Bond guru Bill Gross signals a new era for Treasury markets

The bond bear market is finally upon us after more than 25 years, bond guru Bill Gross said

CNBC 10 January 2018

The real number to keep an eye on is 2.6 per cent yield on the 10-year Treasury note, says Bill Gross.

How policymakers plan to solve a long-term global debt crisis

Bill Gross, 6 December 2016

Bill Gross: Can capitalism function efficiently at the zero bound? No.

Low interest rates may raise asset prices, but they destroy savings and liability based business models in the process. Banks, insurance companies, pension funds and Mom and Pop on Main Street

The reason nominal growth is critical is that it allows a country, company or individual to service their debts with increasing income, allocating a portion to interest expense and another portion to theoretical or practical principal repayment via a sinking fund.

Without the latter, a credit-based economy ultimately devolves into Ponzi finance, and at some point implodes.

Watch nominal GDP growth. In the U.S. 4-% is necessary, in Euroland 3-4%, in Japan 2-3%.

Bill Gross, Janus 3 August 2016

What is the “stall speed” of an economy?

In his latest just released monthly letter, Bill Gross lays out the global economy as an analogy to Monopoly

where the narrative only works if everyone gets $200 in cash on every rotation around the board.

It’s the $200 of cash (which in the economic scheme of things represents new “credit”) that is responsible for the ongoing health of our finance-based economy.

Without new credit, economic growth moves in reverse and individual player “bankruptcies” become more probable.

And without banks creating new loans and injecting money into the broader economy, economic activity grinds to a halt.

Zerohedge 6 July 2016

Bill Gross just released monthly letter

US government debt is a safe haven the way Pearl Harbor was a safe haven in 1941

Bill Gross $10tn negative-yield bonds a ‘supernova that will explode one day’

FT 10 June 2016

Bill Gross made a surprising announcement when he said that he was starting to short credit.

This 40-year period of time has been quite remarkable – "a grey if not black swan event that cannot be repeated."

zerohedge 2 June 2016

In his just released monthly letter, "Bon Appetit!", he provided some additional insight on why he has become so bearish on credit instruments.

In short, as he says that since the inception of the Barclays Capital U.S. Aggregate or Lehman Bond index in 1976,

investment grade bond markets have provided conservative investors with a 7.47% compound return with remarkably little volatility.

He attributes this tremendous performance to the "carry" trade, facilitated by ever higher debt,

and ever lower interest rates over the past 30 years, a condition he thinks will not repeated again.

He then goes on to explain why the "carry" trade will no longer provide the kind of returns investors are used to.

Bill Gross says negative rates are going to crush the banks

MarketWatch 3 March 2016

After a life of trend spotting, Bill Gross missed the big shift

Gillian Tett, FT September 28, 2014

When the Fed’s crisis-fighting policies end, Mr Gross’s bets may turn out to be correct.

It is also possible that fundamentals will start to shape markets more forcefully – allowing bond investors to intimidate governments again.

But, as John Maynard Keynes observed, the problem with markets is that they can remain “irrational” longer than investors can stay solvent – or than eccentric investment gurus can command respect. In that sense, then, Mr Gross is a potent symbol of a distorted investment world.

Unreserved collateral-based lending on overnight repo have allowed for

an expansion of credit beyond the bounds of a central banker’s imagination.

Two-year yields are the same as overnight fund rates allowing for no incremental gain

– a return that leveraged banks and lending institutions have based their income and expense budgets on.

A bank can no longer borrow short and lend two years longer at a profit.

Bill Gross, FT 6 September 2011

While Democrats favor tax increases and mild adjustments to entitlements, Republicans pound the table for trillions of dollars of spending cuts and an axing of Obamacare.

Both, however, somewhat mystifyingly, believe that balancing the budget will magically produce 20 million jobs over the next 10 years.

Bill Gross, July 2011

---

Many commentators remain complacent about the debt ceiling;

the very gravity of the consequences if the ceiling isn’t raised, they say, ensures that in the end politicians will do what must be done.

But this complacency misses two important facts about the situation: the extremism of the modern G.O.P.,

and the urgent need for President Obama to draw a line in the sand against further extortion.

