|

Rolf Englund IntCom internetional

|

Stabiliseringspolitik - Economics - EU och EMU - Cataclysm - USD/SEK

Finanskrisen

John Taylor has a message for economists who say Ben S. Bernanke is ignoring a benchmark guide

for interest rates: They’re wrong.

Taylor should know: He wrote the rule.

Bloomberg July 24 2009

Economists from Goldman Sachs Group Inc., Macroeconomic Advisers LLC, Deutsche Bank Securities Inc. and even the San Francisco Federal Reserve Bank argue the Taylor Rule, a pointer for finding the correct level for interest rates, suggests the Fed should be doing a lot more to stimulate the economy.

My trips to Sweden have once again reminded me about the dangers of conducting monetary policy with interest rates at the Zero Lower Bound (ZLB).

Lets say we can describe monetary policy with a simple Taylor rule:

r = rN+a*(p-pT)+b(ygap)

The Market Monetarist, 26 November 2013

In this post I will particularly focus on the exchange rate dynamics at the ZLB.

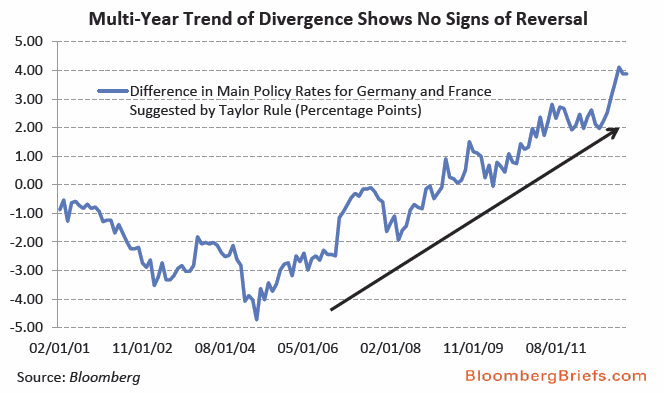

Franco-German Divide Nears Record High

We ask - rhetorically once again -

how can they expect to hold this together with a single monetary policy.

Tyler Durden 22 February 2013

Unemployment levels are stunningly wide with Germany at a mere 5.3% relative to France's 10.6%.

All of this is summed up perfectly in the 'Taylor Rule' suggesting main policy rates that are 4 percentage points apart - a record since the Euro began

- stoking inflationary concerns in Germany (relative to France).

The market, as repressed as it ever was, is starting to wake up to this divergence with France 10Y yields at their widest relative to Germany in 2013 today.

My first and most important answer comes in addressing Prof Taylor’s first and second objections to my column:

his analysis does not pass the “so what?” test.

Prof Taylor’s own chart showed that the fastest recovery was after the Great Depression.

Does this show that policy was particularly good? No.

The important point about that recovery is that it followed a huge contraction.

Looking at the recovery without the contraction is Hamlet without the prince. It tells one nothing important.

Martin Wolf, Financial Times October 29, 2012

That is why Carmen Reinhart and Kenneth Rogoff look at the performance of the economy, relative to its pre-crisis starting point.

That is a good measure of performance during and after a crisis. Recovery on its own is not.

ECB and The Taylor Rule - a difference of 9 per cent

President Trichet’s European Central Bank again faces the conundrum that its monetary policy rarely suits all 17 members of the euro area

Spain, Portugal, Ireland and Greece would need an average rate of minus 4.6 percent, according to estimates by Credit Suisse equity strategists

Germany requires a rate of 4.5 percent, they say.

Bloomberg Apr 4, 2011

The Taylor Rule

Professor Taylor made one huge, simplifying assumption, that the neutral real Fed funds rate is a constant 2%.

Paul McCulley April 2010

The “considerable period” pre-commitment to 1% Fed funds had worked its magic, inducing animal-spirited risk- taking on both Wall Street and Main Street, and it was time, as I put it, for the Fed to end “happy hour prices” for liquidity:

The workhorse model for contemplating the destination was (and is to this day!) the Taylor Rule, primarily because Professor Taylor made one huge, simplifying assumption, that the neutral real Fed funds rate is a constant 2%.

