David Stockman 2018

US Dollar - US Current Account - U.S. Trade Deficit

U.S. Trade

Deficit: Causes, Magnitude and Consequenses

Rolf Englund, May 2001

China held about 5.8% of the total debt, or about $1.15 trillion. (Hong Kong, a “special administrative region” of China, held another $202.6 billion.)

China was the top foreign holder of Treasury securities, ahead of Japan, which held just under $1.1 trillion.

U.S. Trade Deficit - Statistics

Brad Setser, a former Treasury official who is now at Roubini Global Economics, an economic-analysis firm, reckons that if non-oil import growth continues at its recent pace and the oil price stays over $50 a barrel, America’s annual trade deficit would reach nearly $800 billion by the end of 2005

while the oil price seems to be the most imminent risk, the size and rate of growth of the global imbalances are the real reason to worry. If the world economy continues on autopilot, those imbalances are set to increase. And you do not need to be a Cassandra to predict that, eventually, they will create a nasty problem.

National Center for Policy Analysis: The Meaningless Trade Deficit

Klas Eklund på

SvD:s ledarsida 2000-08-11

För 20 år sedan inledde Ronald Reagan en våg av

skattesänkningar i västvärlden. När USA

sänkte sina skatter skärptes trycket på andra att

följa efter. Under en period blundade många i Europa och

en rad ekonomer (däribland jag själv) hävdade att

Reaganomics var ett oansvarigt tänkande. Men vi hade fel.

USA har ryckt åt sig ett stort försprång och har

världens mest framgångsrika ekonomi.

levyforecast.com/2018/05/Twin-Deficits-This-Time-Its-Different.pdf

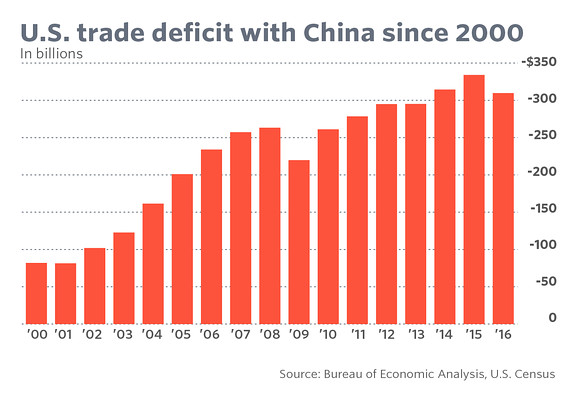

China and Europe's refusal to reduce their extravagant trade surpluses on U.S. trades

is becoming an unbearable theater of the absurd.

America's rising trade and budget deficits call for decisive action.

CNBC 20 August 2018

Washington's huge fiscal and monetary stimuli will give the world economy an estimated $600 billion shot in the arm this year.

That amount represents the difference between the expected U.S. purchases and sales of goods and services in world trade.

America’s current-account deficit is headed to more than 3% of nominal GDP

Aug 6, 2018 CARMEN M. REINHART , VINCENT REINHART

Germany’s finance minister’s obsession with surpluses will damage EU neighbours

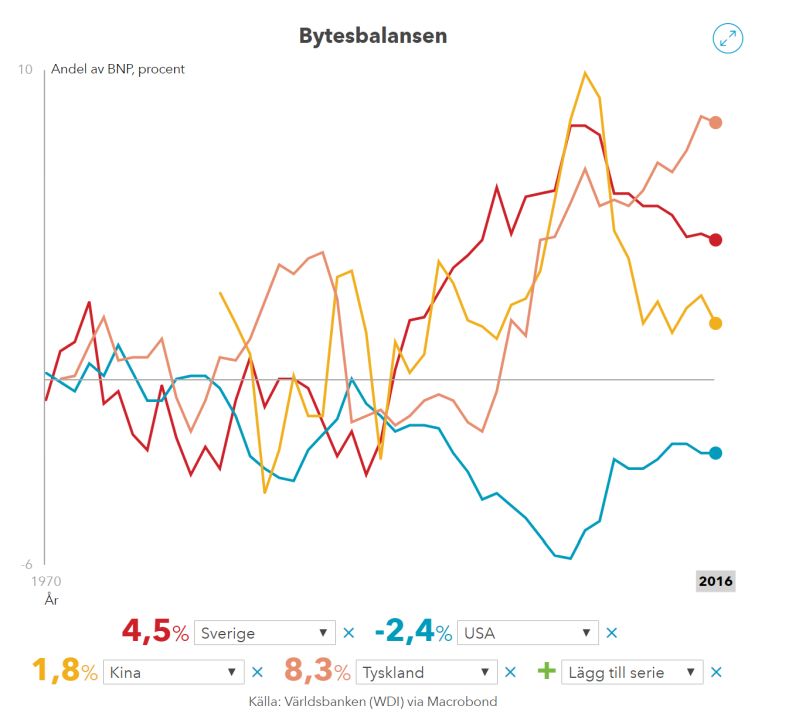

Germany has been running current account surpluses of around 8 per cent for the past couple of years.

Wolfgang Münchau FT 6 May 2018

If foreigners use their dollars to build a factory in, say, South Carolina, our real economy gets a boost that neutralizes the circular flow’s leak. But if they only buy stocks and bonds in our financial economy, that shouldn’t provide as much of an offset to the leak.

Well, data show the foreign sector mostly draining dollars from our real economy and then investing them in our financial economy.... more here

US Current Account Deficit at Google

Källa Ekonomifakta januari 2018

IMF 2018 External Sector Report

While the current configuration of global excess imbalances does not pose an imminent danger, we project that,

under planned policies, these imbalances will grow over the medium term, eventually posing a risk to global stability.

Maurice Obstfeld IMF 24 July 2018

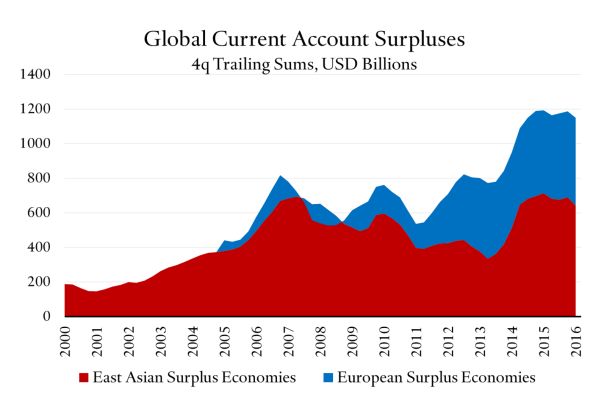

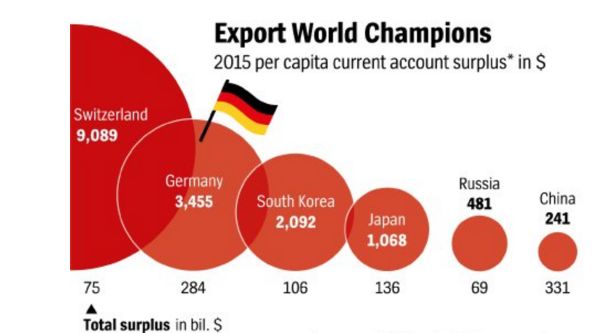

Higher-than-desirable current account balances prevail in northern Europe—in countries such as Germany, the Netherlands, and Sweden—as well as in parts of Asia—in economies like China, Korea, and Singapore.

Lower-than-desirable balances remain largely concentrated in the United States and the United Kingdom.

IMF Sounds The Alarm On Global Debt, Warns "United States Stands Out"

zerohedge 18 April 2018

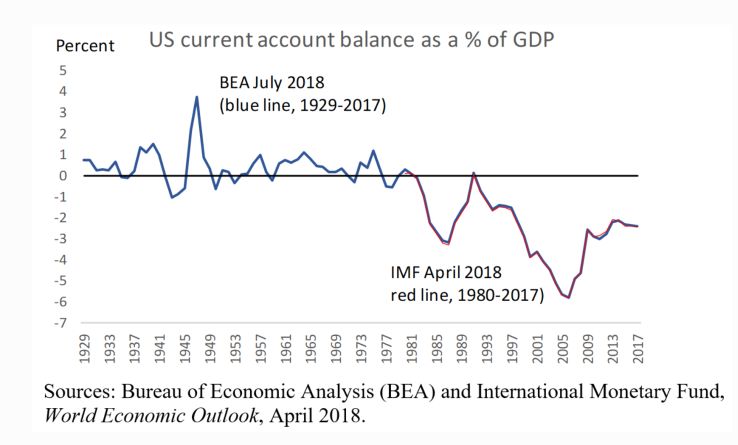

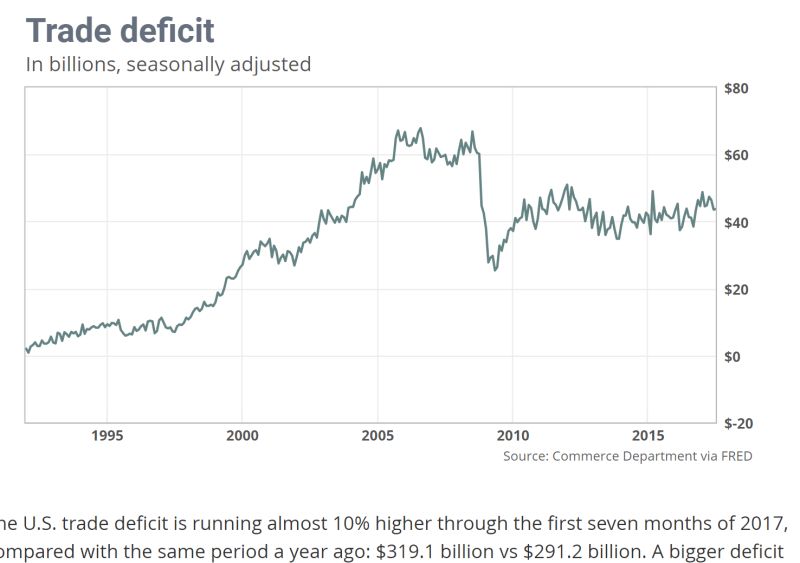

/The current-account deficit increased to $466.2 billion (preliminary) in 2017 from $451.7 billion in 2016./

