|

Aktuellt nu:

Conundrum -

Cataclysm -

Houseprices |

|

|

To listen to the Bears over the past few years, you would have thought we would all be in breadlines and soup kitchens by now. |

Greenspan's reputation may not be totally secure |

|

The flattening of the yield curve has been much talked about lately |

The tax-break-enhanced buildup in U.S. real estate wealth since 2000 has been about $5 trillion. |

|

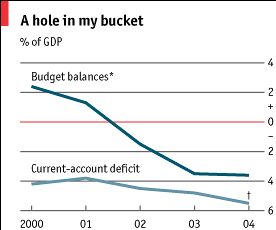

The imbalances are now enormous, far more glaring than at any point in the past. |

Managing an economy with demand at 107% of income/GDP

involves continually stoking up confidence to ensure capital gains to justify

rising household debt take-up – without which the economy founders into a

deflationary spiral. |

|

"Den 27 augusti 1975 slog nyheten ned som en

bomb i den svenska debatten" |

The Mess Greenspan Leaves |

|

The idea of supply-side economics was born when a guy called Arthur Laffer sketched a curve on a cocktail napkin in 1974, and the debate over its merits has been raging ever since. |

The Republican Party is fracturing before our eyes. |

|

Rudolf Meidner har avlidit. Han blev 91 år gammal. |

Rudolf präglades av en kombination av klarsinne, intellektuell briljans och unik förmåga att hitta konkreta lösningar på motsägelsefulla problem. |

|

Få personer har i modern tid haft så stor betydelse för samhället och för arbetarrörelsen som Meidner. |

The late Herbert Stein is famous for saying that what can’t go on forever, won’t. |

|

En skärskådning av det svenska partisystemet blottar nya skiljelinjer och underliggande, latenta partier. Ett sådant skulle kunna vara pragmatikerna (p), som förenar delar av s och m. |

H |

|

Studio Etts fredagskrönikör Björn Elmbrant har läst en bok som behandlar |

The US current account deficit narrowed in the third quarter of this year because of $9bn of insurance payments in the wake of Hurricane Katrina paid by foreign insurance companies |

|

Richard Rainwater. Richard who? |

Let’s begin with a riddle: Why is the dollar like a Republican president? |

|

Monetary analysis is essential, not old-fashioned |

Lennart Berntson om Werner Schmidt - C-H Hermansson. En politisk biografi |

|

The U.S. trade deficit unexpectedly widened to a record $68.9 billion in October |

BBC: Earlier this week, China announced its own trade surplus was at $90.8bn for the first 11 months of 2005, three times the level of the previous year. |

|

Standard & Poor's Corp. cut its credit rating on General Motors (GM, news, msgs) to B from BB- today. S&P is pessimistic that GM's recovery plan will work, the agency said, and the auto giant may have to seek more drastic measures, namely Chapter 11. |

Sverige ska starta egen produktion av vaccin. |

|

Skillnaderna mellan olika invandrargrupper är mycket stora när det gäller brottslighet. |

Greg Ip, Fed stenographer (née Wall Street Journal reporter), penned a story titled |

|

The number of zeros on formal statistics sometimes disguises their real meaning. |

New figures coming out of the US economy confirms that in almost every respect it is doing significantly better than expected. It is impressive. |

|

The biggest secret during the past few years in the bond market has been why intermediate and long-term interest rates have remained so low in the face of a 300 basis point uplift from the Federal Reserve. |

Vad kan vi lära av kraschen? |

|

The Greenspan Warnings |

Derivatives Dangers |

|

Oljan behöver inte ta slut för att det ska bli kaos. Det räcker med att den blir en bristvara för att vår civilisation, uppbyggd av plast och billiga transporter, hotar att kollapsa. |

Under the placid surface, there are disturbing trends: huge imbalances, disequilibria, risks - call them what you will. Altogether the circumstances seem to me as dangerous and intractable as any I can remember, and I can remember quite a lot. |

|

F. A. Hayek: "The continuous injection of additional amounts of money at points of the economic system where it creates a temporary demand, which must cease when the increase of money stops or slows down, together with the expectation of a continuing rise in prices, draws labor and other resources into employments which can last only so long as the increase of the quantity of money continues at the same rate - or perhaps even only so long as it continues to accelerate at a given rate . . . would rapidly lead to a disorganization of all economic activity." |

Jean-Philippe Cotis, Chief Economist: |

|

House prices in the US have risen by more than 50 per cent in the past decade but in spite of fears of a crash, the property market is not overvalued, according to a new analysis of the world housing boom by the Organisation for Economic Co-operation and Development. |

If the pernicious drift toward fiscal instability in the United States and elsewhere is not arrested |

|

Why does the European Central Bank want to raise interest rates? |

M3 is today definitely not reflective of marketplace perceptions with respect to “moneyness.” |

|

Moderaterna är övertaktiska och

undviker konfrontation i alla frågor. Jag är inte ens säker på att det valtaktiskt

är rätt. De sviker dem som vill ha en annan politik. |

The European Central Bank is about to raise its interest rate for the first time in two and a half years. Does this move make any sense? |

|

Discontinuance of M3 |

Sture Eskilsson, tidigare informationsdirektör i SAF, är den person som har betytt mest för den marknadsliberala opinionsbildningen i Sverige under de senaste decennierna. |

|

This Time it Really is Different |

Instead of trying to come up with something clever on a subject in which we are already in way over our heads, this post simply provides |

|

Einstein and the US Dollar: Is the US Currency Rewriting the Laws of Gravity? |

|

|

Deteriorating Global Liquidity |

Olja - jakten på det svarta guldet när världens oljekällor sinar |

|

"Världsekonomin på väg mot avgrunden" |

The Coming Disaster in the Derivatives Market |

|

SAF:s legendariske informationschef berättar om sina insatser för fri företagsamhet under den långa karriären i näringslivets organisationer från sent 1950- till sent 1990-tal. |

Om boken "Bortom den starka statens politik?" av Rothstein, Bo och Vahlne Westerhäll, Lotta (red), SNS förlag |

|

Om Sture Eskilssons "Från folkhem till nytt klassamhälle" |

Less like a titan and more like the Titanic, holed below the water-line, sinking slowly by the bow to the sound of loud shocks and bangs as bulkheads give way, one after the other. |

|

Can GM be saved? |

Rick Wagoner, chairman and chief executive of General Motors: |

|

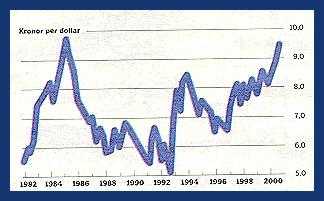

Kronan har försvagats lite mer än vad vi räknat med. Varför det är så är lite av ett mysterium säger Ingemar Hansson. |

The extraordinary importance of American interest-rate policy. |

|

Bara tre gånger under de senaste tio åren har kronan varit svagare mot euron (och dess föregångare ecun) än vad den är i dag. |

Sweden's current account surplus is equivalent to 3 per cent of GDP. |

|

A method to the dollar madness |

If President Chirac and his ministers had any sense they would stop philosophising about the ideals of the French Revolution and would focus instead on the practical policies required to accelerate the economy’s growth rate |

|

"To date, despite a current account deficit exceeding 6% of our gross domestic product, we -- or more exactly, the economic entities that comprise the U.S. economy -- are experiencing few difficulties in attracting the foreign saving required to finance it, as evidenced by the recent upward pressure on the dollar," |

It’s often forgotten that when Bush come to power in early 2001 the US economy was in recession. Since then there has been three waves of tax cuts – the last in 2003 – and a remarkable improvement in the performance of the US economy. |

|

En avvikande uppfattning hade dock Olle Lindgren, ekonom med

anknytning till SE-banken. Den svenska kronan hade inte marknadens förtroende

och skulle komma att falla. Hans inlägg mottogs med avvisande tystnad. |

Politicians and pundits explain /US/ current-account deficit by pointing at China. |

|

U.S. trade deficit at record high - $66.1 billion |

Att bo i eget hus ger ingen inkomst |

|

TV8 Sture Eskilsson utfrågas i ”O som i Ortmark” |

The official U.S. government Web site for information on pandemic flu and avian influenza. |

|

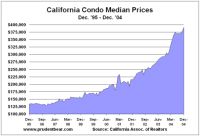

The air is coming out of America’s property-price bubble. |

Vad blev det kvar av stabilitetspakten? |

|

Den svenska kronan har försvagats kraftigt den senaste tiden, och både mot euron och dollarn är kronan svagare än på flera år. |

