30, 2014

The broadest measure of shadow banking assets tracked by the Basel-based Financial Stability Board

grew by $5tn to surpass $75tn last year in 20 countries plus the euro area.

That represented 120 per cent of the region’s gross domestic product - approaching the high of 123.4 per cent recorded in 2007.

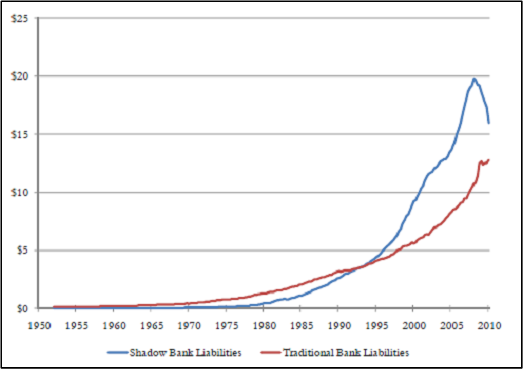

The shadow banking system was at the heart of the financial crisis.

Preventing a re-run of this spiral has been a central goal of lawmakers and regulators since 2008.

Financial Times editorial 14 October 2014

In the meltdowns of Lehman Brothers and AIG, the equivalent of bank runs afflicted money market funds, repo markets and securities lending.

When panicked lenders pulled the short-term funds that backed financial groups’ long-term assets, borrowers could not sell holdings fast enough to meet the demand for cash.

shadow banks

One example is the operation of so-called repo markets, where banks lend to so-called shadow banks,

such as hedge funds, against the security of bonds.

BBC 14 October 2014

This is debt created and lent against the collateral of other debt - debt manufactured on the back of extant debt.

The risk, as the world witnessed in horror just over six years ago with Lehman's demise,

is that when a lender cannot get its money back and sells the bonds held as collateral, this can lead to a collapse in the price of those bonds

- which has the duel pernicious impact of generating huge losses for the lender, imperilling its ability to lend, and causing haemorrhages in bond markets,

thus undermining the ability of households and business to raise precious funds around the back of the banking system.

Massive deflationary credit contraction sets in, of the kind that transformed the financial debacle into the worst economic contraction the world has seen since the 1930s.

The lure of shadow banking

The Economist Special Report, 10 May 2014

The FSB, which defines shadow banking as lending by institutions other than banks, reckons it accounts for a quarter of the global financial system, with assets of $71 trillion at the beginning of last year, up from $26 trillion a decade earlier.

Shadow insurance schemes multiply to $360bn

Financial Times, September 30, 2013

US insurers have offloaded more than $360bn worth of liabilities to subsidiaries in jurisdictions with weaker reserve rules underlining how insurers have shifted a swathe of their holdings into the shadows.

Critics warn that the strategy allows US life insurers to set aside less money as reserves to pay future claims than they would otherwise be required to, leaving insurers and their customers vulnerable in the event of a sudden spike.

Prospect of a deal on Volcker rule worries banks

FT, November 11, 2013

One of the few people that Fed officials have seen is Greg Smith,

the Goldman Sachs banker who resigned from the institution to rail against its “toxic” culture and

told Fed staff that “all principal positions should be prohibited and only agency trading on behalf of customers be permitted”.

His is not exactly the message that banks hope will be heard from their lawyers and lobbyists.

The system of so-called "shadow banking,"

blamed by some for aggravating the global financial crisis,

grew to a new high of $67 trillion globally last year

CNBC, 18 Nov 2012

A report by the Financial Stability Board (FSB) on Sunday appeared to confirm fears among policymakers that shadow banking is set to thrive, beyond the reach of a regulatory net tightening around traditional banks and banking activities.

JPMorgan said the mark-to-market losses came in the bank’s chief investment office, a unit set up to invest excess deposits,

which has drawn controversy after hedge funds alleged it was taking big proprietary bets.

Proprietary trading is set to be banned in the US by the forthcoming “Volcker rule”

Financial Times, 11 May 2012

The losses revealed on Thursday are likely to stiffen regulators’ resolve to enforce that ban broadly.

Carl Levin, a Democratic senator who has pushed for a strict interpretation of the rule, said “the enormous loss” was “just the latest evidence that what banks call ‘hedges’ are often risky bets”.

He called for “tough, effective standards... to protect taxpayers from having to cover such high-risk bets”.

The Volcker rule

Why fences, walls and other myths cannot save us from bankers' risks

- a dilemma shared by much of the Western world

IBC's solution is built on a series of myths, myths that have been ruthlessly promoted by the UK banking lobby

Liam Halligan, Daily Telegraph, 9 Apr 2011

Larry Summers about Banks och Shadow Banks:

“There is a Maginot Line risk,” “That which is being defended is indeed impregnable – but not difficult to circumvent.”