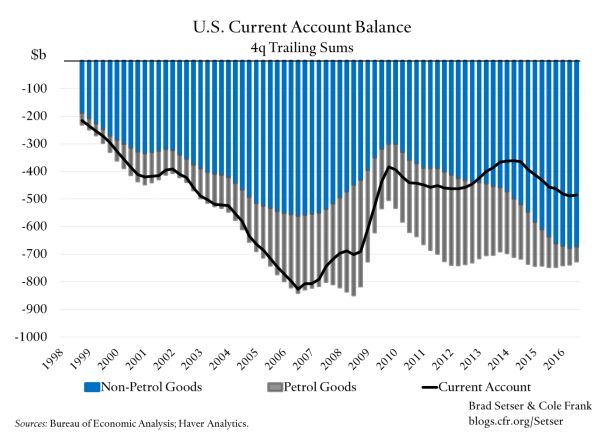

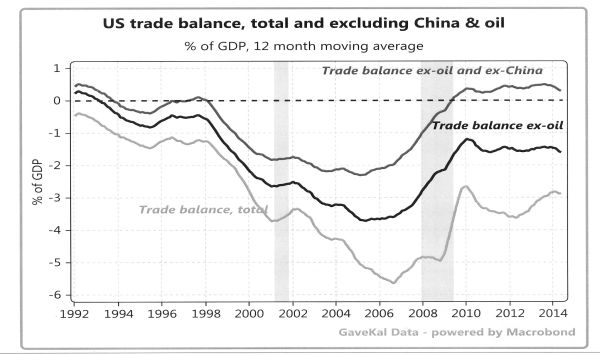

If it weren't for oil and gas, the trade deficit would be a lot bigger.

The U.S. current account deficit grew a bit at the end of last year, to $128.2 billion in the fourth quarter.

That amounts to 2.6 percent of gross domestic product, which from the perspective of the past 15 years or so isn't all that big.

Justin Fox Bloomberg 21 mars 2018

The goods trade balance has been pretty much the sole driver of the big increase in the current account deficit since the early 1980s.

The U.S. trade deficit in goods that aren't oil and gas is now bigger than ever, both in dollar terms and as a share of GDP.

The oil and gas trade balance, which was 4.1 percent of GDP in the fourth quarter of 2004, is rapidly nearing zero, and all indications are that it will turn positive soon.

De stora obalanserna i världshandeln är, precis som Trump hävdar, ohållbara.

De kraftiga överskotten i länder som Kina och Tyskland är orimliga och

underskotten i USA och Sydeuropa undergräver människors tilltro till demokrati och marknader.

Ulf Dahlsten SvD 15 mars 2018

US twin deficits

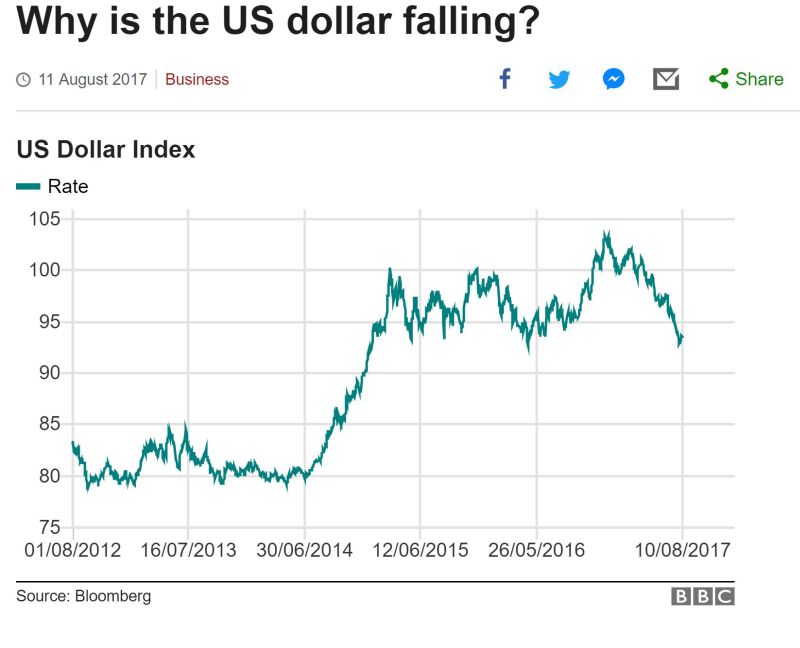

As the dollar weakened last week, Martin Feldstein’s catchphrase from the 1980s

was on the lips of most macro traders.

Gavyn Davies.FT 18 February 2018

This is what happened to the “twin deficits” during the Reagan and Bush fiscal injections

Provided the Fed remains independent from politicians, a dollar crisis seems most unlikely.

Germany digs in heels as world anger mounts over its toxic trade surplus, the world’s largest in absolute terms

The currency claim may raise eyebrows in Washington, where some suspect that the European Central Bank’s negative interest rates (-0.4pc) are a disguised way to hold down the euro – bad etiquette for a currency bloc running a surplus near $430bn, three times that of China.

Ambrose 18 January 2018

U.S. Trade Deficit Balloons to Widest in Almost Six Years

Bloomberg 5 January 2018

Gap grew 3.2% to $50 b

Imports rose 2.5% to a record $250 b

Exports climbed 2.3% to all-time high of $200 b

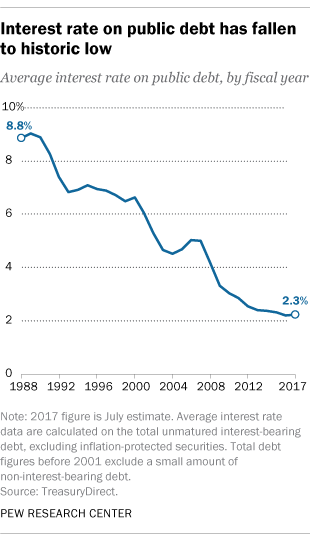

The administration seems set on vast tax cuts at a time of near full employment.

It suggests that this will somehow create a huge upsurge in growth. That is not inconceivable, but it is hugely unlikely.

More likely are rising inflation, a sharp rise in interest rates, a higher dollar and a huge surge in the current account deficit.

Martin Wolf, FT 13 October 2017

It is not America’s current account deficit that looks scary now —

that dubious honour goes to some emerging market countries and oil producers such as Saudi Arabia.

Since the crisis, low oil prices have eliminated a big part of the /savings/ glut.

The German and Chinese contributions, which fell after the crisis, are approaching 2007 levels again

The current preoccupation with large and persistent current-account imbalances is justified.

But it rests on flawed assumptions. The truth is that all current-account imbalances are not created equal.

Charles Wyplosz, Project Syndicate 11 August 2017

It is excessive public spending financed by external borrowing that is most worrisome, because highly indebted governments can default more easily than private entities.

Unlike firms and households, states cannot be closed down or forced to sell assets.

Moreover, they may have some political leverage, as was the case with Greece and Portugal during the euro crisis.

Large and persistent external deficits create vulnerability, because they result in the buildup of debt that can eventually become worrisome for lenders, while locking borrowers into an inescapable pattern of borrowing.

Not counting petroleum products, the U.S. trade deficit in goods is as big as it has ever been

As someone who came of age in the worrying-about-trade-deficits era, I cannot help but find this ... worrisome.

Justin Fox, Bloomberg 9 augusti 2017

Germany overtakes China as largest surplus economy, IMF data show

Germany ran a current-account surplus of $289bn, or 8.3 per cent of GDP in 2016

while China’s fell to $196.4bn, or 1.7 per cent of GDP.

The US had a current-account deficit of $451.7bn, or 2.4 per cent of GDP.

FT 28 July 2017

Will a Smaller Fiscal Deficit Cause the Trade Deficit to Decline or Unemployment to Rise?

Michael Pettis, The Carnegie Endowment for International Peace 22 May 2017

U.S. investment exceeds U.S. savings, and the United States runs a trade deficit that is by definition equal to the gap between investment and savings.

It also runs a capital account surplus equal to the gap because this is the amount of net foreign capital inflow that bridges the gap, and the trade account and the capital account for any country must always balance to zero.

So far there is no disagreement here.

The model Shultz and Feldstein use is the same model, on the surface, that I and most other trade economists use, and is built around accounting identities that can never be violated.

However, accounting identities do not tell us the direction in which causality flows, and so all identity-based arguments must implicitly make assumptions about which of the variables drive the other.

That is the nub of the claim Shultz and Feldstein make. They argue that if we cut the U.S. fiscal deficit, the U.S. trade deficit must automatically decline.

History certainly does seem to suggest that U.S. capital markets are essentially shock absorbers for capital flow requirements around the world.

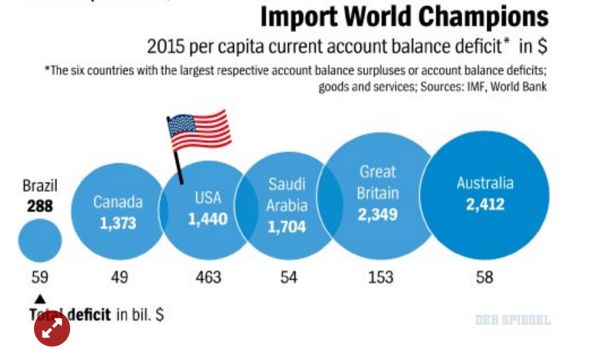

For US President Donald Trump, the measure of a country’s economic strength is its current-account balance

– its exports of goods and services minus its imports. This idea is of course the worst kind of economic nonsense.

It underpins the doctrine known as mercantilism, which comprises a hoary set of beliefs discredited more than two centuries ago.

Mercantilism suggests, among other things, that Germany is the world’s strongest economy, because it has the largest current-account surplus.

Barry Eichengreen, Project Syndicate 14 May 2017

President Trump abandons the strong dollar policy

Gavyn Davies, 15 April 2017

President Donald Trump triggered a slide in the US dollar

as he complained the currency has risen too high

also revealed a major policy U-turn as he said that the US government would not label China a currency manipulator.

FT 12 April 2017

Soaring Trump dollar risks global trade war and China currency crisis, warns Posen

Donald Trump will succeed in ramming through radical tax cuts and fiscal stimulus, causing US federal borrowing to balloon.