The latest annual World Energy Outlook report from the International Energy Agency (IEA) |

|

Lennart Nilsson pictures of The Virus H5N1 |

Germany’s incoming “grand coalition” of Christian Democrats and Social Democrats is about to commit the biggest economic policy error since unification – the attempt to pursue budget consolidation at the expense of all other economic policy goals. In doing so, it risks turning a five-year-long stagnation into a full-scale depression. |

|

Higher interest rates have produced a rally in the U.S. dollar |

|

|

The solution to the conundrum of why rising short rates have not led to higher yields at the long end is this paradox: in order to raise rates, the Fed must stop raising rates. |

CNN takes in-depth look at bird flu |

|

It never fails. Every presentation or speech I have made on the economics of global rebalancing over the past three and a half years almost always ends with the same question: |

President Bush announced Tuesday that he would ask Congress for $7.1 billion in emergency funding to prepare the country for a possible flu pandemic. |

|

Lars Ekdahl, Arkiv Förlag |

“it’s different this time” |

|

Lewis "Scooter" Libby |

Gordon Liddy |

|

It seems clear the Fed is not going to find it easy to maintain relative price stability. |

Let's look at what Bernanke really said. |

|

Alan Greenspan will be remembered as Copernicus, Columbus and Galileo, rolled into one. |

Comment by Rolf Englund: |

|

Dear Ben, Congratulations on your nomination as chairman of the Federal Reserve |

Alan Greenspan is everything an all-powerful central banker should be: boring, elderly, brainy, long-winded, and most importantly LUCKY. |

|

The New Inflation |

Comment by Rolf Englund: |

|

Mr. Bernanke |

Enter Ben Bernanke and His Helicopter Printing Press |

|

WHY THE FED HAS NO OTHER ALTERNATIVE BUT TO PRINT MONEY! |

Fed would like to see a little inflation come back, as well as significantly higher interest rates, before they have to deal with the next recession or slowdown. |

|

Riksdagens finansutskott har beslutat att utvärdera Riksbankens penningpolitik. Utvärderingen ska omfatta perioden 1995-2005. |

Our trade deficit is now roughly the size of the current account deficit, and very large relative to our export base. And our net investment income balances are now likely to move into deficit. |

|

On Thursday October 20th, Indonesia's health minister, Siti Fadillah Supari, expressed concern over clusters of possible bird flu within human families that had been detected in the country in recent days. |

UN says avian flu may hit Africa next |

|

Quarantines work well at controlling the spread of some types of disease. But there isn't any quarantine that would help stop pandemic flu. |

It is little wonder that Mr Greenspan has become an almost legendary figure. Yet how good has his performance been and what lessons does his tenure bequeath? |

|

I think the next Fed chairman is going to be Ben Bernanke. Of course, Bernanke is exactly the opposite of what you'd want to have in a Fed chairman |

Austrian economics |

|

Anders Tegnell, enhetschef på Socialstyrelsens smittskyddsenhet: Svenskarna prioriteras efter en plan |

Sir Liam Donaldson, the chief medical officer: |

|

Många fruktansvärt hemska saker kan drabba Sverige. Terrorister kan slå till med kärnvapen. En pandemi kan dra in över landet. En komet kan slå ner. |

You didn't need an oracle to know that Delphi would end up in America's bankruptcy courts |

|

Europe is not properly prepared for a flu pandemic and has inadequate supplies of vaccines and antiviral drugs, says an internal European Commission document obtained by the Financial Times. |

The government changed the way it calculates the housing portion of the CPI back in 1982 |

|

America's top health official says the world is "woefully unprepared" to respond to a pandemic, a problem made more urgent by concerns that the current avian flu virus could spread into a global health crisis.

|

A plan developed by the Bush administration to deal with any possible outbreak of pandemic flu shows that the United States is woefully unprepared for what could become the worst disaster in the nation's history. |

|

From Washington and Brussels to Hong Kong and Bangkok, governments have belatedly woken up to the global threat presented by the H5N1 strain of avian influenza now endemic in poultry across much of Asia. |

We believe the best choice would be Don Kohn |

|

Something is changing in policy doctrine. |

Five major risks threaten the world economy. |

|

Den nuvarande vice riksbankschefen Villy Bergström reste 1971 till Pyongyang på den nordkoreanska regimens bekostnad. |

Because the U.S. imports about 50 percent more goods and services than it exports, exports have to grow about twice as fast just to stabilize the trade deficit, economists said. |

|

Enligt vår uppfattning stod det finansiella systemet i Sverige inför en kollaps den 24 september 1992. Utländska långivare hade tappat förtroendet för det svenska banksystemet. |

Kronkursförsvaret och Bank- och finanskrisen i korthet |

|

Let me summarize my sequence for house bubble popping |

|

|

After 10 years of economic reforms, the Germans decided they had had enough. |

Före 1970 hade Sverige låga skatter, 65 procents ersättning i a-kassa och sjukförsäkring samt flera karensdagar vid sjukdom - och reallönerna ökade i raketfart. Under 1970- och 1980-talet rusade skatter och ersättningar i väg - och reallönerna låg still. |

|

It cannot go on forever. The question is how and when it will stop |

Alan Greenspan, the world's biggest serial bubble blower and most incompetent, irresponsible Fed chairman of all time |

|

Spanska sjukan var fågelinfluensa |

Fond memories of the successful 1980s adjustment of global trade imbalances have shaped much of the thinking about escape routes this time round. In 1985 the US “twin” current account and fiscal deficits consumed global economic discussions. Just as now, the worry was that a disorderly adjustment would derail the global economy. Yet by 1990 the US current account had been reduced from its peak of 3.4 per of gross domestic product to a manageable 1.4 per cent. |

|

U.S. companies have announced plans to repatriate about $206 billion in foreign profits under a special one-year tax break. |

When he steps down early next year, Alan Greenspan will leave behind a durable, non-inflationary economic expansion. |

|

"En krasch är på väg" |

H |

|

Will the Housing Bubble Fizzle or Pop? |

What is most alarming about the current external trend is that the fall in the exchange rate of the dollar during 2002-04 had no appreciable impact at all in terms of reducing the trade balance. |

|

A real estate slowdown that began in a handful of cities this summer has spread to almost every hot housing market in the country, including New York. |

President Bush on the possibility of an avian flu pandemic |

|

How do we get out of this scenario alive?

|

We set out today wanting to talk about last Friday's commentary by Stephen Roach regarding two speeches made by Alan Greenspan earlier in the week. Normally we would pick out a few passages and excerpt them here, then add a few thoughts of our own in an attempt to enhance the overall experience of deriding the Fed Chairman for his many sins. |

|

The IMF ignored the problems created by Argentina's dollar peg and the resulting strong peso policy - which linked a sinking Argentine economy to a rising US economy and a rising dollar back in the late 90s.

|

George Bush reading The Economist magazine! |

|

Verkligheten tvingar alla partier att anpassa sig. |

U.N. backs off 150m flu deaths |

|

The entire US economy is on life support from the People’s Bank of China and the Bank of Japan. |

Drömmer jag? Det är våren 2005 och jag läser en intervju med Anders Borg, hjärnan bakom moderatledaren Fredrik Reinfeldts politik. Stycket som jag läser om och om igen handlar om 90-talet och det han säger gör mig stum. Så här står det:

|

|

I ett år nu har moderatkansliet försörjt politiska reportrar och kommentatorer med en ström av promemorior. De har utgått från förhållandet att ungefär en miljon svenskar i arbetsför ålder inte försörjer sig på arbetsmarknaden. |

Finland remaining the most competitive country World Economic Forum (WEF) said. It was followed by the US, Sweden, Denmark and Taiwan. |

|

As the latest World Economic Outlook from the International Monetary Fund notes, analysts have advanced two contrasting views of what is driving the global pattern of surpluses and deficit. |

Äntligen! |

|

In Lisbon on Saturday, I shared a panel with French philospher and author Bernhard-Henri Levy discussing the present state of Europe and our position in the wider world. Tomorrow I'm heading to Paris to share a panel with former European Commission President Jaques Delors to discuss how Europe can overcome its present crisis. |

Classical economic theory suggests that interest rates automatically bring saving and investment into a productive balance. |

|

I am a bit more cautious than most about projecting a massive boom if Germany implements efficiency enhancing reforms. |

There are those dollar bears who just keep wondering when will the dollar crash? The answer, of course, is when people stop buying it. |

|

Eventually, global balance must be restored through slower spending-growth in America compared with that in the rest of the world. |

Jag ställde frågan hur Lars Calmfors kunde tänka sig att den strukturella arbetslösheten skulle minska genom att öka utbudet av arbetskraft. |

|

Villy Bergström har i sin bok "Kapitalbildning och industriell demokrati" utvecklat tankarna om löntagarägda företag och branschfonder |

