Alan Greenspan memoirs:

The Age of Turbulence

Next Bubble Is Forming:

U.S. Government Bonds

News Home

Home - Index -

News - Krisen 1992 - EMU - Economics - Cataclysm -

Wall Street Bubbles

Subprime - US Dollar - Houseprices

Why Greenspan does not bear most of the blame

The US is in no way exceptional for the level of residential investment.

Somewhat to my surprise, the share of residential investment in UK gross domestic product has been much the same as in the US.

The outliers here are Ireland and Spain.

Martin Wolf FT April 8 2008

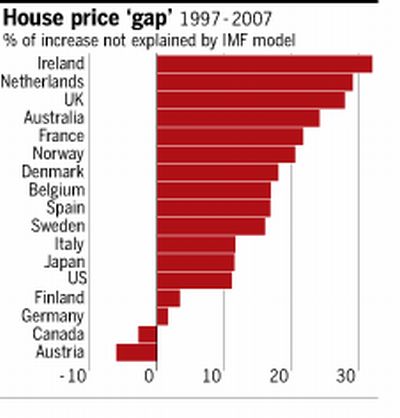

The biggest apparent overvaluations occurred in Ireland, the Netherlands and the UK.

The chart shows the proportionate increase in house prices between 1997 and 2007 that cannot be explained by the fundamental drivers:

affordability (the lagged ratio of house prices to disposable incomes);

growth in disposable incomes per head; interest rates (short- and long-term);

credit growth; changes in equity prices;

and changes in working-age population.

Thus, the rises reveal the extent to which a country has experienced what seems to be a bubble.

The US is in the middle ranks.

So what might explain these bubbles? I would point to four causes:

very low long-term real interest rates, because of the global savings glut;

low nominal interest rates, because of both low real rates and the benign inflationary environment;

the lengthy experience of economic stability;

and, above all, the liberalisation of mortgage finance in many countries.

The greater the availability of finance, the easier it was for purchasers to pay higher house prices and the higher those prices, the more willing were people to purchase, in the expectation of still higher prices.

The WEO makes clear that house prices tended to rise fastest where finance was most easily available, as one might expect.

Comment by Rolf Englund:

Another outstanding article by Martin Wolf.

Perhaps this will count as the ultimate article in this field.

I am puzzled why the remarkably similar housing bubbles that emerged in more than two dozen countries between 2001 and 2006 are not seen to have a common cause.

The dramatic fall in real long term interest rates statistically explains, and is the most likely major cause of, real estate capitalization rates that declined and converged across the globe. By 2006, long term interest rates for all developed and major developing economies declined to single digits, I believe for the first time ever.

Alan Greenspan, Financial Times April 6, 2008

Det finns inga tecken på att bostadsmarknaden i Sverige är övervärderad

"prisökningarna har varit lägre än i "bubbelländer" som Norge, Spanien och Storbritannien".

Klas Eklund 10/5 2005 DI