The Peterson Institute thinks the current account deficit could rise to 5pc of GDP.

Ambrose Evans-Pritchard, 11 April 2017

The US president signed an executive order on Friday 2017-03-31

calling for a 90-day country-by-country and product-by-product

study of the US’s $500bn annual trade deficit.

FT 31 March 2017

“The jobs and wealth have been stripped from our country year after year,

decade after decade, trade deficit upon trade deficit,” he said.

“Thousands of factories have been stolen from our country.”

America's Unsustainable Current Account Deficit

"Never in the history of modern economics has a large industrial country run

persistent current account deficits of the magnitude posted by the U.S. since 2000."

National Bureau of Economic Research, 23 January 2017

The amount of foreign capital inflows required to sustain an American economy in which both the government and individuals eschew savings and spend beyond their means

-- and imports far exceed exports -- has soared to record highs.

A day of reckoning for what economists call our "current account deficit" is likely to arrive soon.

And the price will be paid in a currency drop that will significantly reduce domestic economic growth.

That's the conclusion of a study by NBER Research Associate Sebastian Edwards.

In Is the U.S. Current Account Deficit Sustainable? And If So How Costly Is Adjustment Likely to Be?

(NBER Working Paper No. 11541)

The result, Edwards believes, would be a 21-to-28 percent depreciation in the value of the trade-weighted dollar and a considerable slowdown of the American economy.

And that may be a "best case" scenario. He warns that the damage inflicted on the U.S. economy by a sharper and/or more immediate correction in the current account deficit could actually be much worse.

"I have not presented the results from 'pessimistic' scenarios, where foreigners reduce their net demand for U.S. assets below the current level (of about 30 percent of GDP).

U.S. Trade

Deficit: Causes, Magnitude and Consequenses

Rolf Englund, May 2001

US trade deficit widened to a near five-year high in January

The trade gap grew by $4.2bn to $48.5bn in January

FT 8 March 2017

zc

US policymakers should worry about China’s capital account, not its current account.

That is where danger now lies.

Martin Wolf, FT 4 April 2017

The macroeconomic issue is simple:

China saves more than it can profitably invest at home.

In 2015, gross national savings were 48 per cent of GDP.

Mr Xi has people in his government who at least understand these issues.

Is the same also true for Mr Trump? The stability of the world economy depends on the answer.

Alas, I suspect it is no.

What's Really Driving the Trade Deficit

During this time trade imbalances were mostly determined by direct differences in the cost of traded goods, while capital flowed from one country to another mainly to balance trade flows. Today, however, conditions have changed dramatically.

Capital flows dwarf trade flows, and investment decisions by fund managers determine their direction and size.

Michael Pettis, Bloomberg 3 April 2017

This has profound implications for trade.

Large, persistent trade surpluses such as the one China runs with the U.S. are no longer the consequence of explicitly mercantilist measures.

Instead, they're driven by policies that distort domestic savings rates by subsidizing production at the expense of households.

US President Donald Trump suffers from an acute strain of trade deficit disorder.

The US has trade deficits with 101 nations. This is not a bilateral problem.

Reflects a far deeper problem: the US’s saving deficit.

Stephen Roach, FT 7 March 2017

Lacking in saving and wanting to grow, the US must import saving from countries like China, Germany, and Japan, which have big surpluses.

But it must run a massive balance of payments deficit in order to attract the foreign capital.

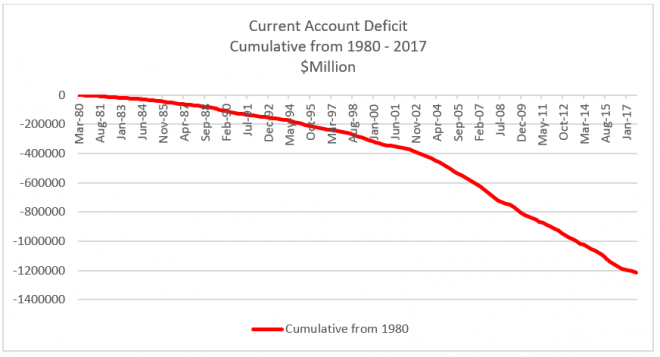

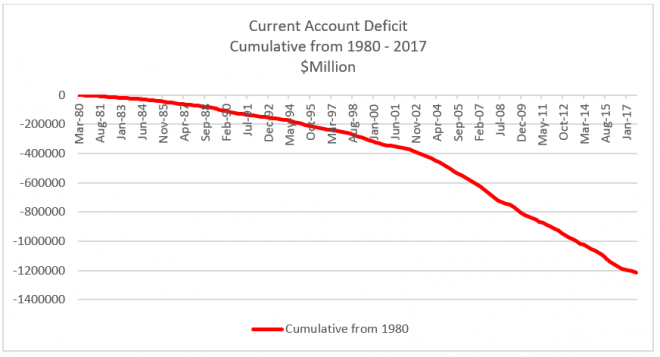

Since 2000, the cumulative $8.3tn balance of payments deficit has been almost identical to the $8.6tn multilateral trade gap over the same period.

Trade deficit disorder is a manifestation of that denial, which can lead to major policy blunders and destabilising dislocations at home and abroad.

It offers the fantasy of a bilateral solution for a multilateral problem.

This delusion must be treated before it is too late.

I see a story driven less by a swing in global capital flows and

more by a swing in global commodity prices (and changes in the global pattern of commodity production).

Brad Setser, March 15, 2017

In a recent talk at the Council on Foreign Relations

former US Treasury Secretary Larry Summers described himself as a “chastened prophet”

– a description that former Chairman of the Fed Paul Volcker also embraced.

Both warned about the risks associated with large US current account deficits several years ago.

Brad Setser May 25, 2007

The Federal Reserve might be doing the right thing for the U.S. economy by moving to bring interest rates back up to normal.

But for foreign companies and governments that have borrowed trillions of U.S. dollars, the adjustment could be painful.

Mark Whitehouse, Bloomberg 19 March 2017

As of September, non-bank companies and governments outside the U.S. had some $10.5 trillion in dollar-denominated debt outstanding, according to the Bank for International Settlements.

That's more than triple the level of September 2004, the last time the Fed was about this far into a cycle of rate increases

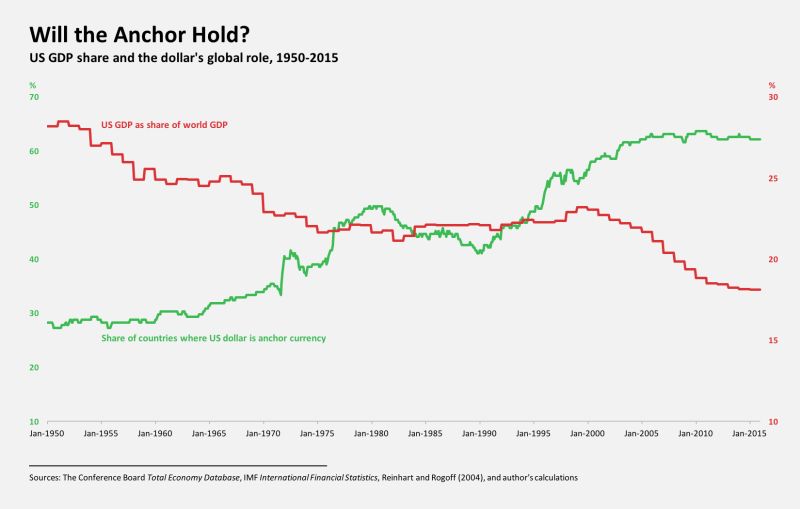

The Dollar, Bretton Woods, Triffin and China

Carmen Reinhart, Project Syndicate 2 March 2017

The divergence between the trends for production and finance emerges as a relatively

smaller US economy supplies reserve assets in step with rising global demand for them (primarily from emerging markets).

The Bretton Woods system came to an end in March 1973, when the dollar and other major currencies were allowed to float and the dollar depreciated further.

Now as then, the US could meet the rest of the world’s appetite for dollars by issuing more dollar debt.

This would require the US to run sustained current-account deficits, mirrored in fiscal deficits.

Of course, while the link to gold is passé, any domestic fiscal objective to curb US debt growth would be at odds with the international role as sole provider of the reserve currency.

Carmen Reinhart is Professor of the International Financial System at Harvard University's Kennedy School of Government.

The United States has the world's largest trade deficit and has run one since 1975.

In 2015, the deficit on goods and services was $500.4 billion, higher than the $490.2 billion deficit in 2014.

The deficit occurred because exports, at $2.3 trillion, were lower than imports, at $2.761 trillion.

(Source: "U.S. International Trade in Goods and Services," U.S. Census Bureau.)

The U.S. trade deficit in goods alone was $762.5 billion, 2.4 percent higher than last year.

From the mid-1970s to 2008, the US economy had kept global capitalism in

an unstable, though finely balanced, equilibrium.

It sucked into its territory the net exports of economies such as those of Germany, Japan and later China,

providing the world’s most efficient factories with the requisite demand.

How was this growing trade deficit paid for?

Yanis Varoufakis 11 November 2016

United States Current Account 1960-2017

tradingeconomics.com/united-states/current-account

In the early 1990’s, Foreign Affairs devoted an entire issue to an article written by political science professor Samuel Huntington titled the “Clash of Civilizations,” which predicted a terror war between Islam and the west.

And now Peter Peterson just wrote an article about the deficit crisis facing the United States and the almost inevitability of a dollar crisis.

Peterson succeeded David Rockefeller as the Chairman of the Council for Foreign Relations in 1985.

He had been the CEO of Lehman Brothers. He served as Secretary of Commerce in the Nixon administration.

Mr. Swanson 11/4 2005

What I want to underscore in this article is the point that the people in the know all recognize the reality of the deficits our country faces and the high possibility of a full-blown dollar crisis. They know the dollar will drop.

Riding for a Fall, Peter G. Peterson From Foreign Affairs, September/October 2004

This article is adapted from "Running on Empty: How the Democratic and Republican Parties Are Bankrupting Our Future and What Americans Can Do About It,"

News Release: U.S. International Transactions

US Department of Commerce

Before 1971, US global hegemony was predicated upon America’s current-account surplus with the rest of the capitalist world,

which the US helped to stabilize by recycling part of its surplus to Europe and Japan.