FT February 2 2011

“Risk is risk,” said Gary Cohn, president of Goldman Sachs. “My concern is that risk will move from the regulated, more transparent banking sector to a less regulated, more opaque sector.”

As the International Monetary Fund and World Bank meetings start in Washington,

the word “deleveraging” is haunting policymakers and investors.

It is now crystal clear to everybody that debt levels were absurdly high during the credit boom.

Gillian Tett, FT October 7 2010

July 13th 2010, by S.C. The Economist Economics Free exchange

ONE of the failures leading up to the crisis was the inability of regulators to understand the scale of the shadow banking system or its interconnectedness with the overall financial system.Click

a new Glass-Steagall Act – a complete separation between classic commercial banking and investment banking

Capitalism works – and works far better than any other system – because the discipline of the marketplace keeps greed, folly and incompetence in check.

When this is lacking, when businesses are considered too big, too important, or too interconnected to fail, this crucial discipline disappears, and

disaster is almost inevitable. Separation is essential to avoid this.

Nigel Lawson, Financial Times 5 February 2012

In an important speech last December, the Bank of England’s Andrew Haldane argued that the accounting system for banks needed radical reform. He concluded: “A distinct accounting regime for banks would be a radical departure from the past. But if we are to restore investor faith in banking sector balance sheets, nothing less than a radical rethink may be required”. He is absolutely right.

Between mid-1979 and November 1980 the sterling rate against the dollar rose from $2 to $2.45. There followed the sharpest fall in UK real output in a three-year period since 1850.

Real manufacturing output fell 20 per cent In three years. Unemployment rose 60 per cent 4n the 18 months up to January 1981, and for the only time in UK history the rise continued for seven years.

- Then, sterling fell 30 per cent against the D-mark between July 1985 and February 1987, - with dramatic results. In 1986, unemployment started to drop for the first time for seven years.

Nigel Lawson discovered that he had performed, though unintentionally, an economic miracle.

Fixed exchange rates and the lessons of history

Douglas Jay, FT 1990-10-10

There are a couple of things to say about Britain’s banks

They still pose a serious threat to the nation’s long-term stability and prosperity.

They rely for their profits – and for the huge bonuses paid to senior staff – on the fact that taxpayers are underwriting the risks.

Thus public subsidy is turned into private profit

Philip Stephens, FT, April 11, 2011

Add to the mix the banks’ pivotal role in the global financial crash, and it is unsurprising that bankers are today less popular than second-hand car dealers and journalists.

Nationalisation of the banks’ losses has left most British households facing cuts in their standard of living as steep as any since the 1920s.

The banks have responded by reinstating big pay-outs for top executives and traders.

The Volcker rule

Why fences, walls and other myths cannot save us from bankers' risks

- a dilemma shared by much of the Western world

IBC's solution is built on a series of myths, myths that have been ruthlessly promoted by the UK banking lobby

Liam Halligan, Liam Halligan, Daily Telegraph, 9 Apr 2011

Glass-Steagall Act

Never again will the American taxpayer be held hostage by banks that are too big to fail,"

President Obama

BBC 22/1 2010

The thinking behind the ring-fencing recommendation is that if the wholesale or investment banking arm of a universal bank were to go bad, the retail operation - which looks after our savings, lends to business and moves money around - would not be tainted.

Robert Peston, BBC, 11 April 2011

And if in the event it was the universal bank's retail banking side that ran into difficulties, rather than the wholesale or investment arm, then in theory it would be cheaper and easier for taxpayers to rescue the retail bank as a ring-fenced, separable subsidiary: there would be no need for taxpayers to bail out the entire giant universal bank, as British taxpayers were forced to do in 2008 in the case of Royal Bank of Scotland.

Goldman Sachs and other banks should give up their bank status if they want to avoid the ban on proprietary trading proposed by the White House,

Paul Volcker, head of President Barack Obama’s Economic Recovery Advisory Board, FT February 12 2010

“The implication for Goldman Sachs or any other institution is, do you want to be a bank?” Mr Volcker said in a video interview video interview with the Financial Times.

“If you don’t want to follow those [banking] rules, you want to go out and do a lot of proprietary stuff, fine, but don’t do it with a banking licence.”

We need to learn from those countries that evidently did it right. And leading that list is our neighbor to the north. Right now,

Canada is a very important role model.