"Jag vågade inte säga vad jag trodde" |

|

Det är förfärligt det som har hänt i många europeiska länder under de senaste åren. Folken sviker sina ledare. Etablissemanget kan inte längre räkna på blind lydnad från den råa hopen. |

VOTERS OF GERMANY, I salute you! On Sunday you delivered a fair, constructive and intelligent verdict on your political class. |

|

Angela Merkel |

The new German government’s deflationary macroeconomic policies will sabotage potentially favourable results of supply-side reforms. |

|

A girl with symptoms of bird flu died in a Jakarta hospital on Wednesday as the Indonesian government announced it would carry out mass culling of poultry in high-risk areas |

The most lethal human epidemics - including the three great flu pandemics of the 20th century - have all involved germs crossing the species barrier from birds and animals to people. Many microbiologists say a combination of four factors makes influenza potentially the most dangerous of all known viruses: |

|

In his testimony to Congress on July 20, 2005, Mr. Greenspan declared it quite likely that the world is currently experiencing a global savings glut. Agreeing with Ben Bernanke, he mentioned this glut as one of the factors behind the so-called interest conundrum, i.e., declining long-term rates despite rising short-term rates. |

The oil industry is bracing for a disaster as Hurricane Rita hit Category 4, with the potential to reach Category 5, and heads towards energy infrastructure in Texas. |

|

My conversations quickly exposed a deep fault among the conference attendees. Those who analyzed or forecast the U.S. domestic macroeconomy agreed that a steep decline in the value of the dollar sometime in the next five years was overwhelmingly likely, but by and large they did not think that such a decline would pose a big problem for the U.S. economy. |

I suspect the stock of outstanding synthetic credit derivatives - $ 1500 b in synthetic CDOs in 2004 v. $300 b or so in 2001, is the only thing than has increased more rapidly than China's reserves over the past few years. |

|

The Nobel Prize in economics in 2002 went to a psychologist, Dr. Daniel Kahneman, who helped pioneer the field of behavioral finance. He basically shows that investors are irrational.

|

Den svenska massarbetslösheten fordrar ett omfattande reformprogram som bygger om socialförsäkringarna, sänker skatterna på arbetsinkomster, uppmuntrar företagande och ökar flexibiliteten på arbetsmarknaden. |

|

The Texas energy specialist, Matthew Simmons, has suggested that the world derives false comfort from Saudi Arabian assurances of willingness to increase production to meet consumer shortfalls (Twilight in the Desert, Wiley). |

The US current account deficit shrank to $195.7 billion from April through June, from a revised record $198.7 |

|

If investors in index-linked bond market were genuinely that fearful about the future, current equity prices would be hard to justify. |

Twenty years after the Plaza Agreement agreed co-ordinated intervention among the leading economies to reduce the value of the US dollar |

|

The U.S. trade deficit unexpectedly narrowed to $57.9 billion in July |

From Goldilocks to stagflation.

|

|

The runaway budget deficits are compounded by the persistent and growing imbalance in our trade accounts -- jeopardizing the inflow of foreign funds we have used to finance our debt. |

En arbetstidsförkortning med 25 procent leder till att 33 procent fler eller 400 000 personer måste anställas i den offentliga sektorn. |

|

Dollar crashes, interest rates fall? |

Comment at Setser site by Rolf Englund: |

|

China daily is reporting that China's exchange rate will fluctuate more widely |

Lars Heikensten, 55 |

|

För tio år sedan trädde en reform inom psykiatrin i kraft. Psykiskt sjuka människor skulle få större möjligheter att vara delaktiga i samhällslivet. Kommunernas ansvar för att utveckla boendeformer och sysselsättning för människor i målgruppen klargjordes |

If the dollar dives, what will happen to America's interest rates? |

|

Almost all those saying the housing market is healthy told us the stock market was not in a bubble in 1999. |

En stigande export till USA är vad som håller i gång både Asien och Europa. I längden är detta ohållbart, |

|

Remember the run-up to the popping of the technology stock bubble in March 2000. |

Psykiatrireformen |

|

A drop in the U.S. savings rate by 1.7 percentage points, while seemingly small, actually represents a substantial contribution to consumption growth of about $175 billion or 2 percentage points. |

Even the unflappable Bank for International Settlements (BIS) seems uneasy. In its quarterly report released on Monday September 5th, it gives warning that |

|

Vad förklarar att USA de senaste 15 åren haft dubbelt så hög årlig produktivitetsökning per timme som EU, samtidigt som USA skapat 18 miljoner nya arbetstillfällen mot EU:s 2,2 miljoner? |

In the macro world, strikes, wars, and natural disasters have long been thought of as classic exogenous shocks -- those out-of-the-blue disruptions that jolt economies and markets. |

|

"Livbolagen går mot ljusare tider" |

700 bn dollar |

|

Schröder did a statesman-like explanation of the geostrategic importance of integrating Turkey with the rest of the European Union, which made Merkels resistance on this issue look rather pedestrian. |

- I den politiska debatten gör båda sidor sitt bästa för att blanda bort korten. |

|

Det är bara när det gäller arbetslösheten som politikerna inte kommer med "skarpa" förslag. |

Mikael Gennser: |

|

The breakdown of order in New Orleans, the looting and the mobs, the state of emergency and shoot-to-kill policy, do not look like something that should happen in the world's only superpower.

|

With hindsight, it seems obvious that building a city for 500,000 people in a bowl-shaped depression below sea level on a coast of the US known for hurricanes was tempting fate. |

|

Between 1990 and 2000 the US’s Hispanic population grew by 61 per cent: this year, America’s 41m Latinos overtook blacks to become the nation’s largest minority |

70 dollar per fat är |

|

U.S. home prices leapt 13.4% in the second quarter from a year earlier, the largest gain in 25 years |

The Katrina Crisis |

|

It is too early to conclude that Mr Greenspan handled the stockmarket bubble successfully. |

Historical experience argues that monetary policy should be the first line of defence against both slump and inflationary boom. |

|

We recently marked the fifth anniversary of the peak of the great millennial stock market Bubble. |

In some areas hardest hit by the disruption, $3-per-gallon gas has already become a fond memory in less than a week |

|

The most important development this year is the establishment of bird flu infection among wild birds - waterfowl in particular. This increases the risk that avian migrations will carry the virus around the world. |

Chairman Alan Greenspan's Fed has already contributed to higher oil and commodity prices by keeping monetary policy too loose for too long in 2003 and 2004. |

|

Many say the final assessment of Greenspan's tenure as Fed chairman will not be written until it is clear how the possible housing market bubble is resolved. |

Why are oil prices so high? |

|

Konjunkturinstitutets chef Ingemar Hansson: |

One way or another, the economy will eventually eliminate both imbalances. |

|

Konjunkturfall kan vara av tre slag, som ibland inträffar samtidigt och förstärker varandra: normal lågkonjunktur, externa chocker som krig eller terrorangrepp och politiska misstag som det svenska kronförsvaret i början av 1990-talet. |

- De befriade sig från en bunker men fick en borg |

|

The supply of homes on the market now stands at 2.75 million - the highest since May 1988. |

Arbetslinjen, kallas det. Resonemanget känns igen från snart sagt alla moderata utspel på senare tid.

Många ska arbeta mycket och länge, lyder det moderata beskedet. Det är förstås ett angeläget budskap i ett land där allt fler arbetar allt mindre. |

|

Den stora fastighetsbubblan för femton år sedan drog med sig hela den

svenska ekonomin.

|

Det har blivit populärt att tala om finanspolitiska stimulanser, d v s ökade

offentliga utgifter eller skattesänkningar för att stimulera ekonomin. |

|

Med fonderna tar vi över. Det var LO-tidningens huvudnyhet från LO-kongressen 1976 |

H |

|

By Andrew Balls In Jackson Hole, Wyoming

|

By Andrew Balls In Jackson Hole, Wyoming

|

|

H5N1 avian influenza – first steps towards development of a human vaccine |

I just googled "house price bubbles" |

|

At issue is whether financial innovations that have made it easier for Americans to buy homes have also made the system less stable and more subject to shocks that could drive many from their homes. |

Investors are not even aware of their incapacity to take action to prepare for a sharply declining market. |

|

Since Alan Greenspan took office as Fed chairman, it has taken an average of $3.60 of debt growth to generate $1 of nominal gross domestic product growth |