This underpinned economic stability and sharply declining inequality everywhere.

But, as America slipped into a deficit position, that global system could no longer function,

giving rise to what I have called the Global Minotaur phase.

Yanis Varoufakis, Project Syndicate 28 November 2016

The U.S. current account deficit decreased to $113.0 billion in the third quarter of 2016 from $118.3 billion

The deficit decreased to 2.4 percent of GDP from 2.6 percent in the second quarter.

BEA 15 December 2016

The U.S. current-account deficit rose 11.7% in the third quarter 2015 to the highest level since 2008

The deficit increased to a seasonally adjusted $124.1 billion from a revised $111.1 billion in the second quarter

It’s the biggest gap since the fourth quarter of 2008.

MarketWatch 17 December 2015

As a percentage of the U.S. economy, the current-account deficit equaled 2.7% of gross domestic product, up from 2.5% in the prior quarter. That’s the highest percentage in three years.

The U.S. current account deficit is down sharply from the peak of 6.5% of GDP in the fourth quarter of 2005,

but it’s up from the most recent low of 2.4% in mid-2009.

Current Account Deficits: Is There a Problem?

A common complaint about economics is that the answer to any question is, “It all depends.”

IMF March 2012

If the deficit reflects an excess of imports over exports, it may be indicative of competitiveness problems,

but because the current account deficit also implies an excess of investment over savings,

it could equally be pointing to a highly productive, growing economy.

If the deficit reflects low savings rather than high investment, it could be caused by reckless fiscal policy or a consumption binge.

Or it could reflect perfectly sensible intertemporal trade, perhaps because of a temporary shock or shifting demographics.

Without knowing which of these is at play, it makes little sense to talk of a deficit being “good” or “bad.”

Deficits reflect underlying economic trends, which may be desirable or undesirable for a country at a particular point in time.

How Dangerous Is the U.S. Current Account Deficit?

Cletus C. Coughlin , Michael R. Pakko , William Poole

The Federal Reserve Bank of St. Louis April 2006

For US President Donald Trump, the measure of a country’s economic strength is its current-account balance

– its exports of goods and services minus its imports. This idea is of course the worst kind of economic nonsense.

It underpins the doctrine known as mercantilism, which comprises a hoary set of beliefs discredited more than two centuries ago.

Mercantilism suggests, among other things, that Germany is the world’s strongest economy, because it has the largest current-account surplus.

The explanation for Germany’s external surplus is that it saves more than it invests.

The correspondence of savings minus investment with exports minus imports is not an economic theory; it’s an accounting identity.

Germans collectively spend less than they produce, and the difference necessarily shows up as net exports.

In 2016, Germany ran a current-account surplus of roughly $ 297 billion, or 8.6% of GDP

Changing the exchange rate would not diminish the incentive for Germans to save.

In the current European environment of near-zero interest rates, there’s little risk that additional public investment will crowd out private investment.

Barry Eichengreen, Project Syndicate 14 May 2017

Handelsutbyte är nog bra, med betoning på utbyte.

Men om ett land, t ex USA, har ett stort underskott och två andra länder, t ex Tyskland och Kina, har stora överskott, då blir det ju inget fullständigt utbyte.

Jag är nog Merkantilist i den meningen att jag tror det är bättre att ha ett litet överskott i utrikeshandeln än att ha stora underskott.

zc

U.S. Trade Gap Widens to $55.5 billion a 10-Year High

Overall exports came in at $211 billion

Imports $266.5 billion

Bloomberg 6 december 2018

US trade deficit increases more than expected in September and is now up 10% for 2018

The shortfall rose to $54 billion for the month, and reflective of a 10.1 percent increase year to date

CNBC 2 November 2018

The goods deficit stood at $76.3 billion, the highest on record on a seasonally adjusted basis.

Exports increased to $212.6 billion, a $3.1 billion gain from August,

while imports rose $3.8 billion to $266.6 billion.

America’s foreign trade deficits on goods transactions are getting worse.

Trade deficits with the EU and China, growing at respective annual rates of 15 percent and 10 percent

Michael Ivanovitch CNBC 9 July 2018

Michael Ivanovitch served as a senior economist at the OECD in Paris, international economist at the Federal Reserve Bank of New York,

and taught economics at Columbia Business School.

Washington must make it possible to bring back into productive labor force some of the 95 million Americans without jobs and a meaningful future.

The U.S. administration deserves credit for boldly moving to stop decades of rising trade deficits and foreign debt.

It should do that by negotiating its unassailable trade case with Germans and the Chinese.

Shooting tariff hits to force concessions is a road to nowhere.

The U.S. trade deficit shrank 2.1% in April to a seven-month low.

But the gap is still on track to widen in 2018 to the highest level in a decade.

MarketWatch 6 June 2018

Year-to-date, the goods and services deficit increased $20.8bn from the same period in 2017. (FT)

China is an easy political target.

After all, it accounted for 46% of America’s colossal $800 billion merchandise trade gap in 2017.

Stephen S. Roach Project Syndicate 23 May 2018

Underskottet i USA:s handelsbalans ökade till 57,6 miljarder dollar, motsvarande drygt 483 miljarder kronor, i februari

Det är den sjätte månaden i rad som USA:s handelsunderskott ökar och är det största på nio år

SvD/TT 5 april 2018

OBS att underskottet är på en månad.

The U.S. trade deficit rose to $56.6 billion in January and hit a nearly 10-year high

MarkerWatch 7 March 2018

The funny thing is that Trump has an overwhelming case.

US experienced its last annual trade (goods) surplus in 1975.

David Stockman 5 March 2018

Since then, there has been a continuous and deepening of the US trade deficit. That is, a 43-year plunge into the red that marks the vast off-shoring of US production, jobs, and wages.

In all, it cumulates to about $15 trillion more of stuff America bought versus what it sold to the rest of the world since 1975

Even when you throw in the $4 trillion surplus on the services account ( tourism, transportation, insurance, royalties and business services) during the same 43-year period, the deficit on current account with the rest of the world is still $11 trillion, and that's in then-year dollars.

Inflated to 2017 purchasing power, the balance with the rest of the world since 1975 is well larger than the current GDP of the US.

American consumers have relied on appreciation of equity holdings and home values

to support over-extended lifestyles.

Stephen S. Roach 26 February 2018

It is also the case for the US Federal Reserve, which has turned to unconventional monetary policies to support the real economy via so-called wealth effects.

Over the past 35 years, America has /been/ running balance-of-payments deficits every year since 1982 (with a minor exception in 1991, reflecting foreign contributions for US military expenses in the Gulf War).

2017 the U.S. trade gap leaped to a nine-year high of $566 billion.

The last time the U.S. ran a surplus was in 1975.

MarketWatch 6 February 2018

China and these 10 countries account for most of the trade deficit

U.S. Trade Deficit Balloons to Widest in Almost Six Years

Bloomberg 5 January 2018

Gap grew 3.2% to $50 b

Imports rose 2.5% to a record $250 b

Exports climbed 2.3% to all-time high of $200 b

U.S. trade deficit shows no sign of shrinking

The trade gap in goods with China increased to $33.6 billion in July

MarketWatch 6 Sept 2017

It was unchanged with Germany at $5.5 billion.

The deficit with China was the highest in a year.

Germany’s trade surplus is a threat to global stability

Amounts to 9 pc of GDP.

Measured by capita, it is roughly three times the size of the Chinese trade surplus

Matthew Lynn, Telegraph 15 April 2017

America hardly makes any of the stuff it buys from China anymore

The U.S. trade deficit totaled $501 billion in 2016 and China accounted for about 62% of the overall gap.

MarketWatch 6 April 2017

In early February, Germany announced a new record trade surplus: $281bn, versus $210bn for China.

Peter Navarro, Mr Trump’s chief trade adviser, has accused Germany of exploiting the “grossly undervalued”

implied Deutschmark exchange rate to the detriment of both its European neighbours and the US.

US trade deficit widened to a near five-year high in January

The trade gap grew by $4.2bn to $48.5bn in January

FT 8 March 2017

12 x 48,5 = 582 miljarder dollar

US President Donald Trump suffers from an acute strain of trade deficit disorder.

The US has trade deficits with 101 nations. This is not a bilateral problem.

Reflects a far deeper problem: the US’s saving deficit.

Stephen Roach, FT 7 March 2017

One of the defining characteristics of the Trumpites is that they are locked in the 1980s.

They believe that the Euro is an invention by the Germans to pursue higher exports by stealth.

But if that were the kind of tactic that Schaeuble were pursuing,

he would answer his American critics by denying that Germany’s imbalance is at all relevant.

Adam Tooze, 6 February 2017

Trump has (mainly) got it wrong about Germany manipulating the euro

The country has amassed €1.5 trillion in net foreign assets (half of this through poorly secured intra-ECB Target-2 lending)

David Marsh, MarketWatch Feb 6, 2017

Germany’s current account surplus of 9% of gross domestic product, the biggest in the world in dollar terms, underlines an uncomfortable disequilibrium caused by EMU but extending far beyond it. Three-quarters of Germany’s current-account surplus last year was with seven counties — the U.S., the U.K. , France, Sweden, Austria, Canada and Denmark — five of which are outside the eurozone.

This year will be the 12th consecutive year in which Germany registers a surplus around or higher than 6% of GDP,

making a mockery of the Europe’s pretence of controlling macroeconomic imbalances.

Wise German thinkers — including Schäuble himself — realize that years of current-account surpluses are not good news for Germany.

The country has amassed €1.5 trillion in net foreign assets (half of this through poorly secured intra-ECB Target-2 lending), important parts of which will probably be unrepayable.

Germany trade surplus of nearly $300bn outpacing China by more than $50bn

Schäuble blames ECB for euro that is ‘too low’ for Germany

FT 5 February 2017

According to the Ifo Institute, Germany recorded a trade surplus of nearly $300bn last year, outpacing China by more than $50bn to hold the world’s largest trade surplus.

In 1971, European finance ministers told John Connally, then US Treasury secretary, that American monetary policy was creating problems for Europe because it was exporting inflation.

Connally replied: “The dollar is our currency, but it’s your problem.”