With that assumption, plus assumptions for the Fed’s implicit inflation target and the Fed’s estimate of the full-employment GDP potential (alternatively, the NAIRU), it is easy to calculate where the Fed putatively should, according to Taylor, peg the nominal Fed funds rate. Indeed, Bloomberg now has a plug-and-play version of the Taylor Rule, where anybody can pretend to be a FOMC member.

And most conveniently, if you assume that inflation is at target and unemployment is at the NAIRU, all the “active” terms in the Taylor Rule drop out, and the neutral nominal Fed funds rate is simply the 2% neutral real Fed funds rate assumption plus the at-target inflation rate, which Taylor assumed – and the Fed preached both then and now – to also be 2%.

Thus, in an equilibrium Taylor world, the neutral nominal Fed funds rate is 4%, which is why, in my view, the consensus view in April 2004 held that the looming tightening cycle would take the Fed funds rate at least that high (and presumably, higher if and when inflation rose above target and/or the unemployment rate overshot the NAIRU to the downside, implying the need for “restrictive” monetary policy). John Taylor’s insights were and are very powerful.

And, indeed, his Rule is elegant. But it is also hostage to his assumption that the neutral real Fed funds rate is a constant 2%. I didn’t buy it in 2004 and don’t buy it today. In fact, I had voiced this view prior to that April 2004 first evening with you, notably in my August 2003 monthly2 (ironically just as the Fed evoked the “considerable period” regime).

My thesis was simple: The neutral real, after-tax Fed funds rate should be zero!

A year later, the evidence is in: Depression 2.0 has indeed been avoided. No, I haven’t yet bought that second home. In fact, I actually sold my only one, at a good level, as I was no longer using it, preferring to live in a little rental house on the water where I have my 32-foot fishing boat, named the Moral Hazard, and my 18-foot electric Duffy boat, named the Minsky Moment. Yes, I am sorta non-normal.

Paul McCulleyRoger E. Alcaly about

Getting Off Track: How Government Actions and Interventions Caused, Prolonged, and Worsened the Financial Crisis

by John B. Taylor

NYRB Volume 57, Number 5 March 25, 2010

By any measure, the crisis was a consequence of extraordinarily reckless behavior—by banks and other financial institutions, by governments and their financial regulators, and by consumers—behavior that continued even in the face of a widely shared sense that serious trouble was brewing

The failure of central bankers and regulators to rein in leverage — the practice of borrowing as much as thirty or more times one's equity capital to increase investment potential —and excessive risk-taking owes much to complacency that had developed over the preceding twenty to twenty-five years.

Taylor's first public criticism was made two years after leaving that position in a paper presented to the annual August gathering of central bankers and monetary economists in Jackson Hole, Wyoming

Taylor argues that if the Fed had started raising interest rates in 2002, shortly after the end of the recession that followed the bursting of the technology stock bubble, the housing market would not have grown as wildly as it did. He bases his argument on his own "Taylor rule,"

Raising interest rates so slowly and steadily promoted excessive risk-taking, and should have concerned Greenspan, according to his stated views. The Fed's policies thus seem especially peculiar. They helped to create a false sense of security and stability that enticed financial institutions and investors to leverage their investments enormously, borrowing sums that dwarfed the capital they committed.

Last summer, I wrote a piece, "Lessons Learned from the Greenspan Era," for the Jackson Hole monetary conference

John B. Taylor, Wall Street Journal, July 13, 2006

The Fed and the Crisis: A Reply to Ben Bernanke

In his recent speech, the Fed chairman denied that too-low interest rates were responsible.

Does this mean we're headed for a new boom-bust cycle?

John B. Taylor WSJ JANUARY 10, 2010

Exploding debt threatens America

John Taylor, Financial Times May 26 2009

The deficit in 2019 is expected by the CBO to be $1,200bn (€859bn, £754bn). Income tax revenues are expected to be about $2,000bn that year, so a permanent 60 per cent across-the-board tax increase would be required to balance the budget. Clearly this will not and should not happen. So how else can debt service payments be brought down as a share of GDP?

