Skuldfrågan

Who is responsible

Rolf Englund:

- There is no such thing as rational expectations.

John McCain:

"Wall Street has betrayed us.

News Home

Home - Index -

News - Krisen 1992 - EMU - Economics - Cataclysm -

Wall Street Bubbles

US Dollar - Subprime - Houseprices

"Medelklassfamiljer har intalat sig att stigande huspriser är

en naturlag och låtit kreditkortsskulderna svälla"

En bonusdriven finansbransch har sålt stora mängder obskyra värdepapper

– samtidigt som man i Washington har sänkt skatter och fattat beslut om nya jätteprojekt utan att våga be folket om pengar.

PJ Anders Linder, SvD 25/1 2009

Låginkomsttagare har köpt hus som de inte har haft råd med.

Medelklassfamiljer har intalat sig att stigande huspriser är en naturlag och låtit kreditkortsskulderna svälla; det går ju alltid att ta ut extra bolån.

I den mycket läsvärda The Ascent of Money (Penguin, 2008) konstaterar historikern Niall Ferguson att vid första kvartalet 2006 bestod en tiondel av de amerikanska hushållens köpkraft av pengar som de fått via ökad belåning av huset!

The real cost of home ownership depends on real house prices, interest rates and other housing costs (such as depreciation, repairs, insurance and taxes). But, above all, it also depends on expected changes in house prices. The more house prices are expected to rise, the cheaper the effective purchase price also becomes.

This last point is central. If people's expectations of future price increases are affected by their recent experience prices will tend to overshoot fundamentals:

this is just how bubbles form.

Martin Wolf, FT 24/11 2006

John Mauldin, February 2, 2008:

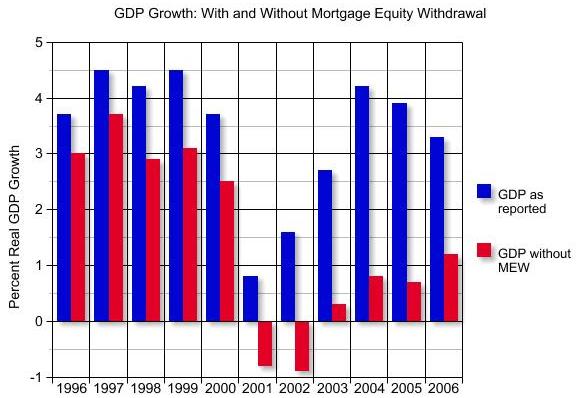

Notice that mortgage equity withdrawals (MEWs) accounted for 2-3% of the growth of overall GDP in 2001-6.

Without MEWs we would have seen two solid years of recession (the red bars) rather than a few quarters, and a decidedly below trend economy.

Such large MEWs were possible because of the bubble in housing prices and

the availability of cheap and easy mortgages.