Paul Krugman, New York Times, 30 June 2011

To begin with, let’s get reacquainted with the fundamental economic problem of our age – lack of global aggregate demand – and how we got to where we are today:

(1) Twenty years of accelerated globalisation incrementally undermined the real incomes of most developed countries’ workers/citizens,

forcing governments to promote leverage and asset price appreciation in order to fill in what is known as an “aggregate demand” gap – making sure that consumers keep buying things.

Bill Gross March 2010

Our economy’s lights, if not switched off in a rehash of the 1930s Depression, have certainly been dimmed in a 21st century version likely to be labelled the Great Recession.

McHouses, McHummers, and McFlatscreens, all financed with excessive amounts of McCredit created under the mistaken assumption that the asset prices securitising them could never go down.

There is a developing optimism that we can go back to the lifestyle of yesteryear.

Forecasts based on econometric models inevitably miss these secular/structural breaks in historical patterns because it is impossible to quantify human behaviour

Bill Gross, July 2009

Staying Rich in the New Normal

Bill Gross June 2009

While policymakers, including the President and Treasury Secretary Geithner, assure voters and financial markets alike that such a path is unsustainable and that a return to fiscal conservatism is just around the recovery’s corner, it is hard to comprehend exactly how that more balanced rabbit can be pulled out of Washington’s hat.

Private sector deleveraging, reregulation and reduced consumption all argue for a real growth rate in the US that requires a government checkbook for years to come just to keep its head above the 1% required to stabilise unemployment.

Five more years of those 10% of GDP deficits will quickly raise America’s debt to GDP level to over 100%, a level that the rating services – and more importantly the markets – recognise as a point of no return.

At 100% debt to GDP, the interest on the debt might amount to 5% or 6% of annual output alone, and it quickly compounds as the interest upon interest becomes as heavy as those “sixteen tons” in Tennessee Ernie Ford’s famous song

The fact is that supply-side economics was a partial con job from the get-go.

Granted, from the 80% marginal tax rate that existed in the US and the UK into the late 60s and 70s, lower taxes do incentivise productive investment and entrepreneurial risk-taking.

But below 40% or so, it just pads the pockets of the rich and destabilises the country’s financial balance sheet.

Bill Clinton’s magical surpluses were really due to ephemeral taxes on leverage-based capital gains that in turn were due to the secular decline of inflation and interest rates that at some point had to bottom.

We are reaping the consequences of that long period of overconsumption and undersavings encouraged by the belief that lower and lower taxes would cure all.

To understand modern Republican thinking on fiscal policy, we need to go back to perhaps the most politically brilliant (albeit economically unconvincing) idea in the history of fiscal policy: “supply-side economics”.

Martin Wolf July 25, 2010

TIPS or inflation-protected securities can benefit

2½% real yields cannot possibly be maintained unless deflation as opposed to inflation becomes the odds-on favourite.

What bond investors know as “breakeven inflation rates” are currently signaling a future where the US CPI averages -1% for the next 10 years.

Possible, but not likely.

Bill Gross January 2009

The near certainty of future budget deficits approaching 6-7% of GDP should alert bond investors to once again become vigilant as was the case in the 1980s and 90s. Vigilantes we should be, but that is a battle to be fought in the Treasury market where low yields offer little reward and increasing risk

I'd say you got to buy TIPS.

You want inflation protection, and the value of TIPS is near historic

Bill Gross Forbes 6/1 2009

Legendary bond investor Bill Gross sees slower growth and a stock market driven by yield rather than capital gains. Still, he's not hiding in Treasuries.

Bill Gross oversees $790 billion at asset manager PIMCO, more than the gross domestic product of most countries, and has posted impressive returns. Lately the King of Bonds is sounding grim. He expects slower U.S. growth, lower corporate profits and a lower standard of living for years to come.

The damage from this Wild West of capitalism…is irreparable…When you lose half your 401(k) you care more about the return of your money than return on your money.

The lack of animal spirits will influence investing for years to come. The government will have to play risk taker of last resort.