Inflation will do it. But how much?

To bring the debt-to-GDP ratio down to the same level as at the end of 2008 would take a doubling of prices.

And 100 per cent inflation would, of course, mean a 100 per cent depreciation of the dollar. Americans would have to pay $2.80 for a euro; the Japanese could buy a dollar for Y50; and gold would be $2,000 per ounce.

This is not a forecast, because policy can change; rather it is an indication of how much systemic risk the government is now creating.

The rule brilliantly argued for by Milton Friedman in the 1960s was a money supply rule.

But would a monetary rule make sense in the spontaneous and generally innovative economies of, say, the US and the UK?

It is a good question.

Edmund Phelps, Financial Times, 25/4 2006

The Economist:

The current Fed chairman, Alan Greenspan, will retire shortly after his term as a governor expires at the end of January 2006. Who will replace him? One plausible candidate is John Taylor, the Treasury's point man for international affairs. He may not be the favourite to take charge but, according to many of his peers, the Fed long since submitted to “Taylor's rule”. This rule, which Mr Taylor first expounded in 1993, tries to capture the method behind the Fed’s interest-rate moves. Though it enjoys a great deal of discretion, America’s central bank, Mr Taylor argued, is systematic, not capricious, in responding to the rhythms of the economy.

Before 2007, independent central banks would have had no problem presenting credible exit strategies.

They would have pointed to their inflation target, and how they would use their medium-term inflation forecast or some other analytical framework to ensure that the price level would remain on a stable trajectory.

Wolfgang Münchau, FT July 26 2009

Ben Bernanke was elegant, concise, and yet he missed the point.

Last week, in his testimony to congress, the chairman of the Federal Reserve presented his “exit strategy” – a toolkit of policies to prevent an increase in inflation once the economy starts to recover.

The policies are the best modern central banking has to offer.

That is simply not the case any longer.

There are two big problems that need to be considered. One is the commercial banking system.

If the European Central Bank, for example, decided to exit tomorrow by raising interest rates, the likely consequence would be a banking meltdown.

A credible monetary exit strategy, in Europe at least, would read like a suicide note.

The other problem, which is more troublesome for the US than the eurozone, is fiscal policy. As James Hamilton, professor of economics at the University of California, San Diego, pointed out in a recent analysis,

http://www.econbrowser.com/archives/2009/07/looking_for_an_1.html

the direction of US debt, combined with the intermingling of monetary and fiscal policy, is inconsistent with the goal of long-term price stability.

Should there ever be a funding crisis, it is not clear how the Fed could easily raise interest rates under such circumstances without causing a political and economic bloodbath.

the ECB’s recent extraordinary €442bn ($630bn, £380bn) injection of one-year liquidity at an interest rate of 1 per cent. This is a win-win game for the banks, especially since they were able to post collateral consisting of less than perfect securities, to put it mildly – those with a rating of BBB- or higher.

Riksbanken har inklusive dagens SEK-auktion med fast ränta lånat ut 303 miljarder kronor

och 17,8 miljarder dollar.

Omräknat till dagens valutakurs har Riksbanken totalt lånat ut 500 miljarder kronor

Riksbanken 2009-07-13

It is weird that inflation has remained so stable,

despite huge shortfalls in output, relative to pre-crisis trends, and prolonged high unemployment.

Understanding why this is the case is important because the answer determines the correct policy action.

Martin Wolf, Financail Times 16 April 2013

We know that workers are resistant to cuts in nominal wages. This has remained true throughout the Great Recession: it is indeed one of the reasons why the adjustment in the eurozone is so painful. So, for this reason too, inflation would be sticky, at least downwards.

RE: Varför skäller man på Ingves? Det är ju riksbankens onda genius EO Svensson som velat sänka räntan?

Dagens penningpolitik med minusränta riskerar att dra ner Sverige i en ny finanskris.