Today Peter Navarro, the head of President Donald Trump’s National Trade Council, argues that Germany is using an undervalued euro to export deflation.

If Angela Merkel, the German chancellor, were like Mr Trump she would probably tell him that the euro was “our currency and his problem”.

The mere fact that Germany has joined the euro leads to an undervaluation of the German currency. This is probably correct, but his argument that the existence of the euro explains the US trade deficit is still flawed.

Mr Navarro neglects US trade with eurozone members other than Germany. For countries such as Italy, Spain or France, the exchange rate to the dollar would be lower than today if they went back to national currencies. In this case they would export more to the US and import less.

Clemens Fuest,

president of the Ifo Institute and director of the Centre for Economic Studies at the University of Munich

FT 2 February 2017

Is Germany a Currency Manipulator?

Will the administration call for Germany’s exit from the euro?

Jeromin Zettelmeyer (PIIE)February 1, 2017

Jeromin Zettelmeyer, senior fellow at PIIE, is a former director-general for economic policy at the German Federal Ministry for Economic Affairs and Energy.

Navarro's central economic assertion — that “while the euro freely floats in international currency markets,

this system deflates the German currency from where it would be if the German Deutschmark were still in existence”

— is uncontroversial.

If Germany were to leave the euro area, German exports would become more expensive and German imports cheaper, reducing the German current account surplus

Freely floating currencies are consistent with large, persistent deviations from trade and current account balance. The reason is that freely floating exchange rates are shaped not only by demand for and supply of currency associated with trade but also with the demand for currency associated with investment flows.

In fact, the initial consequence of euro membership was not to make Germany more competitive.

Quite the reverse: /se Wolodarski 2003/

Because of north-south capital flows and faster productivity growth in the poorer euro member countries,

Germany quickly became overvalued within the euro area, triggering a recession in 2003.

If the diagnosis is that euro membership constitutes currency manipulation, will the administration call for Germany’s exit from the euro?

Such an exit would disrupt Europe economically and politically, and wreak havoc on the world economy.

The United States has complained about the German current account surplus for years, and so has the European Commission.

The result of these complaints has been a set of policy recommendations directed at Germany

Yet, the German government has refused to implement them, partly because of the Ministry of Finance’s obsession with balanced budgets, and partly because these reforms are politically difficult

If the Trump administration were to throw its political and economic weight behind these reforms, it would be good for Germany, Europe, and the United States.

As a matter of strict objective fact, Donald Trump’s trade guru is correct.

Germany is the planet’s ultimate currency manipulator.

Ambrose, Telegraph 1 February 2017

The implicit Deutsche Mark is indeed “grossly undervalued”

The warped mechanism of monetary union allows Germany to lock in a permanent ‘beggar-thy-neighbour’ trade advantage over Southern Europe,

inflicting mass unemployment on the victim countries and blighting their futures.

Whatever you think of Peter Navarro’s trade philosophy,

he is right that Germany’s chronic, huge, and illegal current account surplus - 8.8pc of GDP - saps global demand and seriously distorts the world economy.

Is Navarro right about Germany and the trade surplus?

So yes, the criticism is fair.

Eurointelligence 1 February 2017

The orthodox view is that the US can always achieve full employment by active use of fiscal and monetary policy tools.

Experience since 2000 and especially since the financial crisis suggests this may be difficult.

As I have argued elsewhere, huge current account surpluses in some countries forced deficit countries into financial excesses

as an (ultimately unsustainable) way to maintain demand in line with potential output.

Martin Wolf, FT 31 January 2017

Martin Wolf, The Shifts and the Shocks: What We've Learned--and Have Still to Learn--from the Financial Crisis Paperback – November 24, 2015 Amazon

The crisis vindicated the concern of John Maynard Keynes about the potentially

malign role of surplus countries in the global economy.

In 1950, employment in manufacturing was 13m, while that in the rest of the economy was 30m.

By the end of 2016, it was 12m and 133m, respectively.

I have been wrong since at least 2001

U.S. Trade Deficit: Causes, Magnitude and Consequenses

Stein's Law: If something cannot go on for ever it will stop.

Trade Deficit at $42.6 Billion in October 2016

Calculated Risk 6 December

America’s growing strong dollar conundrum poses a threat to Mr Trump’s vows to slash the trade deficit

FT 13 December 2016

William Cline, a senior fellow at the Peterson Institute for International Economics, see further currency gains ahead.

He estimates in a new research report that as of mid-November the dollar was overvalued by roughly 11 per cent,

and argues that fiscal stimulus and associated interest rate increases risk yet further increases in the dollar.

The US current account deficit is on track to widen from 2.7 per cent of gross domestic product this year to nearly 4 per cent by 2021.

Sustained recovery requires decreased domestic US spending and

increased domestic spending in China and much of the rest of the world,

together with adjustments in exchange rates.

Olivier Blanchard, Financial Times, June 18 2009

The writer is chief economist of the IMF

We should expect the Trump administration to pay particularly attention to the US trade deficit

and if the trade deficit grows Trump is likely to blame countries like Mexico and China for that.

The paradox is that Trump’s own policies combined with the Federal Reserve’s likely response to the fiscal expansion

(higher interest rates) in itself is likely to cause the US trade deficit to balloon.

The Market Monetarist, 18 November 2016

The US has a current account deficit because the US national savings rate is very low.

Household savings fell to just 3.3 per cent of gross domestic product last year and corporate savings to just 4.6 per cent.

More than three-quarters of these private savings were offset by the 6.1 per cent of GDP dissaving by the federal, state and local governments.

So even with a relatively low level of business investment and residential construction,

the excess of national investment over national savings resulted in a current account deficit of 2.3 per cent of GDP.

Martin Feldstein, FT May 15, 2014

The overall trade-weighted value of the renminbi has not changed in the past decade

but the Chinese currency has strengthened by 30 per cent relative to the dollar during those 10 years.

The US trade deficit narrowed to its lowest level in four years in November,

as rising sales of oil pushed US exports to a record high.

BBC 7 January 2014

Remember Joe Sixpack?

Having spent most of the postwar decades acting as the world’s consumer of last resort,

America’s middle class was expected to play a more modest role after the 2008 crash. For a few years, US consumption went into hibernation.

Now, with China’s growth slowing, Europe’s stalled and some of the early excitement fading from Japan’s “Abenomics”,

prospects for global growth once again hinge on Joe’s appetite to spend.

Edward Luce, Financial Times, July 7, 2013

The US middle class is hardly in an ideal condition to roar back as the engine of world growth. Median earnings have fallen by 5.4 per cent since the US recovery began. Unemployment remains closer to 8 per cent than 7 per cent. And households have at least temporarily stopped paying off their debt.

In May, surging imports pushed the US trade deficit up by 12 per cent to $45bn, which was the largest jump in five years.

Imports from China accounted for almost two-thirds of that. If it continues, the US-China deficit will exceed $300bn this year.

Meanwhile, US exports fell.

The US trade deficit unexpectedly widened in November to USD 48.7 billion,

exceeding all estimates in a Bloomberg survey of economists and the biggest since April,

from $42.1 billion in October. Falling petroleum prices prevented the import bill from climbing even more

Bloomberg 11 January 2013

The US trade deficit shrank in February to $46 billion, the smallest since October

as imports fell by the most in three years,

reflecting the smallest amount of crude oil purchases in 15 years and a drop-off in demand for Chinese goods

Bloomberg/BBC 12 April 2012

Exports rose by 0.1% to an all-time high of $181.2bn

Imports fell by 2.7% to $227.2bn, with imports from China down by 18.2%.

The current-account deficit in the U.S. widened more than forecast in the fourth quarter

to $124.1 billion, the biggest in three years

Bloomberg 14 March 2012

The trade deficit in the U.S. widened in January to 53 billion

Imports advanced 2.1 percent to 233 billion

Exports increased 1.4 percent to 182 billion

Bloomberg 9 March 2012

Record imports widen US trade deficit to $48.8bn in December

BBC 10/2 2012

Imports rose 1.3% to a record $227.56bn, boosted by demand for foreign cars and machinery.

US exports grew slightly, by 0.7 percent to $178.8 bn helped by the weak dollar

The widening of the trade gap was bigger than had been expected.

49 x 12 = 588

Nice chart, as always, at CalculatedRisk

Ask yourself: Why is it so hard to restore full employment?

It’s true that the housing bubble has popped, and consumers are saving more than they did a few years ago.

But once upon a time America was able to achieve full employment without a housing bubble and with savings rates even higher than we have now.

What changed? The answer is that we used to run much smaller trade deficits

Paul Krugman, New York Times, 2 October 2011

A return to economic health would look much more achievable if we weren’t spending $500 billion more each year on imported goods and services than foreigners spent on our exports.

To get our trade deficit down, however, we need to make American products more competitive, which in practice means that we need the dollar’s value to fall in terms of other currencies.

That, above all, means China. And none of the arguments against holding China accountable can stand serious scrutiny. Some observers question whether we really know that China’s currency is undervalued. But they’re kidding, right?

The flip side of the manipulation that keeps China’s currency undervalued is the accumulation of dollar reserves — and those reserves now amount to a cool $3.2 trillion.

US trade deficit widens to $ 53.1 bn in June

Total exports for the month fell by $ 4.1 bn to $ 170.9 bn

Imports fell by $ 1.9 bn to $ 223.9 bn.

BBC 11 August 2011

50.2 billion USD, 330 miljarder SEK in May

The trade deficit in the U.S. widened in May to the highest level in almost three years, reflecting a surge in crude oil imports.

The gap grew 15 percent to $50.2 billion, exceeding all forecasts of 73 economists surveyed by Bloomberg News and the biggest since October 2008

Bloomberg 12 July 2011

Imports rose 2.6 percent to $225.1 billion, second only to the record $231.6 billion reached in July 2008.

Excluding petroleum, the trade gap rose to $19.8 billion from $17.5 billion in April.

Exports decreased 0.5 percent to $174.9 billion

Full textRE: Summary:

Imports 225 billion

Exports 175 billion

Trade deficit 50 billion

The Economic Consequences of the Peak

Top of pageThe U.S. trade deficit widened in March, to $48.2 billion

Exports grew 4.6 percent to a record $172.7 billion.