I'm a registered Republican, and I want little regulation and low taxes. But the government already owns 20% of the banking industry and guarantees 75% of its liabilities

The banking industry has been nationalized. People don't realize that. There are so many programs. It's hard to keep up.

Gosh it was only six years ago that I cemented my place in stock market history by

predicting that the Dow would fall from 8,500 to 5,000,

instead of going up to 14,000 where it peaked in October of 2007

Bill Gross, December 2008

PIMCO’s Investment Committee to a man (no women yet) believes that capitalism is the best and most effective economic system ever devised,

but it has a flaw: it is inherently unstable.

Bill Gross, October 2008

The banking system needs another $500 billion to survive

beyond the $700 billion rescue plan being contemplated by Congress, said Pimco founder Bill Gross.

CNBC.com 25 Sep 2008

Homes purchased in 2004 and beyond are now at risk

some 25 million or so

Bill Gross, August 2008

Bear Stearns' bailout has echoes of 1907 panic

In my opinion, the private credit markets have forfeited their privileged right to operate relatively autonomously

because of incompetence, excessive greed, and in minor instances, fraudulent activities.

Bill Gross, April 2008

What is good for Ambac, the bond insurer, is good for the country.

Well, perhaps in the short run if it prevents a run on the shadow banking system. But not in the long run.

William (Bill) Gross, FT February 7 2008

The Shadow Banking System

is at the center of the problem.

Bill Gross, December 2007

What we are witnessing is essentially the breakdown of our modern day banking system,

a complex of levered lending so hard to understand

that Fed Chairman Ben Bernanke required a face-to-face refresher course

from hedge fund managers in mid-August.

Bill Gross, December 2007

Bill Gross, chief investment officer of Pimco, the world’s largest bond fund,

has in recent years become famous for issuing downbeat warnings about the credit world.

This month, however, his tone has turned positively apocalyptic.

“We haven’t faced a downturn like this since the Depression,”

Gillian Tett, FT November 27 2007

Bill Gross, who runs the world's largest bond fund,

has called on President George W. Bush rather than the Federal Reserve

to bail out American homeowners struggling with sub-prime mortgages.

Daily Telegraph 23/8 2007

During times of market turmoil it helps to simplify and get basic

– explain things to a public and even yourself in terms of what can be easily understood.

Goodness knows it’s not a piece of cake for anyone over 40 these days to understand the maze of financial structures

that now appear to be unwinding.

Bill Gross, September 2007

RE: Even more excellent than usual

They were created by youthful financial engineers trained to exploit cheap money and leverage who showed no fear and who have, until the last few weeks, never known the sting of the market’s lash.

They are wizards of complexity. I, however, having just turned 63, am a professor of simplicity.

The significance of proper disclosure is, in effect, the key to the current crisis.

Financial institutions lend trillions of dollars, euros, pounds, and yen to and amongst each other. In the U.S., for instance, the Fed lends to banks, which lend to prime brokers such as Goldman Sachs and Morgan Stanley which lend to hedge funds, and so on. The food chain in this case is not one of predator feasting on prey, but a symbiotic credit extension, always for profit, but never without trust and belief that their money will be repaid upon contractual demand.

When no one really knows where and how many Waldos there are, the trust breaks down, and money is figuratively stuffed in Wall Street and London mattresses as opposed to extended into the increasingly desperate hands of hedge funds and similarly levered financial conduits.

These structures in turn are experiencing runs from depositors and lenders exposed to asset price declines of unexpected proportions. In such an environment, markets become incredibly volatile as more and more financial institutions reach their risk limits at the same time. Waldo morphs and becomes a man with a thousand faces. All assets with the exception of U.S. Treasuries look suspiciously like every other.

But should markets be stabilised, the fundamental question facing policy makers becomes, “what to do about the housing market?” Granted a certain dose of market discipline in the form of lower prices might be healthy, but market forecasters currently project over two million defaults before this current cycle is complete. The resultant impact on housing prices is likely to be close to -10%, an asset deflation in the U.S. never seen since the Great Depression.

70% of American households are homeowners, and now many of those that bought homes in 2005-2007 stand a good chance of resembling passengers on the Poseidon – upside down with negative equity. A 10% “hook” in national home prices is serious business indeed. It’s little wonder that Fed, Treasury, and Congressional leaders are shifting into high gear.