Moderatledaren har vänt ett parti som suttit fast i gamla dogmer till att tänka om och tänka nytt från grunden. Det har lett till både en mer realistisk politik och ett ökat väljarstöd |

|

Fågelinfluensan närmar sig Europa. |

Roche Gives WHO 3M Doses of Bird Flu Drug |

|

What is Voice-over-IP? |

Ekonomin är för stel för att skapa ordentligt med nya jobb när det går uppåt, och i stället för att mjuka upp strukturerna vill regeringen mjuka upp statsfinanserna. |

|

Nu sällar sig professor Lars Jonung, expert i Bryssel och tidigare rådgivare åt statsminister Bildt, till kritikerna av Lindbeck och Feldt. |

Nu i augusti är det exakt 30 år sedan Rudolf Meidner kom med sitt förslag om att införa löntagarfonder i Sverige. |

|

US existing home sales dropped 2.6% to an annual rate of 7.16 million. |

The writer is professor of economics at Harvard University. He is a former chief economist at the International Monetary Fund |

|

U.S. Trade Gap Widens as Oil Soars |

The start of the post-oil age does not begin when the last drop of oil is sucked from under the Arabian desert. It begins when producers are unable to continue increasing their output to meet rising demand. |

|

Renate Kunast, consumer protection minister, said: "We are preparing for a worst-case scenario." |

In December 1996, when Alan Greenspan made his famous comment on the possibility of “irrational exuberance” in stock prices, the Dow Jones industrial average stood at 6,400 |

|

Handläggningstiden är för närvarande drygt 7 veckor |

It's nice to see that Stephen Roach is back from his summer vacation. In the first paragraph of his first missive since returning to his duties at Morgan Stanley, he reminds us once again, why he is our favorite economis |

|

Since December 2000 employment in U.S. manufacturing has fallen 17 percent, but /antalet fastighetsmäklare/ membership in the National Association of Realtors has risen 58 percent. |

The contrast between the macroeconomic management of the US and that of the eurozone during the past five years could not be greater |

|

The news that the U.S. housing bubble is over won't come in the form of plunging prices |

The price of crude oil is not only reaching new heights in nominal terms but approaching the record real levels seen in 1979. |

|

Fears that lower interest rates could re-inflate Britain’s housing bubble. |

En rad länder i västra Europa plågas av en ihållande ekonomisk kris. Arbetslösheten stiger och tillväxten sjunker. I Tyskland, Italien och Frankrike - liksom Sverige - tilltar svårigheterna trots god konjunktur och låg ränta. |

|

The IS-LM framework, invented by Sir John Hicks in 1937 as an interpretation of Keynes's “General Theory” |

Central bankers - commentators urge them to put their foot on the accelerator, to tap the brakes, or to aim for a soft landing. |

|

A global pandemic of bird flu claiming millions of lives could be stopped if governments work together, say experts. |

Perhaps I have influenced the Financial Times? |

|

The new chairman will need to make tough judgments on the housing sector. |

the central bank has raised its Federal funds rate 25 basis points after each meeting |

|

Svenskt Näringslivs utspel om nödvändiga förändringar av reglerna för konflikter på arbetsmarknaden sätter återigen samförståndspolitiken på prov. Reportage om hur vattendelaren än en gång går mellan arbetarrörelse och arbetsgivare. |

The Fed’s recent monetary approach, combined with the US Treasury’s practice of confining much of its new borrowing to short- and intermediate-term notes, explains a great deal of what the Fed has dubbed a “conundrum” |

|

Flu viruses can swap many genes rapidly to make new resistant strains, US researchers have found. |

HANOI, Vietnam (AP) -- Bird flu has killed two more people in Vietnam |

|

Sedan en tid har det hävdats att Sveriges sysselsättningsproblem både beror på och skulle kunna lösas med finans- och penningpolitiska stimulanser. |

Under the names of "relativism" and "postmodernism", today's prevailing style of thought has it that we can believe what we like and that all beliefs are equally valid, because there is no such thing as truth or objectivity. |

|

Tiny Singapore may have felt a sense of pride as China and Malaysia have adopted a version of its managed floating exchange rate system after abandoning their fixed currency pegs against the US dollar. |

Between 1995 and 1998, a number of investors participated in the great "Yen carry trade". For three years, it was fantastic |

|

Will China's float sink the housing bubble? |

America’s trade deficit of $700bn is nine times China’s trade surplus. |

|

About statement by Lawrence Lindsey, a former Fed governor and Bush adviser |

Watershed in global markets |

|

Pengarna från besparingarna använder moderaterna till förvärvsavdrag som är relativt sett mest betydelsefulla för låg- och medelinkomsttagare. Det är en operation som ytterligare ökar skillnaden mellan att arbeta och lyfta bidrag. |

Moderaterna vill se en utbudsexplosion på arbetsmarknaden genom stramare bidrag och lägre skatt på jobbinkomster. |

|

WASHINGTON (Reuters) - Whether it's a national bubble or just pockets of regional froth, an end to surge in home prices could inflict economic harm that would make the 2000 tech bust look tame in comparison. |

LOs kampanj "Jag/vi räddade Sverige" |

|

Since credit cards were first issued and automobiles were first financed, bankers and car salesman have been more than happy to assist individuals in realizing their full borrowing potential. Realizing their full potential, that is, by borrowing more money than they really should. |

The debate has an eerie sense of déjà vu. Today, there are those who dispute the very existence of a US property bubble. Similarly, five years ago, there were many who argued that US equities were not over-valued |

|

Ett enda ämne dominerar amerikanernas samtal i dag, och det är inte Irak. Det är bostadsmarknaden. |

First, let me confess my ignorance, I know very little about housing. However, I do know something about bubbles and something about psychology. |

|

Statsminister Göran Persson har upprepat otaliga gånger att den borgerliga regeringen 1991–94 skapade en ekonomisk kris som han har fått reda upp |

In 1896, Svante Arrhenius, the Nobel Prize-winning chemist, predicted that burning fossil fuels would increase the concentration of carbon dioxide in the atmosphere and cause global warming. The recent statement from national science academies around the world confirms Arrhenius’s broad conclusion. It also shows that emissions of CO2 are disturbing the delicate balance of factors (such as sea temperature, salinity, currents, ice sheets and solar radiation) that maintained an exceptionally stable, gently warming climate over 8,000 years while human beings achieved the astonishing transformation that we call modern civilisation.

|

|

Greenspan's most vehement critics are convinced he has made a fundamental error as a monetary economist. |

"Is it a bird, is it a plane?" |

|

Sammanlagt var 375 846 personer öppet arbetslösa eller i åtgärder. |

The asset price bubbles are no accident. |

|

THE WORLD HITLER NEVER MADE: |

The U.S. current account deficit is on track to reach seven percent of GDP in 2005. That figure is unprecedented for a major economy. |

|

Investors recently had expressed optimism - some disbelief - that the market had stood face to face with record crude-oil prices and barely blinked. |

|

|

OpenOffice.org Writer vs. Microsoft Word |

Twilight in the Desert: |

|

Borgarna var långt ifrån ensamma om ansvaret för krisen,

men det var ändå Bildt & Wibble som tvingades administrera den och låna upp dessa hundratals miljarder för att täcka underskotten. |

The increasing attention paid to growing U.S. current account deficits has bred nightmare scenarios of a sharp decline in the foreign-exchange value of the dollar and rising U.S. interest rates. |

|

The 'Conundrum' Explained |

The IEA argues that remaining oil reserves could cover only 70 years at the average annual consumption between 2003 and 2030.

|

|

Lars Heikensten: |

Lars Heikensten: |

|

The US current account deficit at record high |

How the current housing boom ends could decide the course of the entire world economy over the next few years. |

|

Strange things are happening in the world economy: falling interest rates on long-term securities, declining spreads between returns on safe and riskier assets, large fiscal deficits and huge global current account “imbalances” should not, in normal circumstances, coincide. So what is going on? |

Coming in at $3 billion less than some had feared, today's release of April's $57 billion trade deficit is being heralded as good news. The fact that the fourth worst monthly deficit ever is considered good news is startling evidence of just how far the bar has been lowered when it comes to America's deteriorating trade imbalance. |

|

U.S. exports advanced 3.0% |

Cutting rates so low for so long Mr. Greenspan turned a slump into a residential property bubble. If he were to "normalize" rates, the bubble would pop. |

|

Cataclysm |

Mr. Greenspan told Congress's Joint Economic Committee. |

|

In Treating U.S. After Bubble, Fed Helped Create New Threats |

A few years ago only a handful of geologists and academics were considering such a possibility. |

|

Jim Grant reported some fascinating numbers in his latest issue of Grant's Interest Rate Observer. |

The interest rate conundrum is challenging enough. But now the dollar is springing back to life in the face of America’s record current account deficit. |

|

Stephen Roach turns 180 degrees |

Steven B. Schnall, the president of the New York Mortgage Company: |

|

I am going to write here about a coming depression in general terms. I have some suggestions for how to prepare. |