Imports grew 4.9 percent to $220.8 billion

as the average price for imported oil hit $93.76 per barrel, the highest since September 2008.

CNBC 11 May 2011

The Economic Consequences of the Peak

The /US/ petroleum /trade/ deficit decreased in February

as the quantity declined even as import prices continued to rise

Prices will be even higher in March and April

CalculatedRisk 12/4 2011

The trade deficit with China was $18.8 billion (NSA) in February.

The oil and China deficits are essentially the entire trade deficit.

The Economic Consequences of the Peak

The January US trade deficit increased to $46.3 billion.

Exports rose 2.7 percent to an all-time high of $167.7 billion.

But imports rose a faster 5.2 percent to $214.1 billion.

That reflected a big jump in America's foreign oil bill.

CalculatedRisk March 10, 2011

A widening trade deficit is bad for the U.S. economy.

When imports outpace exports, more jobs go to foreign workers than to U.S. workers.

CNBC 10 Mar 2011

US Trade Deficit /$40.6 bn/ increased in December

The first graph shows the monthly U.S. exports and imports in dollar

The second graph shows the U.S. trade deficit, with and without petroleum

CalculatedRisk, February 11, 2011

Higly Recommended

The graph shows the U.S. trade deficit,

with and without petroleum

CalculatedRisk December 12, 2010

Higly Recommended

The trade deficit widened 8.8 percent to $46.3 billion in August

CNN 14 october 2010 with nice chart

China announced a surplus of $16.9 billion for September, down slightly from its $20 billion surplus in August.

U.S. ran up a record-high $28 million deficit with China in August.

Exports rose by 1.8% as US-made goods such as aircraft, industrial machinery and computers proved popular.

Imports dipped 2% as consumer demand for items such as clothing, televisions and toys fell.

The fall in imports reflects the slowdown of the US economy, with consumers and businesses spending less.

The trade figures marked a turnaround from June, when the trade gap had reached a 20-month high.

However, despite July's better numbers,

the trade deficit is running at an annual rate of $495.1bn, 32% higher than the $374.9bn deficit for 2009,

when imports fell significantly due to the global slowdown.

BBC

U.S. Trade Deficit Unexpectedly Widens to $49.9 Billion as Exports Decline

- the highest level since October 2008

Bloomberg Aug 11, 2010

The trade deficit in the U.S. unexpectedly widened in June to the highest level since October 2008 as consumer goods imports rose to a record and exports declined.

The gap expanded $7.9 billion, the most since record-keeping began in 1992, to $49.9 billion in June

A $42.1 billion deficit was projected by economists, according to the median forecast in a Bloomberg News survey.

Imports climbed 3 percent, while exports dropped 1.3 percent, the most since April 2009.

Exports from the U.S. decreased to $150.5 billion

Imports increased in June to $200.3

"The U.S. trade deficit widened unexpectedly"

CNBC 13 July 2010

- The trade gap widened 4.8 percent to $42.3 billion, the largest since November 2008, defying a consensus Wall Street forecast for it to narrow

U.S. imports rose 2.9 percent to the highest since October 2008

A slight drop in the average price for imported oil to $76.93 per barrel helped keep the monthly trade gap from widening further.

2.4 percent rise in U.S. exports

Nice charts

by CalculatedRisk

The trade deficit in the U.S. widened in February

increased 7.4 percent to USD 39.7 billion

Bloomberg April 13 2010

Imports climbed 1.7 percent

Exports increased 0.2 percent to $143.2 billion

The US trade deficit widened in March to the highest level in more than a year to $40.4 billion

May 12 (Bloomberg)

Imports climbed 3.1 percent in March to $188.3 billion, led by a $2.76 billion surge in crude oil and increasing demand for foreign-made automobiles

Exports rose 3.2% to $147.87bn.

The average price of a barrel of crude for the month was $74.32, the highest since October 2008.

Excluding petroleum, the trade gap shrank to $15.6 billion from $16.4 billion in February.

The US trade deficit fell to USD 37.3 bn

Imports dropped with crude oil imports at their weakest level since February 1999, at 245 million barrels.

Exports fell by $500m to $142.6bn

imports dropped by $3.1bn to $180bn

March 2010

The US trade deficit rose to $40.2bn in December,

10% higher than in November and the largest for 12 months.

BBC 10/2 2010

Exports totalled $142.7bn dollars climbing 3.3%

while imports totalled $182.9bn up 4.8% in December, with oil imports rising to their highest level since October 2008.

But for the whole of 2009, the deficit totalled $380.7bn, the smallest in eight years.

The trade deficit in the U.S. widened in November to $36.4 billion

Exports increased 0.9 percent, the seventh consecutive gain, to $138.2 billion

Imports increased 2.6 percent, reflecting a jump in oil prices, to 174,6

Bloomberg Jan. 12 2010

US trade deficit in October $32.9 billion.

Exports were up 2.6 percent,to $136.8 billion

Imports rose 0.4 percent to $169.8 billion.

Bloomberg Dec. 10 2009

A plunge in demand for petroleum checked the gain in imports.

The monthly trade gap grew to $36.5 billion

The U.S. trade deficit widened in September by an unexpectedly large 18.2 percent,

the most in more than 10 years, as oil prices rose for the seventh straight month and imports from China bounded higher

A separate report showed non-oil import prices up 0.7 percent.

CNBC/Reuters Friday, 13 Nov 2009

Imports grew 5.8 percent in September, while exports rose 2.9 percent.

The gap between US imports and exports grew 16 percent, in July

the most in more than a decade, to $32 billion

from a revised $27.5 billion in June that was larger than previously estimated

Bloomberg 10/9 2009

Imports rose 4.7% while exports rose 2.2%.

The U.S. trade deficit in May decreased to $26 bn,

the smallest deficit since November 1999

Bloomberg July 10 2009

Exports rose 1.6 percent, the biggest increase since July 2008, to $123.3 billion,

Imports fell 0.6 percent to $149.3 billion

U.S. demand for imported auto parts was held down in May by production cutbacks and factory shutdowns by Detroit.

The import figures were held down by a decline in oil to $12.9 billion from $13.8 billion

Foreign earnings on U.S. assets decreased to $116.6 billion from $117.1 billion in the prior three months.

U.S. income on overseas assets, including wages and compensation, decreased to $133 billion from $135.4 billion.

The current-account gap amounted to 2.8 percent of gross domestic product, the lowest since 1991.

The deficit was 6.6 percent of GDP during the last quarter of 2005, the highest level since records began in 1960.

Ekonomifakta:

"Sverige har sedan 1994 visat överskott i bytesbalansen. Det innebär i enkelhet att vi exporterar mer än vi importerar.

Ett annat sätt att se på saken är att vi producerar mer än vi konsumerar.

Klicka här för ett alldeles utmärkt diagram som även visar Bytesbalansen i Sverige, Japan och USA

Underskottet i den amerikanska bytesbalansen uppgick under första kvartalet till 101,5 miljarder dollar.

Analytiker hade räknat med ett underskott på 85,0 miljarder dollar, enligt Bloomberg News snittprognos.

DI 2009-06-17

Bytesbalansen för fjärde kvartalet visade ett underskott på reviderade 154,9 miljarder dollar (-132,8).

Underskottet i handelsbalansen uppgick till 91,2 miljarder dollar under första kvartalet

.The U.S. current account deficit

shrank in the first quarter to $101.5 billion, the smallest deficit since the fourth quarter of 2001

Reuters 17/6 2009.

The first quarter deficit equaled 2.9 percent of gross domestic product,

a sharp drop from 4.4 percent in the fourth quarter, and the lowest since 2.8 percent in the first quarter of 1999.

Min egen gamla spådom är att Euron spricker när dollarn faller, vilket den måste göra för att rätta till underskottet i USA:s handelsbalans.

Rolf Englund 14/6 2009

US trade gap narrows by 28.3 per cent, to $26bn in February

April 9, 2009

Imports dropped 5.1 percent to $152.7 billion

U.S. exports climbed 1.6 percent to $126.8 billion

Non-oil goods imports were down 25% y/y.

Automobile imports are now down over 50% y/y

Brad Setser with nice charts 9/4 2009

The U.S. trade deficit

Imports fell faster than exports, shrinking the gap to $36 billion.

Excluding petroleum, the deficit was little changed at $21.3 billion.

Bloomberg March 13 2009

Treasuries dropped today after Chinese Premier Wen Jiabao said he is “worried” about the country’s holdings of the securities and wants assurances that the investment is safe.

Benchmark 10-year note yields rose to 2.96 percent at 8:39 a.m. in New York from 2.86 percent late yesterday.

Imports slumped 6.7 percent to $160.9 billion

Exports decreased 5.7 percent to $124.9 billion, the lowest level since September 2006, as sales of automobiles, semiconductors, telecommunications gear and drilling equipment dropped

US Trade gap narrows for 2nd straight year

In 2008, the trade gap narrowed to $677.1 billion,

down from the revised 2007 trade deficit of $700.3 billion.

CNN 11/2 2009

Prior to the past two years of narrowing annual trade gaps, the trade deficit had been on a 16-year upward trend,

starting in 1991, when the annual trade deficit was only $31.2 billion.

During that time, the trade deficit declined only in 2001, a recession year,

The monthly deficit narrowed 4% to $39.9bn

Imports fell 5.5% to $173.7bn in December. Imports from China were down 11.3%.

US exports also declined, falling 6% to $133.8bn.

BBC 11/2 2009

The U.S. trade deficit narrowed in June to 56.8 billion

Imports rose 1.8 percent to 221.2 billion

Exports increased 4 percent 164.4 billion

The deficit with the Organization of Petroleum Exporting Countries expanded by $200 million to a record $18.1 billion.

Bloomberg

Comment by Rolf Englund:

But the deficit is still very very large.

55 x 12 = 660

U.S. trade deficit narrowed in May to $59.8 billion

Imports rose 0.3 percent to $217.3 billion

Exports increased 0.9 percent to $157.5 billion

The U.S. trade deficit widened in April to $60.9 billion

Imports grew to a record $216.4 billion.

Exports climbed to a record $155.5 billion

US trade deficit in March gap narrowed to $58.2bn

Imports fell by $6.1bn to $206.7bn

Exports fell to $148.5bn.