Nobody quite knows exactly where the subprime losses truly lie

Nobody knows the real value of these instruments either

Gillian Tett, Financial Times August 23 2007

Is Ben's Stagflation Quagmire Gross's Real Grim Reality?

It will not be loan losses that threaten future economic growth

but the tightening of credit conditions that are in part a result of those losses

Bill Gross, April 2007

Pimco's Bill Gross, head of the world's largest bond fund, says

it's time to drop the strong dollar policy and

restore U.S. manufacturing strength

Business Week, 14/6 2006

Bill Gross, manager of the world's largest bond fund, is everybody's go-to guy when it comes to reading the tea leaves about Federal Reserve policy and the potential direction of interest rates. Lately, though, the manager of the $94-billion PIMCO Total Return fund has found himself making some off-the-mark projections. A year ago, he pegged 10-year Treasury rates going no higher than 4.5% during the next three to five years. They are now 5%.

The Fed, the ECB, and the BOJ held short rates at negative real or 0% yields for some time and

the stimulative effects on asset prices and growth are still part of the current environment.

To the extent that they are now moving closer to historical Taylor Rule norms,

the move towards equilibrium may in fact be destabilising

if done too quickly or moved towards restrictive territory.

Bill Gross, June 2006

Although the “stability” produced many inherent disequilibriums including the U.S. consuming 80% of the world’s excess savings reflected in an $800 billion current account deficit, there seemed nothing impossible about this mission, I suppose. And there’s nothing improbable about its continuing either until China/Japan are in closer proximity to their destinations – China to eventually have a self-sustaining, internally demand balanced economy and Japan to have permanently exorcised the D word from its lexicon.

We at PIMCO are of the persuasion that the “Yen carry trade” embodied in 0% borrowing rates by Japanese individual and global institutional investors has been a significant factor in the compression of yields and risk spreads in almost all financial markets. As their 0% rate morphs now into something higher, financial markets will feel the impact. And as speaker Charles Gave pointed out, an economy dependent on asset appreciation which in turn is dependent on low yields, is more vulnerable than one based on income.

Kommentar av Rolf Englund:

Observera i diagrammet ovan att USAs senaste överskott i bytesbalansen

uppnåddes 1992, när den svenska ekonomin var nära sammanbrott när Bildt-

regeringen med stöd av Ingvar Carlsson m fl, m fl, försvarade kronkursen.

Den kronkurs som försvarades var 5:30

Läs mer här

Conclusion:

US have a large trade deficit. It cannot go on for ever. When it

stops the dollar will drop. It is disturbing that the only time US had a near zero deficit was in 1992 and the dollar was

low against the swedish krona.

Rolf Englund, maj 2001

I religiously read Bill Gross of PIMCO.

I particularly enjoyed this month's piece. Gross is talking to his clients about the problems of bond investing.

Given that he sits on top of the biggest pile of bonds in the world, I find it always useful to pay attention to him.

John Mauldin, 3/4 2006

General Motors is a canary in this country’s economic coal mine;

a forerunner for what’s to come for the broader economy

Bill Gross, Pimco, May 2006

The annual Economic Report of the President

It’s in chapter 6 that the gang really becomes its most imaginative.

Why admit to a chronic malady known as the current account deficit

when tautologically you can discuss, and in fact label the entire chapter

"The U.S. Capital Account Surplus!"

Bill Gross, Pimco, March 2006

The biggest secret during the past few years in the bond market

has been why intermediate and long-term interest rates have remained so low

in the face of a 300 basis point uplift from the Federal Reserve.

Today's short rate of 4% is really equivalent to 6% in my view,

a rate that was only 50 basis points shy of the cyclical tightening peak of 6½% in 2000.

Bill Gross, Mauldin's Outside The Box 5/12 2005

“it’s different this time”

Because the U.S. economy has evolved into a highly levered finance-based economy, it stands to our reason that this modern day version is more sensitive to changes in interest rates than those of years past.

PIMCO has for several years now focused on the real interest rate – Fed Funds minus inflation – as the most legitimate indicator of neutrality.