Anders Björnsson och Nord-Korea |

|

The US Trade Deficit is Unsustainable, Bud Conrad |

The low interest rates that rescued us from the last recession might be the cause of the next |

|

Economists are reading the wrong fairy tale. |

It's Not a Bubble Until It Bursts |

|

House of Cards? |

The home price boom in the U.S. has had a peculiar form since it began in the late 1990s: |

|

Remember the stock market bubble? |

Grumpy Old Men |

|

“If something cannot go on forever,” |

Let us think the unthinkable: |

|

"The Strange Tale of the Bare-Bottomed King." |

Although France's three biggest political parties, the mainstream media, the business establishment, and much of the cultural elite have been in favour of the constitution, the No camp has remained firmly ahead |

|

US Home sales soar to record, |

US Home prices jumped about 15% from a year ago, |

|

We have seen what 20 million people of Taiwan can achieve in a free and democratic Chinese society. |

Skeptics have been warning about a bubble in housing prices for years. This past week, the skeptics' case grew stronger. |

|

Billions of dollars in hedge-fund money disappeared into thin air amid the GM mess. |

Hedge funds and other investors seek to offload assets after suffering losses.

|

|

De genomtänkta högerattityderna behövs i politiken |

Sverige är det land i Europa som har

flest utlandsfödda i förhållande till

folkmängden, |

|

The current-account deficit, now more than $1.8 billion a day, or $2,250 per man, woman and child per year |

An emergency plan for dealing with a European financial crisis was agreed at the weekend by EU finance ministers, central bankers and financial regulators. |

|

Sverige uppvisar ett jättelikt sparöverskott i form av ett överskott i bytesbalansen på hela 8 procent av BNP. |

Riksbanken har värjt sig mot att sänka räntan trots den låga inflationen. |

|

Bo Siegbahn |

Hitler tände världsbranden när han den 1 september 1939 anföll Polen, vilket omöjliggjorde fortsatt passivitet från brittisk och fransk sida. |

|

The U.S. trade deficit unexpectedly shrank in March to $55 billion |

Stagflation, the remix |

|

Bostadspriserna har fördubblats på sju år och nästa fastighetskris är nära, |

Det finns inga tecken på att bostadsmarknaden i Sverige är övervärderad |

|

Biggles-sidan uppdaterad |

|

|

Hösten 1989 skrev Tiden (s) om östeuropa att vi i Sverige kan vara till bestående nytta för det nya samhälle som tar form i öst bara under förutsättning att vår neutralitetspolitik består. Genom den understryker vi, skrev Tiden, att vi inte står i tjänst hos de aggressiva elementen inom NATO, och i den har vi en talande symbol för den medelväg som vi även ideologiskt beträder. |

Försvarsministern Leni Björklund samtalade på måndagen i Washington med sin amerikanska kollega Donald Rumsfeld om att Sverige kraftigt ska öka sitt engagemang och fördubbla personalen i Afghanistan. |

|

As Boomers Retire, a Debate: |

The difference, thus far, between what Japan has experienced in the 15 years since its bubble popped in 1990 |

|

Häromveckan sålde en polare till mig en etta på 26

kvadratmeter på första våningen för 1,1 miljon

kronor. |

America lost, capitalism won |

|

I am not a believer in conspiracy theories. But |

Vietnamrörelsen blev en folkrörelse och de flesta var med. |

|

The punitive 1919 Treaty of Versailles leading inevitably to Hitler’s capture of power in a resentful Germany in 1933. |

Just about every American is in denial about the pain they will feel if they housing market takes a turn for the worse. |

|

Lessons From the Fall of Saigon |

Längs vägen där kommunisternas stridsvagnar rullade in för 30 år sen står nu Pepsi Cola-automater och en del av ekipagen i den stora paraden här i dag var sponsrade av företag som American Express och Visa. |

|

The market does not know whether it should worry about growth or inflation, or possibly both: "stagflation". |

Very important article |

|

Deflation is in the Cards. Yes Readers, that is correct. |

What seems clear is that there are three main schools of thought |

|

The Group of Seven said in its communiqué that "we emphasise that more flexibility in exchange rates is desirable for major countries and areas that lack such flexibility to promote smooth and widespread adjustments in the international financial system, based on market mechanisms". |

The Savings and Loans Associations Bailout |

|

It is in US long-run interests to avoid an explosive build-up of net external liabilities. |

The Great Transition Part I: Giant Popping Sound |

|

Paul A. Volcker: |

Last bubble was brief, but still irrational |

|

Söndag 17 april är det 30 år sedan röda khmererna tog makten i Kambodja.

Nästan två miljoner människor dödades under den maoistiska gerillans fyra år vid makten. |

Söndag 17 april är det 30 år sedan röda khmererna tog makten i Kambodja.

Nästan två miljoner människor dödades under den maoistiska gerillans fyra år vid makten. |

|

Johan Hakelius ledarsidan i SvD augusti 1997: |

P O Enquists berömda artikel 1975-05-15 om Kambodjas horhus

innehåller även den lika maffiga som pinsamma meningen: |

|

Beijing Youth Daily, a popular newspaper in China's capital, relies on a diet of starlets and sports to attract readers. |

Brad Setser, a former Treasury official who is now at Roubini Global Economics, an economic-analysis firm, reckons that if non-oil import growth continues at its recent pace and the oil price stays over $50 a barrel, America’s annual trade deficit would reach nearly $800 billion by the end of 2005 |

|

In the early 1990’s, Foreign Affairs devoted an entire issue to an article written by political science professor Samuel Huntington titled the “Clash of Civilizations,” which predicted a terror war between Islam and the west. |

Brad Setser, Oxford University |

|

Richard Clarida in Wall Street Journal |

Bloomberg |

|

This week both the World Bank and the International Monetary Fund (IMF) have come out with reports warning that America’s fiscal irresponsibility poses serious risks to the world economy. |

Jane Fonda gör pudel om Vietnam |

|

The World Bank: |

Since it takes 150,000 jobs a month just to keep up with the birth rate and immigration, anything less than that and we are actually losing jobs no matter what the hype from CNBC says. |

|

Skandia Liv, med VD:n Urban Bäckström spekulerar i en starkare krona och svagare dollar. |

– Welcome to the Bubble Economy, 2005. |

|

From January 1980 to January 2005, M3 US grew 420%. |

It's a Totally New Paradigm |

|

”Den enda period sedan 1700 då vår uppskattade realränta varit så här låg var åren under och närmast efter andra världskriget |

The doomsday scenario, considered unlikely by most economists but not impossible |

|

Americans have come to see their homes much like cash machines, withdrawing $223bn last year from the equity in them. |

Greenspan's Second Bubble |

|

Ten Reasons why China should move its peg and pull the plug on the US reckless policies |

In an environment in which profits, business success, and jobs themselves have been driven in substantial part by a 20-year trend of lower interest rates, an observer must make the unmistakable conclusion that we have come to the end of the road. |

|

Essentially what we are saying is that all global asset prices markets will remain severely distorted as long as the main suppliers of excess savings to the world economy - the Japanese private investors - continue to live in a zero-rate environment. |

A Guide to Global Inflation-Linked Bonds |

|

US, Germany, France and UK face junk debt status |

The U.S. trade deficit - Is it good or bad? |

|

Important, if true |

The Fed's mistake has been to keep the dollar presses running at full throttle for too long. |

|

A bubble or mania is a type of investing phenomenon that occurs when investors put too much demand on a stock or sector. |

When the Federal Reserve raises interest rates, trouble usually follows. |

|

Vad som är fullständigt oacceptabelt är att den nu sittande

riksdagen, vald utan att frågan om EU-grundlagen behandlades i

valdebatten, skall fatta beslutet. |

The U.S. current account deficit 2004 widened to a record $665.9 billion, equivalent to 5.7 percent of GDP |

|

Hayek, Currency Competition and |

Whom to believe - Buffett or Greenspan? |

|

Many economic commentators argue that the trade deficit somehow results from low saving and the federal budget deficit. |

SCB har räknat ut vad alla som får sjukpenning, är förtidspensionerade, är arbetslösa eller i åtgärder eller får socialbidrag motsvarar i antal heltidspersoner. |

|

Kudlow On The Trade Deficit |

Five years to the day after the peak of the last global investment bubble, signs that another one may be about to burst could be seen, ironically enough, in the telecommunications industry. |

|

The resolution of our current account deficit... does not strike me as overly worrisome |