PAUL KRUGMAN January 31, 2010

First, some background. Over the past decade the United States and Canada faced the same global environment. Both were confronted with the same flood of cheap goods and cheap money from Asia. Economists in both countries cheerfully declared that the era of severe recessions was over.

But when things fell apart, the consequences were very different here and there. In the United States, mortgage defaults soared, some major financial institutions collapsed, and others survived only thanks to huge government bailouts. In Canada, none of that happened. What did the Canadians do differently?

It wasn’t interest rate policy.

For in Canada essentially all the banks are too big to fail: just five banking groups dominate the financial scene.

Above all, Canada’s experience seems to support those who say that the way to keep banking safe is to keep it boring — that is, to limit the extent to which banks can take on risk. The United States used to have a boring banking system, but Reagan-era deregulation made things dangerously interesting.

More specifically, Canada has been much stricter about limiting banks’ leverage, the extent to which they can rely on borrowed funds. It has also limited the process of securitization, in which banks package and resell claims on their loans outstanding — a process that was supposed to help banks reduce their risk by spreading it, but has turned out in practice to be a way for banks to make ever-bigger wagers with other people’s money.

The Volcker rule – that deposit-taking banks would not be able to engage in proprietary trading, or to own hedge funds or private equity firms – is the first time any government has proposed a sensible structural remedy for the problems created by bailing out banks in 2008.

John Gapper FT January 27 2010

For that reason, I welcome the conversion of the US president to splitting up banks rather than letting them remain too big to fail and relying on tough regulation, higher capital charges and mechanisms for winding them down if they get into trouble. For the first time, a government is directly attacking the size and complexity of over-mighty institutions.

A law intended to elicit votes and popular support is only problematic if it is a bad law.

A plan drawn up by a former chairman of the Federal Reserve and first suggested in a report from the G30 group of international banks is not a piece of political chicanery.

Nor do I see why it is impractical. Hedge funds and private equity funds are easy enough to split off from banks that have federal deposit insurance and official backing such as access to the Fed discount window.

There is a case, which I discussed in an earlier column, for going further and taking asset management out altogether.“Volcker Rule”

As Paul Tucker, deputy governor of the Bank of England, noted in an important recent speech,

“shadow banking” also had to be rescued.

Any institution that promises to redeem its liabilities on demand, while investing in longer-term or riskier assets, has bank-like characteristics and is vulnerable to a run.

Martin Wolf January 26 2010

The list turned out to be long: money market funds; finance companies; structured investment vehicles; and securities dealers (such as Lehman). As Mr Tucker notes, money market funds alone were as big as the transactions deposits of all US banks.

Mr Volcker is proposing a version of the distinction between commercial and investment banking brought into the US by the Glass-Steagall Act of 1933.

Mr Obama referred to a “Volcker Rule” that “banks will no longer be allowed to own, invest, or sponsor hedge funds, private equity funds, or proprietary trading operations for their own profit, unrelated to serving their customers”.

Would it really be possible to draw and, more importantly, police a line between legitimate activities of banks and activities “unrelated to serving their customers”?

It is, alas, not the case that the US government can credibly promise to make banks safer, while leaving this vast forest of shadow institutions to the market. That would only be possible if it could separate banks from the shadow system and did not care what happened to the latter.

The Shadow Banking System and Hyman Minsky’s Economic Journey

How did financing get so creative? It didn’t happen within the confines of a regulated banking system,

which submits to strict regulatory requirements in exchange for the safety of government backstopping.

Instead, financing got so creative through the rise of a “shadow banking system,” which operated legally,

yet almost completely outside the realm of bank regulation.

Paul McCulley, May 2009

What lies behind the credit squeeze is the combination of reduced trust in and decimated capital at financial institutions.

it's still not clear how much of the bailout will reach the components of the shadow banking system — largely unregulated financial organizations including investment banks and hedge funds — that are at the core of the problem.

Paul Krugman, The New York Review of Books, December 18, 2008

It seems that hedge funds have been designated for ritual sacrifice, even though they played no more than a cameo role in the genesis of this crisis.

It was not they who took on extreme debt leverage: it was the banks

– up to 30 times in the US and nearer 60 times for some in Europe that used off-books "conduits" to increase their bets.

Ambrose Evans-Pritchard, Daily Telegraph April 2009

The shadow banking system is unravelling

Nouriel Roubini, FT September 21 2008

Last week saw the demise of the shadow banking system that has been created over the past 20 years. Because of a greater regulation of banks, most financial intermediation in the past two decades has grown within this shadow system whose members are broker-dealers, hedge funds, private equity groups, structured investment vehicles and conduits, money market funds and non-bank mortgage lenders.