Bill Gross, November 2005

Let me summarize my sequence for house bubble popping

Bill Gross, Pimco, October 2005

"The Strange Tale of the Bare-Bottomed King."

Future finance-based consumption is limited by our ability to keep pumping lower and lower yields, which in the past have led to higher and higher TIPS, home, stock, and associated asset prices.

Bill Gross, Pimco May 2005

Age does have some benefits if only in knowing what not to do if given a second chance.

PIMCO Founder and CIO Bill Gross addressed the graduating MBA class at

Duke University's Fuqua School of Business

May 8, 2004

My most certain idea is that real interest rates in the United States will have to be kept low,

that the old Taylor rule is out

About bonds that are protected against inflation (TIPS/realräntepapper)

Bill Gross November 2004

"The Strange Tale of the Bare-Bottomed King."

Future finance-based consumption is limited by our ability to keep pumping lower and lower yields, which in the past have led to higher and higher TIPS, home, stock, and associated asset prices.

Bill Gross, Pimco May 2005

One day sometime in the early 21st century, there was a global economy that was growing at what appeared to be a decent enough rate but...

We always want more of everything so how could there ever be a lack of "aggregate demand" in this magic kingdom? The historical textbook example of this malady probably first appeared during the depression of the 1930s when what Keynes labeled as capitalism's "animal spirits" were so dampened that corporations and consumers sat out the dance, preferring to hide their money in a mattress instead of risking it in a transaction during a deflationary spiral. In their place, government became the buyer of last resort.

The world's most recent example has unfolded in Japan over the past decade...

It isn't prudent for U.S. citizens to continue to expect to consume 6% more than they produce, nor is it rational for investors to expect foreign central banks - primarily the Chinese and Japanese - to invest that 6% surplus and other direct investment monies into the U.S. Treasury market forever.

At some point it comes undone, either through a massive revaluation and dollar decline, a Treasury buyer's boycott, or a whimpering U.S. consumer beaten down by the cost and/or amount of their burgeoning leverage - much of which is housing related.

Surely, near 0% real short-term rates here and abroad have got to stimulate an inflationary resurgence. Au contraire. China has opted into BWII for one reason only - to employ hundreds of millions of unemployed workers in its interior. And it is those same workers, requiring only 5-10 cents per U.S. wage dollar that have kept inflation competitively low nearly everywhere in the global economy

Nearly everyone knows that oil prices, housing prices, and even stock prices are up in the past few years and in some cases spectacularly. Not everyone knows why.

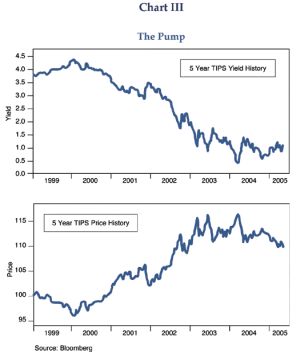

can best be explained via the price action of a good old inflation protected Treasury, a 5-year maturity TIPS shown in both yield and price terms in Chart III.

our King's seamstress as having done a rather poor job of sewing. That seems evident because her creations have been put together not based on savings and domestic investment but on finance-based consumption fed from asset appreciation based on the Pump.

Future finance-based consumption, however, is limited by our ability to keep pumping lower and lower yields, which in the past have led to higher and higher TIPS, home, stock, and associated asset prices.

If we had to forecast (and we do), we believe a range of 3 - 4 1/2% for 10-year nominal Treasuries will prevail during most of our secular timeframe and that yields on Euroland bonds will be slightly lower due to their structural unemployment problems, disinflationary incorporation of new Central and Eastern European countries into their existing family of nations, and more growth-inhibiting demographics.

The 14% 5-year TIPS capital gain over the past few years that Alan Greenspan has been able to manufacture probably can only go up by 5 more points, because a 0% real yield for a 5-year maturity TIPS serves as a practical limit

With a couple of little tricks at its disposal, the government has made a practice of understating inflation,

and by extension, overstating GDP and productivity.

- about "an important article by Pimco's high-profile portfolio manager Bill Gross"

Bill Fleckenstein, CNBC 4/10 2004