US trade deficit rose in February to $62.3 billion

Exports rose 2% to $151.4 billion

Imports rose 3% to $213.7 billion

CNN April 10, 2008

The U.S. trade deficit narrowed in december to $58.8 billion

Exports rose 1.5 percent to $144.3 billion

Imports declined 1.1 percent to $203.1 billion

For 2007,

exports of $1,621.8 billion and

imports of $2,333.4 billion resulted

in a goods and services

deficit of $711.6 billion

US Trade Deficit grew 9.3 percent, the most in two years,

to $63.1 bn from $57.8 bn in October, Bloomberg

Exports rose 0.4 percent to $142.3 bn

Imports rose 3 percent to $205.4 bn

U.S. Trade Gap Widened in October to 57.8 bn

Excluding petroleum, the imbalance was the smallest since 2004.

Bloomberg 2007-12-12

Exports rose 0.9 percent to $141.7 bn

Imports increased 1 percent to $199.5 bn

An increase in shipments of capital goods, including commercial aircraft lled the gain. Boeing, the world's second-biggest plane maker, delivered 28 aircraft to foreign buyers in October, up from 23 in September.

The dollar was down 8.2 percent against a trade-weighted basket of currencies from its biggest trading partners in the 12 months ended in October

US trade deficit for September dipped by 0.6 percent 56.5 billion

Exports climbed to a record 140.1 billion + 1.1 percent

Imports rose by 0.6 percent to 196.6 billion, the second-highest level on record.

CNN 2007-11-09

Oil imports fell by 0.8 percent to 10.5 billion, an improvement that is likely to be temporary given the recent surge in oil prices to close to $100 per barrel.

Through September, the trade deficit is running at an annual rate of $703.4 billion,

down by 7.4 percent from last year's $758.5 billion.

The US trade gap fell in June

Imports outstripped exports by $58.1 billion in June

Exports rose 1.5 percent to $134.5 billion

Imports rose 0.5 to $192.7 billion.

The U.S. trade deficit widened to $60 billion in May

LA Times 13/7 2007

Imports rose 2.2% to $192.1 bn

Exports rose 2.2% to $132 bn.

The U.S. trade deficit in April $58.5 billion

Bloomberg 8/6 2007

Exports rose 0.2 percent to a record $129.5 billion

Imports slipped 1.9 percent to /129.5 + 58.5/ $188 billion

Oil imports fell to $24.9 billion, from $25 billion

U.S. March Trade Gap widened 10.4 percent to $63.9 billion

Imports rose 4.5 percent to $190.1 billion

Exports rose 1.8 percent to $126.2 billion

Bloomberg 10/5 2007

U.S. February Trade Deficit $58.4 Billion

Imports of goods and services fell 1.7 percent in February to $182.4 billion

Exports fell 2.2 percent to $124 billion

April 13 (Bloomberg)

Bland oraklen på World Economic Forum i Davos i januari var det en fråga som dominerade:

Skulle bostadsbubblan i USA ta kål på högkonjunkturen?

En enda deltagare i världens mest kvalificerade panel, professor Nouriel Roubini, talade om en krasch.

De övriga förutspådde ett nästan lika soligt 2007 som 2006.

Niklas Ekdal, DN signerat 18/8 2007

När rädslan för att låna ut pengar sprider sig får centralbankernas insatser begränsad, eller i värsta fall motsatt, verkan. Regeringar kan inte heller göra så mycket mer än att undvika en politik som blåser upp bubblan extra ifrån början.

Tänkte inte på det, sade Anders Borg, slopade fastighetsskatten.

The Forthcoming Fed Rate Cuts May Not Prevent a US Hard Landing

Nouriel Roubini, Aug 17, 2007

If Nouriel Roubini's recession call is right, the US trade deficit could well fall, not just stabilize, in 2007.

Nouriel though is a real grizzly, not just a bear.

He doesn't believe the world will be able to decouple from the US.

A global slump would cut into US exports as well as US imports

Brad Setser 4/4 2007

It is rather hard to come up with a novel list of policy changes to support global adjustment.

Brad Setser 28/3 2007

During January the gap between imported and exported goods fell to $59bn

exports of goods and services rising by 1.1% to a historic high of $126.7bn

The US trade deficit rose 6.5% last year to hit a new record high of $763.6bn

Exports of goods and services rose 12.8% to $1.44 trillion

Imports gained 10.5% to $2.2 trillion

BBC 13/2 2007

Comment by Rolf Englund:

The problem is that the deficit is so large that the deficit increases even though

exports rise considerably faster than imports.

Because the U.S. imports about 50 percent more goods and services than it

sells abroad, exports have to grow about twice as fast just to stabilize the deficit.

Read more here

The U.S. trade deficit decreased by 1% to $58.23 billion in October

Exports rose 0.9 percent to $124.8 billion.

U.S. imports rose to $183 billion from $182.47 billion even though oil imports fell.

US will run a $875b deficit for the year 2006 Brad Setser

The US trade gap shrank 8.4 percent in October to $58.9 bn

U.S. imports fell 2.7 percent /to 182.5 bn/ aided by an 11.3 percent drop in the price of imported oil to $55.47

Lower oil imports also more than offset record imports of consumer goods

Exports increased 0.2 percent to a record $123.6 billion

CNBC 12/12 2006

Meanwhile, the politically sensitive trade deficit with China swelled to a record $24.4 billion in October, as imports from that country surged to $29.3 billion, also a record.

US trade deficit at all-time high, 59,9 bn billion

Financial Times 13/10 2006

Exports remained healthy, growing at 2.3 per cent in August against 2.4 per cent for imports,

but with imports starting from a much larger base, the net effect was a widening deficit.

The U.S. trade deficit at record high $68 billion

as imports reached an all-time high and exports declined for the first time in five months.

Bloomberg et al 12/9 2006

Imports of goods and services rose 1 percent in July to $188 billion.

Exports declined 1.1 percent to $120 billion.

Because the U.S. imports about 50 percent more goods and services than it sells abroad, exports have to grow about twice as fast just to stabilize the deficit.

The Economist 14/4 2005

The US Trade Deficit climbed by just $500m to $63.8bn in May.

This was despite a $4.4bn increase in the deficit on petroleum products

Excluding petroleum, the deficit shrank from $42.3bn to $38.4bn.

BBC 12/7 2006

2.4 per cent increase in exports to $118.7bn

Imports rose 1.8 per cent to a record $182.5bn.

The U.S. trade deficit widened in April to $63.4 billion

Imports rose 0.7 percent to $179.1 billion. Exports fell 0.2 percent to $115.7 billion

Bloomberg 9/6 2006

BBC: The trade gap was $252bn for the year to date, leaving it on course to exceed the record $716bn recorded in 2005.

The U.S. trade deficit soared to an all-time high of $725.8 billion in 2005

The deficit with China hit an all-time high as did America's deficits with Japan, Europe, OPEC, Canada, Mexico and South and Central America.

Fox News 10/2 2006

Imports rose by 12.9 percent to an all-time high of $2 trillion

Exports were up 5.7 percent to a record high of $1.27 trillion.

For December, the trade deficit edged up a slight 1.5 percent to $65.7 billion, the third highest monthly figure on record.

The U.S. trade deficit improved slightly in November but was still the third highest on record

Economists believe that when December figures are included, the final deficit for 2005 will top $710 billion.

Fox News 11/1 2006

The deficit declined by 5.7 percent in November to $64.2 billion after hitting a record of $68.1 billion in October.

But even with the improvement, the trade deficit for the first 11 months of 2005 totaled $661.8 billion, surpassing the previous annual record of $617.6 billion set in 2004.

Economists believe that when December figures are included, the final deficit for 2005 will top $710 billion.

China's trade surplus more than tripled to $102bn in 2005

BBC 11/1 2006

Record US trade deficit $856.6bn in 2006

6.5% of US GDP

BBC 14/3 2007

The U.S. current-account deficit widened to a record $225.6 billion last quarter

as the trade gap grew and the country paid more interest to overseas investors.

Bloomberg 18/12 2006

The gap amounted to 6.8 percent of the economy... The deficit reached an all-time high of 7 percent of gross domestic product in 2005's fourth quarter.

On current trends, the US will run a $875b deficit for the year.

Brad Setser 18/12 2006

Offical inflows will finance about $325b of it

And there still will be a $200b gap - "errors and ommissions" - between identified net flows and the financing the US needs.

The shortfall in investment flows rose to a record of $3.8bn, signalling that an increasing number of US assets are in foreign hands.

The U.S. trade deficit unexpectedly widened to a record $68.9 billion in October

Imports rose 2.7 percent and exports increased 1.7 percent

Bloomberg 14/12 2005

The gap in goods and services trade reported by the Commerce Department today exceeded even the highest estimate in a Bloomberg News survey of economists.

Economists expected the deficit to narrow to $62.8 billion

BBC: Earlier this week, China announced its own trade surplus was at $90.8bn for the first 11 months of 2005, three times the level of the previous year.

New figures coming out of the US economy confirms that in almost every respect it is doing significantly better than expected. It is impressive.

Carl Bildt blog 6/12 2005

U.S. trade deficit at record high - $66.1 billion

Imports rose 2.4 percent and exports slumped 2.6 percent

Bloomberg 10/11 2005

Imports rose to a record $171.3 billion

Exports slumped to $105.2 billion

Because the U.S. imports about 50 percent more goods and services than it sells abroad, exports have to grow about twice as fast just to stabilize the trade deficit, economists said.

Because the U.S. imports about 50 percent more goods and services than it exports, exports have to grow about twice as fast just to stabilize the trade deficit, economists said.

The U.S. trade deficit widened to $59 billion in August

Bloomberg 13/10 2005

Imports rose 1.8 percent to $167.2 billion.

Exports increased 1.7 percent to $108.2 billion

The U.S. trade deficit unexpectedly narrowed to $57.9 billion in July

Imports in July fell to $164.2 billion.

Exports climbed to $106.2 billion.

"It's the sunny side to slower consumer spending."

Bloomberg/WSJ 13/9 2005

The value of crude oil imported into the U.S. rose in July to a record $15.3 billion

The price of a barrel of crude oil averaged $49.03.