Like banks, most members of this system borrow very short-term and in liquid ways, are more highly leveraged than banks (the exception being money market funds) and lend and invest into more illiquid and long-term instruments. Like banks, they carry the risk that an otherwise solvent but liquid institution may be subject to a self fulfilling and destructive run on its liquid liabilities.

But unlike banks, which are sheltered from the risk of a run – via deposit insurance and central banks’ lender-of-last-resort liquidity – most members of the shadow system did not have access to these firewalls that prevent runs.

Bank for International Settlements annual report

“How,” asks the report, “could a huge shadow banking system emerge without provoking clear statements of official concern?”

How, indeed?

How big are the risks now? The answer is: very large.

As I argued in a speech at a BIS conference last week...

Martin Wolf, Financial Times, July 1 2008

Credit default swaps are "instruments of destruction" that should be outlawed

George Soros CNBC 12 Jun 2009

Soros said the asymmetry of risk and reward embedded in CDS exerted so much downward pressure on the bonds underlying the contracts that companies and financial institutions could be brought to their knees.

He said one financial institution that discovered to its cost the risk/reward distortions of CDS was insurer American International Group, which was a big seller of CDS, offering banks protection against a deterioration in their bond portfolios, especially mortgage-linked securities.

The U.S. government stepped in to save AIG from collapse under bad mortgage bets last September, and has put up to $180 billion at the company's disposal since.

"AIG thought it was selling insurance on bonds and as such CDS were outrageously overpriced. In fact AIG was selling bear market warrants and it severely underestimated their value," Soros said.

Derivatives

A nuclear winter?

When Warren Buffett said that derivatives were “financial weapons of mass destruction”, this was just the kind of crisis the investment seer had in mind.

The Economist print, Sep 18th 2008

The modern financial complex has morphed into something unrecognizable

The shadow banking system of hedge funds and CDOs, CLOs, PIPES, etc.

I'm sure that Bernanke, Paulson, and their cohorts understand this, but...

Bill Gross 1/10 2007

Cramer screamed at the CNBC camera, "They know nothing, they know nothing!"

Just who "they" were was left to the imagination, but it was clear that in Cramer's world Rukeyserian bullishness was not the order of the day.

Indeed, it was not. As Cramer was railing, I and other PIMCO professionals were attempting to describe to high-ranking Treasury and Fed officials the near-frozen commercial-paper markets and the draining confidence of bond and stock investors worldwide. It was Thursday, August 14. Stocks had closed down 210 points and were expected to open hundreds of points lower on Friday. The country's largest mortgage originator, Countrywide Financial, was rumored to be in liquidation mode (it survived that crisis). This was to be Ben Bernanke's first test, an opportunity to prove that he and his board of governors knew "something" as opposed to "nothing."

The modern financial complex has morphed into something unrecognizable to many astute market veterans and academics. Bernanke's fellow governors and Hank Paulson's staff at the Treasury spread their roots during an era in which traditional banking activity - lending out deposits backed by a certain level of reserves - was the accepted vehicle for liquidity creation. Remember those old economics textbooks that told you how a $1 deposit at your neighborhood bank could be multiplied by five or six times in a magical act of reserve banking? It still can, but financial innovation has done an end run around the banks. Derivatives and structures with three- and four-letter abbreviations - CDOs, CLOs, ABCP, CPDOs, SIVs (the world awaits investment banking's next creation; perhaps IOU?) - can now take a "depositor's" dollar and multiply it ten or 20 times. Reserve banking, and the Federal Reserve that regulates the system, appear anemic in comparison.

I'm sure that Bernanke, Paulson, and their cohorts understand this, but it isn't yet clear how much they appreciate it. Alan Greenspan admits in his newly published book that he didn't appreciate until recently the impact adjustable-rate mortgages and their subprime character, accompanied in some cases by outright fraud, would have on the housing market. If the Fed was so slow to grasp the role that subprime mortgages played in the housing boom and bust, do the Fed and the Treasury of today totally comprehend what happens when the nonbanking private system suddenly stops flooding the market with credit?

To use the old saw in updated form, a recession is when home prices in a neighboring state go down - a depression will be when the price of your home does. Well, if that be the definition of modern depression, then 70 million American homeowners will soon be residing in Bush, not Hoovervilles.

The Next Dominos:

Junk Bond And Counterparty Risk

one of the more important editions of Outside the Box this year. This is a must read. You absolutely need to understand the nature of the systemic risk we are facing, and Ted does a great job of explaining in very clear terms the nature of the risks that we have created in our modern markets.

Ted Seides at John Mauldin 26/11 2007