Ett genomförande av den arbetarstyrda ekonomin fordrar långtgående reformer,

bl a måste den nuvarande kapitalägarklassen pensioneras och produktionsmedlen socialiseras. |

|

The U.S. trade deficit widened to $58.3 billion in January. |

One of my deepest concerns is that the current complacency with the trade deficit which stems from the relative stability of the US economy and markets will lead to an event as dramatic as the fall of the NASDAQ. |

|

56 private economists surveyed by the Wall Street Journal Online this month see another force at work: |

|

|

Dollar sinks on trade gap worries |

Every Fed tightening cycle has brought a financial crisis. |

|

Bo Södersten och sanningen |

Tiden är kommen för att visa att en konsekvent tillämpning av socialdemokratisk ideologi innebär en djuptgående förändring av samhället. |

|

"- Det enda som ska ha inflytande i företagen är arbetet, kapitalet ska ägas av samhället, kollektivet, som sedan ställer detta till löntagarnas förfogande, sa han." |

Se även boken "Kapitalismen byggde landet" |

|

The Mystery of Low Interest Rates |

Let me be clear about what I think Roach is saying but cannot say directly. |

|

Warren Buffett has warned that the US trade deficit risks creating a “sharecropper’s society” |

Over the past couple of weeks, investors have been falling over themselves to snap up new offerings, whether they be long dated or short term, high yield or sovereign. |

|

Saving is a good thing, but it is possible to overdo it. |

Arbetslivsministern: Jämviktsarbetslösheten i svensk ekonomi ligger i dag ordentligt under 4 procent" |

|

Dress rehearsal for a dollar deluge |

If I believed in Austrian business cycle theory |

|

Hur hög är då denna neutrala "lagomränta" som Fed siktar på? |

Conundrum (gåta eller kvistig fråga, kinkigt problem enligt Norstedts engelsk-svenska ordbok) är onekligen "veckans ord" på Wall Street. |

|

European Sado-Monetarism |

I have updated my page about Biggles |

|

Remember these names. Toshihiko Fukui. Zhou Xiaochuan. Perng Fai-Nan. Park Seung. Joseph Yam. And Yaga Venugopal Reddy. |

Forget trade deficits: go for growth |

|

The idea that central banks should track asset prices is hardly new. |

H |

|

Vad är det för land där bara knappt 13 procent

av BNP investeras i företag och bostadsbyggande?

Där bytesbalansöverskottet blev 206 miljarder

kronor eller 8 procent av fjolårets BNP? |

Ingemar Hansson menade att det var vilseledande av Fölster att påstå att den låga investeringskvoten beror på dåligt näringslivsklimat i Sverige. |

|

If the mighty dollar can be rocked by a single paragraph in a report to the Korean parliament something is amiss. |

Det avgörande för vad som kommer att hända med världsekonomin är om det låga amerikanska hushållssparandet kombineras med ytterligare stigande räntor i USA. Då kan vi se en dämpning av fastighetspriser och privat konsumtion i USA som får starka negativa effekter för hela världsekonomin. |

|

Allianspartierna tar striden för 1990-talets valfrihetsreformer och mot höjda skatter, men de erbjuder inget långsiktigt alternativ till högskattesamhället. Ingen kräver att de ska tala för chockterapi, men det behövs en idé om en annan väg. |

Det finns bara en stensäker placering: att köpa statens realränteobligationer. |

|

The truth of the matter is this: |

U.S. wholesale prices rose 0.3 percent in January. |

|

PJ Anders Linders tvångstankar |

In fact, the current-account deficit has little to do with American profligacy and nearly everything to do with policies that make the U.S. a magnet for foreign capital and faster growth. |

|

No Problem |

Testimony of Chairman Alan Greenspan |

|

Sven Rydenfelt klicka här |

Sven Rydenfelt (1911 - 2005) Timbro |

|

The Dollar and The Trade Deficit |

Resistance to systemic risk may be eroded |

|

The underlying source of economic growth over the last couple years has come from folks using the housing ATM to live beyond their means. |

Samuel Brittan happened, prompted by Professor Charles Goodhart, to read Professor Milton Friedman’s seminal presidential address to the American Economic Association in 1967 somewhat sooner than any other prominent commentator in Britain at that time |

|

Will the Bretton Woods 2 Regime Unravel Soon? |

Papers covering the UK's exit from the Exchange Rate Mechanism in 1992 have been released after a Treasury document was inadvertently e-mailed to the BBC. |

|

US trade gap hits record in 2004 |

H |

|

Why long-term bond yields are low |

Världen flödar av pengar som väntar på att lånas ut. Räntorna är ovanligt låga för att vara i en så pass stark konjunktur. |

|

A consequence of the contraction in profit margins of exporters to the United States, and thus low pass-through of dollar depreciation to U.S. import prices, has been minimal pressure on U.S. consumer price inflation in recent years. |

H |

|

Cutting the budget deficit won't do much to shrink the gaping U.S. trade deficit, a Federal Reserve study has found |

H |

|

Statstelevisionen: |

Prices, when freely set, bring order and concord to the unplanned activities of market economies — as if by an invisible hand. |

|

Bostadspriserna har på många håll skenat. I delar av Stockholms innerstad har de sedan länge accelererat bortom förnuftets gräns. |

|

|

José Manuel Barroso verkar vara en klåpare, inte vuxen uppgiften att leda den nya EU-kommission. |

US Short-term interest rates and inflation are both rising, the current-account deficit is huge and widening, the dollar has fallen and the fiscal outlook has worsened. |

|

The economic crisis 2004, predicted by many, has not materialised. |

Jean-Claude Trichet, president of the European Central Bank, warned this month of “unsustainable price increases in property markets” that could result from excess liquidity and strong credit growth. |

|

The great question is whether the US will be able to reduce the deficit through a gradual manufacturing revival or, dramatically, through a domestic spending recession |

China's overall trade surplus was a modest $32 billion last year, peanuts compared with America's trade deficit of over $600 billion |

|

Moderate growth in the presence of substantial policy stimulus during the recovery phase of a U.S. business cycle raises some serious questions about the level of interest rates that is consistent with long-term U.S. growth. |

Are inflation targets "The End of History?" |

|

Redan under 1970-talet, när jag forskade om kapitalbildningen i Sverige, oroade jag mig för den nedgång vi då såg i investeringarna som andel av BNP. Under de trettio år som gått har denna oro inte minskat, snarare tvärtom – den har ökat i takt med att den nedåtgående trenden i investeringarna har fortsatt. |

Ur Rolf Englund första löntagarfondsartikel, 1974, i Svensk Linje m anl av Bo Södersten och Villy Bergström |

|

The president of Harvard University, Lawrence H. Summers, sparked an uproar at an academic conference Friday when he said that innate differences between men and women might be one reason fewer women succeed in science and math careers. |

If a weaker dollar can’t do the trick, what can? |

|

"Det är först när man har fallande huspriser och hög arbetslöshet som det får stora effekter", sade Stefan Fölster. |

The U.S. trade deficit unexpectedly grew to $60.3 billion in November, the widest ever,

as demand for oil and consumer goods drove imports to a record. |

|

Svenskt Näringslivs chefsekonom Stefan Fölster upprepade sitt budskap om den låga investeringskvoten i Sverige jämfört med exempelvis övriga EU-länder.

|

Argentina plans to repay all its $15bn debt with the International Monetary Fund, |

|

I continue to believe that our stock market is the financial equivalent of an 8.0-plus earthquake waiting to happen. |

The future of the dollar seems today to be the most important issue for the world economy in 2005. |

|

Clearly, import demand needs to decrease. Which policy levers could bring this about? |

Europas sista sommar. |

|

The pundits who have been predicting higher interest rates based on large U.S. budget and current account deficits have some explaining to do. |

Hushåll som lånar till husköp och annat måste vara beredda att klara en ränta som är två till tre procent högre än i dag. |

|

Hushållen ökar sin belåning och huspriserna skjuter i höjden. Risken stiger för överhettning och påföljande bakslag, men ingen gör något åt det. |

The great housing boom of the early 21st century is looking shaky. Governments are growing nervous about whether prices will hold, and what will happen if they do not.

|

|

Asteroid could hit Earth in 2029 |

Hervé Gaymard, France's new finance minister, on Thursday warned of a global "economic catastrophe" if the US, Europe and Asia did not work together to stem the decline of the dollar against the Euro. |

|

Welcome to the vicious cycle |

"En kunskapsföraktande radikalfeminism" |

|

A significant decline in both consumption and investment will mean a recession in the US.