``As we leave the peak of the business cycle behind, demand for imported goods should start to wane,'' said Ellen Beeson, an economist at Bank of Tokyo-Mitsubishi Ltd. in New York. ``It's the sunny side to slower consumer spending.''

WSJ: The value of crude-oil imports rose to a record $15.30 billion from June's $14.58 billion as the average price per barrel climbed by $4.63 to $49.03. The volume of crude imports dropped to 312.02 million barrels from 328.32 million the previous month. The U.S. paid $20.97 billion for all types of energy-related imports in July, up from $19.93 billion in June.

U.S. Trade Gap Widens as Oil Soars

In June grew 6.1% to $58.82 billion

U.S. imports rose 2.1% to a record $165.65 billion

American exports, at $106.83 billion, showed little growth.

Wall Street Journal 15/8 2005

The price of a barrel of crude oil -- averaging domestic and imported sources on the New York Mercantile Exchange -- rose to $59.03 in July, from $56.42 in June and $49.87 in May,

The rising import bill in July could well mean another big trade-deficit number when the Commerce Department releases its own July report in a month

U.S. exports advanced 3.0%

The U.S. trade deficit widened to $57 billion in April as Americans paid record prices for oil and bought more goods from China

Imports rose 4.1%

10/6 2005

While trade deficits subtract from calculations of economic growth, economists said rising imports also are a sign of healthy demand in the U.S.

Imports rose 4.1% to $163.38 billion

U.S. exports advanced 3.0% to $106.42 billion

The U.S. current account deficit

dropped to $208.7 billion in Q1 from a downwardly revised $223.1 billion in the fourth quarter

Wall Street Journal 16/6 2006

The first-quarter shortfall amounted to 6.4% of gross domestic product, which was last reported at $13.037 trillion in current dollars for the three months ending March 31.

The US current account deficit narrowed in the third quarter of this year because of $9bn of insurance payments in the wake of Hurricane Katrina paid by foreign insurance companies

The deficit was equal to 6.2 per cent of GDP.

FT 18/12 2005

The current account recorded a $195.8bn deficit in the three months ending in September, down from a revised $197.8bn in the second quarter.

The third-quarter deficit was equal to 6.2 per cent of gross domestic product.

The trade deficit was $182.8bn in the third quarter, up from $173.6bn in the third.

The US current account deficit shrank to $195.7 billion from April through June, from a revised record $198.7

The second-quarter deficit is the second-highest ever and twice as much as it was four years ago.

Bloomberg 16/9 2005

At the current pace, the U.S. needs to attract about $2.1 billion a day in investment from abroad to fund the deficit and keep the value of the dollar steady. The deficit accounted for 6.3 percent of gross domestic product, down from a record 6.5 percent in the first quarter.

A drop in government grants of aid and other transfers abroad was more than enough to offset a wider trade gap and the first deficit in income payments since the second quarter of 2002.

The U.S. paid foreigners more income on their holdings of American assets than it received from U.S. investments abroad.

The US current account deficit at record high

$195.1bn in the first quarter of 2005

6.4 % of GDP

BBC 17/6 2005

“IF SOMETHING cannot go on forever,” said Herb Stein, “it will stop.”

The subject of this now-famous dictum by the late chairman of Richard Nixon’s Council of Economic Advisers was a balance-of-payments crisis stemming from the dollar’s exchange rate, which was then at an unsustainably high level.

Sound familiar?

The Economist 25/5 2005

... a ballooning current-account deficit in America, an overheating economy in China and a global economy dangerously dependent on American consumer demand, which in turn is dangerously dependent on heavy borrowing and ever-increasing house prices to keep consumers feeling flush.

In rising numbers, at rising volumes, economists have been telling governments that this cannot go on forever.

But when—and how sharply—will it stop?

There is a risk that America's impressive monetary management may be undone by its profligate fiscal policy: government borrowing is helping drive up a current-account deficit that the OECD expects to approach $900 billion by 2006.

Unless they stop spending and start saving, Americans — and the world — remain vulnerable to a sharp correction in the dollar.

Six out of seven of the largest OECD economies last year ran cyclically adjusted budget deficits approaching or exceeding 3% of GDP (Canada is the notable exception). Should export demand dry up, these countries have very little room to use fiscal policy to compensate by stimulating domestic demand.

The U.S. trade deficit unexpectedly shrank in March to $55 billion

the narrowest in half a year, as imports of consumer goods fell and exports grew to a record.

Bloomberg 11/5 2005

Imports of all goods and services fell in March to $157.2 billion.

Exports rose to $102.2 billion.

Financial Times editorial

Warning: global economic imbalances are getting worse.

The US trade deficit rose to a new record $61bn in February.

This was not supposed to happen.

14/4 2005

Global imbalances were expected to narrow as the economic cycle matured. Instead they are increasing. The International Monetary Fund is worried that this trend will continue, increasing the risk of a sudden adjustment at some point in the future.

The economic argument is familiar. The US current account deficit is not sustainable in the long run. If private investors lose faith that a gradual adjustment is feasible, or foreign central banks stop accumulating US assets, the dollar could fall sharply. This would probably prompt a similarly abrupt rise in US interest rates, which could kill off the US housing and consumption boom and explode over- leveraged financial institutions, with severe global consequences.

Two months ago Alan Greenspan suggested that market forces appeared "poised to stabilise and, over the long run, possibly to decrease" the US current account deficit. The IMF believes the current account deficit will indeed stabilise but at an unsustainable level: about 5.7 per cent of gross domestic product in 2005 and 2006, unless the dollar falls further.

China increased its foreign reserves by $200bn last year, as it intervened to keep its currency pegged to the depreciating US dollar.

http://news.ft.com/cms/s/b64d1dda-ac36-11d9-bb67-00000e2511c8.html

Top

Bloomberg

The U.S. trade deficit surged in February to a record $61 billion

driven by a jump in oil prices and imports of Chinese textiles that overwhelmed record exports.

12/4 2005

Imports rose 1.6 percent in February to $161.5 billion

Exports rose 0.1 percent to $100.5 billion

The U.S. trade deficit - Is it good or bad?

The answer to this will be derived by refuting the two most common views of the implications of the trade deficit, the mercantilist and the supply-side view, who are strongly at odds with each other but still both manages to get it wrong

Stefan M.I. Karlsson Mises 21/3 2005

The mercantilist view of the trade deficit is the one held by protectionists of various stripes, including paleoconservatives like Pat Buchanan and Paul Craig Roberts, CNN News anchor Lou Dobbs and the left-wing Economic Policy Institute.

Having seen the fallacy of the mercantilist "trade deficits kills jobs"-theory, does this mean that we should adhere to the supply-side view, taken by among others the aforementioned Dan Griswold, that trade deficits are a non-issue and never a problem? No, it doesn't mean that.

While the supply-side view is closer to the truth, it still neglects that the processes driving trade imbalances are sometimes unsound.

Current account deficits are simply a matter of people in one country on the aggregate borrowing more from foreigners than lending to them. And just as it is sometimes good, sometimes bad for individuals to borrow, so is it sometimes good, sometimes bad for countries to have current account deficits.

If a country has a large current account deficits which reflects a large capital inflow to finance sound investments, then current account deficits are a very good thing, as we have seen in the case of rapidly growing Estonia. But if the capital inflow is used to finance excessive consumption and/or malinvestments then it is a unhealthy thing.

While the U.S. current account deficit does to some extent reflect the more flexible economic structure and accordingly bigger investment opportunities compared to Europe and Japan, it is also to a large extent driven by unhealthy factors created by the U.S. government. This includes of course the budget deficit which has driven down the national savings rate to dangerously low levels and it also includes the low interest rates policies of the Federal Reserve which has been fueling a housing bubble. The excess demand created by these policies have clearly been a factor in pushing up the trade deficit.

Alan Greenspan and asset price bubbles

The U.S. current account deficit 2004 widened to a record $665.9 billion, equivalent to 5.7 percent of GDP

Bloomberg 16/3 2005

The U.S. current account deficit widened to a record $187.9 billion from October through December, as Americans bought more imports, a government report showed.

The deficit, the broadest measure of trade because it includes financial transfers, followed a $165.9 billion gap the previous three months, the Commerce Department said today in Washington. For all 2004, the deficit reached a record $665.9 billion, equivalent to 5.7 percent of nation's gross domestic product, the most ever.

``The adjustment will not be comfortable'' though it is likely to be ``orderly,'' said Jan Hatzius, a senior economist at Goldman, Sachs & Co. in New York, in a March 11 report to clients.

The dollar will need to drop an additional 15 percent against a broad, trade-weighted index of the country's trading partners in order to help the trade gap narrow, Hatzius said.

Vi /Sverige/ har skaffat oss ett exportöverskott som i bytesbalanssaldo är 6 procent av (BNP).

Läs mer hos Danne Nordling

Kudlow On The Trade Deficit

Mr. Kudlow's rhetoric typifies an ongoing Wall Street, government, and media propaganda effort

that would even amaze George Orwell.

Peter Schiff 11/3 2005

Today, with the release of January's $58.3 billion dollar trade deficit (the second worst monthly result on record), the enormity of the imbalance was once again overshadowed by the rhetoric immediately following its release.

As he has in the past CNBC's Larry Kudlow extolled the virtues of the trade deficit as reflecting America's superior economic growth, while chastising Europe and Japan for not doing their fair share in moving the world's economy forward. In essence, Mr. Kudlow criticized Europeans and Japanese as being economic slackers (because all they do is save money and manufacture products), while praising Americans, who borrow those savings and consume those products, for doing all the hard work.

Give me a break. When asked if he though the fact that Americans were "living beyond their means was a problem" Kudlow's reply was to deny that they were. Apparently, he believes that one's means are merely a function of how much one can borrow. It reminds me of the old joke about the housewife who was amazed to discover that her checking account was overdrawn as there were still unused checks remaining in her book. Further, when asked if he believed that the debt Americans were accumulating was problematic, he assured the television audience that it was not, because "Americans were putting the money to good use." I'm not exactly sure to what good use he is referring, as American's borrow mainly to consume. Imagine trying to convince a banker to loan you money on the grounds that you would put it to good use by buying a big screen T.V. and taking a vacation.