Att finjustera prisökningar till 2 procent, som är målet, är omöjligt, menar han och förordar ett mer flexibelt mål.

Lars Jonung DN 10 september 2015

Alla större centralbanker i västvärlden, som Federal Reserve och ECB, med inflationsmål har misslyckats att nå målet de senaste åren.

Verktyget, räntevapnet, har visat sig alltför lamt för att rå på fallande råvarupriser som tillsammans med digitalisering och globalisering håller nere pristrycket.

Tidigare riksbankschefen Lars EO Svensson har nyligen argumenterat för att en lägre ränta i själva verket skulle ge lägre risker

men det resonemanget gav inte Stefan Ingves mycket för.

– Blir det billigare att låna så lånar man mer.

SvD Näringsliv, 5 september 2013

Mer av Jonung och om E O Svensson här.

The rich world’s central banks need a new target

Advantages in targeting the level of nominal GDP

The Economist 27 August 2016

Like other areas of public policy, central banking is prone to fads and fashions. From limits on money-supply growth to pegging exchange rates, orthodoxies wax and wane. Yet the practice of inflation-targeting has proved remarkably long-lived.

For almost three decades, central bankers have agreed that their best route to stabilising an economy is to aim for a specific target for inflation, usually 2% in advanced economies and a little higher in emerging ones.

This orthodoxy is still intact in many emerging economies where inflation is yet to be tamed. But in the rich world the consensus is beginning to fracture.

Many economists (and this newspaper) see advantages in targeting the level of nominal GDP, the total amount of spending in the economy before adjusting for inflation.

Changing targets is not something policymakers should do lightly; their credibility depends on stability.

Rethinking Inflation Targeting

Central banks routinely deny responsibility for any prices other than consumer prices,

ignoring that the value of money is reflected in all prices, including commodities, real estate, stocks, bonds,

and, perhaps most important, exchange rates.

Axel Weber, former president of the Deutsche Bundesbank and a former member of the Governing Council of the ECB, Chairman of UBS Group

Project Syndicate, 8 June 2015

Within a complex and constantly evolving economy, a simplistic inflation-targeting framework will not stabilize the value of money.

Dags att utreda inflationsmålet

Varför är just två procents inflation så önskvärd?

Gunnar Wetterberg, Expressen 19 juni 2016

Ju snabbare hjulen rullade, desto mer steg inflationen – och då var det dags att dämpa med räntan.

Det är fortfarande det tankemönster som dominerar,

men för tio år sedan skrev chefsekonomen Bill White vid centralbankernas samarbetsorgan BIS ett varnande papper.

Om bankerna håller räntan låg på grund av den låga inflationen exploderar istället priserna på aktier och fastigheter, med alla risker det skapar.

Why have markets reached their exposed position? The answer is that success breeds excess.

This is the argument of a fascinating new paper from William White, economic adviser to the Bank for International Settlements.

Martin Wolf, Financial Times 24/5 2006

Riksbankens mål om 2,0 procents inflation tillkom i all hast för litet mer än 20 år sedan

Inflationsmålet skulle inte ha funnits där, om Sverige hade klarat att hålla fast växelkurs.

Johan Schück, DN 2015-05-08

Inflation targeting is not dead yet

Invented in the 1990s and widely propagated in the 2000s,

targets for consumer price inflation failed to prevent the asset price bubble prior to 2008,

or the subsequent financial collapse.

Many investors now believe that inflation targets have been abandoned in all but name.

Gavyn Davies, FT blog, April 13, 2013

There is, however, a major problem with this line of argument. It does not tally with what the major central banks say they are actually trying to do, either in public or in private.

Far from disappearing, inflation targets continue to gain prominence. Furthermore, they still play an essential role in ensuring good economic performance.

A case to reset basis of monetary policy

The current regime is meant to stabilise inflation

and help stabilise the economy. It has failed

Martin Wolf, FT February 7, 2013

Proponents of the current regime (of which I was one) justified it not only on the proposition that it would stabilise inflation, but that it would help stabilise the economy. It failed to do so.