|

The first step towards an answer is deciding what a sustainable US current account deficit might be |

|

Believing in hedge funds - or fairies |

Den nya ekonomin är här för att stanna. Åtminstone under ett decennium till. |

|

Trade Gap Widens to a Record $55.5 Bln |

The most acute risks are posed by the large and rapidly growing US current account deficits. |

|

A floating threat |

A weaker dollar and higher bond yields would be catastrophic for current global upturn

|

|

U.S. Twin Deficits No Problem |

The growing external deficits of the world's "sole superpower" have put the global economy |

|

Trichet should not bemoan the rising euro |

|

|

Jag tror att dollarn är kvar på nivån 1,20 mot euron om ett år |

The Age of Inflation is finished |

|

Don't Confuse Me With the Facts |

America has habits that are inappropriate, to say the least, for the guardian of the world's main reserve currency: rampant government borrowing, furious consumer spending and a current-account deficit big enough to have bankrupted any other country some time ago. This makes a dollar devaluation inevitable |

|

Kan man undvika recession i USA när man måste minska importen med 600 miljarder dollar?

|

To bring about a substantial reduction in the external deficit without a deep recession, the US needs a huge change in internal relative prices. |

|

The rising balance of payments deficit implies that the budget deficit must get progressively worse from now on if stagnation is to be avoided. |

Unilateral action can stop the dollar's slide |

|

Europe must help slow the dollar's decline |

Kvinnliga riksdagsledamöter som känner sig trakasserade av riksdagsmännen ska kunna få professionellt stöd från riksdagen. Det är ett förslag för hur riksdagen ska komma till rätta med förlöjligande och osynliggörande av kvinnor i riksdagen. |

|

The day could come when foreign investors demand better terms for financing America's spending spree (and savings shortfall). |

Does reduction of the US current account deficit require or |

|

Persistent and widespread efforts to resist currency moves are doomed to fail, and if pursued long enough, can lead to serious resource misallocation. |

A dollar crash, if it occurred, could trigger a terrifying global slump. |

|

No end in sight for dollar slide |

|

|

Nihilism är inte tolerans |

Bara under tredje kvartalet hade Sverige ett överskott i utrikes betalningar med 54 miljarder kronor. |

|

Adjusting to the dollar's inevitable fall

|

En del sade vid murens fall att anti-kommunisterna hade ”fått rätt”. Jag ogillar det uttrycket: fått rätt. |

|

Sedan 2002 har den amerikanska dollarn fallit med 35 procent. Under de senaste veckorna har takten i nedgången ökat. |

The solution is a tax rise |

|

Den kraftiga dollarförsvagningen kan få negativa konsekvenser på svensk export. |

The stock market's pessimism about the dollar's decline is a little perplexing. |

|

Dollar moving in one direction only: down |

Alan Greenspan triggered fresh falls in the dollar on Friday after issuing a strong warning about the unsustainability of the US current account deficit. |

|

If the dollar is not allowed to fall against the yuan, it will probably continue to fall heavily against something else. |

Vaclav Havel: |

|

Klas Eklunds slutsats är att dollarn kommer att försvagas gradvis men att det inte blir något ras – åtminstone inte under de närmaste åren som är hans prognoshorisont. |

The world needs another Plaza Accord |

|

Dokument inifrån TV2 17/11 2004: Novemberrevolutionen |

The Bush administration has apparently decided that letting the dollar slide is a good way to shrink America's trade deficit. |

|

Den 19 januari ger Martin Wolf den årliga Sven Rydenfelt-föreläsningen i Lund hos Timbro. |

The dollar is likely to fall further. |

|

Dollarn måste falla med 30-40 procent |

Minus 35 procent på mindre än fyra år dollarn under 7 kr och lägsta nivån någonsin mot euron. |

|

Republicans risk disgrace if they raise taxes or if America suffers a financial and inflationary crisis because of its failure to bring the federal budget back under control |

Alan Greenspan, will retire shortly. Who will replace him? |

|

The U.S. trade gap unexpectedly narrowed in September to $51.6 billion as oil imports fell. |

My most certain idea is that real interest rates in the United States will have to be kept low, that the old Taylor rule is out |

|

Dollarn har rasat med över 36 procent mot kronan sedan toppnoteringen för drygt tre år sedan på 11:01 kronor. |

The Next Bush Recession? |

|

US deficit: |

US deficit: |

|

Dollar at record low against euro |

Bubbles, crashes and power shifts |

|

There are many reasons to be concerned about the dollar, but the number one reason is the trade deficit. |

The wolf at the door |

|

The dollar has to fall a long way from where it is now, if the current account deficit at full employment is to diminish |

|

|

Dollar Adjustment: How Far? Against What? |

Wall Street Collapses |

|

Hayek - Marknadsekonomins intellektuella portalgestalt |

How can we be sure we don't have a recession coming in 2005? |

|

”Det finns en bristande probleminsikt. Inom fem år kan /USA:s/ utlandsskuld nå 50 procent av

BNP. |

"USA har ryckt åt sig ett stort försprång och har världens mest framgångsrika ekonomi" |

|

The dollar fell below $1.26 per euro for the first time since February |

The “stagflation” (economic stagnation alongside roaring inflation) that was common in the 1970s is now a worry once again. |

|

The orgy of tax-cutting, with big revenue losses, continues unabated. |

A Deficit America Can Live With |

|

P-O Edin: Skillnaden mellan dagens arbetslöshet och den arbetslöshet som är förenlig med stabila priser (Nairu)... är 1,5-2 procent |

The US dollar crashed on Friday |

|

This year's Nobel prize honours two economists |

The U.S. trade gap in August rose to $54.04 billion |

|

Ny version - nu med tabeller och diagaram |

Four Nordic nations are placed in the top six for growth prospects, along with the US and Taiwan, in a survey of 101 countries in the World Economic Forum's annual review of global competitiveness.

|

|

”Jag har aldrig trott på Lenin” |

Nobelpristagare ekonomi 2004 |

|

Hiv och aids är biologiska vapen - tillverkade för att utrota den svarta rasen.

Det hävdar kenyanskan Wangari Maathai som i går fick Nobels fredspris. |

Assistant Minister Prof Wangari Maathai yesterday claimed that HIV/Aids was a biological weapon manufactured by the developed world to wipe out the Black race from developing countries. |

|

Det mesta talar för att man i framtidens skolböcker kommer att läsa om socialismen att den var en idériktning som samlade stora skaror anhängare under tiden 1880—1980 men senare vittrade bort på samma sätt som andra frälsningsläror har gjort och kommer att göra. Socialismen kommer att visa sig vara en av de många historiens idéströmningar som med tiden avslöjades inte som vägen till framtiden, utan en återvändsgränd. En återvändsgränd som slutar vid en mur. |

Dallas Fed president Robert McTeer warned that “Over time, there is only one way for the dollar to go - lower”. Just for good measure, he also talked about the theoretical possibility of a “crisis” precipitating “rapidly rising interest rates and a rapidly depreciating dollar” if and when the wider world stops funding the rapidly expanding US current account deficit. |

|

Det är väl inte bara Ohly som borde skämmas? |

Det är väl inte bara Ohly som borde skämmas? |

|

De omkring 3 500 deltagarna samlades i stora mässhallen till en öppningsceremoni med följande program.

Den röda fanan (kör och unisont) under innmarsch av en fana. Arbetets söner (unisont) Tal av partiordförande Olof Palme

Potpurri på arbetarsånger Tal av FNL:s representant Madame Thi Binh, PRR:s utrikesminister och chefförhandlare i Paris

Befria Södern, FNL:s nationalsång (kör och unisont) Talman Birgitta Dahl gjorde förra lördagen något ovanligt i svensk politik: erkände att hon hade haft fel (DN 23/8) Hon hade plågats av att hon "inte tillräckligt snabbt begrep och tog avstånd från Pol Pot-regimens grymheter Efter 20 års betänketid var tillfället inne att göra slut på detta själsliga lidande. |

Reformeringen av arbetsrätten måste syfta till att stärka arbetets, löntagarnas ställning på arbetsplatserna. Den skall ge de fackliga organisationerna bättre möjligheter att i förhandlingar hävda medlemmarnas intressen. Den skall också ge arbetstagarna reella möjligheter att sluta avtal i frågor där arbetsgivarna tidigare, i kraft av paragraf 32, haft ensam beslutanderätt.