In terms of lost output, the current slump is far worse than the inflationary 1970s and disinflationary early 1980s.

Even with growth at 1.5 per cent a year from now on, output would return to its level of the first quarter of 2008 only in the first quarter of 2015: in brief, seven lost years.

This is abysmal, even if a productivity collapse (with worrying longer-term implications) shielded employment.

Nivån på inflationsmålet om man även fortsättningsvis ska ha ett sådant.

Siffran 2 procent grundades inte på någon djupare analys när den valdes.

De senaste årens kris har visat på faran med låga inflationsmål.

De innebär att också styrräntan normalt ligger lågt. Därmed blir fallhöjden ner till nollränta liten.

Det går då inte att uppnå en kraftigt negativ realränta (nominell ränta minus inflation) i en djup recession,

vilket är önskvärt för att stimulera efterfrågan.

Lars Calmfors, Kolumn DN 3 april 2013

Hög inflation blev ett problem i världsekonomin på 1970-talet. En orsak var att centralbankerna, på välmenande politikers initiativ, förde en expansiv penningpolitik med alltför låga räntor för att minska arbetslösheten. Detta misslyckades. Resultatet blev i stället både inflation och arbetslöshet.

Receptet blev att göra centralbankerna mer oberoende av det politiska systemet med ett tydligt uppdrag att åstadkomma prisstabilitet. Det skedde också i Sverige.

Riksbanken valde 1993 själv ett inflationsmål på 2 procent. 1999 fick banken även formellt större självständighet.

Den nya penningpolitiska regimen tycktes på de flesta håll garantera en stabil makroekonomisk utveckling ända fram till finanskrisen 2008.

Då blev det tydligt att stora finansiella obalanser växt fram trots att inflationen hållits låg.

Quantitative easing's failure to quash the threat of deflation

is finance's equivalent of the bump in the data that alerted physicists

to the possibility of a new boson.

Mark Gilbert Bloomberg 18 August 2016

The mismatch between economic theory and the real-world outcome of zero interest rates poses

a direct challenge to the current orthodoxy that puts a 2 percent inflation target at the heart of monetary policy in most of the developed world.

John Williams, the president of the Federal Reserve Bank of San Francisco:

Central banks need to consider aiming for a higher inflation target

FT 15 August 2016

The current 2 per cent inflation target is not well suited to an economy with a depressed natural interest rate

“There are limits to what monetary policy can and, indeed, should, do.

The burden must also fall on fiscal and other policies to do their part to help create conditions conducive to economic stability,”

said Mr Williams in an “economic letter” published by the San Francisco Fed.

If Williams is overenthusiastic on education, he is under enthusiastic on fiscal stimulus.

He fails to emphasize the supply side benefits of infrastructure investment that likely enable debt financed infrastructure investments

to pay for themselves as suggested by in a paper by Brad DeLong and myself and the International Monetary Fund.

Lawrence H. Summers, Washington Post 18 August 2016

Inflation Targets Reconsidered

Paul Krugman May 13, 2014

princeton.edu/users/pkrugman/pksintra.pdf

Did inflation targeting fail?

Central banks have mostly escaped blame for the crisis.

How can it have gone so wrong? Also about The Taylor Rule

Martin Wolf, Financial Times, May 5 2009

Just over five years ago, Ben Bernanke, now chairman of the Federal Reserve,

gave a speech on the “Great Moderation”

– the declining volatility of inflation and output over the previous two decades.

In this he emphasised the beneficial role of improved monetary policy.

Central bankers felt proud of themselves.

Pride went before a fall. Today, they are struggling with the deepest recession since the 1930s, a banking system on government life-support and the danger of deflation.

How can it have gone so wrong?

This is no small matter. Over almost three decades, policymakers and academics became ever more confident that they had found, in inflation targeting, the holy grail of fiat (or man-made) money.

Frederic Mishkin of Columbia University, a former governor of the Federal Reserve and strong proponent of inflation targeting, argued, in a book published in 2007,

Monetary Policy Strategy (Massachusetts Institute of Technology, 2007)

that inflation targeting is an “information-inclusive strategy for the conduct of monetary policy”.

In other words, inflation targeting allows for all relevant variables – exchange rates, stock prices, housing prices and long-term bond prices – via their impact on activity and prospective inflation.

Now that we are living with the implosion of the financial system, this view is no longer plausible.

No less discredited is the related view, also advanced by the Fed, that it is better to deal with the aftermath of asset price bubbles than prick them in advance.

John Taylor of Stanford University, a former official in the Bush administration, argues that the Fed lost its way by keeping interest rates too low in the early 2000s and so ignoring his eponymous Taylor rule,

which relates interest rates to inflation and output.

Getting Off Track (Hoover Institution, 2009)

This caused the housing boom and the subsequent destructive bust (see charts).

This unforeseen crisis is surely a disaster for monetary policy.

Most of us – I was one – thought we had at last found the holy grail.

Now we know it was a mirage. This may be the last chance for fiat money.

Homeowners - the root of all evil?

Skuldfrågan/ Who is responsible?

Caroline Baum questions the accuracy, timeliness, and, ultimately, the usefulness of the Federal Reserve’s main gauge of inflation pressure in the system – the “output gap” – in today’s column at Bloomberg.

timiacono.com/ April 12, 2010

As in the 1970s, it seems the central bank would be quite surprised to see any substantive inflation develop today with U.S. unemployment high and factories chugging along at a full ten percentage points below the normal level of utilization.

Read about Stagflation here

Of course, over the last ten years, they’ve been quite surprised by a lot of things, not the least of which was all the trouble they caused by keeping rates too low for too long six or eight years ago.

Oh yeah, that’s right. The Fed still thinks thatlow rates had nothing to do with inflating the asset bubbles that led to multiple financial market meltdowns in recent years…

Chasing the Neutral Rate Down:

Financial Conditions, Monetary Policy, and the Taylor Rule

Paul McCulley and Ramin Toloui, February 2008

Central bankers and financial market participants like to refer to monetary policy as being in one of three states: neutral, accommodative, or restrictive. They also like to describe inflation as being at target (or in the “comfort zone” as Fed Chairman Bernanke puts it), above target, or below target. And finally, they like to describe unemployment as at its full employment potential level,1 above it, or below it. When inflation is at target, full employment prevails, and monetary policy is neutral…we have the nirvana of equilibrium!

John Taylor – a Stanford economics professor who also served several times as a U.S. government official3 – proposed in the early 1990s a pre-specified rule for setting the overnight policy rate based upon the deviation of inflation from its target level (inflation gap) and of actual GDP from its full-employment potential level (output gap).4 When inflation is above target, the central bank should increase the real short-term interest rate; when growth is below potential, the central bank should cut the real short-term interest rate. When a mix of factors prevails, the policy rate should reflect that, too. Taylor went on to illustrate that this rule provided a good template for understanding how the Fed actually did move interest rates, as well as a critical guide to how the Fed should move interest rates to maintain a stable economic trajectory.

Last summer, I wrote a piece, "Lessons Learned from the Greenspan Era," for the Jackson Hole monetary conference

John B. Taylor, Wall Street Journal, July 13, 2006

Since the beginning of Mr. Bernanke's term, the Fed has responded by raising the funds rate by 75 basis points -- to 5.25% from 4.5%, which is the neutral rate according to the St. Louis Fed's version of the "Taylor rule."

Some have argued that the lesson learned from this recent volatility experience is that the Fed should set a specific numerical target for inflation. I disagree; recent experience indicates setting such a target could increase volatility again.

Mr. Taylor, undersecretary of Treasury for international affairs 2001-2005, is a senior fellow at the Hoover Institution and the Mary and Robert Raymond professor of economics at Stanford.

My most certain idea is that real interest rates in the United States will have to be kept low, that the old Taylor rule is out

About bonds that are protected against inflation (TIPS/realräntepapper)

Bill Gross Investment Outlook November 2004