Men en sådan jämställdhet mellan arbete och kapital kan inte vara slutmålet för den ekonomiska demokratin. Det skulle innebära att ett fåtal kapitalägare gavs samma rätt till inflytande som miljoner löntagare, och att kapital och arbete betraktas som jämbördiga produktionsfaktorer. Fackföreningsrörelsen avvisar en sådan syn. Det mänskliga arbetet måste sättas främst.

|

|

|

Politicians are failing not only to enthuse voters, but they are silent on the biggest challenge |

|

Man kan inte bomba fram demokrati eller hålla allmänna val i kulregn. Ett eskalerat våld mot hatet och motståndet i arabvärlden är ingen lösning för USA och Israel. |

With inflation apparently conquered, it may not be surprising that yields are returning to levels regularly seen in the first half of the 20th century. |

|

Det svenska bytesbalansöverskottet |

Någonting har hänt, men vad? DNs ledare återupptar debatten om Keynes, NAIRU och stabiliseringspolitik - Very Important |

|

The world may face its first-ever global house-price bubble, and if it bursts |

IMF: The question is not whether the US deficit will adjust |

|

Oil and Stagflation |

Normalization Means Higher Inflation |

|

"Risk för global kris" |

Stand by for a pensions bail-out |

|

The risks ahead for the world economy |

|

|

Rolf Englunds site om gamla radioapparater |

Text H |

|

Bubbles are getting blown out of all proportion

|

Carl Bildt fortsatte att hävda att det inte rörde sig om någon bankkris utan bara en Nordbankskris |

|

Varför försvarades den fasta kronkursen så kraftfullt under hösten 1992? |

Ingvar Carlsson om kronkursförsvaret 1992: |

|

|

Nouriel Roubini's Global Macroeconomic and Financial Policy Site |

|

Dagens Nyheter 6 september 2004: Sommaren 1997 när Carl Bildt återvände till svensk politik efter uppdragen i Bosnien åtnjöt Bildt större och bredare förtroende i det svenska samhället än någonsin tidigare.

Han var den självklare statsministerkandidaten och han kom hem för att återta regeringsmakten. Ingvar Carlsson om kronkursförsvaret 1992: |

US consumer spending rose 0.8% - incomes rose 0.1% |

|

EMU-profeterna får stå i skamvrån |

|

|

America's dangerous deficit |

The US Current Account Deficit and the Euro Area |

|

Mattias Bengtsson slutar som chef för Timbro |

Timbros ägare - Finansmannen Mats Qviberg har bytt fot i EMU-frågan och

säger nu att han ska rösta nej. En viktig orsak är "de dagliga

utspelen och brösttonerna" från ja-sidans företrädare.

|

|

Sanningen om da Vinci-koden |

Dan Brown site |

|

Financial Times;

Jan 02, 2003 |

With Lou Dobbs, CNN, Friday, August 20, 2004 Paul

Roberts, author of "The End of Oil" says the global supply of oil is being

depleted at an alarming rate. |

|

If Asian central banks stopped financing the US current

account deficit, the euro's exchange rate would shoot through the roof to the

detriment of the eurozone economy. |

|

|

America on the comfortable path to ruin

|

Som att prata dricks i baren på Titanic

|

|

Greenspan is running out of buttons to

push |

The US economy has grown reasonably fast since the second half

of 2003 and the general expectation seems to be that satisfactory growth will

continue more or less indefinitely. |

|

En ny bostadsbubbla skulle innebära att

priserna faller dramatiskt i de regioner där priserna stigit som mest.

|

The vigour of America's expansion is once again in doubt

|

|

Det är möjligt att den västerländska

civilisationen nådde sin höjdpunkt 1965, någonstans mellan

"Hylands hörna" och studentupproret 1968. |

Concern over the softening of global economic expansion

heightened on Friday with data showing the US trade deficit at new record

levels, lack of vigour in Europe and an abrupt slowdown in growth in Japan

|

|

BBC: The US trade deficit has unexpectedly swollen by 19% to

a record $55.8bn in June |

The most basic index of performance is real gross domestic

product per hour worked ("productivity"). |

|

There are big medium-term risks ahead |

Debt and the dollar, employment and interest rates, the US

economy and world trade, money supply and inflation/deflation,taxes, deficits,

commodity prices, politics, war, regulation plus a host of other variables.

|

|

Inflated expectations |

|

|

Vad spelar tillgångspriser och krediter

för roll i penningpolitiken |

Are markets about to start panicking about the

dollar again - with good reason? |

|

The Asset Economy |

Anatole Kaletsky: |

|

The threat of extreme events |

|

|

US current account deficit widens to $1.5bn a day |

|

|

Americas trade gap is growing again. |

|

|

The US trade deficit grew 3.8% to hit a fresh record of $48.3bn

in April |

|

|

Beware bursting of the money bubble |

|

|

Sekterismen inget exklusivt religiöst, kristet eller

frikyrkligt problem |

The US trade deficit widened to a record $46 billion in March

|

|

De farliga jasägarna |

The unravelling mystery |

|

Om det inte skall hållas folkomröstning, skall det

då göras grundlagsändring med mellanliggande val? DN svarar Englund |

Warren Buffett |

|

Just as certain as death and taxes is the knowledge that we

shall one day be forced to learn to live without oil. |

|

|

In the late 1990s, Greenspan decided to ignore the

growing bubble in technology stock prices. |

|

|

A housing market collapse draws nearer |

|

|

John Makin, resident scholar at the American Enterprise

Institute in Washington: |

|

|

Say's Law |

|

|

Is the house price bubble set to burst? |

|

|

Avoiding a housing crash |

|

|

Those with a memory of what happens when a bubble bursts know

that, if history is any guide, the bear market that began in 2000 is not over -

not by a long shot. |

|

|

Low rates are the problem, not the cure |

|

|

Johan Lybeck: Räntan borde istället

höjas tycker han |

The terrorist enemy holds no territory, defends no

population, is unconstrained by rules of warfare, and respects no law of

morality. Such an enemy cannot be deterred, contained, appeased, or negotiated

with. It can only be destroyed. |

|

BMW bets on dollar rebound |

|

|

HP to sell Linux-based computers |

|

|

Medianhuspriset i Stockholm skulle sänkas med hela 600.000

kronor om räntan var 3 procentenheter högre |

The jobs picture is even worse than it seems |

|

Per Ahlmarks bok: |

The U.S. trade deficit widened to a record $43.1

billion in January |

|

The first Arab Human Development Report |

The failure of the US economic

recovery, now more than two years old, to produce meaningful job growth has

generated much talk about its political consequences. |

|

Berkshire Hathaway, the insurance and holding company

run by legendary investor |

|

|

Last week, Alan Greenspan was a study in

contradiction. |

|

|

Varning för global bubbla |

On Tuesday, Argentina must repay $3.1bn to the International

Monetary Fund |

|

fundera ut hur vi moderater skall utforma ett lågskattesamhälle som är så lockande för en majoritet av valmanskåren att det kan genomföras. Om vi moderater inte kan presentera ett sådant förslag kommer vi heller aldrig att i verkligheten kunna sänka skatten. Den som vill sänka skatten i verkligheten måste

ägna sina tankar åt verkligheten. Herr Ordförande, Det vore

inte mycket idé att orda om några MUF-ares jippon här i

Österåker om det inte vore så att deras handlande visar

på ett problem som vi inom moderaterna har att hantera. |

Hayek's Challenge: |

|

I Ekonomisk Debatt nr 7 2003 argumenterar Anders Borg för

att finanspolitiken bör ges en tydligare institutionell ram. Han

förundras också över svenska ekonomers keynesfobi |

|

|

Höj omedelbart styrräntan drastiskt - från 1,0

till 3,0 procent! |

|

|

The fall in real yields |

The dollar, said John Connolly, treasury secretary

to Richard Nixon, "is our currency, but your problem". |

|

The dollar has hit a series of historic lows

against just about every currency. |

The coming storm |

|

Asia will not rethink currencies soon |

The blissful combination of higher growth and

lower inflation that has characterized the U.S. economy since last spring is

the inverse of stagflation, the nightmare scenario that followed the oil shock

of 1973-74 |

|

The 7 stages of a dollar crisis |

Inflation in the US has hit its lowest level for

nearly 38 years, according to the latest official data. |

|

The US january trade deficit widened by more than expected,

from $38.4 to $42.5bn |

The recent performance of inflation has been

especially notable in view of the substantial depreciation of the dollar in

2003. |

|

"Det mest sannolika", skriver han, "är att

vi får se ett börsras utan like följt av ett sammanbrott

för dollarn, en händelsekedja som kan tänkas göra slut

på USA:s imperieställning". |

The current-account deficit basically reflects

America's lack of saving, by both households and the government |

|

Did President Ronald Reagan really prove that deficits do not

matter? |

|

|

Dollar's threat to eurozone |

|

|

There is a big risk that the current “easy

money” policy is spilling over into inflation in the price of shares and

houses. |

|

|

Martin Wolf: IMF must stand up to blackmail -

Argentina |

|

|

Bildt-regeringen, drabbades av historiens hittills värsta

valutakris |

US government will run up a budget deficit of

nearly $500bn in 2004 - the largest in US history in absolute terms, 5% of

GDP |

|

Sakta men säkert stärks kronan och